Published as part of the Financial Stability Review, May 2022.

One important lesson learned from the use of capital-based macroprudential policies in recent years is that tightening such policies during boom phases is unlikely to have a notable impact on credit supply and the build-up of imbalances, while the accumulated resilience and the release of buffers in downturns produces large benefits. Capital-based policies are particularly relevant to the ECB since they are a focal point for the ECB’s macroprudential tasks as enshrined in European legislation.[1] A prime example of a capital-based tool is the countercyclical capital buffer (CCyB). This instrument was designed in the aftermath of the global financial crisis to enhance the resilience of the financial system and reduce procyclicality.[2] Enacting capital-based policies such as the CCyB directly enhances banking system resilience by inducing banks to increase their capital ratios. Further transmission to the real economy by way of effects on bank credit supply depends on overall economic conditions and the relevance of capital constraints in the banking sector. While such constraints are unlikely to be binding when capital buffers are activated during economic booms, the coronavirus (COVID-19) pandemic has shown that the release of buffers and other requirements in a downturn can ease binding constraints and effectively support credit supply and economic activity.[3]

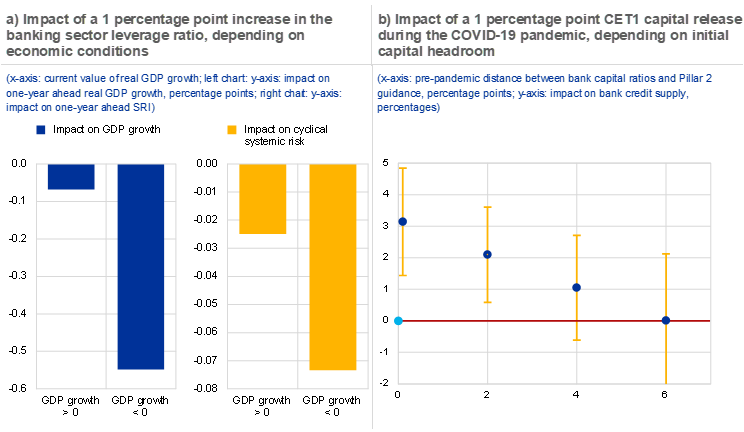

During periods of solid economic activity, an appropriate tightening of macroprudential capital buffer requirements is unlikely to lead to binding bank capital constraints and should therefore not have a large dampening effect on credit supply or the build-up of imbalances.[4] Banks usually respond to higher capital buffer requirements by increasing their capital targets and capital ratios.[5] This directly enhances their overall resilience, as more capital will be available in the banking system for a given set of exposures. Furthermore, capital-based measures may affect bank credit supply and the build-up of imbalances over the cycle. This occurs if banks pass on higher funding costs to customers by raising lending rates (“price channel”, resting on the observation that bank capital is usually considered more costly than debt) or if they directly limit the quantity of credit when they are unable to meet higher capital requirements (“quantity channel”). When economic conditions are favourable, banks tend to have a high capacity for internal capital generation through retained earnings and can also raise new equity in markets, both of which reduce the likelihood of banks being subject to binding capital constraints. Moreover, available capital headroom allows banks to smooth adjustments to higher capital ratio targets over time. Therefore, transmission via both the price channel and the quantity channel is expected to be limited in economic booms,[6] and tightening capital buffers during upswings is likely to have low costs in terms of reduced economic activity (via the limited impact on credit supply), with correspondingly limited effects on the build-up of imbalances (Chart A, panel a).

In periods of crisis, the availability of and ability to release macroprudential capital buffers can ease bank capital constraints and effectively support credit supply and economic activity. The materialisation of systemic risk is usually associated with high economic uncertainty and sizeable bank losses. These, in turn, depress capital ratios closer to prudential requirements and hamper banks’ internal capital generation capacity as well as their ability to raise new equity. This means that banks are more likely to become capital-constrained and react by reducing credit supply via the quantity channel, with potentially large negative repercussions for the real economy. In such situations, releasing capital buffers that were built up in good times increases capital headroom and eases regulatory pressure on banks, enabling them to absorb losses while continuing to provide key financial services. This channel is particularly relevant for banks that have little capital headroom and would therefore become capital-constrained without the releases (Chart A, panel b).[7] The support to bank credit supply through the release of capital buffers can, in turn, help cushion the economic downturn and avoid additional losses in the banking sector.

These transmission mechanisms offer important lessons for the effectiveness of capital-based measures and the design of the macroprudential capital buffer framework. First, building capital buffers in good times will be effective in that it will increase banking system resilience, but the muting effect on the build-up of financial imbalances is likely to be limited. Second, and related to the first point, the economic cost of building capital buffers is likely to be low when the economy is experiencing an upswing or when banking sector conditions are favourable. The possible magnitude of economic costs is an important consideration when macroprudential policies need to address vulnerabilities under heightened uncertainty, as is the case in the current environment. Third, the availability and release of capital buffers during crises can effectively support credit supply and economic activity by alleviating potential bank capital constraints. Overall, therefore, enhancing the role of releasable capital buffers within the macroprudential framework, which includes building them up when times are good, appears to be a robust policy strategy. This message is reinforced by the fact that the measurement of cyclical systemic risk is subject to uncertainty, and the pandemic has illustrated that large systemic shocks may occur independently of a country’s position in the financial cycle. A higher amount of releasable capital buffers would therefore strengthen the ability of macroprudential authorities to act countercyclically when adverse shocks materialise.[8]

Chart A

During expansions, increasing capital buffers has little impact on economic activity and the build-up of imbalances, but the release of capital can support credit supply in downturns, particularly for banks for which capital requirements are binding because they have little capital headroom

Sources: Eurostat, ECB (AnaCredit and Supervisory Banking Statistics) and ECB calculations.

Notes: Panel a: results are based on panel local projections for euro area countries from Q1 1970 to Q3 2021. The dependent variables are annual real GDP growth and the systemic risk indicator (SRI) proposed by Lang et al.* The projection horizon is one year ahead. The impulse is a 1 percentage point increase in the banking sector leverage ratio, measured as total capital divided by total assets. The effect of the impulse differs according to whether current real GDP growth is positive or negative. Additional controls include current values of real GDP growth, the output gap, inflation, the SRI, the Country-Level Index of Financial Stress(CLIFS) and the ten-year government bond spread. Changes in the banking sector leverage ratio are not necessarily related to exogenous changes in prudential requirements, but controlling for a large set of current macro-financial variables in the regressions helps to isolate the impact of changes in the leverage ratio that are not related to these current macro-financial conditions. Panel b: the results are from bank-firm level regressions including firm fixed effects to control for credit demand, several bank-specific controls and monetary and fiscal policy measures (including, among other things, the percentages of post-event credit from bank i to firm k that are subject to government moratoria or government guarantees). The dependent variable is the change in the logarithm of loans from bank i to firm k between Q3-Q4 2019 and Q3-Q4 2020. The coefficients displayed (blue dots in the chart) are from an interaction between the CET1 capital release measure (the combined buffer requirement (CBR) release together with the change in Pillar 2 requirement (P2R) composition, the latter bringing forward a legislative change that was initially scheduled to come into effect in January 2021 as part of the latest revision of the Capital Requirements Directive) and the pre-pandemic (Q4 2019) distance to the Pillar 2 guidance (P2G). Yellow whiskers indicate two standard deviation confidence intervals around the estimated coefficients.

*) Lang, J.H., Izzo, C., Fahr, S. and Ruzicka, J., “Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises”, Occasional Paper Series, ECB, No 219, February 2019.

For an overview of the ECB’s macroprudential policy framework, see the chapter entitled “Topical issue: The ECB’s macroprudential policy framework”, Macroprudential Bulletin, Issue 1, ECB, 2016; for an overview of macroprudential policy and powers within the Eurosystem, see the box entitled “Macroprudential policy and powers within the Eurosystem”, Financial Stability Review, ECB, November 2019.

For a comprehensive discussion of the objectives and the rationale of the capital buffer framework, see, for example, the article entitled “Macroprudential capital buffers – objectives and usability”, Macroprudential Bulletin, ECB, October 2020.

For an analysis on the effects of capital release measures during the pandemic see, for example, the special feature entitled “Bank capital buffers and lending in the euro area during the pandemic”, Financial Stability Review, ECB, November 2021. Besides the CCyB, which made up only 0.1% of risk-weighted assets in the banking union before the COVID-19 pandemic, the analysis also considers the release of other buffers (such as the Systemic Risk Buffer) and the one-off change in the composition of microprudential Pillar 2 requirements (which effectively decreased banks’ CET1 capital requirements). The coupling of capital release measures with monetary policy action in the form of liquidity provision can help to further ease binding constraints and enhance banks’ risk-bearing capacity. See, for example, Altavilla, C. et al., “The great lockdown: pandemic response policies and bank lending conditions”, Working Paper Series, No 2465, ECB, September 2020, for an analysis of the complementarities between monetary policy and prudential policy.

On the state dependence of the effects of changes in capital requirements on lending, see the box entitled “A macroprudential perspective on replenishing capital buffers”, Financial Stability Review, ECB, November 2020, which also provides an overview of the academic literature on this topic.

See, for example, Couaillier, C., “What are banks’ actual capital targets”, Working Paper Series, No 2618, ECB, December 2021.

Under the assumptions of a full pass-through of funding costs to lending rates, constant lending spreads, a constant equity premium and a constant risk weight, the change in lending rates is given by where ∆CR is the policy-induced change in the capital requirement, ρ is the constant equity premium and RW is the risk weight. For a 10% equity premium and a 50% risk weight, a 1 percentage point increase in the capital ratio should therefore increase bank lending rates by only 5 basis points. Such an increase in lending rates corresponds to just one-fifth of a standard monetary policy tightening step and is unlikely to lead to a large drop in credit demand based on standard elasticity estimates from the literature. This is consistent with many empirical findings showing that lending rates only increase by a few basis points in response to a 1 percentage point increase in capital requirements; see, for example, Dagher, J. et al., “Benefits and costs of bank capital”, Staff Discussion Note, No 16/04, IMF, 2016 or Budnik et al., “The benefits and costs of adjusting bank capitalisation: evidence from euro area countries”, Working Paper Series, ECB, No 2261, April 2019.

See the special feature entitled “Bank capital buffers and lending in the euro area during the pandemic”, Financial Stability Review, ECB, November 2021.

The ECB response to the European Commission’s call for advice on the review of the EU macroprudential framework includes additional considerations and policy options regarding ways in which the role of the releasable buffers in the current capital framework can be strengthened further. See, in particular, the detailed discussion on possible policy options in Annex 2 of the response document.