Published as part of the Financial Stability Review, May 2022.

This box presents an assessment of the euro area banking sector’s resilience to adverse macroeconomic scenarios in the light of the Russian invasion of Ukraine. While euro area banks’ direct exposures to Russia are limited overall, disruptions in energy and commodity markets pose risks to economic activity in the euro area that could adversely affect banks’ balance sheets. To examine these risks, the ECB has combined three macroeconomic scenarios (a baseline scenario, an adverse scenario and a severely adverse scenario) with stress-testing tools to perform an in-house assessment of the solvency of significant euro area banks. The resulting vulnerability analysis (VA) is a desktop exercise which does not include interactions with banks. The exercise estimates the impact on bank capital of potential losses arising from (i) exposures to euro area economic sectors which have strong trade links with Russia or are dependent on commodity imports from the region, (ii) broader macro-financial stress triggered by current events and (iii) revaluation risks related to increased market volatility and reduced liquidity. For this purpose, top-down models, which are consistent with the EBA 2021 Methodological Note[1], were used to assess banks’ credit, market and profitability risks. The estimated impacts are contingent on the underlying scenario assumptions, which are characterised by a high degree of uncertainty.

Chart A

Key macro-financial features of the scenarios and their impact on credit risk parameters

Sources: Bloomberg Finance L.P., March 2022 ECB staff macroeconomic projections, Oxford Economics, OECD Input-Output tables and ECB calculations.

Notes: Financial shocks in panel a include shocks to commodities, the EUR/RUB exchange rate and the Russian stock market index (MOEX). Panel c shows the interquartile interval for the sectoral probability of default (PD) estimates for the severely adverse scenario.

Relative to a baseline scenario of a modest slowdown in growth, two alternative adverse economic scenarios explore the impact of additional commodity and equity price shocks.[2] Under the VA-adverse and VA-severely adverse scenarios, oil and gas prices rise by around 80% and 180% respectively (Chart A, panel a), while euro area equity prices fall by more than 20%, matching the sizeable drop observed in the immediate aftermath of the invasion.[3] However, the same financial shocks are assumed to affect the real economy differently: under the VA-adverse scenario investment and consumption are affected only temporarily, while under the VA-severely adverse scenario the effects last longer, giving rise to confidence shocks that further dampen economic activity and match the severity of the 2021 EBA EU-wide stress test. Annual GDP growth turns negative under the VA-adverse scenario in 2023, while the euro area economy is in recession in all three years under the VA-severely adverse scenario (Chart A, panel b). The macro-financial scenarios are fed into econometric models which capture the heterogenous exposure of euro area firms to these shocks, yielding different probability of default paths for corporate exposures to vulnerable[4] and non-vulnerable sectors (Chart A, panel c).

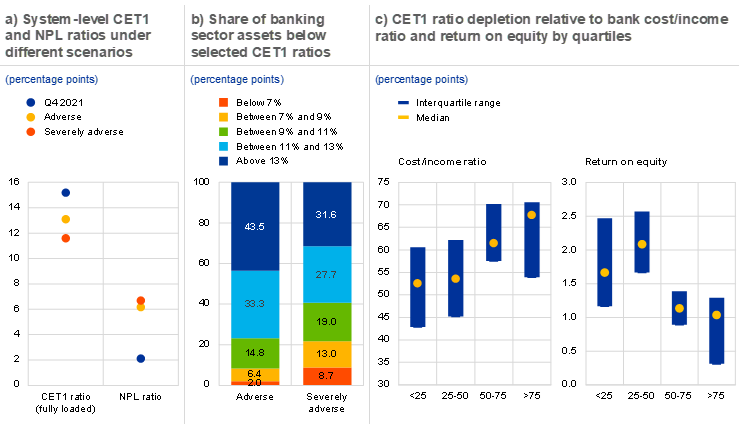

The results obtained from this exercise confirm that the euro area banking sector is resilient to the macroeconomic ramifications of the war in Ukraine. The system-level Core Equity Tier 1 (CET1) ratio (in fully loaded terms) is estimated at 13.1% under the VA-adverse scenario and 11.6% under the VA-severely adverse scenario (Chart B, panel a), with capital depletion amounting to around 2.1 percentage points and 3.6 percentage points respectively. CET1 ratios fall below 7% for just over 2% of banking sector assets under the VA-adverse scenario and for just over 8% under the VA-severely adverse scenario (Chart B, panel b). Credit risk is the main driver of capital depletion in both adverse scenarios, with sectoral concentration in vulnerable sectors[5] amplifying credit losses that materialise due to the macroeconomic shocks. In addition, the system’s income generating capacity is weakened by funding cost increases, which also reflect the expiration of targeted longer-term refinancing operations under all scenarios. These increases offset the gains expected from rising rates on the asset side, resulting in an overall weakening of net interest income compared with the starting point. At the bank level, higher capital depletion correlates strongly with a lower return on equity and with higher cost/income ratios, reflecting the drag exerted by projected operating costs on capital ratios (Chart B, panel c).

Chart B

The banking sector is resilient overall to the second-round effects arising from the Russia-Ukraine war: capital depletion is higher for banks with ex ante higher operating costs and lower returns

Sources: ECB (Supervisory Banking Statistics) and ECB calculations.

Notes: NPL stands for non-performing loans. Panel c shows results based on the severely adverse scenario and displays banks grouped by interquartile buckets, with <25 capturing banks with a CET1 ratio depletion below the 25th percentile, 25-50 capturing banks with a CET1 ratio depletion above the 25th percentile and below the median, 50-75 banks above the median and below the 75th percentile and >75 banks above the 75th percentile.

See the EBA 2021 EU-Wide Stress Test Methodological Note for details.

The baseline scenario is anchored to the March 2022 ECB staff macroeconomic projections for the euro area, which included a first assessment of the impact of the war. To account for the uncertainty surrounding the evolution of the conflict and its economic ramifications, two adverse scenarios were created. The three scenarios combined cover a wide spectrum of macroeconomic outcomes for the euro area to offer insights into potential feedback effects on the banking system, also once the baseline projections have been reappraised in the context of the Eurosystem staff macroeconomic projections for the euro area, which are due to be released in June.

Mechanically, the adverse scenarios take as their starting point shocks to commodity and stock market prices which are based on the actual increases observed in the immediate aftermath of the invasion. They are likely to incorporate financial markets’ expectations that the shortages in the supply of Russian commodities in Europe would worsen further, with the additional possibility of a full-scale embargo (as reflected in financial market news in the early weeks of March).

Sectors are identified as (non-)vulnerable by combining information from the OECD Input-Output tables and NACE 2-level projections of gross value added (GVA) at the country level produced by Oxford Economics for its 2022 war scenario. Sectors that are highly exposed to Russian trade or experience a negative GVA shock over the three-year horizon are classified as vulnerable in this exercise.

Sectoral impairments are projected using a combination of (i) micro-econometric models for sector-level probabilities of default and (ii) proxies capturing bank-level concentration to vulnerable sectors.