Risk of spillovers from US equity market corrections to euro area markets and financial conditions

Published as part of the Financial Stability Review, May 2021.

US equity market prices have surged over the last year, prompting concerns about stretched valuations and the potential risk of market corrections. Cyclically adjusted price/earnings (P/E) ratios for the United States have reached historically high levels over the last year (see Chart A, left panel). In the past, periods of elevated valuations relative to earnings have tended to be followed by substantial market downturns. In view of these developments, this box examines the implications of a possible correction in US stock prices for euro area financial conditions and financial stability.

The recovery in stock prices since March 2020 has been supported by rising earnings expectations, accommodative interest rates and a significant increase in risk appetite. The rise in US equity prices to over 20% above the pre-pandemic level has been driven by an increase in earnings expectations as well as buoyant risk appetite (see Chart A, right panel). While the rise in earnings expectations did mirror strong realised earnings recorded for the fourth quarter of 2020, relatively elevated uncertainty around the earnings outlook points to risks surrounding further equity market developments.

US equity prices could decline substantially, should US Treasury yields increase further on expectations of tighter monetary policy without significantly stronger real growth. The increase in US nominal Treasury yields at the beginning of 2021 dampened some of the momentum in equity markets. But this did not lead to an equity price correction, as the higher yields reflected an improved macroeconomic outlook, which also supported earnings expectations and risk-taking (see Chart A, right panel). In a scenario where investors reassess the likelihood and pace of monetary policy tightening, investor risk appetite is likely to decline, leading to a fall in equity prices. Such a scenario could arise, for example, in response to a series of upward surprises in inflation figures that leads investors to expect an earlier withdrawal of US monetary policy accommodation. The shift in yields could induce a risk asset correction, with potential spillover effects on markets outside the United States.

Chart A

US equity prices, although supported by rising earnings expectations and accommodative interest rates, appear relatively high, with evidence of strong investor risk appetite

Sources: Robert Shiller database, Bloomberg Finance L.P., Refinitiv and ECB calculations.

Notes: Left panel: real cyclically adjusted P/E ratio for the S&P 500 (real prices over real ten-year trailing average earnings). Right panel: decomposition of cumulative percentage changes in the S&P 500 price index, based on a dividend discount model (see Geis, A., Kapp, D. and Kristiansen, K., “Measuring and interpreting the cost of equity in the euro area”, Economic Bulletin, Issue 4, ECB, 2018). The model includes share buybacks, discounts future cash flows with interest rates of the corresponding maturity and includes five expected dividend growth horizons. Contributions from payouts/dividends are not shown in the chart. The selected periods in the right panel show the change between the trough reached in the week ending 20 March 2020 and the end of 2020, as well as the change since the beginning of 2021.

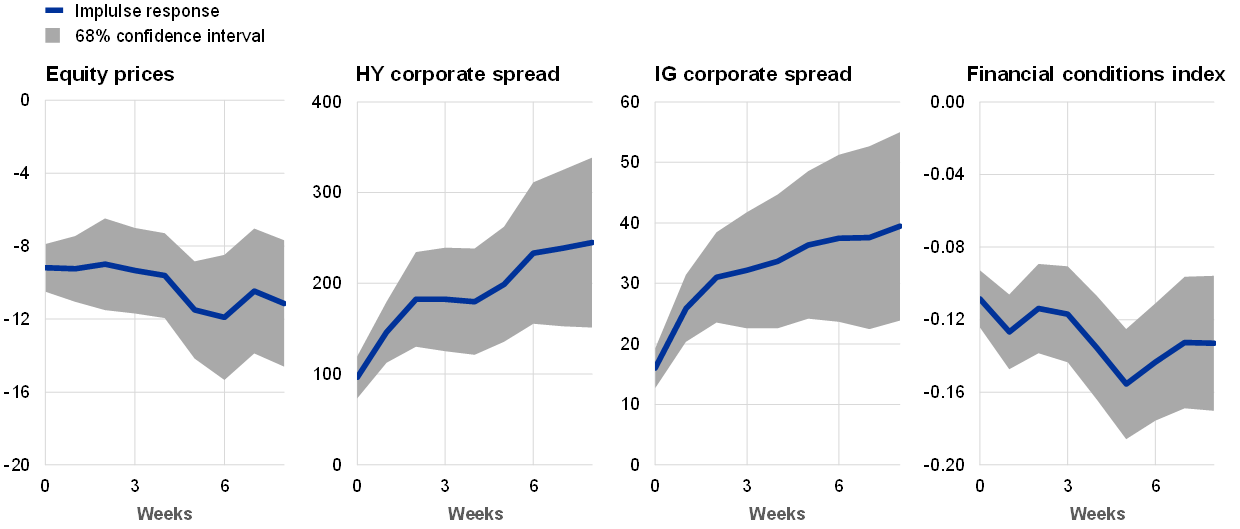

The spillovers to euro area equity markets from a potential US equity market correction could be substantial. For example, past empirical relationships imply that a 10% correction in US equity prices that is associated with a US monetary policy tightening shock might lead to a fall of around 9% in euro area equity prices (see Chart B). One channel could emerge from interest rate spillovers, with greater uncertainty about the future path of US short-term interest rates leading to an increase in euro area bond term premia, which would, in turn, put downward pressure on euro area equities.

An equity market correction would also likely have a broader tightening effect on euro area financial conditions. Past US equity market corrections have also been associated with increases in euro area corporate bond spreads for both investment-grade and non-investment-grade sectors. Overall, a 10% correction in US equity markets could therefore lead to a significant tightening of euro area financial conditions, similar to around a third of the tightening witnessed after the coronavirus shock in March 2020 (see Chart B). These results suggest that spillovers from US equity market repricing could be substantial – with significant repercussions for euro area financial conditions and financial stability.

Chart B

Spillovers to euro area markets from a potential US monetary policy tightening shock could be substantial

Effect of a US monetary policy tightening shock calibrated to a 10% decline in US equity prices on euro area equities, corporate bond spreads and financial conditions

(percentage changes (left panel), basis points (middle panels) and change in standardised index (right panel); calibrated to a 10% decline in US equity prices)

Sources: Refinitiv and ECB calculations.

Notes: The chart shows estimated impulse responses following a decline in US equity prices driven by a US monetary policy tightening shock. The estimation is based on local projections over the period 2003-21 using weekly data, controlling for a lagged VIX index, macro surprises and two-year yields. The shock series are derived from a structural BVAR for the United States with sign and magnitude restrictions using the BEAR toolbox, see Dieppe, A., Legrand, R. and van Roye, B., “The BEAR toolbox“, Working Paper Series, No 1934, ECB, July 2016. The financial conditions index is computed as a weighted average of five financial variables. For further details, see Arrigoni, S., Bobasu, A. and Venditti, F., “The simpler the better: measuring financial conditions for monetary policy and financial stability”, Working Paper Series, No 2451, ECB, August 2020. HY: high-yield; IG: investment grade.