- RESEARCH BULLETIN NO. 75

- 13 October 2020

How has the US coronavirus aid package affected household spending?

The 2020 US CARES Act (Coronavirus Aid, Relief, and Economic Security) aimed to bolster consumer spending. We model the spending and saving behaviour of households during the coronavirus (COVID-19) pandemic, differentiating between the employed, temporarily unemployed and persistently unemployed, and examine how the CARES Act should affect this behaviour. To do this we use a benchmark model which realistically captures the differences in income, wealth and spending between households, and which matches the responses to previous stimulus policies well. We extend the model to account for the fact that, during a lockdown, many types of spending are undesirable or impossible, and that some of the jobs that disappear during lockdown will not reappear when it is lifted. We estimate that, in the case of a short-lived lockdown (which was the median point of view in April 2020), the CARES Act should be sufficient to allow a swift recovery in consumer spending to its pre-crisis levels. For a longer-lasting lockdown (if there is a “second wave” of the virus), an extension of enhanced unemployment benefits is likely to be necessary for consumption spending to recover quickly. We have made the modelling software available for other researchers, so that they can examine the consequences of alternative assumptions about the length of the lockdown, distribution of the stimulus payments, and other modelling choices.

How do we use models that capture inequality to analyse the pandemic and the US fiscal aid package?

In our work originally published online on 15 April 2020 (Carroll et al., 2020b), we show that economic models with realistic heterogeneity, i.e. models capturing inequality, can be used to analyse government policies in a timely manner. Specifically, we investigate what such a model implies about how the US fiscal response to the current pandemic (the CARES Act, passed on 27 March 2020) is likely to affect the spending of different households (and how the individual household choices would aggregate to a macroeconomic outcome).

We adapt a standard model that includes the precautionary saving motive to incorporate two aspects of the coronavirus crisis.

First, during a lockdown, many types of spending are undesirable or impossible. We model the restricted spending options by assuming that during lockdown spending is less enjoyable (there is a negative shock to the “marginal utility of consumption”) and calibrate the reduction in spending to 11 percent of total spending, in line with data on the composition of consumption expenditures.

Second, because the tidal wave of layoffs in the US for employees of businesses that have closed down has a large impact on their income and spending, assumptions must be made about the employment dynamics of laid-off workers. Specifically, the unemployed in our model consist of two categories: “normal unemployed” and “deeply unemployed”. Similarly to in a normal recession, the normal unemployed will be able to quickly return to their old jobs (or similar ones). However, some people become deeply unemployed, facing a more persistent unemployment shock. This reflects the fact that some kinds of job will not resurface quickly after the lockdown and that people who worked in these sectors will have more difficulty finding a new job. In our model we choose an unemployment rate in Q2 2020 that increases to just over 15 percent, consisting of five percent “deeply unemployed” households and ten percent “normal unemployed” households.[2] The likelihood of different households becoming unemployed reflects the fact that the hardest hit sectors disproportionately employ young and unskilled workers.

As for the fiscal response, our model captures the two primary features of the CARES Act that aim to bolster consumer spending:

- The boost to unemployment insurance benefits, amounting to $600 per week for up to 13 weeks (i.e. a total of $7,800 if unemployment lasts for 13 weeks).

- The direct one-time stimulus payments to most households, of up to $1,200 per adult.

- Our modelling assumptions – about who will become unemployed, how long it will take them to return to employment, and the direct effect of the lockdown on consumer spending – could prove to be inaccurate. Reasonable analysts may differ on all of these points, and prefer a different calibration. To encourage exploration of different assumptions, we have made available our modelling and prediction software, with the goal of making it easy for fellow researchers to test alternative assumptions. Instructions for installing and running our code can be found here; alternatively, adjustments to our parametrisation can easily be explored with an interactive dashboard here.

How has household spending responded to the US aid package?

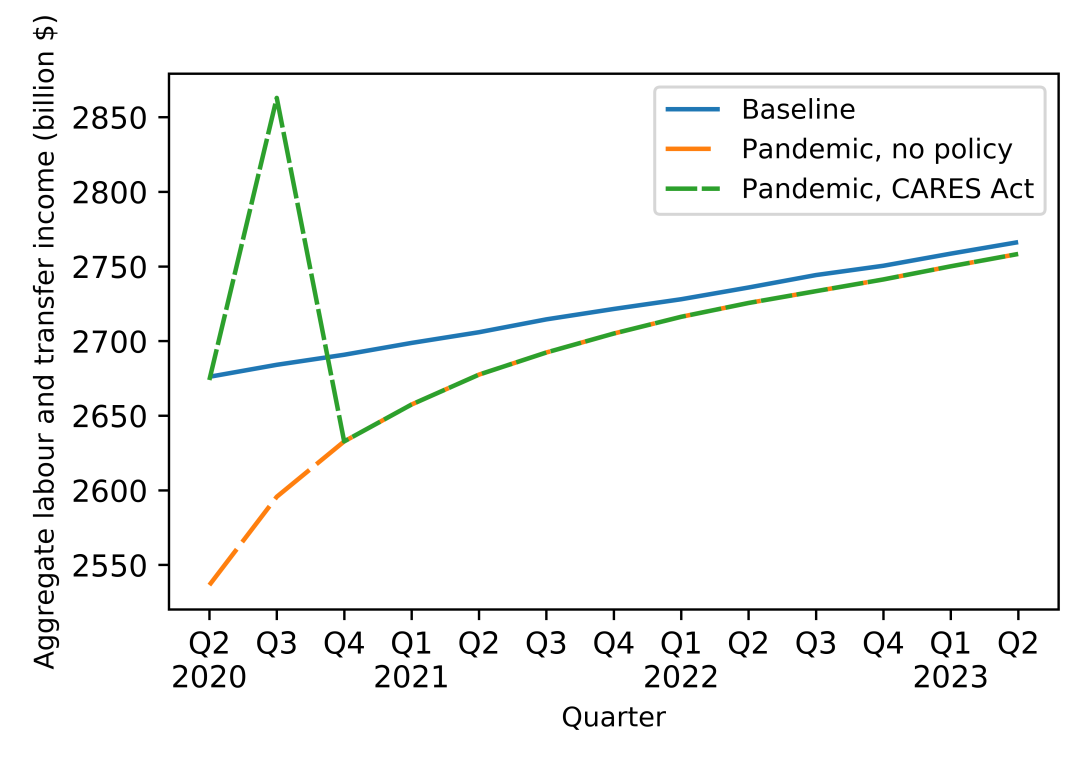

We first calibrate the size of the income and unemployment shocks that hit individual households. Figure 1 shows the path of labour income, calibrated for the baseline scenario and in the pandemic, both with and without the CARES Act. We calibrate the lockdown to last two quarters. Income in quarters Q2 and Q3 2020 is substantially boosted (by around 10 percent) by the extra unemployment benefits and the stimulus payment. After two years, aggregate labour income has almost fully recovered. So far, the existing data reflect that the assumption we made in April 2020 is approximately correct.

Figure 1: Effects of the pandemic and the fiscal stimulus on labour and transfer income

Note: The figure compares aggregate quarterly income (in USD billion) for three scenarios: the baseline scenario with no pandemic, the pandemic scenario with no policy response and the pandemic scenario with the fiscal policy response. Transfer income denotes unemployment benefits and stimulus payments.

We then use our model to analyse the implications of the shocks and the fiscal stimulus for spending of individual households. The model includes the precautionary saving motive, which means that households optimally adjust their spending when hit with an adverse income shock, depending on the size and persistence of the shock, the amount of liquid savings they hold, the expected life cycle income path, their impatience and other factors. Figure 2 shows the three scenarios for aggregate consumption, as generated in our model. The pandemic reduces consumption by ten percent in Q2 2020 relative to the baseline.

Figure 2: Consumption response to the pandemic and the fiscal stimulus

Note: The figure compares aggregate quarterly consumption (in USD billion) for three scenarios: the baseline scenario with no pandemic, the pandemic scenario with no policy response and the pandemic scenario with the fiscal policy response.

Without the CARES Act, consumption remains depressed until the second half of 2021, at which point spending returns to the baseline level, as a result of the building-up of liquid assets during the pandemic by households that do not lose their income. The limited spending options during the lockdown make households save more than they otherwise would, with the result that they build up liquid assets. When the lockdown ends, the pent-up savings of the always-employed are available to finance a resurgence in their spending. On the other hand, the depressed spending of the two groups of unemployed people keeps total spending below the baseline until most of them are re-employed, at which point their spending (mostly) recovers while the always-employed are still spending their extra savings built up during the lockdown.

How do consumption responses vary by employment status?

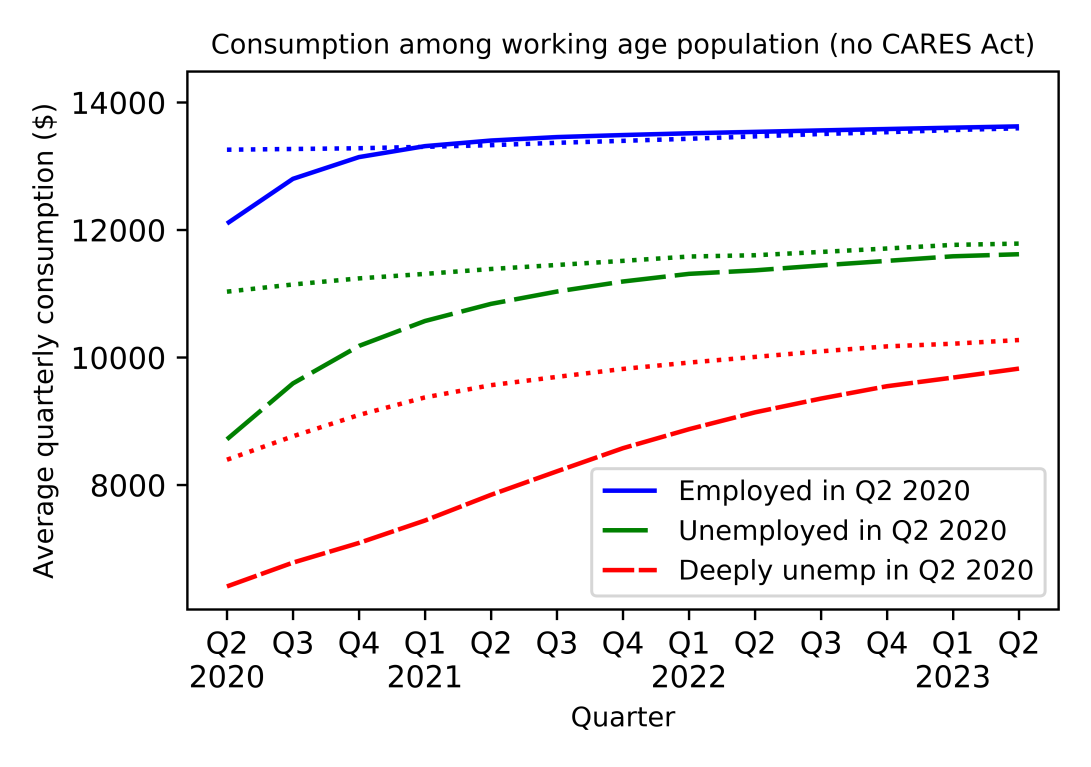

The consumption response varies substantially depending on the employment status of households in Q2 2020. For each of the three employment categories (employed, normal unemployed and deeply unemployed), Figure 3 shows the average household’s consumption relative to the baseline scenario with no pandemic (dashed lines). The upper panel shows consumption without any policy response, while the lower panel includes the CARES Act.

Figure 3: Consumption response by employment status in Q2 2020

Note: The figure compares average quarterly consumption per person (in USD) for two scenarios: no policy (top panel) and CARES Act (lower panel), for three groups of individuals: people employed after the pandemic, people normally unemployed after the pandemic and people deeply unemployed after the pandemic. The dotted lines show the baseline, counterfactual scenario in which the pandemic did not occur.

Households who do not lose their jobs initially build up their savings, both because of the lockdown-induced suppression of spending and because most of these households will receive a significant stimulus payment, much of which the model says will be saved. Even without the lockdown, we estimate that only about 20 percent of the stimulus money would be spent immediately upon receipt, consistent with evidence from prior stimulus packages regarding spending on nondurable goods and services. Once the lockdown ends, the spending of the always-employed households rebounds strongly thanks to their healthy household finances.

The second category of households is the “normal unemployed”, those who lose their job and perceive that it is likely they will be able to resume their old job when the lockdown is over. Our model predicts that the CARES Act will be particularly effective in stimulating their consumption, given the perception that their income shock will be largely transitory. Our model predicts that by the end of 2021, the spending of this group recovers to the level it would have reached in the absence of the pandemic; without the CARES Act, this recovery would take more than a year longer.

Finally, for households in the “deeply unemployed” category, our model says that their marginal propensity to consume using the money from the CARES Act will be smaller, because they know they must stretch that money further. Even with the stimulus from the CARES Act, we predict that consumption spending for these households will not fully recover until the middle of 2023. Even so, the Act makes a big difference to their spending, particularly in the first six quarters after the crisis. For both groups of unemployed households, the effect of the stimulus payments is dwarfed by the increased unemployment benefits, which arrive earlier and are much larger (per recipient).

Overall, the figure illustrates an important feature of the unemployment benefits (which for the unemployed are the decisive part of the support) that is lost at the aggregate level: the response provides the most relief to households whose consumption is most affected by the pandemic. For the unemployed – and especially for the deeply unemployed – the consumption drop when the pandemic hits is much shallower and their spending returns faster toward the baseline when the fiscal stimulus is in place. These findings turned out to be reflected in the actual data when they became available, documenting that the stimulus and insurance programmes played an important role in limiting the effects of labour market disruptions on spending, especially for vulnerable households (see e.g. Cox et al., 2020).

Given the uncertainty about how long and deep the current recession will be, our paper also investigates a more pessimistic scenario in which the lockdown is expected to last for four quarters (rather than two).[3] The longer lockdown causes a much longer decline in spending than the shorter lockdown in our primary scenario. In the shorter pandemic scenario consumption returns to the baseline path after roughly two years without the CARES stimulus in place; the CARES stimulus shortens this recovery to roughly one year. In the longer lockdown the recovery takes around three years and the CARES stimulus shortens this recovery to about two years. In this more pessimistic lockdown scenario, we find that an extension of enhanced unemployment benefits is likely to be necessary for consumption spending to recover more quickly. Such an extension ensures that aggregate spending returns to the baseline path after roughly one year, rather than two, and does so by targeting the funds to the people who are worst hurt by the crisis and to whom the cash will make the most difference.

Conclusions

Our paper illustrates that models with realistic household heterogeneity are nowadays accessible to a large group of economists in academic and policy institutions. These models can easily be used in real time for various policy simulations, such as the effects of the pandemic or the fiscal stimulus on the consumption of individual households.

Our work is subject to several caveats. For example, the model assumes that unemployment benefits do not affect the job search efforts of the unemployed and does not account for the fiscal cost of the stimulus. Finally, we have conducted the exercise for specific parameter values. We invite readers to test the robustness of our conclusions by using the associated software toolkit to choose their own preferred assumptions on the path of the pandemic, and of unemployment, to better understand how consumption will respond.

References

Carroll, C.D., Crawley, E., Slacalek, J., Tokuoka, K. and White, M.N. (2020a), “Sticky Expectations and Consumption Dynamics”, American Economic Journal: Macroeconomics, No 12(3), pp. 40-76.

Carroll, C.D., Crawley, E., Slacalek, J. and White, M.N. (2020b), “Modeling the Consumption Response to the CARES Act”, ECB Working Paper Series, No 2441, July.

Cox, N., Ganong, P., Noel, P., Vavra, J., Wong, A., Farrell, D. and Greig, F. (2020), “Initial Impacts of the Pandemic on Consumer Behavior: Evidence from Linked Income, Spending, and Savings Data”, Brookings Papers on Economic Activity, forthcoming.

- This article was written by Christopher D. Carroll (Johns Hopkins University), Edmund Crawley (Federal Reserve Board), Jiri Slacalek (European Central Bank) and Matthew N. White (University of Delaware). It is based on the ECB Working Paper no. 2441, “Modeling the Consumption Response to the CARES Act”. The authors gratefully acknowledge the comments of Ramon Gomez Adalid, Alberto Martin and Louise Sagar. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank.

- This calibration reflects the fact that while in a normal recession permanent layoffs lead the increase in unemployment, in the current recession temporary layoffs have dominated the dynamics so far.

- In addition, in this scenario the unemployment rate will increase to 20 percent, consisting of 15 percent deeply unemployed and 5 percent normal unemployed. In this scenario we compare how effectively the CARES package stimulates consumption, also considering a more generous, counterfactual plan in which the unemployment benefits continue until the lockdown is over.