Macroeconomic implications of heterogeneous long-term inflation expectations: illustrative simulations through the ECB-BASE

Published as part of the ECB Economic Bulletin, Issue 3/2021.

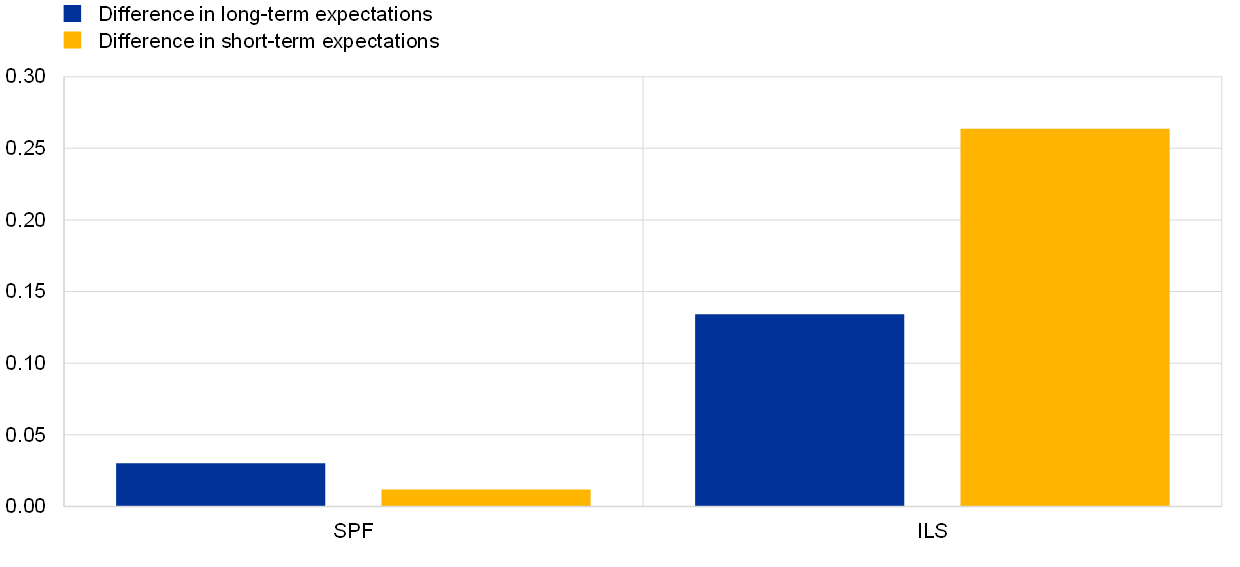

This box explores how heterogeneous expectations across agents can change the macroeconomic outcomes of an increase in long-term inflation expectations. Over the recent period, long-term inflation expectations of financial market participants, which can be measured either from financial market instruments like inflation-linked swaps (ILS) or from surveys of professional forecasters, have been rising. As shown in Chart A, between the fourth quarter of 2020 and the first quarter of 2021, inflation expectations increased only slightly according to the ECB Survey of Professional Forecasters (SPF), while this pattern was more pronounced for market-based measures.[2] In assessing the macroeconomic implications of a rise in long-term inflation expectations, a critical factor with regard to the propagation mechanism is whether other sectors of the economy (notably households and firms) share the same expectations as priced by financial markets. This issue is explored through the lens of the ECB-BASE[3] model, conducting illustrative simulations where the agents modelled have different perceptions of a shift in long-term inflation expectations.

Chart A

Changes in HICP expectations in the SPF and ILS rates

(changes between Q4 2020 and Q1 2021, year-on-year growth rates, percentage points)

Sources: Statistical Data Warehouse and Eurosystem staff calculations.

Notes: This chart shows the difference between Q4 2020 and Q1 2021 expected inflation. Two sources of expected inflation are compared. The first one is HICP inflation expectations from the ECB Survey of Professional Forecasters (SPF). It corresponds to the average of point forecasts given by the forecasters. The second is the inflation calculated from the euro area inflation-linked swap (ILS) rates. For each source of inflation, long-term and short-term expectations differences are shown. In the case of the SPF, the short term is the 2021 expected annual inflation and the long term is the five-year-ahead expected annual inflation. For ILS, the short term is calculated as the percentage deviation between the two-year-ahead swap rate and the one-year-ahead swap rate and the long term corresponds to the percentage difference between the ten-year-ahead swap rate and the five-year-ahead swap rate.

The macroeconomic implications of alternative mechanisms of expectations formation, their heterogeneity across economic agents and the interplay with monetary policy remain an active field of theoretical and empirical research. A significant part of the literature on structural macroeconomic models relies on the assumption of rational expectations and perfect common knowledge among economic agents. At the same time, data cannot explain exactly how expectations are formed and there is evidence suggesting departures from rational expectations, even if some convergence towards rational expectations over time cannot be excluded. Accordingly, the literature has modified macroeconomic models to incorporate alternative mechanisms of expectations formation, such as learning (Slobodyan and Wouters[4]), hybrid expectations (Levine et al.[5]), rational inattention (Maćkowiak and Wiederholt[6]) and sticky information (Reis[7]).

In the context of central bank macroeconomic models, the large semi-structural model ECB-BASE can be operated under various expectations settings and allows for some heterogeneous design across model agents. These features are well suited to examining the transmission of changes in long-term inflation expectations. Heterogeneous perceptions across economic agents could indeed significantly affect the associated macro-financial implications. The key mechanisms at play operate through the perceived real rates across economic agents: to the extent that households and firms update their long-term inflation expectations, higher long-term nominal yields could still be consistent with lower real rates and thereby provide an expansionary effect on spending. On the other hand, where financial market participants increase their long-term inflation expectations by more than other economic agents and this is reflected in market prices, the subsequent rise in nominal financing costs translates into higher real rates for households and firms which may weigh on their spending decisions.

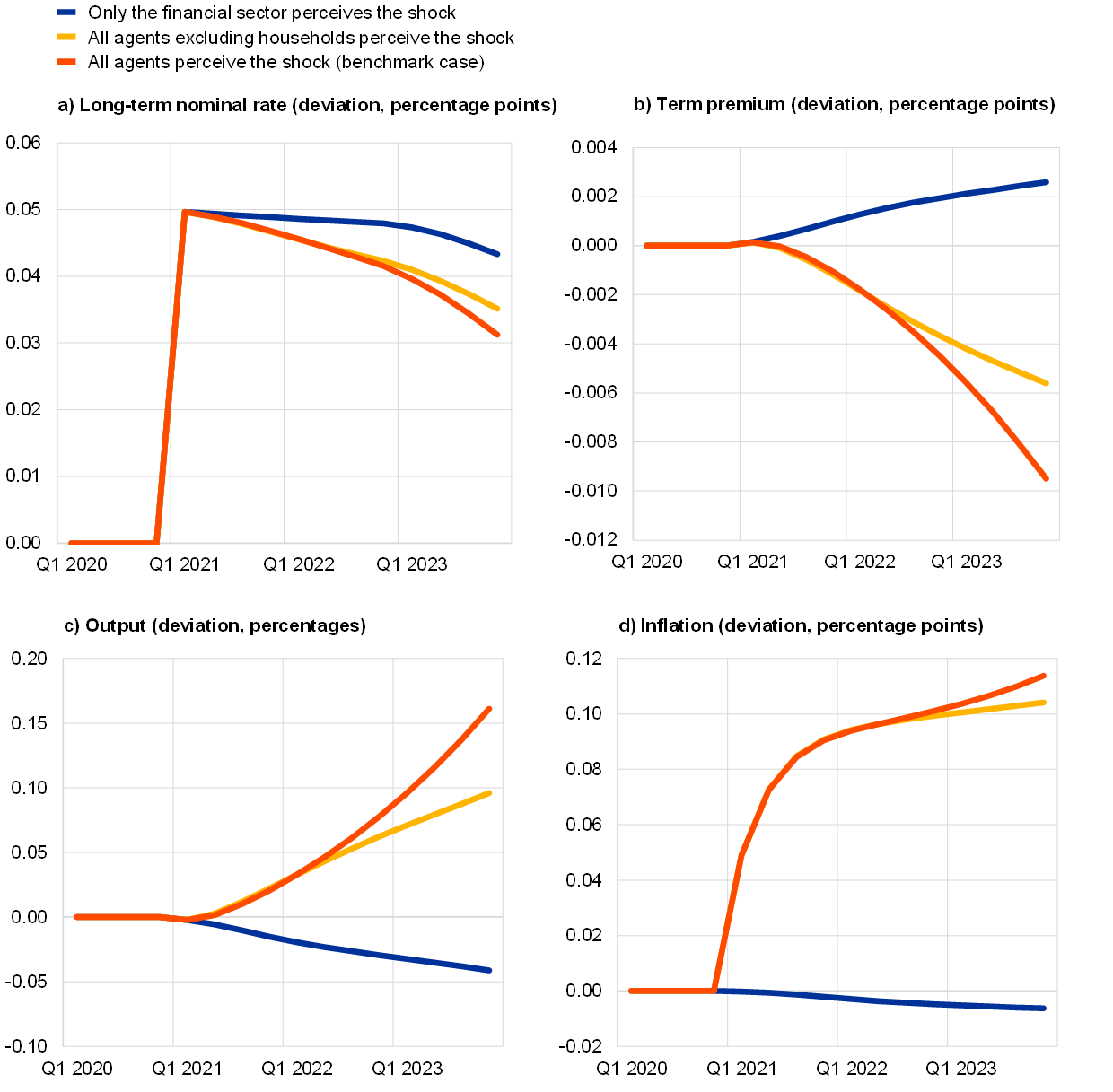

The ECB-BASE can be used to perform a sensitivity analysis on the macroeconomic implications of an illustrative exogenous shift in long-term inflation expectations. Assuming a 0.1 percentage point permanent increase in long-term inflation expectations, three simulation modalities are contrasted according to the perception of shock by i) all agents; ii) all agents (also including firms as in the first modality), but excluding the household sector; or iii) the financial sector only.[8] Chart B presents the simulation results for output, inflation, the term premium and the long-term interest rate. In all cases, financial markets are pricing the increase in inflation expectations and update their beliefs on the future course of the short-term interest rate. Consequently, long-term interest rates increase on impact by around 50 basis points in the three scenarios.[9] Beyond this first stage of transmission, the macroeconomic propagation crucially depends on expectations in the other sectors.

Chart B

Macro-financial implications of higher longer-term inflation expectations

(impact of a 0.1 percentage point increase in long-term inflation expectations, per annum)

Source: ECB calculations based on the ECB-BASE model.

Notes: In all simulations we assume a 0.1 percentage point increase in long-term inflation expectations. Monetary policy and the exchange rate are kept unchanged. The scenarios vary according to the perception of the shock across the various agents. In red: all agents perceive the shock (benchmark case). In yellow: all agents excluding the household sector perceive the shock. In blue: only the financial sector perceives the shock.

A broad-based expectation of higher longer-term inflation can be expected to lift the short to medium-term inflation outlook and have an expansionary effect on economic activity. If the shift in long-term inflation expectations is common knowledge among all sectors of the economy, price and wage-setters would factor in such perceptions when taking decisions, thereby leading to an increase in short-term inflation expectations and ultimately actual inflation. Indeed, although the long-term nominal rates increase (despite the short-term nominal interest rate remaining unchanged, as monetary policy is assumed not to react), the real rates drop owing to the increase in inflation expectations, thereby stimulating capital expenditures by firms. The easing of real financing conditions also reaches households, notably through higher house prices and wealth, and stimulates residential investment. Conversely, the real income channel works in the opposite direction for consumption as households perceive an erosion of their expected real income. On balance, the net effect is expansionary after a few quarters and overall output increases by 0.2% above the baseline after two years. The economic stimulus then validates the increase in short-term inflation and contributes to the build-up of underlying inflation pressures: inflation reaches 0.1 percentage point above the baseline over the simulation horizon.

If households do not perceive an increase in long-term inflation expectations, the positive impact on output and inflation is somewhat less pronounced. In the second simulation, households do not change their inflation expectations when forming expectations about permanent incomes, wealth and real rates. Consequently, the tightening of nominal lending rates is also perceived in real terms, leading to a drop in house prices and wealth compared with the previous simulation. Lower wealth and expectations about permanent incomes drive consumption behaviour over the simulation horizon, leading to lower consumption and lower output than in the previous simulation.

Assuming that the financial markets are the only segment of the economy repricing higher longer-term inflation expectations, the associated tightening of financing conditions would hamper the spending decisions of firms and households and prevent any price pressures from building up. The increase in long-term inflation expectations leads to an increase in long-term rates. Inflation and wages do not increase, however, as price and wage-setters do not internalise increases in long-term inflation expectations. Real rates increase as households and firms do not perceive the shift in long-term inflation expectations, which leads to a drop in investment and lower wealth. Consumption drops owing to lower wealth and real incomes, and the worsening of expected economic conditions leads to an increase in the term premium and risk premia.

- The authors would like to thank Alice Carroy for her valuable research assistance and contribution to this box.

- Inflation expectations may also be measured through business and household surveys: on the latter, see the article entitled “Making sense of consumers’ inflation perceptions and expectations – the role of (un)certainty”, Economic Bulletin, Issue 2, ECB, 2021.

- See Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, September 2019.

- Slobodyan, S. and Wouters, R., “Learning in an estimated medium-scale DSGE model”, Journal of Economic Dynamics and Control, Vol. 36(1), 2012, pp. 26-46.

- Levine, P. et al., “Endogenous persistence in an estimated DSGE model under imperfect information”, The Economic Journal, Vol. 122, No 565, 2012, pp. 1287-1312.

- Maćkowiak, B. and Wiederholt, M., “Business Cycle Dynamics under Rational Inattention”, The Review of Economic Studies, Vol. 82, No 4, 2015, pp. 1502-1532.

- Reis, R., “Optimal Monetary Policy Rules in an Estimated Sticky-Information Model”, American Economic Journal: Macroeconomics, Vol. 1, No 2, 2009, pp. 1-28.

- In the model, the long-term inflation expectations play a role of perceived inflation target. The perceived inflation target, together with estimated dynamics, forms the basis for the inflation expectations of agents. The change in perceived inflation target therefore affects inflation expectations and, via the Phillips curve and other behaviour equations that depend on expectations, the macroeconomy at large.

- We assume an ex ante rational pricing kernel of the expected average short-term rate over the horizon. This implies that the expected average short-term rate is consistent with outcomes under a scenario where all agents adapt their expectations.