The impact of the recent inflation surge across households

The impact of the recent inflation surge across households

Published as part of the ECB Economic Bulletin, Issue 3/2023.

1 Introduction

This article investigates the impact across households of the surge in euro area inflation since mid-2021. High inflation was spurred by a combination of factors. Starting in 2021, the euro area and global economies reopened after the lockdown period against the background of lingering supply bottlenecks. In early 2022, after the Russian invasion of Ukraine, the price of imported energy, which had already been increasing, skyrocketed. This implied a large negative terms-of-trade shock for the euro area.[1] While the surge in inflation was initially triggered predominantly by global factors, the role of domestic demand increased over time with the recovery of the economy after the COVID-19 pandemic restrictions were lifted.[2]

The origins of inflation along with households’ characteristics contribute to determining the welfare effects of persistently high inflation and its distributional implications. The exposure to inflation shocks depends on the level and the composition of three main household characteristics: consumption, income and wealth. In the current inflationary episode, the distributional consequences via the consumption channel have been particularly large because the terms-of-trade shock primarily affected necessities such as energy and food. Low-income households spend proportionately more on such necessities and have little scope for substituting expenditure on these items.[3]

Different households also have different margins of adjustment to inflationary shocks depending on their income and balance sheet characteristics.[4] Apart from lowering consumption, households can borrow, tap into their savings, work longer hours and ask for wage increases. However, low-income households tend to have less or no scope for reducing consumption, tapping into savings, accessing credit and bargaining for higher wages. Furthermore, they face a higher unemployment risk if the surge in inflation triggers an economic downturn, which becomes more likely when inflation is driven, to a large extent, by foreign supply shocks.[5] Finally, households can hedge against high inflation via the wealth channel. Holding real assets such as housing or equity is a better hedge against inflation than holding cash. The option of hedging wealth against inflation is typically more easily available to high-income households, whereas low-income households tend to hold relatively more cash or liquid assets.

This article offers an assessment of the effects of the recent inflation surge on euro area households through these channels. Section 2 discusses the empirical evidence related to the expenditure channel by focusing on inflation heterogeneity and its welfare implications across households. Section 3 presents evidence on the income channel. Section 4 analyses the distributional effects of inflation on household wealth via portfolio compositions and the implications of the inflation surge on borrowers. Section 5 concludes the article.

2 The expenditure channel

When inflation results from sharp changes in relative prices, the inflation rates experienced by single households become more heterogeneous, reflecting households’ different consumption baskets. The literature on inflation heterogeneity notes that on average through time there is no systematic gap between the inflation experienced by lower- and higher-income households.[6] However, the effects of higher inflation on the welfare of lower-income households tend to be stronger when the prices of energy and food increase relative to average inflation (Chart 1, panel a) and when inflation is more volatile in general.[7] This reflects the higher spending share of low-income households on necessities. According to the 2015 Household Budget Survey for the euro area, households in the bottom income quintile spend about 50% of their total expenditure on rent, food and utilities compared with around 25% for households in the top income quintile (Chart 1, panel b).

Chart 1

Inflation and consumption basket exposure by selected components

a) Annual inflation in headline HICP, energy utilities, food and rent

(annual percentage changes)

b) Euro area consumption baskets by income quintile

(share of total expenditure, scaled to 1,000)

Sources: Eurostat and ECB calculations.

Notes: Classification of Individual Consumption by Purpose (COICOP) weights add up to 1000; “Other essentials” includes health, communications, education, water supply and miscellaneous services related to the dwelling. “Discretionary” includes all remaining COICOP categories. Panel b refers to 2015. The latest observations in panel a are for February 2023.

The gap in inflation experienced by households in the bottom and top 20% of the income distribution peaked in late 2022, at the highest level since the mid-2000s (Chart 2, panel a).[8] Complementing this, evidence based on the ECB Consumer Expectations Survey (CES) shows that the spending growth differential between consumers in the bottom and the top quintiles of the income distribution is somewhat narrower than the corresponding gap in perceived inflation.[9] Alongside compositional differences in the spending basket, higher-income consumers reported that they search for deals to curb total spending when inflation rises (Box 1).

Chart 2

Difference in annual inflation between the lowest and highest income quintile households and its decomposition

a) Inflation difference between the lowest and highest income quintile households in the euro area

(percentages)

b) Decomposition of the inflation difference between the lowest and highest income quintile households

(percentages)

Sources: Eurostat HBS, ISTAT and ECB calculations.

Notes: The contributions of individual components are calculated as the component-level inflation rate multiplied by the difference in the weights of the component in the quintile-specific consumption baskets. Quintile-specific inflation rates are calculated including rents but excluding spending on “imputed rents and owner-occupied housing costs”. Weights are based on the 2015 HBS and mechanically updated using the relative price developments in each COICOP sub-component. The latest observations are for February 2023.

Higher-income households have more room to buffer rising prices. They can substitute across consumption classes, reduce consumption by cutting expenses on discretionary items such as air travel or recreational services, and they can also “trade down” within each expenditure category. For instance, according to the ECB’s CES, consumers in households with an income in the top 20% of the distribution can envisage cutting down future consumption of durables to limit total spending almost three times as much as those with an income in the lowest quintile. Also, higher-income households pay a higher price for comparable grocery items and can react by “trading down” from expensive varieties such as organic foodstuffs to budget products, shifting to cheaper outlets or increasing their shopping intensity to hunt for bargains.[10] The “trading down” phenomenon as a buffer for cushioning adverse income shocks was also documented during the global financial crisis.[11] More recently, Kouvavas highlighted it as a source of bias in inflation measurement owing to a shift in composition towards goods and services of a lower quality.[12]

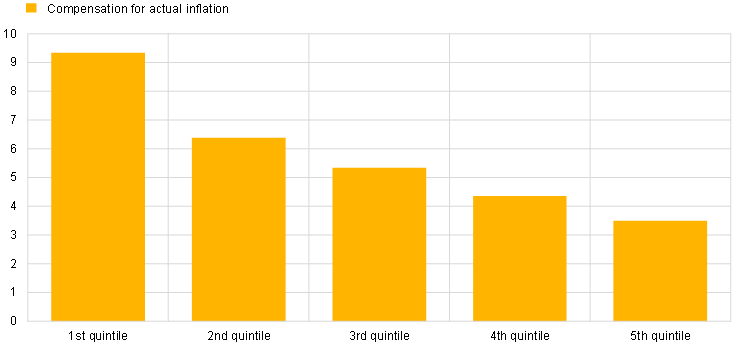

The welfare loss associated with higher inflation can be quantified by calculating the hypothetical lump-sum transfer that would reinstate the pre-inflation welfare level. Evidence based on the ECB’s CES shows that the lump-sum transfer required to compensate households in the lowest income quintile for inflation in 2022 would be three times as large as a fraction of their income, as the transfer to households in the top income quintile (Chart 3).[13] The differential widens to ten times when comparing the bottom and top 5% of the income distribution.

Chart 3

Hypothetical lump-sum transfer compensating for inflation in 2022 across income quintiles

(percentages of net nominal income)

Sources: Eurostat and CES.

Notes: The lump-sum transfers refer to the entire population. These are computed assuming a Cobb-Douglas utility function. This results in income compensations being equivalent to the weighted sum of inflation rates by spending category (experienced and perceived) between t1 and t0, multiplied by the share on total spending of each category in net income at t0.

However, these lump-sum transfers could overstate the actual welfare losses incurred by high-income households, which in 2022 spent more to meet their pent-up demand, in particular for travel and recreation. Evidence based on the ECB’s CES shows that in 2022 the spending to income ratio rose more than it normally would for any percentage point increase in the spending share of utilities. Furthermore, there is evidence of unusually low saving ratios for households that spent more on furniture, restaurants and travel. Both types of spending contributed to the surge in inflation. However, in one case, higher spending met basic needs following an exogenous rise in the price of necessities and, in the other case, more spending reflected utility optimisation by consumers allocating time and financial resources to leisure activities after the pandemic restrictions were lifted. Implications are markedly different in the two cases, with welfare losses substantially higher in the case of an exogenous rise in the price of a necessity as compared to a luxury good.[14] Therefore, the lump-sum transfer should be adapted to take discretionary consumer choices into account.

Box 1

How consumer behaviour changes with inflation

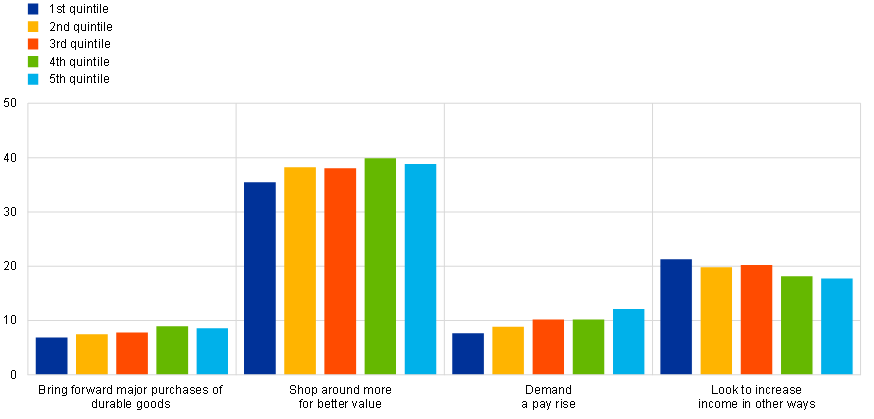

In December 2022 CES participants were asked to consider their inflation expectations 12 months ahead and select the measures they might take to curb the effects of expected inflation on their total spending. Different actions were chosen by different income groups to varying degrees (Chart A). The strategy of shopping around for deals was most frequently reported, especially by consumers in the top 20% of the income distribution who reported it 40% of the time, compared with 35% reported by consumers in the bottom 20% of the distribution. This reflects the greater extent to which higher earners can “trade down” their shopping basket, while low-income consumers are already buying mainly budget items. Also, the option to bring forward major purchases of durable goods was selected almost twice as often by consumers with an income above the median who, in general, purchase durable and large items more frequently than those in the lower-income quintiles. In terms of income adjustment, only one in ten consumers would directly ask for wage compensation, and this occurred more often among those with high incomes, reflecting their relatively stronger bargaining power. Conversely, consumers with low incomes would search for alternative means, such as a second job or working longer hours, to compensate for the more expensive cost of living. On average, consumers with a lower income chose this strategy almost three times more frequently than demanding wage compensation. Overall, survey results seem to confirm that consumers with high incomes have more of a buffer to cushion the impact of higher prices on their welfare.

Chart A

Strategies to cope with price inflation across income quintiles

(percentages)

Source: CES.

Notes: The question in the CES reads as follows: “Please think about your expectations for changes in prices in general over the next 12 months. Which of the following actions, if any, are you taking, or planning to take, over the next 12 months? Please select all options that apply. 1. Bring forward major purchases of durable goods. 2. Reduce usual spending and put aside more money. 3. Shop around more actively for goods and services with better value. 4. Reduce the amount of money usually put aside and increase spending. 5. Liquidate (some or all) savings to finance spending. 6. Demand a pay rise from your current employer. 7. Look to increase your income in other ways (e.g. change jobs, take on a second job, work more hours with current employer). 8. None of the above.”

3 The income channel

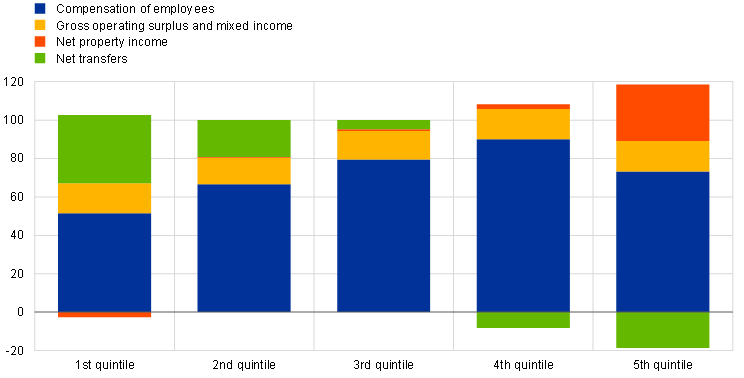

Inflationary shocks transmit differently to households depending on their income and its composition. Wages and social benefits largely make up the income of lower- and middle-income households (Chart 4). While minimum wages and pensions are indexed to inflation in many countries, providing some protection to households at the lower end of the income distribution, general wages typically adjust to inflation partially and with some lags.[15] By contrast, higher-income earners receive around 40% of their income from financial investments and entrepreneurial activities, which adjust more rapidly to inflation, offering a better hedge, also owing to income source diversification (Section 4).[16] In the current inflation episode, in an environment of resilient demand, many firms were able to increase profit margins, also recouping losses experienced during the pandemic restrictions. Part of these profits were redistributed as dividends, benefiting those households that hold equities in their portfolios.

Chart 4

Decomposition of gross income by sources and across income quintiles

(percentages)

Sources: Eurostat income, consumption and survey data.

Note: The latest observations are for 2021.

Low- and middle-income earners report being more vulnerable to purchasing power losses. Low-income workers could rely on collective wage bargaining power through unions. However, based on evidence from the ECB’s CES they seem aware that individually their leverage is limited. Their income expectations react less significantly to rising inflation and, when queried, they are more likely to search for an alternative income source (e.g. by working more hours or taking on a second job) than to ask for a pay rise. High-income households, by contrast, are more likely to ask for pay compensation (Box 1). Additionally, the ECB’s CES notes that the probability of losing one’s job in an economic slowdown declines steadily as income rises, with low-income individuals regularly reporting higher expected unemployment rates.

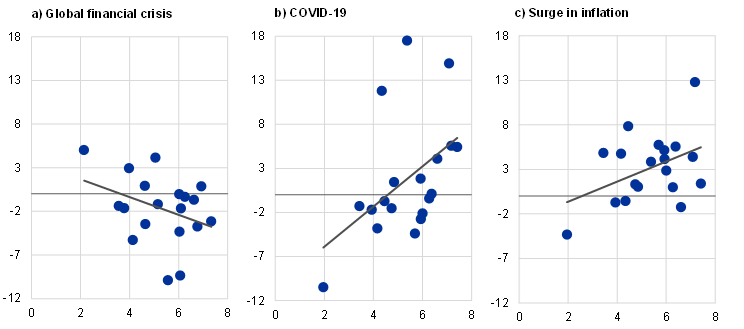

This time, employment dynamics did not contribute to inequality through the income channel. In this regard, it is interesting to compare how employment across income groups evolved in different episodes. At the beginning of the pandemic lockdowns, contact-intensive services skewed unemployment risks and income losses towards workers in lower-income quintiles, who tend to be more frequently employed in hospitality and restaurants.[17],[18] However, unlike during the global financial crisis, employment was more resilient in well-paid sectors (Chart 5). At the same time, large-scale national job retention schemes – particularly short-time work schemes which were introduced in almost all EU Member States – succeeded in preventing layoffs and containing unemployment, protecting the most vulnerable workers.[19] As a result, employment dropped less significantly in the economic sectors with lower average income rates. Even more so, since pandemic restrictions were lifted in the second half of 2021, employment has recovered especially well in those contact-intensive sectors that had initially been more affected by the pandemic. The ECB’s CES shows that unemployment rates increased more significantly for workers with below-median incomes in the second half of 2020.They then fell by a greater degree for the same income class in the course of 2021 (Chart 6).[20] At the same time, no further improvements were visible in 2022, and early signs of a general deterioration emerged in the second half of the year.

Chart 5

Average income and employment developments by economic activity

(x-axis: average income deciles; y-axis: percentage change in employment)

Sources: Eurostat labour force survey and Survey on Income and Living Conditions (EU-SILC).

Notes: “Global financial crisis” refers to the period from the fourth quarter of 2008 to the fourth quarter of 2010; “COVID-19” refers to the period from the fourth quarter of 2019 to the second quarter of 2021; “Surge in inflation” refers to the period from the third quarter of 2021 to the third quarter of 2022. The latest observations by average income decile are for 2021. The latest observations of employment by sector are for the third quarter of 2022. The sectors are classified according to the NACE, which is the statistical classification of economic activities in the European Community.

Chart 6

Dynamics of unemployment rates by income class

(percentage points)

Source: CES.

Notes: Unemployment rates are the ratio between the unemployed population and the labour force, calculated separately for each income group. Differences in unemployment rates are relative to the unemployment rate in the second quarter of 2020. The latest observations are for the fourth quarter of 2022.

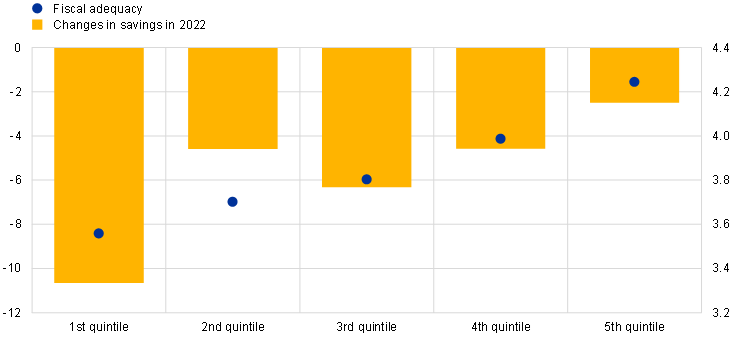

Households with low earnings have thinner savings buffers and are therefore in greater need of government measures to prevent financial distress. Lower-income households also have lower saving rates, lower accumulated savings and, by extension, less room to buffer cost increases when faced with adverse shocks.[21] They often dissave, with a negative median saving rate of -5.86% for the bottom income quintile, whereas those in the top quintile of the income distribution save around 40% of their net disposable income.[22] Based on saving flows reported on a quarterly basis in the ECB’s CES, the share of dissavers among households in the bottom income quintile is estimated to have risen by 5 percentage points in 2022 to 25% compared with 2021. The saving rate for those in the bottom income quintile with positive savings fell by 10 percentage points, four times more than the drop estimated for consumers in the top income quintile. The ECB’s CES asked respondents to grade the perceived adequacy of fiscal measures in protecting their financial situation from the impact of high energy prices.[23] Despite the very substantial increase in energy prices, the average perceived adequacy at the end of 2022 improved compared with the previous year.[24] The negative association between the size of the saving drops in 2022 and the perceived adequacy of government measures indicates that lower-income households have a greater need for fiscal support (Chart 7). The higher the income, the lower the sacrifice in savings and the higher the average adequacy score.

Chart 7

Changes in savings and adequacy scores of fiscal measures

(left-hand scale: percentage of net nominal income; right-hand scale: perceived adequacy of intervention on a scale of 0 to 10)

Sources: Eurostat and CES.

Notes: The question on fiscal adequacy was formulated as follows: “Many governments are currently taking measures to ease the burden on households of higher energy prices. To what extent do you think that the measures in your country will be sufficient to maintain your household’s usual spending on goods and services? Scale: 0 = completely insufficient, 10 = fully sufficient”. The change in the saving rate in 2022 only considers consumers who were net savers. In the CES, quarterly saving flows are reported in intervals; these were mapped into point estimates through a double-censored Tobit model of savings using households’ characteristics and total spending. In the estimation, savings are assumed to fall within a range defined by the upper and the lower value in the interval.

Box 2

Inflation, fiscal policy and inequality

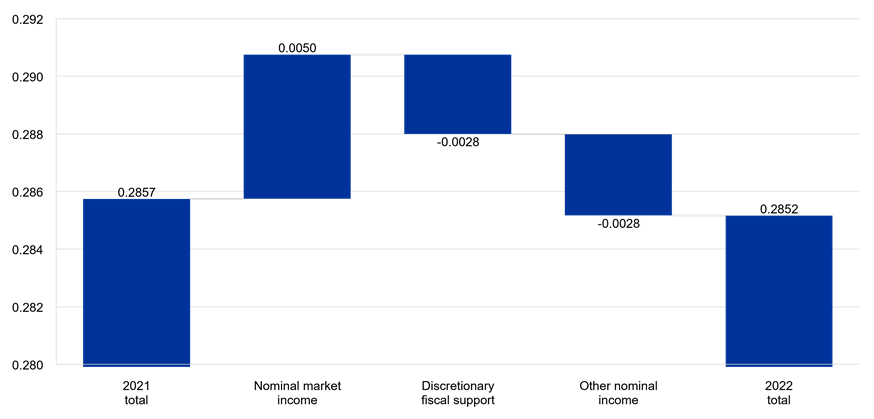

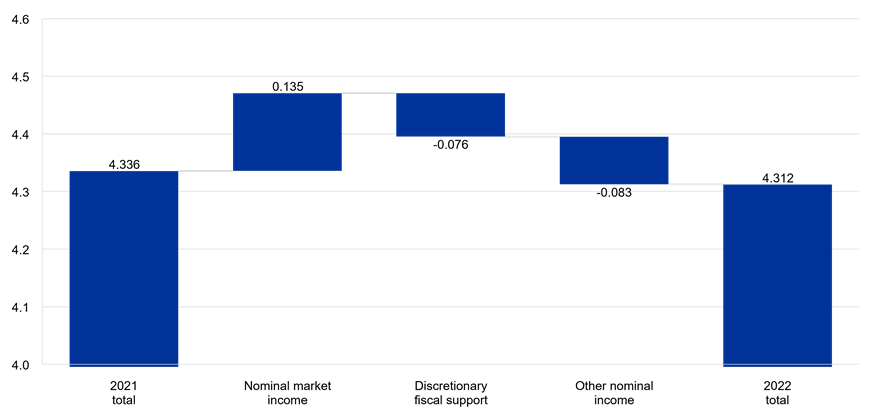

Governments across the euro area acted to mitigate the impact of high inflation by implementing measures to contain price increases and by supporting households and firms through direct transfers and tax relief.[26] This box assesses the impact of these fiscal measures on households’ income inequality scores in 2022 and compares them with the perceived effects reported in the ECB’s CES.

Overall, fiscal measures taken by governments have offset the inequality gap opened up by high consumer price inflation. The ESCB Working Group on Public Finance, together with the European Commission’s Joint Research Centre, has assessed the distributional impact of government measures to compensate for high consumer inflation in 2022.[27] Although the size and impact of the packages providing fiscal relief for energy prices have varied across countries, these inflation compensation measures have curbed the widening of after-tax income inequality in the euro area. Chart A, panel a shows the change in the Gini coefficient for disposable household income between 2021 and 2022. For the euro area, the inflationary shock resulted in an uptick in income inequality.[28] This was offset by discretionary energy-related fiscal support to households. Lower-income households also benefited more from other government transfers and non-energy related policy changes. The inequality gap has now closed. The income quintile share ratio – an alternative measure of inequality that calculates the ratio of the total income received by the 20% of the population with the highest income to the 20% with the lowest – paints a very similar picture (Chart A, panel b).

Chart A

The effect of fiscal measures on the euro area Gini coefficient and the at-risk-of-poverty rate

a) Gini coefficient

b) Income quintile share ratio

Source: Amores, A. et al. (forthcoming).

Notes: The results are calculated from microsimulations based on EUROMOD and data from EU-SILC. Other nominal income growth is a result of policy changes unrelated to extraordinary inflation compensation measures, such as changes to social benefits or tax schedules. Lower values of the Gini coefficient denote lower inequality. The euro area aggregate is proxied by Germany, Greece, Spain, France, Italy and Portugal.

The ECB’s CES asked respondents to report about the type of support they received from their government aimed at tackling the effects of high energy prices on their balance sheet. Those in the bottom 20% of the income distribution reported having received direct and/or welfare payments compensating for increased energy spending more frequently, in line with economic data. Conversely, households in the top 20% of the income distribution reported having primarily benefited from untargeted measures like energy and fuel price caps (Chart B).[29] Moreover, the respondents with low incomes who reported having benefited from direct payments have improved their perception of fiscal measures adequacy by more, in line with compensation measures targeting this income class.

Chart B

Fiscal measures by income quintile

(percentage of respondents)

Source: CES.

Note: The vertical axis plots the percentage of consumers who reported having benefited from fiscal support measures.

In conclusion, while the bulk of government measures did not target only lower-income households, they did mitigate the inflation gap created by high energy-driven consumer price inflation to some degree and this is reflected in household survey data. At the same time, the ECB’s CES results also show that fiscal measures did not exclusively target the most vulnerable social groups and that benefits were felt by households across the income spectrum. Indeed, some measures favoured higher earners over lower-income households, raising questions regarding both their efficiency and their economic side effects.

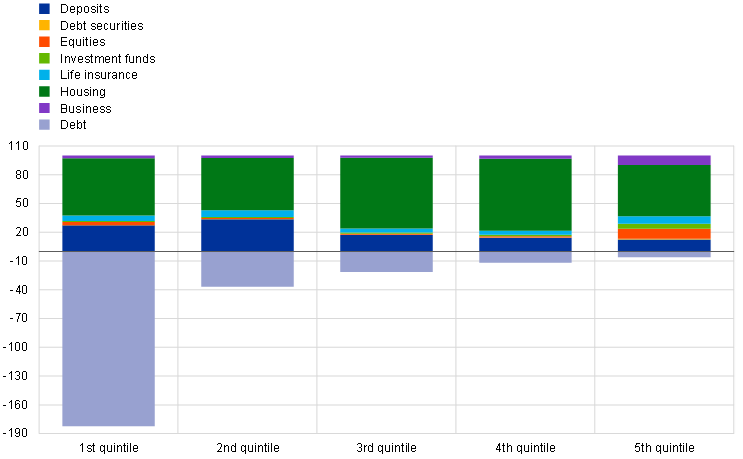

4 The wealth channel

There is significant inequality in household wealth and balance sheet portfolio compositions along the wealth distribution. In 2022, ECB distributional wealth accounts showed that the bottom quintile of euro area households held only around 1% of total assets, while the top quintile owned around 70% (Chart 8, panel a). Financial wealth is even more concentrated, with around 90% held by households in the top quintile. In the euro area, the leverage ratio for households in the top 20% of the wealth distribution remained low at below 10% and stayed largely constant over time. In addition, the leverage ratio for those in the bottom 20% rose over time, reaching nearly 160% and indicating that this group relied heavily on debt to finance their investment plans, overexposing them to interest rate hikes.[30] This section first assesses how inflation can directly affect net worth valuations and alter the distribution of wealth across the population by lowering the real value of assets and liabilities. It then discusses an indirect channel of inflation transmission to wealth inequality working through households’ heterogenous exposure to changes in monetary policy.

Chart 8

Assets and liabilities, and portfolio composition across the net wealth distribution

a) Assets by net wealth quintile

(EUR thousands per household)

b) Portfolio composition by net wealth quintile

(percentage of assets)

Sources: ECB Experimental Distributional Wealth Accounts and ECB calculations.

Notes: Panel a): adjusted total assets/liabilities (financial and net non-financial) based on net wealth concept, per household. Panel b): debt includes both mortgage and consumer loans and is represented with a minus. The latest observations are for the third quarter of

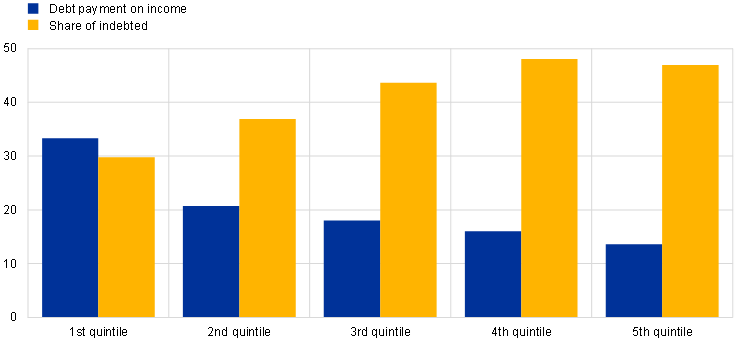

The composition of assets and liabilities across the wealth distribution determines the extent to which high inflation can affect wealth inequality. In general, owing to income uncertainty and barriers to entry in most markets for non-monetary financial assets, poorer households hold a greater proportion of their wealth in cash or bank deposits. While cash and bank deposits are easily accessible, they are also subject to purchasing power erosion caused by inflation. In contrast, richer households are more likely to split their holdings in equities, investment funds and bonds, which offer better protection against inflation, owing to portfolio diversification (Chart 8, panel b). Early studies focusing on the mid-1950s to 1970s concluded that high inflation leads to a drop in wealth inequality by redistributing wealth from lenders to borrowers through changes in the real value of nominal assets and liabilities.[31] However, while higher inflation does erode the real value of nominal assets, it can, in certain circumstances, also lower the real value of nominal liabilities such as mortgages. Some empirical analyses confirm that moderate unexpected inflation substantially redistributes wealth from richer, older households that are net creditors to younger, middle-class households with fixed mortgage debt.[32] However, if expectations adjust, an inflation premium will erase the initial benefit for borrowers by increasing the debt burden. The CES shows that fewer lower earners are indebted, but those that are allocate more of their income to debt repayments. At the bottom of the income distribution, a third of income is used for debt payments (including non-mortgage consumer loans), whereas at the top, less than 15% is allocated for debt repayments (Chart 9). Finally, when higher unexpected inflation reduces the real interest income of low and medium-income households and increases the profit income of high-income households, the Fisher channel is weakened.[33] In this regard, wealth composition plays a salient role in the transmission of inflationary shocks.

Chart 9

Debt payment-to-income ratio and share of indebted households across the income distribution

(percentages)

Sources: CES and ECB calculations.

Note: The chart shows the share of net income in households with positive debt allocated to debt payments and the share of households with positive debt.

The wealth channel tends to work asymmetrically when inflation is largely driven by external supply shocks, as is the case in the current episode. This is because the Fisher channel only works fully if income adjusts to inflation, lifting the payments burden from indebted households, which are usually those at the bottom of the wealth distribution. This would happen more naturally when inflation is driven by demand shocks. However, as discussed in Section 3, incomes have hitherto stagnated in the current inflationary episode. At the same time, inequality in savings has been exacerbated by inflationary cost-push shocks, to the extent that low-income households have been forced to tap more into their liquid savings.[34]

The wealth distribution is strongly affected by asset valuations. Changes in the net wealth of euro area households are primarily driven by gains and losses on real estate and equity holdings, as well as portfolio rebalancing effects which, in turn, have followed house and stock prices very closely. However, because house prices are less volatile than equity prices and housing wealth is more evenly distributed across households, their correlation with inequality in real estate holdings is weaker than the correlation between equity prices and holdings, which are predominantly held by richer households.[35] Financial wealth inequality in the form of equities, as measured by the Gini coefficient, increased steadily during the sovereign debt crisis, but has moved significantly less since then (Chart 10).

Chart 10

Changes in asset prices, financial wealth and inequality in the euro area

(left-hand scale: annual percentage changes; right-hand scale: Gini coefficient, annual percentage changes)

Sources: Eurostat, ECB Experimental Distributional Wealth Accounts and ECB calculations.

Notes: The Gini coefficient is calculated based on distributional wealth accounts statistics, only available with a reference date of 2009. Equity prices are measured by the Dow Jones EURO STOXX 50 Price Index, which, while relatively narrow, correlates with the financial wealth valuation indicator. The latest observations are for the third quarter of 2022.

5 Conclusions

This article reviews the different channels of the heterogenous impact of inflation across households and assesses their effects in the current inflationary episode. The analysis of data from various sources suggests that the strength of the three main channels has been different.

The expenditure channel has been particularly strong because low-income households are more exposed to increases in the prices of necessities such as energy and food. The prices of these necessities increased far more than other prices following the sharp surge in commodity prices since mid-2021. This effect is amplified by the fact that low-income households have limited scope for “trading down” from expensive varieties or substituting spending across different classes.

By contrast, a resilient labour market and fiscal support measures have mitigated the adverse distributional effects of high inflation on households through the income channel. Nevertheless, when assessing the impact of high inflation in 2022 on saving behaviour, low-income households again appear to have suffered disproportionately. Despite the fiscal relief available, more households dissaved, and those with limited savings had to make the most significant sacrifices.[36] This is consistent with government support increasingly being perceived as inadequately compensating for the loss in purchasing power by lower-income consumers.

So far, the impact of inflation via the wealth channel is less clear as inflation worked asymmetrically. It has not led to a redistribution of nominal wealth to borrowers by reducing the real value of their debt, as incomes have not sufficiently adjusted to inflation so far. Still, it has reduced the real value of the net assets predominantly owned by higher-income households. When inflation is mostly driven by a terms-of-trade shock, incomes do not rise enough to reap the benefit of the falling real value of debt.

Monetary and fiscal policy each have a role to play in addressing the impact of high inflation. Fiscal policy can best contribute to alleviating the impact of the adverse terms-of-trade shock – especially on lower-income households – through targeted, temporary and tailored income support measures. Monetary policy can best contribute by bringing inflation back to a level in line with the price stability objective.[37] Central to this is the anchoring of inflation expectations, so as to avoid a wage-price spiral. By supporting lower-income households specifically, whose livelihoods depend strongly on the purchasing power of wages, fiscal policy also indirectly helps to ward off a wage-price spiral.

When assessing the impact of energy price changes on households’ purchasing power, the ratio between the GDP and private consumption deflators (or between income and the expenditure deflators) is a useful indicator.

See the box entitled “The role of demand and supply in underlying inflation – decomposing HICPX inflation into components”, Economic Bulletin, Issue 7, ECB, 2022.

For consumption shares by income quintile, see the box entitled “The impact of the recent rise in inflation on low-income households”, Economic Bulletin, Issue 7, ECB, 2022. See also Strasser, G., Messner, T., Rumler, F. and Ampudia, M., “Inflation heterogeneity at the household level”, Occasional Paper Series, ECB, 2023, forthcoming.

For a recent analysis of the implications of the energy price shock in heterogenous agent models, see Auclert, A., Monnery, H., Rognlie, M. and Straub, L., “Managing an Energy Shock: Fiscal and Monetary Policy”, mimeo, 2023.

Bernanke, B.S., Gertler, M. and Watson, M., “Systematic Monetary Policy and the Effects of Oil price Shocks”, Brookings Papers on Economic Activity, Vol. 1, 1997, pp. 91-142; Hamilton, J.D. and Herrera, A.M., “Oil Shocks and Aggregate Macroeconomic Behavior: The Role of Monetary Policy”, Journal of Money, Credit and Banking, Vol. 36, No 2, April 2004, pp. 265-286; Hamilton, J.D., “Historical oil shocks”, NBER WP, No 16790, February 2011; Kilian, L., “The Economic Effects of Energy Price Shocks”, Journal of Economic Literature, Vol. 46, No 4, December 2008, pp. 871-909; and Edelstein, P. and Kilian, L., “How sensitive are consumer expenditures to retail energy prices?”, Journal of Monetary Economics, Vol. 56, No 6, September 2009, pp. 766-779.

Hobijn, B. and Lagakos, D., “Inflation inequality in the United States”, The review of income and wealth, Vol. 51, Issue 4, December 2005.

Gürer, E. and Weichenrieder, A., “Pro-rich inflation in Europe: Implications for the measurement of inequality”, German Economic Review, Vol. 21, Issue 1, 2020; Strasser et. al., op. cit.; Osbat, C., “Measuring inflation with heterogeneous preferences, taste shifts and product innovation: methodological challenges and evidence from micro data”, Occasional Paper Series, ECB, 2023, forthcoming; Jaravel, X., “Inflation Inequality: Measurement, Causes, and Policy Implications”, Annual Review of Economics, Vol. 13, No 1, August 2021, pp. 599-629.

The gap in experienced inflation can only be measured approximately for recent years because consumption expenditure weights by income class for the euro area are only released with a substantial lag. We updated the 2015 weights using the corresponding relative price changes in each category of consumption. This assumes that the inflation rate of each category is the same across households (i.e. food inflation is the same for every household and only the share of expenditure allocated to food differs).

See the ECB’s Consumer Expectations Survey.

The GfK (Gesellschaft für Konsumforschung), a market research company, provides information on expenditures on fast-moving consumer goods by individual households in Germany for different income classes. In 2018 the share of expenditure at discounters was around 47% for the lower two income categories and around 33% for the two higher-income classes, indicating more room for the higher-income categories to reduce the cost of the shopping basket by changing their shopping habits.

See the article entitled “Grocery prices in the euro area: findings from the analysis of a disaggregated price dataset”, Economic Bulletin, Issue 1, ECB, 2015.

Kouvavas, O., “Trading Down and Inflation”, University of Warwick, mimeo, 2020.

Assuming a Cobb-Douglas utility function, the hypothetical transfers are computed – separately for experienced inflation and perceived inflation – as a weighted sum of inflation by spending category, multiplied by the share of spending on each category in relation to total income. The spending by main category is reported at a quarterly frequency in the CES. Experienced inflation over the previous 12 months by spending category was examined in December 2021 and December 2022. Experienced inflation is based on official statistics of inflation by spending category. See Causa, O., Soldani, E., Luu, N. and Soriolo C., “A cost-of-living squeeze? Distributional implications of rising inflation”, OECD Economics Department Working Papers, No 1744, December 2022.

See Attanasio, O.P. and Pistaferri, L., “Consumption Inequality”, Journal of Economic Perspectives, Vol. 30, No 2, 2016, pp. 3-28 and Fang, L., Hannusch A. and Sil, P., “Luxuries, Necessities, and the Allocation of Time”, Working Paper 2021-28, Federal Reserve Bank of Atlanta, December 2021.

Wage sluggishness prevents adjustments in general. This holds true for rising prices and also in the case of adverse shocks to growth. See Consolo, A., Koester, G., Nickel, C., Porqueddu, M. and Smets, F., “The need for an inflation buffer in the ECB’s price stability objective – the role of nominal rigidities and inflation differentials”, Occasional Paper Series, No 279, ECB, September 2021 and Gautier, E., Conflitti, C., Faber, R.P., Fabo, B., Fadejeva, L., Jouvanceau, V., Menz, J., Messner, T., Petroulas, P., Roldan-Blanco, P., Rumler, F., Santoro, S., Wieland, E. and Zimmer, H., “New facts on consumer price rigidity in the euro area”, Working Paper Series, No 2669, ECB, June 2022.

Several studies document a positive relationship between inflation and income inequality. Romer, C.D. and Romer, D.H., “Monetary Policy and the Well-being of the Poor”, Working Paper Series, No 6793, National Bureau of Economic Research, 1998, find that in the United States, higher unanticipated inflation corresponds to a higher-income share for the poor and a lower Gini coefficient. Bulir, A., “Income inequality: Does inflation matter?”, Working Paper Series, No 1998/007, International Monetary Fund, 1998, finds that past inflation affects current levels of income inequality. Binder, C., “Inequality and the inflation tax”, Journal of Macroeconomics, Vol. 61, 2019, finds that the correlation between inflation and income inequality has changed over time, becoming negative notably in Europe.

European Commission analysis based on European Union Statistics on Income and Living Conditions (EU-SILC) statistics reveals that in the early stages of the pandemic, the income losses for the low-income groups were three to six times higher than for their peers in the high-income groups across EU Member States.

See the box entitled “COVID-19 and income inequality in the euro area” in the article “Monetary policy and inequality”, Economic Bulletin, Issue 2, ECB, 2021.

See the article entitled “Automatic fiscal stabilisers in the euro area and the COVID-19 crisis”, Economic Bulletin, Issue 6, ECB, 2020.

The EU-SILC of 2021 shows an overall improvement in equality between 2019 and 2021 reflected in reduced “at-risk-of-poverty rates”, higher median disposable and employment income, especially for the first quintile. Government support, targeted to lower-income quintiles, has largely contributed to these achievements. See also the box entitled “The labour market recovery in the euro area through the lens of the ECB Consumer Expectations Survey”, Economic Bulletin, Issue 2, ECB, 2022.

See Battistini, N., Di Nino, V., Dossche, M. and Kolndrekaj, A., “Energy prices and private consumption: what are the channels?”, Economic Bulletin, Issue 3, ECB, 2022.

Eurostat income, consumption and wealth experimental statistics.

Consumers were asked in October 2021 and December 2022 to grade the adequacy of their national fiscal measures in preserving their financial conditions from the negative impact of high energy prices on a scale from 0 (completely inadequate) to 10 (fully adequate).

See the article entitled “Fiscal policy and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

The authors would like to thank Simeon Bischl and Aleksandra Kolndrekaj for their valuable research assistance and contribution to this box.

See the box entitled “The distributional impact of fiscal measures to compensate for high consumer price inflation” in the article “Fiscal policy and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

The study uses a tax-benefit microsimulator (EUROMOD with the indirect tax tool extension) with microdata as the input (combined EU-SILC and Household Budget Survey). The full analysis is presented in Amores, A. et al., “The distributional impact of fiscal measures to compensate consumer inflation”, Occasional Paper Series, ECB, forthcoming.

Market incomes increased unequally across the distribution. In 2022, the market income of the bottom quintile increased by around 1%, while the richest 20% of households gained roughly 4% in market income.

Consumers in December 2022 were also asked to report what sort of support they received. The most frequent responses were direct payments either to compensate for increased energy costs or welfare payments and discounts on energy and/or fuel consumption, followed by subsidised public transport.

Around 60% of the total leverage in the bottom quintile of the wealth distribution is attributed to mortgage loans.

See Bach, G.L. and Ando, A., “The Redistributional Effects of Inflation”, The Review of Economics and Statistics, Vol. 39, No 1, 1957 and Wolff, E., “The Distributional Effects of the 1969-75 Inflation on Holdings of Household Wealth in the United States”, Review of Income and Wealth, Vol. 25, No 2, 2005, pp. 195-207.

Doepke, M. and Schneider, M., “Inflation and the Redistribution of Nominal Wealth”, Journal of Political Economy, Vol. 114, No 6, 2006, pp. 1069-1097, and Cardoso, M., Ferreira, C., Leiva, J.M., Nuño, G., Ortiz, Á. and Rodrigo, T., “The heterogeneous Impact of Inflation on Households’ Balance Sheets”, Working Paper Series, No 176, Red Nacional de Investigadores en Economía, 2022, note that the results are driven especially by households in the upper-income quantile.

Heer, B. and Süssmuth, B., “Effects of inflation on wealth distribution: Do stock market participation fees and capital income taxation matter?”, Journal of Economic Dynamics and Control, Vol. 31, Issue 1, 2007, pp. 277-303.

See the box entitled “The recent drivers of household savings across the wealth distribution”, Economic Bulletin, Issue 3, ECB, 2022.

Adam, K. and Tzamourani, P., “Distributional Consequences of Asset Price Inflation in the Euro Area”, European Economic Review, Vol. 89, 2016, pp. 172-192.

See also the box entitled “Who foots the bill? The uneven impact of the recent energy price shock”, Economic Bulletin, Issue 2, ECB, 2023.

In line with the literature suggesting that income inequality tends to decline visibly when monetary policy succeeds in anchoring inflation at low and stable levels: see Hobijn, B. and Lagakos, D., “Inflation Inequality in the United States”, Review of Income and Wealth, Vol. 51, Issue 4, 2005, pp. 581-606 and “The distributional footprint of monetary policy”, Annual Economic Report, Bank for International Settlements, 2021.