The global financial cycle: implications for the global economy and the euro area

The global financial cycle: implications for the global economy and the euro area

Published as part of the ECB Economic Bulletin, Issue 6/2018.

As financial markets became progressively more integrated internationally over the past decades, economists wondered to what extent policymakers can isolate domestic financial conditions from external factors. This article reviews the terms of this debate and provides fresh evidence on the co‑movement in capital flows and stock prices across a panel of 50 advanced and emerging economies. In particular, the article focuses on the relative importance of global risk and US monetary policy for the global financial cycle and touches upon the implications for the exchange rate regime. Global risk aversion emerges as a significant driver of capital flows and stock returns and its impact is amplified by capital account openness, but not necessarily by the exchange rate regime, which matters only for asset prices, not for capital flows. The quantitative relevance of US monetary policy and the US dollar exchange rate seems to be episodic. In particular, the correlation between US interest rates and capital flows throughout the crisis is positive, rather than negative as the theory would predict, indicating the need for further empirical analysis of the role of US monetary policy as the driver of the global financial cycle. The article also finds that financial market tensions have been typically synchronised between the euro area and the United States but that financial conditions in the two areas have often decoupled. Overall, this confirms that the effectiveness of the ECB’s monetary policy has not been impaired by the global financial cycle.

1 Introduction

Over the past decades, financial markets have become progressively more integrated internationally. The size of world gross external liabilities, scaled by domestic GDP, increased from less than 50% at the beginning of the 1990s to around 200% at the onset of the global financial crisis in 2007.[1] The growth in cross‑border liabilities came to a halt with the crisis, but the world today is much more financially integrated than 30 years ago.[2]

According to the literature, increasing financial integration has led to the emergence of a “global financial cycle”, strongly influenced by US monetary policy. While financial integration is supposed to foster risk sharing internationally, economists wondered whether this integration, at the same time, could cause a faster and more uniform transmission of shocks across several economies, leading to the emergence of a global financial cycle. Rey (2015) provides a potential operational definition of this concept: “global financial cycles are associated with surges and retrenchments in capital flows, booms and busts in asset prices and crises” and are “characterised by large common movements in asset prices, gross flows and leverage”. Crucially, changes in monetary policy conditions in the centre economy, namely the United States, and in risk aversion globally, e.g. during the global financial crisis, would drive the global financial cycle, prompting swings in capital flows and asset prices across the globe.[3]

Such a global financial cycle, if present, would limit the potential benefits of financial integration. A stronger co‑movement of asset prices internationally would drastically reduce the ability of economic agents to diversify away idiosyncratic shocks – i.e. country‑specific ones, such as a domestic recession – through the acquisition of foreign assets.[4]

The existence of a global financial cycle would also have implications for policymakers and the choice of the exchange rate regime. According to the classical “trilemma” of monetary policy, if the capital account is open, it is impossible to run an independent monetary policy – i.e. to set the policy rate autonomously from that of the main centre economy, e.g. the United States – and, at the same time, have an exchange rate target. In this case (trilemma hypothesis), the choice of the exchange rate regime does matter, since a floating exchange rate would allow the running of an independent monetary policy. A global financial cycle would morph this trilemma into a dilemma for policymakers, leaving them with only two alternative options: (i) to keep the capital account closed, maintaining control of domestic financial conditions, or (ii) to open the capital account, relinquishing control of domestic financial conditions. Once the capital account is open, a global cycle would “set the tone” of domestic financial conditions – i.e. the interest rates that final borrowers, such as non‑financial corporates and households, actually pay – irrespective of the ability of the domestic central bank to set the policy rate autonomously and the prevailing exchange rate regime. In this second case (dilemma hypothesis), the choice of the exchange rate regime is virtually irrelevant.

This article provides an overview of the debate on the global financial cycle and offers a fresh look at the evidence supporting the existence thereof. In particular, the article focuses on the relative importance of global risk and US monetary policy for the global financial cycle. Moreover, the article also touches upon the implications of this cycle for policymakers when adopting the exchange rate regime. The empirical analysis is based on a dataset consisting of capital flows – in particular gross capital inflows across four main categories: direct investment, portfolio equity, portfolio debt and other investment (such as bank loans, deposits and trade credits) from the International Monetary Fund’s Balance of Payments Statistics database. The dataset also contains risky asset prices – stock market returns from Global Financial Data – for a sample of 50 economies since 1990 on a quarterly basis.[5] The article studies the relationship of these variables with those that have been consistently identified as the main drivers of the global financial cycle in the literature: global risk aversion and US monetary policy. Finally, the article elaborates on the implications for the global economy and the euro area.

2 Is there a global financial cycle? Revisiting the evidence

The existence of a global financial cycle rests on the validity of two distinct assumptions: one regarding the co‑movement of capital flows and asset prices, and one regarding the drivers of such a co‑movement. First, gross capital inflows, leverage of the banking sector, credit and risky asset prices share a common pattern over the past three decades.[6] Second, this pattern is inversely related to measures of global risk aversion and is driven by the US monetary policy. The purpose of this section is to revisit the evidence supporting the first leg of the analysis, the co‑movement of capital flows and asset prices; the next section will elaborate on the evidence regarding the underlying drivers of this co‑movement.

2.1 The co‑movement of capital flows and asset prices

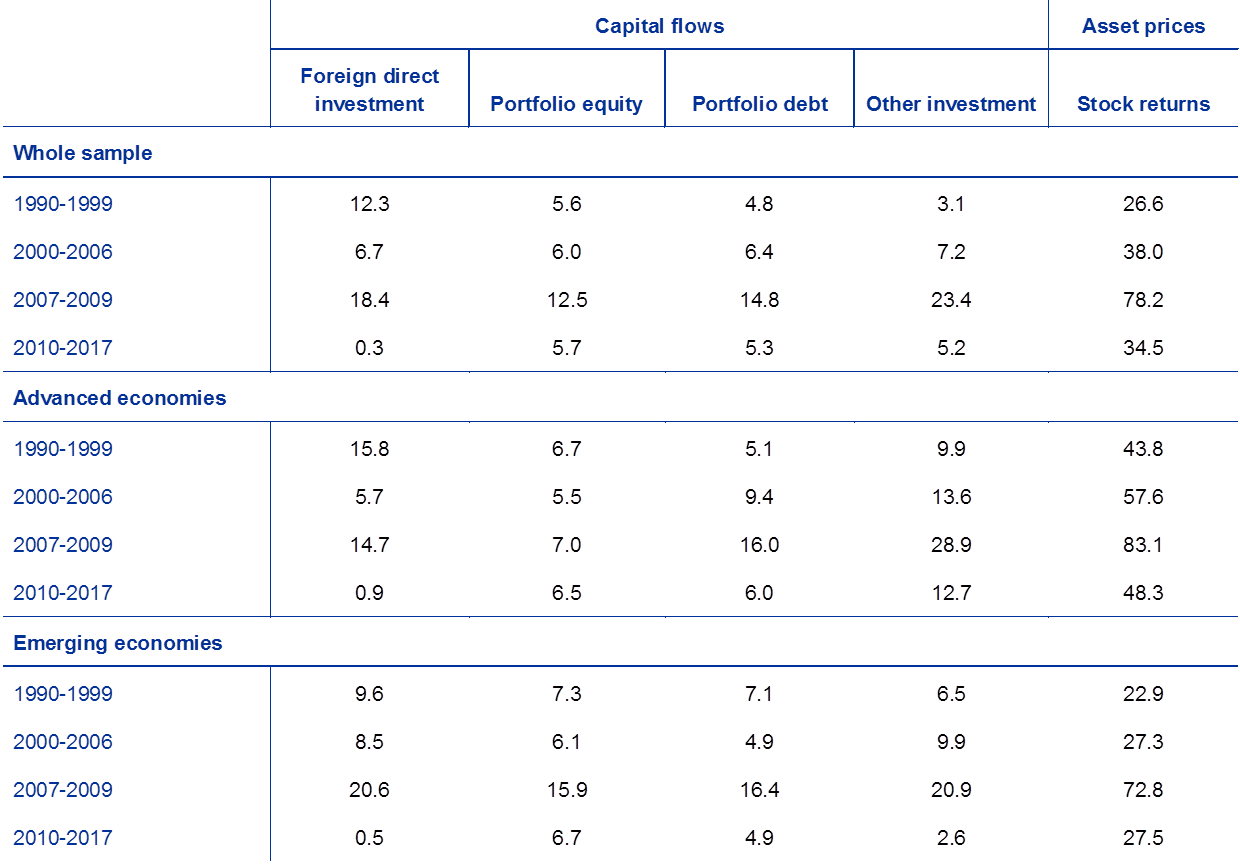

Capital flows and, in particular, asset prices, to a certain extent, share a common pattern across countries. Table 1 reports average bilateral correlations across the 50 economies in the full sample and separately for advanced and emerging economies. For each type of capital flow or asset price, all possible bilateral correlation coefficients between each pair of countries are calculated over the period 1990‑2017 and then averaged, providing a simple and intuitive measure of co‑movement. All correlations in Table 1 are positive, confirming the presence of a common pattern for capital flows and asset prices.

Financial integration leads to a higher co‑movement of asset prices with respect to capital flows. Table 1 shows that the degree of synchronicity of asset prices is much stronger than the one for capital flows. Under financial integration, international arbitrage exerts a strong pressure towards the equalisation of external finance premia[7], even with limited exposure to foreign assets and a substantial degree of home bias.[8]

Table 1

Correlation of capital flows and asset prices since the 1990s

Averages (unweighted) of bilateral correlations of country capital flows and asset prices: 1990‑2017

(percentages, quarterly data)

Sources: IMF Balance of Payments Statistics, Global Financial Data and ECB calculations.

The co‑movement of capital flows across countries is positive, though not particularly elevated. Among the different types of capital flows, “other” flows (bank loans and trade credits) display the highest correlation (10%), in particular within the group of advanced economies (17%). To a large extent, this is the manifestation of what Bruno and Shin (2015) define as the transmission of the international “bank leverage cycle” (that is, the tendency of banking systems to expand balance sheets in good times) and of the retrenchment in capital flows – in particular risk‑sensitive cross‑border banking flows – following the global financial crisis.[9]

The co‑movement of capital flows and risky asset prices increased in the run‑up to the global financial crisis, peaking during the crisis.[10] Table 2 shows the average of quarterly bilateral correlations over different time periods. In particular, the period corresponding to the global financial crisis (2007‑09) has been isolated, since it is known that high volatility tends to shift upwards any estimated correlation between two series, even if the underlying structural relationship between these two series has not changed.[11] With the exception of foreign direct investment, the synchronisation of capital flows and asset prices is higher in the run‑up to the global financial crisis in the 2000s than in the 1990s. Unsurprisingly, the measured degree of synchronisation peaks during the global financial crisis between 2007 and 2009 when cross‑border capital flows and stock market prices collapsed.

Table 2

Correlation of capital flows and asset prices for different sub‑samples

Averages of bilateral correlations of country capital flows and asset prices: sub‑samples

(percentages, quarterly data)

Sources: IMF Balance of Payments Statistics, Global Financial Data and ECB calculations.

The most recent period is characterised by a decline in the synchronisation of capital flows and asset prices. Following the global financial crisis, between 2010 and 2017, the synchronisation of capital flows and stock prices abated, generally returning to a level slightly lower than in the 2000s, but higher than in the 1990s (Table 2, first panel).[12] The picture is not substantially different when distinguishing advanced economies from emerging economies. Notably, the decline in the co‑movement of capital flows after the global financial crisis appears to be more marked among emerging economies than in advanced ones (Table 2, second and third panels).

Overall, there is strong evidence of a common cycle in risky asset prices and some support for the presence of a common pattern in capital flows across the globe. The boom and bust cycle in the run‑up to the global financial crisis tends to magnify the evidence in favour of the presence of a global financial cycle. Importantly, in the run‑up to the global financial crisis, a global cycle is particularly evident for banking flows among advanced economies.

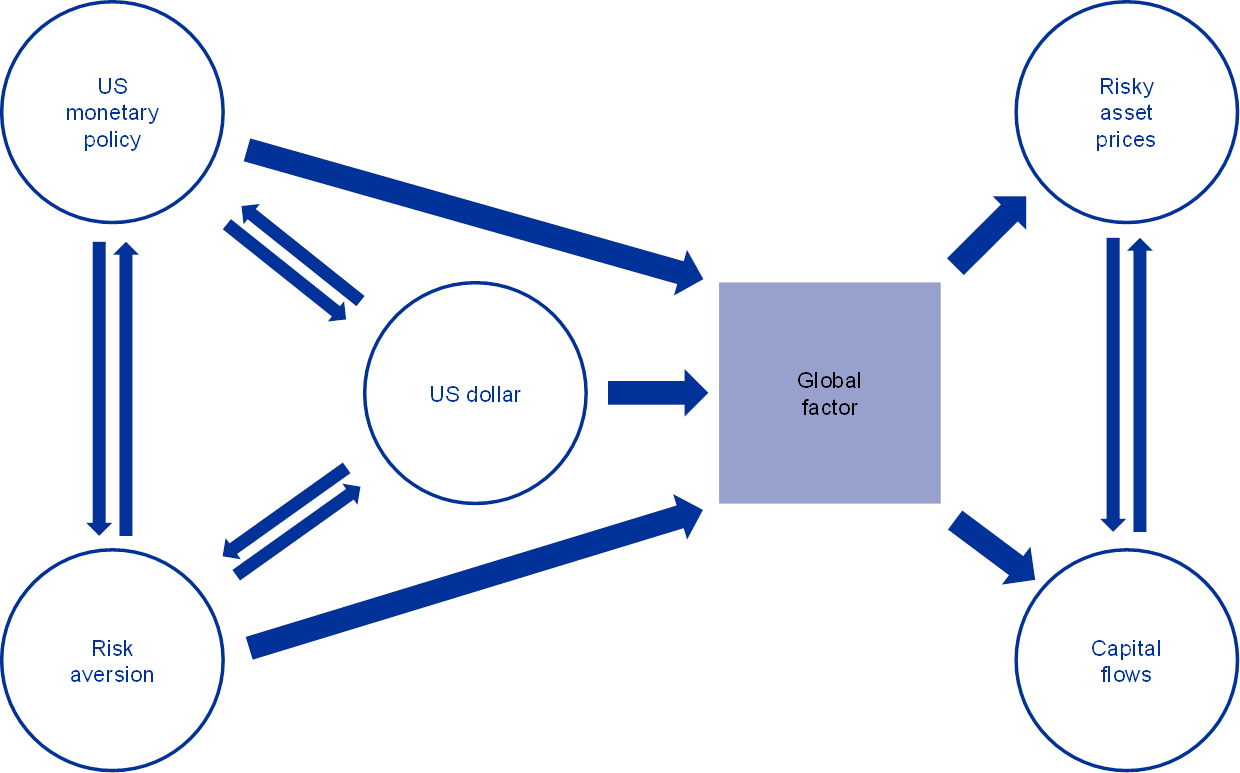

3 The global financial cycle: drivers and channels of transmission

The economic literature has identified two main potential drivers of the global financial cycle: US monetary policy and global risk aversion. Figure 1 depicts in a stylised way the complexity of the mechanism and the channels of transmission of the global financial cycle. For instance, the stance of US monetary policy may affect risk attitude globally, but the causality may run in the opposite direction. An “unexpected” tightening that surprises the markets is normally associated with an increase in risk aversion, a decline in the price of risky assets and a widening of external finance premia beyond the US borders. At the same time, risk aversion shocks – e.g. those generated by the global financial crisis or by major geopolitical events such as war or terrorist attacks – may induce changes in the stance of monetary policy to counteract the negative effects of these shocks on the economy.

Figure 1

The transmission channels of the global financial cycle

Source: ECB.

A global factor shaping the co‑movement of risky asset prices is closely related to global risk aversion, which has been identified as one of the main drivers of the global financial cycle. As shown in the previous section and extensively documented by a growing body of literature, returns on risky assets share a common component that drives a non‑negligible fraction of their fluctuations. According to Miranda‑Agrippino and Rey (2018), for instance, this global factor would explain up to a quarter of the variance of a large cross‑section of risky returns.[13] This factor would reflect the risk appetite of global investors and therefore would be negatively related to the degree of risk aversion of the market.

A second central driver of the global financial cycle identified throughout the literature is the role of US monetary policy, which drives asset prices, both domestically and globally. Spillovers originating from US monetary policy have received special scrutiny in the literature, owing to the central role played by the US dollar in global financial markets. Indeed, around 60% of the international debt securities issued in the world and about as much of global cross‑border loans are denominated in US dollars.[14] In this context, particular attention has been given to the role of global banks, large intermediaries with a strong presence in cross‑border lending, which amplify the international dimensions of US monetary policy. Indeed, monetary policy, by changing the value of the assets in global banks’ balance sheets, alters both their leverage position and their willingness to take risk. For instance, a monetary policy expansion would boost asset prices, strengthen the capital position of banks and induce them to further expand their balance sheets, not only domestically but also through international lending. At the same time, lower interest rates compress safe‑asset yields, inducing banks to search for higher returns by taking on more risks.[15]

Given its prominence in international markets, the US dollar also plays a catalytic role, reinforcing the transmission channels of US monetary policy to cross‑border flows. For instance, a US monetary policy tightening would be associated with a rise in the value of the US dollar. In turn, the appreciation of the US dollar would lead to a deterioration in the balance sheet and the perceived credit risk of non‑US borrowers with US dollar liabilities, triggering further cross‑border retrenchment worldwide. A monetary policy loosening would have the opposite effect.[16]

3.1 Global risk aversion and the global financial cycle

The first step of the analysis focuses on the relationship between capital flows and global risk aversion. The literature often uses the VIX index, a measure of implied volatility of the US stock market, as a proxy for global risk aversion.[17] Alternative measures aimed at capturing more “global” trends have also been proposed. For instance, Miranda‑Agrippino and Rey find that the common component of a large panel of returns on risky assets traded on all the major global markets (i) co‑moves with the VIX and the US Baa‑Aaa spread and (ii) is strongly correlated with measures of implied stock price volatility in Europe (VSTOXX and VFTSE). Hence, rather than solely relying on the VIX, this analysis also uses a Global Stock Market Factor, constructed from stock returns for 63 countries (see Box 2 for details of the methodology). Both indicators, the VIX and the Global Stock Market Factor, should capture uncertainty about the future – as measured by the realised volatility of the markets – and the degree of risk aversion of the markets.[18] Compared with the VIX, the Global Stock Market Factor should better capture global developments.

Capital flows soared at the start of the new millennium, as both the VIX and the global factors declined, and collapsed during the global financial crisis in 2008‑09, as risk aversion mounted. Chart 1a shows the development of capital flows, aggregated across all four categories and, separately, for advanced economies and for emerging economies against the VIX (inverted scale). Chart 1b displays aggregate capital flows against the Global Stock Market Factor (inverted scale). In both charts the co‑movement of capital flows and proxies of risk aversion in the run‑up to the global financial crisis and immediately afterwards is particularly evident. Importantly, it should be noted that between the early 2000s and 2009, there is an upward trend in capital inflows both for advanced and (to a lesser extent) for emerging economies. The process of financial integration is truly global.

Outside the crisis period, the relationship between capital flows and global risk is weaker than in the first decade of the 2000s, in particular when using the VIX index as a gauge of risk. Both Chart 1a and Chart 1b display a less marked pattern of co‑movement of capital flows and the two proxies of global risk in the 1990s and since 2010 when the major central banks introduced quantitative easing measures that contributed to a decline in market volatility. This is confirmed by the correlation of these series over the whole sample and across three different decades, shown in Table 3. The correlation of the Global Stock Market Factor with global capital flows to either advanced economies (-0.61) or emerging economies (−0.51) is much tighter and more stable than the one of the VIX index (around ‑0.3). Notably, the negative relationship between the VIX and global capital flows is not present since 2010.

Chart 1

Capital flows, the VIX and the Global Stock Market Factor since 1990

(quarterly data, capital flows as a percentage of GDP)

Sources: IMF, Datastream and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2017. Capital flows are reported as a share of the country group’s GDP, i.e. capital flows to advanced economies divided by the sum of advanced economies’ GDP, and similarly for emerging economies. The Global Stock Market Factor is constructed from stock returns for 63 countries (see Box 2 for details of the methodology).

A formal econometric analysis confirms that a Global Stock Market Factor shares a tight relationship with capital flows across different asset categories. The relationship between capital flows, stock market returns and several different measures of global risk is investigated empirically in a panel setting, including variables controlling for the influence of domestic (“pull”) factors for capital flows. The results confirm that a global financial cycle in capital flows is strongly connected to measures of risk in global stock markets (see Box 1).

Table 3

Correlation of capital flows and global risk since the 1990s

Correlation matrices: sub‑samples

(quarterly data)

Sources: IMF, Datastream and ECB calculations.

Notes: Capital flow liabilities as a percentage of GDP. US policy rate refers to the effective federal funds rate extended with the Wu‑Xia shadow rate. Nominal USD appreciation is calculated as the log change in the nominal effective exchange rate (NEER). * Asterisk indicates statistical significance at the 5% level.

As mentioned in the introduction, the global financial cycle could limit the ability of policymakers to isolate domestic financial conditions. Even when adopting a flexible exchange rate regime – which allows for some independence in setting policy rates according to existing evidence[19] – a global risk shock would be transmitted across the globe to capital flows and risky asset prices, irrespective of the prevailing exchange rate regime (dilemma hypothesis).

The econometric evidence partly supports the presence of a dilemma in the transmission of global risk to capital flows and stock markets (see Box 1). Indeed, the analysis shows that global risk affects capital flows in those economies that have liberalised the capital account, as predicted by the theory. At first sight, the exchange rate regime does not seem to matter in the transmission of global risk. The irrelevance of the exchange rate regime is consistent with the existence of a dilemma, not a trilemma, in the presence of a global financial cycle. However, when restricting the sample to those economies that have a liberalised capital account, a rigid exchange rate regime appears to facilitate a stronger transmission of global risk to stock markets, providing support to the traditional view of the trilemma in international economies, where floating rates allow for a degree of freedom in facing external shocks.

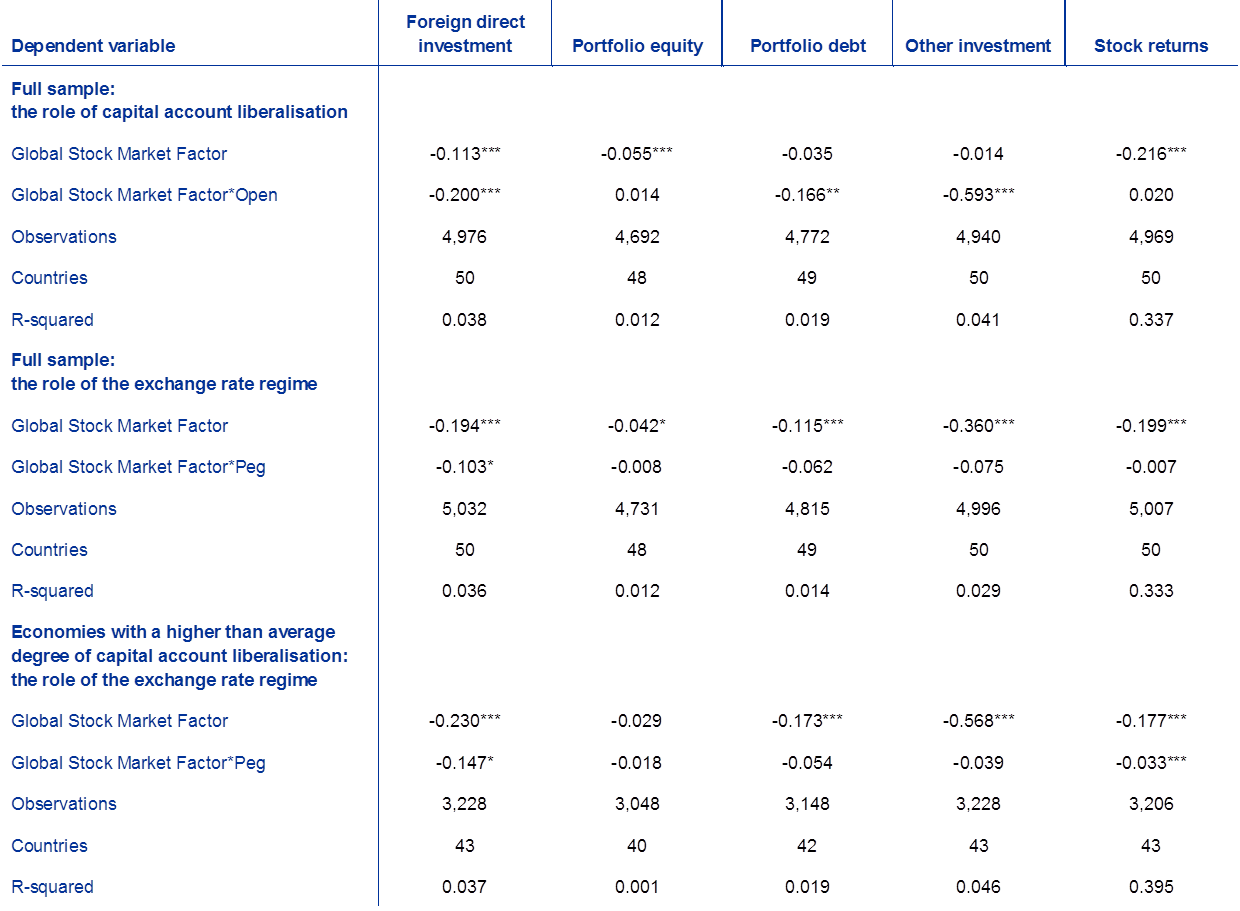

Box 1 The transmission of global risk factors and the policy trilemma

The transmission of global risk to capital flows and stock prices is studied in a simple panel regression across a sample of 50 economies. The model is the following:

where Yit, the dependent variable, is one of the four main categories of capital flows – direct investment, portfolio equity, portfolio debt or other flows – or stock returns in country i at time (quarter) t. The coefficient ai captures country‑specific fixed effects that do not vary across time; Zit is a vector of domestic control variables that can affect capital flows and returns, including domestic inflation and real GDP growth; and, finally, Xt is a proxy of global risk and eit is an error term.[20] Alternatively, two different proxies of risk have been included: the VIX and the Global Stock Market Factor.

Table A presents the results of these regressions for two different models, one including the VIX (model 1) and one using the Global Stock Market Factor (model 2). The coefficients of the control variables are omitted for space reasons. As expected, most of the coefficients are negative, suggesting that when global risk rises, cross‑border capital flows and risky asset prices decline around the world. Zooming into different types of capital flows, direct investment emerges to be less sensitive to global risk, since the decision to invest abroad is based on long‑run expectations of profitability. Among the various proxies of risk, the Global Stock Market Factor is the indicator most closely connected to capital flows and stock prices, since the coefficient is statistically significant for all types of flows and the regression displays the best goodness of fit.[21] However, the ability of the model to capture the volatility of capital flows – particularly high at the quarterly frequency – is very limited, as shown by the reported R‑squared. For stock returns, instead, the change in the Global Stock Market Factor has a good fit and explains one‑third of the variation of the stock returns. Overall, this simple model confirms that a global financial cycle in capital flows and asset prices is negatively associated with global risk.

Table A

The transmission of global risk to capital flows and asset prices

Sources: IMF, Datastream and ECB calculations.

Notes: For stock returns, in model 2, the Global Stock Market Factor is taken in first differences. The asterisks ***, ** and * indicate statistical significance at the 1%, 5% and 10% level, respectively.

An extension of the model makes it possible to consider an interesting policy angle: the role of capital account openness and the exchange rate regime in the transmission of risk to capital flows and risky asset prices. According to the new “dilemma” in international finance, once the capital account is open, a floating exchange rate cannot isolate the domestic economy from the transmission of shocks driving the global financial cycle, such as risk aversion shocks. To test this hypothesis, the model is augmented with two dummies distinguishing countries with a higher than average degree of capital account openness (Open) from those that are more closed, and countries with a fixed exchange rate regime (Peg) from those with a floating regime.[22] These dummies are interacted with the global risk factor to control if the transmission of risk shocks is stronger among countries with a fixed exchange rate (trilemma hypothesis) or not (dilemma). Among the risk factors, the Global Stock Market Factor has been selected, since it performed better in the first stage of the analysis compared with the VIX.

Table B

The transmission of global risk: the role of capital account liberalisation and the exchange rate regime

Sources: IMF, Datastream and ECB calculations.

Notes: For stock returns, the Global Stock Market Factor is taken in first differences. The asterisks ***, ** and * indicate statistical significance at the 1%, 5% and 10% level, respectively.

Table B summarises the results, focusing on the global risk factor and its interaction with the dummies, omitting other controls. A negative coefficient for the interaction term of global risk with a specific characteristic (e.g. Open or Peg) suggests that the countries possessing that feature are more affected by global risk. First, as expected, the transmission of global risk to capital flows and asset prices is stronger among those economies with a more open capital account, in particular for direct investment, portfolio debt and other investment (e.g. bank loans), as the interaction term is negative and statistically significant. Second, at first sight, the exchange rate does not seem to matter. Even though the coefficient of the dummy for countries pegging their currency interacted with global risk is negative, the statistical significance is weak. This provides support to the new theory of the global financial cycle that stresses the limited ability of a floating rate to shield domestic financial conditions from the global ones. It is possible to qualify this result, analysing a finer partition of the sample. Focusing on the countries that are relatively more open – those potentially more exposed to the global financial cycle – the transmission of global risk to stock prices is higher among pegs than for floaters, supporting the traditional trilemma hypothesis.

Summing up, global risk aversion emerges as a significant driver of capital flows and stock returns and its impact is amplified by capital account openness, but not necessarily by the exchange rate regime, which matters only for asset prices when the capital account is open, not for capital flows.

3.2 US monetary policy and the global financial cycle

Empirically, there is a broad consensus that monetary policy actions of large central banks, such as the Federal Reserve System, spill over to global financial markets. A wealth of studies have shown that monetary policy decisions by the Federal Reserve have an impact on capital flows, exchange rates and the international co‑movement of asset prices. These papers generally find that a tightening of US monetary policy significantly influences foreign economies via an increase of foreign long‑term interest rates and a depreciation of their currencies against the US dollar. Furthermore, the transmission to foreign long‑term rates is mostly attributable to effects on term premia.[23]

However, there does not seem to be a stable relationship between the US policy rate, the value of the US dollar and global capital flows. Chart 2a and Table 3 show that the US interest rate – specifically the effective federal funds rate extended with the Wu‑Xia shadow rate[24] during the zero lower bound period – is generally uncorrelated with global capital flows, with the exception of the crisis. In the 2000s, the correlation of US interest rates with capital flows is positive – not negative as expected – and the correlation with indicators of risk aversion such as the VIX is negative – not positive as expected. In the run‑up to the global financial crisis, US interest rates increased in tandem with cross‑border capital flows and when the global financial crisis erupted, the Federal Reserve was forced to ease monetary policy.

The value of the US dollar is negatively correlated with capital flows, even though the relationship is clearly driven by the cycle in the run‑up to the global financial crisis. Chart 2b shows that the nominal effective exchange rate of the US dollar depreciated from 2002 to the onset of the global financial crisis in the autumn of 2008. During this period, capital flows were on an upward trend among advanced and emerging economies. The crisis signals a turning point for both the US dollar, which appreciates sharply, and capital flows, which retrench dramatically. However, outside the period 2000‑09, the relationship is less stable. Table 3 reports the correlation of the value of the US dollar – taken in log changes to avoid issues of stationarity in the series – with capital flows, confirming a tight negative relationship between 2000 and 2009 – a correlation coefficient ranging between ‑0.43 for advanced economies and ‑0.49 for emerging ones – and a looser connection in the 1990s for both advanced and emerging economies and since 2010 for advanced economies.[25] Possibly, the impact of monetary policy and the role of the US dollar on the global financial cycle should be analysed with different techniques, e.g. through the identification of monetary policy shocks with high‑frequency data and VAR analysis; however, this would go beyond the scope of this article.[26]

Chart 2

Capital flows, US interest rates and the US dollar since the 1990s

(quarterly data; capital flow liabilities as a percentage of GDP; US policy rate as a percentage; nominal USD exchange rate, index: Jan. 1997 = 100)

Sources: IMF, Datastream and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2017. Capital flows are reported as a share of the country group’s GDP, i.e. capital flows to advanced economies divided by the sum of advanced economies’ GDP, and similarly for emerging economies. US policy rate refers to the effective federal funds rate extended with the Wu‑Xia shadow rate. Nominal USD exchange rate refers to the nominal broad trade‑weighted exchange value of the US dollar, where an increase in the index denotes an appreciation (note the inverted scale in Chart 2b).

3.3 Summary of the empirical evidence

Overall, the evidence reviewed here suggests that capital flows and risky asset prices have been influenced by global risk factors in the past decades. This influence is particularly evident in the period preceding the global financial crisis and in its immediate aftermath. Notably, the most recent period has instead been characterised by a loosening of the cycle. Moreover, the exchange rate regime does not seem to matter for the transmission of the cycle, with the possible exception of risky asset prices when the capital account is open.

While the central role of US monetary policy and the presence of a US dollar cycle connected to the global financial cycle is a concept well entrenched among economists, more work is needed to pin down the economic significance of these drivers of the financial cycle for the global economy. In different terms, while the existence of a causal nexus between US monetary policy and capital flows cannot be excluded, the quantitative relevance of changes in US interest rates for international capital flows appears limited and would have to be ascertained. This implies that the risks for global capital flows and risky asset prices of a gradual, well‑communicated normalisation of US monetary policy should not be exaggerated.[27]

4 Implications for the euro area

The euro area is not an island: product and financial market openness make the euro naturally exposed to changes in global financial conditions. In the previous sections, a connection between, on the one hand, global risk aversion and, on the other hand, capital flows and stock returns has been outlined. This section delves into the implications of the observed co‑movement in asset prices for euro area financial conditions. The transmission of global shocks to the euro area economy is amplified by the presence of large, global euro area banks that play a central role in international lending. Due to its size and interconnectedness, however, the euro area is not only a receiver but also a generator of shocks that affect the global financial cycle.[28]

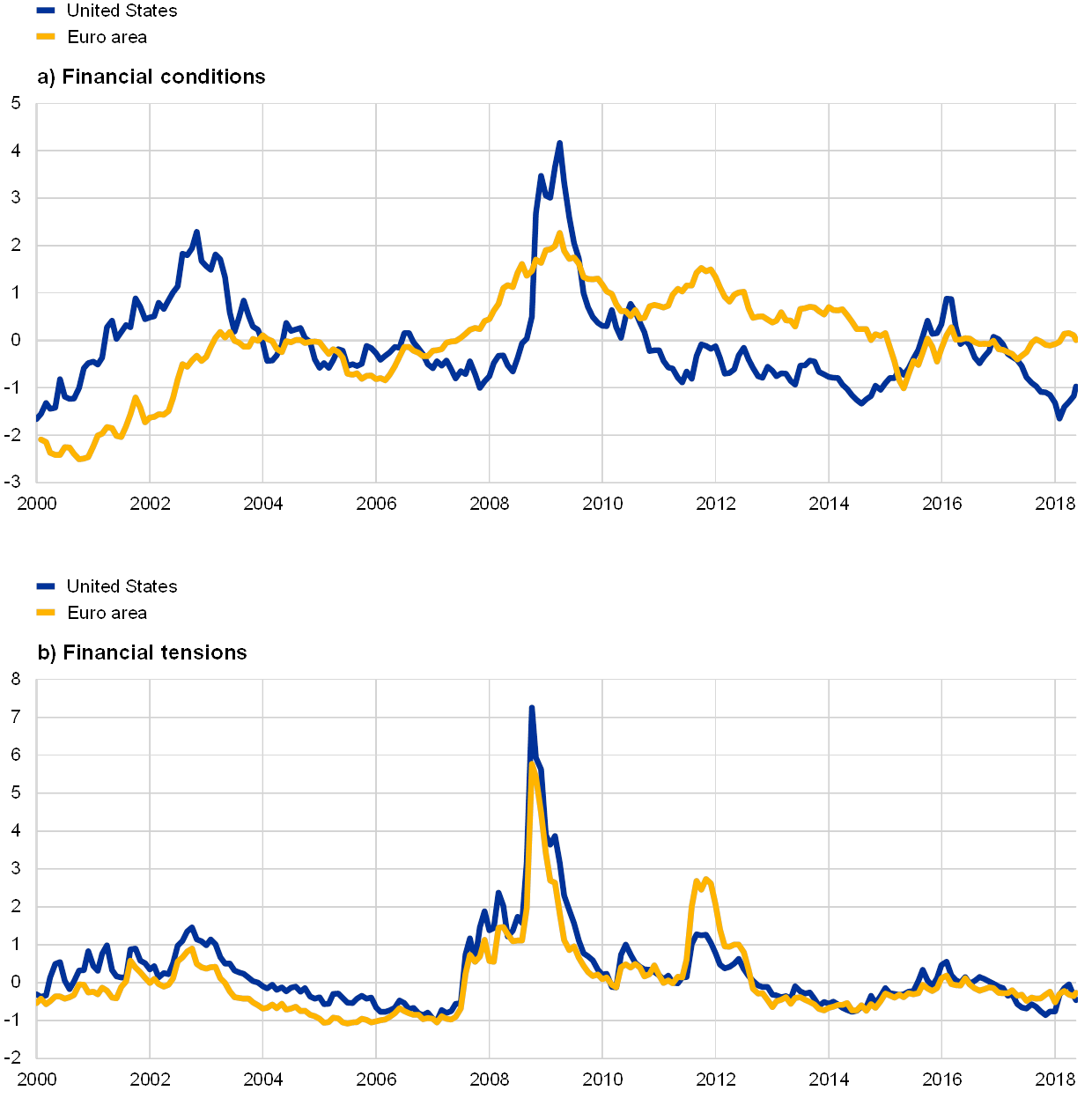

Given the prominence of the US economy in driving the financial cycle, it is interesting to focus on the relationship between US and euro area financial conditions. This can be done using composite “financial condition indices” that assemble information from a small set of financial variables.[29] We look at two such indices, which convey slightly different information. The first index, computed by Goldman Sachs, gives a relatively large weight to the level of interest rates paid by sovereigns and corporates and also takes into account the tightening effects of exchange rate appreciations.[30] The second index, computed by Bloomberg, assigns more importance to interest rate spreads, as well as realised volatilities in bond, stock and money markets. Furthermore, it does not include exchange rates. It is therefore more indicative of rising financial turbulence, as gauged by time‑varying risk premia.[31] In other words, the prominence given by the latter index to spreads and volatilities implies that it is more sensitive to temporary financial tensions. Although both indices are defined as measures of financial conditions, for the sake of exposition we will refer to them in the rest of the discussion as indices of financial conditions and financial tensions, respectively.

The degree of synchronisation of financial conditions between the United States and the euro area is overall tenuous and changes over time, also reflecting differences in the monetary policy stance. Chart 3a shows the index of financial conditions for the United States and for the euro area between 2000 and 2018.[32] In the case of the United States, three distinct periods of financial tightening can be identified. The first, between 2001 and 2003, coincides with the bursting of the dot‑com bubble in the US stock market. The second follows the bankruptcy of Lehman Brothers. The third, from the middle of 2014 to the beginning of 2016, is largely driven by an appreciation of the dollar. The timeline for the euro area is characterised by two important differences. First, the impact of the 2001 US recession is very muted. Second, the tightening of financial conditions during the Great Recession (2008‑09) is much more gradual and less pronounced. These differences show up in notably different correlations across time periods. Before the financial crisis, the correlation in financial conditions is mildly positive (0.33); it increases during the crisis (0.71 between 2007 and 2012); and from July 2012 onwards it turns negative.[33] The change in sign reflects the progressive loosening of financial conditions in the euro area, also thanks to monetary policy accommodation and the relative stability (bar the temporary tightening of financial conditions between 2014 and 2016) in the United States.

The co‑movement in financial tensions is instead very strong. Chart 3b shows the two indices of financial tensions for the United States and for the euro area. It is evident that financial tensions are, most of the time, dormant. However, when they manifest themselves (in 2008 both in the United States and in the euro area and in 2011 mainly in the euro area) they have a large impact on the real economy, possibly generating non‑linear effects. Overall, the correlation between the two indices is strong and stable (ranging between 0.8 and 0.9), suggesting that (i) financial tensions are triggered by movements in global risk and (ii) risk premia both in the United States and in the euro area are heavily influenced by this common component (see Box 2).[34]

Overall, two key messages emerge from this analysis. First, financial conditions in the euro area evolve largely independently from global forces, also thanks to the ability of monetary policy to steer expected rates on safe assets and term premia in the desired direction. Second, credit spreads and realised volatilities in the United States and in the euro area are highly synchronised, reflecting the global nature of risk appetite in closely financially integrated markets.

Chart 3

Financial conditions and financial tensions in the United States and in the euro area

(Z‑scores of monthly averages of daily data, i.e. number of standard deviations from zero)

Sources: Goldman Sachs and Bloomberg Analytics.

Notes: The latest observation is for June 2018. The financial condition indices refer to the Goldman Sachs (panel a) and Bloomberg (panel b) constructed financial condition indices for the United States and the euro area. Positive deviations from zero signify a tightening, while negative deviations from zero signify a loosening.

Box 2 The global financial cycle: is the euro area special?

This box documents how the Global Stock Market Factor is computed and explores its relative importance for euro area stock returns. A dynamic factor model for stock returns in 63 countries is estimated. The first common factor is the Global Stock Market Factor.[35] Once this factor is estimated, its relevance for the individual indicators can be assessed through simple variance decomposition. More formally, for each country “i” at time “t” we have:

where is either stock returns or cross‑border flows, is a common factor, and is an idiosyncratic component (with variance that accounts for the part of that is not common across countries. Since and are uncorrelated, we can estimate the share of variance of accounted for by the common factor as . Estimation is carried out on a set of 63 countries, comprising advanced and emerging economies.

Chart A shows the estimated share of variance accounted for by the Global Stock Market Factor in the 63 countries considered. Two results stand out. First, commonality is very heterogeneous across countries. Second, the relevance that the global factor has for the equity returns of euro area countries (dark blue bars) and the United States (yellow bar) is overall comparable, indicating that global shocks are an important factor in shaping both euro area and US equity price movements.

Chart A

Degree of commonality of country‑specific stock returns

Estimated share of variance accounted for by the common factor

Source: ECB calculations.

5 Concluding remarks

Real economy and financial market integration over the past decades has influenced the synchronisation of capital flows and asset prices across the world. Some authors have advocated the existence of a global financial cycle that manifests itself through the co‑movement of cross‑border flows and translates into more aligned risky asset prices and external finance premia across different economies. This was the case in the run‑up to the global financial crisis and in its aftermath, in particular for cross‑border banking flows among advanced economies and for stock prices. However, after the crisis, the synchronisation of capital flows and stock prices has abated, returning to the levels observed between the 1990s and the 2000s.

The global financial cycle is closely connected to global risk factors. A measure of global risk aversion (constructed as the common factor that drives a panel of equity returns) has a significant impact on capital flows and stock returns. Moreover, capital account openness – but not necessarily the exchange rate regime – amplifies the effects of global risk aversion. The exchange rate regime matters only for the transmission of global risk to asset prices when the capital account is open. The impact of US interest rates and the US dollar exchange rate on capital flows, instead, appears to be episodic.

The influence of the global financial cycle on the euro area depends on the particular measure that is analysed. The article finds that financial market tensions have typically been synchronised between the two areas. Bouts of volatility, which can have strong non‑linear effects on economic activity, are quickly transmitted from one economy to the other. However, financial conditions in the euro area have often decoupled from those in the United States, also owing to differences in the monetary policy stance. Overall, this confirms that the effectiveness of the ECB’s monetary policy has not been impaired by the global financial cycle.

- The ratio is computed as the sum for available countries of nominal US dollar liabilities over the sum of nominal US dollar GDP.

- See Lane, P. R. and Milesi‑Ferretti, G., “International Financial Integration in the Aftermath of the Global Financial Crisis”, IMF Working Paper No 17/115, May 2017.

- Rey, H., “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, NBER Working Paper No 21162, May 2015, page 2. The evidence supporting the presence and economic significance of a global financial cycle has been challenged by a recent study by Cerutti, E., Claessens, S. and Rose, A. K., “How Important is the Global Financial Cycle? Evidence from Capital Flows”, IMF Working Paper No 17/193, September 2017.

- Risk sharing, that is the ability of agents to insure their consumption streams against idiosyncratic shocks, can occur via the “capital channel” (e.g. income on financial assets held abroad), the “fiscal channel” (e.g. cross‑border transfers between governments) and the “credit channel” (borrowing abroad by individuals and governments, either in credit markets or through supranational insurance mechanisms such as the European Stability Mechanism). In the euro area, risk sharing takes place mainly via the capital channel. For a discussion, see the article entitled “Risk sharing in the euro area”, Economic Bulletin, Issue 3, ECB, 2018.

- The sample includes Argentina, Australia, Austria, Brazil, Bulgaria, Canada, Chile, China, Colombia, Costa Rica, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Israel, Italy, Japan, Latvia, Lithuania, Malaysia, Mexico, New Zealand, Norway, Pakistan, Peru, Philippines, Poland, Portugal, Korea (Republic of), Romania, Russian Federation, Saudi Arabia, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, United Kingdom, United States and Uruguay. Similarly to other studies, the analysis focuses on “gross inflows” (i.e. net purchases and sales of domestic assets by foreign residents), which are crucial for assessing financial stability and global credit conditions. “Net flows”, which broadly mirror current account balances, are more relevant for assessing the sustainability of net international investment positions. As regards risky asset prices, the focus is on stock returns, since it is difficult to obtain other measures, such as corporate bond prices or mortgage rates, for a large panel of countries including emerging economies since the 1990s.

- See Passari, E. and Rey, H., “Financial Flows and the International Monetary System”, Economic Journal, Vol. 125, No 584, May 2015, pp. 675‑698. Moreover, Jordà, O., Schularick, M., Taylor, A. M. and Ward, F., show that the synchronisation of credit, house prices and equity prices across countries has increased above real sector integration across elected advanced economies over the past 150 years. However, in the past three decades, it is the co‑movement of the equity markets that stands out as particularly elevated (“Global Financial Cycles and Risk Premiums”, NBER Working Paper No 24677, June 2018).

- This is the difference between the cost to a borrower of raising funds externally and the opportunity cost of internal funds.

- Dedola, L. and Lombardo, G., “Financial frictions, financial integration and the international propagation of shocks”, Economic Policy, Vol. 27, Issue 70, April 2012, pp. 319‑359.

- See Bruno, V. and Shin, H. S., “Cross‑Border Banking and Global Liquidity”, Review of Economic Studies, Vol. 82, No 2, 2015, pp. 535‑564. For an analysis of the heterogeneous impact of the global financial crisis on cross‑border capital flows, see Milesi‑Ferretti, G.-M. and Tille, C., “The great retrenchment: international capital flows during the global financial crisis”, Economic Policy, Vol. 26, Issue 66, April 2011, pp. 289‑346.

- Due to limited data availability, we do not look at the prices of risky bonds but only at equity prices.

- For a discussion, see Forbes, K., “Global economic tsunamis: Coincidence, common shocks or contagion?”, speech given at Imperial College, London, 22 September 2016, available on the Bank of England’s website. See also Forbes, K. and Rigobon, R., “No Contagion, Only Interdependence: Measuring Stock Market Co‑movements”, Journal of Finance, Vol. 57(5), October 2002, pp. 2223‑2261.

- Direct investment appears to be an exception and follows a cycle that is different from other asset classes.

- Miranda‑Agrippino, S. and Rey, H., “US Monetary Policy and the Global Financial Cycle”, NBER Working Paper No 21722, February 2018.

- See “The international role of the euro”, ECB, June 2018.

- See Bruno, V. and Shin, H. S., “Capital flows and the risk‑taking channel of monetary policy”, Journal of Monetary Economics, Vol. 71, 2015, pp. 119‑113, Cesa‑Bianchi, A., Ferrero, A. and Rebucci, A., “International credit supply shocks”, Journal of International Economics, Vol. 112(C), 2018, pp. 219‑237, and Rey, H., “International Channels of Transmission of Monetary Policy and the Mundellian Trilemma”, IMF Economic Review, Vol. 64, No 1, 2016.

- See Bruno, V. and Shin, H. S. (2015), ibid.

- See for instance Habib, M. M. and Stracca, L. (2012) for an application to currencies (“Getting beyond carry trade: What makes a safe haven currency?”, Journal of International Economics, Vol. 87, Issue 1, May 2012, pp. 50‑64). The choice of the VIX can be justified on three grounds. First, implied volatility is strongly correlated across countries so that even country‑specific variables mostly capture global trends. Second, the US stock market plays a central role in global financial markets owing to the importance of the US dollar. Third, the VIX is available for a long time span.

- For a discussion, see Bekaert, G., Hoerova, M. and Lo Duca, M., “Risk, uncertainty and monetary policy”, Journal of Monetary Economics, Vol. 60, No 7, 2013, pp. 771‑788.

- See Obstfeld, M., Shambaugh, J. and Taylor, A., “The trilemma in history: tradeoffs among exchange rates, monetary policies, and capital mobility”, Review of Economics and Statistics, Vol. 87(3), 2005, pp. 423‑438.

- The model is estimated with a Driscoll‑Kraay estimator accounting for cross‑sectional and temporal dependence of the residuals. The results are robust to the inclusion of different lags of the dependent variable.

- For consistency with how it is constructed, the Global Stock Market Factor enters the equation for equity returns in first differences.

- Capital account openness is measured using the de jure index developed by Chinn, M. D. and Ito, H., “What Matters for Financial Development? Capital Controls, Institutions, and Interactions”, Journal of Development Economics, Vol. 81, Issue 1, October 2006, pp. 163‑192. The exchange rate regime classification is based on Ilzetzki, E., Reinhart, C. M. and Rogoff, K. S., “Exchange Arrangements Entering the 21st Century: Which Anchor Will Hold?”, NBER Working Paper No 23134, February 2017.

- Neely, C., “The Large Scale Asset Purchases Had Large International Effects”, Journal of Banking and Finance, Vol. 52, March 2014, pp. 101‑111, Rogers, J. H., Scotti, C. and Wright, J. H., “Evaluating Asset‑Market Effects of Unconventional Monetary Policy: A Multi‑Country Review”, Economic Policy, Vol. 29, No 80, 2014, pp. 3‑50, and Jarociński, M. and Karadi, P., “Deconstructing monetary policy surprises: the role of information shocks”, Working Paper Series, No 2133, ECB, 2018. ECB monetary policy has similar effects; see, for instance, “Monetary policy, exchange rates and capital flows”, speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the 18th Jacques Polak Annual Research Conference hosted by the International Monetary Fund, Washington D.C., 3 November 2017.

- Wu, C. and Xia, D., “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound”, Journal of Money, Credit and Banking, Vol. 48, March 2016, pp. 253‑291.

- Over the past few years, the relationship between capital flows and the US dollar has remained significantly negative for emerging markets. This outcome may be explained by the increased attractiveness of the US dollar as a safe haven since the start of the global financial crisis. It is possible to note that the value of the dollar is positively correlated with risk factors (around 0.2) since 2010, but not in the 1990s.

- Replacing the level of US interest rates with US monetary policy shocks identified with high‑frequency data or an index of US monetary policy uncertainty does not substantially alter these findings. In a dynamic panel setting similar to the one introduced in Box 1, distinguishing between different types of capital and controlling for pull factors, US monetary policy shocks are negatively related to portfolio equity flows and stock returns, but not to other types of capital flows.

- See the speech by the Federal Reserve Chairman J. H. Powell entitled “Monetary Policy Influences on Global Financial Conditions and International Capital Flows” at “Challenges for Monetary Policy and the GFSN in an Evolving Global Economy”, Eighth High‑Level Conference on the International Monetary System sponsored by the International Monetary Fund and the Swiss National Bank, Zurich, Switzerland, 8 May 2018.

- For instance, recent analyses show that the ECB’s asset purchase programme (APP) has triggered substantial capital flows across borders, favouring a substantial portfolio adjustment towards foreign sovereign bonds and increasing the average maturity of bonds in the portfolios. Also, APP announcements have caused a broad‑based depreciation of the euro and boosted equity prices around the world; see “The international dimension of the ECB’s asset purchase programme”, speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the Foreign Exchange Contact Group meeting, 11 July 2017.

- See, for instance, “Financial conditions and growth at risk”, Global Financial Stability Report, IMF, October 2017, Chapter 3.

- The index, computed by Goldman Sachs, is a weighted average of a short‑term interest rate, a long‑term riskless bond yield, a corporate credit spread, the ratio of an equity index to a lagged ten‑year average of earnings per share, and a trade‑weighted exchange rate. In the case of the euro area, the index also includes a measure of fragmentation, i.e. a sovereign credit spread. It assigns to the different indicators a weight that reflects their predictive content for GDP four quarters ahead which is also inversely related to their standard deviation.

- The indices are computed by Bloomberg. The index for the United States includes: (i) for money market rates, the TED spread, the LIBOR/OIS spread and the commercial paper/T‑bill spread; (ii) for the bond market, the Baa corporate/Treasury spread, the municipal/Treasury spread, the high‑yield Treasury spread and the swaption volatility index; and (iii) for the stock market, the VIX and the deviation of Standard & Poor’s share prices from their five‑year moving average. All the components are aggregated using equal weights. For the euro area, the index includes: (i) for money market rates, the euro TED spread and the EURIBOR/OIS spread; (ii) for the bond market, the JP Morgan High Yield Europe Index and the EU ten‑year swap spread; and (iii) the deviation of EURO STOXX share prices from their five‑year moving average, the VDAX‑NEW index and de‑trended share prices.

- The indicators are in deviations from a historical mean and standardised, so that periods in which they are positive (negative) indicate financial conditions being tight (loose) relative to their mean level.

- July 2012 is taken as the cut‑off period to account for changes in market expectations about the likelihood of the ECB adopting unconventional monetary policy measures following the speech given by Mario Draghi, President of the ECB, at the Global Investment Conference in London on 26 July 2012.

- An interesting observation is that the crisis that originated in the United States in 2008 had a stronger impact on the euro area than the euro area sovereign debt crisis had on the United States. While more refined analyses would be needed to ascertain the strength of the respective causal effects, it is plausible that the strong activity of euro area banks in the United States amplified the effects of the US crisis on the euro area economy.

- The methodology follows Miranda‑Agrippino and Rey (2015). Nevertheless, this exercise uses only national averages of equity returns and does not consider the prices of risky bonds.