Euro area monthly balance of payments (April 2015)

- In April 2015 the current account of the euro area recorded a surplus of €22.3 billion. [1]

- In the financial account, combined direct and portfolio investment recorded increases of €41 billion in assets and €4 billion in liabilities.

Current account

The current account of the euro area recorded a surplus of €22.3 billion in April 2015 (see Table 1). This reflected surpluses for goods (€30.4 billion), services (€3.4 billion) and primary income (€2 billion), which were partly offset by a deficit in secondary income (€13.5 billion).

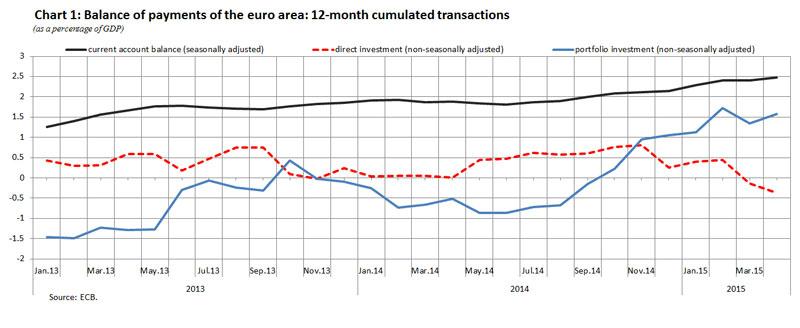

The 12-month cumulated current account for the period ending in April 2015 recorded a surplus of €251.5 billion (2.5% of euro area GDP), compared with a surplus of €187.7 billion (1.9% of euro area GDP) for the 12 months to April 2014 (see Table 1 and Chart 1). The increase in the current account surplus was due to increases in the surpluses for goods (from €214.5 billion to €279.5 billion) and primary income (from €45.5 billion to €52.6 billion), as well as a decrease in the deficit for secondary income (from €142.7 billion to €140.4 billion). These were partly offset by a decrease in the surplus for services (from €70.4 billion to €59.8 billion).

Financial account

In the financial account (see Table 2) in April 2015, combined direct and portfolio investment recorded increases of €41 billion in assets and €4 billion in liabilities.

Euro area residents recorded an increase of €7 billion in direct investment assets, which was due to increases in equity (€4 billion) and debt instruments (€3 billion). Direct investment liabilities increased as well, namely by €21 billion, on account of increases in equity (€10 billion) and debt instruments (€12 billion).

As regards portfolio investment assets, euro area residents made net acquisitions of foreign securities in a total amount of €34 billion, owing to net purchases of both equity (€20 billion) and long-term debt securities (€26 billion). These net purchases were partially offset by net sales of short-term debt securities (€12 billion). The decrease of €17 billion in euro area portfolio investment liabilities was mainly due to net sales/amortisations by non-euro area residents of euro area long-term debt securities (€38 billion), which were partially offset by net purchases of short-term debt securities (€14 billion) and equity (€6 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded positive net flows of €4 billion.

Other investment recorded increases of €72 billion in assets and €127 billion in liabilities. The increase in assets was mainly driven by MFIs (excluding the Eurosystem) (€63 billion) and, albeit to a lesser extent, by other sectors (€12 billion). The increase in liabilities was due almost entirely to increases for MFIs (excluding the Eurosystem) (€128 billion) .

The Eurosystem’s stock of reserve assets decreased by €22 billion in April 2015 (to €668 billion), which was explained by negative revaluations of gold (€9 billion), the appreciation of the euro vis-à-vis the main currencies (US dollar and Japanese yen) and net sales of reserve assets (€5 billion).

In the 12 months to April 2015 combined direct and portfolio investment recorded cumulated increases of €563 billion in assets and €441 billion in liabilities, compared with increases of €738 billion and €789 billion respectively in the 12 months to April 2014. This resulted from a significant decrease in the direct investment activity of both euro area residents abroad and non-residents in the euro area, while activity in portfolio investment showed a significant increase in the net purchases of foreign debt securities by euro area residents and a relatively small decrease in total portfolio investment liabilities.

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs increased by €23 billion in the 12 months to April 2015, compared with an increase of €331 billion in the preceding 12-month period. This development in the MFIs’ net external assets continued primarily to reflect a surplus of €268 billion in the current and capital account balance, which has in the last 12 months been partially compensated for by, among other things, (i) larger net purchases of portfolio investment assets by euro area non-MFI residents (from €258 billion to €353 billion) and (ii) a shift from net purchases by non-residents of debt securities issued by euro area non-MFI residents (€126 billion) to net sales/amortisations (€46 billion), thus reducing the involvement of domestic banks.

Data revisions

This press release incorporates revisions for the period from January 2015 to March 2015. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological information: ECB’s website

Monetary presentation of the balance of payments Next press releases:- Monthly balance of payments: 20 July 2015 (reference data up to May 2015);

- Quarterly balance of payments and international investment position: 9 July 2015 (reference data up to the first quarter of 2015).

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

For media queries, please contact Rocio Gonzalez, Tel.: +49 69 1344 6451.

[1]1] References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts