- PRESS RELEASE

- 3 March 2020

ECB pushes for EU capital markets integration and development

- Euro area financial structure moves away from bank dominance as non-bank intermediaries assume greater role

- No broad increase observed in marketable financial instruments

- ECB sees scope for equity to play greater role in firms’ funding

- Development of equity markets could help decarbonise EU economies

According to the new European Central Bank (ECB) report on “Financial Integration and Structures in the Euro Area”, the financial structure of the euro area continues to be dominated by non-marketable instruments, despite an increase in financial integration in 2019. The share of listed equity and debt securities in the total financing of euro area countries remained relatively low compared with that of bank loans and unlisted equity, and has not changed much for many years now. Given that overall financial integration has not yet reached a satisfactory level and that euro area households, firms and governments would benefit from broader and deeper capital markets, the ECB expresses strong support for recent initiatives to advance with the European capital markets union (CMU) project. “The first phase of CMU delivered important results, but more can be achieved. Relaunching CMU should be a priority for the years ahead,” said ECB Vice-President Luis de Guindos about the report which focuses on structural developments in the financial sector.

The size of the euro area financial system has remained broadly unchanged in recent years, at six to seven times gross domestic product. The strong dominance of banks has been on the decline since the early 2000s, but this has been more than offset by a rise in the importance of non-money market investment funds and other financial institutions. Non-bank financial intermediaries, of which investment and pension funds are the fastest growing type, now account for almost 60% of total euro area financial assets. The report notes that this deserves attention, as it could reflect not only financial development, but partly also a migration of risks from the banking sector to less regulated sectors.

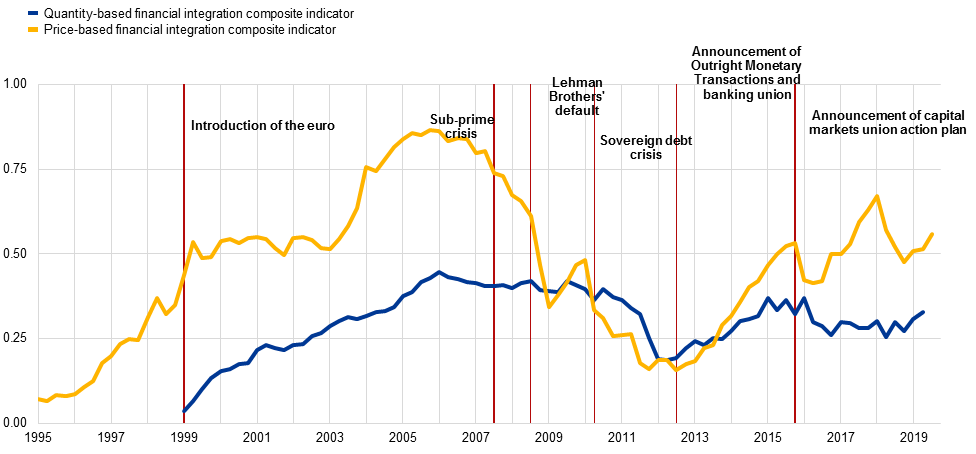

Price-based and quantity-based composite indicators of financial integration

(quarterly data; price-based indicator: Q1 1995 – Q3 2019; quantity-based indicator: Q1 1999 – Q2 2019)

Source: ECB and ECB calculations.Notes: The price-based composite indicator aggregates ten indicators for money, bond, equity and retail banking markets, while the quantity-based composite indicator aggregates five indicators for the same market segments except retail banking. The indicators are bounded between zero (full fragmentation) and one (full integration). Increases in the indicators signal greater financial integration. From January 2018 onwards the behaviour of the price-based indicator may have changed due to the transition from EONIA to €STR interest rates in the money market component. OMT stands for Outright Monetary Transactions. For a detailed description of the indicators and their input data, see the Statistical Web Annex to this report and Hoffmann, P., Kremer, M. and Zaharia, S. (2019), “Financial integration in Europe through the lens of composite indicators”, Working Paper Series, No 2319, ECB, September.

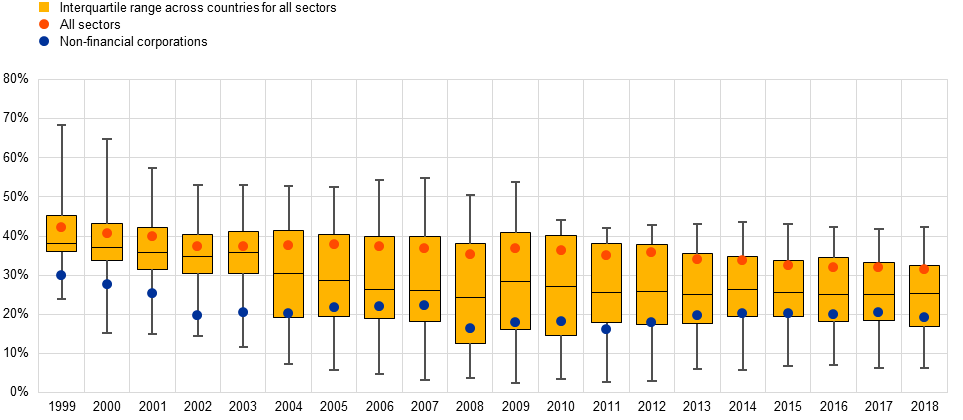

Marketable proportion of external funding among euro area countries

(ratio; annual data: 1999‑2018)

Source: ECB.Notes: The marketable part of a euro area country’s capital market is defined as the total debt securities and listed shares over total loans (adjusted for intra-company loans), trade credits, debt securities and equity (including listed and unlisted shares as well as other equity). For the years 1999‑2003, the plot is based on only 12 countries (specifically, it excludes Cyprus, Estonia, Malta, Lithuania, Latvia, Slovakia and Slovenia).

The continuing dominance of non-marketable financing instruments, such as loans and unlisted equity, is indicative of the need for capital markets to broaden and deepen. Only certain marketable instruments, notably debt securities issued by non-financial corporations, are showing a slight medium-term upward trend in the euro area, while the amount of public equity listed on exchanges remains relatively small.

The last decade also saw rapid growth in fintech entities, with the euro area now hosting around one-fifth of the total number worldwide. Most of the 2,800 fintech firms in the euro area are locally owned, and many are located in smaller, technology-oriented countries. However, the sector lacks a statistical classification, which is key to being able to analyse it better and compare it with other sectors of the financial industry.

In order to foster financial integration and development, it is necessary to complete the banking union and progress towards a real CMU. In the policy section of the report, it is argued that, when it comes to the CMU, there is scope to increase the proportion of public equity in firms’ funding. Furthermore, euro area private equity markets should become a more dynamic source of risk capital, providing better growth opportunities for young and innovative companies. Mr de Guindos pointed out that “a number of factors and frictions on both the demand and the supply side are limiting the development of risk capital markets in Europe”. The growth of young and innovative companies typically drives productivity gains and fosters substantial employment growth.

Over time, the further development of equity markets could make a significant contribution to decarbonising EU economies. New ECB research suggests that countries with economies that have a funding structure more focused on equity than bank credit or other forms of debt have reduced their carbon footprints more than other countries in recent decades. Equity markets are a better source of funding for innovative companies, with banks often lending against the kind of tangible collateral that so-called brown, or polluting, industries can provide more of than green industries.

Note:

Financial Integration and Structure in the Euro AreaFor media queries, please contact Peter Ehrlich, tel.: +49 69 1344 8320

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts