- THE ECB BLOG

Shining a light on climate risks: the ECB’s economy-wide climate stress test

Blog post by Luis de Guindos, Vice-President of the ECB

Frankfurt am Main, 18 March 2021

Jump to a shorter version of this blog post, which also appeared in several euro area newspapers

Climate change is one of the greatest challenges facing humankind this century. If left unchecked, it is likely to result in more frequent and more severe climate events, causing widespread devastation and economic disruption. Substantial changes in our production, consumption and living habits are required if the world is to avert catastrophic climate change. However, the changes required may themselves disrupt the economy and the financial system.

While the primary responsibility for combating climate change lies with governments, central banks can play an important contributory role. They can help ensure that the financial system is resilient to the transition to a low-carbon economy, by providing more and better information to market participants on the risks from climate change. Stress tests can be an important tool here, as they can cast a light on climate risks that currently still lurk in the darkness.

In this blog post, I will describe the framework for the economy-wide climate stress test that we are currently conducting at the ECB. It encompasses approximately four million companies worldwide and 2,000 banks – almost all monetary financial institutions in the euro area – and covers a period of 30 years into the future. This comprehensive exercise – the first of its kind – aims to assess the exposure of euro area banks to future climate risks by analysing the resilience of their counterparties under various climate scenarios. It is a vital step forward in our quest for knowledge on the impact climate risks have on economic and financial stability, which until now has been poorly identified, quantified and understood.

Climate risks differ from the more familiar risks that arise during the standard business cycle. To measure the impact of these risks, the specific transmission channels in the economy and the financial system – which traditional financial models may not fully capture – must be carefully identified and measured. Climate change occurs slowly over a long period of time with potentially irreversible consequences. Modelling frameworks therefore need to incorporate plausible representations of both the economy and the climate in a way that clarifies how they interact, as well as how policies to prevent or mitigate climate change affect them both over the long run.

Progress on these fronts has been hampered to date by a lack of data. Only a minority of companies worldwide report their carbon footprints, and there is still room for improvement in terms of disclosure by financial institutions.[1] Information on potential future exposure to extreme climate events is even scarcer. That is why climate stress test exercises up until now have focused solely on the near-term impact of climate policies.[2]

The ECB economy-wide climate stress test extends the analysis to include the impact of extreme climate events over a much longer time period (30 years). This is an important innovation that provides a more balanced picture of the long-run trade-offs involved in climate policies and has been made possible thanks to a newly created and unique dataset that identifies and maps climate risks to individual companies and banks.

Preliminary results show that in the absence of further climate policies, the costs to companies arising from extreme weather events rise substantially, and greatly increase their probability of default. The resulting ‘hot house world’ will be particularly challenging for certain regions projected to become markedly more vulnerable to events such as heatwaves and wildfires in the future. Climate change thus represents a major source of systemic risk, particularly for banks with portfolios concentrated in certain economic sectors and, even more importantly, in specific geographical areas

Our results also show that there are clear benefits in acting early. The short-term costs of the transition pale in comparison to the costs of unfettered climate change in the medium to long term. The early adoption of policies to drive the transition to a zero-carbon economy also brings benefits in terms of investing in and rolling out more efficient technologies. These results underline the crucial and urgent need to transition to a greener economy, not only to ensure that the targets of the Paris Agreement are met, but also to limit the long-run disruption to our economies, businesses and livelihoods.

The framework for the economy-wide stress test is explained in more detail below. Work will continue over the course of this year to refine the results and understand how this counterparty exposure influences the profitability and lending dynamics of the euro area banking sector. The results will help inform ongoing climate work across the ECB, including the separate supervisory climate stress-test of individual banks that ECB Banking Supervision will carry out in 2022.[3]

Climate change as a source of systemic risk

Climate-related risks to the economy and financial sector are usually divided into two categories. The first is physical risk, in other words the economic impact stemming from the expected increase in the frequency and magnitude of natural hazards. Production plants located in areas that are exposed to natural hazards, for example close to rivers or the seashore and therefore prone to flooding, could suffer significant damage should a climate event occur. This damage could interrupt the production process in the short term and potentially lead to business failure in the longer term.

The second is transition risk, where the potential delayed and abrupt introduction of climate policies to reduce CO2 emissions could have a negative impact on certain carbon-intensive industries. For example, industries that rely heavily on non-renewable or highly polluting resources, such as mining or fossil fuel extraction, could face a sharp fall in profits and higher production costs.

Both transition and physical risks can have a detrimental effect on financial institutions. Direct exposures to affected firms through lending or asset holdings can generate losses if defaults occur. In addition, there may be exposures to households and firms that are indirectly affected, through supply-chain linkages, or from lower demand and higher unemployment as a result of a more generalised economic downturn.

While it is common to distinguish between transition risks and physical risks, in truth the two are intertwined. In the absence of further climate policies, businesses face higher costs from increasing physical risk. Yet policies to limit carbon emissions, such as a carbon tax, may increase the costs of raw materials and energy, or require businesses to carry out a costly and large-scale overhaul of their production processes to eliminate the use of carbon.

Transition and physical risks are therefore two sides of the same coin: greater policy action may increase the impact of transition risks, but at the same time reduce physical risks in later decades. This relationship is one of the key elements captured and quantified in the ECB economy-wide climate stress test.

Stress tests: a vital tool to assess risk

Since the financial crisis, stress tests have become a vital part of the supervisory and financial stability toolkit to assess the resilience of financial institutions to adverse conditions.[4] A stress test of the banking system investigates how bank liquidity and capital would be affected under a number of severe – but plausible – scenarios of potential future events. These hypothetical scenarios describe situations that are expected to have a negative impact on banks’ businesses and balance sheets, such as a recession or a financial market crash.

Climate stress tests have a similar objective: to test the resilience of banks and non-financial corporations in a range of climate scenarios. These different scenarios combine plausible representations of future climatic conditions with estimates of the macroeconomic impact of policies designed to limit the extent of climate change. For example, a climate scenario could include a reduction in CO2 emissions that would be compatible with meeting the temperature targets in the Paris Agreement by 2100 as well as paths for technological development, adoption rates for renewable sources of energy and energy prices.

The stress test exercise described here has been conducted centrally by ECB staff, relying on internal datasets and models. It therefore differs in approach from the supervisory climate stress test, already announced for 2022, which instead will rely on banks’ self-assessment of their exposure to climate change risk and their readiness to address it.[5] The results of the economy-wide exercise will be finalised for the banking sector by mid-2021 and will be used to inform the supervisory climate exercise that will be performed next year.

The main components of the ECB climate stress test

The economy-wide climate stress test is the most comprehensive exercise of its kind to date. It combines a comprehensive dataset of millions of companies with data on bank exposures and a set of climate and economic development scenarios.

Chart 1

Innovative components of the ECB climate stress test

Source: ECB

The unprecedented dataset constructed by the ECB collects financial and climate information for millions of firms. The carbon footprint of firms worldwide is used to determine the potential impact of green policies.[6] This database contains information on both past and future firm-level emissions, accounting for firm-specific emission reduction targets under different scenarios.

A forward-looking physical risk score for each firm in the sample[7] measures the future incidence of extreme natural phenomena as a result of climate change, such as riverside and coastal floods, wildfires, heat and water stress, and windstorms. These scores are matched to individual company addresses. They therefore capture detailed characteristics of physical risk exposure, which is essential for the impact of natural hazards to be analysed accurately. Other data sources have been used to complement firms’ climate-related information with financial variables.[8]

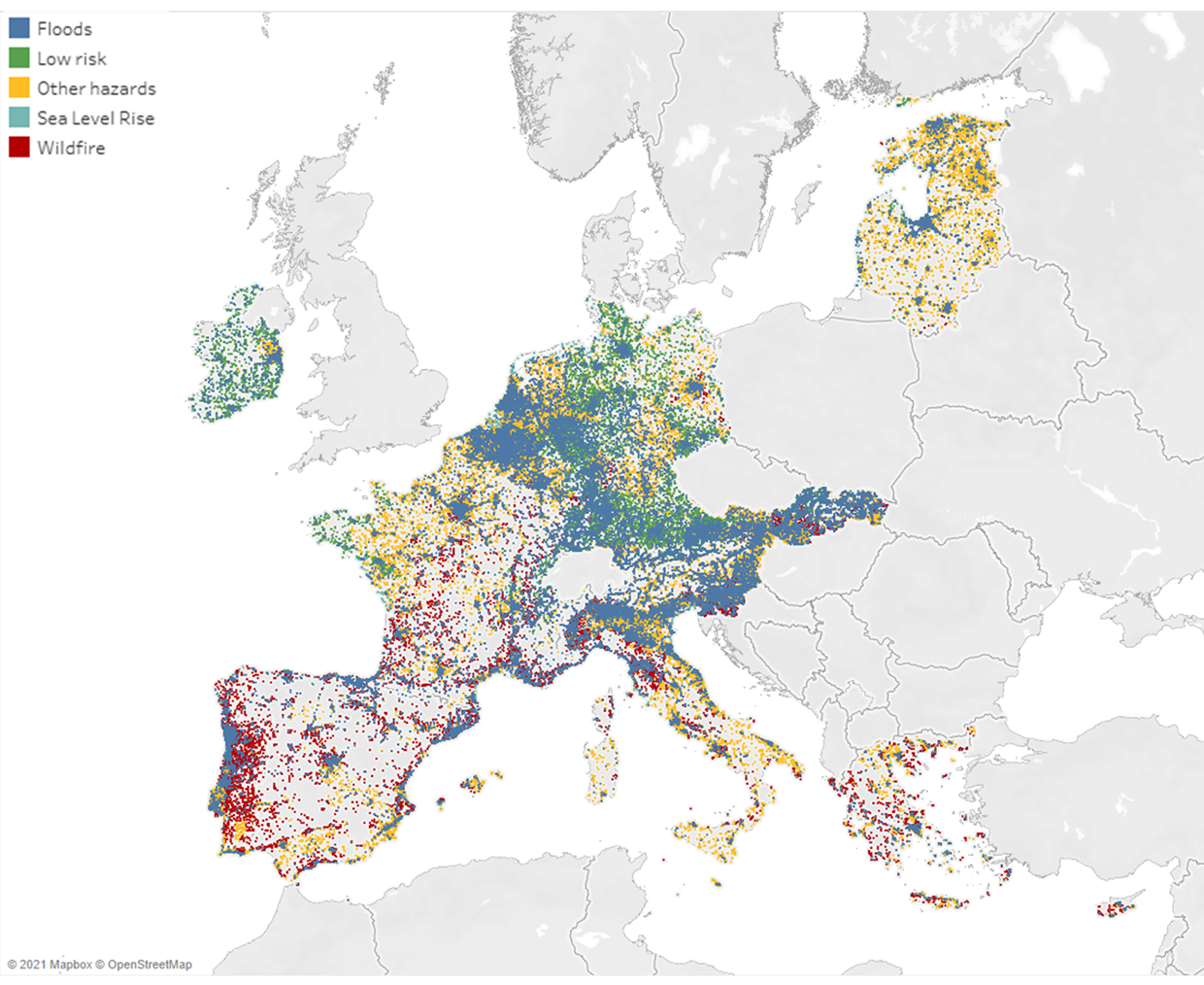

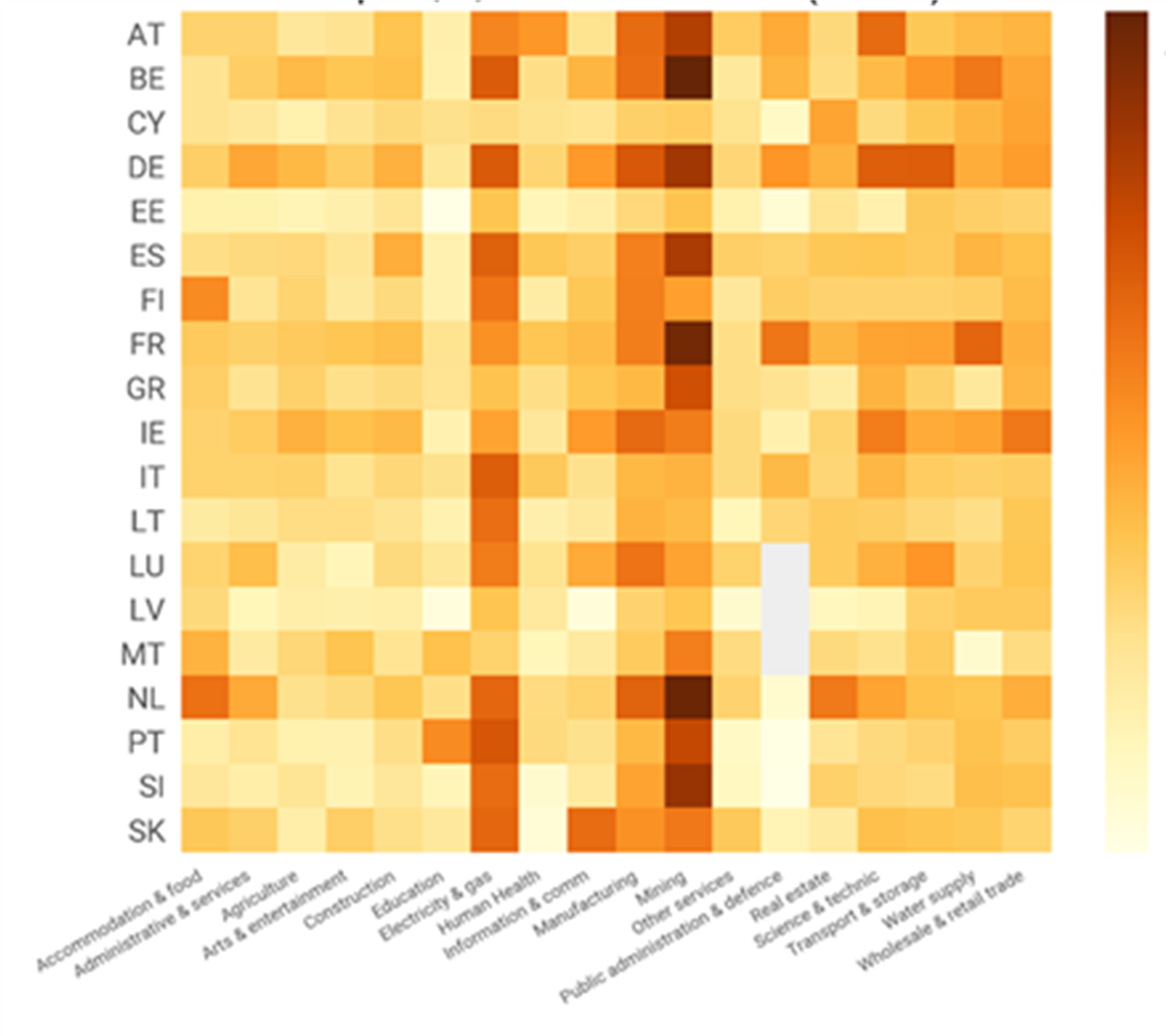

The ECB firm-level dataset highlights that some specific sectors of the economy and geographical areas in Europe may be particularly vulnerable to physical and transition risk. For physical risk, there are clear divergences across countries and regions in terms of both the aggregate rate of physical risk and the specific type of risk. Southern European countries are on average more susceptible to heat stress and wildfires, while middle and northern European countries are more vulnerable to flooding risk (Panel A in Chart 2). Turning to transition risk, mining, energy, and manufacturing activities correspond to the most carbon-intensive sectors, meaning that firms operating in those sectors could be adversely affected by policies to reduce emissions, particularly if the transition to a green economy is sudden and abrupt (Panel B in Chart 2).

Chart 2 A

Mapping of transition and physical risk for euro area firms

Panel A. Physical risk: forward-looking physical risk score of euro area firms

Source: ECB calculations based on the Four Twenty Seven dataset. Each dot corresponds to a firm in the sample. Gaps in the mapping are due to (a) economic activities being concentrated in specific industrial areas in some countries, and (b) Four Twenty Seven data not being available for latitudes above 60 degrees for flood risk. Other hazards include water stress, heat stress and hurricanes and typhoons. For simplicity only euro area firms are displayed in the chart, although data are available for a much broader sample.

Chart 2 B

Mapping of transition and physical risk for euro area firms

Panel B. Transition risk: carbon footprint of European firms averaged by country-sector (2018)

Source: ECB calculations based on the Urgentem dataset. For simplicity only euro area firms are displayed in the chart, although data are available for a much broader sample.

The ECB climate stress-test combines these company-level exposure data with the aggregate trajectories for transition and physical risk embedded into scenarios created by the Network for Greening the Financial System (NGFS).[9] This approach makes it possible to conduct a careful assessment of the impact on costs and the probability of default of companies – a measure of financial risk – and clarifies the trade-off between the costs of transitioning towards a greener economy and a no-transition scenario.

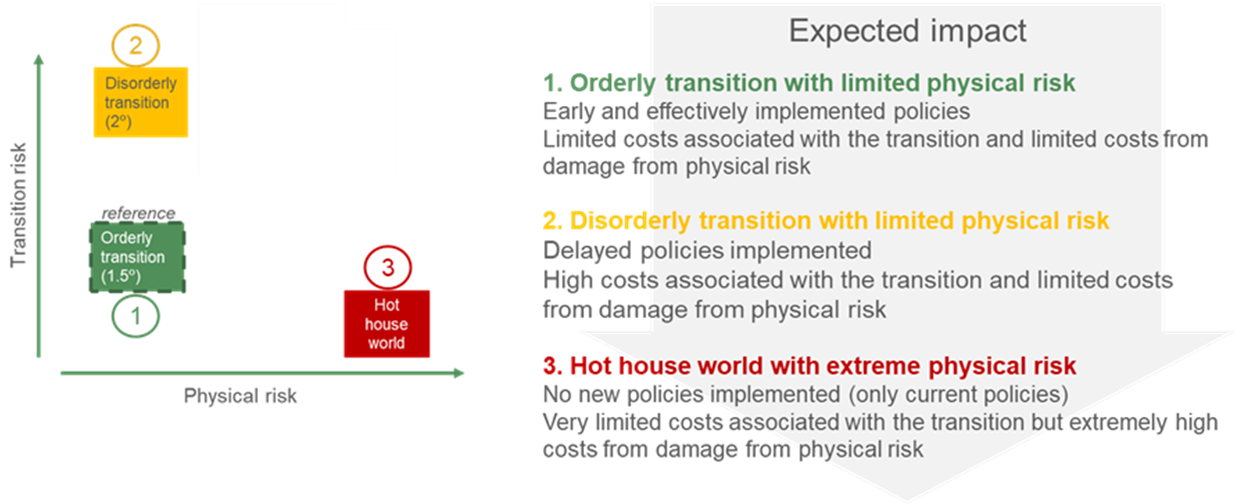

Several scenarios are used. The ‘orderly transition’ scenario considers the timely and effective implementation of climate policies, which successfully limit global warming. Costs from both transition and physical risks are therefore relatively contained. By contrast, the ‘hot house world’ scenario considers the impact if no new climate policies are implemented. The costs associated with the transition are consequently limited, but those related to physical risk accelerate and are extremely high by the end of the scenario. The ‘disorderly transition’ scenario considers the impact of a delayed and abrupt implementation of climate policies.

Chart 3

ECB climate scenarios

Source: ECB

Preliminary results

Preliminary results show that a timely and effective transition to a greener economy is always the preferable course of climate policy action. While firms’ probability of default initially rises, mainly due to the costs of adapting to green policies, this increase is more than offset in the medium to long term by the much lower costs to cover physical risk. The development of new and more sustainable technologies allows firms to become more energy efficient and to achieve significant production cost gains. In the long run, these cost efficiencies outweigh the cost of adopting new technologies, thereby boosting corporate profitability and creditworthiness.

In the hot house world scenario, the damage caused by more frequent and severe natural disasters far exceeds the transition costs arising under the orderly scenario. Firms in regions that are highly exposed to physical risk could see a significant share of their physical capital destroyed if natural hazards materialise, especially in the long run. In addition, these firms would see an increase in insurance premiums, leading to a further deterioration in their profitability.

In the disorderly transition scenario, the costs of implementing green policies are higher than in the orderly transition. However, in the long run these costs are still lower than the costs of extreme physical risk associated with a hot house world scenario.

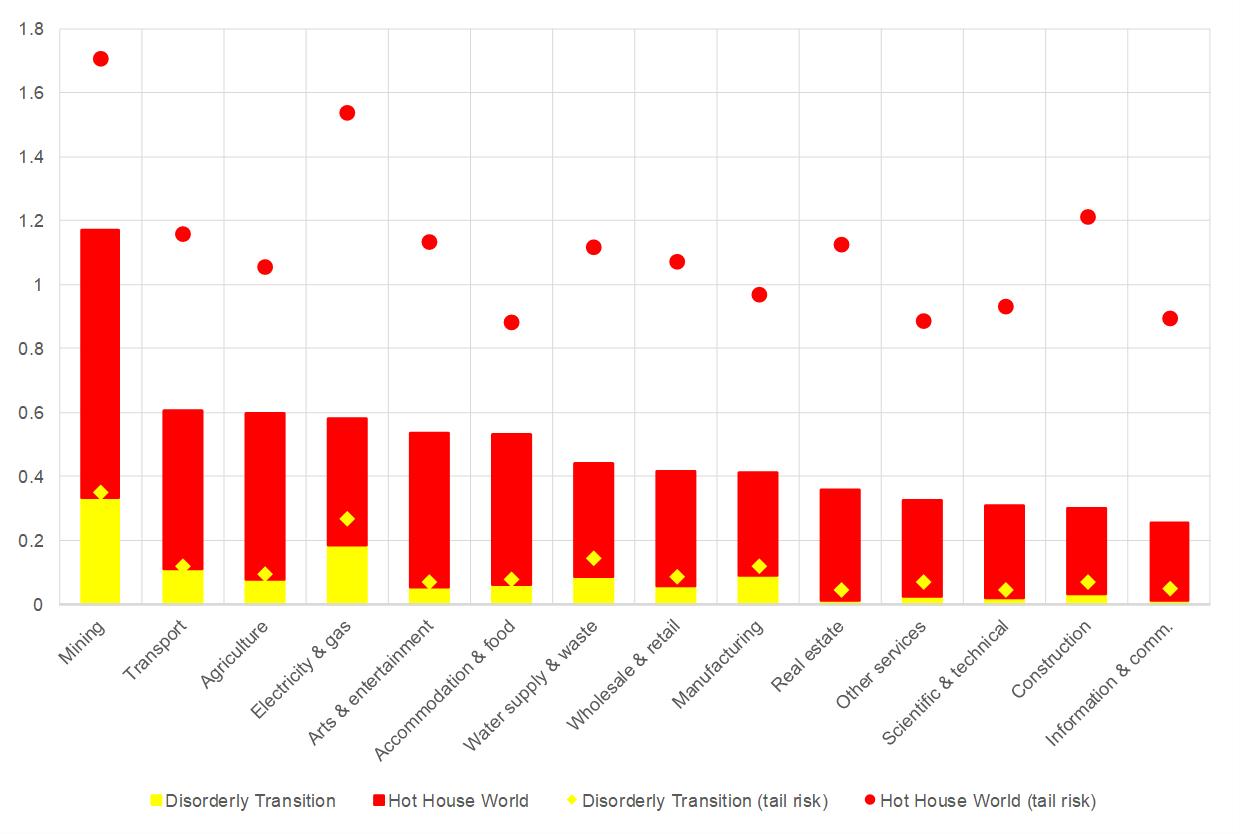

Figure 4 displays the differences in firms’ default probabilities (PDs) over the next 30 years under the disorderly transition scenario (yellow bars) and the hot house world scenario (red bars) with respect to the orderly transition scenario. The results show that default probabilities are always much higher in case of no transition to a greener economy, even when looking at different sectors. A disorderly transition would also lead to larger PDs than an orderly transition, however of a lower magnitude with respect to the hot house world scenario. Additionally, the increase in PDs in case of a disorderly transition is more significant for the most polluting sectors, such as mining, electricity and transport.

Figure 4

Differences in firms’ default probabilities (%) in the two adverse scenarios with respect to the orderly transition scenario, by sector and group of firms (mean firms, and firms mostly exposed to physical risk)

Source: ECB calculations

Note: the bars represent the median changes in default probabilities over the next 30 years; the dots instead report the changes in default probabilities when considering the firms that are most exposed to physical risk (95th percentile based on firms’ physical risk score).

Preliminary outcomes also show that the impact of climate risks on corporates is extremely heterogeneous across sectors and geographical areas. The biggest polluting firms, together with those in regions that are the most vulnerable to physical risk, could be exposed to up to four times as much climate risk as the average firm over the next 30 years. The yellow and red dots in Figure 4 report the increase in default probabilities when considering only the firms most vulnerable to physical risk, also in this case with respect to the orderly transition scenario. The outcomes indicate that in case of no transition, the vulnerability of firms located in geographical areas particularly exposed to physical hazards would increase substantially. Indeed, climate change amplifies risks to economic activity and the potential disruption could become extreme in some geographical areas, especially if no further policies to reduce carbon emissions are introduced.

Next steps

The ECB plans to take a number of further steps to broaden and strengthen these preliminary results. First of all, the firm-level impacts will be used to assess banks’ resilience to climate risks through loans, security and equity holdings. The full set of results will be available by mid-2021, including how changes in firms’ solvency translate into changes in bank-level vulnerability to transition and physical risk. The exercise will include more than 2,000 consolidated banking groups, covering almost all banks in the euro area.

The current framework will then be extended to include a more dynamic response by banks to climate change. In particular, the decline in the creditworthiness of certain firms could incentivise banks to adjust the composition of their portfolios, shifting their investments towards less risky firms. Those changes in bank exposures could trigger second-round effects on the real economy, for example through investment demand. The current framework will be expanded to consider these dynamics in the second half of 2021. Finally, the impact on the portfolios of non-banks such as asset managers and insurance companies will also be considered to arrive at a comprehensive view of the impact of climate change on the entire financial sector.

***

The following is a shorter version of the blog post, which appeared as an opinion piece in the following publications: De Tijd (Belgium), Stockwatch.com.cy (Cyprus), Kauppalehti (Finland), L’Agefi (France), Börsen-Zeitung (Germany), Kathimerini (Greece), Il Sole 24 Ore (Italy), El Economista (Spain).

Stress testing the financial sector’s resilience to climate change

Climate change has the potential to cause substantial disruption to our economies, businesses and livelihoods in the coming decades. Yet the associated risks remain poorly understood, as climate shocks differ from the financial shocks observed during previous crises. Climate change occurs slowly over long periods, which creates significant uncertainty about how extreme climate events will materialise in the future. Both public and private institutions have a great deal of work ahead of them to effectively identify and assess the potential impact of these risks given that the traditional risk management tools may not suffice. With this in mind, the ECB has designed the first economy-wide climate stress test to help both authorities and financial institutions assess the impact of climate risks on companies and banks over the next 30 years.

Typically, climate change risks are split into two broad categories. The first is physical risk, which stems from the expected increase in the frequency and magnitude of disasters caused by natural hazards. Businesses located in exposed areas, for example close to rivers or the seashore and therefore prone to flooding, could suffer significant damage should a climate event occur. This damage could interrupt the production process in the short term and potentially lead to business failure in the longer term. Physical risks differ across countries and regions, with southern Europe on average more susceptible to heat stress and wildfires, while central and northern Europe are more vulnerable to flooding.

The second category is transition risk, where the delayed or abrupt introduction of climate policies to reduce CO2 emissions could have a negative impact on certain energy and carbon-intensive industries, such as mining, cement or steel. Higher tax rates on carbon usage could, for example, increase production costs and reduce profitability.

Both physical and transition risks can harm financial stability if banks or other financial institutions are exposed to defaulting firms through their lending or asset holdings. Yet while it is common to distinguish between the two types of risk, in truth they are intertwined. Greater climate policy action may increase the impact of transition risks in the near term while simultaneously reducing the incidence of physical risks in future decades. The ECB climate stress test captures and quantifies this potential trade-off using a 30-year timeline to take account of the long-run impact.

The ECB climate stress test examines the resilience of companies and banks to a range of climate scenarios. These scenarios set out plausible representations of future climatic conditions while also accounting for the impact on businesses of measures taken to limit the extent of climate change, such as carbon taxes. The ECB scenarios are based on those provided by the Network for Greening the Financial System but have been adjusted to capture the relationship between transition risk and physical risk more thoroughly.

The orderly scenario considers the timely and effective implementation of climate policies which successfully limit global warming. The hot house world scenario considers the impact if no new climate policies are implemented and is associated with a very significant increase of physical risk in the medium to long run. The disorderly scenario considers the impact of a delayed and abrupt implementation of climate policies.

These scenarios, together with a unique dataset that identifies and quantifies transition and physical risk exposures for millions of companies worldwide, provide the background for analysing the impact of climate change on businesses and banks.

Preliminary results show that, in the absence of further climate policies, the costs to companies arising from extreme events increase substantially. The results also show that there are clear benefits in taking action early: the short-term costs of adapting to green policies are significantly lower than the potentially much higher costs arising from natural disasters in the medium to long term. Climate change thus represents a major source of systemic risk, particularly for banks with portfolios concentrated in certain economic sectors and geographical areas.

These results underline the crucial and urgent need to transition to a greener economy, not only to ensure that the targets of the Paris Agreement are met, but also to limit the long-run disruption to our economies, businesses and livelihoods.

- ECB (2020), ECB report on institutions’ climate-related and environmental risk disclosures.

- See Vermeulen, R. et al. (2018), “An energy transition risk stress test for the financial system of the Netherlands”, Occasional Studies, Vol. 16, No 7, De Nederlandsche Bank; Allen, T. et al. (2020), “Climate-Related Scenarios for Financial Stability Assessment: An Application to France”, Working Paper Series, No 774, Banque de France; European Systemic Risk Board (2020), “Positively green: Measuring climate change risks to financial stability”, June

- https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr201127~5642b6e68d.en.html

- See de Guindos, L. (2019), “The evolution of stress-testing in Europe”, keynote speech given at the annual US-EU Symposium organised by the Program on International Financial Systems, Frankfurt, 4 September.

- In the standard terminology for stress tests, the economy-wide exercise described in this blog post is “top-down”, whereas the supervisory stress test is “bottom-up”.

- The carbon footprint of firms is derived from the Urgentem dataset: for more information, please visit their website Urgentem.net.

- The physical risk scores of firms are derived from the Four Twenty Seven dataset: for more information, please visit their website 427mt.com.

- Financial information of firms are derived from Orbis, Bloomberg, Eikon and iBACH.

- NGFS (2020), “NGFS Climate Scenarios for Central Banks and Supervisors.” Network of Central Banks and Supervisors for Greening the Financial System, Paris.