Published as part of the ECB Economic Bulletin, Issue 2/2024.

The ECB monitors developments in the international role of the euro and publishes the resulting information on a regular basis. The ECB’s most recent report on this topic (which was published in June 2023) showed no significant change in the international role of the euro in 2022 relative to 2021, with the share of the euro in total international currency use averaging close to 20% across various indicators, in line with the previous year.[1] The report showed that the euro was continuing to play an important role in the international monetary system, as it remained the second most important currency in various market segments, such as official holdings of foreign exchange reserves and international bond issuance.

Payments can also indicate global use of a currency. For a given currency, such an indicator can be computed as the value of cross-border payments between banks denominated in that currency relative to total payments between banks across all currencies.[2] Payments between banks can be handled using different mechanisms – e.g. multilateral arrangements (i.e. payment systems), bilateral arrangements (i.e. the use of correspondent banks) or a combination of the two.[3] These payments are typically carried out using standardised messages exchanged via the Swift network.[4]

Several payment systems around the world (including large-value payment systems for the euro, such as T2) use Swift as a communication network for their participants.[5] T2 – like its predecessor, TARGET2 – is the Eurosystem’s real‑time gross settlement system for euro-denominated payments, processing and settling payments in central bank money. In 2023 it accounted for 92% of all euro‑denominated payments settled by large-value payment systems in value terms and 70% in volume terms. T2 traffic is therefore a key determinant of the total value of euro payments processed by large-value payment systems – and thus also a major component of the total value of euro payment messages exchanged and recorded in the Swift network.

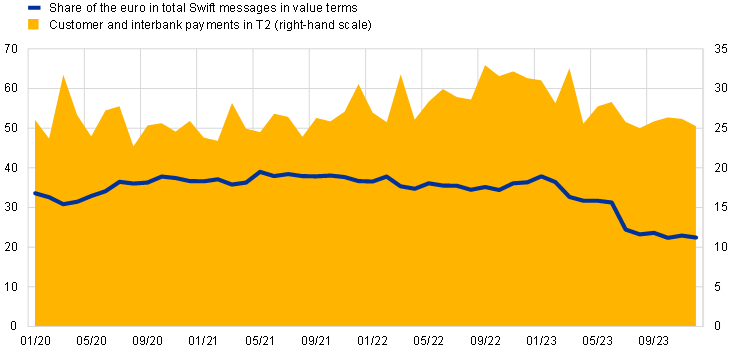

After March 2023 the share of the euro in total Swift payment messages showed a decline in value terms. For the most used currencies worldwide (a group which includes the euro), Swift publishes a monthly indicator showing each currency’s use in global payments, as measured by the value of the payment messages that financial institutions send via the network.[6] According to this Swift indicator, euro-denominated payment messages exchanged via Swift accounted, on average, for 36.0% of total messages across all currencies between January 2020 and February 2023 (Chart A); this share then dropped to 32.6% in March 2023 and 31.7% in April 2023. By the fourth quarter of 2023, the euro’s share had stabilised at a lower level, averaging 22.6%.[7]

Chart A

Share of the euro in total payments processed via Swift in value terms and T2 traffic

(left-hand scale: percentages; right-hand scale: EUR trillions; monthly totals)

Sources: Swift, TARGET2, T2 and ECB calculations.

Notes: The last data point relates to December 2023. The Swift indicator captures messages exchanged via Swift as live and delivered on the basis of the MT103 and MT202 message types (customer and interbank payments respectively) and their ISO equivalents. The T2 statistics may be subject to revision owing to methodological changes resulting from the launch of the consolidated T2-T2S platform.

The apparent drop in the share of the euro in total payment messages exchanged via Swift coincided with a major infrastructure change in Europe and a move to a new Swift message standard. On 20 March 2023 the Eurosystem launched its consolidated T2-T2S platform – the new central bank-operated backbone infrastructure for the euro, which has increased the efficiency of liquidity management and payment practices, allowing participants to streamline their payment activities.[8] At the same time, financial institutions in the euro market also migrated from the legacy message standard (MT) to the new ISO 20022 message standard (pacs) in the Swift network. This shift supports greater interoperability, straight-through processing and more granular classification of financial data.

Both changes had an impact on euro-denominated payment messages exchanged via Swift – thus, ceteris paribus, affecting the share of the euro in total messages processed via Swift. The new set-up under the consolidated T2‑T2S platform and the new message standard have changed the ways in which euro payments are made and euro liquidity is managed, with a particularly significant impact in the area of liquidity management for intra- and interbank flows. Some transactions now carried out using the new message standard, which are typically large in value, are actually excluded from the computation of the Swift indicator, which is why the indicator fell post-March 2023.[9]

This technical explanation for the drop in the share of the euro in total payment messages processed via Swift is confirmed by developments in the value of euro payments settled between banks in T2, which show different dynamics (Chart A). The average monthly value of euro‑denominated customer and interbank payments settled in T2 rose to more than €27.3 trillion in 2023, compared with €25.9 trillion in TARGET2 in 2020. Moreover, those values only saw a slight adjustment – rather than a full level shift – as a result of the new liquidity management arrangements in March 2023. A similar trend can be observed in the average monthly volume of customer and interbank payments processed via T2, which rose to 7.8 million transactions in 2023 (compared with 6.3 million transactions in TARGET2 in 2020).[10]

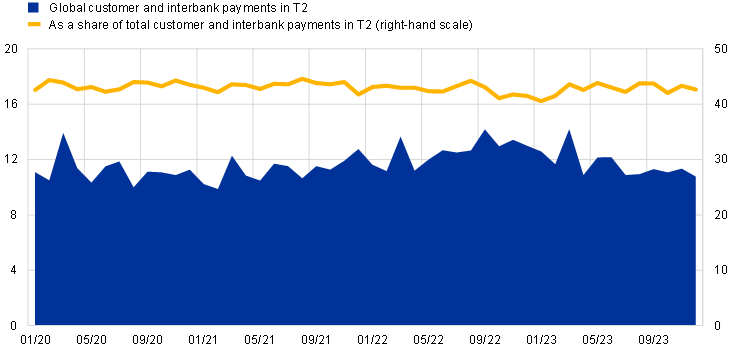

Another indicator of the euro’s role as a global currency is the percentage of euro payments in T2 (in value terms) where the instructing bank and/or the beneficiary bank is located outside the euro area. T2 – like its predecessor, TARGET2 – allows banks around the world to make cross-border payments in euro, with banks outside the euro area generally being reliant on correspondent banks with direct access to euro area payment systems for this.[11]

That indicator of global euro payments in T2 did not see a break post-March 2023, confirming that euro payments involving at least one bank located outside the euro area have remained stable. The monthly value of such global customer and interbank payments in T2 averaged €11.6 trillion between March and December 2023, in line with previous years. These payments accounted for 43.0% of all payments between banks in T2 in that period, with no sign of any decline post‑March 2023 (Chart B).

Chart B

Global customer and interbank payments in T2

(left-hand scale: EUR trillions; right-hand scale: percentages; monthly totals)

Sources: TARGET2, T2 and ECB calculations.

Notes: The last data point relates to December 2023. “Global” payments are those where the instructing bank and/or the beneficiary bank is located outside the euro area. The T2 statistics may be subject to revision owing to methodological changes resulting from the launch of the consolidated T2-T2S platform.

In conclusion, the apparent drop in the share of the euro in total Swift messages post-March 2023 does not stem from a decline in the value of payments made via T2 or a reduction in its global reach. As the backbone financial market infrastructure for the euro, T2 continues to be a major component of total euro payments processed via Swift in value terms. Instead, the decline in the share of the euro in total Swift messages in value terms appears to reflect the launch of the consolidated T2-T2S platform and the market’s move to the new ISO 20022 message standard. This has resulted in changes to banks’ liquidity management practices and the message types used, with some payments no longer being included in the Swift indicator. Thus, when monitoring the global role of the euro, single indicators based on payment traffic need to be interpreted with caution.

See “The international role of the euro”, ECB, 2023.

Throughout this box, the term “payments between banks” covers both customer payments (i.e. payments made by banks on behalf of their customers) and interbank payments (i.e. payments made by banks for their own business).

Payments originated via correspondent banking arrangements can be settled bilaterally between banks or channelled through payment systems. See “Eleventh survey on correspondent banking in euro”, ECB, 2020.

Swift is the world’s leading provider of secure financial messaging services, with more than 11,000 financial institutions using it worldwide. Swift allows for standardised, secure and efficient communication.

T2 uses both Swift and Nexi as network service providers.

This indicator (which is based on a subset of all payment messages exchanged via Swift) is included in Swift’s monthly RMB Tracker.

Data for the months of March, April, May and June 2023 do not include an ex post correction that was applied by Swift in July 2023 and communicated in its operational newsletter.

See the ECB press release of 21 March 2023. The analysis presented in this box uses T2 data as of 20 March 2023 and TARGET2 data before that date.

Prior to the migration to ISO 20022, interbank payments were sent as MT202 messages, while payments on behalf of customers were sent as MT103 messages. These are now sent as pacs.009 and pacs.008 messages respectively. Moreover, with the migration to the ISO 20022 standard, at least some of the MT messages relating to liquidity transfers, cash management and reporting have changed to camt messages. The Swift indicator only captures MT202 and MT103 messages and their pacs equivalents, while camt messages are excluded.

See also the statistics on traffic settled in TARGET services.

These payments are settled in the account of a direct T2 participant. See “Eleventh survey on correspondent banking in euro”, ECB, 2020.