Central bank money settlement of wholesale transactions in the face of technological innovation

Published as part of the ECB Economic Bulletin, Issue 8/2023.

1 Introduction

Through its TARGET Services, the Eurosystem facilitates the settlement of wholesale financial transactions in central bank money, the safest and most liquid settlement asset. The possibility to settle such transactions in central bank money (that is, in the form of reserves held by financial institutions at the central bank) helps to reduce risks to the financial system and to support financial stability and trust in the currency. The provision of settlement infrastructures is part of how the Eurosystem carries out its basic task of promoting the smooth operation of payment systems.[1]

The Eurosystem is continuing to modernise its settlement infrastructures and adapt them to changing user needs. The Eurosystem is committed to providing euro central bank money for settlement via infrastructures that are fit for purpose and that make use of a single central bank money liquidity pool; even if banks hold several accounts within the TARGET Services, they should be able to manage their liquidity across these accounts such that they function, in effect, as a single pool. In line with this commitment, the Eurosystem has consolidated, from a technical and functional perspective, its wholesale payments (formerly TARGET2, now replaced by T2) and securities settlement services (T2S). It also plans to launch a unified system – the Eurosystem Collateral Management System – for managing assets used as collateral in Eurosystem credit operations, replacing the current systems used by national central banks.

The Eurosystem is analysing the potential impact of emerging technologies, including distributed ledger technology (DLT), on the settlement of wholesale financial transactions. This work was initiated in response to increasing interest within the financial industry in the possible applications of DLT in areas such as securities-related transactions settlement on a delivery versus payment (DvP) basis and cross-currency payments settlement on a payment versus payment (PvP) basis. Should there be a significant adoption of DLT by market participants, this may require changes on the side of the central banks, to ensure that wholesale transactions can continue to be settled in central bank money.

The initial analysis by the Eurosystem consisted of market outreach and analysing possible responses in the event of a significant uptake of DLT. The Eurosystem asked financial market stakeholders for their views on the potential future use of DLT for wholesale financial transactions, and how these transactions could potentially be settled in central bank money. Should the use of DLTs become more prevalent for wholesale financial transactions, possible Eurosystem responses could include enabling market DLT platforms to interact smoothly with Eurosystem infrastructures based on existing technology, or making central bank money available in a new form that can be recorded and transferred on a DLT platform. These responses are not mutually exclusive.

Following this initial analysis, the Eurosystem has started exploratory practical work. The aim of this work is to gain further insights into how the interaction between existing or new DLT-based infrastructures for settlement in central bank money and market DLT platforms could be facilitated. The exploratory work consists of experiments, in which only mock transactions will be settled in a test environment, and trials, in which a limited number of actual transactions will be settled.

This article discusses the rationale for the Eurosystem exploring central bank money settlement of transactions registered on DLT platforms, the results of its analysis so far and the envisaged next steps. Section 2 provides background on the role of central bank money in the settlement of wholesale financial transactions. Section 3 discusses market developments regarding the use of new technologies, such as DLT, for wholesale financial transactions. Section 4 discusses the implications of a potential market uptake of DLT for the Eurosystem’s wholesale central bank money settlement infrastructures. Section 5 outlines the Eurosystem’s plans to further explore how wholesale financial transactions recorded on DLT platforms could be settled in central bank money.

2 Central bank money at the heart of the financial system

The importance of central bank money settlement

Financial market infrastructures (FMIs) – that is, payment systems, central securities depositories, securities settlement systems, central counterparties and trade repositories – are the backbone of the financial system. These facilitate financial transactions between the customers of different financial institutions, and between financial institutions themselves. The safe and efficient functioning of systemically important market infrastructures is pertinent for financial stability.

To preserve and strengthen financial stability, international standards prescribe that an FMI should conduct its settlements in central bank money where practical and available. This is laid down in the 12 Principles for financial market infrastructures established by the BIS’s Committee on Payment and Settlement Systems and the International Organization of Securities Commissions.[2] Central bank money refers to central bank liabilities, issued for use as money. Digitally, central bank money is made available to commercial banks in the form of reserves (that is, funds held in accounts at the central bank). Commercial banks in turn issue their own liabilities, namely commercial bank money, to their customers. When the customer of one bank makes a transfer to the customer of another bank, this can be settled via a funds transfer between the banks’ accounts at the central bank. Interbank transactions could also be settled in commercial bank money. In this case, credit and liquidity risks may arise, for example if the settlement bank becomes insolvent. The 12 Principles therefore require FMIs that settle in commercial bank money to strictly control and minimise credit and liquidity risks arising from commercial settlement banks. Using central bank money (whenever practicable and available) for settlements within FMIs makes the use of commercial bank money by banks’ clients safer by reducing exposures between banks that could ultimately result in losses for their clients. While the clients will pay or receive payment in the commercial bank money of their respective banks, the use of central bank money in payments between their respective banks reinforces and demonstrates the convertibility of commercial bank and central bank money at par. This supports public trust in the currency as the value of a euro is the same, regardless of its issuer.[3]

Using central bank money is particularly relevant for the settlement of wholesale financial transactions, typically carried out between banks and other financial market participants, which stand out because of their high value. The average transaction value in T2, the Eurosystem’s large-value payment system, is €5.5 million. While half of the transactions in T2 are below €6,500, at the upper end of the distribution much higher transaction values can be found. For example, in 2022 almost 219 payments with a value of more than €1 billion were made per day, even though these accounted for only 0.05% of payment flows (in terms of number of transactions).[4] Moreover, the structure of the wholesale financial market can lead to a concentration of payment activities and associated exposures within individual banks. Settling wholesale financial transactions in central bank money, rather than in commercial bank money, reduces risks associated with such a concentration.

Wholesale central bank money services or “wholesale central bank digital currency”?

Central bank digital currencies (CBDCs) are a hotly debated topic. In such discussions, a distinction is often made between retail and wholesale CBDCs. The former is relatively well understood, since a digital form of central bank money available to the general public is a new concept, and it can be clearly distinguished from other types of money, such as central bank money in physical form (cash) and existing digital forms of money that are either not central bank money or not available to the general public. The concept of wholesale CBDCs lends itself to misunderstandings.

Wholesale CBDC is often presented as a new concept, but central bank money has in fact been available in digital form for wholesale transactions for decades. The Eurosystem enables this through its TARGET Services, which ensure the free flow of cash, securities and collateral across Europe.

The debate is therefore not about whether to provide digital central bank money for wholesale transactions, but about possible technological changes in how this money is provided. For this reason, the Eurosystem has announced that it is exploring new technologies for wholesale central bank money settlement, rather than wholesale CBDC. Therefore, the latter term will not be used in the remainder of this article.[5]

Other central banks around the world are also exploring the potential use of new technologies for wholesale central bank money settlement. A BIS survey[6] of 86 central banks, carried out in late 2022, showed that the majority of these banks were involved in researching wholesale CBDC (to use the terminology of the survey), with many of these also involved in practical experimentation. Some central banks are now taking the next step of testing real transactions with market participants. The Swiss National Bank, for example, recently announced a pilot project involving six commercial banks, in which it will make central bank money available on a regulated third-party platform.[7] Likewise, the Monetary Authority of Singapore announced a pilot project with live transactions between commercial banks, allowing them to issue commercial bank money tokens to their customers and settle associated interbank transactions in central bank money.[8]

Regular improvement of TARGET Services

The role of central bank money as the preferred settlement asset for wholesale financial transactions requires reliable and up-to-date infrastructures. As the following paragraphs recall, the Eurosystem therefore makes continuous efforts to modernise its market infrastructure services, ensuring that they are future-proof and can meet the needs and expectations of market participants.

Over the past two decades, the Eurosystem has made significant progress in integrating and modernising its wholesale settlement infrastructures. Through the transition from the national real-time gross settlement systems to TARGET in 1999, and then to TARGET2 in 2007, the Eurosystem created the first pan-European integrated market infrastructure for wholesale payments. This service was complemented by TARGET2-Securities (T2S), in order to harmonise post-trade services for securities transactions. T2S provides a common platform through which securities and cash can be transferred on a DvP basis. In 2018 TARGET Instant Payment Settlement (TIPS) was launched to allow instant retail payments between banks across the EU to be settled in central bank money in real time on a 24/7/365 basis.

Moreover, in December 2017 the Eurosystem began a major project to consolidate the technical and functional aspects of TARGET2 and T2S, resulting in the launch of the new T2 platform in March 2023. This consolidation further harmonises and integrates TARGET Services through a move to the ISO 20022 message standard, a global standard for financial information that is being increasingly adopted by FMIs worldwide, as it facilitates the exchange of richer and more structured data compared with most current proprietary standards.[9] Moreover, the T2 platform contains a set of common components that are shared across TARGET Services, such as a harmonised interface for participants to access the Services. The consolidated platform also offers enhanced cyber resilience and enables participants to steer, manage and monitor liquidity across all TARGET Services. It will be complemented by the Eurosystem Collateral Management System, a unified system for managing assets used as collateral in Eurosystem credit operations.

The Eurosystem is continuing its efforts to develop TARGET Services. The governance arrangements for the TARGET Services, including the change and release management processes, allow the Eurosystem to enhance capacity and resilience where needed, and to respond to business, regulatory and technological developments. Exploring the possible use of, or interactions with, new technologies is part of these continuous efforts to improve the Eurosystem’s market infrastructures.

3 Potential use of new technologies such as DLT for settling wholesale financial transactions in central bank money

New technologies: DLT

The emergence of DLT could potentially change the market for, and environment of, wholesale financial transactions. A series of private and public initiatives has emerged globally, with the aim of exploring new business opportunities and improving the functioning of market processes through the use of DLT. The potential large-scale adoption of DLT by market participants, for instance for securities transactions, would require the provision of central bank money in a way that is compatible with the new DLT ecosystems, in order to support the settlement of the cash leg of those transactions.

DLT refers to a family of technologies that enable participating entities to validate data and to update a shared ledger, without relying on central coordination. In contrast to existing payments and securities settlement systems, which are generally based on centralised infrastructures where market participants connect to a central database, in DLT networks a database is shared across a network and its data are accessible to the network’s members, who can also actively participate in the network’s operation. Figure 1 contrasts centralised ledgers (as typically used in existing FMIs) and distributed ledgers.

Figure 1

Differences between centralised and distributed ledgers

Source: Santander InnoVentures, Oliver Wyman and Anthemis, “The Fintech 2.0 Paper: rebooting financial services”, 2015.

In a DLT network, any kind of asset (financial or otherwise) can, in principle, be registered in the form of a digital token that could be directly exchanged between participants without the need for a trusted third party to manage accounts. Such a token is a unit of digital information that may represent a real-world asset, such as a security that is registered in a central securities depository. Alternatively, the digital token may be the asset itself, for example a security issued directly as a DLT token.

Many DLT platforms include the possibility to programme “smart contracts”. Smart contracts are automatable, “contractual” arrangements embedded in computer software, which the latter can validate, execute and record automatically, as soon as certain predefined conditions have been met, based on information from the distributed ledger itself or a predefined (external) source. The use of such smart contracts could make processes more seamless, depending on the concrete setup of the infrastructure and the smart contracts themselves; for example, frictions could arise due to the need to retrieve information from an external source or to execute transactions across multiple (DLT or non-DLT) platforms that cannot interoperate smoothly.

Market experiences with DLT for wholesale financial transactions

In recent years, a number of market participants in the financial sector have been increasingly exploring the opportunities of DLTs to generate new business models and to improve the functioning of market processes. The Eurosystem has gathered information on relevant market initiatives from market stakeholders and their associations (through surveys and meetings). National central banks of the Eurosystem have provided further information on market and public sector initiatives related to the use of new technologies such as DLT in wholesale payments and securities settlement (including national initiatives, initiatives focusing on the EU or euro area, and global initiatives).

Based on market experiences, two success factors emerge: cooperation between financial institutions in shared projects, and having a clear business case that is built on market needs. Cooperation allows market players to pool their resources and minimise costs or possible losses, while simultaneously avoiding the risk of being left behind in the event of the successful uptake of DLTs. Key to developing a clear business case is the early involvement of potential users to identify use cases that they consider promising – for example, to address existing inefficiencies.

Factors that may contribute to the failure of a DLT project are varied and include both internal and external factors. Internal factors include erroneous design choices (technology readiness, complexity of the project) and suboptimal vendor management. External factors that have been reported by market stakeholders as potential contributors to the failure of a DLT project include the absence of reliable solutions for the settlement of the cash leg of DLT transactions in central bank money, as well as adverse regulatory developments (for instance, April 2022 guidance from the U.S. Securities and Exchange Commission restricts, in practice, the ability of US entities and groups to hold digital assets in custody).[10] Possibly the most important element, however, is the reverse of one of the key success factors: the absence of a clear business case for using DLT. If existing inefficiencies are not technology-based, a change to a different technology may not be the appropriate solution.

Potential benefits and challenges of DLT

Market stakeholders that consider using DLT for wholesale transactions see potential for this technology to improve efficiency by reducing reliance on intermediaries. The main potential benefits explored by market stakeholders relate to the distributed nature of DLT platforms; this enables the shared operation of the relevant platform by its participants, together with the possibility of automating processes through smart contracts. Activities for which participants currently rely on centralised operators could then be conducted by the participants themselves.

On a DLT platform, two-leg transactions (that is, DvP or PvP settlement) could be technically automated without the need to rely on intermediaries. Particularly in a DLT context, this type of technical automation is often referred to as atomic settlement. While DvP and PvP transactions can be conducted with current technology, proponents of DLTs argue that smart contracts can function as a technical solution to ensure that either both or neither of the legs of the transactions are executed, and that both legs are executed as close to simultaneously as possible, without relying on a central validating entity. In addition, the legal finality of DvP/PvP would need to be ensured, as is the case today. Proponents argue that with such atomicity there would be less counterparty risk, fewer delays linked to multiple layers of matching and validation, fewer intermediaries and, therefore, lower costs.

As well as permitting the automation of two-leg transactions, DLT platforms could also allow market participants to define and set conditions for operations in the system, without needing to rely on intermediaries. These could be, for example, conditions for the execution of transactions or the generation of information flows. Like atomic settlement, this feature can be enabled using smart contracts. From a technical perspective, any authorised user of a DLT platform could deploy smart contracts and automate processes directly, if the operator allows it.

The need for reconciliation could be reduced through the use of a shared ledger, which is inherent in DLT. Market stakeholders expect that this feature of DLT could make reconciliation processes (aligning different systems and databases managed separately by each market participant and intermediary) easier, thereby fostering the traceability and auditability of transactions. Some stakeholders also point to the potential for improving the transparency of parties that do not currently have visible transactions in FMIs (including Eurosystem market infrastructures), such as auditors, corporate clients or even the general public (for example, to verify green investments).

In addition, many market stakeholders expect that DLT-based solutions would provide 24/7 instant settlement and the possibility of broader access to FMIs. They have these expectations for both market-operated and central bank-operated systems. These characteristics are, however, less closely linked to the technology itself than the three aspects mentioned above. The ability to operate 24/7 is not DLT-specific. Indeed, the Eurosystem already operates a 24/7 settlement system, TIPS, which is not based on DLT. Similarly, restrictions on access to TARGET Services are not due to technological limitations. Any decision on granting such access to additional parties would be a policy decision, not a technological one, and may be driven primarily by monetary policy implementation and financial stability considerations rather than by market infrastructure considerations.

Market feedback on the future of DLT

The majority of market stakeholders surveyed by the Eurosystem expect a significant uptake of DLT for wholesale payments and securities settlement, with an indicative time horizon of between five and ten years. Those market stakeholders who expect DLT uptake for wholesale financial transactions generally believe this will take place across the board, in all forms of asset settlements. In their view, DLT settlement could potentially become systemically relevant for securities in general, as part of an overall industry move towards DLTs, in which increasing numbers of assets are registered on a DLT platform.

Those market stakeholders who see potential for DLT for wholesale financial transactions believe that this technology could significantly benefit segments they deem to be characterised by clear inefficiencies and constraints. In their view, international payments (cross-border, cross-currency and correspondent banking payments) could be improved in terms of speed and availability, and the settlement and servicing of illiquid/non-listed instruments could benefit from improved liquidity management and transparency of the registers. Instruments currently not serviced by FMIs (such as over-the-counter traded securities or credit claims) could, in the future, be registered on DLT platforms, thereby possibly making previously non-tradeable assets tradeable.

At the current stage of market explorations, there is considerable uncertainty about the future landscape of DLTs used for wholesale payments and securities settlement. In the longer term, some market stakeholders expect consolidation to only a few major platforms, possibly with an important role for a central bank-run platform. A few expect a fragmented landscape with many (over 50) DLT platforms being used for different types of assets. Most market stakeholders, however, anticipate a landscape between these two extremes, expecting no more than ten DLT platforms to be significant for wholesale financial transactions. In the meantime, market participants will have to make technological choices; while a range of different DLT platforms is available, it is not yet clear which platforms would be most suitable for scalable applications of DLT. Moreover, while sharing a database across a network promotes transparency, the broad adoption of DLT will require the assurance of sufficient privacy for users’ data.

The use of multiple DLT platforms, as well as the coexistence of DLT platforms with other infrastructures, may lead to market fragmentation. As noted above, the use of multiple DLT platforms that cannot smoothly interoperate can hamper the seamless processing of transactions. With a view to the overall efficiency of the market, it is therefore important for market stakeholders and the Eurosystem to consider how such an outcome can be averted. As is the case for existing technologies, the ability to agree on industry standards will be important.

Avoiding fragmentation does not necessarily imply a move to a single platform; interoperability and harmonisation can also play an important role. Central banks could bring value through their involvement in harmonising certain aspects of the DLT ecosystem to help bring about interoperability (for example, through regulation and harmonisation of protocols and data taxonomies).

4 Implications of market DLT uptake for Eurosystem TARGET Services and settlement in central bank money

Implications of market DLT uptake

Market stakeholders do not often mention central bank money settlement itself as a service to be improved through the use of DLT. Instead, their interest in new central bank money settlement solutions is driven by their explorations of DLT for other parts of the transaction chain, such as securities settlement.

Should there be a significant industry uptake of DLT for wholesale financial transactions, it would be important to ensure that central bank money can continue to be used to settle the cash leg of such transactions. The Eurosystem has therefore been exploring the suitability of its current services in such a scenario, and whether new solutions might be better able to meet the needs of market participants that are using DLT to register and transfer financial assets. These new solutions may, but need not, involve the provision of central bank money in the form of DLT tokens.

Many market stakeholders state that, in the absence of a DLT-compatible central bank money settlement solution, they would look for alternatives. In such a situation, market stakeholders may consider using alternative settlement assets, such as commercial bank money or stablecoins. Such alternatives would not provide the same level of safety as central bank money. A partial move from central bank money to other settlement assets could also increase liquidity fragmentation and have adverse implications for financial stability.

At the same time, some market stakeholders argue that the speed of DLT adoption, if not its success, might to some extent depend on the involvement of the central banking community. The ability to settle transactions in central bank money could be a requirement for certain market participants, preventing them from adopting DLT as long as a suitable central bank money settlement solution is not in place. In addition, central bank involvement could be perceived as support for DLT as an innovation in financial services.

Possible Eurosystem responses

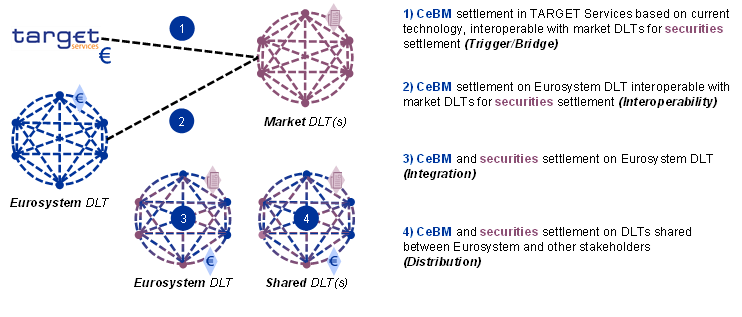

The Eurosystem has analysed possible responses to a potential market DLT uptake for settling wholesale financial transactions and has identified four conceptual solutions. Each of these solutions would enable euro central bank money settlement between banks for transactions where transfers are made using DLT. Figure 2 depicts these four conceptual solutions in a stylised manner. This figure and the paragraphs below describe the example of a securities transaction, but similar solutions could also be used for foreign exchange transactions.

Figure 2

Conceptual solutions for central bank money settlement of wholesale transactions registered on DLT platforms

Source: ECB.

Notes: Blue lines, dots and icons represent central bank money (CeBM). Purple lines, dots and icons represent securities.

A first option would be to create a technical interface between a DLT platform on the market side and a non-DLT infrastructure (such as the existing TARGET Services) on the Eurosystem side. This technical interface should enable communication between those two infrastructures so that either both or neither of the legs (the securities leg on the market DLT platform and the cash leg in the Eurosystem infrastructure) are settled. Such solutions are referred to as Trigger/Bridge solutions.

A second option would be to offer a Eurosystem DLT platform for euro central bank money settlement, combined with a technical interface between that platform and market DLT platforms. This is conceptually very similar to the first option: again, the securities leg would settle on the market DLT platform, and the cash leg in a Eurosystem infrastructure. The key difference is that in this case the Eurosystem infrastructure would be based on DLT. This type of solution is referred to as a full-DLT Interoperability solution.

A third option would be to offer a Eurosystem DLT platform where both euro central bank money and securities are settled. This is conceptually similar to the existing T2S platform, but based on DLT. This type of solution is referred to as a full-DLT Integration solution.

A fourth option would be to use a platform (or several platforms) jointly operated by the Eurosystem and other parties for the settlement of both euro central bank money and securities. This type of solution is referred to as a full-DLT Distribution solution.

Same-platform settlement solutions, such as the Integration and Distribution solutions described above, are similar to the concept of a “unified ledger” proposed by the BIS in its 2023 Annual Economic Report.[11] In a unified ledger, as researched and theoretically described by the BIS, various types of assets (central bank money, commercial bank money and other assets) are represented in the form of programmable tokens to enable seamless automation and integration of complex transactions. This would not, however, imply one global ledger for all assets and use cases. As noted by the BIS, there could be a multiplicity of individual unified ledgers, potentially connected to each other and to existing systems.

The governance of platforms with a wider scope in terms of assets, participants or use cases would presumably be more complex than for platforms with a narrower scope. Issuers and holders of different types of assets will each have their own requirements and may need to play their part in the governance arrangements for the platform. The design of such platforms and their governance would therefore be likely to take more time, and if the requirements of different users and operators of a platform are too divergent, it may not be possible to come to an agreement that suits all of them.

In any solution that may ultimately be implemented, the Eurosystem will need to ensure that both the provision of euro central bank money for settlement and the settlement itself take place under the ultimate control of the Eurosystem. With regard to the current TARGET Services, the Eurosystem is responsible for the overall direction, management and control, including common cost and pricing methodology, security and policies, for example regarding which entities are allowed to hold central bank money for wholesale purposes. The provision of any new Eurosystem solution for the central bank money settlement of DLT-based transactions must not come at the expense of the Eurosystem’s control over the central bank money it issues.

The solutions described here are not mutually exclusive. Any solution for the provision of central bank money settlement would be relevant only if and when DLT becomes more widely adopted by market participants. It could be an option to initially offer one solution in response to short-term demand, while another – more complex – solution is launched, potentially offering more advanced functionalities or catering for more use cases. It is also conceivable that different use cases may call for different solutions, in which case multiple solutions may coexist in the long term.

The conceptual solutions described above have already been developed and tested, individually, by some national central banks within the Eurosystem. In the Trigger solution developed by the Deutsche Bundesbank, euro central bank money settlement would take place in the existing TARGET Services, specifically in T2. In the TIPS Hash-Link solution developed by the Banca d’Italia, settlement would take place in an infrastructure based on TIPS, which is currently used for settling instant retail payments (that is, payments between individuals and non-financial institutions). Finally, in the full-DLT solutions developed by the Banque de France, euro central bank money settlement would take place on a DLT platform, operated by the central bank or jointly with other parties. Further information on these solutions can be found in publications from the respective national central banks.[12]

5 Next steps: Eurosystem exploratory work

In April 2023 the Eurosystem announced that it would embark on a Eurosystem-level exploration of how wholesale financial transactions recorded on DLT platforms could be settled in central bank money. This Eurosystem-coordinated work will build on the previous experiments by individual national central banks and the earlier market outreach and analysis carried out at Eurosystem level.

Together with interested market players, the Eurosystem intends to test three cross-platform settlement solutions.[13] These solutions will be provided by the three national central banks mentioned above. The Eurosystem as a whole will analyse the results of these explorations, using common metrics for all three solutions. Through this coordinated analysis, the Eurosystem aims to gain further insights into the merits of these solutions in terms of their ability to allow users to reap the envisaged benefits of DLTs and to support various wholesale use cases.

The envisaged exploratory work includes experiments, in which only mock transactions will be settled in a test environment, and trials, in which a limited number of real transactions will be settled. These trials could be used, for example, by participants in the EU’s DLT Pilot Regime, a temporary regulatory regime for infrastructures for the trading, clearing and settlement of DLT-based financial instruments.[14]

With this initiative, the Eurosystem aims to expand its knowledge and gain consistent and coordinated feedback on the solutions from market players. Some of the previous explorations by individual national central banks also involved market players. However, so far market players have not been able to test all three solutions and compare their merits for the use cases relevant to them. The Eurosystem-coordinated exploratory work will give them the opportunity to do so.

This exploratory work does not prejudge any future decision on the potential implementation of any of the solutions offered in trials and experiments. The Eurosystem will use insights from the exploratory work when developing its vision for the future wholesale financial transactions ecosystem. It will also further monitor and assess to what extent market players are indeed adopting DLT to overcome existing inefficiencies or to create new business opportunities. The impact of a potential uptake of DLT on the structure of the market, including the risk of market fragmentation, also requires further analysis. Without pre-empting any future Eurosystem decision on whether to implement a solution using new technology, it is clear that any solution must support market integration.

The ultimate goal of these efforts is to ensure that central bank money remains a monetary anchor that supports the stability, integration and efficiency of the European financial system. The Eurosystem acknowledges the demand for central bank money as the safest settlement asset and thus remains committed to providing settlement in central bank money for wholesale transactions through infrastructures that are fit for purpose. The forthcoming exploratory work will be helpful for determining how (that is, in which way and form) central bank money settlement could be usefully offered in a scenario where DLT is widely adopted by the financial industry.

Article 127 of the Treaty on the Functioning of the European Union (OJ C 326, 26.10.2012, p. 47).

See Committee on Payment and Settlement Systems and Technical Committee of the International Organization of Securities Commissions, “Principles for financial market infrastructures”, Bank for International Settlements and OICV-IOSCO, April 2012.

See Committee on Payment and Settlement Systems, “The role of central bank money in payment systems”, Bank for International Settlements, August 2003.

See “TARGET Annual Report 2022”, ECB, Frankfurt am Main, June 2023.

See “Eurosystem to explore new technologies for wholesale central bank money settlement”, Press Release, ECB, 28 April 2023.

See Kosse, A. and Mattei, I., “Making headway – Results of the 2022 BIS survey on central bank digital currencies and crypto”, BIS Papers, No 136, Bank for International Settlements, July 2023.

See “SNB launches pilot project with central bank digital currency for financial institutions”, Press Release, Swiss National Bank, 2 November 2023.

See “Shaping the Financial Ecosystem of the Future”, Speech by Mr Ravi Menon, Managing Director, Monetary Authority of Singapore, at the Singapore FinTech Festival 2023, 16 November 2023.

See Committee on Payments and Market Infrastructures, “Harmonised ISO 20022 data requirements for enhancing cross-border payments”, Report to the G20, Bank for International Settlements, October 2023.

U.S. Securities and Exchange Commission, “Staff Accounting Bulletin No. 121”, 11 April 2022.

See Bank for International Settlements, “Blueprint for the future monetary system: improving the old, enabling the new”, BIS Annual Economic Report, 20 June 2023.

See Deutsche Bundesbank, “Digital money: options for payments”, Monthly Report, April 2021; Diehl, M. and Drott, C., “Empowering central bank money for a digital future”, SUERF Policy Note, Issue No 312, June 2023; La Rocca, R., Mancini, R., Benedetti, M., Caruso, M., Cossu, S., Galano, G., Mancini, S., Marcelli, G., Martella, P., Nardelli, M. and Oliviero, C., “Integrating DLTs with market infrastructures: analysis and proof-of-concept for secure DvP between TIPS and DLT platforms”, Research Papers, No 26, Banca d’Italia Markets, Infrastructures, Payment Systems, July 2022; Banque de France, “Wholesale Central Bank Digital Currency experiments with the Banque de France: Results and key findings”, November 2021; and Banque de France, “Wholesale central bank digital currency experiments with the Banque de France: New insights and key takeaways”, July 2023.

A Call for Expression of Interest to participate in these trials and experiments has been published on the ECB’s website.