Changes in the investor base for euro area non-financial corporate bonds and implications for market pricing

Published as part of the ECB Economic Bulletin, Issue 5/2023.

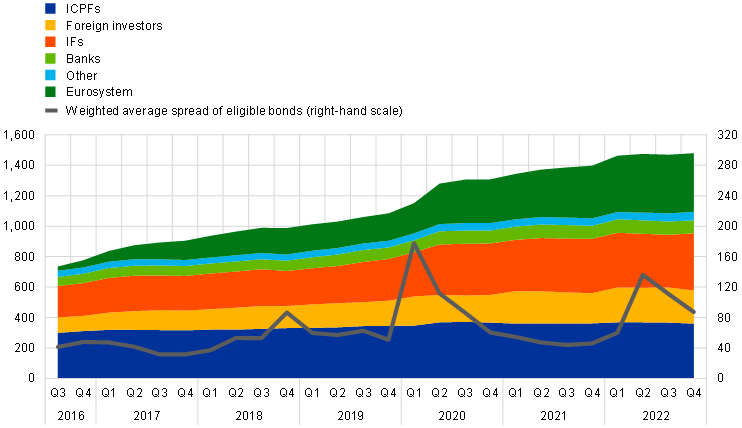

The non-financial corporate bond market in the euro area has grown substantially over the past decade as issuance responded to strong private and public sector demand. This became particularly pronounced following the introduction of the ECB’s corporate sector purchase programme (CSPP) in 2016.[1] Owing to sustained positive net issuance, the amount of CSPP-eligible bonds outstanding doubled between 2016 and 2022 to a total of €1.5 trillion. Net of Eurosystem holdings, it grew by around 50% to reach €1.1 trillion in 2022.[2] Despite the substantial growth in this segment, there was no upward trend in swap spreads on eligible bonds over the period, suggesting that new issuances were met by strong demand (Chart A).[3] While demand for CSPP-eligible securities rose across all private sector investor groups, their holdings grew at markedly different rates, implying a change in relative holdings between 2016 and 2022. This heterogeneity sheds light on how private sector investors absorb increases in supply.[4]

Chart A

Holdings of CSPP-eligible securities across sectors

(left-hand scale: EUR billions; right-hand scale: basis points)

Sources: ECB, Intercontinental Exchange and ECB calculations.

Notes: “Eurosystem” refers to the holdings of CSPP-eligible securities under the CSPP and the pandemic emergency purchase programme (PEPP). The spread is based on the option-adjusted swap spread of CSPP-eligible bonds, weighted by the bonds’ nominal value.

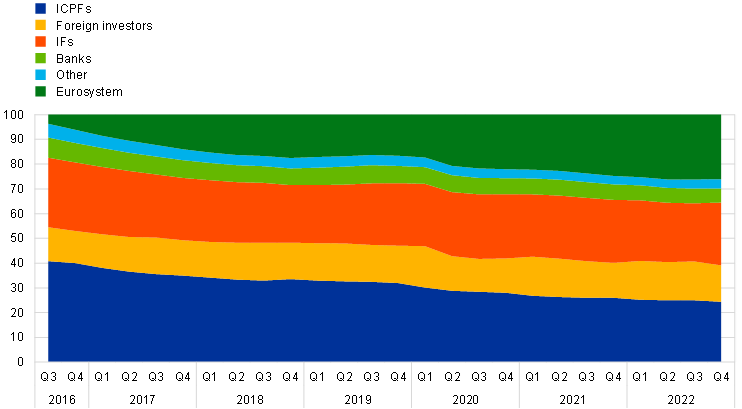

The distribution of CSPP-eligible bonds across the private sector changed significantly from 2016 onward, with a decline in the relative presence of insurance corporations and pension funds (ICPFs). In 2016, euro area ICPFs were the largest holders of CSPP-eligible bonds, with a market share of 41% (Chart B). Thereafter, the market share of ICPFs steadily declined, falling to 24% by the end of 2022.[5] The decrease is attributable not only to the increase in the Eurosystem’s CSPP holdings but also to investment funds (IFs) and foreign investors increasing their holdings at a faster pace than ICPFs.[6] As a result, the private sector investor base became less concentrated, with the holdings of IFs recently becoming larger than those of ICPFs.

Chart B

Distribution of CSPP-eligible securities holdings across sectors

(percentages)

Sources: ECB and ECB calculations.

Notes: The chart shows the holdings of each institutional sector as a percentage of the total.

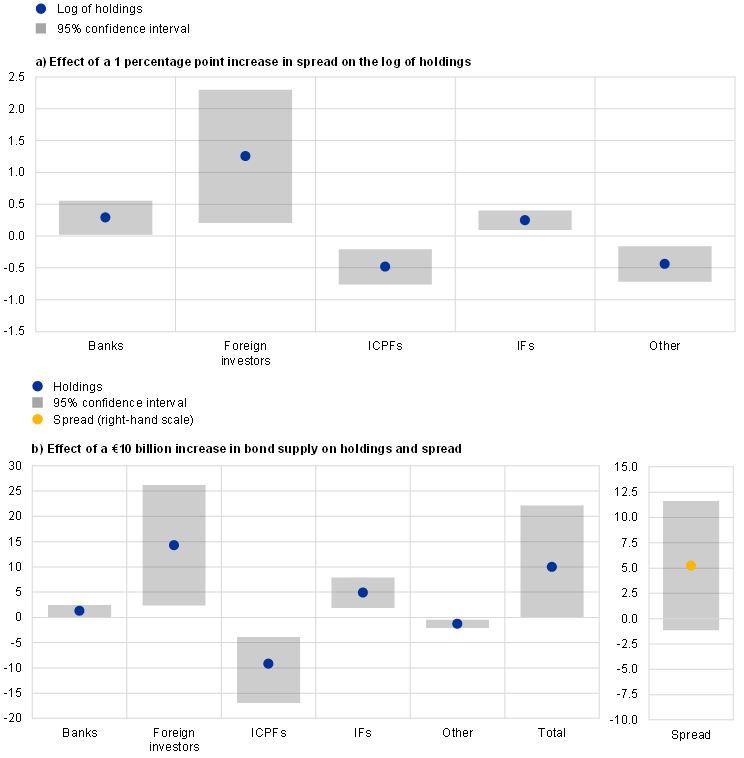

The changes in the distribution of bond holdings implies, under low market stress, a stronger response of private sector demand for euro area non-financial corporate bonds to increases in spreads. Total private sector demand, obtained by aggregating the demands of the constituent investor groups weighted by their holdings, is found to respond positively to a contemporaneous increase in bond spreads. However, this aggregate response masks heterogeneity across investor groups: while ICPFs are estimated[7] to display a negative elasticity of corporate bond demand with respect to spreads (i.e. they reduce their holdings of CSPP-eligible securities when spreads rise), IFs, foreign investors and banks tend to increase their CSPP-eligible holdings when spreads rise (Chart C, panel a).[8] Therefore, the reduction in the market share of ICPFs serves to make the aggregate elasticity of demand with respect to spreads more positive. These empirical relations can, however, reflect the specific sample period characterised by low interest rates and may change in the future.[9]

Chart C

Private sector demand for CSPP-eligible securities

(panel a: log EUR billions; panel b: left-hand scale: EUR billions; right-hand scale: basis points)

Sources: ECB, Intercontinental Exchange and ECB calculations.

Notes: Panel a) shows the estimated effects of 1 percentage point increase in the spread of CSPP-eligible bonds on the logarithm of the holdings of each sector. Panel b) shows the effect of an unexpected €10 billion increase in the supply of CSPP-eligible bonds on the holdings of each sector and total private sector holdings (both in EUR billions) and on the equilibrium spread (in basis points). The effects are estimated over the periods Q2 2017 to Q3 2019 and Q1 2022 to Q4 2022 using instrumental variables and, for the IF sector, are obtained after excluding the holdings of IFs in Luxembourg and Ireland.

The higher responsiveness of private sector demand to spreads suggests an attenuated impact of increases in bond supply on spreads (Chart C, panel b). The observations of recent years indicate that ICPFs can amplify upward pressures on spreads originating from increases in bond supply, as they tend to sell bonds when spreads rise. Other private sector investors are left to absorb the increased supply as well as the bonds sold by ICPFs, implying a further increase in spreads to induce them to do so (when compared to a hypothetical situation in which ICPF holdings remain unchanged).[10] When ICPFs hold a lower share of the corporate bond market, this amplification can be proportionately weaker. For this reason, under low market stress, the decrease in the market share of ICPFs has moderated the effects of changes in bond supply on spreads compared to when ICPFs were the largest holders of CSPP-eligible bonds. This moderating effect could, however, weaken over time if the demand elasticities or the private sector investor base change, for example as a reaction to the Eurosystem reducing its holdings of euro area non-financial corporate bonds.[11]

For a description of the growth of the CSPP universe and eligibility, see, for example, the article entitled “The impact of the corporate sector purchase programme on corporate bond markets and the financing of euro area non-financial corporations”, Economic Bulletin, Issue 3, ECB, 2018.

The analysis confines itself to the CSPP-eligible universe, as this allows private sector demand to be disentangled from public sector demand. The CSPP universe includes bonds issued by non-bank financial institutions, but it is mostly composed of investment-grade bonds of non-financial corporations and therefore serves as a good proxy for the euro area non-financial corporate bond market.

While the average share of bonds in debt financing has increased over time, loans remain the dominant source of financing for euro area firms. One factor that has contributed to the decrease in the relative importance of loans in the capital structure is the reduction in the cost of financing via debt securities compared with bank loans, which can in part be attributed to the introduction of the CSPP. For more details on these developments, see, for example, Work stream on non-bank financial intermediation, “Non-bank financial intermediation in the euro area: implications for monetary policy transmission and key vulnerabilities”, Occasional Paper Series, No 270, ECB, September 2021.

For complementary analyses of the Eurosystem holdings of corporate bonds and their market implications, see Zaghini, A., “The CSPP at work: Yield heterogeneity and the portfolio rebalancing channel”, Journal of Corporate Finance, Vol. 56, June 2019, pp. 282-297; Todorov, K. “Quantify the quantitative easing: Impact on bonds and corporate debt issuance”, Journal of Financial Economics, Vol. 135, February 2020, pp. 340-358; Arce, Ó, Mayordomo, S. and Gimeno, R., “Making Room for the Needy: The Credit-Reallocation Effects of the ECB’s Corporate QE”, Review of Finance, Vol. 25, February 2021, pp. 43-84; and Zaghini, A. and De Santis, R.A., “Unconventional monetary policy and corporate bond issuance”, European Economic Review, Vol. 135, June 2021.

Excluding the holdings of the Eurosystem, the market share of ICPFs decreased from 43% in 2016 to 33% in 2022.

The holdings of ICPFs grew less partly because their assets under management did not grow as significantly as those of other large investor groups over the period.

The corporate bond demand of each investor group is estimated using the framework in Koijen, R.S.J. and Yogo, M., “A Demand System Approach to Asset Pricing”, Journal of Political Economy, Vol. 127, No 4, 2019, pp. 1475-1515. To limit the possible influence of the CSPP on the demand elasticity of each investor group, the sample period excludes quarters in which Eurosystem purchases were particularly elevated. For related evidence of demand elasticities across the private sector, see the box entitled “The Eurosystem’s asset purchase programme, risk-taking and portfolio rebalancing”, Financial Stability Review, ECB, May 2019.

Euro area private sector investors other than banks, IFs and ICPFs also moderate the positive response, but only marginally as their holdings of CSPP-eligible bonds are relatively small. The negative elasticity of demand to spreads of this investor group is entirely attributable to the behaviour of households. For related evidence on the asset demands of the household sector, see Gabaix, X., Koijen, R.S.J., Mainardi, F., Oh, S.S. and Yogo, M., “Asset Demand of U.S. Households”, mimeo, 2022.

For instance, using lagged returns (rather than contemporaneous spreads) and an earlier sample from 2004 to 2014, Timmer, Y., “Cyclical investment behavior across financial institutions”, Journal of Financial Economics, Vol. 129, No 2, August 2018, pp. 268-286, finds that ICPFs act countercyclically, i.e. increase their holdings when holding period returns have been low. At the same time, he acknowledges the mixed empirical evidence in the literature, indicating both pro- and countercyclical behaviour of ICPFs, and asserts in particular that a low-interest rate environment may weaken the countercyclical behaviour.

The amplification is analogous to that observed in the government bond market, where ICPFs respond to higher yields by decreasing their holdings, thereby exerting further upward pressure on yields. Such behaviour is due to the duration of the liabilities of ICPFs being more responsive to long-term interest rates than the duration of their assets. This implies that when government bond yields rise, the duration gap between the assets and liabilities of ICPFs decreases, which allows them to sell longer-term bonds. See Domanski, D., Shin, H.S. and Sushko, V., “The hunt for duration: Not waving but drowning?”, IMF Economic Review, Vol. 65, International Monetary Fund, March 2017, pp. 113-153; the box entitled “Investment strategies of euro area insurers and pension funds: procyclical or countercyclical?”, Financial Stability Review, ECB, November 2017; Koijen, R.S.J., Koulischer, F., Nguyen, B. and Yogo, M., “Inspecting the mechanism of quantitative easing in the euro area”, Journal of Financial Economics, Vol. 140, 2021, pp. 1-20; and Carboni, G. and Ellison, M., “Preferred habitat and monetary policy through the looking-glass”, Working Paper Series, No 2697, ECB, August 2022.

In June 2023 the Governing Council decided to discontinue the reinvestments under the asset purchase programme as of July 2023.