What can central banks do in a financial crisis?

Speech by Jean-Claude Trichet, President of the ECB, Susan Bies Lecture, Kellogg Distinguished Lecture Series, Evanston, Illinois, 27 April 2010

Introduction

The global economy is now recovering – albeit in a gradual manner – from the deepest recession experienced since the end of the Second World War. The recession was triggered by a financial crisis, to which the policy response has been both innovative in nature and unprecedented in magnitude. While these measures have proved remarkably successful in stabilising the financial system, the broader repercussions of the crisis continue to shape the outlook for prices, public finances and the economy as a whole.

The events of the past three years have provided a salutary reminder of the macroeconomic importance of linkages between the financial sector and the real economy. It has become commonplace to observe that models of the economy that neglected financial and monetary factors have been found wanting. [1] Policy-makers, practitioners, and the research community have embarked on a quest to improve their understanding of these linkages and develop more robust frameworks for managing systemic risk and macroeconomic dynamics.

At the outset of this quest, it is worth remembering the words of the eighteenth-century Anglo-Irish philosopher, Edmund Burke: “Those who don't know history are destined to repeat it.” For this financial crisis is hardly a unique event. On the contrary, the evolution of the global economy over many centuries has been punctuated by financial crises. In recent decades, such crises came to be seen as the preserve of emerging markets. But mature economies too have been subject to periodic asset price booms and asset price busts.

Should we thus view financial crises as unavoidable? Are our efforts to prevent them futile? Or can we hope to reduce their frequency, severity and impact on the broader economy? These are the questions that I will discuss here today. More precisely, I will offer some thoughts on how we can refine the macroeconomic policy framework so as to prevent crises and make crisis management more robust.

These are challenging questions. I do not pretend that I can offer complete answers today. In central banks, finance ministries and international institutions, we are collectively seeking new and better policy responses. Taking inspiration from Burke, I will draw on my experience as a policy-maker over the past three decades to tease out some lessons from history about the required policy framework. After all, history offers our only empirical guide.

A large part of my professional career has involved dealing with episodes of financial disruption.

As President of the Paris Club in the mid-1980s, I was closely involved in the resolution of the sovereign debt crisis that had struck a large number of countries in Latin America, Africa and the Middle East. More than 50 countries defaulted. Even if advanced economies were not touched directly, their financial systems were deeply implicated. And the impact on entire continents in the emerging world – economically, and by way of consequence in social and human terms – was profound.

At the French Treasury and then as Governor of the Banque de France, I also witnessed first hand the exchange rate crises of the European Monetary System in 1992-93. A succession of emerging market crises followed later in the decade: the “tequila crisis” in Mexico in 1994; the Asian crisis from 1997; and the Russian crisis of 1998. Each of these rocked global financial markets and created new challenges for monetary and financial policy.

Here in the United States, the collapse of LTCM in 1998 and the bursting of the “dot-com bubble” at the turn of the century were episodes of significant financial disruption, with an impact that reverberated across the Atlantic. And, as President of the European Central Bank since 2003, I have been very closely involved in the global response to the current crisis, in concert with colleagues at the Fed and other leading central banks.

In short, my professional life has been one of dealing frequently with financial crisis. What have I learned from this experience? And what are the implications from these lessons for the refinement of policy design?

In anticipation of my answer to these questions, allow me to give an initial flavour of my response, which will be organised around two themes.

First , I will argue that financial crises share some commonalities. In particular, crises are associated with the emergence of euphoria and complacency in financial markets, typically supported by rapid credit growth and a growing belief that new concepts like financial innovation or technological advances have rendered old limits on economic performance obsolete. The existence of such commonalities in the anatomy of financial crisis gives rise to a number of hopes. They suggest that it is possible to develop warnings of nascent crises at an early stage. They imply that policy- makers could design and implement policies that contain or avoid such crises.

Yet these hopes should not give rise to complacency, still less to the belief that by tweaking our policy framework we can condemn financial crises to the past.

While sharing commonalities, each financial crisis is also unique: what triggers the crisis, how it is propagated through the financial system, and which sectors are most affected are specific to each episode. Such considerations bring me to the second theme of my remarks: the need for a flexible and innovative approach to crisis management. Policy-makers need to be constantly alert, aware that financial turmoil is likely to emerge in a way that they did not anticipate. As a result, they must be prepared to act decisively to contain financial disruption of a form for which they were not ideally prepared. At the same time, these inevitably somewhat discretionary actions need to be embedded within a credible, rules-based and medium term-oriented framework, which ensures that the immediate needs of crisis management do not place at risk future price stability, future macroeconomic stability and future financial stability.

Marrying an exploitation of commonalities with a respect for specificities is the key to managing financial crises. Allow me now to develop further these two themes.

Exploiting commonalities: A more robust policy framework

All financial crises are unique, but they also share a number of commonalities. [2]

For example, many crises exhibit a common evolution. The starting-point is typically structural change to the real economy – the unexpectedly rapid take off of emerging economies in the 1980s; the emergence of a new technology; the opening-up of new markets; or the implementation of comprehensive fiscal and regulatory reform. While the sign of the impact of such changes on economic performance is well understood, the magnitude and timing of the impact is highly uncertain. Such uncertainty is perhaps best characterised as Knightian: given the novelty and magnitude of the change, uncertainty cannot easily be boiled down to a calculus of probabilities. [3]

Entrepreneurs and investors seek to exploit the new opportunities created by the improved environment. Households seek to raise consumption in anticipation of higher future incomes and wealth. Such efforts rely on the financial sector: finance provides the necessary bridge between opportunities and expectations today, and higher productivity, output and incomes tomorrow. [4]

How do financial intermediaries manage these inter-temporal flows in such an uncertain environment? The challenge of doing so is compounded by changes to the financial sector itself. Technological advances or regulatory changes in the real economy are also likely to have direct implications for banks and financial markets. Financial innovation abounds in such a situation. Financial regulators are faced with new instruments and processes to police.

In this context, financial market participants face both a favourable macroeconomic environment – stronger economic growth and relatively benign price developments – and many new, and apparently profitable, opportunities at the firm level. The question arises of whether such circumstances prompt them to lapse into euphoria: to take on more risk; to expand balance sheets more rapidly; to increase leverage; and to bid up asset prices. [5]

Of course, the underlying shock to fundamentals is in many cases favourable and offers the prospect of greater prosperity. But the danger exists that financial imbalances may emerge in such a situation. Such imbalances both increase the vulnerability of the financial sector and the broader economy to future economic shocks and may create unsustainable positions in financial institutions that will eventually unravel of their own accord.

In principle, economic fundamentals impose a limit on such euphoria and imbalances, thereby introducing self-equilibrating forces for the economy. But assessing such fundamentals is notoriously difficult – for policy-makers and the private sector alike – all the more so because the evolution of fundamentals themselves can be influenced by the pervasive euphoric state of financial markets.

In this context, levels of leverage, liquidity or asset prices completely outside historical norms can be justified on the basis of a four-word refrain, recently used by Carmen Reinhart and Ken Rogoff for the title of their book: “this time is different”. [6]

But, as Reinhart and Rogoff demonstrate, experience over several centuries reveals that the self-sustaining booms induced by this sequence of events are ultimately unsustainable. They culminate in financial crash, with severe consequences for both the financial sector and the stability of the real economy. This time is not so different after all.

How well does this pattern of behaviour map into recent events? The onset of financial turmoil in 2007 and its intensification in 2008 were marked by specific events in the money markets, to which I will return. As is typical, the trigger and propagation of the current crisis were specific. Nonetheless, a number of commonalities identified by the academic literature on financial crises are clearly discernible.

Globalisation – in particular, the integration of the large emerging markets into the global economy – represents a significant, positive real shock, both to those economies and to the rest of the world. The impact on economic performance is beneficial, but of much-debated magnitude. As a result, from the turn of the century, we witnessed the incidence of a positive shock to economic fundamentals with uncertain implications, typical of those that initiate a boom-bust financial cycle.

Financial innovation was also key. The rapid growth of securitisation techniques, as the banking sector increasingly adopted an “originate-to-distribute” business model, had important implications for the economic outlook. Advocates of securitisation saw it resulting in both a better distribution of credit and liquidity risk and easier and cheaper bank access to funding. Such benefits justified the higher levels of leverage and liquidity observed from the middle of the decade. Both financial market participants and the regulatory authorities were swayed by these arguments, at least to some extent, and were therefore willing to tolerate much greater leverage than had been seen in the past.

Yet, with the benefit of hindsight, it is now clear that the value of these financial innovations was more apparent than real. What were portrayed as increases in equilibrium leverage ratios were, in fact, an accumulation of financial imbalances. Credit and liquidity risk transfer was a chimera: in many cases, these risks ultimately resided on bank balance sheets, arguably in a more toxic form than previously.

But at the peak of the credit boom, such concerns were forgotten. Enjoying abundant liquidity, the volume of capital chasing limited investment opportunities led to an aggressive “search for yield”. The demand for risky financial assets surged, feeding the securitisation frenzy. Credit growth accelerated well into double digits. And spreads and yields were depressed to very low levels, consistent with an under-pricing of credit and liquidity risks.

Ultimately, this accumulation of imbalances proved unsustainable. The growing losses on US sub-prime mortgage instruments triggered an evaporation of confidence in banks’ solvency, causing the interbank money markets to freeze. The specifics of this triggering event and the course of its subsequent propagation proved hard to predict in real time. But, with the considerable benefit of hindsight, one can easily identify warning signals of the subsequent financial distress in the data for 2006-07. And at that time, central bank communication pointed to excessive monetary and credit growth, an under-pricing of risk and an excessive narrowing of spreads as causes for concern.

Similar traits can be recognised in previous crises.

The high-tech bubble of the second half of the 1990s was rooted in the belief that a technological revolution based on the “new economy” had opened new vistas of economic opportunity. It spawned novel financing techniques via the explosion of venture capital and private equity. Expectations again ran ahead of reality, as the speculative excesses in “dot-com” investments ultimately led to the collapse of equity prices at the turn of the century.

Emerging market crises display similar characteristics. The commodity boom in the 1970s and the miracle of the “Asian tigers” in the 1990s spawned the belief that emerging economies could make an extraordinary development leap. Newly liberalised markets for international capital, supported by financial innovations (such as syndicated loan markets or emerging market mutual funds) fuelled the ensuing economic boom. But the euphoria of the embryonic economic miracle eventually proved ill-founded, leading to financial crisis and a sharp reversal of capital flows.

A comprehensive review of every episode of financial crisis lies well beyond the scope of this lecture. Nevertheless, this brief overview already illustrates the commonalities shared across crises in different locations and at different times.

Such commonalities offer hope that policy-makers can detect, at an early stage, a nascent financial crisis. On the basis of inductive logic, we can exploit historical regularities to help predict the future. Being able to identify financial tensions would allow appropriate policy actions to be taken in a timely manner.

Of course, the existence of commonalities in the historical experience does not amount to rigorous statistical proof that such relationships can be identified in the data and exploited for policy purposes. It has proved difficult to construct a robust economic indicator that provides a reliable signal of growing financial excesses.

In part, this reflects some of the processes that I have mentioned, which are integral to the boom-bust cycles themselves. Continuous and often rapid financial innovation can alter the character and relevance of existing monetary and financial statistics. And in an increasingly interconnected world, financial and economic imbalances more and more assume a global dimension.

These caveats notwithstanding, research conducted at the ECB and elsewhere points to a link between boom-bust financial cycles and the evolution of broad measures of money and credit. [7]

For example, the ratio of global credit to global GDP offers an indication of nascent financial stress. The departure of this ratio from its historical trend offers a signal of emerging financial imbalances and asset price misalignment. Of course, the indicator is imperfect: one needs to define the appropriate credit measure, agree how to aggregate to a global indicator, decide how to estimate the trend and identify an appropriate threshold of distress.

Nevertheless, even the simple portrayal in Figure 1 corroborates the intuition behind my assertion that early warning indicators of financial distress can be meaningful. [8] As shown in the chart, credit developments lead financial distress: the positive “credit gap” that emerged during the 1980s precedes the US savings and loans crisis; that observed in the second half of the 1990s precedes the collapse of the dot-com bubble; and growing credit excesses are apparent from 2005, before the onset of the current crisis.

Figure 1: Global excess credit

(Deviations of credit / GDP ratio from trend, in %)

Source: Alessi and Detken (2009) based on BIS and IMF data. `

Notes: The shaded areas denote widespread housing/equity boom episodes. The global credit gap is constructed using data on private credit for a panel of 13 OECD countries. Credit- to-GDP ratios are computed for each country and then averaged across countries by means of GDP weights based on PPP exchange rates).

Considerations of this type support the ECB’s emphasis on monetary analysis, including a regular assessment of credit developments, as a central aspect of the framework for preparing monetary policy decisions. More specifically, we have always foreseen that a close monitoring of monetary and credit developments constitutes an important element in identifying asset price misalignments that may threaten price and macroeconomic stability. The ECB continues actively to conduct research along these lines, in the context of its continuing enhancement of monetary analysis. [9]

At times, the ECB’s decision to pay close attention to monetary and financial developments in formulating monetary policy has been controversial. The canonical model of monetary policy neglected the role of monetary aggregates and of their counterparts, emphasising the output gap as the main indicator of inflationary pressures. [10]

Recent events have forced a re-evaluation of such models in the research community. It seems to me that the ECB’s approach has been vindicated by the financial crisis. The importance of monitoring money and credit developments is becoming more recognised in both the academic literature and the policy debate. Indeed, leading academics have argued in favour of defining and monitoring new monetary indicators to detect the build-up of leverage within the financial sector. [11]

Of course, recognising the importance of monetary analysis is not a panacea. It is only the starting-point of a difficult process that requires an ongoing monitoring and understanding of financial innovation and continuous attempts to sharpen and deepen our understanding of financial developments. Nor should monetary analysis, or the detection of the build-up of financial imbalances, be seen as an end in itself. Monetary analysis is only useful insofar as it improves policy decisions and furthers the achievement of the ECB’s ultimate objective.

The primary objective of the ECB is the maintenance of price stability in the euro area. From the outset, we have emphasised the need to adopt a medium-term orientation in pursuit of this objective, acknowledging the long and variable lags in the transmission of monetary policy, which make ”fine-tuning” of price developments in the face of the inevitable economic shocks both impossible and potentially counterproductive. [12]

Adopting such a medium-term orientation allows a degree of flexibility to monetary policy-makers. There are many paths of policy interest rates that are consistent with maintaining price stability over the medium term. In choosing among these various paths, policy-makers may seek policy settings that contain the emergence of financial imbalances, so as to impart greater stability to the economy as a whole.

Analysis of monetary and credit developments may offer insight into the slow accumulation of financial imbalances and thus identify a growing threat to macroeconomic stability in general, and price stability in particular, over the longer term. Given such signals, central banks can respond in a commensurate and timely manner.

Responding to money and credit developments in this way implies “leaning against” financial imbalances and asset price misalignments. Even if such an approach creates some inflation volatility in the shorter run, it better serves price and macroeconomic stability at longer horizons.

While conducting monetary policy in this way helps to provide an environment of price and macroeconomic stability that is conducive to financial stability, alone it will not suffice. Responsibility for the maintenance of financial stability should largely fall on the shoulders of regulators and supervisors. Along this dimension, the crisis has highlighted the distinction between risks facing individual financial institutions and risks to systemic financial stability. Let me elaborate on this point, which I see as crucial.

Managing risk is, of course, an indispensable aspect of financial intermediation. Banks have to remunerate depositors and must constantly search for investment opportunities, offering rates of return that are higher than the cost of funding. Financial economics tells us that, ultimately, increasing risk is the only way to earn higher returns. So, almost by definition, financial intermediation would not be possible without risk-taking.

Problems arise in two cases. The first case involves financial intermediaries choosing a combination of risk and returns that is not efficient from their individual perspective. This can happen when financial players’ incentives are aligned against prudent practices. These problems should be tackled by an appropriate micro-supervisory framework. Indeed, until recently, the main focus of financial supervision was on ensuring the soundness of individual financial institutions.

Supervision at the micro level is a very challenging task. It is vastly complicated by the uncertainties and innovations that characterise the historical experience. In the interests of brevity, I will not dwell on these challenges here, but in coming to an overall assessment they should not be neglected.

Problems can also arise in a second case, in which the choice of risk and returns may be appropriate at the individual bank level. Individual banks, however, may not take into account the impact of their decisions on the rest of the financial system.

For example, individual banks may be rationally willing to hold the risky tranche of a mortgage-backed security for a fee that appears to be in line with prevailing market rates. The banking system as a whole may, however, fail to appreciate in full the various dimensions of risk for that security. More specifically, it may fail to appreciate that widespread holdings of assets exposed to a common risk can generate catastrophic consequences for the system as a whole. When the value of those assets starts falling, a fire sale can be ignited as each bank attempts to guard against further reductions in value, but no bank is on the other side of the market.

Such considerations are magnified in the context of the uncertainties and innovations that characterise the build-up to financial crisis. In such a situation, individual institutions and regulators may not be fully aware of all interconnections and correlations associated with new financial instruments and business models.

The risk of systemic instability, and its potential costs for the economy, has long been recognised in both the academic literature and in policy circles. This is reflected, for example, in the fact that many central banks have been producing regular financial stability reports, which try to identify and analyse these risks. The crisis, however, has heightened the need to deepen this analysis and, moreover, to take appropriate policy actions to address these risks and prevent them from imposing severe losses on the real economy. Against this background, the need for additional tools and policies, which fall under the broad heading of macro-prudential policy, has been widely recognised.

In the case of Europe, this has led to a decision by the European Council to create a new independent body responsible for the conduct of macro-prudential oversight: the European Systemic Risk Board (ESRB). The main task of the ESRB will be to identify and assess risks to the stability of the European Union’s financial system and issue risk warnings when the risks appear to be significant. When appropriate, the ESRB could complement its risk warnings with policy recommendations for remedial action.

In pursuing this task, the ESRB will also have to rely heavily on the commonalities that we have identified in our experience of financial crises. It is these commonalities that provide the basis for identifying risks at an early enough stage that remedial policies can be introduced.

By exploiting the common features of the lead-up to previous financial crises, policy-makers can identify nascent financial distress. By refining the existing policy regime on both monetary and prudential dimensions, policy-makers can exploit such information to reduce the frequency and severity of financial crises, and thereby their impact on macroeconomic and price stability.

Respecting specificities: Effective crisis management

Yet even if a refined policy framework promises to be more effective in diffusing nascent financial distress, it would be naive to rule out altogether the possibility of future crises. What can policy-makers do once a crisis erupts? What have we learnt from experience about how financial crises should be managed?

Financial crises typically induce a large and sudden fall in aggregate demand, owing to negative wealth effects, a collapse of confidence or, more generally, both. While these shocks are difficult to quantify in real time, conceptually they are similar to the shocks addressed by monetary policy on a continuing basis. To simplify, downward pressure on price developments associated with a fall of economic activity can be countered using standard interest rate policy, reducing official rates so as to spur spending and bolster confidence. Such measures serve the maintenance of price stability.

The timing of the interest rate response is crucially important. Financial crises can strike suddenly. By implication, the response to the crisis should be commensurably swift and decisive. This requires a stance of permanent alertness, to identify promptly new threats to price stability, including those arising from the crisis itself.

The current crisis, however, has demonstrated that deeper market failures may occur in the financial sector, such that standard interest rate changes alone may prove insufficient to restore economic and price stability. Introducing measures to address these market failures naturally requires that the failures themselves are correctly identified and well understood. It is on this dimension that the specificities associated with each financial crisis can play a key role.

To illustrate, it is helpful to recall how the current crisis was triggered and propagated. The money markets played a crucial role in this respect. Until mid-2007, money markets were viewed as quiescent and well-behaved – not as candidates for the outbreak of financial turmoil. [13] But, through the re-pricing and re-rating of sub-prime-related credit risk transfer instruments, the money markets came to play a central role.

To be more concrete, the difficulties experienced by a small number of investment funds in June 2007, owing to the non-performance of US sub-prime mortgage securities, led rating agencies to downgrade a large number of asset-backed instruments. The immediate consequence of these downgrades was a deterioration in the quality of the balance sheets of banks holding those securities, as their price fell and capital losses were incurred.

As the number of large and complex financial institutions severely affected by the re-pricing of asset-backed securities was recognised, this financial shock was propagated to the broader financial market and real economy. The ensuing rounds of write-downs and a lack of transparency regarding exposures to these toxic instruments created an atmosphere of anxiety and suspicion. The root cause of this information problem was this generalised uncertainty regarding counterparty risk, which, at some point, made it impossible for lenders to distinguish between healthy and distressed institutions.

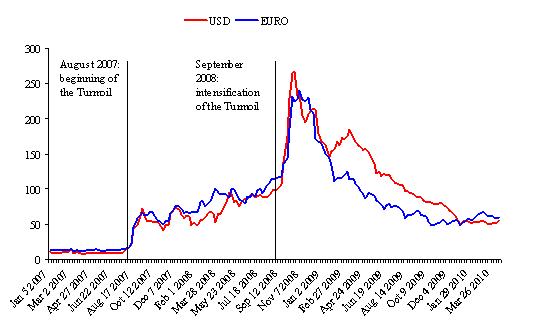

These informational problems became manifest in a freezing of the money market. Figure 2 illustrates the unprecedented extent of the turbulence using a common measure of liquidity and counterparty risk.

Figure 2: Interbank market spreads

(Basis points)

Notes: Spreads are the difference between 12-month EURIBOR / Libor and Overnight Index Swap rates, in basis points.

Source: Reuters / Haver Analytics and ECB calculations. Latest observation 16 April 2010.

More precisely, the spread between the cost of unsecured short-term funding from other financial intermediaries – in the euro area, the so-called EURIBOR rate – and the interest rate on the equivalent index swap rates, which had been negligible around the middle of the decade, suddenly rose to record levels.

These events were especially worrying because they threatened to disrupt the transmission of monetary policy to the real economy. To the extent that firms and households borrow at interest rates indexed to unsecured interbank rates, the emergence of a large and variable spread between policy rates and these market rates implied a potential loss of control of central banks over financing conditions.

Given heightened concerns about counterparty risk – which intensified dramatically after the failure of Lehman – cash-rich banks proved unwilling to lend to banks needing liquidity. [14] As a result, the money market came close to a total freeze. The ensuing decline in banks’ ability to raise funds led to a tightening of credit conditions facing enterprises and households. There was a clear and present danger that the resulting tightening of financial conditions would lead to augment the risk of a deflationary spiral, to trigger additional credit losses and a vicious downward cycle of financial and real distress.

To avert this danger, central banks introduced a variety of non-standard measures to permit their reduction of policy interest rates to be fully transmitted. In the case of the ECB, the Governing Council acted swiftly to address these risks through our policy of enhanced credit support. [15]

Since banks play a central role in the intermediation of credit in the euro area, we have largely directed our efforts at banks rather than intervening to influence activity and spreads in specific financial markets. To satisfy the higher liquidity needs of banks, we decided to allocate liquidity on a full allotment basis at fixed rates. We also lengthened the maturity of our operations up to one year, to give banks a more medium-term perspective in their liquidity planning. This measure greatly attenuated the maturity mismatch between assets and liabilities in banks’ books, which would otherwise have further deterred bank lending. At the same time, we expanded the list of assets that we accept as collateral in our operations. By expanding the list of eligible collateral, we ensured that banks could refinance that large proportion of their assets that had become less liquid in the crisis. In addition, we provided liquidity in foreign currencies to banks by means of swap arrangements with the Federal Reserve and other central banks. Finally, we decided to purchase of €60 billion of covered bank bonds in order to revive this market segment, which is important in Europe.

The fact that our operational framework was very flexible from the start has been a considerable asset. Unconventional measures did not require modifications to the same extent as elsewhere and this flexibility enabled us to react very quickly.

As a result of these measures, the adjustment of retail bank interest rates in response to reductions in policy rates appears to have remained effective during the financial turmoil. Banks’ short-term lending rates, which are generally affected by movements in the three-month EURIBOR, declined by 341 basis points between September 2008 and February 2010, while the three-month EURIBOR declined by around 436 basis points during the same period. Long-term bank lending rates declined over this period by 151 basis points, while seven-year government bond yields declined by 121 basis points.

Lending rates to non-financial corporations also declined almost in parallel with the key ECB interest rates, as did most bank interest rates on loans to households for house purchase and consumer credit. While lending rates to households remain relatively high, their level does not seem to indicate a malfunctioning of the transmission mechanism, but rather high levels of credit risk compared with normal economic conditions.

All in all, the evidence suggests that the enhanced credit support policies introduced by the ECB were successful in ensuring the effectiveness of the reduction in the key ECB policy rates. [16] Currently, these improvements are guiding a gradual phasing-out process. [17] The speed and path of the phasing-out of non-standard measures will depend on developments in financial markets and the economy. The current situation of ample liquidity in euro area money markets guarantees a continued positive impact on financing conditions. As regards the monetary policy stance itself, it will be designed as always to deliver price stability, in the medium and long term, in line with our definition.

As is natural, I have focused on the ECB experience. But let me emphasise that, faced with unprecedented challenges, central banks around the globe demonstrated a remarkable unity of purpose in meeting the financial crisis. Different economies, with different channels of transmission and different financial structures, required different policy responses. But, in the end, the action taken by the leading central banks proved successful in containing financial distress.

The cross-sectional variation in crisis management measures is mirrored in the historical dimension. Crisis management needs to be attuned to the specifics of the situation. The recent episode had one of its epicentres in the money market, and Central Banks measures focused very much on that segment. But on previous occasions the focus was elsewhere. For example, during the crisis of the mid 1980s, emerging market sovereign debt was central. The crisis management implemented in recent years would have been ill-suited to address the challenges of the 1980s.

All in all, experience demonstrates that crisis management requires a great degree of alertness and agility. Since policy-makers are unlikely to know precisely how the financial crisis will become manifest, they need to monitor developments closely and be prepared to act rapidly and decisively, as required. The specifics of the situation need to be identified quickly and an appropriate response developed to contain contagion and restore stability.

Given the idiosyncrasies of each episode, history may provide little guidance in dealing with these specificities. Rather policy-makers must rely on deductive logic, based on robust underlying principles, in formulating their policy response. Such an approach requires a willingness to be flexible and innovative, while recognising the potential risks associated with entering uncharted territory in terms of policy design.

Concluding remarks

Let me sum up the lessons I draw from my experience – both recent and more longstanding – of dealing with financial crisis.

Firstprevention is better than cure

By implication, we need to refine the macroeconomic policy framework so as to make it more robust and resistant to financial crisis. Crucial to such refinements are a number of elements: constructing early warning indicators of nascent financial distress; developing macroprudential policy instruments to contain systemic risk; and ensuring that monetary policy is credible in the pursuit of price stability over the medium term.

Second , I would guard against complacency.

However well-designed the macroeconomic policy framework, I am sceptical of the view that financial crises can be prevented with certainty. We need to prepare for such crises, even while we aim to avoid them. Policy-makers must maintain a continuous state of alertness and a readiness to act decisively, so as to contain such crises should they emerge.

This brings me to my third and final point: crisis management requires agility and innovation to meet the idiosyncrasies of a specific crisis, but at the same time respect for well-established principles to guide decisions in uncharted waters.

In short – and as I have argued on previous occasions [18] – central bankers must continually maintain a posture of “credible alertness”, which would permit to counter at any time any unexpected threat to price stability and so contribute to a solid anchoring of inflation expectations. At the same time, being permanently alert, the central bank can take without delay the measures, including non-conventional, that might be required under unexpected and exceptional circumstances. It is what we have done ourselves in the exceptional circumstances that we have had to cope with since August 2007.

But it is very important to stress that the non-conventional measures, taken to counter unexpected market disruptions should, in our view, never run against our primary goal, which is to deliver price stability over the medium term. It is the core of the so-called “separation principle”. This has been well understood by the observers and the market: our medium to long-term inflation expectations have remained well anchored since the beginning of the period of turbulences.

To conclude, allow me to reflect again more broadly on how historical experience should inform policy-makers’ decisions.

Almost a century ago, in the aftermath of the First World War and the deep psychological and physical scars it left on Europe, the writer H.G. Wells noted that: “human history becomes more and more a race between education and catastrophe”. [19]

No doubt this statement resonates with policy-makers grappling with the current financial crisis. Thanks to a prompt global policy response, I am confident that catastrophe has been avoided.

But education absolutely must remain ahead in the race, even if the outlook remains uncertain. We must ensure that the appropriate lessons are learnt and better policies implemented as a result. This is the current agenda for central bankers throughout the world.

Wells – realistically, but also reassuringly – concluded that “clumsily or smoothly, the world, it seems, progresses and will progress”.

In their pursuit of an improved policy framework, I am confident that central bankers will do likewise.

-

[1]Prominent examples of critiques of the existing macroeconomic literature include: P. Krugman (2009), “How did economists get it so wrong?” New York Times (2 September); and W.H. Buiter (2009), “The unfortunate uselessness of most ‘state-of-the-art’ academic monetary economics” Financial Times (3 March).

-

[2]The seminal discussion in the academic literature was provided by C. Kindleberger (1978, reprinted 2009), Manias, panics and crashes: A history of financial crises, 5th edition, Wiley Investment Classics.

-

[3]See: F.H. Knight (1921), Risk, uncertainty and profit, Houghton Mifflin Company.

-

[4]For an application of this framework in the context of emerging markets, see: R.I. McKinnon and H. Pill (1997), “Credible economic liberalizations and overborrowing” American Economic Review 87(2), pp. 189-193.

-

[5]Literature on the so-called “risk-taking channel” of monetary policy transmission provides a deeper insight into such behaviour; see (inter alia): C.E.V. Borio and H. Zhu (2008), “Capital regulation, risk-taking and monetary policy: A missing link in the transmission mechanism?” BIS working paper No 268; Y. Altumbas, L. Gambacorta and D. Marques (2010), “Bank risk taking and monetary policy” ECB Working Paper No 1166; G. Jiménez, S. Ongena, J-L. Peydro and J. Saurina Salas (2010), “Credit supply: Identifying balance sheet channels with loan applications and granted loans” CEPR discussion paper No 7655; and A. Maddaloni and J-L. Peydró (2009), “Bank risk-taking, securitisation, supervision and low interest rates: Evidence from lending standards” ECB Working Paper, forthcoming.

-

[6]See: C.M. Reinhart and K.S. Rogoff (2009), This time is different: Eight centuries of financial folly, Princeton University Press.

-

[7]See (inter alia): D. Gerdesmeier, B. Roffia and H-E. Reimers (2009), “Asset price misalignments and the role of money and credit” ECB Working Paper No 1068; and R. Adalid and C. Detken (2007), “Liquidity shocks and asset price boom/bust cycles” ECB Working Paper No 732.

-

[8]See: L. Alessi and C. Detken (2009), “Real time early warning indicators for costly asset price boom/bust cycles: A role for global liquidity” ECB Working Paper No 1039.

-

[9]See: J. Stark (2007): “Enhancing the monetary analysis” speech at the conference ‘The ECB and its Watchers IX’, September 2009.

-

[10] See: A. Beyer and L. Reichlin (eds.) (2008), The role of money: Money and monetary policy in the 21st century, European Central Bank.

-

[11]See: T. Adrian and H.S. Shin (2008), “Liquidity, monetary policy, and financial cycles” FRB New York Current Issues in Economics and Finance 14(1), pp. 1-7.

-

[12]See: ECB (1999), “The stability-oriented monetary policy strategy of the Eurosystem”, Monthly Bulletin (January).

-

[13]See: C. Holthausen and H. Pill (2010): “The forgotten markets: How understanding money markets helps to understand the financial crisis”, ECB Research Bulletin 9, pp. 2-5.

-

[14]See: F. Heider, M. Hoerova and C. Holthausen (2009), “Liquidity hoarding and inter-bank market spreads: The role of counterparty risk” ECB Working Paper No 1126.

-

[15] See: J.-C. Trichet (2009), “The ECB’s enhanced credit support” Keynote address, University of Munich, July.

-

[16]See: M. Lenza, H. Pill and L. Reichlin (2010), “Monetary policy in exceptional times” CEPR discussion paper No 7669; and P. Donati (2010), “Monetary policy effectiveness in times of crisis: Evidence from the euro area money market” ECB Working Paper, forthcoming.

-

[17]See: J.-C. Trichet (2009), “The ECB’s exit strategy” speech at the conference ‘The ECB and its Watchers XI’, September 2009.

-

[18]See: J-C. Trichet (2009), “Credible alertness revisited” speech at the Jackson Hole symposium on ‘Financial stability and macroeconomic policy’, August 2009.

-

[19]See: H.G. Wells (1920), The outline of history. Garden City Publishing, ch. 41.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts