Instruments which are recognised in accordance with the applicable accounting standard

- Question ID: 2020/0017

- Date of publication: 31/01/2020

- Subject matter: General clarifications

- AnaCredit Manual: Part I

Question

The instructions for the reporting of instruments recognised in accordance with the applicable accounting standard have changed. To date, instruments recognised in accordance with the applicable accounting standard that are neither held nor serviced by the observed agent have been excluded from the scope of AnaCredit following the instructions in the AnaCredit Manual. However, as these instruments constitute a material subset of loans as referred to in Article 4(1)(a)(ii) of the AnaCredit Regulation, the instructions in the AnaCredit Manual need to be amended to the effect that transferred instruments where the transferor (an observed agent in AnaCredit) cannot derecognise the transferred instrument are also collected.

Answer

The AnaCredit Regulation distinguishes between (i) instruments held by the observed agent, and (ii) instruments serviced by the observed agent.

Under AnaCredit, the creditor is the counterparty with the right to receive payments which the debtor is unconditionally obliged to make under the instrument, and irrespective of whether or not the lack of payment is mitigated by any protection (see Section 3.2.2 in Part I of the Reporting Manual).

Meanwhile, the servicer is the counterparty responsible for the active management of the instrument on a day-to-day basis (e.g. collecting principal and interest payments from debtors).

Moreover, the observed agent transfers an instrument if it transfers the contractual rights to receive the cash flows of the instrument.

Additionally, counterparties that acquire ownership of credit obligations (transferees) from a creditor (a transferor) become creditors themselves, although they have not directly lent funds to the debtors. Note that the retention by the transferor of the role of a servicer to administer the collection and distribution of payments does not affect the determination of whether the observed agent transfers the contractual rights to receive the cash flows from an instrument. For example, securitisations with a financial vehicle corporation (FVC) or other loan transfers in which the transferee acquires the legal ownership of the loan, where the FVC becomes the creditor (see Section 6.4.1 in Part II of the Reporting Manual), irrespective of whether the creditor collects the repayments directly or collection is carried out by a third party, and the observed agent ceases to be the creditor of the instrument (if the transfer is full), as transferring an instrument is effected by transferring a legal title to receiving payments arising under the instrument.

Pursuant to the clarifications provided in Section 4.2 in Part I of the AnaCredit Reporting Manual, only instruments held by observed agents or instruments that are serviced by resident observed agents are considered in the context of AnaCredit reporting, provided that they fulfil the other conditions referred to in Articles 1, 4 and 5 of the AnaCredit Regulation. In particular, in line with Article 1(8) and (9) of the AnaCredit Regulation, instruments are reported to AnaCredit only if the observed agent acts as either the creditor or the servicer (see Section 4.2 in Part I of the Reporting Manual).

However, these instructions inversely affect an important class of instruments and are being revised. Specifically, regarding instruments that are transferred but where the transfer does not qualify for derecognition in accordance with the applicable accounting standard, such instruments are reported to AnaCredit (in accordance with Article 4(1)(a)(ii)) even if they are neither held nor serviced by the observed agent. Consequently, the instructions referred to in Section 4.2 of Part I of the Reporting Manual, and in particular relating to Case IV on the treatment of instruments in which the observed agent acts as neither creditor nor servicer, are amended to the effect that such instruments are also considered for AnaCredit reporting.

Against this background, the clarifications provided in Section 4.2 of Part I of the Reporting Manual concerning the reporting obligations of the creditor and the servicer are amended.

In general, instruments in relation to which the observed agent acts as neither creditor nor servicer and which are subject to AnaCredit reporting are transferred instruments which do not qualify for derecognition under the applicable accounting standard.

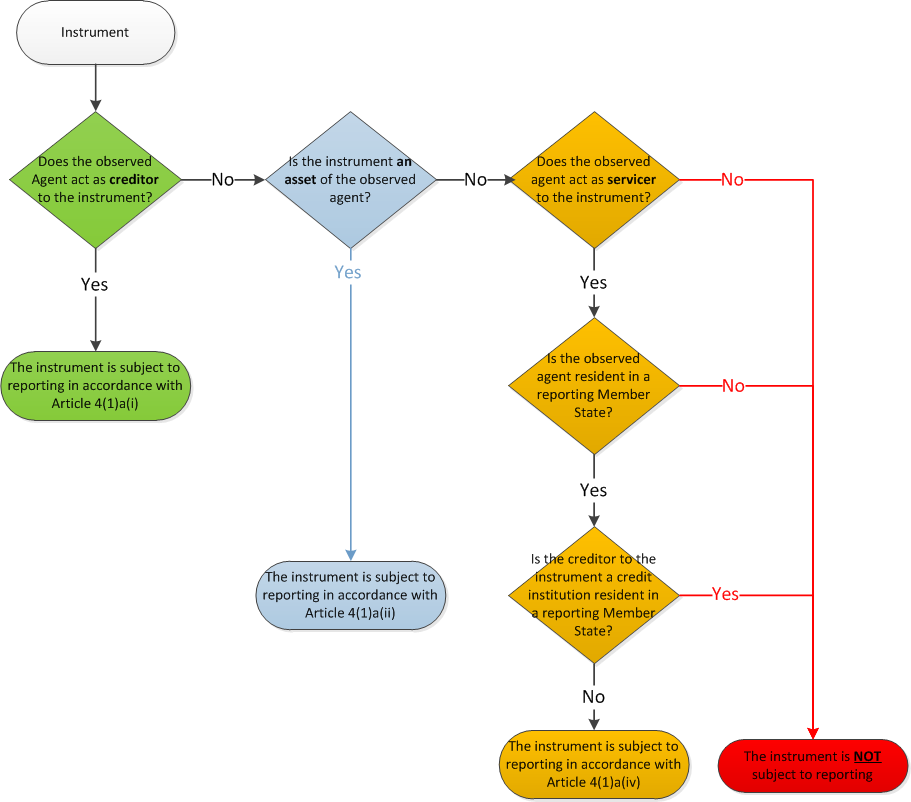

In particular, Chart 8 in Part I of the AnaCredit Reporting Manual is amended as follows.

Figure 1: (Revised Chart 8 in Part I of the Reporting Manual) Flow chart for instruments held or serviced by the observed agent, or that are an asset of the observed agent

Given the need for a lead-in time for reporting agents to adjust their reporting systems, the new AnaCredit instructions will apply no later than as of 31 July 2020. The changes to the instructions do not require revisions of past data to be sent to AnaCredit.

For example, in relation to the retention of substantially all the risks and rewards, IFRS stipulates that when an entity has transferred an asset, but has retained substantially all the risks and rewards, the asset is not derecognised. In the same vein, IFRS specifies that, if the observed agent has retained control of transferred assets, it continues to recognise the financial asset in line with its continuing involvement in the financial asset. Under IFRS accounting for continuing involvement in transferred assets, continuing involvement in transferred assets applies when an entity neither transfers nor retains substantially all the risks and rewards of ownership of a transferred asset, and retains control of the transferred asset. Whether the entity has retained control of the transferred asset depends on the transferee’s (i.e. a party to whom the asset was transferred) ability to sell the asset.

Typically, such transferred instruments are subject to AnaCredit reporting, because the observed agent retains the right (or obligation) to service the instruments, e.g. to collect payments. However, pursuant to the amended instructions, even if the observed agent did not retain the right to service the instrument, the instrument is subject to AnaCredit reporting, because the observed agent has not derecognised the instrument and the instrument is an asset of the observed agent. In such cases, the creditor is the counterparty to whom the observed agent transferred the instrument and the servicer is the counterparty actually responsible for the administrative and financial management of the instrument.

To illustrate how the requirements are applied, please consider the following two stylised examples of securitised instruments (note that the same considerations on “creditor” and “servicer” apply to loan transfers other than securitisations).

Case 1) Bank OA1 is resident in a reporting Member State and applies IFRS accounting standards. In a tranched securitisation, OA1 transfers the legal ownership of loans to corporation FVC1. The seller keeps the servicing rights as it continues the administrative processing of the loans. As substantially all risks and rewards are transferred, the seller OA1 derecognises the securitised loans from the balance sheet.

Case 2) Bank OA2 applies IFRS accounting standards. In a tranched securitisation, OA2 transfers the legal ownership of loans to corporation FVC2. The seller does not keep the servicing rights, as the administrative processing of the loans is run by a third party. Because of risks being retained, significant risk transfer has not been achieved by this transaction and the securitised loans do not qualify for derecognition from the balance sheet.

In the first case, FVC1, which acquires the legal ownership of the loans, becomes the creditor, while OA1, which transfers the ownership of these loans, ceases to act as the creditor. Moreover, the balance sheet recognition status of the loans is “entirely derecognised”. Consequently, the reporting obligation vis-à-vis the observed agent OA1 in respect of these instruments is triggered by its acting as servicer pursuant to Article 4(1)(a)(iv)(ii).

Meanwhile, in the second case, while the transferee FVC2 is the creditor, OA2 is neither the creditor nor the servicer. However, as the observed agent has not derecognised the instruments, they are assets of the observed agent. Consequently, in line with the clarifications provided above, although OA2 acts as neither the creditor nor the servicer, the transferred/securitised instruments are subject to AnaCredit reporting, and obligation is triggered by Article 4(1)(a)(ii), as the instruments are not derecognised from the balance sheet[1].

Therefore, in both cases the originator transferred the legal ownership of the instruments to the FVCs, which now become the creditors. Nonetheless, whether or not the instruments are subject to AnaCredit reporting depends on whether the seller has retained the servicing rights or continues to recognise the transferred instrument in accordance with the accounting standard.

Please note that the flowchart for instruments held or serviced (Chart 8 in Section 4.2 in Part I of the Reporting Manual) remains valid without amendments – for example, when the observed agent transferred an asset, but has retained substantially all the risks and rewards, the asset is not derecognised and is therefore subject to reporting in accordance with Article 4(1)(a)(ii) through the decision box “Is the instrument an asset of the observed agent?” in the flowchart.

Notably, in the context of traditional securitisations where the originator fully transfers the ownership of loans, the originator is not the creditor, despite the fact that it may not be allowed by the applicable accounting standard to derecognise the loans.

- [1]Please note that OA2 may be the originator and OA2 may therefore be reported in the counterparty-instrument dataset with the role “originator”. However, in relation to transfers other than securitisation, where no originator is identified in AnaCredit, OA2 would have no role in the counterparty-instrument dataset.