Introduction

Market infrastructures constitute one of the three core components of the financial system, together with markets and institutions. The market infrastructure for payments[1] consists of the set of instruments, networks, rules, procedures and institutions that ensure the circulation of money. The principal objective of this segment of the financial system is to facilitate the execution of transactions between economic agents and to support the efficient allocation of resources in the economy.

The Eurosystem has the statutory task of promoting the smooth operation of payment systems. This is crucial for a sound currency, for the conduct of monetary policy, for the functioning of financial markets, and for supporting financial stability. A key instrument which the Eurosystem uses for carrying out this task[2] is the provision of payment settlement facilities. To this end, the Eurosystem operates the TARGET2 system, the second-generation Trans-European Automated Real-time Gross settlement Express Transfer system[3] for the euro.

In May 2008 TARGET2 replaced the first-generation system, TARGET, which was created in 1999 by the Eurosystem for the settlement of large-value payments in euro, offering a central bank payment service across national borders in the European Union (EU).

TARGET was developed to meet three main objectives:

- to provide a safe and reliable mechanism for the settlement of euro payments on a real-time gross settlement (RTGS) basis;

- to increase the efficiency of inter-Member State payments within the euro area; and, most importantly,

- to serve the needs of the monetary policy of the Eurosystem.

Similarly to its predecessor, TARGET2 is used for the settlement of payments connected with monetary policy operations, of interbank payments, of customer payments exchanged between banks and of transactions related to other payment and securities settlement systems (i.e. ancillary systems). As TARGET2 provides intraday finality, i.e. settlement is final for the receiving participant once the funds have been credited, it is possible to reuse these funds several times a day. Since June 2015 TARGET2 participants have also been able to open dedicated cash accounts (DCAs) on the TARGET2-Securities (T2S) platform[4], which they can use to settle the cash leg of their securities transactions.

Building on the synergies between the two market infrastructures, the Eurosystem has begun to consolidate TARGET2 and T2S services. This will provide an opportunity to enhance the RTGS services offered to users, to further strengthen cyber resilience and to establish a single access point to a range of market infrastructure services.

TARGET2 offers harmonised services at the EU level and a single pricing structure. It provides ancillary systems with a harmonised set of cash settlement services and supports its users with enhanced liquidity management tools. In this manner, it contributes to financial integration, financial stability and liquidity efficiency in the euro area.

TARGET2 is accessible to a large number of participants. Over 1,700 credit institutions in Europe use TARGET2 to make payments on their own behalf, on behalf of other (indirect) participants or on their customers’ behalf. Taking into account branches and subsidiaries, more than 51,000 banks worldwide (and thus all of the customers of these banks) can be reached via TARGET2.

The report and its structure

This report is the 18th edition of the TARGET Annual Report. The first edition was published in 2001, covering TARGET’s two first years of operation (1999 and 2000). As in previous years, the report presents the main facts relating to the TARGET system, taking into account the developments which took place in TARGET2 in the course of 2017. The report is mainly addressed to decision-makers, practitioners, lawyers and academics wishing to acquire an in-depth understanding of TARGET2. It will hopefully also appeal to students with an interest in market infrastructure issues and TARGET2 in particular.

The report provides information on TARGET2 traffic, its performance and the main developments that took place in 2017. The report is complemented by other annexes that present a list of general terms and abbreviations, and a glossary.

In addition to the core content, the report includes seven boxes, providing detailed information on topics of particular relevance in 2017 and an in-depth analysis of a specific TARGET2 feature. The boxes focus, respectively, on the tenth anniversary of TARGET2; the evolution of traffic in TARGET2; TARGET2 liquidity and its usage; TARGET2 cross-border activities; the TARGET2/T2S consolidation project and future RTGS services; TARGET2 cyber and end-point security; and forthcoming TARGET2 adaptations to the TARGET Instant Payment Settlement (TIPS) service. In the report, the references made to the first-generation TARGET system (which was in operation from January 1999 to May 2008) are also applicable to its second generation, TARGET2 (which has been in operation since November 2007).

Note

Please note that liquidity transfers between TARGET2 and T2S DCAs and payments processed on DCAs are not included when calculating the TARGET2 indicators presented in this report.

Despite the fact that DCAs are legally part of TARGET2, these (technical) transactions are excluded from the calculations in order to prevent the system’s indicators being artificially inflated and to make the figures more easily comparable from year to year. Nevertheless, as a matter of transparency, some general (cash-based) and per-country statistics on DCAs are provided on the ECB website.[5]

TARGET2 activity in 2017

In 2017 TARGET2 maintained its leading position in the European landscape, processing 90% of the total value settled by large-value payment systems in euro, and in the world as one of the biggest payment systems. Compared with the previous year, the total turnover processed decreased by 3% and amounted to almost €433 trillion[6]. The total volume of payments, however, increased by 1.6% to reach more than 89 million transactions.

The highest daily turnover during the year was recorded on 30 June, with a total value of €2,409 billion, and the highest daily payments volume was recorded on 18 April, when 534,892 transactions were processed.

The availability of TARGET2’s Single Shared Platform (SSP) in 2017 stood at 100%.

1 Evolution of TARGET2 traffic

Table 1

Evolution of TARGET2 traffic

Note: There were 257 operating days in 2016 and 255 in 2017.

1.1 TARGET2 turnover

TARGET2 turnover in 2017 amounted to a total value of €432.8 trillion, corresponding to a daily average of €1.7 trillion. Chart 1 shows the evolution of TARGET2 traffic over the last seven years. In 2011 and 2012, TARGET2 settlement volumes continued to recover after the decrease caused by the financial crisis, with an annual growth rate range of around 3%. The observed sudden drop in 2013, by 22%, was mainly due to a change in the statistical methodology. This change involved some transactions ceasing to be included in the aggregate representing the turnover.[7] Overall, after two years of stable figures, TARGET2 turnover fell by almost 15% between 2015 and 2017, following the launch of TS2. In 2017 alone, the TARGET2 value decreased by almost 3%, owing to the migration of the central securities depositories (CSDs) in wave 4 as well as in the final wave. As a consequence of their migration to T2S, final securities settlement of the cash leg of securities transactions is no longer carried out on the RTGS accounts of their participants in TARGET2. Instead, it takes place via the DCAs held in T2S. Although significant increases in the volume of other transactions were observed in 2017, including an 8% rise in the value of interbank transactions, these were not sufficient to compensate for the loss of securities settlement-related turnover.

Chart 1

TARGET2 turnover

(left-hand scale: EUR billions; right-hand scale: percentage)

In terms of the activities involving market participants (i.e. excluding central bank and ancillary system transactions), interbank transactions (transactions exclusively involving credit institutions) accounted for 78% of the total value of the payments in 2017, whereas the remaining share was composed of customer transactions (i.e. transactions processed on behalf of a non-bank party, be it an individual or a corporate). Compared with the previous year, the value of both types of payment increased: by 8% for interbank payments and by 2% for customer payments.

A comparison of the TARGET2 turnover and the euro area’s annual GDP (around €11 trillion) shows that TARGET2 settles the equivalent of the annual GDP in less than seven days of operations. This indicates the role and efficiency of TARGET2, which provides intraday finality for transactions and allows the funds credited to the participant’s account to become immediately available for other payments. Consequently, the same euro can be reused several times by several TARGET2 participants within the same day.

Chart 2 depicts the average daily turnover generated in TARGET2 for each month in 2016 and 2017, thus showing the seasonal pattern of the system. While the general pattern for both years is very similar, the values recorded in 2017 are slightly lower than in 2016.

Chart 2

Average daily TARGET2 turnover

(EUR billions)

Chart 3 displays the highest and lowest daily TARGET2 values for each month of 2017, as well as the average daily values for each month. Usually, the days with the highest peaks are at quarter ends, typically on the last days of the month, owing to reimbursements and due dates in various financial markets. In line with this, in 2017 the day with the largest turnover of the year, with a total value of €2,409 billion, was 30 June.

Chart 3

Monthly maxima and minima, troughs and averages of TARGET2 daily values in 2017

(EUR billions)

Throughout 2017, the range of TARGET2 turnover, expressed by the difference between the highest and the lowest value, was 50%[8], compared with 52% recorded the year before. Overall, similarly to 2016, the average values decreased towards the end of the year, when the lowest figures were observed.

Peaks and troughs in the system’s values can also be influenced by other factors, such as TARGET2 holidays or the end of reserve maintenance periods. For example, the lowest values are typically observed during the summer holidays and on days that are national holidays in some Member States or in other important economies. In 2017, the lowest values were processed on 23 November, which was a public holiday in the United States (Thanksgiving).

Finally, Chart 4 provides a comparison of traffic developments in the major payment systems in the world. In particular, it depicts the daily average turnover in euro equivalents for the last 19 years of TARGET(2), Continuous Linked Settlement (CLS), Fedwire Funds (the USD-denominated RTGS system operated by the Federal Reserve System) and the Bank of Japan Financial Network System (BOJ NET). Some common patterns, including the effect of the financial crisis on the number of processed transactions, can be identified across systems. However, the comparability of TARGET2 with other systems is hampered by the change in the TARGET2 statistical methodology in 2013, as well as by the migration of the securities settlement systems to T2S.[9] In the latter case, if the average daily volume in TARGET2 after 2015 were considered together with the average daily turnover on DCAs, which are technically held in T2S, total traffic would have continued to increase, as was the case for other systems.

Chart 4

Major large-value payment systems around the globe

(EUR billions)

Box 1

TARGET2 celebrates a decade in operation

2017 marked the tenth anniversary of TARGET2. Launched in November 2007, the single technical platform offers an alternative to the multiple local RTGS systems interlinked via the first-generation TARGET system. Its harmonised service for real-time settlement in central bank money increases efficiency and resilience in the European payments landscape and lowers both operational and service costs.

As the first pan-European market infrastructure provided by the Eurosystem, TARGET2 also paves the way for the deeper integration of financial markets in Europe. This box offers more insights into the ways in which TARGET2 has supported the European financial industry over the years.

Connecting financial institutions in Europe

TARGET2 has significantly broadened its outreach over the past decade, ensuring a smooth flow of liquidity among an increasing number of financial institutions. Its flexible pricing policy for the provision of core services has made it attractive to both big and small players in the financial industry. Almost 2,000 accounts were held with TARGET2 at the end of 2017 compared with around 900 in 2008, marking a steady increase over the years (see Section 3.1 RTGS accounts).

The high share of TARGET2 cross-border activities (see Section 1.10 Share of inter-Member State traffic) clearly illustrates that participants can connect to the RTGS system at virtually any point in Europe, thus facilitating the flow of capital and liquidity across borders.

Figure A

Payment flow between the direct participants in TARGET2

Supporting the conduct of monetary policy

TARGET2 has proved successful in fulfilling its main objective of supporting the monetary policy operations of the Eurosystem. In particular, together with T2S it has been instrumental in facilitating the unconventional monetary policy conducted by the Eurosystem.

Facilitating the operations of other market infrastructures

The settlement services of TARGET2 are used not only by credit institutions, but also by other financial market infrastructures, such as other large-value payment systems, retail payment systems, clearing houses and securities settlement systems, referred to as ancillary systems. In 2017 TARGET2 settled the positions of 79 ancillary systems. In addition, it offers a special range of services and procedures tailored to meet their requirements. Acting in its operational capacity, the Eurosystem ensures that the ancillary systems meet the safety and efficiency standards it has set for pan-European market infrastructures.

The RTGS system also plays an important role in the functioning of T2S, the Eurosystem’s securities settlement engine. Launched in June 2015, T2S brings together both cash and securities accounts on a single technical platform. The two market infrastructures are interlinked, as TARGET2 facilitates settlement in T2S by providing the liquidity needed for the cash leg of securities transactions.

Helping banks cope with challenging liquidity conditions

When Europe was successively hit by the global financial crisis and the sovereign debt crisis, regulatory authorities introduced a series of measures to ensure safety and stability in the banking sector. Among these measures are increased capital and liquidity requirements for banks. To help banks ensure regulatory compliance, TARGET2 offers liquidity-saving features, such as liquidity reservations and priorities, limits, offsetting mechanisms and optimisation algorithms.

Maintaining high technical standards

Over the past decade, TARGET2 has served as a robust and reliable financial market infrastructure. In recent years, it has not been affected by any major operational incidents and has maintained close to 100% technical availability. This is essential for the efficient business operations of its users, as well as for the European financial market as a whole.

Adapting to the instant payment environment

The global payments landscape is transforming, driven not only by policy and regulation, but also by technological innovation and changing consumer behaviour. By definition, RTGS systems offer settlement in real time. The past years have seen a growing demand for the near real-time settlement of retail payments, also known as instant payments.

To meet this demand the European payments industry is moving forward at a quick pace. With the aim of providing a pan-European solution, the European Payments Council launched its SEPA Instant Credit Transfer (SCT Inst) scheme in November 2017. To support its users in adopting SCT Inst, TARGET2 amended a procedure in its ancillary system interface (ASI) by way of its latest software release 11.0, which was deployed on 13 November 2017. This allows automated clearing houses (ACHs) to offer a pan-European solution for instant payments in euro, backed by central bank money.

In the same vein, the Eurosystem is developing a new TARGET Instant Payment Settlement (TIPS) service as an extension to TARGET2. TIPS will enable payment service providers to offer fund transfers in real time and around the clock, 365 days a year, settled in central bank money. It will join the family of TARGET services offered to the financial industry in November 2018.

Continuously embracing efficiency and innovation

The Eurosystem constantly strives to bring more efficiency and innovation into its market infrastructure services and ultimately achieve greater integration in the European financial landscape. Its liquidity management and the RTGS services offered by TARGET2 are being revised as part of the TARGET2-T2S consolidation project (see Box 5 for more details).

Having successfully met its objectives and ready to face future challenges, TARGET2 is now embarking on its second decade in operation – with exciting times ahead.

1.2 Volume of transactions in TARGET2

After low transaction volumes resulting from the financial crisis, TARGET2 traffic had been slowly recovering with a positive trend between 2010 and 2013 (Chart 5). Although the number of transactions never reached pre-crisis levels, the system attracted around four million transactions more over that period. However, this trend was reversed in 2014 and 2015. During this period, owing to the finalisation of the migration to SEPA instruments[10], there was again a significant reduction in the customer payment segment leading to lower TARGET2 volumes. Following the completion of the migration to SEPA, TARGET2 traffic stabilised at around 88 million transactions yearly and further rose to 89 million in 2017[11].

Chart 5

TARGET2 traffic

(left-hand scale: EUR millions; right-hand scale: percentages)

The exact volume settled in TARGET2 in 2017 amounted to 89,276,944 transactions, corresponding to a daily average of 350,106 payments. Compared with the previous year, the overall number of processed payments increased by 1.6%. The increase was mainly driven by the two largest categories, namely customer and interbank payments, which grew significantly enough to overcome the lower number of ancillary system-related transactions. More detailed information on the evolution of the different traffic segments is provided in Box 2.

Box 2

Traffic evolution in TARGET2

The Eurosystem has been carefully monitoring the development of TARGET2 volumes over time, especially given the relevance of these volumes for TARGET2 revenues and cost recovery. This box aims to share the insights gained from the analysis of the 2017 volumes.

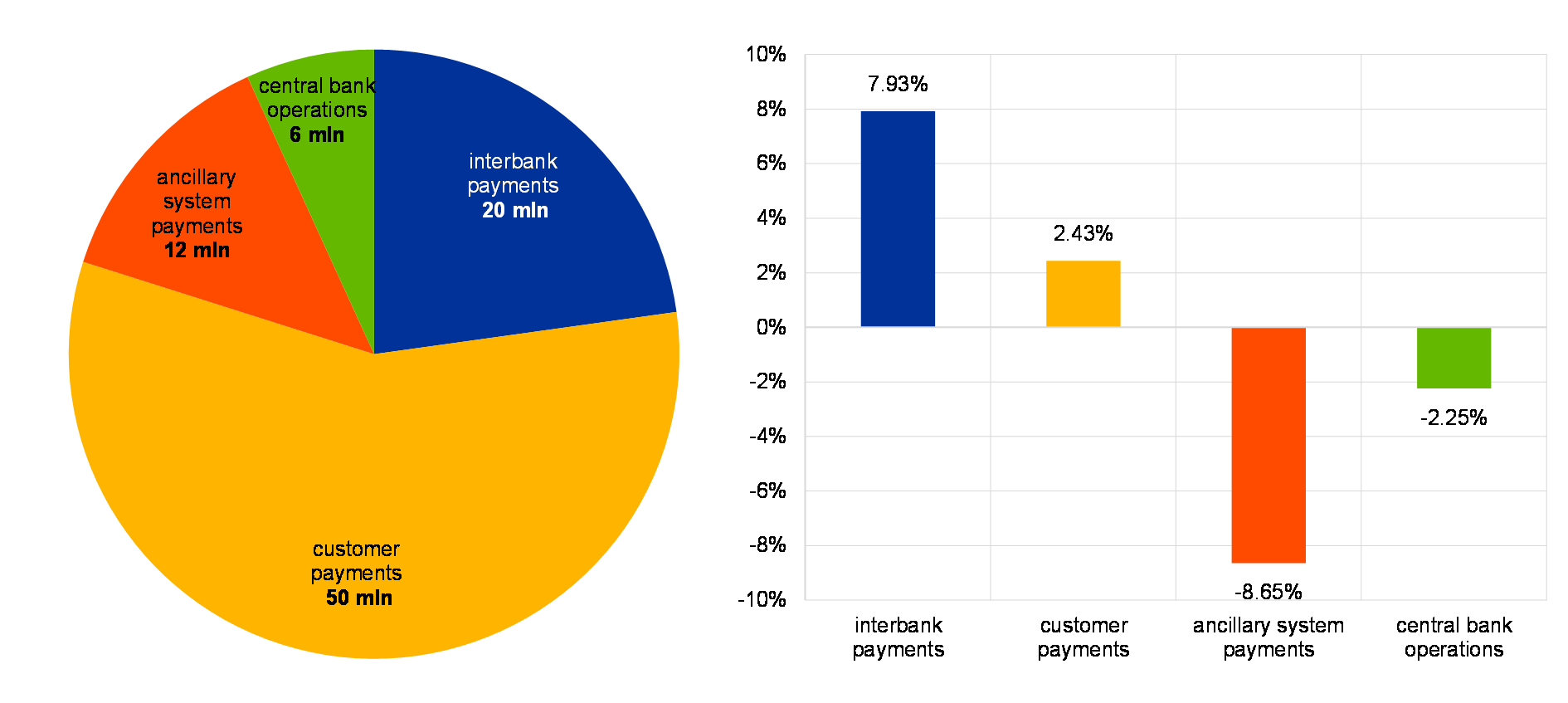

In 2017, customer payments made up 57% of the total TARGET2 traffic in terms of volume, followed by interbank payments (23%), ancillary system payments (13%) and other payments such as central bank operations (7%). Total traffic increased by 1.64% compared with 2016. This may come as a surprise, especially given the two migration waves of CSDs to T2S on 6 February and 18 September, which reduced ancillary system traffic. However, other developments counteracted the impact of these migrations, resulting overall in a volume similar to that recorded in the previous year.

Chart A illustrates the distribution of payments across payment types in 2017 and the year-on-year growth rates recorded in 2017.

While in 2017 customer payments increased by 2.43% compared with 2016 and central bank-related payments decreased by 2.25%, the greatest changes were seen in interbank and ancillary system traffic. The daily average ancillary system volumes decreased by 8.65% compared with 2016, while interbank payments increased by 7.93%.

Chart A

TARGET2 traffic – volume distribution and yearly growth rate for 2017 payments by payment type

Customer payments, which represent more than half of all TARGET2 payments, displayed the strongest seasonal pattern in 2017. This is particularly evident in the falls recorded in April (Easter) and the summer months, as well as in the increase towards the end of the year.

Interbank payments accounted for between 1.5 and 1.8 million transactions per month during 2017, and were also affected by seasonal trends. Overall, this category increased by approximately 8% compared with 2016, with the increase evenly distributed across payment values and countries.

Chart B

TARGET2 traffic – number of interbank, customer, ancillary system and central bank-related payments per month in 2017

Ancillary system payments almost halved over the course of 2017, falling from 16% of overall TARGET2 payments in January 2017 to just 8% in December 2017. The decrease in such payments, both in absolute terms and based on their relative importance with respect to overall TARGET2 payments, is mainly due to the two migration waves to T2S in 2017, in particular the most recent wave. For example, on 18 September 2017 one CSD which had previously contributed to larger TARGET2 volumes migrated, settling on a gross basis, causing a substantial drop in ancillary system payments in TARGET2.

Payments related to central bank operations were relatively stable in 2017.

All in all, the migration waves to T2S had the greatest impact on TARGET2 volumes in 2017. However, these were counteracted by a slight increase in the already-large base of customer payments and a rise in interbank payments. As a result the overall volumes remained stable, even slightly exceeding those in 2016.

For most of 2017 the average daily volumes in TARGET2 calculated on a monthly basis were above the levels recorded for the corresponding month of 2016 (Chart 6) – as much as 15% higher in April. Daily average volumes were only slightly lower than in 2016 in June, October and November. Overall, Chart 6 indicates a much stronger seasonal pattern than observed in the previous year.

Chart 6

Average daily TARGET2 volumes per month

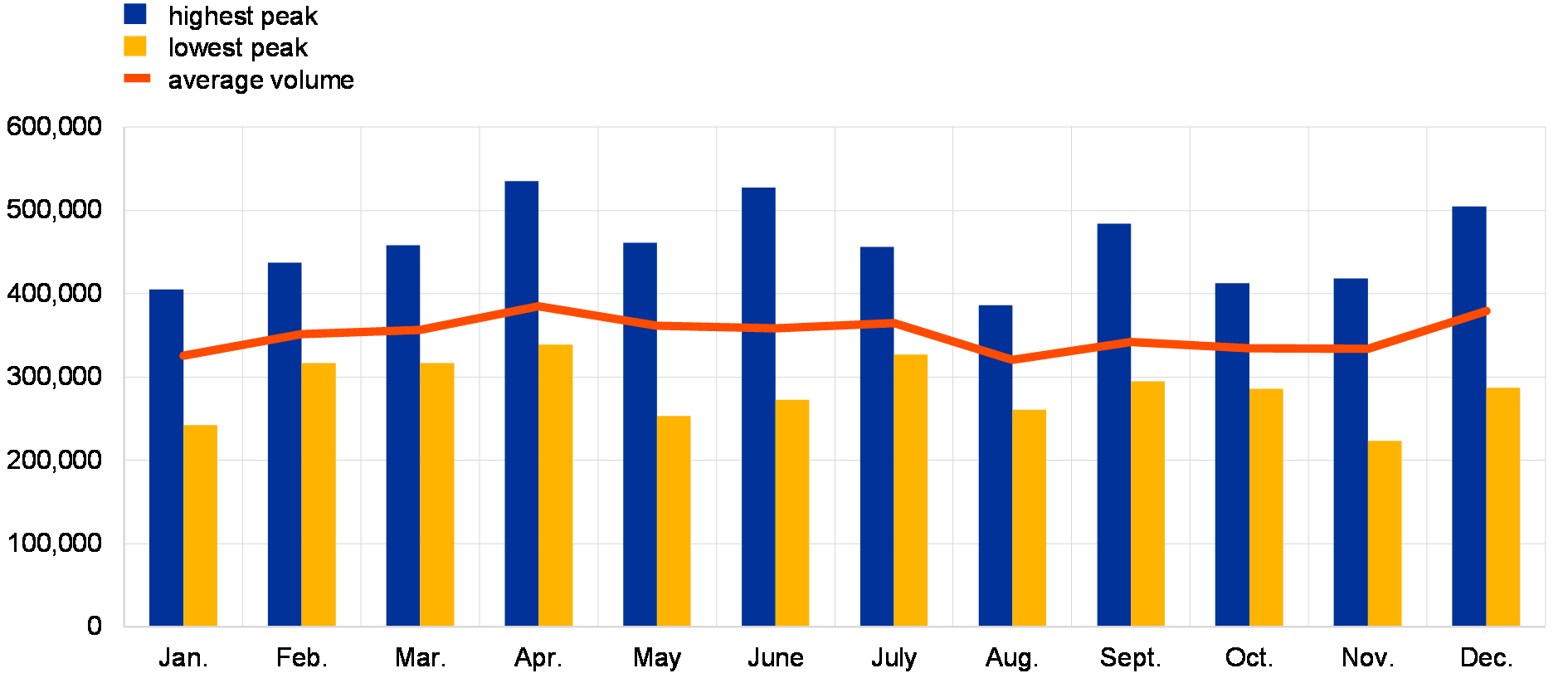

The highest average daily volume was recorded in April, when it reached more than 385,000 transactions. Such high figures can be associated with high daily volumes normally observed just before and after the Easter break as well as at the beginning (and end) of each quarter.

Chart 7 depicts the peaks and troughs in terms of daily volume on RTGS accounts in TARGET2 in 2017 and the average daily volume for each month. As already observed in the value-based figures, the peaks typically fall on the last day of the month, and are especially pronounced at the end of the quarter for the same reasons (i.e. deadlines in financial markets or for corporate business). In 2017 the highest daily volume was recorded on 18 April, which was the first day after the Easter holidays, when 534,892 transactions were processed. The lowest daily volume was recorded on 1 November (223,273 transactions), i.e. a public holiday in most European countries (All Saints' Day).

Chart 7

Monthly peaks, troughs and averages of TARGET2 daily volumes in 2017

Chart 8 shows the yearly moving average of TARGET2 volumes (i.e. the cumulative volume processed in the preceding 12 months) for each month. This indicator helps to eliminate the strong seasonal pattern observed in TARGET2 traffic. The variation of this cumulative volume from one year to the next is also presented as a percentage. The chart shows that the cumulative volume started to decline in the second half of 2008 at the time when the financial crisis erupted. The number of transactions continued to drop sharply almost until the end of 2009. After that, TARGET2 volumes were roughly stable until the end of 2011. They then started to grow moderately until the end of the first quarter of 2014, when they reached their highest point since the crisis. Thereafter, the cumulated volume started dropping for the reasons already explained at the beginning of the section (SEPA migration) and, in October 2014, the cumulated growth rate on a yearly basis turned negative and decreased further until mid-2016. However, in the second half of 2016, the negative trend was reversed and TARGET2 monthly volumes grew steadily throughout almost all of 2017.

Chart 8

TARGET2 volumes

(left-hand scale: in million transactions; right-hand scale: percentages)

Chart 9 compares the growth rate (between 2016 and 2017) of traffic in TARGET2 with the growth rates of the major payment systems worldwide as well as with the growth rate of the SWIFT payment-related FIN traffic (category 1 and 2). The chart reveals that, with the exception of EURO1[12], the traffic of the main payment systems recorded positive growth rates. The decline observed for EURO1 may be attributable, similarly to previous years, to the ongoing shift of traffic from large-value payment systems to ACHs. The most considerable increase – of around 14% – was recorded by SIC, followed by SWIFT. SWIFT’s payment-related FIN traffic increased in all regions, but the highest contribution to its growth rate came from its European and Middle Eastern operations.

Chart 9

Comparison of the changes in traffic in some major large-value payment systems and SWIFT between 2016 and 2017

(in percentages)

1.3 Interactions between TARGET2 and T2S

T2S is the Eurosystem’s pan-European platform for securities settlement in central bank money, which went live on 22 June 2015. It brings together both securities and cash accounts on a single technical platform, the T2S platform.

Although the accounts are centralised on a single platform, the legal and business relationships of the holders of the securities and cash accounts remain with the CSDs and national central banks respectively.

DCAs are opened with the national central banks and used exclusively for the securities settlement business in T2S. These euro-denominated accounts, although technically held on the T2S platform, are legally part of TARGET2. At the end of 2017 there were 742 active DCAs on the T2S platform.

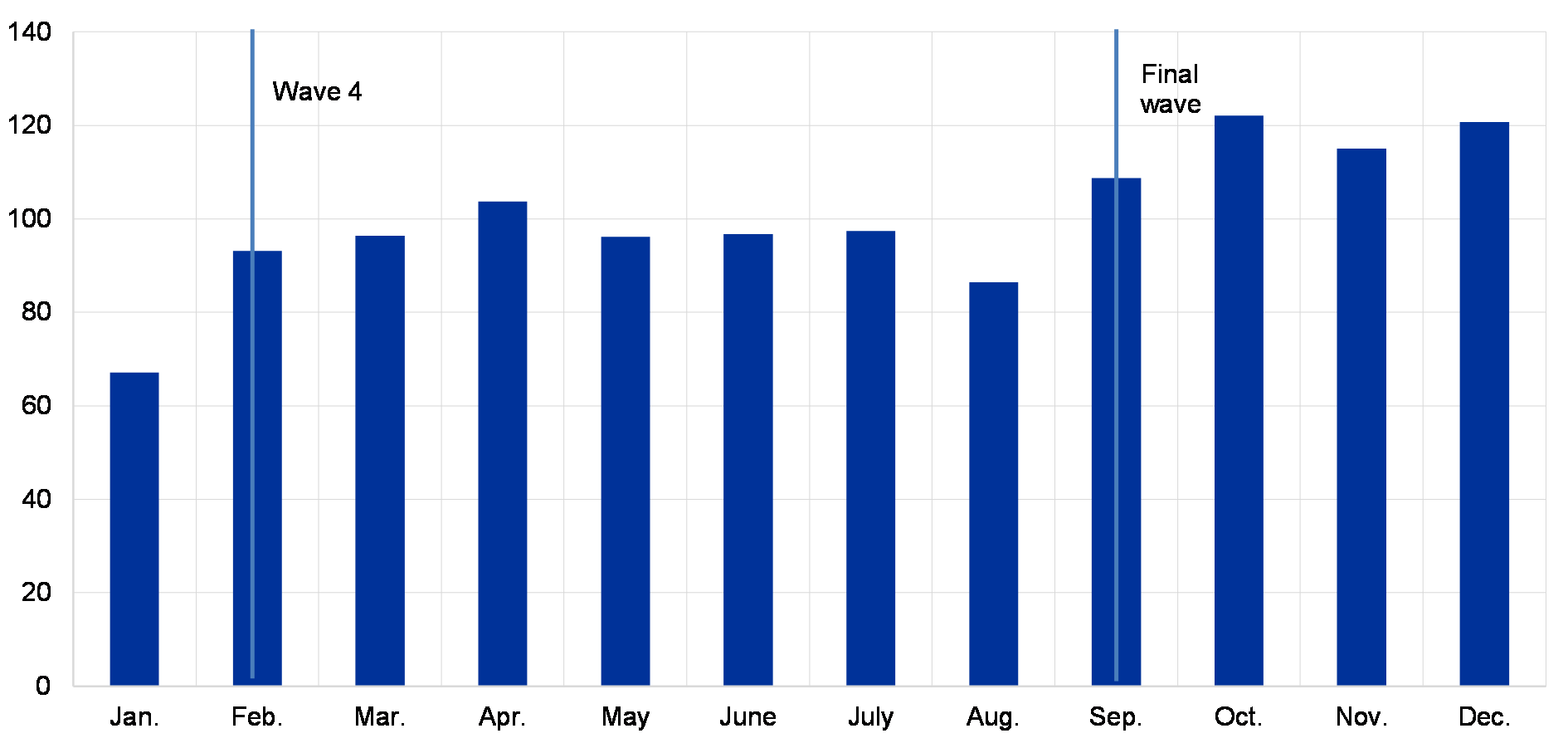

In 2017 the last two migration waves joined T2S, rendering the system fully operational. The fourth migration wave took place over the weekend of 3-5 February 2017, marking the transition of the OeKB CSD (Austria), Clearstream (Germany), KELER (Hungary), LuxCSD (Luxembourg), CDCP (Slovakia) and KDD (Slovenia). Seven months later, on 18 September 2017, Iberclear Spain and Nasdaq CSD (Estonia, Latvia and Lithuania) completed the final migration wave.

Charts 10 and 11 below present the daily average volumes and values of liquidity transfers between the TARGET2 payment accounts and the T2S DCAs. At the start of each T2S business day, liquidity is sent from TARGET2 to T2S, while, towards the end of the day, any liquidity on DCAs is swept back to the RTGS accounts in TARGET2.[13] During the day, liquidity can be freely transferred from TARGET2 to T2S and vice versa.

Chart 10

Daily average volumes of liquidity transfers between the TARGET2 RTGS accounts and the T2S DCAs in 2017

As depicted in Chart 10, after migration wave 4 (6 February 2017), the number of daily transfers from TARGET2 to T2S increased by around two-thirds, while a smaller increase was seen in the value of these transfers (see Chart 11). After the final migration wave (18 September 2017), liquidity transfers to T2S increased by 11% in volume and 24% in value on average. By the end of 2017, liquidity transfers from TARGET2 to T2S were 92% higher in terms of volume and 80% higher in terms of value, compared with the beginning of the year. July and August recorded lower volumes and values owing to seasonal effects in the summer months.

Chart 11

Daily average value of liquidity transfers from the TARGET2 RTGS accounts to DCAs in 2017

(EUR billions)

The chart 12 compares the average cumulated central bank liquidity held in T2S after each T2S migration wave until December 2017.[14]

Chart 12

Time distribution of liquidity in DCAs: daily averages between each migration wave (from the launch of T2S until December 2017)

(EUR billions)

It can be seen that, with every migration wave, the overall intraday liquidity held in T2S shifted upwards. The largest shift in 2017 happened with migration wave 4, after which the average central bank liquidity held in T2S rose from approximately €35 billion to approximately €58 billion. A smaller upward shift, from approximately €58 billion to approximately €73 billion, followed the final migration wave.

Despite the increase in liquidity held in T2S, its intraday pattern remained largely unchanged across migration waves. The liquidity is injected into T2S at the beginning of the TARGET2 night-time phase (19:30[15]) and then its level remains fairly constant until the start of the T2S daytime phase (from 05:00 onwards). During the day, more liquidity reaches T2S and fluctuations occur. Around 16:00, there is a spike in the liquidity held in T2S, probably owing to participants sending liquidity to T2S to reimburse auto-collateralisation and ensure the settlement of remaining transactions. At 16:30 the liquidity in T2S decreases sharply owing to the optional cash sweep that brings liquidity back from T2S to TARGET2. The next drop, to zero, is observed towards the end of the business day and is related to the execution of the automated cash sweep from T2S to TARGET2 at 17:45, when all remaining liquidity on DCAs is pushed from T2S back to TARGET2. It should be noted that the optional cash sweep at 16:30 is still preferred to the automated cash sweep at 17:45.

Since the last migration wave, the vast majority of liquidity transfers in terms of value (97.81% of those from TARGET2 to T2S and 99.62% of those from T2S to TARGET2) took place between an RTGS account and a T2S DCA held at the same central bank.

Chart 13

Cross-border and domestic value shares of liquidity transfers from TARGET2 to T2S (left-hand side) and from T2S to TARGET2 (right-hand side)

As illustrated by these charts, the connection between TARGET2 and T2S, which allows banks to exchange liquidity smoothly between TARGET2 RTGS accounts and DCAs, gives rise to interdependencies between the two platforms.

Chart 14 shows the daily average value of transactions settled on DCAs, i.e. all movements on DCAs, including cash legs of delivery-versus-payment transactions (around 70% of the total value) and liquidity transfers (more than one quarter of the total value).

The highest daily average value of the processed T2S transactions was recorded in December 2017, when it reached €884.4 billion. The lowest average values occurred in January 2017, i.e. before the last two migration waves (€608.22 billion) and in the summer period (€613.8 billion in August 2017).

Chart 14

Daily average value of settled transactions in 2017

(EUR billions)

Chart 15 represents the daily average value of auto-collateralisation transactions in T2S per month. Overall, as of the fourth T2S migration wave auto-collateralisation has constituted about 9% of the average daily T2S turnover. The use of auto-collateralisation on flow (in yellow), i.e. settlement transactions that are financed via credit received from a central bank and collateralised by securities that are about to be purchased, remained relatively stable throughout the year. On the contrary, auto-collateralisation on stock, i.e. where the credit received from a central bank is collateralised by securities already held by the buyer, followed a similar seasonal pattern as observed in the changes to the daily average value of settled transactions.

Chart 15

Daily average value of auto-collateralisation transactions in T2S during 2017

(EUR billions)

1.4 Comparison with EURO1

EURO1 is the only direct competitor of TARGET2 in the landscape of large-value payment systems denominated in euro. The market share of TARGET2 in this landscape is therefore defined as its relative share vis-à-vis EURO1, and this is depicted in Chart 16. The two systems are different by design, since EURO1 operates on a net settlement basis and only achieves final settlement in central bank money at the end of the day. Furthermore, they respond in part to different business cases, since only TARGET2 settles in central bank money and processes ancillary system transactions and payments related to monetary policy operations. However, the actual composition of the traffic in the two systems is largely made up of interbank and customer payments. This helps to explain, in part, the relative share of TARGET2 vis-à-vis EURO1, as shown in Chart 16, which only takes into account these two payment categories. In 2017, TARGET2 maintained its share in terms of both value and volume of the payments processed. It processed 90% of the value and 63% of the volume settled by large-value payment systems in euro.

When reading Chart 16, it should in any case be kept in mind that it does not provide a full picture of the banks’ routing preferences vis-à-vis all systems, but only a partial picture of the market’s preferences related to the settlement of large-value euro-denominated transactions. In particular, the extent to which payments are channelled through ACHs or correspondent banking arrangements is not reflected in this chart.

Chart 16

Market share of volumes and values settled in TARGET2 vis-à-vis EURO1

(in percentages)

Note: This chart is not affected by the change in the statistical methodology implemented in 2013 since the calculations are based on interbank and customer payments only, and do not include transactions with the central banks, which were the ones most affected by the methodological change.

1.5 Value of TARGET2 payments

Chart 17 shows the evolution of the average value of a TARGET2 payment from 2008 until 2017.[16] The continuous decline from 2015 onwards can be associated with the migration to T2S of securities settlement system traffic. In 2017 the average value of a payment continued to decline, falling to €4.8 million, representing a decrease of 4% compared with the previous year. This change is partly due to the decrease in ancillary system traffic, typically characterised by high-value transactions.

Chart 17

Average value of a TARGET2 payment

(in EUR)

Chart 18 illustrates the distribution of TARGET2 transactions per value band, indicating the shares, in terms of volume, that fall below a certain threshold. The picture remained largely unchanged compared with the previous year. Generally, almost 70% of all TARGET2 transactions were for values lower than €50,000. Payments above €1 million only accounted for 12% of traffic, compared with 10% the year before.

Chart 18

Distribution of TARGET2 transactions across value bands in 2017

(in percentages)

On average, there were almost 200 payments per day with a value above €1 billion, which accounted for 0.06% of payment flows. Given the wide distribution of transaction values, the median payment in TARGET2 is calculated as roughly €8,400, which indicates that half of the transactions processed in TARGET2 each day are for a value lower than this amount. This figure confirms that TARGET2 offers a range of features attracting a high number of low-value transactions, especially of a commercial nature. Although the picture has changed slightly since the completion of the migration to SEPA, particularly as regards commercial payments, TARGET2 is still widely used for low-value payments, especially urgent customer transactions. This is not unusual in the field of large-value payments and is also observed in other systems worldwide.

Chart 19

Intraday pattern: average value of a TARGET2 payment

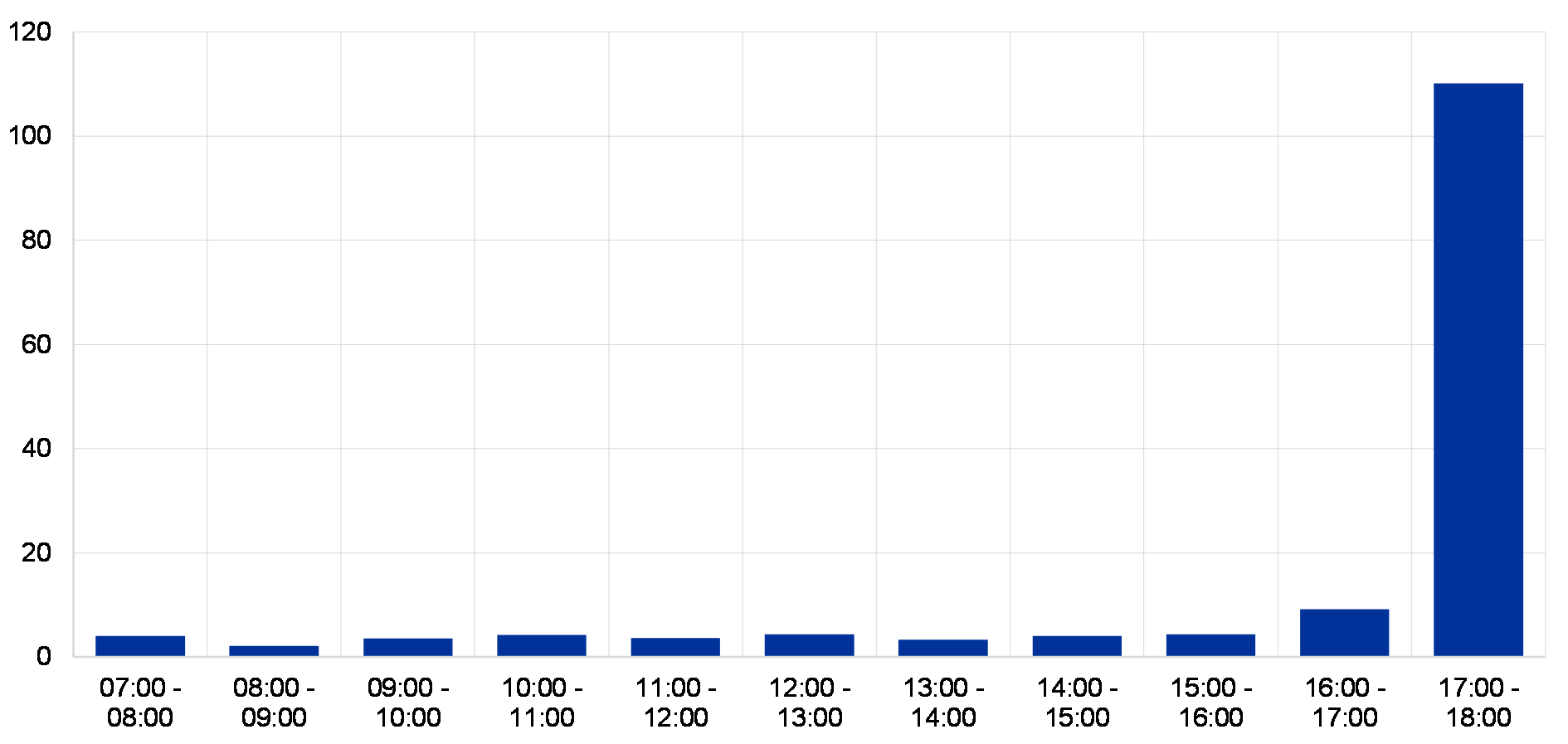

(EUR millions)

Chart 19 depicts the average value of TARGET2 payments executed at different times of the day. The chart indicates that in 2017, as in previous years, TARGET2 settlement was marked by a strong intraday pattern. After the system opens at 07:00, the hourly average value of transactions fluctuates minimally throughout the day. Between 09:00 and 13:00 the average value increases slightly owing to the settlement of CLS and other ancillary system transactions around this time. A more visible increase is recorded between 16:00 and 17:00, when ancillary systems such as EURO1 settle their cash balances in TARGET2. The last hour of operations, between 17:00 and 18:00, is reserved for interbank transactions, while the cut-off time for customer payment types is 17:00. The average size of payments increases dramatically over this time owing to banks squaring their balances and refinancing themselves on the money market. Overall, the last two hours of the TARGET2 operation are characterised by a limited number of transactions, albeit at very high values. The average payment value in this period rose by 14% compared with the previous year, continuing the trend observed in the previous years.

The chart does not take into account the payments that take place before the start and after the end of the business day, since these transactions fall under the night-time settlement category (see Section 1.6) and relate to pure accounting, e.g. liquidity transfers from the local accounting systems of central banks or fuelling of sub-accounts.

Box 3

TARGET2 liquidity and its usage

The liquidity that TARGET2 participants hold on their TARGET2 accounts has increased dramatically since the start of the Asset Purchase Programme (APP) in March 2015 (see Chart A). This liquidity represents central bank money, as banks hold it in the form of deposits with the central bank. Typically the amount of central bank money can only be modified through monetary policy operations. Since the launch of the APP, deposits held with central banks which are eligible for settling payments in TARGET2 have more than doubled.

In line with the increase in the liquidity available in TARGET2, TARGET2 liquidity velocity has decreased (see Chart A). Liquidity velocity represents the value of payments made for each unit of liquidity, i.e. one euro.[17] In other words, it measures the number of times a euro changes ownership on average in a day. Generally speaking, liquidity velocity is calculated as the total number of payments settled in a day in TARGET2 relative to the liquidity available in the system, which includes deposits as well as the liquidity drawn from the intraday credit lines[18]. The correlation coefficient between liquidity velocity and the liquidity available in TARGET2 of -0.8 confirms expectations of a strong negative correlation between the two series. While liquidity velocity stood at 5.13 in March 2015, it had fallen to 3.18 by the end of 2017. This indicates that one euro of liquidity is now used to settle fewer payments than at the beginning of the APP. This decrease is not interpreted as a reduction in the efficiency of bank liquidity management, but is most probably due to the APP and the amount of liquidity it has created in TARGET2. The APP provides high liquidity levels for banks on average (significantly higher than in previous years) and thus reduces the turnover of a single euro for payments purposes.

Chart A

Liquidity available in TARGET2 vs. TARGET2 liquidity velocity

(EUR billions)

Source: TARGET2, ECB calculations

Note: This chart covers the period from June 2008 to December 2017. lhs stands for left-hand side and rhs for right-hand side. Figures represent monthly averages. T2 liquidity is computed as the start-of-day balances in TARGET2, to which overnight deposits are added while overnight loans are subtracted. Additional adjustments are made for banks in Belgium, Germany, Luxembourg and Spain to account for national specificities. T2 liquidity velocity calculation is based on Benos et al., op.cit.

Overall, the TARGET2 intraday credit lines and their usage have also decreased since the APP was launched (see Chart B). A TARGET2 intraday credit line is a facility in TARGET2 through which banks can overdraw their intraday account against eligible collateral posted. At the end of 2017, the average maximum credit accessible by a bank in TARGET2 was 60% lower than at the beginning of the APP. With the liquidity made available through the APP, it is natural that banks would need to rely less on intraday credit, and can thus make other use of the collateral that would otherwise be blocked for the intraday credit line. This is supported by the fact that the usage of the intraday credit line, i.e. the percentage of total payments settled using the intraday credit line, has also decreased. The reversal seen in both series in Chart B is due to a change in the Bundesbank’s procedure for providing intraday credit made in September 2013.

Chart B

TARGET2 intraday credit line and its usage

(EUR billions)

Source: TARGET2, ECB calculations.

Note: This chart covers the period from June 2008 to December 2017. lhs stands for left-hand side and rhs for right-hand side. Figures represent monthly averages. The intraday credit line is calculated as the maximum intraday credit that can be accessed on average by one bank during the day against collateral posted. The usage of the intraday credit line represents the percentage of payments that are settled using the intraday credit line calculations based on McAndrews and Rajan, “The timing and funding of Fedwire Funds transfers”, FRBNY Economic Policy Review, 2000.

1.6 Night-time settlement in TARGET2

TARGET2 operates during the day from 07:00 to 18:00, and also offers the possibility to settle payments during the night. While in the day trade phase the system is open to regular payments business of financial institutions and ancillary systems, the night-time settlement is only for ancillary systems connecting via the ASI as well as liquidity transfers to/from T2S. Other operations, such as bank-to-bank transactions or customer payments, are allowed during the day only.

There are two night-time settlement windows: 19:30 to 22:00 and 01:00 to 07:00. The two windows are separated by a technical maintenance window, during which no settlement operations are possible.

Since the system is closed during the night to any other form of payments processing, ancillary systems can take advantage of banks’ stable and predictable liquidity situations, thereby settling their transactions efficiently and safely. Overall, the night-time windows are mainly used by securities settlement systems and by retail payment systems. On average, around 10,000 payments, representing a value of €73 billion, were settled every night in TARGET2 in 2017. Both figures are significantly lower than last year, mainly due to the migration of securities settlement systems to T2S and the processing schedule of the Deutsche Bundesbank’s ancillary system “SEPA Clearer”, which moved parts of the bulk settlement from night-time settlement to daylight settlement.

Chart 20 shows how the volume and value settled in TARGET2 during the night have evolved since 2009. The increase in volume in November 2011 relates to the ancillary system SEPA Clearer starting to make use of the night-time settlement service in TARGET2. Since then, the number of payments settled during the night-time has increased steadily, notably in 2014, whereas values have remained fairly stable. The trend reversed in 2015 and in 2016, with both night-time settlement values and volumes decreasing by 24% and 15%, respectively. As indicated above, the changes in the night-time settlement pattern in this period can be primarily attributed to securities settlement systems which have migrated their operations to T2S. In December 2017, the night-time settlement values and volumes reached historically low levels due to SEPA Clearer – which initially caused a sudden increase in 2011 – limiting TARGET2 night-time settlement activity.

Chart 20

Night-time settlement in TARGET2

(left-hand scale: number in transactions; right-hand scale: EUR billions)

1.7 Payment types in TARGET2

Charts 21 and 22 present the breakdown of TARGET2 volumes and turnover by type of transaction. Traffic is divided into four categories: payments to third parties (e.g. interbank transactions and customer transactions), payments related to operations with the central bank (e.g. monetary policy operations and cash transactions), ancillary system settlement, and liquidity transfers among participants belonging to the same group.

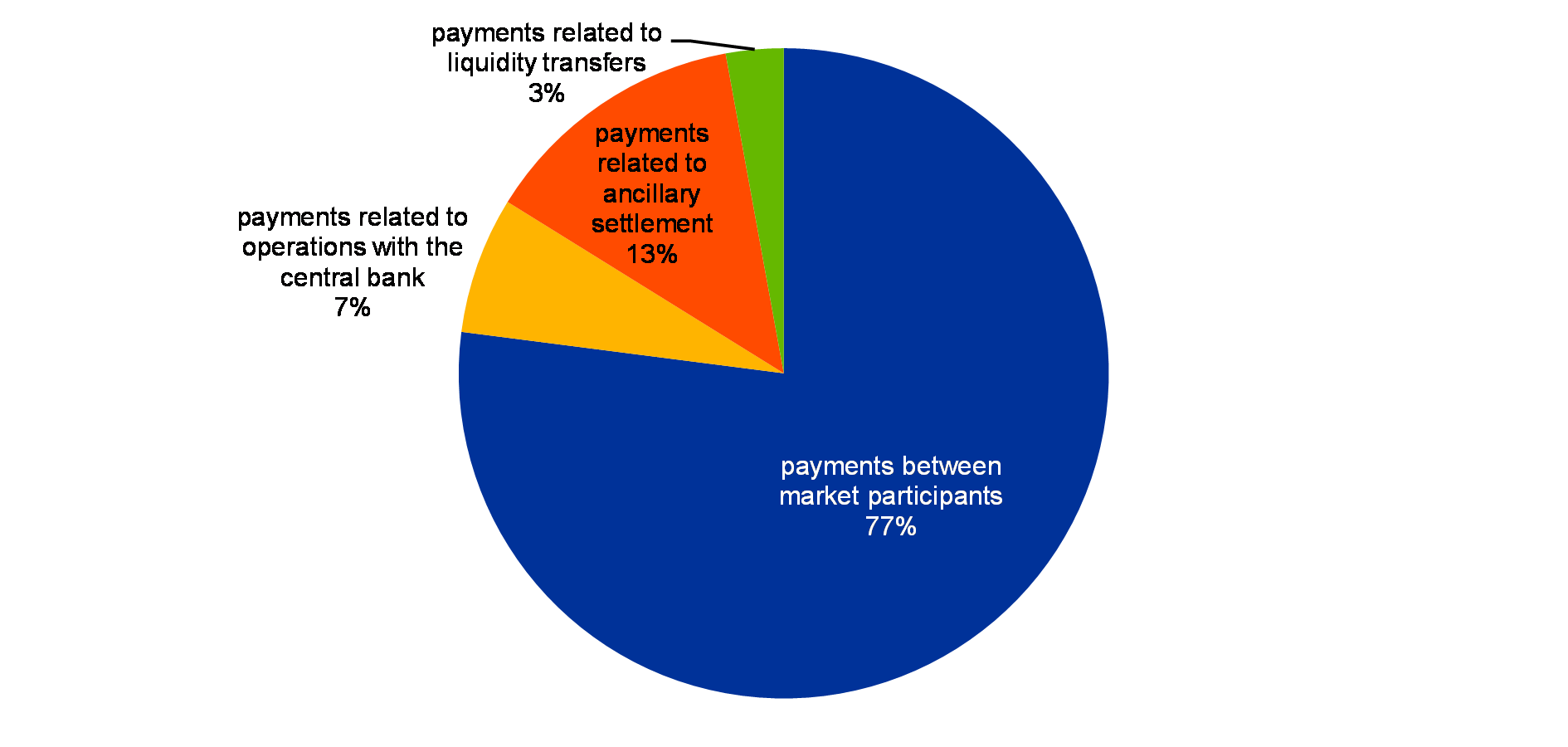

More than three-quarters of the TARGET2 volume is made up of payments to third parties, namely interbank traffic and customer payments. The volume of ancillary system settlement represents 13% of the total volume, 7% is generated through operations with the central bank, and the remaining share of 3% is linked to liquidity transfers. Overall, all these figures remained similar compared with the previous year.

Chart 21

Breakdown of TARGET2 volumes in 2017

(in percentages)

Chart 22

Breakdown of TARGET2 turnover in 2017

(in percentages)

With regard to turnover, the composition is visibly different, as payments between participants represent only 42% of the total value. As a consequence of the lower values settled by securities settlement systems, in 2017 the share of the payments related to ancillary system settlement decreased further, accounting for just one fifth of the total turnover, compared with almost one third in 2015 and a quarter in 2016.

The difference between the volume-based and value-based indicators across payment categories stems from the fact that the average sums involved in monetary policy transactions, ancillary system instructions and liquidity transfers are typically much larger than payments to third parties.

1.8 The use of prioritisation

Among the features of TARGET2 that help participants optimise their use of liquidity are the priority options. These allow participants to reserve a certain amount of liquidity for specific payment priorities. When submitting payments in TARGET2, participants can assign them a certain priority: “normal”, “urgent” or “highly urgent”. In general, payments are settled immediately on a “first in, first out” basis, as long as sufficient liquidity is available in the participant’s RTGS account. However, if this is not the case, payments which cannot be settled immediately are queued according to their priority. Participants can reserve a determined amount of their liquidity for the priority classes “urgent” and “highly urgent”, and less urgent payments are made when the excess liquidity is sufficient. This is a way of securing liquidity for more urgent payments. The priorities for pending transactions can be changed at any time via the information and control module (ICM).

Chart 23 gives an overview of the use of priorities in TARGET2 in 2017 in terms of the overall TARGET2 volume. It shows that almost 80% of transactions were assigned normal priority, while 14% were highly urgent and the remaining part urgent. The distribution of the use of the priorities when submitting payments to TARGET2 has remained stable over the years and participants acknowledge the benefits of this feature, which helps them to manage their liquidity.

Chart 23

Use of priorities in TARGET2 in 2017

(in percentages)

1.9 Non-settled payments

Non-settled payments in TARGET2 are transactions that are not processed by the end of the business day due to, for example, participants’ erroneous transactions, a lack of funds in the account to be debited or the sender’s limit being breached, and are ultimately rejected. Chart 24 shows the evolution of the daily average of non-settled payments on a monthly basis between 2009 and 2017 in terms of both volume and value. The average daily number of non-settled transactions in 2017 decreased sharply, amounting to as little as 782 transactions for the whole year and 271 transactions in the last quarter (i.e. a 75% decrease in unsettled transactions compared with the average observed in 2016). The decrease was mainly driven by the migration to T2S of one of the securities settlement systems. Due to its specific technical set up, this system generated transactions that, while being correctly transmitted to TARGET2, were then rejected either due to liquidity shortage or due to cancellation. Due to its size, the behaviour of this participant was so significant that it impacted the overall statistical reporting on the TARGET2 non-settled payments.

Chart 24

Non-settled payments in TARGET2

(left-hand scale: number in transactions; right-hand scale: EUR billions)

For the same reasons, the average daily value of non-settled payments also decreased drastically, falling to an average of just €16 billion for the whole year and €4 billion in the last quarter.

Overall, non-settled payments in 2017 represented 0.2% of the total daily volume and 1.0% of the total daily turnover in TARGET2. The levels can be considered very low and confirm that the distribution of liquidity across participants was appropriate throughout that period.

Further studies conducted on the use of credit lines in TARGET2 revealed that participants do indeed rely primarily on the liquidity available on the account to settle payments, while only around 3% of turnover on average is settled through recourse to credit lines (see Box 2 TARGET2 liquidity and its usage). This is another factor explaining why the level of non-settled payments in TARGET2 is so low.

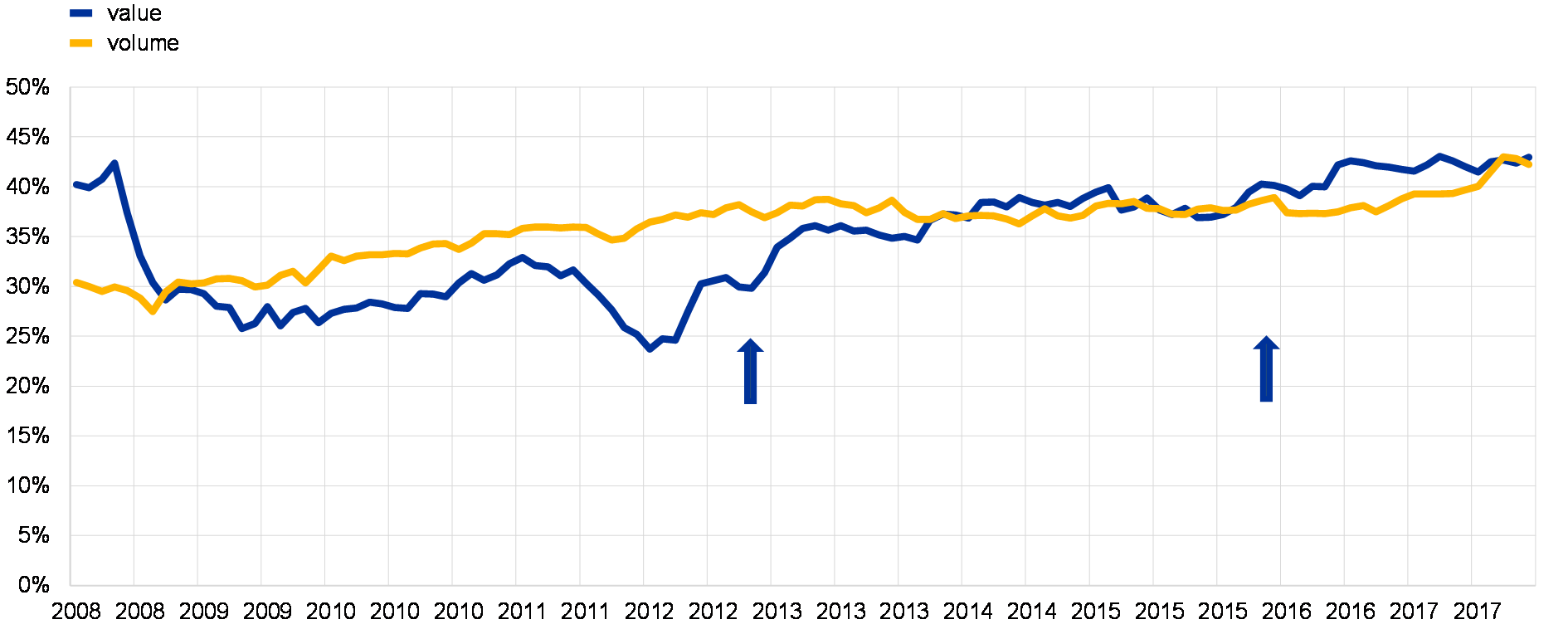

1.10 Share of inter-Member State traffic

The share of inter-Member State traffic in TARGET2 indicates the percentage of traffic that is exchanged between participants belonging to different banking communities. Chart 25 shows that, in 2017, this share continued to increase, reaching 42% in value and 40% in volume, which marked an increase of two percentage points for both categories. Overall, since 2009, there has been a positive trend in both volume-based and value-based indicators, reflecting the increasing level of financial integration in the large-value payment segment, largely supported by TARGET2.

Chart 25

Share of inter-Member State traffic in TARGET2

(in percentages)

When analysing these data, it should be kept in mind that whether a payment is sent or received by a given banking community may have more to do with the bank’s internal organisation than the real geographical anchorage. For example, a subsidiary of a French bank, located in Italy, owing to its internal organisation, may send TARGET2 payments to another bank, also located in Italy, via its headquarters established in France. In such a case, despite the fact the payment is taking place between two entities located in the same country, the payment flow will be considered to be a cross-border one. On the contrary, banks located in EEA countries whose central banks do not provide TARGET2 services, e.g. the UK or Sweden, can participate in TARGET2 component systems provided by other central banks. For example, if a UK bank participating in TARGET2-Bundesbank sends TARGET2 payments to banks in Germany which also participate in TARGET2-Bundesbank, the payment flows will be considered as domestic, despite the fact that they are taking place between entities located in different countries.

The inter-Member State payments shown in Chart 25 were identified based on the national banking communities of the sending and receiving direct participants on the platform. Since it is also possible to connect to TARGET2 from a non-EEA country, e.g. as an indirect participant or addressable BIC holder, the evolution of the cross-border share in terms of volume was also computed on the basis of the originator and beneficiary of the payment, taking into account the full payment chain information (i.e. originator, sending settlement bank, receiving settlement bank, beneficiary). When calculating the inter-Member State shares based on the originator and beneficiary of the payment, the share of cross-border payments in 2017 amounted to 50% in terms of volume and 43% in terms of value. Therefore, taking into account the full payment chain leads to a higher cross-border share in volume and slightly lower share in value, indicating that the average value of a cross-border payment when the originator and beneficiary are taken into account is lower than that when only the sending and receiving direct participants are taken into account.

Box 4

TARGET2 cross-border activities

As an index of financial integration, the cross-border share of payments in TARGET2 has been closely monitored since the financial and sovereign crises. The share shows the percentage of overall TARGET2 payments[19] settled between TARGET2 RTGS accounts opened at different national central banks connected to TARGET2.

Chart A shows the historical evolution of the share, in terms of both value (euro) and volume (number of transactions), since June 2008.

Overall, the share is more volatile in terms of value than in terms of volume, suggesting that large-value cross-border payments were the payments affected most strongly during the financial and sovereign debt crises. Indeed, between September 2008 and January 2009, the share of cross-border activity in terms of value dropped by 12%, compared with a 2% drop in terms of volume. After recovering slightly, the share of cross-border activity decreased again in terms of value, by 6% between October 2011 and May 2012, while the share in terms of volume decreased to a lesser extent. Since then, the share in terms of value has been steadily recovering, returning to pre-crisis levels around mid-2016.

Chart A

istorical evolution of the cross-border share of traffic in TARGET2.

The TARGET2 cross-border share can be broken down by payment category, distinguishing between interbank, customer, ancillary system and central bank operations, as shown in Chart B[20].

Chart B

Composition of the cross-border share in value and volume by payment type

As can be seen, interbank payments have historically represented the largest category of cross-border payments in terms of volume, while customer payments have dominated in terms of volume.

The cross-border share of customer payments has remained largely unchanged in terms of value, and in terms of volume has even increased over time, which is in line with the fact that customer payments are by nature linked to the commercial activity of banks’ clients and less influenced by financial market developments. The cross-border share of ancillary system payments decreased slightly in terms of value during the sovereign debt crisis, but subsequently recovered, decreasing in volume only following the more recent migrations to T2S. Overall, the financial and sovereign debt crises appear to have had a limited impact on both shares. The troughs in the overall TARGET2 cross-border share in terms of value observed during the two crises appear to be mostly driven by cross-border interbank transactions. This is in line with what was identified in general at TARGET2 level in Chart A, namely that large-value transactions were most affected during the two crises.

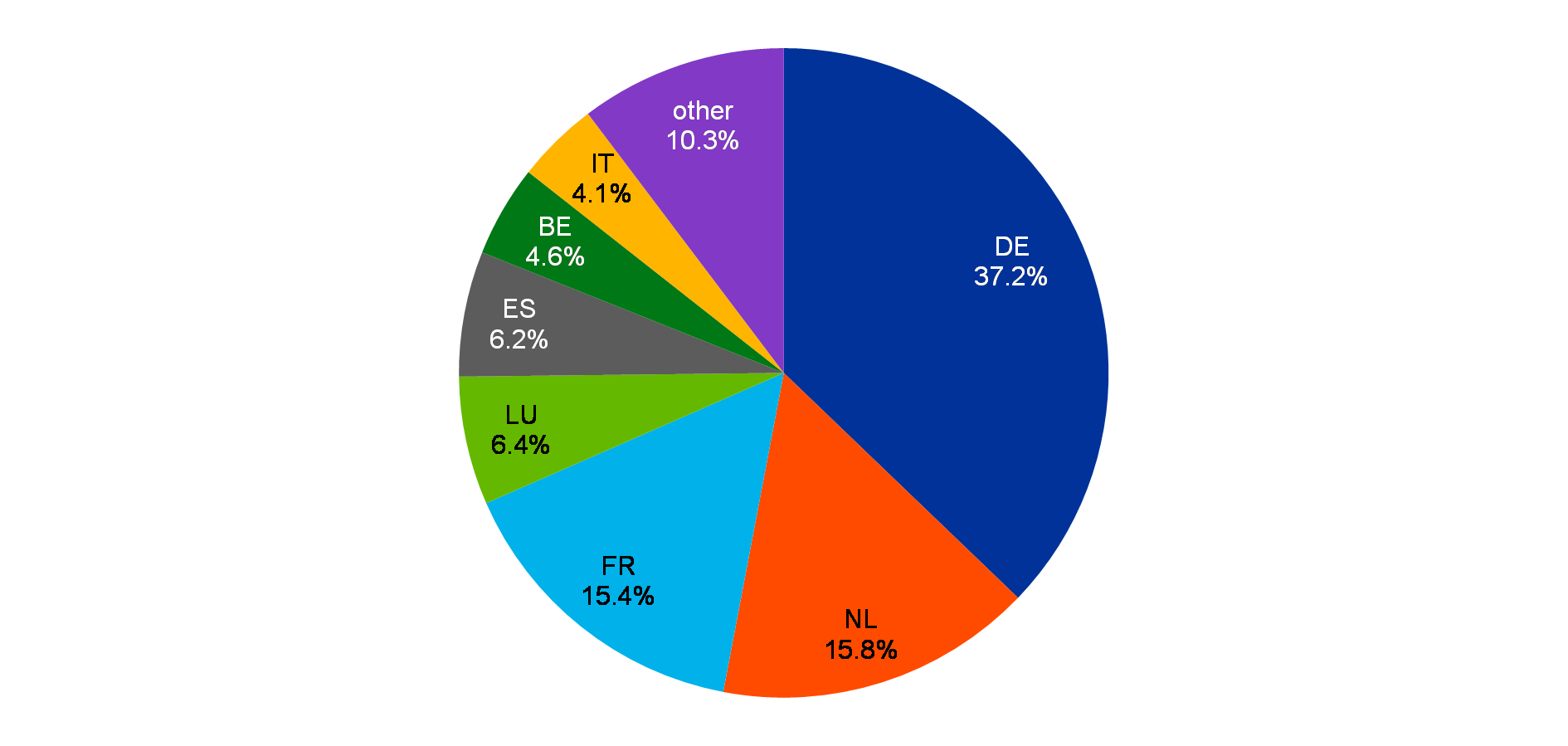

The TARGET2 cross-border share can also be broken down at country level, as shown in Chart C, by payments sent and received, respectively.

The largest senders and receivers of cross-border payments in TARGET2 in terms of value during 2017, when the cross-border share returned to pre-crisis levels, were Germany and France.

Chart C

Average share of cross-border payments sent and received each month by country

(in terms of value)

Note: Based on the location of the national central bank holding the RTGS accounts.

Each country’s contribution to the share of cross-border payments in terms of value indicates the size of each national financial community and its interconnectedness with other communities, as well as the location of other financial market infrastructures. The similar country distribution pattern on both the sending and the receiving sides suggests that the largest financial communities attract cross-border liquidity in particular, and also contribute greatly to its re-circulation.

Overall, the share of cross-border payments in TARGET2 represents an index of financial integration. As of the end of 2017, for every euro settled in TARGET2, 42 euro cents were settled on a cross-border basis, showing that TARGET2 has helped to increase the efficiency of inter-Member State payments.

1.11 Tiering in TARGET2

Tiered participation arrangements occur in a payment system when a direct participant of that system provides services that allow other participants to access the system indirectly. The indirectly connected participants in turn benefit from the clearing and settlement facilities services offered by direct participants.

While indirectly connected parties, i.e. indirect participants and addressable BIC holders, benefit from the settlement facility that would be otherwise costly to access directly, these types of arrangement also entail risks. Tiered participation arrangements can create dependencies that may lead to overall credit, liquidity or operational risks for the payment system, its participants or the stability of the banking system. Close monitoring of the tiering level in TARGET2 is thus of paramount importance. It is also an oversight requirement of Article 17 of the SIPS Regulation[21] (see Box 3 for more details).

During 2017 the aggregate level of tiering on the sending side in TARGET2 reached around 5.2% in terms of value and 15.5% in terms of volume (see Chart 26). This meant that, on average, out of every euro sent by direct participants in TARGET2 during the year, only 5.2 cents were settled on behalf of indirectly connected parties outside their banking group perimeter. More than 70% of the indirect business (consolidated at banking group level) comes from outside the EEA, showing that TARGET2 makes it possible for institutions around the world to access the euro market.

Chart 26

Tiering by sender in TARGET2 in 2017

(in percentages; ten-day moving average)

The largest indirect participant in terms of value sent (consolidated at banking group level) was ranked around 52nd out of all TARGET2 direct participants in 2017.

Further analysis reveals that 55% of all direct participants in TARGET2 (consolidated at banking group level) did not conduct any business during the year on behalf of indirect parties. Overall, these statistics for 2017 point to a relatively contained level of tiered participation in TARGET2.

In more detail, Chart 27 shows that around 480 direct participants do not send or receive any tiered payments. More than 50 send or receive payments on behalf of only one tiered banking group and, at the other end of the spectrum, around 80 direct participants act as a settlement bank for more than 100 tiered banking groups.

Chart 27

Tiered groups per direct participant group

(x-axis: tiered participants; y-axis: direct participants)

1.12 Money market transactions in TARGET2

Market participants use TARGET2 for settling unsecured money market transactions in central bank money. By applying the Furfine algorithm[22] it is possible to identify which TARGET2 transactions are related to money market loans, or, more precisely, to the unsecured overnight money market.[23] This unique dataset is updated regularly to obtain the latest information about the money market. Overall, TARGET2 transaction data provide a rich source of information for both the analysis of monetary policy implementation and TARGET2 operations. The importance of the money market is thus twofold: i) it is an important vehicle for the redistribution of liquidity among TARGET2 participants and ii) it is a large-value and time-critical area of business that the operator needs to be aware of, in particular when dealing with abnormal situations.

The dataset is developed using the TARGET2 simulator environment and comprises data from June 2008 onwards.[24] In 2017, around 31,000 money market loans with a total value of about €2.2 trillion were identified. Overall, the amount of unsecured funds traded in the overnight market during 2017 continued to fall (see Chart 28). This fall can be attributed to the increase in overall excess liquidity within the Eurosystem, and non-standard monetary policy instruments.

Chart 28

Unsecured overnight money market in TARGET2

(left-hand scale: daily totals, EUR billions; right-hand scale: number in transactions )

Chart 29 complements this analysis by showing the cumulative distribution in value of all money market transactions across the day in 2017. Regarding the lending leg, 50% of the total value is settled by around 14:50, while 98% is settled by around 17:00. This confirms the assumption that the last hours of TARGET2 operations are particularly important for the interbank market. In terms of repayment, three-quarters of the loans are repaid by around 11:20 and 90% by around 14:00. These patterns ensure that the repaid liquidity can be reused for payment purposes later that day.

Chart 29

Cumulative distribution of money market transactions during the day in 2017

(in terms of value)

1.13 Shares of national banking communities

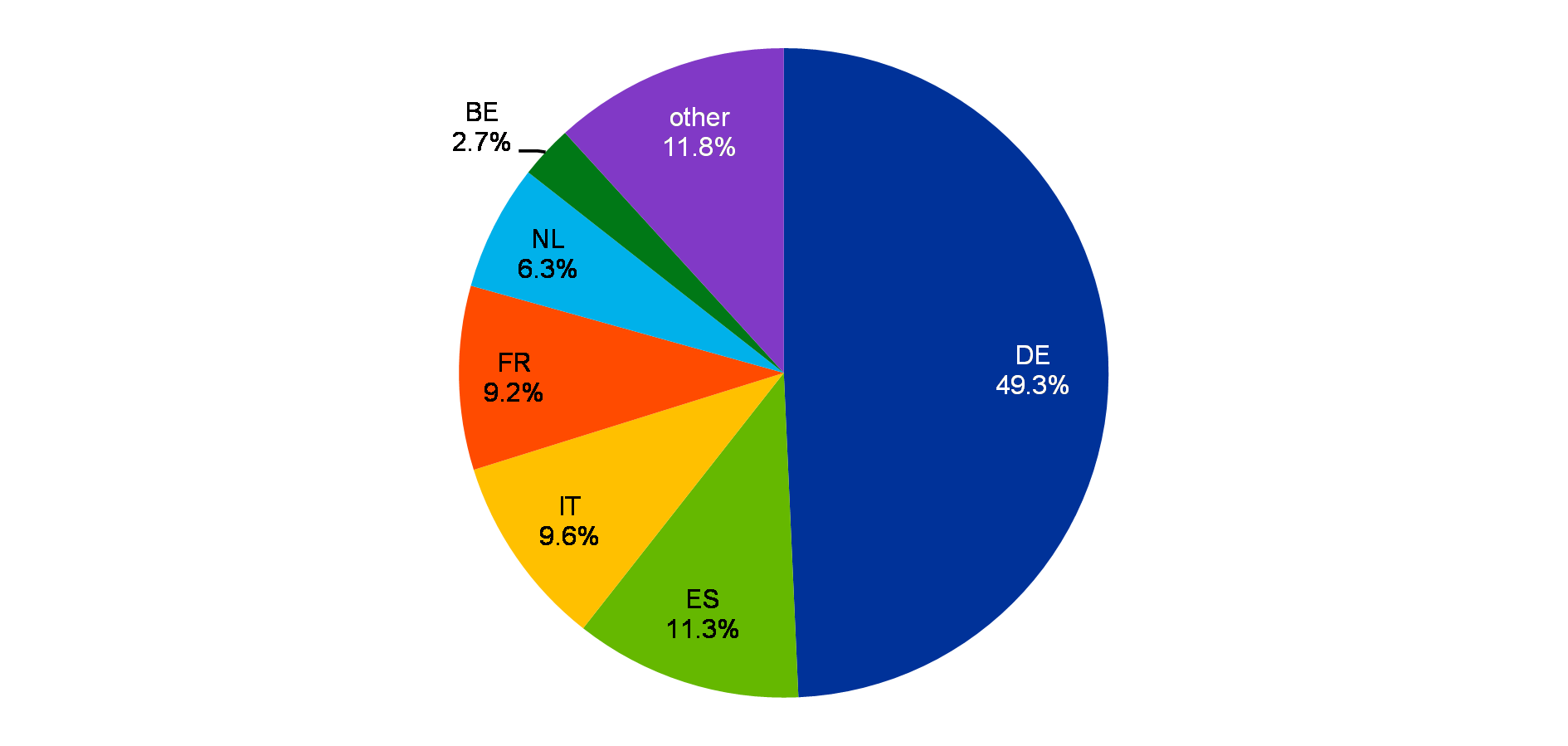

The following two charts break down TARGET2 volumes and turnover according to the share of the national banking communities contributing to its traffic. For the sake of readability, only those countries representing more than 4% of overall TARGET2 turnover are shown.

Chart 30

Country contribution to TARGET2 volume

(in percentages)

Chart 31

Country contribution to TARGET2 value

(in percentages)

In terms of volume, in 2017, similarly to previous years, the largest contributor to TARGET2 traffic was Germany, which accounted for nearly half of the transactions settled in the system. Adding Spain, Italy, France and the Netherlands, the share of transactions increases to 88%, which is also on a par with previous years. Overall, the shares of the biggest contributors to the TARGET2 volume remained the same as in 2016. As regards turnover, the picture is slightly different to the year before, with Germany accounting for more than one-third of the overall value, followed by the Netherlands, France and Luxembourg. The top four countries by turnover generated three-quarters of the total value settled in TARGET2 in 2017. The concentration of turnover has changed slightly compared with the year before, owing to the decrease in the French and Spanish share, by 0.7 and 4.3 percentage points respectively.

It should be noted that the high concentration of both TARGET2 values and volumes in certain countries is not only the result of the size of particular markets. It can also be attributed to the fact that, since November 2007, the TARGET2 system has allowed the activities of banking groups to be consolidated around a single RTGS account held by the group’s head office, thereby increasing the concentration in countries where a large number of these groups are incorporated.

1.14 Pattern of intraday flows

Chart 32 shows the intraday distribution of TARGET2 traffic, i.e. the percentage of daily volumes and values processed at different times of the day in 2017. This indicator is an important one for the operator of TARGET2 as it represents the extent to which settlement is evenly spread throughout the day or concentrated at certain peak times. Ideally, the value/volume distribution should be as close as possible to a linear distribution to avoid liquidity and operational risk.

Chart 32

Intraday distribution of TARGET2 traffic in 2017

(x-axis: time of the day; y-axis: percentage of daily volumes and values)

In terms of value, the path is typically very close to a linear distribution, indicating an even spread throughout the day, which in turn ensures the smooth settlement of TARGET2 transactions.

In terms of volume, the curve is well above the linear distribution, with around one-quarter of transactions being submitted to the system within one hour after the start of operations – which includes transactions sent during the night by participants and warehouse payments – and almost half within three hours after the start. By one hour before the system closes, almost 100% of the TARGET2 volume has already been processed. A comparison with previous years shows no significant deviations.

2 TARGET2 service level and availability

In 2017 100% of the payments settled on the payments module of TARGET2 were processed in less than five minutes (99.8% in 2016).

Compared with previous years, the figure improved as regards delivery of the service and processing times of payments, confirming the high performance level of the SSP of TARGET2. It should be noted that this excellent performance is very beneficial for the banking community, in particular when taking into account their real-time liquidity management.

The processing times of payments are measured for all the payments settled in TARGET2, with the exception of ancillary system settlement transactions using the ASI, payments settled in the first hour of operations (see below on the “morning queue effect”) and payments that were not settled because of a lack of funds or breach of the limits. In practice, around 30% of all TARGET2 payments fall into these three categories of exceptions, meaning that the statistics on processing times apply to around 70% of the system’s traffic.

With regard to requests or enquiries, 99.94%[25] were processed in less than one minute and only 0.06% in one to three minutes, thus remaining on similar levels as in 2016.

Chart 33 helps to better quantify the system’s performance by providing the distribution of processing times on the SSP, i.e. the percentage of traffic with a processing time below a certain number of seconds. The reference point taken is the peak day of the year recorded by the SSP, 18 April 2017, when 534,892 payments were settled. The chart shows that, on this day, 50% of the transactions were settled within 26 seconds and 90% within 39 seconds, thereby confirming the system’s high performance level.

Chart 33

Processing times on 18 April 2017, excluding first hour

(x-axis: seconds ; y-axis: percentage)

A specific phenomenon is worth reporting in the context of TARGET2 performance: the “morning queue effect”. When TARGET2 starts daylight operations at 07:00, a very high number of transactions (about 20% of the daily volume on peak days) are already waiting for settlement, corresponding either to payments submitted by banks on previous days with a future value date (i.e. “warehoused payments”) or to payments released by banks via SWIFT in the hours preceding the opening of the system. On peak days, more than 100,000 transactions may be processed in the first hour, which affects the average settlement time during this period. This huge volume of transactions normally takes around 30 to 45 minutes to be processed. In order to neutralise this effect, the first hour of operations is excluded when the TARGET2 processing times are calculated.

Specifically in the first hour, the use of urgency flags (“urgent” and “highly urgent”) is still highly recommended for payments considered as time-critical transactions (such as CLS pay-ins). Using urgency flags circumvents settlement delays by using different queues (one queue for each type of priority). In addition, attention should be drawn to the possibilities offered in TARGET2 to reserve funds for highly urgent and urgent payments (see Section 1.8 The use of prioritisation).

2.1 Technical availability

In the light of the importance of TARGET2 for the functioning of the financial system and the knock-on effects that any potential malfunctioning could have on other market infrastructures, the Eurosystem pays particular attention to ensuring the smooth operation of the system. This is clearly underlined by the fact that the SSP of TARGET2 achieved 100% technical availability over the last reporting period.

Technical availability is measured on TARGET2 business days during the day trade phase (including end-of-day processing), from Monday to Friday between 07:00 and 18:45 (19:00 on the last day of the minimum reserve period), including extensions required to complete the operational day (e.g. delayed closing owing to a technical problem in TARGET2 or in T2S, which has an effect on TARGET2, or to major problems in ancillary systems settling in TARGET2). The availability measurement does not include systems or networks not directly managed by TARGET2 (in particular, the availability of the SWIFTNet services). Incidents occurring during night-time settlement are not included either.

Technical availability is not intended to measure the impact of partial outages involving the SSP of TARGET2. For example, incidents only affecting the processing of ancillary system transactions without any effect on other payment processing activities cannot be measured within this figure, although they have an overall impact on TARGET2 and are taken into account when assessing the system’s performance. However, such incidents are, where applicable, considered when measuring processing times and, in addition, reported transparently and followed up accordingly.

2.2 Incidents in TARGET2

The ECB publishes up-to-date information about the availability of TARGET2 via the Market Information Dissemination tool. All incidents relating to TARGET2 are followed up with a detailed incident report and risk management process. The aim of this approach is to learn from these events in order to avoid a reoccurrence of the incidents or incidents of a similar nature.

Chart 34

TARGET2 incidents and delays in closing

(left-hand scale: number of incidents/delays; right-hand scale: yearly data in percentages)

In 2017 TARGET2 experienced some issues which, owing to the technical set-up of the SSP, only partly affected the processing of transactions, without making the system completely unavailable. For that reason, they did not have any impact on the overall TARGET2 availability indicator. In particular, on 27 December at 07:00 the SSP service was affected by a technical problem adversely affecting the sending and receiving of payments. The issue was resolved within around 25 minutes, but did lead to further delays for some participants due to the effect on the processing of messages. The root causes of this incident were identified and corrective measures were implemented in order to prevent such interruptions from reoccurring.

In addition to the minor issues affecting TARGET2 operations on a few occasions, the closing of interbank payment cut-off at 18:00 was delayed four times in 2017[26] due to problems related to the repatriation of funds from T2S back to TARGET2 RTGS accounts.

3 TARGET2 participants

3.1 RTGS accounts

In December 2017 the total number of RTGS accounts opened in TARGET2 (encompassing the direct participants, the technical accounts, the ancillary system accounts and the special-purpose accounts) was 1,963, i.e. virtually the same as at the end of 2016.

Chart 35

Number of RTGS accounts in TARGET2

Internet-based participation

In November 2010 internet-based participation was introduced to allow small banks to obtain a direct connection to TARGET2 without necessarily being connected to the SWIFT network. The service, which is subject to a monthly fee of €70, is mainly designed for low-volume participants that are interested in holding an account directly with their central bank: either an RTGS account[27] or a home accounting module account (provided the respective central bank opted for this module). While the initial number of internet-based participants was relatively modest (68 at the end of 2012), it increased significantly in 2013 (reaching 509 participants at the end of 2013) with the phasing out of the last proprietary home accounts still offering payment settlement services. In December 2017 the overall number of internet-based participants was 613, which represented a decrease of 3% compared with the end of 2016. The largest share of internet-based participants is recorded in Germany, followed by France and Italy.

Chart 36

Internet-based participants

3.2 Participation types

At the end of December 2017, 1,073[28] direct participants held an account on the SSP of TARGET2 and were registered as such in the TARGET2 directory. Through these direct participants, 684 indirect participants from the EEA were able to settle their transactions in TARGET2, as well as 5,114 correspondents worldwide.

Table 2

Participation types

Including the branches of direct and indirect participants, a total of 51,557 credit institutions around the world (80% of which are located in the EEA) were accessible via TARGET2 at the end of 2017. Compared with the number of reachable institutions registered at the end of 2016, this figure represents a drop of around 5%, driven mainly by the decrease in the number of addressable BIC holders associated with branches of direct and indirect participants.

Participants and institutions addressable via TARGET2 are listed in the TARGET2 directory, which is available to all direct participants for information and routing purposes. Besides the direct participants that hold an RTGS account for sending payments to and receiving payments from all other direct participants, a number of banks have opted for the opening of special-purpose RTGS accounts, which are not reported as direct participants in the TARGET2 directory. These special-purpose accounts are used, for instance, for the settlement of a certain business, e.g. securities settlement, Eurosystem open market operations, or to fulfil reserve obligations in countries where reserves are computed on RTGS accounts. There were 567 of these accounts, also called “unpublished BICs”, at the end of 2017 (587 in 2016).

3.3 Ancillary systems

At the end of 2017 a total of 79 ancillary systems were settling on the TARGET2 SSP, including 25 retail payment systems, 23 securities settlement systems and 23 clearing houses (including four CCPs). Despite the migration of many securities settlement systems to T2S, these figures are in line with 2016, mainly due to the fact that the systems which migrated to T2S left a portion of their activities still in TARGET2 (e.g. non-securities settlement related activity, such as processing of corporate actions, issuance services, repo transactions or transactions specific to the local market). Moreover, some additional systems connected to TARGET2 in order to use the new ASI 6 real-time procedure as support for the settlement of instant payments.

Table 3

ASI settlement model

1) An ancillary system may make use of more than one ASI settlement model.

Out of the 79 ancillary systems settling on the SSP, 50 made use of the ASI, a feature which was developed to facilitate and harmonise the cash settlement of these systems in TARGET2 (the other ancillary systems use the Participant Interface, which was mainly developed for the participants, i.e. financial institutions). The number of times each of the six available ASI models was used at the end of the year is shown in Table 3. As a result of the migration to T2S, model 1 (which supports the integrated model) is no longer used at all.

Box 5

TARGET2-T2S consolidation

On 6 December 2017 the Governing Council of the ECB approved a new project to consolidate, enhance and optimise the market infrastructure services offered by the Eurosystem. The TARGET2-T2S consolidation project will introduce a new RTGS system, offering enhanced services to the market such as optimised liquidity management features. The project has entered the implementation phase and is planned to be delivered to the market by the end of 2021.

A new RTGS system

TARGET2 has been running smoothly for over a decade, ensuring safety and efficiency in the European payments landscape. This landscape has significantly changed over this time, as a result of technological developments, regulatory requirements and changing consumer demands.

The Eurosystem views the TARGET2-T2S consolidation project as an opportunity to enhance and modernise the RTGS services it offers to the market. The project will adopt messaging standard ISO 20022, in line with the Eurosystem’s strategy to use the same messaging standard across all its services (T2S, TIPS and the new RTGS services). In the same vein, the new RTGS system will support the multi-currency settlement of both large-value payments and ancillary system transactions.

Central liquidity management

The Eurosystem will introduce a centralised tool to allow participants to steer, manage and monitor central bank liquidity across all TARGET services. This tool will accommodate all transactions between the participants, connected central banks and the Eurosystem and thus serve as a centralised source of liquidity in central bank money.

The new tool will function on the basis of a main cash account that a participant can open with its national central bank. This account will be linked to the participant’s DCAs for the new RTGS services, T2S and TIPS. The main cash account will also offer a dashboard, providing a centralised overview of liquidity positions and advanced liquidity management tools to ensure high levels of automation. Importantly, any liquidity held on DCAs will be considered for minimum reserve purposes without having to transfer the liquidity back to the main cash account. In particular, the central liquidity management function will enable users to:

- fulfil minimum reserves;

- access standing facilities;

- participate in monetary policy operations;

- fund cash withdrawals;

- access intraday credit;

- interact with central banks of issue.

Shared services