Macroprudential policy measures

This document provides an overview of the macroprudential policy measures that are being implemented in euro area countries on 3 October 2019. An overview of all measures reported to the ECB under Article 5 of the SSM Regulation[1] is provided on the ECB’s website. The macroprudential policy measures are defined in the ECB’s web glossary for macroprudential policy and financial stability. Their aim is described in further detail in the first issue of the Macroprudential Bulletin.

1 Macroprudential policy measures – an overview

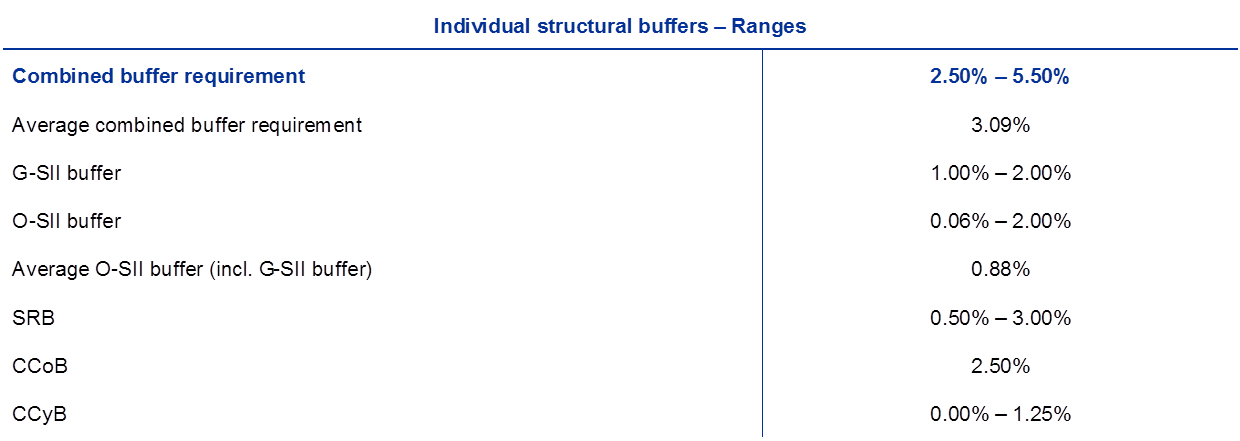

Table A.1 provides an overview of the macroprudential policy measures in the euro area which apply on 3 October 2019.

Table A.1

Macoprudential policy measures

(3 October 2019)

Source: National notifications.

Notes: The figures only include information on supervised banks (e.g. excluding O‑SII buffer requirements for CY investment firms). In some countries, certain financial institutions are designated O‑SIIs, but no additional buffer requirement applies at this time. Small and medium-sized investment firms are exempted from the CCyB and/or the CCoB in Italy, Lithuania, Luxembourg, Malta and Slovakia. For Estonia and Slovakia, the SRB is applied only to domestic exposures, meaning that the buffer applies in addition to the O‑SII or G‑SII buffer, whichever is greater. The combined buffer requirement is calculated according to Art. 131 CRD IV but excludes mandatory or voluntary reciprocity of foreign macroprudential measures according to recommendation ESRB/2015/2. It consists of CET1 capital and comes in addition to a minimum requirement of 8% total capital (4.5% CET1 + 1.5% AT1 + 2% T2). Pillar 2 measures are not included. The minimum combined buffer requirement at country level corresponds to a bank not subject to any individual bank-level structural buffer (G‑SII, O‑SII, SRB). The acronyms used in the above figure and notes are as follows: combined buffer requirement (CBR); global systemically important institution (G‑SII); other systemically important institution (O‑SII); systemic risk buffer (SRB); countercyclical capital buffer (CCyB); and capital conservation buffer (CCoB). * Reflects only countries that have a positive CCyB already activated.

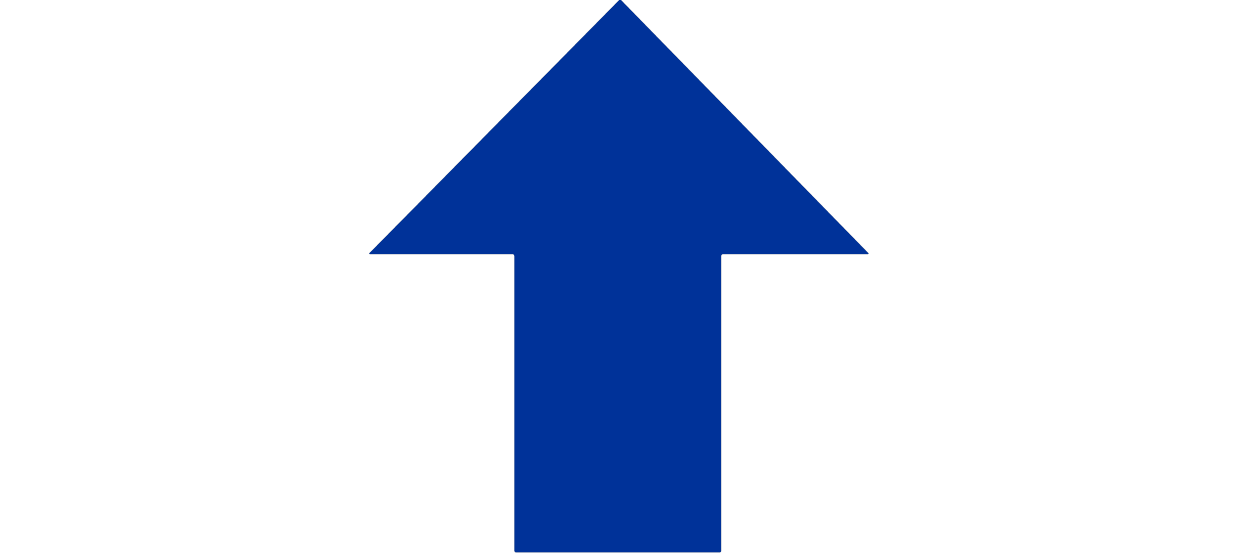

2 Capital requirements at the country level

Chart A.1 shows the minimum and the maximum combined buffer requirements (CBRs), as well as the banks affected by the maximum CBR. Whereas the minimum CBR (blue) is usually applicable to all banks in one country, taking into account the capital conservation buffer (CCoB) and the countercyclical capital buffer (CCyB), the maximum CBR (yellow) relates to financial institutions that are required to apply the other systemically important institution (O‑SII), global systemically important institution (G‑SII) or systemic risk buffer (SRB), whichever is greater.

Chart A.1

Overview of combined buffer requirements

(left-hand scale: percentage of total risk exposure; right-hand scale: total number; measures apply as of 3 October 2019)

Source: National notifications.

Notes: The figures only include information on supervised banks (e.g. excluding O‑SII buffer requirements for CY investment firms). In some countries, certain financial institutions are designated O‑SIIs, but no additional buffer requirement applies at this time. Small and medium-sized investment firms are exempted from the CCyB and/or the CCoB in Italy, Lithuania, Luxembourg, Malta and Slovakia. For Estonia and Slovakia, the SRB is applied only to domestic exposures, meaning that the buffer applies in addition to the O‑SII or G‑SII buffer, whichever is greater. The combined buffer requirement is calculated according to Art. 131 CRD IV but excludes mandatory or voluntary reciprocity of foreign macroprudential measures according to recommendation ESRB/2015/2. It consists of CET1 capital and comes in addition to a minimum requirement of 8% total capital (4.5% CET1 + 1.5% AT1 + 2% T2). Pillar 2 measures are not included. The minimum combined buffer requirement at country level corresponds to a bank not subject to any individual bank-level structural buffer (G‑SII, O‑SII, SRB). The acronyms used in the above figure and notes are as follows: combined buffer requirement (CBR); global systemically important institution (G‑SII); other systemically important institution (O‑SII); systemic risk buffer (SRB); countercyclical capital buffer (CCyB); and capital conservation buffer (CCoB).

3 Changes to macroprudential policy measures since 27 March 2019

3.1 Countercyclical capital buffers

Majority of euro area countries

The national competent authorities of four euro area countries implemented the CCyB rates previously announced (France: 0.50% as of 2 April 2020; Ireland: 1% as of 5 July 2019; Lithuania: 1% as of 30 June 2019; Luxemburg: 0.25% as of 1 January 2020).

The national competent authorities of 12 euro area countries decided to maintain the countercyclical capital buffer (CCyB) rate at 0%. According to the most recent data, the relevant indicators for setting the CCyB rate in these countries do not suggest an increase in cyclical systemic risk and therefore do not signal the need for a deviation from the buffer guide of 0%.

Belgium

In June 2019, the National Bank of Belgium (NBB) decided to raise the CCyB rate from 0% to 0.5%, its main objective being to increase the resilience of the banks against Belgian cyclical risks. This measure will come into effect on 1 July 2020. While cyclical systemic risks are not acute, the NBB considers is prudent to introduce a preventive measure to ensure the continuity of credit provision through the cycle.

Germany

In June 2019, the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) – Federal Financial Supervisory Authority decided to introduce a positive CCyB rate of 0.25%, which will come into effect on 1 July 2020. The G‑FSC (German Financial Stability Committee) assessed that in the current economic setting the build-up of systemic risks has created a threat to financial stability, and therefore recommended BaFin to raise the CCyB rate. The current favourable macroeconomic setting should be used to enable the banking system to conserve and/or accumulate sufficient capital equity, in order to be resilient against possible cyclical systemic risks.

Slovakia

In July 2019, the Národná banka Slovenska decided to increase the CCyB rate from 1.5% to 2%. The decision will come into effect on 1 August 2020. The banking sector and its profit are getting more exposed to cyclical risks, and there are signs of persistent expansionary phase in the financial market.

3.2 Additional capital requirements (O‑SII, G‑SII and SRB buffers)

Majority of euro area countries

The national competent authorities of all euro area countries decided not to revise the existing plans for O‑SII, G‑SII and SRB buffers. According to the last review of the O‑SII, G‑SII and SRB buffers, all countries will maintain the same buffer rates and the same phasing-in plan for the same institutions.

Finland

The Finnish Financial Supervisory Authority (FIN‑FSA) decided in June 2019 to continue the existing SRB. A systemic risk buffer of 1% remains for all credit institutions, except for three banks which have higher levels. The SRB is applied at a consolidated level and applies to all exposures.

Slovakia

In May 2019, the Národná banka Slovenska decided to maintain the existing SRB at 1% for all institutions. The systemic risk buffer shall be maintained on both individual and sub-consolidated basis, and will be applied to all exposures located in the Slovak Republic.

3.3 Other macroprudential measures

Estonia

In September 2019, the Eesti Pank decided to introduce an additional measure based on Article 458(2)(d)(vi) of the Capital Requirements Regulation (EU No. 575/2013). Credit institutions that have adopted the Internal Ratings Based (IRB) approach must use exposure-weighted average risk weight of at least 15% for real estate secured retail exposures to residents of Estonia. The aim of the measure is to pre-emptively limit the decline of average risk weights for mortgage loans and therefore ensure the resilience of the banks to the risks associated with housing loans. The measure comes into force on 30 September 2019.

Finland

The Finnish Financial Supervisory Authority (FIN‑FSA) decided in June 2019 to extend the period of application for the credit institution-specific minimum level of 15% for the average risk weight on housing loans applicable to credit institutions that have adopted the IRB approach, based on Article 458 of the CRR. The extension of the minimum level would come into force on 1 January 2020 and apply for one year. Systemic risks in the Finnish financial system have remained largely unchanged from the perspective of IRB-banks’ risk weights. Finnish IRB-banks’ risk weights are low in international comparison, as well as heterogeneous relative to the risk profile of the mortgage stocks.

Malta

On 29 March 2019, the Central Bank of Malta published Directive No. 16 on the Regulation on Borrower-Based Measures. The Directive came into force on 1 July 2019. The objective of the Directive is to strengthen the resilience of lenders and borrowers against the potential build-up of vulnerabilities which could result in financial losses both to lenders and borrowers stemming from potential unfavourable economic developments. This objective is achieved by setting limits on LTV‑O, DSTI‑O and maturities – thereby preserving sound and prudent lending standards.