Macroprudential policy measures

This document provides an overview of the macroprudential policy measures that were being implemented in euro area countries on 1 August 2018. An overview of all measures reported to the ECB under Article 5 of the SSM Regulation[1] is provided on the ECB’s website.[2] The measures are defined in the ECB’s web glossary for macroprudential policy and financial stability and their aim is described in further detail in the first issue of the Macroprudential Bulletin. Furthermore, the document includes an overview of measures, which will be applied in the coming years.

1 Macroprudential policy measures – an overview

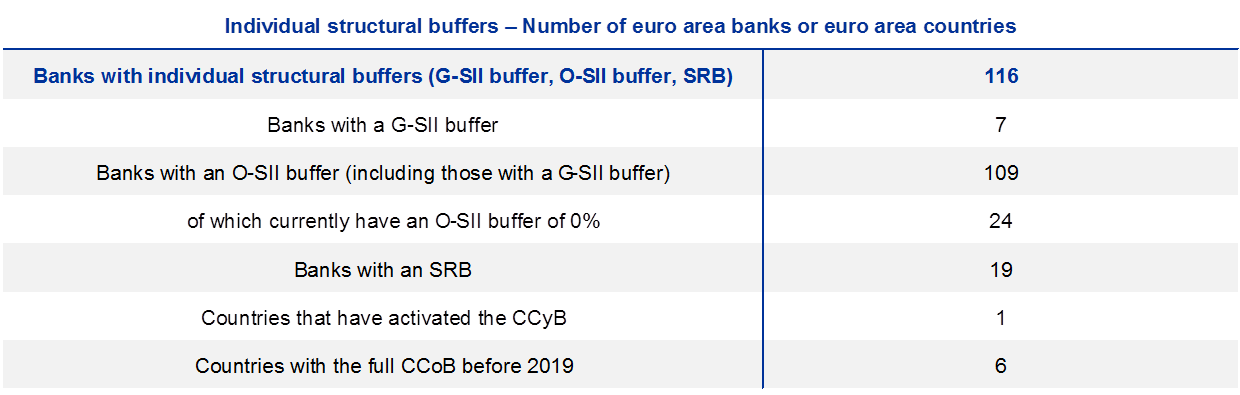

Table 1 provides an overview of the macroprudential policy measures being applied in the euro area on 1 August 2018.

Table 1

Macroprudential policy measures

(1 August 2018)

Source: National notifications.

Notes: The figures only include information on supervised banks (e.g. excluding O-SII buffer requirements for investment firms in Cyprus). In some countries, certain financial institutions are designated as O-SIIs, but no additional buffer requirement applies at this time. Small and medium-sized investment firms are exempted from the CCyB and/or the CCoB in Italy, Lithuania, Luxembourg, Malta and Slovakia. For Estonia and Slovakia, the SRB is only applied to domestic exposures, meaning that the buffer applies in addition to the O-SII or G-SII buffer, whichever is greater. The combined buffer requirement is calculated in accordance with Article 131 of CRD IV, but excludes mandatory or voluntary reciprocity of foreign macroprudential measures in accordance with Recommendation ESRB/2015/2. It consists of CET1 capital and comes in addition to a minimum requirement of 8% total capital (4.5% CET1 + 1.5% AT1 + 2% T2). Pillar 2 measures are not included. The minimum combined buffer requirement at the country level corresponds to a bank not subject to any individual bank-level structural buffer (G-SII buffer, O-SII buffer or SRB). The abbreviations used in the tables, figures and notes in this section are as follows: AT1 – Additional Tier 1; CBR – combined buffer requirement; CCoB – capital conservation buffer; CCyB – countercyclical capital buffer; CET1 – Common Equity Tier 1; CRD IV – Capital Requirements Directive IV; G-SII – global systemically important institution; O-SII – other systemically important institution; SRB – systemic risk buffer; T2 – Tier 2.

2 Future macroprudential policy measures – an overview

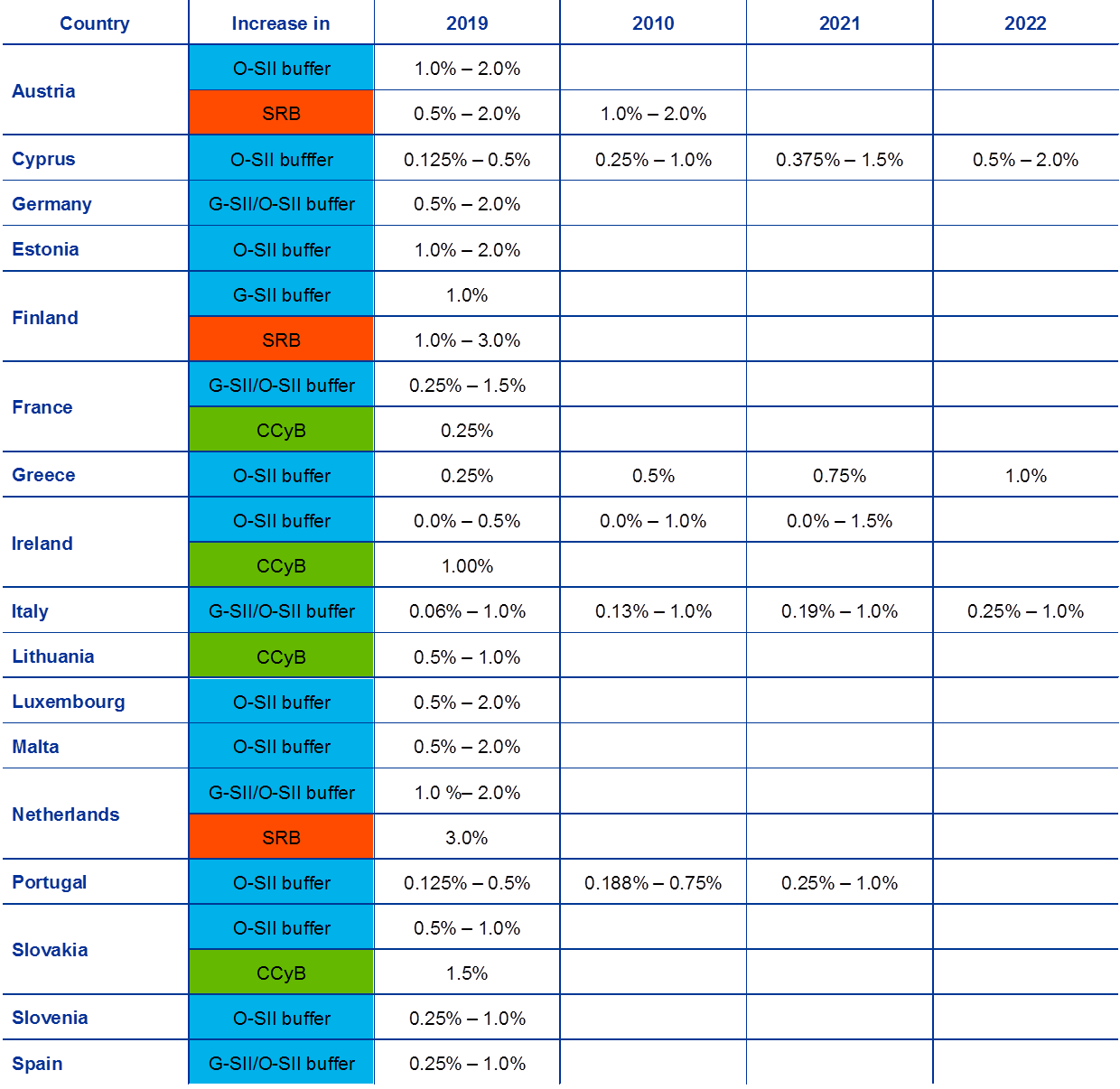

Many national authorities have already announced macroprudential policy measures, which will be applied in the coming years. Most of the measures will be fully phased in from 1 January 2019. In some countries, the phasing-in period will only end on 1 January 2022. Table 2 provides an overview of the future macroprudential policy measures in the euro area which have already been announced.

Table 2

Future macroprudential policy measures

Announced feature measures (cut-off date: 21 August 2018)

Source: National notifications.

Notes: In Lithuania, the CCyB will increase to 0.5% on 31 December 2018 and to 1% on 30 June 2019. In Finland, a G-SII buffer of 1% will apply to Nordea from 1 January 2019. Nordea will become a Finnish bank on 1 October 2018. These measures are subject to Sweden’s competent authority not opposing Nordea’s domicile change (see Section 4.2 Finland). Measures which are not mentioned in the table are already fully phased in.

3 Capital requirements at the country level

Chart 1 shows the minimum and maximum combined buffer requirements (CBRs), as well as the banks affected by the maximum CBR. While the minimum CBR (blue) usually applies to all banks in a single country – taking into account the capital conservation buffer (CCoB) and the countercyclical capital buffer (CCyB) – the maximum CBR (yellow) relates to financial institutions that are required to apply the other systemically important institution (O-SII) buffer, the global systemically important institution (G-SII) buffer or the systemic risk buffer (SRB), whichever is greater.

Chart 1

Overview of combined buffer requirements

(left-hand scale: percentage of total risk exposure; right-hand scale: total number; measures apply as of 1 August 2018)

Source: National notifications.

Notes: The figures only include information on supervised banks (e.g. excluding O-SII buffer requirements for investment firms in Cyprus). In some countries, certain financial institutions are designated as O-SIIs, but no additional buffer requirement applies at this time. Small and medium-sized investment firms are exempted from the CCyB and/or the CCoB in Italy, Lithuania, Luxembourg, Malta and Slovakia. For Estonia and Slovakia, the SRB is only applied to domestic exposures, meaning that the buffer applies in addition to the O-SII or G-SII buffer, whichever is greater. The combined buffer requirement is calculated in accordance with Article 131 of CRD IV, but excludes mandatory or voluntary reciprocity of foreign macroprudential measures in accordance with Recommendation ESRB/2015/2. It consists of CET1 capital and comes in addition to a minimum requirement of 8% total capital (4.5% CET1 + 1.5% AT1 + 2% T2). Pillar 2 measures are not included. The minimum combined buffer requirement at the country level corresponds to a bank not subject to any individual bank-level structural buffer (G-SII buffer, O-SII buffer or SRB).

4 Macroprudential policy measures – 21 August 2018

4.1 Countercyclical capital buffers

4.1.1 Majority of euro area countries

The national competent authorities of 15 euro area countries decided to maintain the countercyclical capital buffer (CCyB) rate at 0%. According to the most recent data, the relevant indicators for setting the CCyB rate in these countries do not suggest an increase in cyclical systemic risk and therefore do not signal the need for a deviation from the buffer guide of 0%.

4.1.2 Ireland

In July 2018 the Central Bank of Ireland took a decision to introduce a positive CCyB rate of 1%, which will come into effect on 1 July 2019. The Central Bank of Ireland acknowledged that the buffer should be positive sufficiently early in the cycle in order to effectively promote resilience, while also accounting for the relative sensitivity of the Irish macro-financial environment to external developments. The chosen rate is expected to be sufficient to support the sustainable provision of credit to the real economy in a possible downturn, in which case the Central Bank of Ireland expects to reduce the buffer rate to a level consistent with mitigating procyclicality, which includes reducing the buffer to zero if necessary.

4.1.3 France

In June 2018 the High Council for Financial Stability (HCSF) decided to raise the CCyB rate from 0% to 0.25%, applicable from 1 July 2019, in order to increase banks’ resilience against cyclical risks. A value of +3.8% for the Basel gap suggests a positive CCyB of 0.5%. At the same time, upward trends are being observed in broad and bank credit to both households and non-financial corporations. According to the HCSF, the French financial system does not face immediate risks to its stability; however, in the light of the macroeconomic and financial context, it is appropriate to raise the CCyB, a decision which is consistent with the preventive objective of macroprudential policy.

4.1.4 Lithuania

In June 2018 the Board of Lietuvos bankas took a decision to further increase the CCyB rate from 0.5% to 1%, which will come into effect on 30 June 2019. Currently, the buffer in Lithuania stands at 0% and will increase to 0.5% on 31 December 2018. The decision taken in the fourth quarter of 2017 to increase the CCyB rate in Lithuania to 0.5% marked a change in Lietuvos bankas’ guiding principles with regard to setting the CCyB rate. In particular, if economic and credit growth are sustainable and no cyclical imbalances form in the economy, Lietuvos bankas aims at the accumulation of a CCyB of at least 1%. Lietuvos bankas is increasing capital requirements now in order to be able to relax them when faced with economic shocks or recession, thus widening the possibilities for credit institutions to maintain credit supply.

4.1.5 Slovakia

Národná banka Slovenska announced in a decision adopted by its Board on July 2018 that the CCyB rate of 1.25% would be increased to 1.5% from 1 August 2019. The current level of the buffer rate is 0.5%, while an increase to 1.25% has already been decided for 1 August 2018. The Basel and the nationally preferred credit gaps stand at +4.9% and +5.1%, respectively. The trends related to the expansionary phase of the financial cycle also applied to the first quarter of 2018 and Slovakia remained among the EU countries with the most dynamic credit growth. At the same time, the financial cycle composite indicator, “Cyclogram”, points to a CCyB level of 2.25%, while various other indicators also point to continuing pressures on the financial market.

4.2 Additional capital requirements (O-SII, G-SII and SRB buffers)

4.2.1 Finland

With a press release on 29 June 2018, the Board of the Financial Supervisory Authority (FIN-FSA) announced its decision on additional capital requirements with the adoption of G-SII buffers, O-SII buffers and SRBs conditional on Nordea’s imminent change of domicile. The new buffer requirements identify Nordea as a G-SII and impose a G-SII buffer of 1% on it. At the same time, three institutions are recognised as O-SIIs (Nordea and OP Group, with O-SII buffers of 2%; and Municipality Finance Plc, with an O-SII buffer of 0.5%). Finally, the SRB for Nordea stands at 3%, for OP Group at 2%, for Municipality Finance Plc at 1.5% and for other Finnish credit institutions at 1%. If Sweden’s competent authority opposes the merger of Nordea Bank AB with Nordea Holding Oyj, then the previous decisions made on 22 December 2017 by the FIN-FSA will remain in force.

4.2.2 Slovakia

On 29 May 2018 Národná banka Slovenska decided to maintain the SRB at its current level (1%) for the same institutions as in the previous year. The SRB of 1% applies to three credit institutions (Slovenská sporiteľňa a.s, Tatra banka a.s. and Všeobecná úverová banka a.s.) and will continue to apply from 1 January 2019.

Národná banka Slovenska also decided to maintain the O-SII buffer rates at their current values and for the same institutions from 1 January 2019. The applicable buffer rates will be maintained at 0.5% (for Tatra banka a.s.) and 1% (for Poštová banka a.s., Slovenská sporiteľňa a.s, Československá obchodná banka a.s. and Všeobecná úverová banka a.s.).

4.3 Other macroprudential measures

4.3.1 Slovakia

Národná banka Slovenska decided to introduce amendments to its macroprudential measures related to housing and consumer loans. The measures have been in force since 1 July 2018 and involve limits on debt‑to‑income ratios for housing and consumer loans, as well as a tightening of loan‑to‑value limits for housing loans. According to these amendments, a borrower’s total indebtedness shall not exceed eight times his/her annual net disposable income (phasing-in applies), while the loan-to-value ratio for housing loans cannot exceed 90% and the maximum share of new housing loans with a loan‑to-value ratio of more than 80% cannot exceed 20% (down from 40%, phasing‑in applies). With these measures, Národná banka Slovenska aims to address the main vulnerability in the Slovakian housing market, which is related to the household stretch, and in particular to rapid credit growth leading to Slovakian households’ increasing indebtedness.

- Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions (OJ L 287, 29.10.2013, p. 63).

- The cut-off date for reporting macroprudential measures was