Mining the environment – is climate risk priced into crypto-assets?

Some crypto-assets have a significant carbon footprint and are estimated to consume a similar amount of energy each year to individual countries like Spain, the Netherlands or Austria. As the mining and expansion of these crypto-assets are fully dependent on energy supply, their valuation is particularly vulnerable to jurisdictions’ climate policies. Increasing financial exposures to such crypto-assets are therefore likely to contribute to increased transition risk for the financial system. This article provides an overview of the estimated carbon footprint of certain crypto-assets such as bitcoin and its causes. It also discusses the primary policy role of public authorities, which need to evaluate whether the outsized carbon footprint of certain crypto-assets undermines their green transition commitments. Finally, it analyses policy options for prudential standard-setters and the need for climate-related considerations in crypto-investors’ practices.

1 Introduction

Some crypto-assets like bitcoin have a significant carbon footprint, with an annualised energy consumption estimated to be similar to that of some mid-sized countries. The main reason for this outsized carbon footprint lies in their underlying blockchain technology, which requires vast amounts of computational power.

Increasing financial exposures to crypto-assets with a significant carbon footprint are contributing to elevated climate transition risk for the financial system. The valuation of these crypto-assets is particularly vulnerable to jurisdictions’ climate policies and the consequences of the green transition to net zero. Jurisdictions may also look more closely into the productive use of different energy sources as a result of the recent spike in energy prices following the Russia-Ukraine war. It seems unlikely that bitcoin investors have currently priced in the negative ecological externalities and authorities’ possible policy measures.

This article discusses the climate transition risk of certain crypto-assets and highlights potential policy responses for authorities, including prudential standard-setters. To this end, the article provides an overview of the estimated carbon footprint of certain crypto-assets such as bitcoin and its causes. It goes on to highlight that an alternative and much less energy-intensive blockchain technology exists that can achieve similar results. Finally, it presents potential policy options.

2 The estimated carbon footprint of crypto-assets

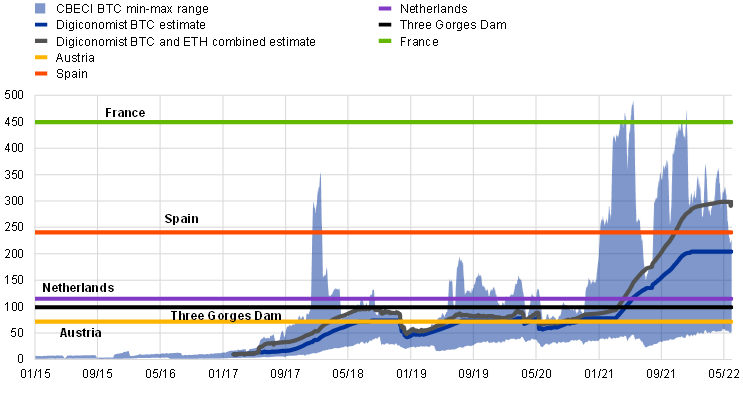

Some crypto-assets such as bitcoin and ether have a significant carbon footprint and are estimated to consume a similar amount of energy each year to some mid-sized countries.[4] While these estimates vary and differ from one year to the next, they put the estimated annualised energy consumption in line with the yearly energy consumption of individual countries, such as Spain, the Netherlands or Austria, and the annual electricity production capacity of the Three Gorges Dam, the world’s largest power station in terms of installed capacity (Chart 1).[5]

Chart 1

Estimated annualised electricity consumption of global bitcoin (BTC) and ether (ETH) compared with that of selected countries

(1 Jan. 2015-31 May 2022; terawatt hours)

Sources: Cambridge Bitcoin Electricity Consumption Index (CBECI), Digiconomist, Cambridge Centre for Alternative Finance, International Energy Agency, Morgan Stanley and ECB calculations.

Note: The horizontal lines denote the annual electricity consumption of countries in 2020 and the annual electricity production capacity of the Three Gorges Dam.

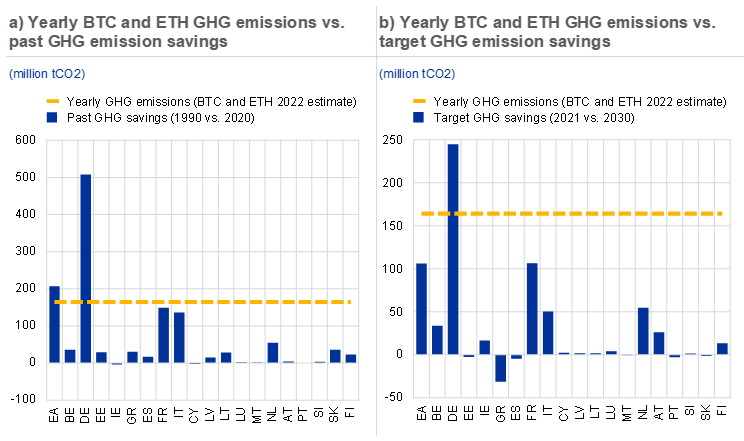

Estimates of the carbon footprint for bitcoin and ether further show that their combined yearly emissions as of May 2022 negate past and target greenhouse gas (GHG) emission savings for most euro area countries (Chart 2).

Chart 2

Past and target GHG emission savings of euro area countries negated by yearly bitcoin and ether GHG emissions

Sources: European Commission, Digiconomist, International Energy Agency and ECB calculations.

Notes: Country emission savings profiles are based on and covered by the EU Climate and Energy Package and the Kyoto Protocol. Target savings reflect the emission reductions required to achieve EU Member States’ emission targets as proposed by the European Commission in a series of amendments to the EU’s Effort Sharing Regulation. These amendments were made in line with the EU target of achieving net emission reductions of at least 55% by 2030, compared with 1990 levels. EA figures represent GDP-weighted averages of country carbon emission savings. Million tCO2 stands for million tonnes of CO2. GHG emission estimates of BTC and ETH reflect an average of daily estimates from 1 Jan. 2022 to 31 May 2022.

3 How can crypto mining be so energy-intensive and what does the crypto industry intend to do about it?

The main reason behind the significant energy consumption of bitcoin lies in its cryptographic protocol, which relies on the proof-of-work (PoW) consensus mechanism. Under PoW, which emerged with the invention of bitcoin, miners use specialised hardware to solve the complex mathematical puzzle of mining the crypto-asset, validate transactions and secure the expanding network. This procedure is computationally expensive and translates directly into high energy consumption.

Besides bitcoin, several other crypto-assets use this consensus mechanism and have a significant carbon footprint. Additional crypto-assets with a significant carbon footprint include ether and tokens based on the Ethereum blockchain. The latter comprise stablecoins (such as Tether or USD Coin[6]), tokenised assets and unbacked tokens.

The crypto-asset community is responding to public criticism of the significant energy consumption of PoW crypto-assets. For example, the Ethereum Foundation has announced a set of upgrades[7] that will be fully launched by 2023 to make ether more sustainable, among other objectives. For bitcoin, two notable initiatives are the Crypto Climate Accord and the Bitcoin Mining Council (BMC).[8] The first is a private sector-led initiative focused on decarbonising the crypto-asset and blockchain industry. More than 200 supporters have publicly committed to achieving net zero emissions by 2030. The latter is a voluntary forum of currently 36 companies, which was founded to “[…] promote transparency, share best practices, and educate the public on the benefits of bitcoin and bitcoin mining.” The BMC states that “bitcoin mining uses a negligible amount of energy, is rapidly becoming more efficient, and is powered by a higher mix of sustainable energy than any major country or industry.”[9] However, this has been challenged by some in the crypto community, who argue that the methodology is not clearly explained and who criticise the lack of details[10] and unreliable data[11].

While these initiatives are welcome in principle, they remain voluntary in nature and are unable to enforce changes in the consensus method. The BMC highlights that “bitcoin’s energy usage is a feature, not a bug, and provides tremendous network security”. Given the differing views on the trade-off between security, decentralisation and scalability of blockchain consensus mechanisms[12], such industry-led initiatives may be unlikely to bring about significant changes in bitcoin’s consensus mechanism. Nevertheless, they could become relevant for stakeholder organisations in the crypto industry as the policy debate about its carbon footprint grows.

Insofar as PoW crypto-assets transition to renewable energy sources, they may crowd out other uses of renewable energy, putting countries’ green transition targets at risk. Renewable energy is limited. The share of renewables in global electricity generation was 29% in 2020. Hence, it will take time to have a fully renewable energy supply.[13] Using existing renewable energy sources to mine bitcoin generally implies that less renewable energy can be used for other purposes such as providing electricity to households, as well as to eventually cover the required climate transition.[14]

4 An alternative and much less energy-intensive blockchain technology exists

The significant energy consumption weakness of PoW can be addressed by another blockchain consensus mechanism, namely proof-of-stake (PoS). The main idea behind PoS is that to become a validator (or “miner”) of transactions, network participants must lock up (or “stake”) a certain amount of the underlying crypto-asset. These locked up crypto-assets are used as a form of collateral for the security of the network. Hence, the decisive factor that determines whether a validator can successfully mine a block is not computing power, but the amount of staked crypto-assets. Crypto-assets built on PoS blockchains thus rely on miners pledging crypto-asset collateral instead of computing power, leading to substantially lower energy consumption.

PoS crypto-assets have generally seen remarkable increases in market capitalisation. That said, the market capitalisation of PoW-based crypto-assets remains high, at around 80% of the total crypto-asset market (Chart 3). Bitcoin owners and miners generally continue to view PoW as the more secure and decentralised consensus mechanism and see the scalability of PoS technology coming at the cost of either the security or the decentralisation of the consensus mechanism. Given this lack of community consensus, it is unlikely that bitcoin’s stakeholders will initiate the adoption of PoS in the near future.

Chart 3

Market capitalisation of PoW-based crypto-assets vs. other consensus mechanism-based crypto-assets

(1 Jan. 2020-31 May 2022; left-hand scale: EUR trillions; right-hand scale: percentages)

Sources: CryptoCompare and ECB calculations.

Notes: Calculations entail approximations based on historical supply and closing price data. The consensus mechanisms with corresponding symbols are as follows: proof-of-work (PoW), proof-of-stake (PoS), delegated proof-of-stake (DPoS), proof-of-history (PoH), Ripple Protocol consensus algorithm (RPCA), Stellar consensus protocol (SCP), proof-of-staked-authority (PoSA). The PoSA and RPCA mechanisms are exclusively used by Binance Coin (BNB) and Ripple (XRP) respectively.

It is estimated that PoS blockchain technology dramatically reduces energy consumption while ensuring the same functionality. Estimates by the Ethereum Foundation suggest that moving the Ethereum blockchain from PoW to PoS would dramatically reduce energy consumption by 99.95% while ensuring the same functionality. A PoS-based Ethereum would put the blockchain’s energy consumption not on the scale of countries, but that of a small town of around 2,100 homes in the United States.[15]

5 Green transition is a risk for crypto valuation

The green transition brings risks for crypto-assets’ valuation. Political and social choices on energy sources and energy consumption levels are needed for the green transition to net zero. These choices could lead policymakers to privilege certain productive activities and their use of energy to meet climate strategy targets and avoid crowding out the limited renewable energy sources for crypto mining. It is unlikely that bitcoin investors have currently priced in the negative ecological externalities and authorities’ possible policy measures.

Increasing financial sector exposure to crypto-assets with a significant carbon footprint is contributing to increased financial sector transition risk.[16] Some authorities have already called for policy measures to address the significant carbon footprint of certain crypto-assets. Following the increased presence of crypto-asset producers in Europe’s Nordic region, the Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency have communicated that Sweden needs the renewable energy targeted by crypto-asset producers for the climate transition of Sweden’s essential services. These authorities see the increased energy use by crypto miners as threatening their ability to meet the Paris Agreement. They have therefore called on the EU to consider a ban on the energy-intensive PoW mining method.[17] Such a call has also been made by the vice-chair of the European Securities and Markets Authority (ESMA).[18] The European Parliament[19] has asked the European Commission to submit by January 2025 a legislative proposal to include in the EU taxonomy for sustainable activities crypto-asset mining activities that contribute substantially to climate change mitigation. In September 2021, China issued a ban on all crypto transactions and mining amid financial stability, consumer protection, financial crime and environmental concerns.[20] Lawmakers in the New York State Senate passed a bill that would prevent the expansion of certain carbon-based crypto mining operations for two years, pending a comprehensive impact study.[21]

6 Potential actions to address concerns over crypto-assets with a significant carbon footprint

First and foremost, public authorities need to evaluate whether the outsized carbon footprint of certain crypto-assets undermines the achievement of their green transition to net zero greenhouse gas emissions. Public authorities should not stifle innovation, as it is a driver of economic growth. Although the benefit for society of bitcoin itself is doubtful[22], blockchain technology in principle may provide yet unknown benefits and technological applications. Hence, authorities could choose not to intervene with a view to supporting digital innovation. At the same time, it is difficult to see how authorities could opt to ban petrol cars over a transition period but turn a blind eye to bitcoin-type assets built on PoW technology, with country-sized energy consumption footprints and yearly carbon emissions that currently negate most euro area countries’ past and target GHG savings (Chart 2). This holds especially given that an alternative, less energy-intensive blockchain technology exists. To continue with the car analogy, public authorities have the choice of incentivising the crypto version of the electric vehicle (PoS and its various blockchain consensus mechanisms) or to restrict or ban the crypto version of the fossil fuel car (PoW blockchain consensus mechanisms). So, while a hands-off approach by public authorities is possible, it is highly unlikely, and policy action by authorities (e.g. disclosure requirements, carbon tax on crypto transactions or holdings, or outright bans on mining)[23] is probable.[24] The price impact on the crypto-assets targeted by policy action is likely to be commensurate with the severity of the policy action and whether it is a global or regional measure.

Investors will have to evaluate whether investing in certain crypto-assets is in line with their environmental, social and governance (ESG) objectives. It is highly unlikely that investments in PoW-based assets can be part of an ESG investment strategy. Even so-called green crypto mining would crowd out other, likely more productive uses of renewable energy.

Financial institutions will have to incorporate the climate-related financial risks of crypto-assets into their climate strategy, which should be an integral part of their overall risk strategy. For banks, for example, the principles for the effective management and supervision of climate-related risks proposed by the Basel Committee on Banking Supervision (BCBS)[25] apply to any exposure or activity of banks and hence also to exposures to crypto-assets. In this regard, banks should identify and quantify climate-related financial risks and incorporate those assessed as material over relevant time horizons into their internal capital and liquidity adequacy assessment processes. Likewise, bank supervisors should assess the extent to which material climate-related financial risks are included in banks’ risk management frameworks and risk appetite along with appropriate processes and procedures to identify, monitor and manage such risks. The European Commission’s proposal to finalise the implementation of Basel III in the EU also expects banks to define internal transition plans to support their ESG strategies; banking institutions with significant exposures to crypto-assets would consequently have to take these exposures into account when designing their transition plans. Worldwide, a large number of banks representing 40% of global banking assets have already voluntarily committed to achieving net zero emissions in their lending and investment portfolios by 2050, with intermediate targets for 2030.[26] Turning to non-bank financial institutions, ongoing efforts to integrate sustainability risks into risk management practices should also factor in the climate-related financial risks of crypto-assets.

Prudential standard-setters may also decide to capitalise the increased transition risk of crypto-assets as part of their holistic approach to capture climate-related risks. Two reasons speak for such an approach. First, as discussed above, the significant carbon footprint of certain crypto-assets means that their transition risk may be more acute and pressing than that of other assets. Second, the cost-benefit analysis for crypto-assets is different from other assets vulnerable to climate risk. To take the example of the banking sector: contrary to other, more traditional assets, crypto is not yet on banks’ balance sheets in a very significant amount. Hence, conservatively capitalising the increased transition risk of crypto-assets will have no immediate impact on bank capital and thus indirectly on bank lending. Nevertheless, such a policy tool will disincentivise investing in such assets from the outset and prevent the build-up of transition risk through crypto-assets in the banking system. As crypto-assets are global by nature and climate risk is a global issue, such an approach would ideally be set at the international level, thus also ensuring a level global playing field. However, the banking sector is not the only sector where prudential standard-setters need to consider their approach to crypto climate transition risk. Similar capitalisation considerations would apply for the insurance sector. For the investment fund sector, disclosure requirements should ensure that investors are able to properly assess climate-related financial risks and understand the carbon footprint related to funds’ crypto-assets.

Capital requirements for crypto climate transition risk could range from risk weights to more punitive capital treatment. For the banking sector, the BCBS could consider imposing uniform additional capital requirements on banks’ engagement in crypto-assets that have a significant carbon footprint. Such capital requirements could be risk-sensitive in the form of risk weight add-ons or – more punitively – could stipulate that banks deduct capital for all new exposures to crypto-assets with a significant carbon footprint[27]. Crypto-assets with a significant carbon footprint could be regarded as at least the crypto-assets that are based on the PoW consensus mechanism. Such a definition would currently include bitcoin and ether, but also stablecoins, tokenised assets and unbacked tokens based on these blockchains. More sophisticated definitions could also be applied, for example in the form of an acceptable carbon footprint (in million tCO2) or energy consumption (in kilowatts) for each crypto-asset.

7 Conclusion

The significant carbon footprint of certain crypto-assets such as bitcoin and ether is likely to affect their future valuation when jurisdictions implement their green transition policies and conflicts over the consumption of limited energy become acute. It is highly unlikely that EU authorities will restrict or ban fossil fuel cars by 2035 (as currently foreseen)[28] but refrain from taking action for assets whose current yearly carbon emissions are enough to negate most euro area countries’ past and target GHG emission savings, as well as the current and future global net savings from the deployment of electric vehicles.[29] Indeed, the latest discussions on the Markets in Crypto-assets (MiCA) Regulation in the European Parliament highlight the debate over the issue,[30] with 2025 now the target date for potential measures.

Increasing financial sector exposures to crypto-assets with a significant carbon footprint are contributing to increased climate transition risk for the financial sector. A key question for all seeking to profit from a highly volatile and speculative asset class will thus not only be whether certain crypto-assets fit with their ESG investment strategies, but also whether the negative externalities of crypto mining and jurisdictions’ climate policies are priced in. The pricing in of these negative ecological externalities and authorities’ possible policy measures could eventually lead to losses on crypto-asset exposures.

Whilst the first and foremost policy role is for governments, financial institutions and prudential standard-setters also have a role to play. Public authorities will have to evaluate whether the outsized carbon footprint of certain crypto-assets undermines the achievement of their green transition commitments. Investors will have to evaluate whether engaging or investing in certain crypto-assets is in line with their ESG objectives. Financial institutions will have to incorporate the climate-related financial risks of crypto-assets into their climate strategy, with their supervisors assessing the extent to which material climate-related financial risks are included in banks’ risk management frameworks. Prudential standard-setters may also choose to follow an ambitious approach by defining capitalisation requirements ranging from risk weights to a more punitive approach, such as a capital deduction for all new exposures to crypto-assets with a significant carbon footprint. Such an ambitious approach is warranted given the significant carbon footprint of certain crypto-assets and their commensurate transition risk. Capitalising crypto transition risk is not expected to have an immediate impact on bank capital and thus indirectly on bank lending, as crypto is not yet significantly on banks’ balance sheets.

References

Basel Committee on Banking Supervision (2022), “Principles for the effective management and supervision of climate-related financial risks”, 15 June.

Beekhuizen, C. (2021), “Ethereum’s energy usage will soon decrease by ~99.95%”, Ethereum Foundation blog, 18 May.

Bindseil, U., Papsdorf, P. and Schaaf, J. (2022), “The encrypted threat: Bitcoin’s social cost and regulatory responses”, SUERF Policy Note, No 262, SUERF, January.

Bitcoin Mining Council (2021), “Global Bitcoin Mining Data Review Q2 2021”, 1 July.

di Carlo, G. and Sedlmeier, J. (2022), “Addressing the Sustainability of Distributed Ledger Technology”, Occasional Papers, No 670, Banca d’Italia, February.

European Parliament (2022), “Cryptocurrencies in the EU: new rules to boost benefits and curb threats”, press release, 14 March.

Financial Stability Board (2022), “Assessment of Risks to Financial Stability from Crypto-assets”, 16 February.

Finansinspektionen (2021), “Crypto-assets are a threat to the climate transition – energy-intensive mining should be banned”, presentation, 5 May.

Gallersdörfer, U., Klaaßen, L. and Stoll, C. (2020), “Energy Consumption of Cryptocurrencies Beyond Bitcoin”, Joule, Vol. 4, Issue 9, September, pp. 1843-1846.

International Energy Agency (2021a), “Global Energy Review 2021”, April.

International Energy Agency (2021b), “Net and avoided well-to-wheel GHG emissions from the global electric vehicle fleet in the Stated Policies Scenario, 2020-2030”, 28 April.

Both European Central Bank.

Both Autorité de contrôle prudentiel et de résolution (France).

The authors would like to acknowledge comments and suggestions made by Rebeca Anguren Martin, Ivana Baranović, Valentina Cappa, Concetta Galasso, Michael Grill, Carlo Di Maio, Fátima Pires, Guan Schellekens and Florian Weidenholzer.

Bitcoin and ether serve as a reference because of the long track record available on their market capitalisation and their use of energy-intensive cryptographic protocols.

Bitcoin and ether’s combined electricity consumption is estimated to account for approximately 80% of the total energy demand of crypto-asset mining. See Gallersdörfer et al. (2020).

The stablecoin Tether is issued on different types of blockchains. The two biggest are Ethereum (which has a significant ecological footprint) and Tron (which is an alternative blockchain based on the proof-of-stake mechanism). As such, Tether on Ethereum does not have the same ecological footprint as Tether on Tron.

One of the upgrades, the proof-of-stake Beacon Chain, has been deployed since December 2020.

See cryptoclimate.org and bitcoinminingcouncil.com for further details on the initiatives.

See Bitcoin Mining Council (2021).

See “Bitcoin Miners Claim More Than Half of Bitcoin Mining Uses Clean Energy”, Decrypt, 2 July 2021.

See “Bitcoin Mining Council survey estimates a 56% sustainable power mix in Q2”, Cointelegraph, 2 July 2021.

Vitalik Buterin refers to this trade-off as the “blockchain trilemma”.

See International Energy Agency (2021a).

See “EU should ban energy-intensive mode of crypto mining, regulator says”, Financial Times, 18 January 2022.

See Beekhuizen (2021).

See Financial Stability Board (2022).

See Finansinspektionen (2021).

See “EU should ban energy-intensive mode of crypto mining, regulator says”, Financial Times, 18 January 2022.

See European Parliament (2022).

See, for example, “China’s top regulators ban crypto trading and mining, sending bitcoin tumbling”, Reuters, 24 September 2021, and “How the Chinese crypto-mining ban is also an environmental move”, Marketplace, 5 November 2021.

The measure is waiting to be signed into law by the Governor of New York. See “New York State Senate Passes Bitcoin Mining Moratorium”, Coindesk, 3 June 2022.

See Bindseil et al. (2022).

For a useful discussion on possible public policy tools, see di Carlo et al. (2022).

See the Reuters article “China’s top regulators ban crypto trading and mining, sending bitcoin tumbling”, the Swedish Financial Supervisory Authority’s call for a ban on crypto mining and the Euronews article “Europe rejects proposal limiting PoW cryptos such as Bitcoin but sets draft rules for sustainability” as recent examples of regulatory efforts against energy-intensive crypto-asset mining.

See Basel Committee on Banking Supervision (2022).

Such an approach would be in line with, for example, the approach advocated by Finance Watch in its open letter to the BCBS.

See “EU proposes effective ban for new fossil-fuel cars from 2035”, Reuters, 14 July 2021.

With current yearly GHG emissions estimated at approximately 164 million tCO2 (see Chart 2), bitcoin and ether’s yearly carbon footprint negates the net GHG emissions avoided from the global electric vehicle fleet (51.9 million tCO2) as well as the GHG emission savings targeted in 2030 (120.9 million tCO2). See International Energy Agency (2021b).

See “Europe rejects proposal limiting PoW cryptos such as Bitcoin but sets draft rules for sustainability”, Euronews, 14 March 2022.