Using the ECB macroprudential stress testing framework for policy assessment – lessons learned from the COVID-19 pandemic

This article summarises the experience of applying the ECB macroprudential stress testing framework to assess the financial policy response to the COVID-19 pandemic. Macroprudential stress testing addresses uncertainty about future economic developments by offering the possibility of designing various plausible macro-financial scenarios. Leveraging this capacity, it could also support the timely and fitting assessment of prudential policies considered in response to the outbreak of the pandemic, providing guidance on the sufficiency of capital releases and encouraging the use of capital buffers by financial institutions. Moreover, macroprudential stress testing is an effective tool for assessing the impact of instruments to be implemented on the path towards normalisation of macroprudential policy in exiting the pandemic.

1 Introduction

Historically, the main objective of macroprudential stress testing has been to assess the resilience of the financial system. Macroprudential stress testing looks at economy-wide outcomes, taking into account the reactions of financial institutions and the propagation of systemic risks (see Budnik et al., 2019). This contrasts with supervisory stress tests, which focus on the solvency or liquidity of individual institutions in isolation and seek to assess the robustness of institutions’ business models to different economic conditions.

The economic recession triggered by the outbreak of the coronavirus (COVID-19) pandemic brought to the fore two complementary applications of macroprudential stress testing. First, such testing can be used to pinpoint the consequences of coordination failures. Macroprudential stress testing integrates both the reactions of financial institutions and the fact that individually optimal decisions, such as deleveraging in support of robust solvency levels in a recession, can have a detrimental system-wide impact that cascades back to these institutions. Second, macroprudential stress testing can support timely impact assessments of policy interventions taken to weather a crisis, especially in times of high levels of uncertainty about how the economy will evolve.

This article summarises the experience of using the ECB macroprudential stress testing framework for policy assessment during and after the COVID-19 pandemic. It discusses how the macroprudential stress testing framework[2] was applied to address the unprecedented uncertainty at the beginning of the COVID-19 pandemic by offering policy assessments contingent on different plausible macro-financial scenarios. It further shows how macroprudential stress testing can be used to back communication by authorities, not only in providing timely assessment of banking sector resilience, but also by guiding financial institutions to take the best decisions from a system-wide perspective. Lastly, the article illustrates how these experiences carry over to the assessment of policies on exit from a crisis, including the setting of macroprudential capital buffers.

The workhorse financial stability model, the banking sector euro area stress test (BEAST) model, applied to macroprudential stress testing by the ECB combines the ability to generate multiple macro-financial scenarios with the ability to track the impact of various policies affecting the banking sector. It captures euro area economies along with individual euro area banks. The model can be used to create a diverse set of macro-financial scenarios reflecting different combinations of economic shocks, and to assess banking system resilience for the full distribution of plausible futures[3] or specific eventualities, such as scenarios portraying economic booms or recessions.

In the course of the COVID-19 pandemic, the ECB macroprudential stress test was used in line with its original objectives of assessing banking system resilience. Its use to complement the single supervisory mechanism (SSM) vulnerability analysis[4] helped make it possible to gain an understanding of the propagation of the economic recession in the banking sector, emphasising the role of mitigation policies in containing risk amplification (see Appendix B in ECB, 2021a). A year later, the 2021 macroprudential stress test, coupled with the 2021 EBA/SSM EU wide stress test,[5] was applied to re-assess the imprint of the pandemic. Its results bolstered trust that the banking system would remain resilient even following the phasing-out of the mitigation policy measures introduced by ECB Banking Supervision and national authorities.

The application of macroprudential stress testing to policy assessment in the presence of high uncertainty relies on looking at the impact of these policies in a range of plausible scenarios. Banks in the model adapted to supervisory, macroprudential and regulatory policies, as well as monetary policy and selected government policies introduced during the COVID-19 pandemic, such as public guarantees and moratoria. Bank reactions, and consequently the impact of these policies, depend on the macro-financial situation. During the pandemic, the unpreceded level of uncertainty about the depth and duration of the economic recession could be addressed by analysing the reactions of banks to different combinations of regulatory and prudential measures in several scenarios.

This article is organised as follows. Section 2 provides a high-level description of the macro-micro workhorse model. Section 3 describes the treatment of scenario uncertainty taking the situation during the pandemic as an example. Section 4 discusses the assessment of pandemic mitigation policies and the use of capital buffers in crisis events. Section 5 illustrates how analogously designed assessments can support the normalisation of macroprudential policies in the aftermath of economic recession. Section 6 concludes.

2 Workhorse macro-micro model

The BEAST[6] is a semi-structural model linking macro and bank-level data regularly used by the ECB for macroprudential stress testing and policy assessment. Both sides of bank balance sheets are modelled in a high level of detail in order to capture bank heterogeneity. The asset side distinguishes between different loan portfolios, equity exposures and securitised portfolios. The model also captures flows between the three International Financial Reporting Standard 9 (IFRS9) asset impairment stages, write-offs of non-performing loans and risk weighting developments. The liability side distinguishes between equity, as well as wholesale and retail funding. For each bank, the changes in profitability and solvency are further broken down into the impact stemming from credit, market and operational risks, net interest income and dividend pay-outs.

A share of model equations captures the pass through of scenarios into bank balance sheets and profit and loss accounts in addition to banks’ behavioural reactions. The first set of equations transmits the impact of macro-financial variables on loan-loss provisioning, trading book income, including revaluation losses, risk weightings, funding costs and net fee and commission income. Banks’ behavioural responses include adjustments to asset and liability volumes, loan and deposit interest rates, and profit distributions, as illustrated in Figure 1.

Figure 1

Schematic illustration of the BEAST model

Source: ECB.

Banks are affected by assorted supervisory, macroprudential and monetary policies. Banks formulate their capital targets ahead of deciding on lending volumes or profit distributions, factoring in their Pillar I and Pillar II minimum and buffer requirements. They are subject to additional restrictions imposed in the form of supervisory coverage expectations[7] (Budnik et al., 2021c). To enable timely assessment of COVID-19 mitigation policies, the model was extended to take into account the banking supervision measures imposed by the ECB in 2020-21, such as profit distribution restrictions, public moratoria and national guarantee schemes (Budnik et al., 2021a). Banks adjust their activities to refinancing rates and changes in long-term interest rates, the latter depending on Eurosystem asset purchase operations. These elements allow for the impact of both conventional and unconventional monetary policy on the banking sector.

The macroeconomic module captures the dynamics of each euro area economy, including trade spillovers between them. Each euro area economy is represented by eleven macro-financial variables, including country gross domestic product (GDP), inflation and house prices, linked together in a structural vector autoregressive model. The country-level dynamics are driven by realisations of structural shocks, such as aggregate demand or monetary policy innovations. An additional block of cross-country trade spillovers link country import volumes to foreign demand variables, and their export prices to foreign price variables. The model puts all the equations together and solves them as a system, thus preserving internal consistency and allowing for simultaneous feedback mechanisms.

The BEAST incorporates two amplification mechanisms. The first is the interaction between solvency and funding costs. A solvency shock reflected in an increase in bank leverage makes the institution more vulnerable to default, with that risk being priced into banks’ unsecured funding costs. This, in turn, has an adverse effect on bank net interest income, eroding bank capital. The second amplification mechanism is the feedback loop between the banking sector and the real economy. In normal times, banks adjust their credit volumes and interest rates largely in line with changes in aggregate credit demand. In adverse economic conditions, banks attempt to restore eroded capitalisation, and credit supply factors become more relevant. Banks’ actions to repair their capital levels take the shape of a negative credit supply shock affecting the macro economy.

The semi-structural design of the model makes it possible to absorb different sources of information available at the point when a forecast is built. It reflects the most recent macroeconomic data, detailed information on banks’ balance sheets and profit and loss accounts, along with existing and upcoming macroprudential and supervisory policies.

3 Uncertainty

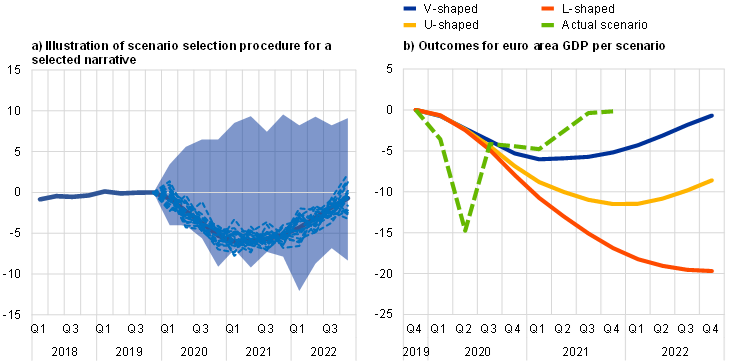

Uncertainty about future economic developments can be addressed by considering many different but plausible scenarios. By using random sequences of structural shocks in the macroeconomic block[8], the model can project many alternative macro-financial scenarios, each of which is consistent with historical data. This leads to a full distribution of potential macroeconomic outcomes that can be illustrated by fan charts, such as that in panel a) of Chart 1, for the level of economic activity in the euro area.

Economic narratives provide a way of selecting a subset of relevant scenarios. Economic narratives emphasise changes in selected variables, e.g. a significant drop in economic activity, their triggers, e.g. supply bottlenecks, or the timing of events, e.g. economic recovery a year after the onset of a recession. The main elements of a narrative are then translated into statistical criteria and all scenario paths are evaluated and ranked using these criteria. The scenarios that best fit the narrative are those ranked highest, as illustrated in panel a) of Chart 1 by dashed lines.[9]

Three families of scenarios were selected to address the uncertainty about the duration and depth of the COVID-19 pandemic. The narratives differed in the severity of output contraction, the intensity of trade disruption, the magnitude of adverse aggregate demand and supply shocks, asset and house price devaluations, increases in the level of unemployment and long-term interest rates, and the degree of accommodation of standard and unconventional monetary policy. The first family of scenarios, dubbed a V-shaped recession, predicted a sharp contraction in economic activity and a relatively quick recovery (starting as early as the second half of 2020). The second family, a U-shaped recession, predicted a slower recovery potentially interrupted by a second wave of the COVID-19 pandemic in the second half of 2020. The third family, an L-shaped recession, envisaged a prolonged period of lockdown causing severe economic contraction.

Chart 1

Scenario paths used for policy assessments following the outbreak of the pandemic

To account for uncertainty over future economic paths, the mitigation policies are assessed under three alternative scenarios

(euro area GDP growth relative to the fourth quarter of 2019 as percentages)

Source: Budnik et al. (2021a).

Notes: The blue shaded area corresponds to the full distribution (fan chart) of potential scenarios. The dashed lines illustrate individual selected scenario paths corresponding to the V-shape recession narrative. These are combined in the V-shape mean path marked by the thick blue line.

The three narratives expressed an increasing degree of pessimism about economic activity in 2020-22. Three mean outcomes for euro area GDP per scenario group are illustrated in panel b) of Chart 1. The first, and least severe, V-shaped set of scenarios is commensurate with slightly negative GDP growth in 2020-22 on a cumulative basis and in the absence of COVID-19 mitigation policies. The U-shaped scenarios result in a cumulative GDP drop of -8%, and the L-shape scenarios give a GDP contraction of -20% over the same period. Comparing these scenarios to actual data available two years later, the U-shape scenarios best match the peak level of recession adversity. However, the quick rebound in economic activity seen in 2020 turned out to be even more optimistic than assumed in the V-shape scenarios.[10]

4 Capital release and buffer use policies

In response to the severe economic shocks triggered by the outbreak of the pandemic and the lockdown measures, supervisory and macroprudential authorities in Europe promptly introduced capital relief measures. The ECB’s supervisory response allowed banks to operate below the level of capital laid down in the Pillar 2 Guidance, front-loaded a more benign interpretation of Pillar II requirements under CRD V[11]/CRR II[12], allowed banks to limit the procyclical impact of loan-loss provisioning rules and implemented profit distribution restrictions for banks. In parallel, and where in place, national macroprudential authorities released countercyclical capital, and occasionally also structural risk buffers.

The capital release package complemented targeted government policies. Generous public guarantee policies were put in place across almost all euro area countries, to lessen the credit supply constraints for corporates, given that losses from guaranteed loans are largely covered by the government. In addition, public moratoria were introduced for both the corporate and household sectors, enabling them to postpone debt repayments for a certain period.

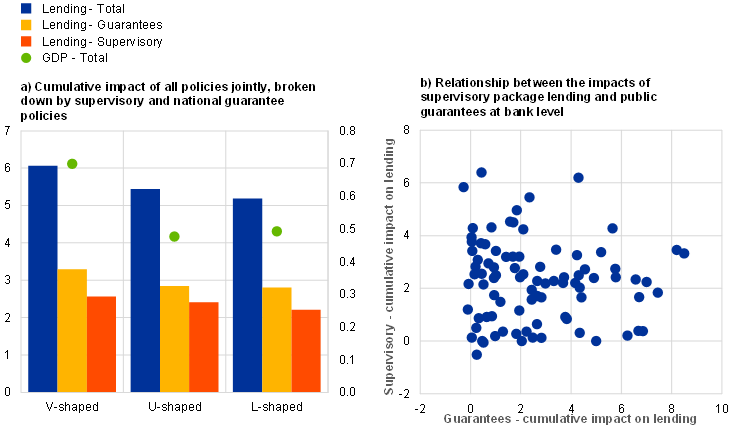

COVID-19 prudential and public-guarantee mitigation policies were best tailored to a relatively short-lasting recession and could have proved insufficient had the recession turned long or deep. The expected cumulated impact of the capital release on lending to the non-financial private sector in the euro area until the end of 2022 was 2.6% in the case of a short-lasting recession (V-shaped) and 2.2% in a deep and long-lasting recession (L-shape). A higher level of available capital, that was not distributed to shareholders due to the binding dividend pay-out restrictions, led to higher lending. In the V-shaped scenario this would have added around 3.3% to the impact of public guarantees and 2.8% in the L-shaped scenario (Chart 2, panel a). Jointly, the policies would have stabilised economic activity measured in GDP terms by 0.7% for the least severe scenario, and by more than 0.5% for the more severe scenario. The impact of supervisory, and government policies would have decreased with the recession severity due to the progressively weaker credit demand outlook. Capital relief and public guarantee programmes primarily sought to prevent credit supply shortages (see Budnik et al. (2021a)).

Chart 2

Cumulative lending impact and relationship of policy packages

Guarantee policy is the main driver of increased lending and higher GDP

(percentage points; (left-hand scale) cumulative lending impact)

Source: Budnik et al. (2021a).

Notes: Blue bar: cumulative impact of all policies jointly. Red bar: supervisory policies. Yellow bar: national guarantee policies. The green dots illustrate the total cumulative impact of all policies on GDP (right-hand scale).

Supervisory and macroprudential policies were complementary to government policies, with the three sets of policies combined leading to a 6.1% higher joint lending impact. Panel b) of Chart 2 shows that the cumulative lending impact of the prudential package (vertical axis) did not systematically correlate with the cumulative lending impact of public guarantees (horizontal axis). By addressing different banks and coaxing them to continue lending to the non-financial private sector, the two sets of policies had a complementary effect at system-level.

Additionally, banks are encouraged to use their existing buffers, including the capital conservation buffer (CCoB)[13]. The procyclical behaviour of the financial system implies that financial intermediaries amplify fluctuations in economic activity. When banks refrain from dipping into their non-releasable but usable capital buffers, they are more likely to deleverage or sell assets than otherwise, thereby potentially amplifying credit supply shortages and intensifying the downturn. Non-use of non-releasable capital buffers is a form of coordination failure, whereby an individual bank benefits from seeking to maintain solvency above regulatory targets, but sector-wide action would relax the capital constraints faced by all banks in the system.

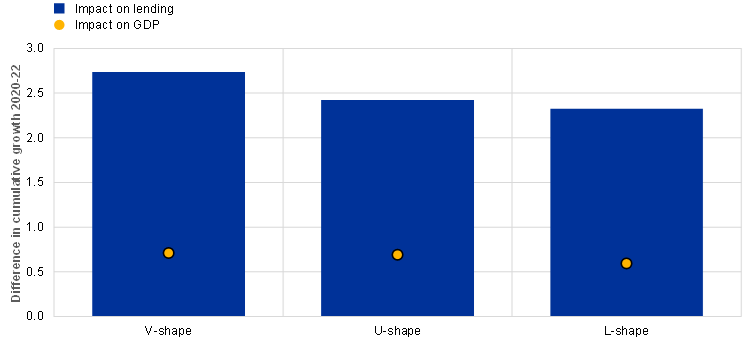

The model results showed that banks’ use of capital buffers leads to better economic outcomes, without a negative impact on their resilience. Using capital buffers to absorb losses and continue lending to the economy during the pandemic-induced recession should have led to an increase in cumulative lending to the real economy of 2.7% and in the least V-shaped scenario, and 2.3% in the most U-shaped adverse scenario, with GDP of between 0.7% and 0.6% respectively over a two-year horizon (Chart 3). The resulting positive impact on economic activity reduces credit losses and sustains banks’ profitability, while Common Equity Tier 1 (CET1) ratios was projected to remain essentially unaffected due to dividend restrictions on banks.

Chart 3

Buffer use in support of lending and economic activity

(impact on lending and GDP in percentage points)

Source: ECB.

5 Exit from the pandemic and toward policy normalisation

The exit from the COVID-19 recession and re-emergence of macro-financial risks in some jurisdictions makes a case for gradual but timely macroprudential policy normalisation. During the second half of 2021 and at the beginning of 2022, measures of cyclical systemic risk and early warning indicators showed that vulnerabilities have been building up in the financial system, especially related to residential property markets.[14] To address these developments, in January 2022 Germany announced a 0.75% countercyclical capital buffer (CCyB) and 2% sectoral systemic risk buffer (sSyRB), and in March 2022 France announced a phase-in of a 0.5% CCyB.[15]

The resilience enhancing role of releasable capital would be observed only in an uncertain future crisis. Assessment of the costs of macroprudential buffers is relatively straightforward, and commonly relies on tracking changes in lending or economic activity during their phase-in under the medium-term economic conditions anticipated. However, the benefits from releasing the buffers in a recessionary environment call for examination of possible future scenarios and selection of those in which the release of the buffers would ideally stabilise lending to the real economy.

The balance of costs and benefits can be considered by applying the same methodology as in Sections 3 and 4 to tackle future uncertainty. The phase-in of the German or French capital buffers are considered here in the context of the conditions described in recent economic forecasts, such as the December 2021 ECB staff macroeconomic projections.[16] Buffer release is considered at the onset of a deep country-specific recession starting in 2026, peaking at the end of 2026, and recovering towards mid-2028. Recessions represent country-specific tail events with a reduction in the country’s economic activity (measured in terms of GDP) and a sharp reduction in house prices, both triggered by negative aggregate demand shocks and coupled with a general recession in the euro area. The economic crises selected have, on average, a peak decline in annual real GDP growth of around 2.5-3.0%.

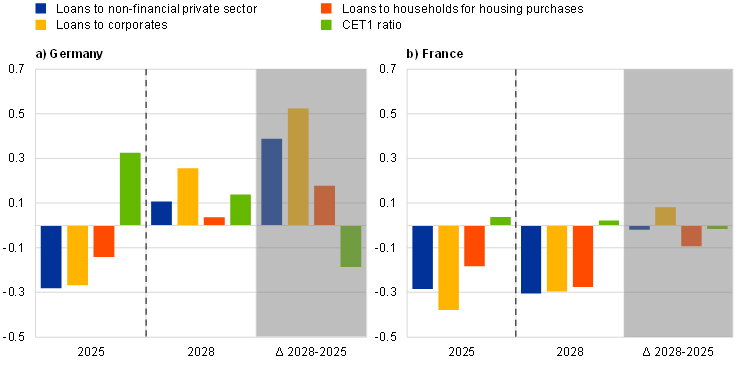

Building up macroprudential capital buffers under the current conditions would have small short-term costs given that they would impose practically no credit supply constraints. The impact of the policies announced would lead to a cumulative reduction of 0.3% in lending in Germany and a similar reduction of 0.3% in France by the end of 2025.[17] At the same time, the average CET1 ratio would increase by 0.3 percentage points in Germany and by 0.05 percentage points in France (Chart 4).

Chart 4

Cost-benefit assessment of announced policies in Germany and France

(deviation from the benchmark in percentage points)

Source: ECB.

Notes: The dashed line indicates the beginning of a recession period. Δ 2028-2025 corresponds to the difference between the deviation of the four interest variables from the benchmark as at 2028 and the deviations as at 2025, i.e. the benefits deriving from the implementation of higher buffers in preceding years and their release during a recession. The benchmark corresponds to 0% CCyB over the entire period of analysis.

The release of capital buffers at the onset of a subsequent recession would support lending, without compromising the actual solvency of banks. In Germany, a joint release of CCyB and SyRB buffers would reduce any reduction in lending to the non-financial private sector by 0.4 percentage points, and to corporates by 0.5 percentage points, over a three-year horizon. At the end of the recession, the average CET1 ratio in Germany would be by 0.14 percentage points higher than if the buffers had not been built up earlier (Chart 4, panel a). In France, a release of a CCyB would lead to bank lending to the corporate sector being higher by 0.1 percentage points during a three-year recession, with no deterioration in solvency levels compared with the situation if no CCyB buffer had been built up earlier (Chart 4, panel b).

6 Conclusions

The conduct of macroprudential policy is often surrounded by uncertainty along many dimensions. Macroeconomic uncertainty increased markedly during the pandemic, prompting the development of macroprudential stress testing to evaluate banking sector and policy outcomes in many potential future situations. The ECB workhorse macroprudential stress testing model, with its flexibility and scenario-generation capabilities, proved to be a good platform for assessing the impact of COVID-19 mitigation policies depending on the duration and depth of the crisis. Lessons learned from the pandemic carry over to the post-pandemic world, where the same methodologies could be applied to assess the costs and benefits of capital buffers implemented.

The uncertainty surrounding possible future scenarios surfaces in many other policy problems, such as interactions between monetary policy and financial stability[18] or policy-setting in the high-risk environment of the Russia-Ukraine war. Scenario selection can help to provide an understanding of the unintended consequences of monetary policy, for instance risks related to the phase-out of asset purchases and market fragmentation. It could also help with navigating the uncertainty of future changes in energy prices and their impact on the European financial sector.

References

Borsuk, M., Budnik, K. and Volk, M. (2020), “Buffer use and lending impact”, Macroprudential Bulletin, No 11, European Central Bank, Frankfurt am Main, October.

Budnik, K., Balatti, M., Dimitrov, I., Groß, J., Kleemann, M., Reichenbachas, T., Sanna, F., Sarychev, A., Sinenko, N. and Volk, M. (2020a), “Banking euro area stress test model”, Working Paper Series, No 2469, European Central Bank, Frankfurt am Main, September.

Budnik, K., Dimitrov, I. and Groß, J. (2020b), “Selecting adverse economic scenarios for the quantitative assessment of euro area banking system resilience”, Financial Stability Review, European Central Bank, Frankfurt am Main, November.

Budnik, K., Dimitrov, I., Groß, J., Jancoková, M., Lampe, M., Sorvillo, B., Stular, A. and Volk, M. (2021a), “Policies in support of lending following the coronavirus (COVID-19) pandemic”, Occasional Paper Series, No 257, European Central Bank, Frankfurt am Main, May.

Budnik, K., Dimitrov, I., Giglio, C., Groß, J., Lampe, M., Sarychev, A., Tarbé, M., Vagliano, G. and Volk, M. (2021b), “The growth-at-risk perspective on the system-wide impact of Basel III finalisation in the euro area”, Occasional Paper Series, No 258, ECB, Frankfurt am Main, July.

Budnik, K., Dimitrov, I., Groß, J., Kusmierczyk, P., Lampe, M., Vagliano, G. and Volk, M. (2021c), “The economic impact of the NPL coverage expectations in the euro area”, Macroprudential Bulletin, Mimeo.

European Banking Authority (2021), “2021 EBA/SSM EU wide stress test: European Banking Authority, 2021 EU-Wide Stress Test: Results”, Paris, 30 July.

European Central Bank (2020), “COVID-19 Vulnerability Analysis: Results overview”, Frankfurt am Main, July.

European Central Bank (2021a), Macroprudential stress test of the euro area banking system amid the coronavirus (COVID-19) pandemic, European Central Bank publication, ECB, Frankfurt am Main, October.

European Central Bank (2021b), “Macroeconomic projections”, European Central Bank webpage.

European Central Bank (2021c), “Pandemic emergency purchase programme (PEPP)”, European Central Bank webpage.

European Systemic Risk Board (2021), “Policy measures in response to the COVID-19 pandemic”, European Systemic Risk Board webpage.

Sarychev, Andrei (2014), “Scenario generation vs. forecasting: predictive performance criteria and the role of vague priors”, Bank of England Working Paper, 13 March.

The authors would like to acknowledge the support of Max Lampe and Jiri Panos.

See the different types of stress testing conducted by the ECB and ECB Banking Supervision.

For instance, a rich distribution of plausible scenarios is analysed in model applications, such as the growth-at-risk analysis in the impact assessment of the Basel III finalisation (Budnik et al., 2021b).

For example, the modelling approach for non-performing exposures aims to reflect the Addendum to the ECB Guidance to banks on non-performing loans: supervisory expectations for prudential provisioning of non-performing exposures. Coverage expectations on new NPLs are introduced as a set of provisioning floors that depend on the type of collateral and time since default. Coverage expectations on legacy NPLs assume that banks fall into one of three groups with a differing initial NPL burden depending on their net NPL ratio at the starting point of analysis.

The distributions of macro-financial variables take additional account of model parameter uncertainty.

Note that all selected scenarios will be consistent with the same narrative, although they differ with regard to the evolution of variables not established by the narrative. For information on how the selection of adverse economic scenarios is used to assess banking system resilience, see November 2019 Financial Stability Review (Chapter 3.2) as well as November 2020 Financial Stability Review (Chapter 3.2, Box 6), which relies on the ranking algorithm by Sarychev (2014).

Note that the actual data, in contrast to scenario data, include the impact of COVID-19 mitigation policies, which contributed to the fast rebound in economic activity.

Capital Requirements Directive V, namely Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (OJ L 150, 7.6.2019, p. 253).

Capital Requirements Regulation II, namely Regulation (EU) 2019/876 of the European Parliament and of the Council 20 May 2019 amending Regulation (EU) No 575/2013 as regards the leverage ratio, the net stable funding ratio, requirements for own funds and eligible liabilities, counterparty credit risk, market risk, exposures to central counterparties, exposures to collective investment undertakings, large exposures, reporting and disclosure requirements, and Regulation (EU) No 648/2012 (OJ L 150, 7.6.2019, p. 1).

ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus, press release, ECB, 12 March 2020.

For more information, see ESRB (2022), “Vulnerabilities in the residential real estate sectors of the EEA countries” and the November 2021 ECB Financial Stability Review (Chapter 1.5).

For the measures announced in Germany and France, see the press releases by BaFin from 12 January 2022 and the press release by HCSF from 24 March 2022.

For more information on ECB staff macroeconomic projections, see the ECB’s website.

To put these numbers into perspective, cumulative loan growth to the non-financial private sector over the same horizon is estimated to be 23.9% in Germany and 22.2% in France.

See 2021 ECB Monetary Policy Strategy Statement.