Macroeconomic impact of Basel III finalisation on the euro area

This article assesses the economic costs and benefits of the Basel III finalisation package for the euro area and shows that the transitory costs of the reform are outweighed by its permanent long-term benefits. Implementing EU-specific modifications to the Basel III reform, such as the small and medium-sized enterprise (SME) supporting factor, credit valuation adjustment (CVA) exemptions and discretion with regard to the operational risk capital charge, reduce the already moderate transitory costs of the reform, although they also reduce its long-run benefits. Approaches that, in addition, modify the implementation of the output floor fail to further reduce the short-term economic costs of the reform while again decreasing its long-term benefits.

1 Introduction

The Basel III standard seeks to strengthen bank resilience following the lessons learned from the global financial crisis. The initial elements of the Basel III framework foresaw increases in capital requirements, especially for high-quality capital, the introduction of capital buffers, and new standards for liquidity and funding. The final elements of the framework were endorsed by the Basel Group of Central Bank Governors and Heads of Supervision in December 2017 and aim to improve the comparability and transparency of risk-weighted assets (RWAs), which form the basis of capital requirements under the Basel III standard. Their implementation was initially scheduled for January 2022, but the timelines have been extended by a year in response to the coronavirus (COVID-19) pandemic.

The Basel III finalisation package includes three sets of measures addressing the variability of RWAs. The package (a) increases the robustness and risk-sensitivity of the standardised approach to credit risk, CVA and operational risk; (b) introduces additional constraints on the use of internal models used for credit risk, and dismisses the internal model-based approach used for CVA and operational risk; and (c) revises the existing Basel I input floors and introduces the output floor. The Basel III finalisation also proposes an additional buffer in order to limit the leverage of global systemically important banks (G-SIBs).

This article estimates the economic costs and benefits of the final Basel III reforms for the euro area. The analysis only covers the elements of the final December 2017 package, since the initial Basel III elements have already entered into force. The assessment employs a large-scale semi-structural model featuring individual banks and economies.

The analysis expands the 2020 European Banking Authority (EBA) assessment of the additional capital needs related to the Basel III reforms.[2] The methodology follows the macroeconomic impact assessment in the 2019 EBA report[3] and in Budnik et al. (2021a). However, just as EBA (2020) report, the article considers the economic impact of different design options for the Basel III finalisation package, i.e. a “plain vanilla” approach and selected EU-specific design options for the reforms. Furthermore, it assesses these options under alternative economic scenarios that differ by varying the imprint of the COVID-19 pandemic.

The remainder of the article is structured as follows. Section 2 presents the four assessed design options for the Basel III finalisation package. Section 3 discusses the methodology used, focusing on the model and the three alternative economic scenarios. Section 4 discusses the costs and benefits of the Basel III finalisation, while Section 5 looks at the solvency and profitability aspects of the reforms from a dynamic balance sheet perspective. Section 6 concludes.

2 The Basel III finalisation and the four design options

The European-level discussion of the Basel III finalisation involves several alternative designs in addition to the original plain vanilla regulatory proposal. The origins of these alternative designs are threefold. First, the European implementation of earlier Basel standards already includes some deviations from the original standards, e.g. the SME supporting factor and CVA exemptions. Second, the Basel III finalisation agreement stipulates that the implementation of some elements, such as the operational risk internal loss component, is optional. Third, there are varying interpretations of what constitutes relevant Basel III capital requirements or buffers in the calculation of the output floor.[4]

The impact assessment benchmarks the impact of a plain vanilla Basel III implementation without any EU-specific modifications against three EU-specific designs, bringing the total to four design options. These are explained below.

(i) The plain vanilla reform design. This option corresponds to the Basel III scenario in the latest EBA report and excludes any EU specificities.

(ii) The main EU-specific approach, which considers three additional features which distinguish it from the plain vanilla package. These are: the application of the SME supporting factor on top of the Basel SME preferential risk weight treatment; the continuation of existing exemptions with regard to the calculation of capital requirements for CVA risk; and the exclusion of the bank-specific historical loss component from the calculation of the capital for operational risk (ILM=1). The output floor is implemented as it is under the plain vanilla approach.

(iii) The alternative EU-specific approach, which builds on the main EU-specific approach but modifies the implementation of the output floor. This option assumes that Pillar 2 requirements and the systemic risk buffer (SRB) apply to unfloored RWAs and not to floored RWAs (as is the case in the plain vanilla and main EU-specific approach).

(iv) The EU parallel stacks approach. This option also builds on the main EU-specific approach but it implements the output floor such that bank capital requirements are defined as the higher of the floored requirements excluding Pillar 2 and SRB and the unfloored requirements including Pillar 2 and the SRB.

3 Methodology

The model and its incorporation of the Basel III reform

The ECB’s macro-micro model (Budnik et al., 2020)[5] was developed to support prudential and regulatory analysis. It includes 19 euro area economies and over 90 euro area banks with their detailed balance sheets and profit and loss statements, covering more than 80% of total assets in the euro area. According to the model, banks react to changing economic conditions by taking regulatory and prudential policies into account in a way that is in line with their historical behaviours. Their reactions are reflected in bank lending and, ultimately, in economic activity in home and host countries.

The features of the final Basel III rules are either translated into model equations or calibrated using the data collected as a part of the December 2019 Quantitative Impact Study (QIS).[6] For instance, model equations replicate the displacement of the advanced IRB approach used to calculate credit risk for certain asset classes by the foundation IRB or standardised approach. Other equations link the new standardised risk weights for real estate exposures to the evolution of house prices, and the operational risk charges to their endogenous components such as bank revenues and funding costs. QIS data are used to inform the calibration of the impact on market risk, CVA and standardised CCR capital charges, as well as most standardised and selected IRB credit risk weights.

The model implementation recognises the state-dependent character of several Basel III finalisation options. The occasionally binding elements of the Basel III finalisation, whose tightness depends on bank-specific and economic conditions, include (i) the G-SIB leverage buffer that modifies the maximum distributable amount, (ii) input floors in the calculation of IRB risk weights, and (iii) the output floor. The latter is expected to be binding more often in economic upturns than in downturns, thereby limiting the procyclicality of capital requirements.

The assessment is an improvement on several aspects of the earlier analysis of the Basel III finalisation in the EBA 2019 report and in Budnik et al. (2021a). First, in the current version of the model, relative risk weights influence bank lending to different economic sectors. Because the revised Basel III framework affects relative risk weights (for example, on corporate versus mortgage-based exposures), it may trigger a move out of lending that is subject to increased risk weights. Second, the model directly incorporates the SSM coverage expectations for non-performing loans (NPLs)[7], which since 2018 have prescribed loan loss provisioning targets for NPLs and will have a bearing on bank profitability[8] during the Basel III finalisation phase-in period. Third, the model incorporates changes in monetary policy from both a conventional and an unconventional perspective. Finally, the model endogenises management buffers which depend on the structure of bank assets and funding. Accordingly, increased capital requirements may subtly reduce management buffers and may offset to a degree the impact of regulation on bank capital needs.

The growth-at-risk (GaR) approach to impact assessment

The costs and benefits of the revised regulation are assessed by comparing two sets of conditional model simulations. First, the model is simulated thousands of times under different scenarios, assuming the currently applicable regulatory framework remains in place. This results in a distribution of possible GDP outcomes, centred at their mean that represents expected economic conditions. Second, the model is simulated under the same set of scenarios but assuming that banks adopt the Basel III finalisation package. The impact of Basel III is derived as the difference between the simulations under Basel III and the simulations for which banks do not adopt the Basel III finalisation package.

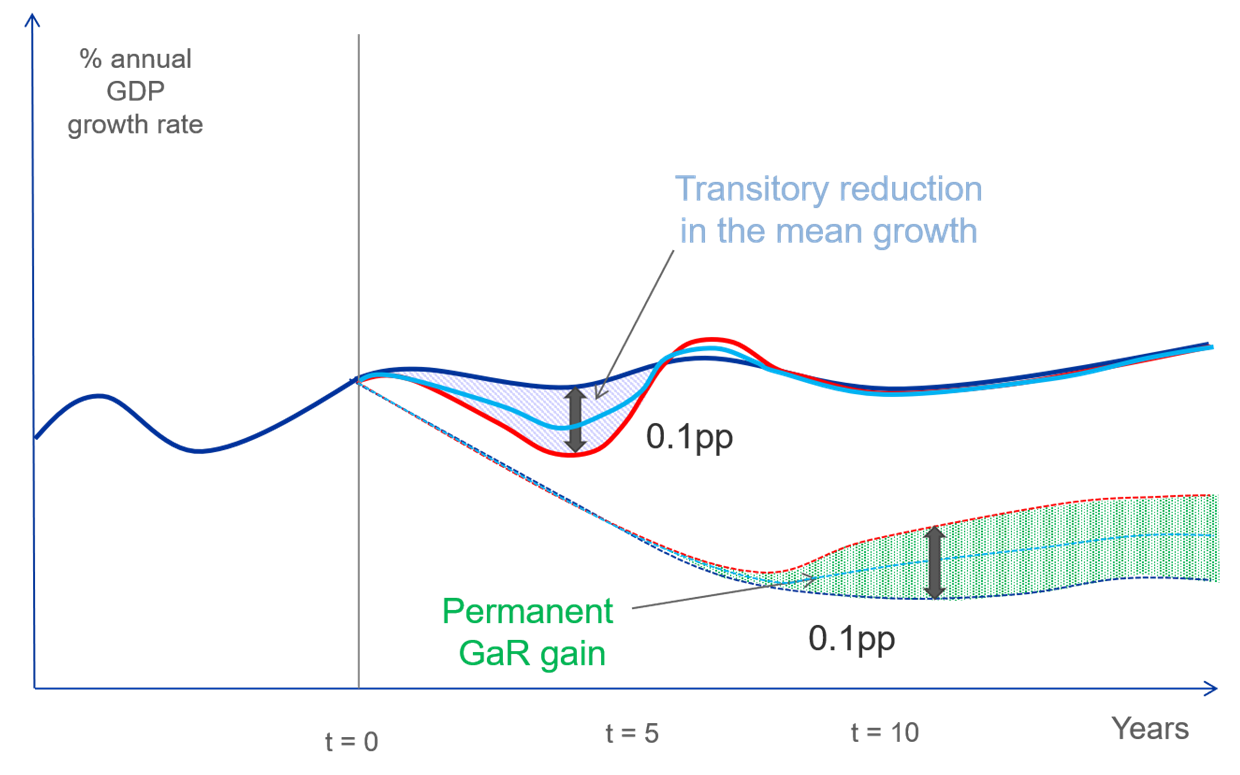

The effects of the Basel III package are assessed by following the GaR approach and by looking at both the means and the tails of the output distribution. [9] The means provide information about the expected effect of the package. A negative difference between the means of economic output, as illustrated by the blue-shaded area in Chart 1, would indicate the economic costs of introducing the package. Tails, or lower percentiles of the distribution, provide information about the effects of the package in adverse economic conditions. These tail events are measured by the 10th percentile of the output distribution, which makes it possible to capture sufficiently adverse circumstances while maintaining sufficient accuracy. A positive difference between the 10th percentiles of the distributions, represented by the green area in Chart 1, would therefore show the benefits of the Basel III finalisation which stem from improved financial intermediation when the economy is hit by a crisis.

Chart 1

Stylised representation of a GaR-based cost-benefit assessment

Alternative economic scenarios

Analogously to the 2020 EBA report, the simulations mostly assume implementation of the reforms starting from 2020. To this end, the model is updated with bank-level data from capital adequacy (COREP) and financial (FINREP) reports available until end-2019. The output floor is phased in gradually over five years.

The impact assessment is run under three alternative economic scenarios for 2020-22. The first, pre-COVID-19, scenario reflects the introduction of the Basel III finalisation in 2020 under “normal” economic conditions corresponding to economic forecasts which were available before the COVID-19 pandemic.[10] The second, COVID-19, scenario reflects the introduction of the Basel III finalisation in 2020 and accounts for the COVID-19 pandemic. It is anchored in the mid-2020 economic forecasts.[11] The third, post-COVID-19, scenario takes COVID-19 developments into account, although it assumes that implementation of the Basel III finalisation will only take place from 2023.

The scenarios that include COVID-19 developments account for the pandemic economic mitigation policies. The impact assessment of the Basel III finalisation under the COVID-19 and the post-COVID-19 scenarios takes account of public guarantees and moratoria. It also assesses measures taken by ECB Banking Supervision in 2020, such as providing banks with the flexibility to operate below Pillar 2 guidance, restrictions on profit distribution, or the front-loading of changes in Pillar 2 requirements, as set out in CRD V/CRR II.[12] Furthermore, to ensure a higher level of comparability between the pre-COVID-19 and the COVID-19 and post-COVID-19 scenarios, the latter scenarios assume the gradual restoration of Pillar 2 guidance from 2023, with capital expectations reaching their pre-pandemic levels in 2025.[13]

4 Costs and benefits of the Basel III finalisation

The transitory economic costs associated with the phase-in of the plain vanilla Basel III finalisation are moderate. In “normal” economic conditions, the implementation of the Basel III standards would result in approximately 0.60 percentage points lower annual growth of loans to the non-financial private sector and about 0.10 percentage points lower annual GDP growth in the euro area (the green bars in Chart 2). These costs decrease over time and the effect on GDP growth turns positive eight to nine years after the phase-in.

Chart 2

Lending and GDP costs of the plain vanilla Basel III implementation

Impact on lending (left) and GDP (right)

(y-axis: impact in percentage points, x-axis: years after the Basel III introduction)

Note: Impact is measured relative to the regime without Basel II finalisation.

The COVID-19 scenario amplifies the costs of the Basel III finalisation. Chart 2 contrasts the transitory reduction in lending and output growth in the pre-COVID-19 (‘”normal times”) scenario with the COVID-19 scenario marked by the dark-blue bars, assuming in both cases the structure of banks’ balance sheets when the reform is introduced to be as they were at the end of 2019. The chart shows that the Basel III finalisation would have resulted in higher macroeconomic costs if it had been implemented during the turbulent macroeconomic conditions caused by the COVID-19 pandemic.

The postponement of the phase-in of the Basel III finalisation until 2023 brings the costs of the package close to the costs estimated for the pre-COVID-19 scenario. As the orange dots in Chart 2 show, phasing in the Basel III finalisation in 2023, when the economic impact of the COVID-19 pandemics will have abated, results in a reduction of costs compared with the earlier implementation in the COVID-19 scenario.

The main EU-specific approach reduces the already moderate transitory economic costs of the plain vanilla package. In “normal” economic conditions, the implementation of the main EU-specific approach (the yellow dots in Chart 3) results in a less than 0.05 percentage point reduction in annual GDP growth from the second to the fourth year after the phase-in, compared with a 0.10 percentage point reduction for the plain vanilla package (the dark blue bars in Chart 3). Similarly, the reduction in lending is also cut by half in the same period. Beyond the initial five-year horizon, the macroeconomic costs of all EU-specific implementations fade and are close to the estimates for the plain vanilla package.

Chart 3

Lending and GDP costs of the plain vanilla versus three EU approaches to the Basel III implementation based on the pre-COVID-19 scenario

Impact on lending (left) and GDP (right)

(y-axis: impact in percentage points, x-axis: years after the Basel III introduction)

Note: Impact is measured relative to the regime without Basel II finalisation.

The EU alternative output floor and EU parallel stacks approaches fail to significantly reduce the costs associated with the main EU-specific approach. The EU alternative output floor approach (the red dots in Chart 3) and the EU parallel stacks approach (the solid green line in Chart 3) lead to slightly lower reductions in lending during the transition, although their impact on GDP growth is comparable to that of the main EU-specific approach.

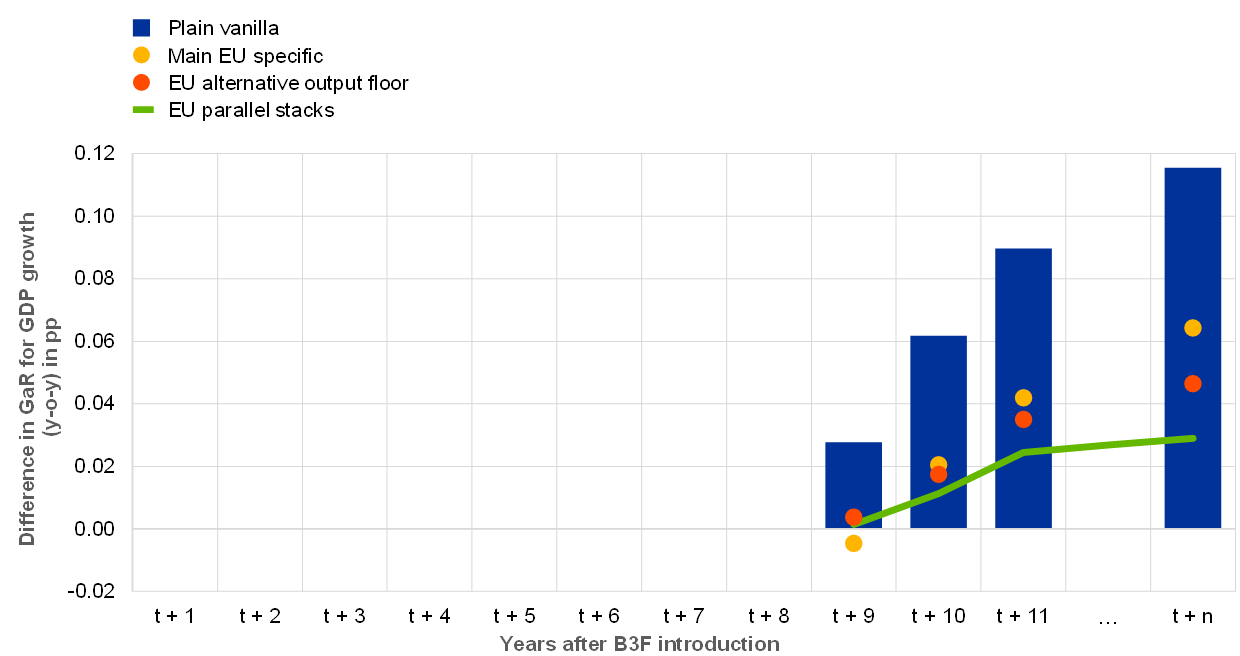

The long-term benefits of the plain vanilla Basel III finalisation amount to a permanent upward shift in the lower (10th) percentile of the GDP growth distribution by over 0.1 percentage points. The shift in GaR can already be observed from the ninth year after the introduction of the reforms (Chart 4). The implementation of Basel III therefore implies higher GDP growth in adverse economic circumstances, as banks would be more resilient and better able to support the real economy, even in severe downturns.

The long-term benefits of the EU-specific approaches are less than those of the plain vanilla package. The long-run benefits of the main EU approach are around 40% below those under the plain vanilla implementation. The benefits of the EU parallel stacks approach – which is the least binding implementation of the output floor – amount to a fraction (a quarter) of the long-term gains under the plain vanilla approach and less than half of the long-term gains of the main EU-specific approach.

Chart 4

The long-term GaR benefits of the plain vanilla approach versus the three EU approaches to the Basel III implementation

(y-axis: impact in percentage points, x-axis: years after the Basel III introduction)

Note: The difference shown is between annual euro area GDP growth with versus without Basel III finalisation in the 10th percentile of the corresponding output growth distributions. The type of scenario assumed for the first three years following the introduction of the Basel III finalisation (i.e. pre-COVID-19 or COVID-19) does not affect this long-term estimate.

The transitory costs of the plain vanilla Basel III approach are outweighed by its permanent long-run benefits. Chart 5 summarises the balance between the costs and benefits of the plain vanilla approach and the main EU-specific approach. The costs amount to a transitory reduction in output growth of around 0.1 percentage points under the plain vanilla approach in the first years following the implementation. The benefits amount to a permanent upward shift in GaR, namely in the lower (10th) percentile of the GDP growth distribution, of over 0.1 percentage points. The costs and benefits of the main EU-specific approach are roughly halved compared with the plain vanilla implementation. The shift in GaR marks higher GDP growth in adverse economic circumstances due to the increased resilience of banks, which are better able to support the real economy, even in severe downturns.

Chart 5

Summary of the cost-benefit assessment of the plain vanilla and the main EU approach to the Basel III implementation

Impact on GDP

(percentage points, y-axis: GDP growth in %, x-axis: years after the Basel III introduction)

Note: Stylised representation.

The solid blue line illustrates the mean GDP growth rate without Basel III finalisation;

the solid red line represents the mean GDP growth rate with the plain vanilla Basel III finalisation; and the solid light blue line the mean GDP growth rate with the main EU-specific Basel III finalisation. The dotted blue line shows the GaR in the absence of Basel III finalisation; the dotted red line shows the GaR in the presence of the plain vanilla Basel III finalisation; and the dotted light blue line shows the GaR in the presence of the main EU-specific Basel III finalisation.

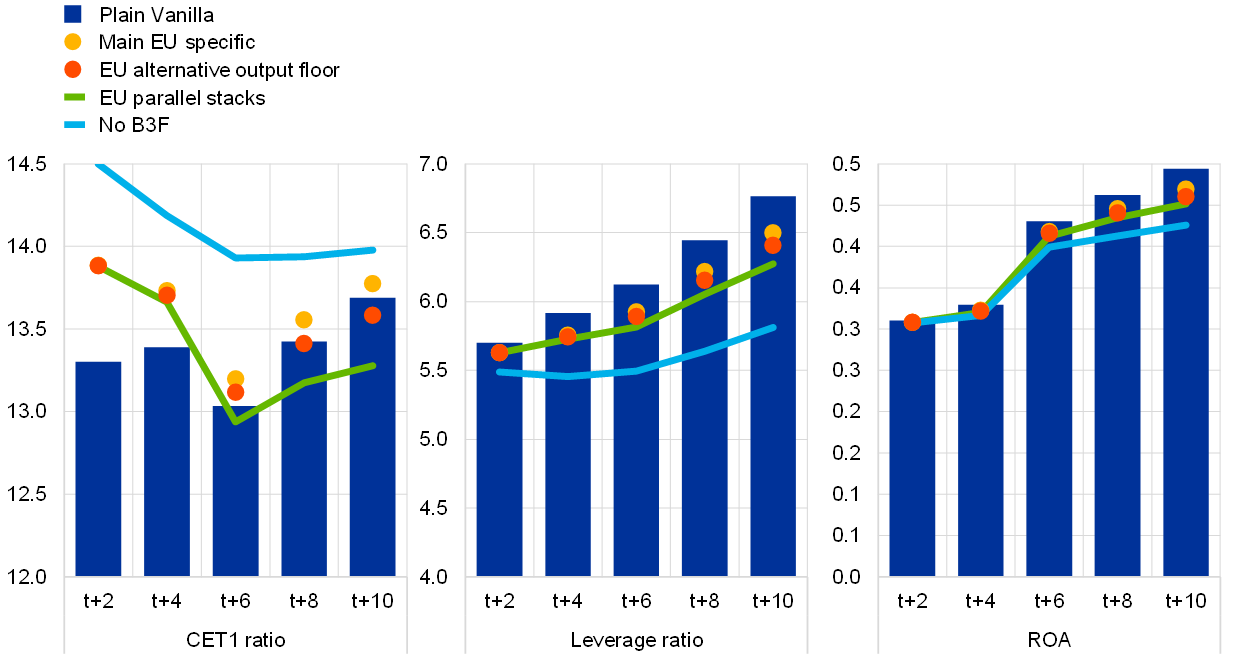

5 The dynamic impact on bank solvency

Completing the Basel III reforms will benefit long-term bank solvency and profitability. An increase in risk-weighted exposures generally reduces the floored CET1 ratio, especially during the phase-in of the reform (Chart 6). The initial capital shortfall stimulates banks’ capital accumulation over time. The ensuing increase in the solvency of the banking system, amounting to an 11% increase in CET1 capital to 2030 under the plain vanilla design, is reflected in a pronounced increase in the leverage ratio. The capital adjustment is supported by the positive impact of the reform on bank profitability (measured by return on assets, ROA) thanks to a virtuous feedback loop between increasing bank capitalisation and decreasing bank funding costs. In reality, such feedback loops may be further enhanced if more comparable and transparent capital ratios can help to enhance general investor confidence and positively affect banks’ overall funding costs.

Chart 6

CET1 ratio, leverage ratio and ROA under the plain vanilla and EU approaches, and without the Basel III finalisation package

CET1 ratio (left), leverage ratio (middle) and ROA (right)

(y-axis: percentages, x-axis: years after the Basel III introduction)

Note: Results are for the pre-COVID-19 scenario.

EU-specific designs entail lower long-term solvency and profitability gains compared with the plain vanilla implementation. The leverage ratio is 0.3-0.5 percentage points lower for any EU-specific approach than for the plain vanilla design, ten years after the phase-in of the package. Moreover, the positive impact of the Basel III finalisation on bank profitability is also compressed under EU-specific designs.

Banks that rely on the internal ratings-based (IRB) approach to calculate RWAs experience the highest increase in their solvency. Chart 7 shows the impact of each Basel III design option on CET1 capital in 2030 for two groups of banks distinguished by the regulatory approach they use to calculate RWAs. The first group includes banks that fully use the standardised approach, as in 2019, whereas the second group includes banks that at least partially use the IRB approach. A higher long-term increase in capital initiated by the Basel III finalisation for IRB than for other banks is in line with expectations, as the package aims to limit the reduction in capital requirements that banks can obtain by applying internal models. The finalisation of the Basel III reform will therefore make IRB banks in particular more resilient to shocks.

Chart 7

Impact on CET1 capital stock in 2030 for banks employing either predominantly standardised or IRB approaches

(y-axis: increase in capital stock as a percentage, x-axis: regulatory approach)

Note: The capital stock in 2030 as the percentage difference from the capital stock without the Basel III finalisation in place. The first group of banks includes banks that fully use the standardised approach, whereas the second group includes banks that at least partially use the IRB approach. Results are for the pre-COVID-19 scenario.

6 Conclusion

The transitory economic costs of the plain vanilla Basel III approach are outweighed by its permanent long-run benefits. The costs of the phase-in of the plain vanilla Basel III finalisation are moderate and amount to a transitory reduction of GDP growth by 0.1 percentage points from the second to the fourth year after its initialisation, and eventually disappear in the seventh year after the introduction of the reform. Notably, the postponement of the phase-in of the Basel III finalisation to 2023 was instrumental in bringing the costs of the package close to the costs estimated for “normal times” before the COVID-19 pandemic. Completing the Basel III reforms will benefit long-term bank solvency and profitability. Banks will be in a better position to absorb losses in adverse economic conditions and will face lower funding costs. The resulting economic benefits amount to a permanent long-run increase in economic resilience and are marked as a permanent upward shift in the lower tail of the GDP growth distribution to 0.1 percentage points above the level which would pertain in the absence of the reform.

The results show that implementing EU specificities may reduce the already moderate transitory economic costs but also reduces the long-run benefits of the Basel III finalisation. The macroeconomic costs of the main EU-specific approach – which involves implementing the SME supporting factor on top of the Basel SME preferential risk weight treatment, continuing the existing CVA exemptions and employing discretion with regard to the operational risk capital charge – are small, staying below a 0.05 percentage point reduction in annual GDP growth in the years directly following the initial phase-in, and gradually fading over the medium horizon. However, the long-run benefits of the main EU approach are around 40% less than the benefits under the plain vanilla implementation.

Approaches that, in addition to the above EU specificities, modify the implementation of the output floor fail to further reduce the short-term economic costs of the reform, although they decrease the benefits even further. The EU alternative output floor approach and the EU parallel stacks approach have a short-term impact on GDP growth which is comparable to that of the main EU specific approach. However, these deviations further reduce the long-run benefits of the reform. The long-run benefits from the least binding output floor implementation (the parallel stacks approach) are negligible, amounting to only a quarter of the benefits under the plain vanilla Basel III finalisation.

Most of the assumptions underlying the estimates of costs and benefits are conservative, which is likely to lead to an overstatement of the costs of the reforms. For example, it is assumed that banks will not have anticipated the moment of the Basel III finalisation phase-in, while in reality banks have several years to prepare and adjust before the new rules come into force. Furthermore, the model only incorporates the dynamics of the largest euro area banks. Since such banks are expected to be those most impacted by the final Basel III rules, this assumption overstates aggregate cost estimates. It is also assumed that banks do not tap equity markets and that they cannot raise capital by issuing new shares.

An important caveat is the assumption of no supervisory response. The analysis assumes that capital requirements and buffers will remain unchanged after the phase-in of the reform (while in fact supervisors are likely to prevent any automatic increases in the absolute value of Pillar 2 requirements[14]). This abstracts from the on-going initiatives aiming at increasing the comparability of capital risk charges across banks which could moderate the marginal impact of the Basel III finalisation package (such as the targeted review of internal models). For instance, the costs of the plain vanilla Basel III finalisation compared with the three EU-specific designs are overstated insofar as Pillar 2 requirements ensure sufficient coverage of risks not included under Pillar 1, and supervisors will eliminate any overlapping charges from Pillar 2 on risks prospectively covered by Pillar 1.

References

Adrian, T., Grinberg, F., Liang, N. and Malik, S. (2018), “The Term Structure of Growth-at-Risk”, IMF Working Papers, No 18/180.

Budnik, K., Balatti, M., Dimitrov, I., Groß, J., Kleemann, M., Reichenbachas, T., Sanna, F., Sarychev, A., Siņenko, N. and Volk, M., (2020) “Banking euro area stress test model”, ECB Working Paper Series, No 2469, September 2020.

Budnik K., Dimitrov, I., Giglio, C., Groß, J., Lampe, M., Sarychev, A., Tarbé, M., Vagliano, G., Volk, M. (2021a) “The Growth-at-Risk perspective on the system-wide impact of Basel III finalisation in the euro area”, Occasional Paper Series, No. 258, ECB, Frankfurt am Main, July 2021.

Budnik, K., Dimitrov, I., Groß, J., Jancoková, M., Lampe, M., Sorvillo, B., Stular, A. and Volk, M. (2021b), “Policies in support of lending following the coronavirus (COVID 19) pandemic”, Occasional Paper Series, No. 257, May 2021.

Budnik, K., Dimitrov, I., Groß, J., Kusmierczyk, P., Lampe, M., Sarychev, A., Vagliano, G. and Volk, M. (2021c), “The economic impact of the NPL coverage expectations in the euro area”, Occasional Paper Series, ECB, Frankfurt am Main, mimeo.

EBA (2019), Policy advice on the Basel III reforms: output floor, August.

EBA (2019), Basel III reforms: Impact study and key recommendations. Macroeconomic assessment, credit valuation adjustment and market risk, December.

EBA (2020), Basel III reforms: Updated impact study results based on data as of 31 December 2019.

ECB (2019), Communication on supervisory coverage expectations for NPEs.

ECB (2019), Staff macroeconomic projections for the euro area, December.

ECB (2020), Staff macroeconomic projections for the euro area, June.

Enria, A. (2019), “Basel III – Journey or destination?”, speech at the European Commission's DG Financial Stability, Financial Services and Capital Markets Union conference on the implementation of Basel III, Brussels, 12 November.

Wang, Y. and Yudong, Y. (2001), “Measuring Economic Downside Risk and Severity risk. Growth at Risk”, World Bank Policy Research Working Papers, No 2674.

- Other contributors include Marcin Borsuk, Louis Boucherie, Giacomo Giraldo, Martina Jancoková, Piotr Kusmierczyk, Gianluca Vagliano and Igor Esteban Zuccardi. The authors would like to acknowledge comments and suggestions made by Pascal Busch, Markus Behn, Alexandra Born, Claudia Mayer, Anton van der Kraaij, Fatima Pires, Carmelo Salleo and Kevin Tracol.

- See EBA (2020), “Basel III reforms: updated impact study. Results based on data as of 31 December 2019”. The impact assessment in this study updates the earlier analysis of Basel III reforms in EBA (2019), “Basel III reforms: impact study and key recommendations. Macroeconomic assessment, credit valuation adjustment and market risk”, 4 December.

- See Budnik et al. (2021a), “The Growth-at-Risk perspective on the system-wide impact of Basel III finalisation in the euro area”, Occasional Paper Series, No. 258, ECB, Frankfurt am Main, July 2021.

- See also EBA (2019), “Policy advice on the Basel III reforms: output floor”, August.

- See Budnik et al. (2020), Banking euro area stress test model, Working Paper Series, No 2469, ECB, Frankfurt am Main, September.

- See BIS (2019), Basel III monitoring exercise as of 31 December 2019.

- See SSM (2019), “Communication on supervisory coverage expectations for NPEs”.

- For an impact assessment of supervisory coverage expectations see Budnik et al. (2021c), “The economic impact of the NPL coverage expectations in the euro area”, Occasional Paper Series, ECB, Frankfurt am Main, mimeo.

- For general introduction to the concept, see Wang and Yudong (2001), “Measuring Economic Downside Risk and Severity risk. Growth at Risk”, World Bank Policy Research Working Papers, No 2674, and Adrian et al. (2018), “The Term Structure of Growth-at-Risk”, IMF Working Papers, No 18/180, July. For the application to the regulatory assessment, see Budnik et al. (2021a), “The Growth-at-Risk perspective on the system-wide impact of Basel III finalisation in the euro area”, Occasional Paper Series, ECB, Frankfurt am Main, Mimeo.

- ECB staff macroeconomic projections for the euro area, December 2019.

- ECB staff macroeconomic projections for the euro area, June 2020.

- For details on the implementation of the COVID-19 mitigation policies in the model, see Budnik et al. (2021b), Policies in support of lending following the coronavirus (COVID-19) pandemic, Occasional Paper Series, No 257, ECB, Frankfurt am Main.

- The assumed timing and capital expectations are not intended to reflect the actual replenishment actions of the ECB. In its communication since July 2020 the ECB has committed to allowing banks to operate below the P2G and the combined buffer requirement until at least end-2022, and it has stated that it would not require banks to start replenishing their capital buffers before the banking sector has reached peak capital depletion (see "ECB extends recommendation not to pay dividends until January 2021 and clarifies timeline to restore buffers", press release, 28 July 2020).

- See Enria, A. (2019), Basel III – Journey or destination?, speech at the European Commission's DG Financial Stability, Financial Services and Capital Markets Union conference on the implementation of Basel III, Brussels, 12 November.