Enhancing macroprudential space when interest rates are “low for long”

The availability of larger releasable buffers before the pandemic would have provided an important complement to the monetary policy mix. Had authorities built up larger countercyclical buffers (CCyB) before the pandemic, it would have been easier to release usable capital in response to the crisis. The prevailing “lower for longer” interest rate environment reinforces the case for building up releasable bank capital buffers in good times to be consumed when a crisis hits, thereby lowering the point where dividend restrictions would be triggered. This article shows that the usefulness of creating macroprudential space by enhancing countercyclical capacity (via proactive use of the CCyB) can effectively complement monetary policy actions during a crisis – particularly when constrained by the effective lower bound on interest rates – and thereby improve the policy mix available to achieve better macro-financial stabilisation.

1 The importance of a well-capitalised banking sector

The strengthening of banking sector solvency after the global financial crisis meant that euro area banks entered the coronavirus (COVID-19) crisis in a solid position. The unexpected emergence of the COVID-19 pandemic and the sheer scale of the real economic impact illustrate the usefulness of a well-capitalised banking sector. So far, thanks to their much improved solvency positions, euro area banks have been able to weather the current storm better than other recent crises (i.e. the global financial crisis and the euro area sovereign debt crisis). ECB’s recent vulnerability analysis showed that under the central, and most likely, scenario “the banking sector is currently sufficiently capitalised to withstand a short-lived deep recession”.[1] Moreover, in a more severe scenario, even if a number of banks need to take action to maintain compliance with their minimum capital requirements, the overall shortfall would remain contained, showing that the banking sector as a whole is sufficiently capitalised.

The limited build-up of releasable capital before the crisis has, however, somewhat hampered the ability of macroprudential authorities to act countercyclically. Notwithstanding the high overall levels of bank capitalisation going into the crisis, the composition of bank capital could have been better optimised, as the amount of releasable capital in the euro area was limited, especially in the form of the countercyclical capital buffer (CCyB).[2] As discussed elsewhere in this issue of the Macroprudential Bulletin, this has constrained the ability of macroprudential authorities to free up capital in order to help banks absorb losses and support economic activity without breaching buffer requirements and thereby triggering maximum distributable amount (MDA) reductions.[3]

A more aggressive build-up of countercyclical capacity prior to the COVID-19 crisis would have given macroprudential authorities more policy space. This article presents model-based simulations to illustrate the usefulness of creating macroprudential policy space by enhancing countercyclical capacity through more proactive use of the CCyB. To illustrate this point, the article views the usefulness of countercyclical macroprudential policy through the lens of the ongoing economic downturn related to the COVID-19 pandemic. It also demonstrates that a stronger CCyB build-up before the crisis would have facilitated monetary policy conduct in support of the economy. This policy complementarity, it is argued, is especially important in the current context of very low interest rates.

2 The usefulness of a more proactive countercyclical capital buffer

A model-based assessment illustrates the usefulness of releasable capital against the backdrop of the COVID-19 pandemic. We use a general equilibrium model incorporating a capital-constrained banking sector and calibrated to a low interest rate environment to demonstrate how a more or less proactive CCyB setting affects economic resilience to shocks.[4] The model is described in more detail in Box 1. To illustrate the importance of enhancing the banking sector’s countercyclical capacity in a timely manner, the model simulates an economic downturn scenario compatible with the observed COVID-19 pandemic shock hitting the euro area economy in 2020.

Had banks held larger releasable CCyBs could have given them more leeway to mitigate the impact of the crisis on their balance sheet. The economic downturn exerts pressure on banks’ balance sheets and solvency position through higher losses and lower demand for financial services. In response, to shield their solvency position, individual banks may have a natural inclination to deleverage their balance sheets.[5] Widespread deleveraging, however, could further accentuate the decline in economic activity.[6]

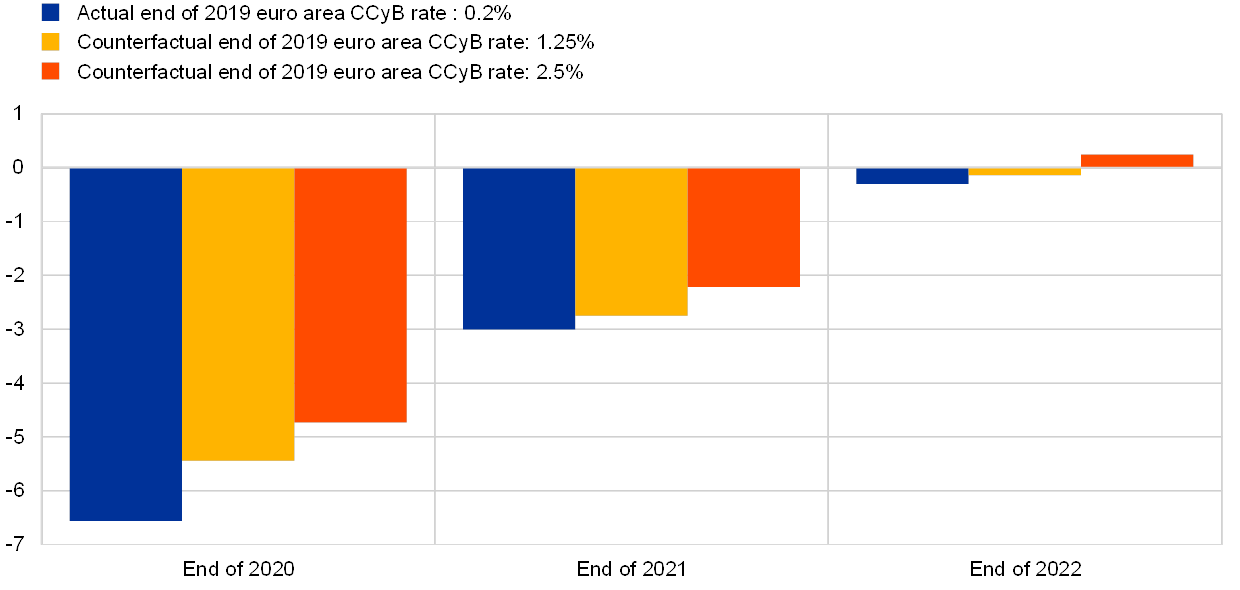

Counterfactual simulations indicate that higher CCyB accumulation before the crisis could have provided important support to bank intermediation capacity during the crisis. So far in 2020, the growth of credit to the non-financial private sector has been robust, driven in particular by firms’ operational financing needs due to reduced cash flows and supported by the sizeable government support measures, substantial monetary policy accommodation and prudential measures.[7] This notwithstanding, the model-based simulations demonstrate that, had the banking sector entered the crisis with higher countercyclical capacity in the form of a larger CCyB, the prudential buffer release actions might have been more forceful, as banks would have faced less stigma for consuming their buffers. Assuming that banks would have made use of the larger CCyB, Chart 1 shows that at the end of 2022 bank credit growth could have been between 2.0% and 4.5% higher under two counterfactual simulations with pre-crisis CCyB levels of, respectively, 1.25% and 2.5% at the euro area aggregate level.[8]

Chart 1

Bank credit growth for different levels of countercyclical capacity

(bank asset growth as percentage deviation from baseline projection with actual pre-crisis CCyB; end of 2022)

Source: Simulations based on Darracq Pariès, Kok and Rottner. (2020).

Note: The baseline is the central forecast of the June 2020 Eurosystem staff macroeconomic projections.

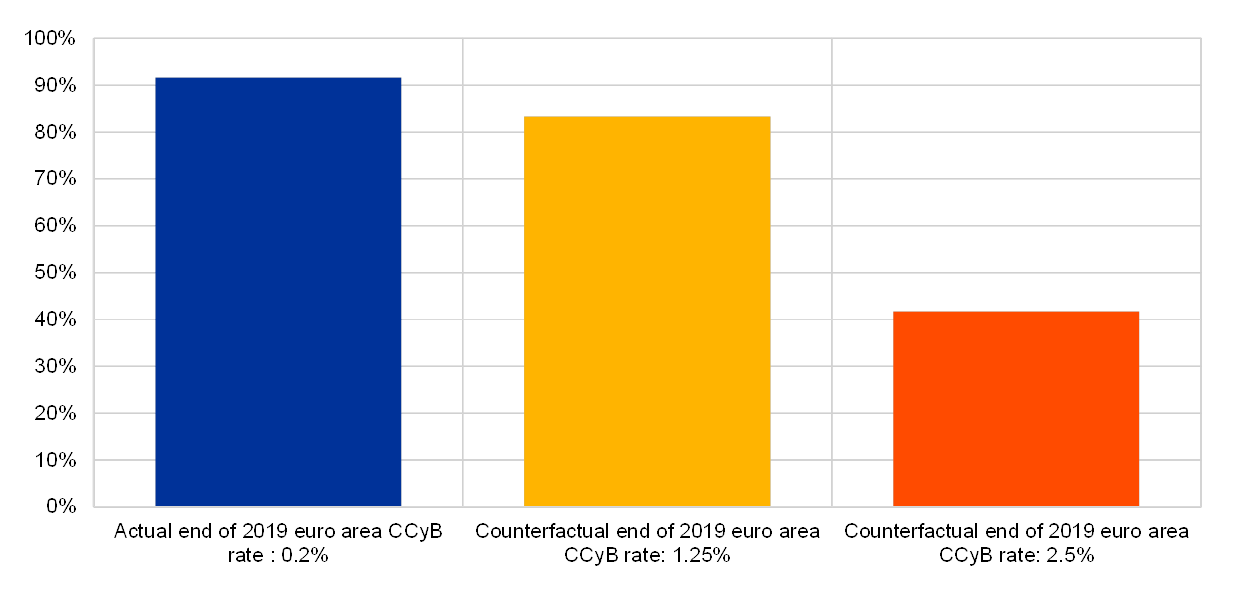

A more aggressive build-up of the CCyB before the crisis would have shielded the economy better. Chart 2 shows the projected path of euro area real GDP (expressed in percentage deviation from the 2019 level) reflecting the demand and supply-side shock following the lockdowns triggered by the COVID-19 pandemic. The blue bars are consistent with the central forecast of the June 2020 Eurosystem staff macroeconomic projections and thus reflect the actual build-up of CCyB in the euro area banking sector of about 0.2% at the end of 2019. The yellow and red bars indicate the projected path of economic activity if authorities had built up larger CCyBs before the crisis (at the end of 2019). It can be seen that, had a more sizeable CCyB been in place, here illustrated by CCyBs of 1.25% and 2.5%, respectively, at the end of 2019, more capital could have been released without triggering MDA restrictions and exposing banks to related stigma effects, preventing them from dipping into their buffers. This would have freed up capital for banks to continue servicing the economy (as shown in Chart 1) and would consequently have supported the resilience of the corporate sector during the recession, leading to a less severe contraction in 2020. More specifically, greater active countercyclical capacity could have limited the fall in the level of real GDP by around 1 to 1.75% in 2020, 0.25 to 0.75% in 2021 and 0.1 to 0.4% in 2022 (see the blue, yellow and red bars in Chart 2).

Chart 2

Real GDP for different levels of countercyclical capacity

(percentage deviation of real GDP level from baseline projection with actual pre-crisis CCyB)

Source: Simulations based on Darracq Pariès, Kok and Rottner (2020).

Note: The GDP path depicted for the series “Actual euro area CCyB rate at end of 2019: 0.2%” corresponds to the June 2020 Eurosystem staff macroeconomic projections (central forecast).

3 Enhancing banks’ countercyclical capacity can reinforce the monetary policy transmission mechanism

A banking sector with more releasable capital enhances the effectiveness of the bank lending channel of monetary policy transmission. In an environment of very low, and even negative, interest rates where at least conventional monetary policy may be constrained by the zero lower bound, a buffer of releasable capital can help dampen contractionary shocks and provide support to the bank lending channel of monetary policy. This is due to the fact that a banking sector with sufficient usable capital can cushion a hit to its net worth better when a contractionary shock occurs and is therefore more able to sustain its financial intermediation function and support the real economy. This reduces the likelihood that bank lending will become unresponsive to interest rate reductions.

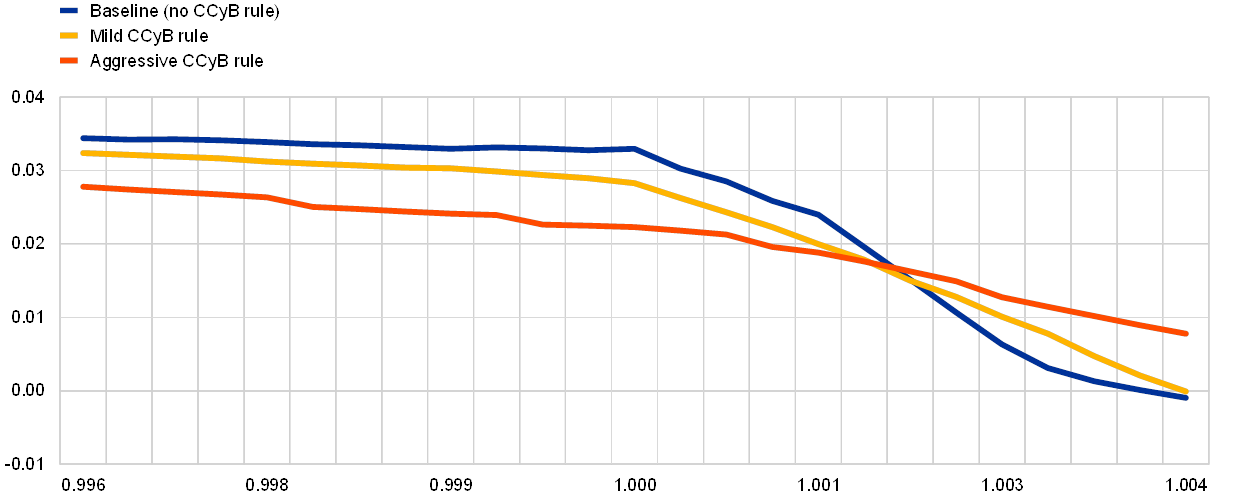

This supportive role of the banking sector implies that the economy should encounter less severe recessions and need fewer interest rate reductions. A key feature of the model applied in this article is that it is tailored towards studying monetary and macroprudential policy interactions in a low interest rate setting (see also Box 1). Specifically, we find that if banks’ pre-crisis countercyclical capacity had been higher, the likelihood of monetary policy being constrained by the effective lower bound would have been reduced (see Chart 3). It is important to highlight that this does not imply that monetary policy accommodation is constrained in these circumstances, but simply that its transmission may be somewhat less efficient.[9] In other words, when the banking sector has more releasable capital, monetary policy potentially retains more of its efficiency, even in the face of large shocks such as the COVID-19 pandemic.

Chart 3

Likelihood of hitting the zero lower bound for different levels of countercyclical capacity

(percentage of quarters over the period 2020-22 where the policy rate could be constrained by the zero lower bound)

Source: Simulations based on Darracq Pariès, Kok and Rottner (2020).

Note: The macroeconomic scenario underlying the simulation corresponds to the June 2020 Eurosystem staff macroeconomic projections (central forecast).

While a proactive CCyB setting helps to restore the monetary policy transmission mechanism in the event of large contractionary shocks, it also affects it in normal times. Notwithstanding the benefits of having a resilient banking sector during crisis times, the macroprudential authorities face a trade-off between stabilising the economy in times of crisis and building up large buffers which may rein in economic activity during cyclical expansions. Model-based evidence presented in Box 1 (see Chart A) suggests that, all else being equal, the economic cost of increasing capital buffers may be smaller than the economic benefits of releasing it, particularly as, in practice, the building-up phase can be spread over a considerable period of time. Overall, even if buffers are somewhat costly to build-up in good times, they are key to stabilising the economy in bad times, and adequate macroprudential space is warranted through the cycle.

Box 1

A non-linear DSGE model for a “low for long” interest rate environment

The simulations presented in this article are based on a newly developed non-linear dynamic stochastic general equilibrium (DSGE) model.[10] This box describes the key features of the model.

Key features of the model

The setup is a New Keynesian macroeconomic framework. The model contains a carefully designed banking sector with three key features. First, banks are assumed to be capital constrained, giving rise to financial accelerator effects as in Gertler and Karadi (2011).[11] Second, banks have market power in setting the deposit rate. However, while banks’ market power is strong in good times, it weakens if the policy rate approaches a negative environment, as in Brunnermeier and Koby (2018).[12] As a consequence, monetary policy affects the deposit rate less if interest rates are low. Third, banks are required to hold low risk, liquid assets for a proportion of their funding based on reserve requirements and regulatory constraints, as in Eggertsson et al. (2019).[13]

These features give rise to non-linear effects of economic shocks and monetary policy responses, depending on the initial state of the economy and the level of interest rates. If the economy is in a vulnerable state of weak growth and monetary policy rates are close to the zero lower bound, a shock to the economy (here assumed to be a shock to risk premia) can have non-linear, asymmetric effects owing to the fact that monetary policy loses some of its effectiveness. Chart A illustrates that in such a situation the negative economic effects of a large contractionary risk premium shock can be larger than the positive effects of a comparable expansionary risk premium shock (compare the solid and dashed blue lines). Economic intuition would suggest that an increase in risk premia, which is a contractionary shock, affects the consumption and savings decisions of households as well as the refinancing costs of banks. Households postpone consumption, so output drops. This affects banks, as their return on assets is lower and asset prices fall. In addition, the funding costs of banks increase. Both effects reduce the net worth and weaken the balance sheets of banks, which amplifies the shock via the financial accelerator mechanism. Monetary policy lowers the interest rate to mitigate the bust. However, the impact of such a policy is non-linear, owing to the imperfect deposit rate pass-through and the lower return on government asset holdings.

Chart A

Real GDP for different sized shocks to risk premia

(x-axis: quarters; y-axis: Percentage deviations to the steady state)

Notes: Impulse response functions of risk premium shocks that differ in the size and sign of the shock. A one standard deviation increase in the risk premium (solid lines) and decrease (dashed lines). Deviations are in percentages. The economy is initially at the risky steady state.

At very low or negative interest rate levels, monetary policy becomes less effective and can even enter “reversal interest rate” territory in which marginal monetary policy accommodation produces contractionary effects.[14] This is illustrated in Chart B, which shows the first period impact on real GDP of an exogenous one standard deviation monetary policy shock for various risk premium shocks (blue line). If the risk premium shock is negative or around zero, which can be interpreted as an expansion or tranquil times respectively, monetary policy is very effective. Importantly, the nominal interest rate is high and is passed through efficiently. In this case, there is no strong state-dependency. In contrast to this, as the bank lending channel of monetary policy transmission becomes less effective, policy rate reductions are less powerful in recessions than in booms, when interest rates are close to the lower bound. This can be seen for large risk premium shocks, where the expansionary impact of monetary policy is reduced and can even become negative (i.e. a reversal interest rate).

Chart B

Real GDP impact of a policy rate reduction for different sized risk premium shocks, with and without active macroprudential policy

(x-axis: size of risk premium shock; y-axis: real GDP impact of monetary policy rate reduction in percentage deviation to baseline)

Notes: First period response to a monetary policy shock combined with different sized premium shocks to compare the baseline with the macroprudential rule. The vertical axis displays the state-dependent difference for the period t = 1 response between a shocked path, which introduces a negative one standard deviation innovation for the monetary policy shock, and a path in which the monetary policy innovation does not occur. The state-dependence results from the different sized risk premium shock that occurs simultaneously in the first period, which is displayed on the horizontal axis.

A proactive macroprudential policy that enhances the resilience of the banking sector over the cycle can preserve the effectiveness of the bank lending channel, as bank net worth is improved and thus more able to withstand shocks, even when interest rates are low. To illustrate this point, the model incorporates macroprudential policy in the form of a CCyB rule whereby authorities build up capital in good times to be drawn down during crisis times. The red and yellow lines in Chart B show that macroprudential policy can be used to avoid reaching a territory with a reversal interest rate. As the buffer dampens contractionary shocks, the economy encounters less severe recessions and fewer interest rate reductions. This implies that monetary policy retains more of its efficiency and is less likely to enter the region with a reversal interest rate. Similarly, in Chart A, there is more symmetry in the transmission of positive and negative risk premium shocks when “aggressive” macroprudential rules are in place.

4 Conclusion

The CCyB is arguably better suited to addressing cyclical stress than other macroprudential buffers. Unlike other macroprudential buffers, the CCyB is specifically meant to be released in response to large macro-financial shocks, such as those encountered in 2020. As a CCyB release reduces the level of MDA triggers[15], all things being equal, less stigma should be associated with the consumption of this buffer comparatively to other buffers.

Counterfactual simulations show that the crisis response could have been enhanced if authorities had built up more macroprudential space. A counterfactual analysis assuming a larger pre-crisis CCyB than had actually been built up in the euro area banking sector before the crisis demonstrates that it could have shielded the economy better. Assuming that a released CCyB is more easily usable than other prudential relaxation measures, more sizeable pre-crisis CCyBs could have provided banks with more countercyclical capacity and thus support the smooth provision of financial services to the real economy. This could have shielded economic activity better and complemented monetary policy (and fiscal) accommodation more effectively.

- See COVID-19 Vulnerability Analysis – Results overview, ECB, 28 July 2020.

- See, for example, Darracq Pariès, M., Fahr, S. and Kok, C. (2019), “Macroprudential space and current policy trade-offs in the euro area”, Financial Stability Review, ECB, May; and the article entitled “Macroprudential capital buffers – objectives and usability” in this issue of the Macroprudential Bulletin.

- The Maximum Distributable Amount, as defined in Article 141 of Directive No 2013/36 (Capital Requirements Directive, CRD IV), determines the absolute EUR amount that banks can distribute to shareholders. When a bank’s CET1 ratio falls below its Combined Buffer Requirement the MDA will be gradually lowered.

- Importantly, in the model, in addition to the regulatory capital constraint (here modelled as a CCyB), banks also face a market-based capital constraint. Therefore, the regulatory capital buffer is an occasionally binding constraint. It affects the capitalisation of the banking sector asymmetrically, depending on the state of the world. This feature is also in line with empirical findings suggesting that market pressure is an impediment to buffer usability; see, for example, the article entitled “Financial market pressure as an impediment to the usability of regulatory capital buffers” in this issue of the Macroprudential Bulletin.

- For an account of euro area bank deleveraging during the Global Financial Crisis and the sovereign debt crisis, see “EU bank deleveraging – driving forces and strategies”, special feature in the June 2012 Financial Stability Review, and “Deleveraging by euro area banks”, Box 5 in the May 2013 Financial Stability Review.

- The prudential, fiscal and monetary policy measures taken in response to the COVID-19 pandemic are likely to have mitigated such real-financial feedback effects. See also Darracq Pariès, M., Kok, C. and Rancoita, E. (2020), “Macroeconomic impact of financial policy measures and synergies with other policy responses”, Financial Stability Review, ECB, May.

- See ECB Economic Bulletin, September 2020.

- While the modelling approaches and the asset coverage are not strictly comparable, these estimates are similar in magnitude to the loan growth simulations presented in “Buffer Use and Lending to the Real Economy” in Enria, A., “The coronavirus crisis and ECB Banking Supervision: taking stock and looking ahead”, The Supervision Blog, ECB, 28 July 2020. See also the article entitled “Buffer use and lending impact” in this issue of the Macroprudential Bulletin.

- Importantly, here we only consider the interest rate instrument, while other monetary policy instruments, such as long-term liquidity providing operations (e.g. TLTROs) and asset purchase programmes (e.g. APP, PEPP), are not considered.

- See Darracq Pariès, M., Kok, C. and Rottner, M. (2020), “Reversal interest rate and macroprudential policy”, Working Paper Series, ECB, forthcoming.

- See Gertler, M. and Karadi, P. (2011), “A model of unconventional monetary policy”, Journal of Monetary Economics, Vol. 58(1), pp. 17-34.

- See Brunnermeier, M. and Koby, Y. (2018), “The Reversal Interest Rate”, NBER Working Paper Series, No 25406, National Bureau of Economic Research.

- See Eggertsson, G.B., Juelsrud, R.E., Summers, L. and Wold, E.G. (2019), “Negative nominal interest rates and the bank lending channel”, NBER Working Paper Series, No 25416, National Bureau of Economic Research.

- See also Brunnermeier and Koby (2018), op. cit.

- See footnote 3 for a definition of MDA triggers.