Euro area bank profitability: where can consolidation help?

Published as part of Financial Stability Review, November 2019.

Low aggregate bank profitability in the euro area, which weakens the resilience of the euro area banking sector, is partly explained by the persistent underperformance of a sub-set of banks. These banks all stand out in terms of elevated cost-to-income ratios. But there also appear to be three distinct groups: (i) banks struggling with legacy asset problems; (ii) banks with weak income-generation capacity; and (iii) banks suffering from a combination of cost and revenue-side problems. The common cost inefficiency problem seems most pronounced for the largest and smallest banks. Three strategies, all of which should reduce overcapacity, could address the root causes, while avoiding increasing market power or the systemic footprint of institutions which are already systemically important. For some banks, the focus should be on targeting continued high stocks of NPLs. But in systems with many weak-performing small banks, consolidation within their domestic system could improve performance. Finally, a combination of bank-level restructuring and cross-border M&A activity could help reduce the costs and diversify the revenues of large banks that are performing poorly.

1 Introduction

Weak bank profitability has been identified as a risk to euro area financial stability since mid-2012 and analysed in several issues of the FSR. Retained bank profits form the first line of defence to absorb losses and build up capital positions. In recent years the euro area banking system has seen return on equity below the estimated cost of equity. Previous ECB analysis has examined the potential drivers of low profitability – including cyclical and structural factors.[2] This work has found that cyclical constraints, such as large stocks of legacy assets, have been important since the crisis, and the low interest rate environment has also constrained bank profitability. Yet, over time, structural issues such as poor cost-efficiency, overcapacity, competitive dynamics and insufficient income diversification have come to the forefront.

A banking system operating with significant overcapacity is prone to unhealthy market dynamics. Weak competitors might follow “gambling for resurrection” strategies and undercut the margins of healthier players. In a situation of fierce competition, banks may be able to cover their variable costs, but not their fixed costs, thus depressing investment in digitalisation and in the adjustment of business models. In turn, the resilience and longer-term prospects of the industry may deteriorate. At the same time, there is no clear exit mechanism for poorly performing, but marginally profitable and adequately capitalised banks, which may not be attractive as takeover targets. There is a natural comparison with zombie firms, which earn low returns and suffer from poor productivity, leading to weaker aggregate economic performance.[3]

Structural changes in the banking sector need to be part of the solution to the weak bank profitability problem. First, banks themselves can address structural inefficiencies to improve their performance. In fact, the set of profitable banks in the euro area have been found to have done exactly this: they have diversified their income sources, improved their cost-efficiency and invested in digital technologies. Second, consolidation in the banking sector may allow banks to use economies of scale and scope, which in principle should bring about improved profitability. Cross-border mergers, while less likely to produce cost savings or economies of scale, would have an additional benefit of improved risk diversification and, thus, more resilient profitability.[4] Finally, authorities need to support the process, not least by removing obstacles to cross-border M&As and other factors hampering the progress towards addressing overcapacity in the sector. This special feature furthers this discussion by examining the issues faced by the weakest-performing banks in the euro area and by drawing out implications for possible solutions.

2 Who are the underperformers?

Persistent underperformance by a sub-set of banks explains much of the weakness in overall euro area bank profitability. While the median significant institution (SI) earned a return on equity close to 6% between 2015 and 2018, about one quarter of institutions achieved less than 3%. The cohort of underperforming significant institutions is identified as those which recorded a below-median return on equity in at least three years between 2015 and 2018. Stronger cyclical momentum, as well as a reduction in non-performing loans (NPLs) and leaner cost structures, have led to some improvement in profitability of weaker performers; however, their returns are consistently below estimates of their cost of equity (see Chart A.1, left panel).

These underperforming banks are heterogeneous in terms of their location and business model. By geographical location, banks from countries more affected by the crisis (including Italy and Spain) and from Germany are over-represented relative to their share in the total number of significant institutions (see Chart A.1, right panel). Moreover, the group is heterogeneous across multiple standard metrics of balance sheet strength and efficiency (e.g. regulatory capital ratios, NPL ratios and cost-to-income ratios).

Cluster analysis finds some common patterns and identifies key drivers of weak profitability in the group of underperformers. Using a non-hierarchical clustering method, underperforming banks are statistically grouped into various clusters based on the potential sources of weakness, such as NPL ratios, cost-to-assets ratios and income-to-assets ratios. This captures cost inefficiencies and weak revenues, respectively, and the share of (current account) deposits in total liabilities to account for the sensitivity to low interest rates.

A number of banks have showed persistently weak profitability over recent years, with the group of underperformers dispersed geographically

Sources: ECB supervisory data and ECB calculations.Notes: Left panel: The green shaded area represents an indicative target range of 6-10% return on equity based on survey-based evidence on banks’ medium and long-term targets, as well as cost of equity estimates. The red rectangle represents the cohort of underperforming banks, i.e. those which recorded a below-median return on equity in at least three years between 2015 and 2018. Right panel: Other countries more affected by the crisis include Cyprus, Greece, Ireland, Portugal and Slovenia.

Three groups can be identified in the data:

Group 1: Legacy asset carriers: Weak profitability for this set of institutions appears to be driven by high levels of NPLs (see Chart A.2); all banks in this cluster displayed an average NPL ratio above 20% between 2015 and 2018, much higher than the average ratio, which declined from about 7% to less than 4%. The banks in this group do exhibit a relatively high income-to-assets ratio, reflecting higher interest rates to less creditworthy borrowers. However, the higher cost of managing troubled assets results in an elevated cost-to-income ratio. Unsurprisingly, most banks in group 1 are located in countries more affected by the euro area debt crisis such as Greece, Italy, Cyprus and Portugal.

Group 2: Weak revenues: Low profitability appears to be driven by weak income-generation capacity. All institutions in this group display a very low income-to-assets ratio: the average for the group stands only at around half that of more profitable banks (see Chart A.2). In turn, the cost-to-income ratios of these banks are high despite a lean cost structure. This cluster is dominated by German lenders, potentially highlighting the high degree of price competition in this market.

Group 3: Multiple sources of weak profitability: The third group is more heterogeneous regarding drivers of weak profitability, with different combinations of cost and revenue-side problems as well as, in some cases, elevated NPLs.

Underperformers can be divided into three groups, with legacy asset problems, cost inefficiencies and weak revenues among the main sources of weakness

NPL, cost-to-income, cost-to-assets and income-to-assets ratios by group of underperformers

(averages for 2015-18, percentages)

Sources: ECB supervisory data and ECB calculations.Notes: Group 1 comprises eight banks with total assets of €0.5 trillion, Group 2 comprises 12 banks with total assets of €2.8 trillion and Group 3 comprises 20 banks with total assets of €1.2 trillion. The benchmark is defined as averages for significant institutions which do not belong to the group of underperformers.

3 The common cost and overcapacity problem

An elevated cost-to-income ratio is a common feature for all groups of poorly performing banks. Therefore, this special feature goes on to estimate cost inefficiencies for various classes of banks.

In a first step, each bank’s costs are benchmarked against the best performers in the industry. The analysis covers a comprehensive sample of commercial, cooperative and savings banks in the euro area.[5] For each bank, the costs which its most efficient peer would incur to provide the same amount of financial intermediation are estimated. Subsequently, a bank’s actual efficiency is measured relative to the estimated optimal cost structure. The method takes into account that banks provide financial intermediation services beyond lending and face different input costs.[6] This enables a comparison of the results across business models and across countries in the euro area where the labour markets remain largely fragmented along national borders and wages vary across countries.

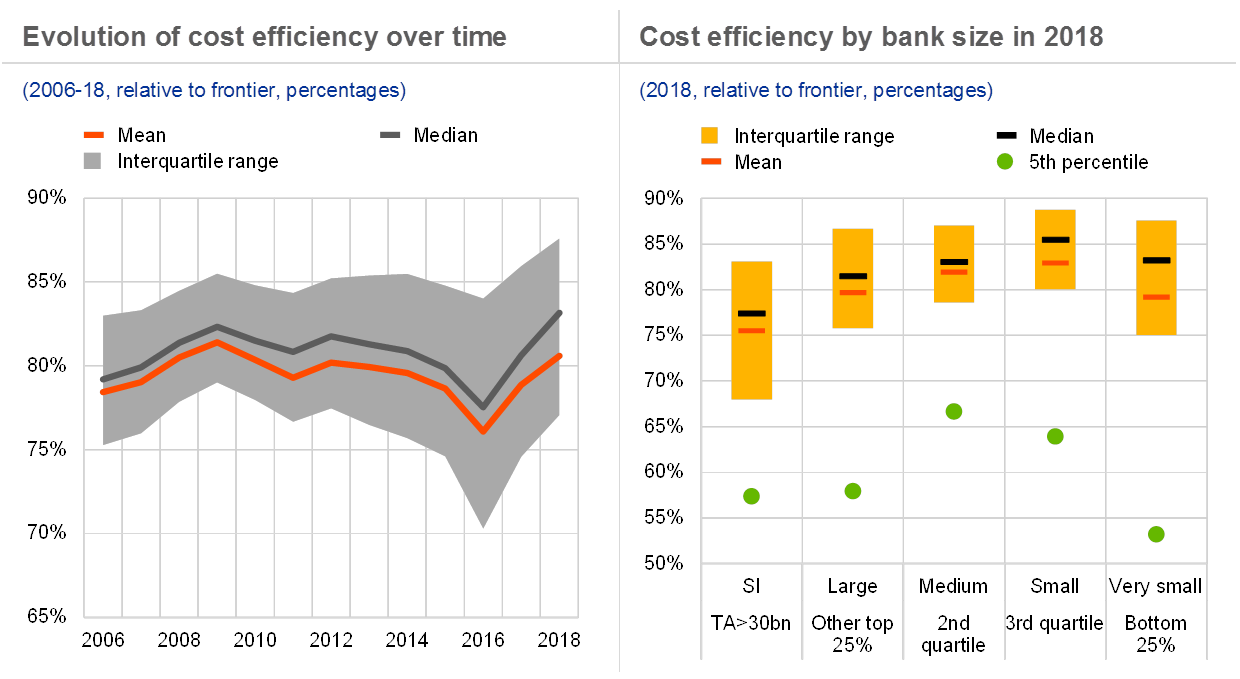

Banks with total assets of more than €30 billion as well as particularly small lenders exhibit pronounced cost inefficiencies. After a period of persistent decline between 2012 and 2016, the average cost-efficiency of euro area banks improved from 2016 to 2018 from 76% to 81% (see Chart A.3, left panel). However, the dispersion around the mean remains elevated and skewed towards lower efficiency levels. While cost inefficiencies can be found for banks across all sizes, they appear particularly pronounced for banks belonging to the very bottom and very top 25% in terms of size (see the 5th percentile, Chart A.3). Moreover, the average efficiency of banks with more than €30 billion of total assets and those in the smallest size category is also lower.

Cost inefficiency is most pronounced among the smallest and the very large banks

Sources: Bureau Van Dijk Bank Focus and ECB calculations.Notes: Based on a stochastic frontier analysis for euro area commercial banks, cooperative banks and savings banks. A value of 80% implies that the most efficient banks would be able to provide the same amount of financial intermediation services at just 80% of the cost. The group of banks with total assets above €30 billion comprises 108 institutions, and the remaining top 25% comprises 290, the 2nd quartile 368, the 3rd quartile 372 and the bottom 25% 344. While the estimations have been carried out for a pooled sample of banks, the results also hold when the frontier is estimated separately for different bank types.

Small commercial and savings banks and large cooperative banks seem to operate with particularly sub-optimal cost structures. Chart A.4 presents the cost (in)efficiency metric by bank type. Two patterns emerge. First, commercial banks as a group appear less efficient. This finding, however, may be distorted by the complex range of financial services offered by these banks. As some of them are only imperfectly captured in the analysis,[7] cost inefficiencies may be overstated. Second, cost inefficiencies among the smallest banks appear significantly elevated for the group of commercial and savings banks compared with larger peers. By contrast, it is the largest cooperative banks that exhibit lower cost-efficiency.

Cooperative, commercial and savings banks differ in terms of cost efficiency

(2018; x-axis: banks by type and size; y-axis: bank efficiency, relative to frontier; percentages)

Sources: Bureau Van Dijk Bank Focus and ECB calculations.Note: Based on a stochastic frontier analysis for the universe of euro area commercial banks, cooperative banks and savings banks.

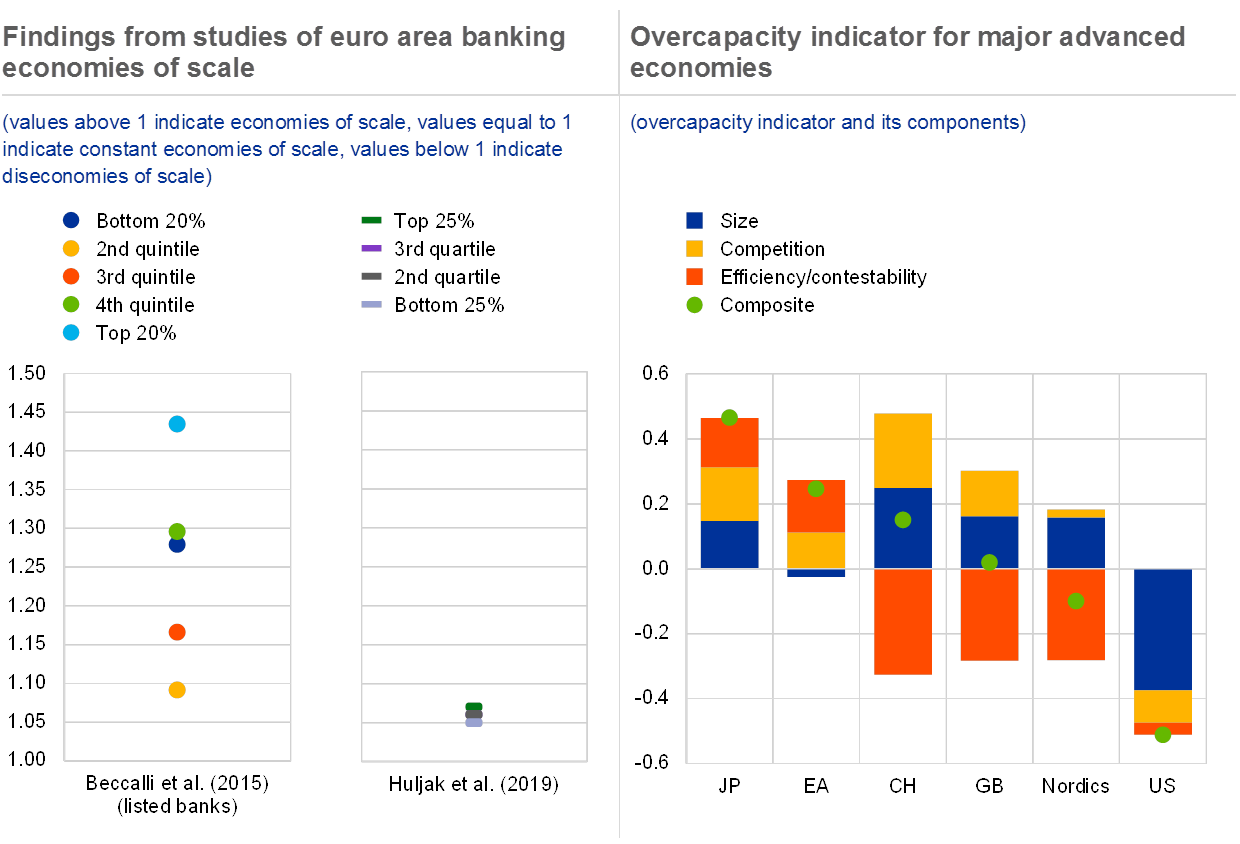

Recent empirical evidence suggests that euro area banks across all size categories also operate on an inefficient scale. Cross-country studies of euro area banks generally seem to support the existence of economies of scale for all size categories,[8] but they are particularly strong for the largest banks (see Chart A.5, left panel[9]). Moreover, some researchers point to information technology as a possible source of economies of scale in banking.[10]

But improving operational efficiency could be impeded by structural features of the euro area banking market. The ECB has long noted that the operations of many euro area banks should become leaner, more digital and more agile to reduce costs and boost profitability.[11] However, the stickiness of the cost base of euro area banks may reflect a deeper market structure issue. There is evidence of overcapacity in the euro area banking market, which manifests itself with two reinforcing phenomena: an excess of physical banking infrastructure and an excess number of competitors (see Chart A.5, right panel).[12] Some of these competitors operate under a non-profit charter, which reduces the market-based incentives to tackle overcapacity.[13]

Cost-cutting and utilising economies of scale is difficult in a fragmented market with numerous, small competitors

Sources: Gardó and Klaus (2019) and ECB calculations.Notes: Right panel: The overcapacity indicator is constructed as a simple average of the z-scores of 12 sub-indicators selected on the basis of economic literature (four per category). Zero denotes an average level of capacity, and positive/negative readings denote more/less capacity than in an average banking system.

Overcapacity is also visible in evidence of limited pricing power for many banks. Bank loan-deposit margins in many euro area countries have been falling in the recent years. At the country level, loan pricing was not adjusted in response to changing estimates of future credit losses (see Chart A.6, left panel), which suggests that banks’ pricing power may be limited, possibly by the presence of weak players which aim at earning the variable costs and not at sustainable profitability over the economic cycle. The mark-ups which banks are able to extract from customers on top of marginal costs (see Chart A.6, right panel) are indeed rather low[14] for all banks except the largest ones, indicating a crowded marketplace where banks possess little market power. By contrast, large banks with total assets in excess of €30 billion command significant pricing power compared with the rest of the system.

Overcapacity in the euro area banking sector may lead to unhealthy competition, which has an impact on pricing behaviour

Sources: Bureau Van Dijk Bank Focus and ECB calculations.Notes: Left panel: Expected credit losses are obtained from banks’ internal ratings-based models and aggregated to the country level by using data reported by all banks which have an approved model for that country. Right panel: Data cover the four largest euro area countries. Mark-ups are measured using credit risk-adjusted Lerner indices for the universe of euro area commercial banks, cooperative banks and savings banks (see Box A for details).

4 Remedies should be tailored to the causes of low profitability

From a financial stability perspective, the objective in addressing weak bank profitability is to create a healthy and resilient banking sector. The empirical analysis here has identified three main drivers of weak profitability: (i) legacy asset problems; (ii) weak income-generation capacity owing to intense competition and a lack of diversification; and (iii) cost inefficiencies given an inefficient scale. A successful response would address the specific driver of low profitability for each group of weak performers and reduce overcapacity in the euro area banking system overall. At the same time, actions must avoid pitfalls such as allowing excessive market power or boosting the systemic footprint of large institutions.

First, weak profitability because of a high stock of non-performing loans could be addressed by policies targeting the legacy asset problems. Despite recent progress in reducing NPLs, continued costs associated with managing NPLs may mask a sound underlying business model that has a significant franchise value. Where the problems are idiosyncratic in nature, an acquisition of the sound parts of the business by a healthy bank may be possible. Where much of a country’s banking system suffers from a legacy asset problem, acquisition and consolidation become less relevant. System-wide measures to manage NPLs and create a stronger banking system that provides funding for the local economy could be more effective.

Second, in systems with many weak-performing and very small banks, consolidation within their domestic system could improve performance. The empirical analysis finds this set of banks to be operating on a sub-optimal scale and at inefficient cost levels. With limited opportunities to diversify their business model, domestic consolidation among less significant institutions could help unlock synergies, whereby more efficient banks may take over and restructure inefficient competitors. Given the very low pricing power of smaller institutions, this type of consolidation would not give rise to local monopolies, and their overall small size prevents the emergence of too-big-to-fail problems. As presented in Box A, consolidation among these firms appears beneficial from a financial stability perspective, improving the overall resilience of the banking system. The mixed empirical evidence on the benefits of bank mergers[15] does suggest that operational risks related to M&A transactions need to be carefully managed and subject to supervisory scrutiny. These mixed findings may reflect methodological issues such as a selection bias in certain studies, since target banks are often underperformers.[16] Integration of the acquisition target, in terms of both business model and systems, may also prove challenging.[17]

A combination of bank-level restructuring and cross-border consolidation appears more appropriate for the largest banks that perform poorly. Given evidence of considerable market power and their large systemic footprint (see Special Feature B in this FSR), domestic consolidation among the largest banks may be problematic from both a competition and a prudential standpoint. At the same time, many of these large banks could still do more to tackle cost inefficiencies. Insofar as these banks have a viable franchise, cross-border acquisitions by stronger banks, possibly leaving low-margin legacy assets behind for a wind-down, could be a solution that offers revenue diversification to the acquirer.

Low market valuation of euro area banks could be an obstacle to these consolidation strategies. M&A activity in the banking sector has been subdued in both Europe and the United States (see Chart A.7), in particular for cross-border transactions.[18] The scepticism of equity investors about euro area banks’ profitability, reflected in low market valuations[19], is pointing to sizeable dilution if new equity needs to be raised in the acquisition process. This may be unacceptable to shareholders, de facto impeding consolidation.

On the regulatory side, completing the euro area banking union should facilitate further consolidation. National rules and requirements, e.g. related to liquidity and capital requirements for subsidiaries, may act as a disincentive to cross-border consolidation. In order to be efficient, cross-border banks need to conduct liquidity and capital management at the consolidated level, and to face as few national options and discretions as possible. Establishing a European deposit insurance scheme and completing the crisis management framework is also an essential part of completing the banking union. Finally, removing further barriers, implied for example by differences in national policy concerning insolvency and taxation, and by divergent regulations of national capital markets, would also assist in fostering bank consolidation.

M&A activity in the euro area banking sector has been very subdued since the global financial crisis

Source: Dealogic.Note: 2019 data are up to mid-September.

Box AMarket power, competitiveness and financial stability of the euro area banking sector

The competitiveness of a banking sector affects its resilience, with implications for financial stability and long-term economic welfare.[20] A healthy level of competition should enhance efficiency and promote product innovation, lowering interest rates and, in turn, reducing firms’ borrowing costs and probability of default. An aggressively competitive market can lead banks to take on too much risk, while also squeezing their margins and undermining their resilience. Combining measures of competitiveness and stability of the euro area banking sector can shed light on whether the current level of competition is enhancing or potentially undermining financial stability.[21]

Since 2001 the increase in the market power of the median euro area bank has been overall positive for financial stability. Market power is the ability of a firm to set prices above its marginal costs,[22] and a higher level of market power for most banks in a system generally suggests a less competitive system as a whole. It can be measured with the adjusted Lerner index, which is the difference between prices (measured using interest income and fee and commission income) and marginal costs (measured as a function of labour, fixed and funding costs) expressed as a ratio of prices. Higher values of the index are associated with stronger market power and reflect weaker competition. According to the adjusted Lerner index, banks’ market power increased after the global financial crisis and has stabilised in recent years, driven by a larger drop in marginal costs compared with bank prices. At the same time, bank stability in the euro area, measured using the distance to default, has improved after the significant drop experienced during the financial crisis (see Chart A, left panel).

Using the past relationship between these competition and stability metrics as a guide suggests that consolidation among smaller banks would not have negative consequences for financial stability in the euro area. An econometric analysis suggests that the relationship between competition and bank stability has an inverted U-shape in the euro area (see Chart A, right panel). This implies that there is indeed an optimal level of competition from a bank stability perspective, which can be estimated to correspond to the Lerner index standing close to 0.5 (given estimation uncertainty). Specifically, increasing market power up to that level would lead to a more stable banking sector as measured by the Z-score, while – beyond that level – higher market power would lead to a decline in the Z-score and thus a more fragile banking sector. However, while the distribution of the adjusted Lerner index has flattened and its mean shifted to the right as market power increased for euro area banks (see Chart A, right panel), only some banks in the tail display levels of market power that could be characterised by a negative relationship with bank stability (e.g. with an adjusted Lerner index above 0.5; see Chart 6 in this special feature).

Chart A

While the market power of euro area banks has been increasing, it did not pass the point where further increases would be detrimental to financial stability

Sources: BankFocus and ECB calculations.Notes: The graphs above use the following empirical framework: Z-scoreijt = + 1 Lernerijt-1 + 2 (Lernerijt-1)2 + 3Xijt-1 + 4Yjt-1 + j + t + ijt, where the indices i, j and t stand respectively for bank, country and time. Variables are lagged by one period to avoid endogeneity problems related to the fact that both the Lerner index and the Z-score include profitability in their numerator. The Z-score enters the regression in logarithmic form; X is a vector of bank-specific characteristics used to control for the heterogeneity among banks in the sample. In particular, controls include proxies for size (the natural logarithm of total assets), revenue mix (share of fees and commissions in operating income), asset composition (share of loans in total assets) and funding structure (share of deposits in total liabilities), as well as a Herfindahl-Hirschman index measure of loan concentration. Y is a vector of two country-specific variables: GDP growth and inflation. To take into account the parabolic relationship between bank stability and competition, the square of the index is also included as an explanatory variable. Furthermore, to control for unobservable variables and common trends, country fixed and year effects are included, limiting potential omitted variable bias in the estimates. Standard errors are robust and clustered at bank level to control for heteroscedasticity. The sample used comprises 3,133 euro area banks over the period 2000-17, leading to 26,549 bank-level observations.

- [1]Input by Michał Adam, Sándor Gardó, Mariusz Jarmużek, Benjamin Klaus and Julian Metzler is gratefully acknowledged.

- [2]See Andersson, M., Kok, C., Mirza, H., Móré, C. and Mosthaf, J., “How can euro area banks reach sustainable profitability in the future?”, Financial Stability Review, ECB, November 2018.

- [3]See Banerjee, R. and Hofmann, B., “The rise of zombie firms: causes and consequences”, BIS Quarterly Review, September 2018, and Caballero, R., Hoshi, T. and Kashyap, A., “Zombie lending and depressed restructuring in Japan”, American Economic Review, Vol. 98, No 5, 2008, pp. 1943-1977.

- [4]See de Guindos, L., “Euro area banks: the profitability challenge”, keynote speech at the ABI Annual Conference, Rome, 25 June 2019, and Enria, A., “Is less more? Profitability and consolidation in the European banking sector”, presentation at the CIRSF Annual International Conference, Lisbon, 4 July 2019.

- [5]The analysis uses an unbalanced sample of between 1,478 and 2,343 banks for 2006-18 obtained from Bureau Van Dijk Bank Focus. Banks with average assets over the full period of below €50 million, banks with loans making up less than 10% of total assets and banks with deposits accounting for less than 10% of total liabilities are excluded to remove “niche” institutions with very limited traditional banking activities.

- [6]The method captures banks’ ability to intermediate funds using labour and fixed assets into bank loans and other investments. The estimation follows Huljak, I., Martin, R. and Moccero, D., “The cost-efficiency and productivity growth of euro area banks”, Working Paper Series, No 2305, ECB, August 2019, but without decomposing efficiency into a persistent and residual component.

- [7]For example, financial guarantees or other services which are not fully reflected in the balance sheet would not be included as an output of financial intermediation in the estimated trans-log cost function, but the associated costs would still be fully considered. As a result, bank efficiency may be underestimated.

- [8]See Dijkstra, M., “Economies of scale and scope in the European banking sector 2002-2011”, Amsterdam Center for Law & Economics Working Paper No 2013-11, 2013; Beccalli, E., Anolli, M. and Borello, G., “Are European banks too big? Evidence on economies of scale”, Journal of Banking and Finance, Vol. 58, 2015, pp. 232-246; and Huljak, I., Martin, R. and Moccero, D., “The cost-efficiency and productivity growth of euro area banks”, Working Paper Series, No 2305, ECB, August 2019.

- [9]Note that the group of listed banks included in the analysis of Beccalli et al. (op. cit.) corresponds to the group of large banks included in this analysis or Huljak et al. (op. cit.).

- [10]See, for example, Boot, A. W. A., “Consolidation and Strategic Positioning in Banking with Implications for Europe”, in Brookings-Wharton Papers on financial services, Washington: Brookings Institution Press, 2003, pp. 37-83.

- [11]See, for instance, de Guindos, L., “Euro area banking sector – current challenges”, speech at the Annual General Meeting of the Foreign Bankers’ Association, Amsterdam, 15 November 2018.

- [12]See Gardó, S. and Klaus, B., “Overcapacities in banking: measurements, trends and determinants”, Occasional Paper Series, No 236, ECB, November 2019. The third dimension of overcapacity, i.e. the overall size of the banking sector in the euro area, which has shrunk significantly since the global financial crisis, appears broadly aligned with other advanced economies.

- [13]These banks, often being cooperatives or owned by the public sector, emphasise local presence and their contribution to the regional economy rather than profit-making.

- [14]The Lerner index is normalised to stand between zero and one, where zero implies perfect competition.

- [15]For evidence of the benefits or at least partial benefits of mergers, see for example Altunbas, Y. and Marques, D., “Mergers and acquisitions and bank performance in Europe: The role of strategic similarities”, Journal of Economics and Business, Vol. 60, 2008, pp. 204-222; Cuesta, R. A. and Orea, L., “Mergers and technical efficiency in Spanish savings banks: a stochastic distance function approach”, Journal of Banking and Finance, Vol. 26, 2002, pp. 2231-2247; and Focarelli, D., Panetta, F. and Salleo, C., “Why do banks merge?”, Journal of Money, Credit and Banking, Vol. 34, 2002, pp. 1047-1066. For research reporting no benefits from mergers, see Lang, G. and Welzel, P., “Mergers among German cooperative banks: a panel-based stochastic frontier analysis”, Small Business Economics, Vol. 13(4), 1999, pp. 273-286.

- [16]See Behr, A. and Heid, F., “The success of bank mergers revisited. An assessment based on a matching strategy”, Journal of Empirical Finance, Vol. 18, 2011, pp. 117-135. Adjusting for this selection bias by using a matching method, the authors show that medium-term effects indicate a neutral, and potentially positive, effect on profitability and cost-efficiency, respectively, in the post-merger years, results which could be not obtained from a “naive” performance comparison of merging and non-merging banks. An extensive literature review is provided in Kolaric, S. and Schiereck, D., “Performance of bank mergers and acquisitions: a review of recent empirical evidence”, Management Review Quarterly, Vol. 64, 2014, pp. 39-71.

- [17]For a case study, see section 1.5 of “The failure of the Royal Bank of Scotland”, Financial Services Authority, 2011, which discusses mistakes in the acquisition of the Dutch bank ABN Amro by the Royal Bank of Scotland.

- [18]For a discussion about barriers to consolidation, see Hartmann, P., Huljak, I., Leonello, A., Marques, D., Martin, R., Moccero, D., Palligkinis, S., Popov, A. and Schepens, G., “Cross-border bank consolidation in the euro area”, Financial Integration Report, ECB, 2017, and Bijsterbosch, M. and Deghi, A., “Cross-border mergers and acquisitions in the EU banking sector: drivers and obstacles”, Financial Stability Review, ECB, November 2017, Special Feature B, Box A.

- [19]See Grodzicki, M., Rodriguez d’Acri, C. and Vioto, D., “Recent developments in banks’ price-to-book ratios and their determinants”, Financial Stability Review, ECB, May 2019.

- [20]For an overview of the related literature, see Marcus, A. J., “Deregulation and Bank Financial Policy”, Journal of Banking and Finance, Vol. 8, 1984, pp. 557-632; Keeley, M., “Deposit Insurance, Risk and Market Power in Banking”, American Economic Review, Vol. 80, 1990, pp. 1183-1200; Allen, F. and Gale, D., “Competition and Financial Stability”, Journal of Money, Credit and Banking, Vol. 36, 2000, pp. 453-480; Boyd, J. H. and De Nicoló, G., “The Theory of Bank Risk Taking and Competition Revisited”, Journal of Finance, Vol. 60, 2005, pp. 1329-1343; and Jiménez, G., Lopez, J. and Saurina, J., “How does competition affect bank risk-taking?”, Journal of Financial Stability, Vol. 9(2), 2013, pp. 185-195.

- [21]When competition increases in a highly competitive banking sector, banks respond by taking on more risk: competition-fragility prevails. When markets are highly concentrated, asset quality and borrowing costs fall: competition-stability prevails. See Martinez-Miera, D. and Repullo, R., “Does Competition Reduce the Risk of Bank Failure?”, Review of Financial Studies, Vol. 23, 2010, pp. 3638-3664.

- [22]A firm has strong market power when the price elasticity of demand is low because demand is not affected much by price variations, and vice versa.