Foreword

The Financial Stability Review (FSR) assesses developments relevant for financial stability, including identifying and prioritising the main sources of systemic risk and vulnerabilities for the euro area financial system – comprising intermediaries, markets and market infrastructures. It does so to promote awareness of these systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Financial stability can be defined as a condition in which the financial system – which comprises financial intermediaries, markets and market infrastructures – is capable of withstanding shocks and the unravelling of financial imbalances. This mitigates the likelihood of disruptions in the financial intermediation process that are systemic; that is, severe enough to trigger a material contraction of real economic activity.

The FSR also plays an important role in relation to the ECB’s microprudential and macroprudential competences. By providing a financial system-wide assessment of risks and vulnerabilities, the Review provides key input to the ECB’s macroprudential policy analysis. Such a euro area system-wide dimension is an important complement to microprudential banking supervision, which is more focused on the soundness of individual institutions. While the ECB’s roles in the macroprudential and microprudential domains have a predominant banking sector focus, the FSR focuses on the risks and vulnerabilities of the financial system at large, including – in addition to banks – activities involving non-bank financial intermediaries, financial markets and market infrastructures.

In addition to its usual overview of current developments relevant for euro area financial stability, this Review includes three special features aimed at deepening the ECB’s financial stability analysis and broadening the basis for macroprudential policymaking. The first special feature examines how banks can reach sustainable levels of profitability. The second examines the financial stability implications stemming from a resurgence of trade tariffs. The third discusses the rapid growth in exchange-traded funds and their potential for transmitting and amplifying risks within the financial system.

The Review has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks.

Luis de Guindos

Vice-President of the European Central Bank

Overview

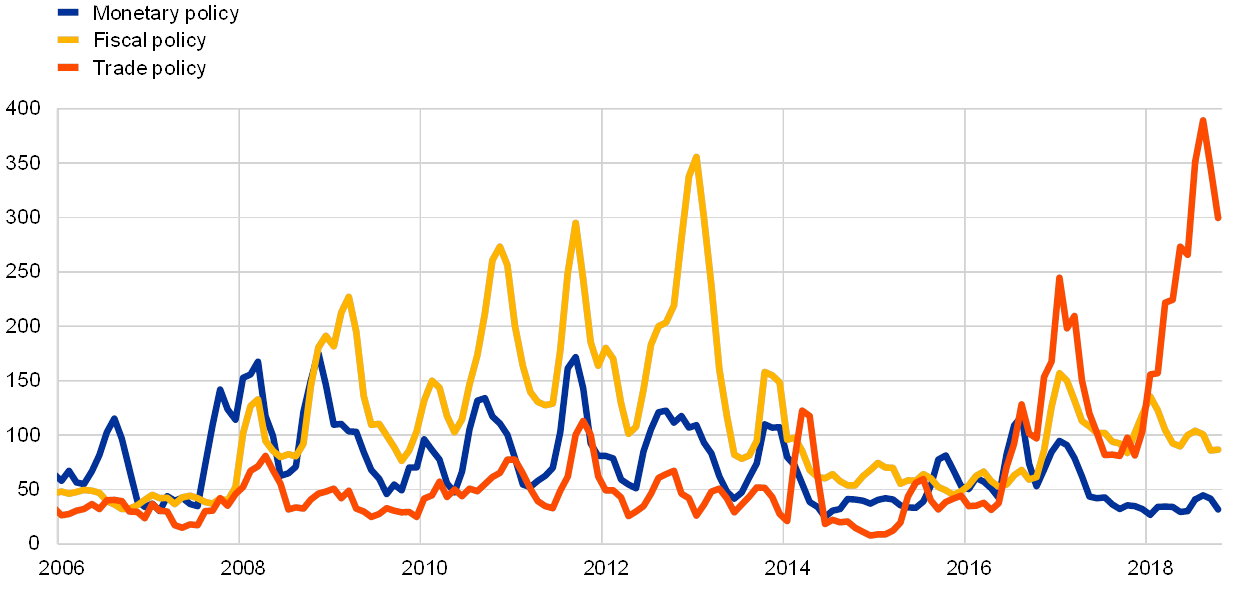

The euro area financial stability environment has become more challenging since the publication of the previous Financial Stability Review in May. On the positive side, a growing economy and improved banking sector resilience have continued to support the financial stability environment in the euro area. Furthermore, a series of volatility events have not spread to the broader global financial system. At the same time, downside risks to the global growth outlook have become more pronounced since May relating to a resurgence in protectionism and stress in emerging markets. Vulnerabilities in financial markets continue to build up amid pockets of high valuations and compressed global risk premia. In the euro area, political and policy uncertainty have increased over the review period.

Looking ahead, four key risks to euro area financial stability could materialise over the next two years. First, the most prominent risk stems from the possibility of a disorderly increase in global risk premia. Second, the risk of renewed debt sustainability concerns has increased over the last six months. Third, legacy issues from the financial crisis continue to dampen bank profitability and could hamper banks’ intermediation capacity. Fourth, possible liquidity strains in the investment fund sector constitute a growing risk. These four risks are all clearly intertwined and would, if they were to materialise, have the potential to be mutually reinforcing.

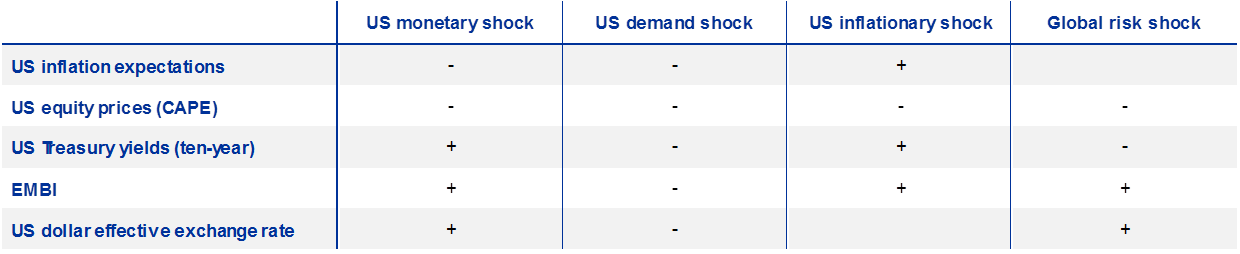

Chart 1

A low (but rising) risk of systemic stress

Financial stability risk index (FSRI) for the euro area economy and composite indicator of systemic stress in financial markets (CISS)

(Jan. 2011-Nov. 2018 (CISS); Q1 2011-Q1 2018(FSRI))

Sources: Bloomberg, Eurostat, ECB and ECB calculations.

Notes: For more details about the CISS, see Holló, D., Kremer, M. and Lo Duca, M., “CISS – a composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012. For more details on the FSRI, see Special Feature A in the May 2018 FSR. The scale of the FSRI represents the deviation from the historical mean expressed in multiples of the historical standard deviation. The CISS is normalised to lie between 0 and 1. FSRI: quarterly frequency; CISS: weekly frequency, two-week moving average. The black vertical line represents the publication of the previous FSR.

Tail risks to GDP growth have been creeping up from low levels, amid intermittent bouts of financial stress. The composite indicator of systemic stress in financial markets has exhibited flare-ups, as sovereign tensions in Italy have risen and some emerging market economies (EMEs) have experienced stress. At the same time, the risk of a sharp fall in GDP growth has been inching up from low levels (see Chart 1).

Risk of a disorderly increase in risk premia

Risks stemming from financial market developments remain material. Over a risk horizon of two years, the main triggers that could unearth a disorderly increase in risk premia relate to both domestic and external factors. These include disorderly market reactions to political or policy uncertainty in the euro area, further stress in EMEs with possible spillovers to advanced economies and a sharp turnaround in US macro-financial prospects. Pockets of high asset price valuations and high correlations across global financial asset prices may amplify a potential pick-up in global risk premia.

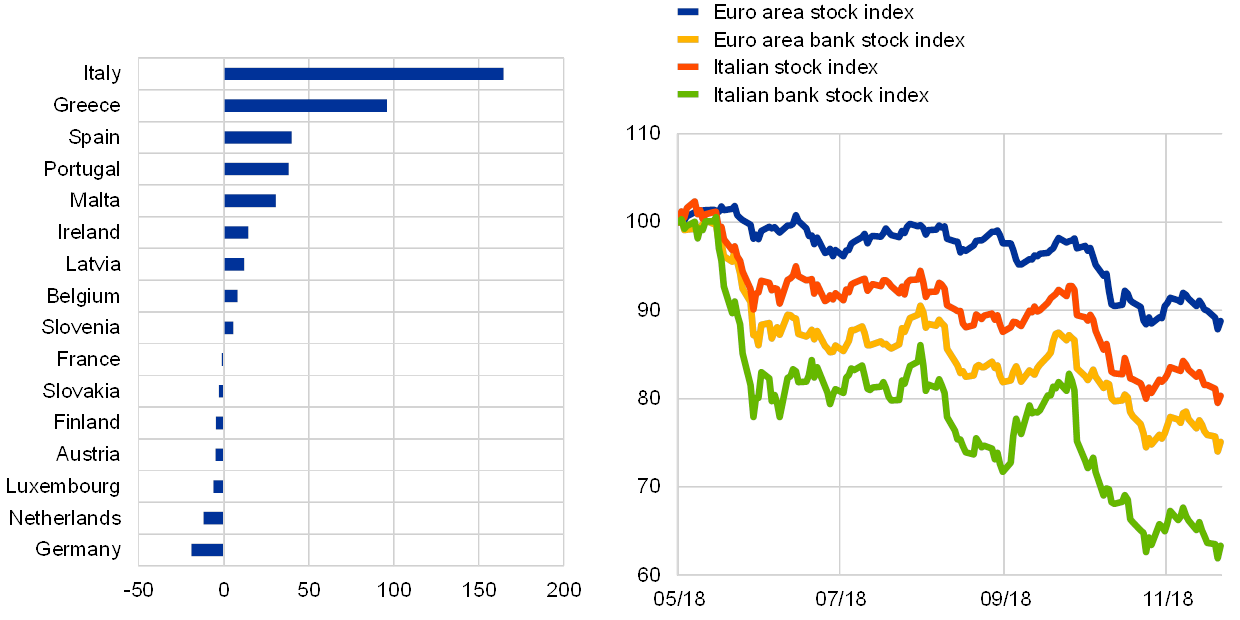

Chart 2

Within the euro area, large price falls in Italian bond and stock markets

Changes in ten-year sovereign bond yields across euro area countries (left panel) and stock market indices (right panel)

(left panel: daily data, changes in basis points between 1 May 2018 and 21 Nov. 2018; right panel: daily data, 1 May 2018-21 Nov. 2018, stock prices indexed to 100 on 1 May)

Sources: Thomson Reuters and Bloomberg.

Italian financial market losses amid political uncertainty have not meaningfully spilled over to other euro area countries. In the second half of May, increased market concerns about debt sustainability – triggered by rising fiscal policy uncertainty in Italy – contributed to higher volatility in domestic financial markets (see Chart 2). Sovereign bond yields in Italy increased sharply, amplified by deteriorating liquidity conditions. Some domestic spillover to the non-financial and financial sectors was also observed. At the same time – in contrast to euro area financial stress episodes in 2011-12 – contagion to other euro area countries was limited. Subsequently, market sentiment stabilised somewhat, but Italian sovereign bond yields and stock prices remained volatile throughout the review period. Financial market tensions combined with protracted budgetary negotiations have culminated in credit rating actions. The stress in the Italian sovereign debt markets in May serves as a reminder of how quickly policy uncertainties can lead to shifts in market sentiment and a repricing of risk. In the latter part of the review period, rising bond yields in the United States triggered a rise in global risk premia with some limited spillover also to the euro area.

The impact of Brexit on euro area financial markets has remained limited. So far, aside from some bouts of volatility in the sterling exchange rate, growing uncertainties related to the Brexit process have not driven any significant repricing in financial markets. While an orderly withdrawal of the United Kingdom from the European Union poses a limited overall risk to the euro area’s financial stability, the uncertainty triggered by a cliff-edge Brexit could have the potential to pose a more significant downside risk to financial stability (see Box 6). In light of the risks, timely preparations on the part of banks and other financial institutions are needed for any possible outcome, including the possibility of a no-deal outcome.

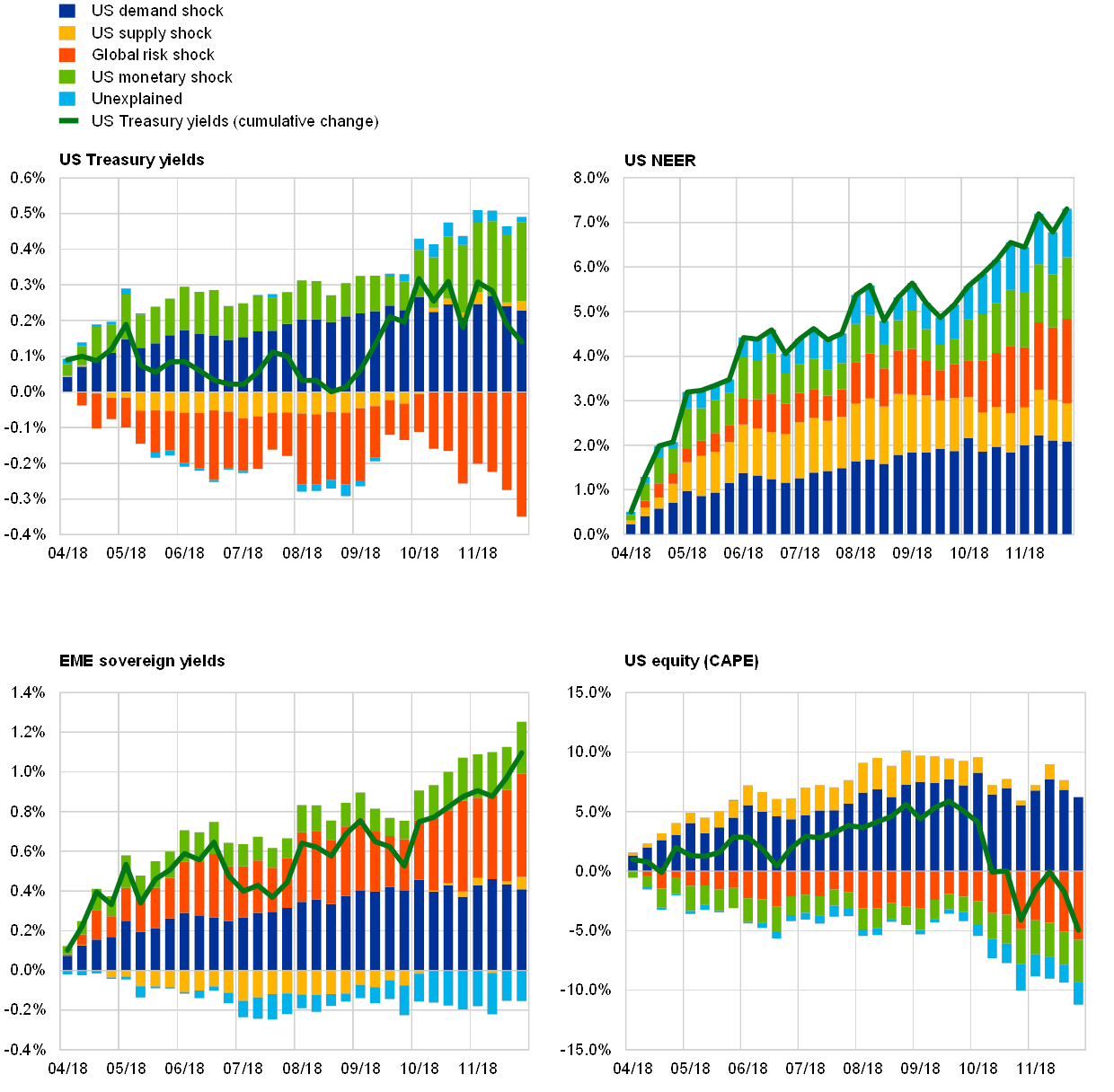

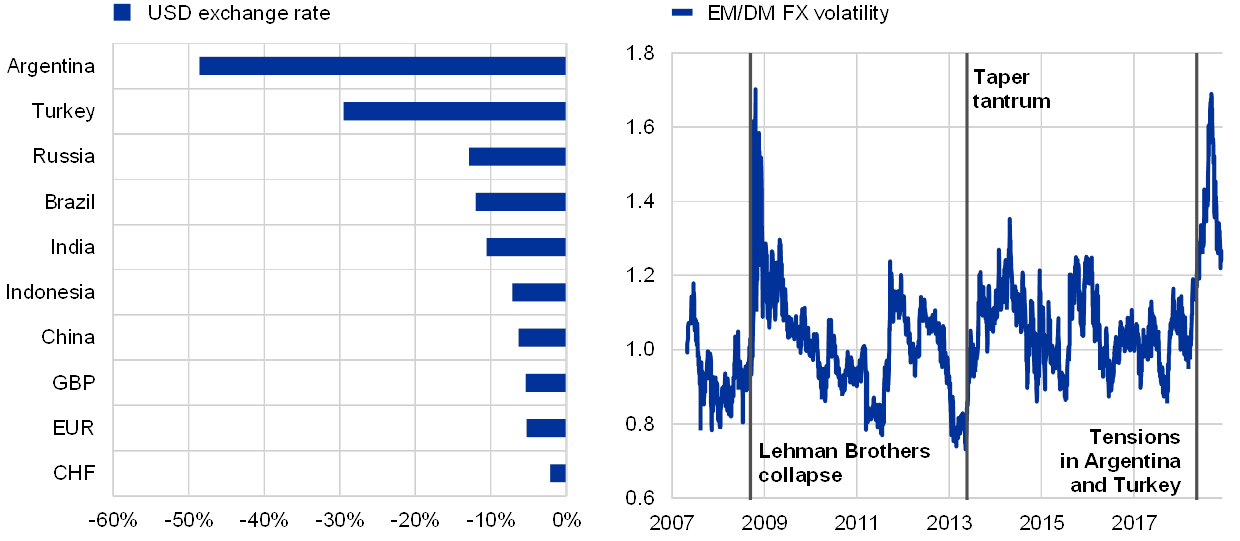

At the global level, some EMEs with significant external imbalances are facing difficulties in adapting to tightening financial conditions. A stronger US dollar and heightened trade tensions unearthed pre-existing vulnerabilities in Argentina and Turkey, triggering renewed stress in EMEs in recent months. A number of EMEs endured significant increases in bond spreads, falling stock prices and large currency depreciations (see Chart 3). However, the EME sell-off was more muted and contained when compared with the widespread stress that occurred during the “taper tantrum” episode in 2013.

Chart 3

Sharp corrections in selected EMEs

EME exchange rate developments during the stressed periods in 2013 and 2018 (left panel); stock market returns and USD-denominated debt to GDP for EMEs (right panel)

(left panel: changes in the US dollar per local EME currency (May 2013-Dec. 2013 (taper tantrum) and Jan. 2018-Nov. 2018 (2018 turmoil)); maximum, minimum, interquartile range and median; right panel: y-axis: changes in the local equity price index; x-axis: USD-denominated debt as a percentage of GDP)

Sources: Bloomberg, Haver Analytics and Thomson Reuters.

Notes: Left panel: AR, BR, CN, ID, IN, MX, MY, RU, SA, TH, TR, and ZA. Right panel: MSCI country indices in local currency are used to calculate the stock market returns from April to October 2018. The size of the bubble is commensurate to the current account deficit. Current account surplus countries are shaded in blue.

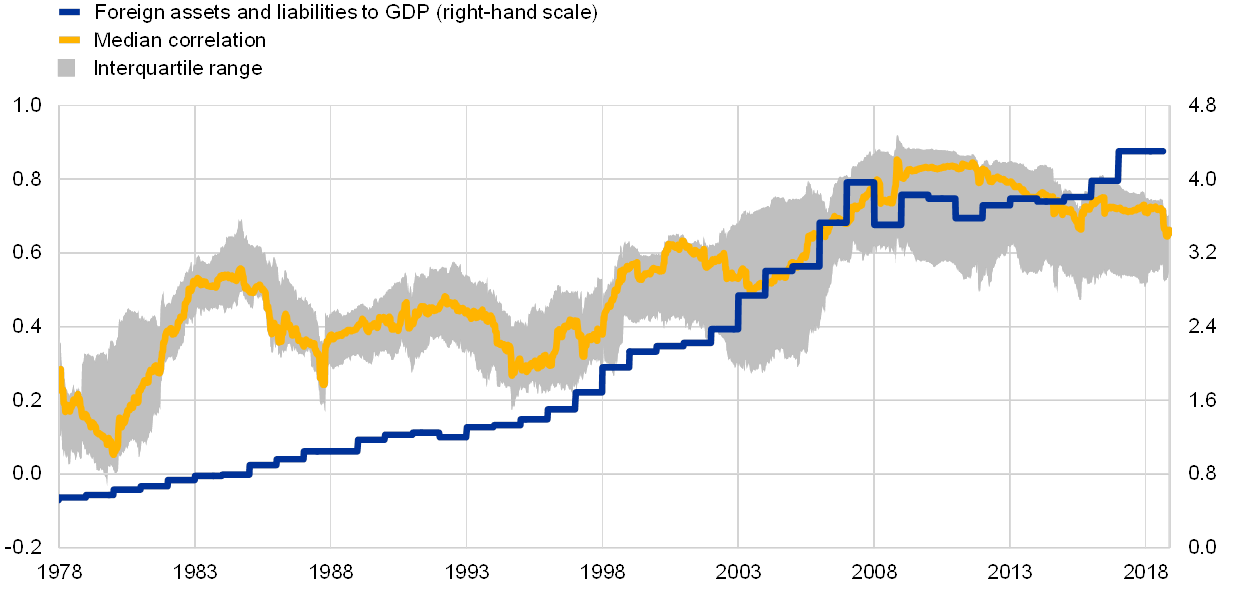

Looking ahead, more generalised stress in EMEs could materialise. The sell-off in May illustrates that global risk sentiment remains fickle. Several EMEs have accumulated large US dollar-denominated debts and would face very high credit risk in the event of a sharp US dollar appreciation. Thus, a quicker than expected US policy normalisation and a subsequent appreciation of the US dollar may trigger an abrupt and broad increase in risk premia on EME financial assets. The expansionary fiscal policy in the United States could aggravate a potential pick-up in risk premia. Widespread contagion across EMEs could also be triggered by rising trade tensions and/or a failure to rein in the high credit growth in China, leading to a hard landing. Contagion across economies (including to advanced economies) could be amplified due to the interconnected nature of global financial markets (see Chart 4).

Chart 4

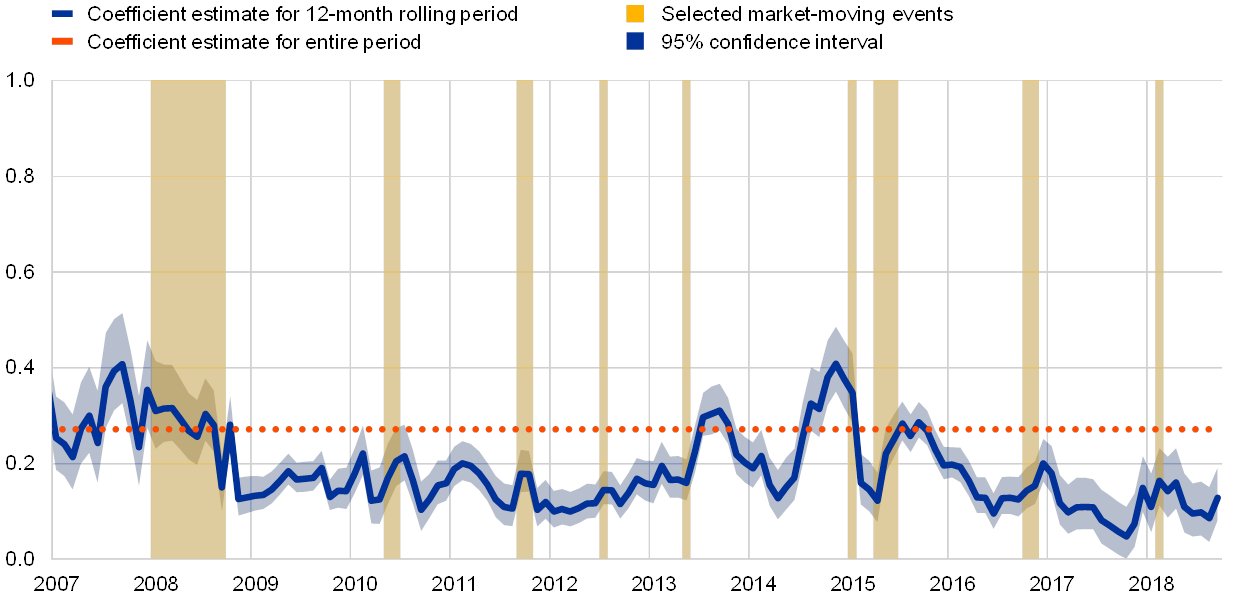

Financial integration brings risk-sharing benefits, but also risks, as asset price corrections may spread across borders and intensify

Bilateral correlations between global stock markets, median correlation and foreign assets and liabilities-to-GDP ratio

(left-hand scale: weekly data, Jan. 1978-Nov. 2018, bilateral correlations based on a three-year moving window; right-hand scale: annual data, 1978-2017)

Sources: Thomson Reuters and ECB calculations.

Notes: Bilateral correlation coefficients between broad stock market indices in the United States, the euro area, Japan, the United Kingdom and emerging markets. The portfolio flow measure follows the methodology provided by Lane, P. and Milesi-Ferretti, G., “External Wealth of Nations”, Journal of International Economics, Vol. 73, November 2007. The sample is based on the 20 largest world economies in terms of GDP in 2015.

A maturing cycle in the United States has led to brittle valuations. Developments in the US economy and financial markets, in turn, have continued to exert a dominant influence in global financial markets. The US economy has continued to grow at a brisk pace in 2018, supported by a favourable job market. The strong fiscal stimulus has added further momentum to the US business cycle and contributed to prolonging the current economic expansion which is now significantly longer than historical norms and the second longest in US modern history (see Chart 5). Looking ahead, a number of market indicators appear to signal downside risks to the macro-financial cycle in the United States. First, the slope of the US yield curve has flattened significantly in recent quarters. In the past, this has been a harbinger of future recessions. Second, investors seem to have become increasingly concerned about price increases in “riskier” US asset classes, stock markets in particular. Despite low volatility, the SKEW index, which gauges the cost of insuring against large drops in stock prices, has increased sharply in recent months as stock prices have risen.

Chart 5

Downside risks to economic growth and asset prices

Length of business cycle expansions (left panel), slope of the US yield curve (middle panel) and VIX and SKEW indices derived from options on the S&P 500 index (right panel)

(left panel: expansions in months; middle panel: Jan. 1988-Nov. 2018, annual percentages; right panel: Q1 2010 – Q3 2018, levels of the VIX and SKEW indices)

Sources: Bloomberg, Thomson Reuters, National Bureau of Economic Research (NBER) and ECB calculations.

Notes: In the left panel, the starting date of business cycle peaks/troughs for the different areas is the following: 1953 for the United States, 1970 for the euro area and 1960 for Japan. The blue bars represent the current business cycle expansion in months, while the yellow dots represent the historical average of expansion periods throughout the entire sample. In the middle panel, the slope is defined as the difference between ten-year and two-year bond yields. The shaded areas represent US recession periods defined by the NBER.

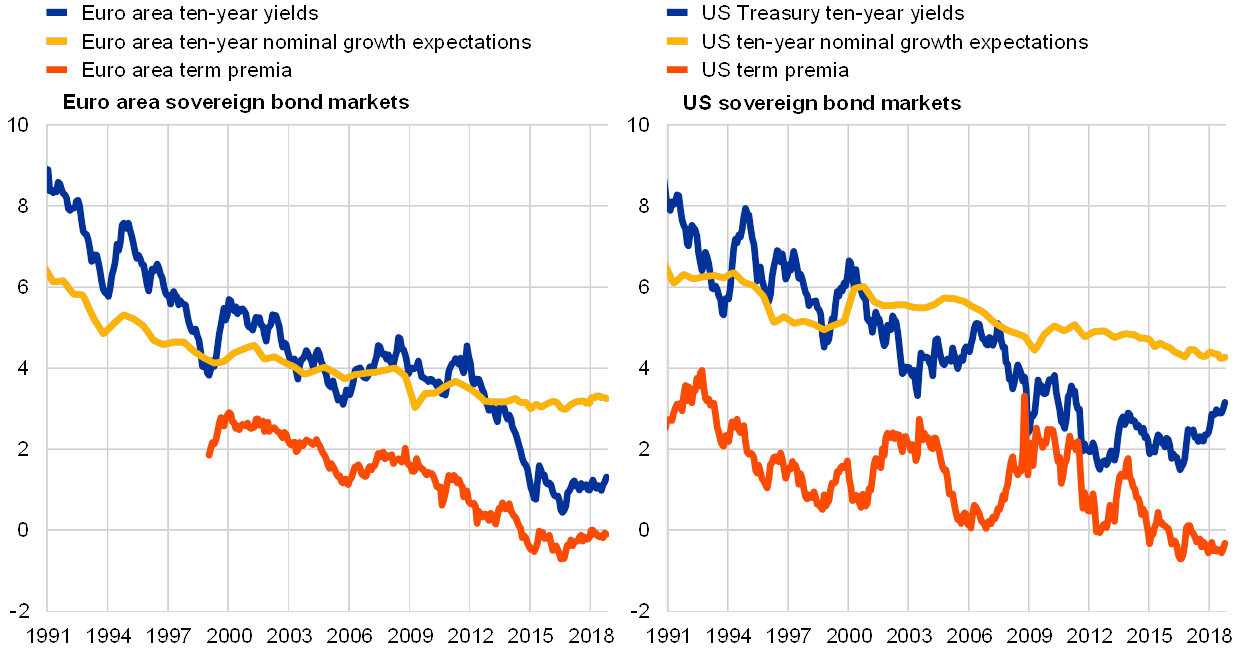

There is a risk of a snapback from an unprecedented compression of term premia. Potential misalignments in asset price valuations are being closely monitored by financial stability authorities, as they represent vulnerabilities in the form of possible asset price corrections. Along with the cyclical recovery in recent years, global valuations across a broad range of asset classes have increased strongly. In the global bond markets, the prolonged period of accommodative monetary policies has contributed to keeping interest rates low across most types of debt instruments. In the sovereign bond markets, US and euro area term premia continue to hover at very low levels, making them susceptible to any reversal of market sentiment (see Chart 6). The risk of a near-term snapback in term premia is, however, higher in the United States owing to the ongoing normalisation of the monetary policy stance. The large US fiscal deficit and the high stock of sovereign debt could amplify increases in term premia. If it were to materialise, an abrupt increase of long-term interest rates in the United States could also spill over to the euro area.

Chart 6

Term premia at historical lows in the euro area and the United States

Long-term government bond yields, nominal GDP growth expectations and term premia in the euro area and the United States

(Jan. 1991-Oct. 2018, percentages per annum, annual percentage changes)

Sources: Thomson Reuters, Consensus Economics and ECB calculations.

Notes: Before 1999, euro area bond yields are approximated by ten-year government bond yields in Germany. The euro area ten-year term premium shown in the chart is estimated on the basis of overnight index swap rates using an affine term structure model following the methodology of Joslin, S., Singleton, K.J. and Zhu, H., “A New Perspective on Gaussian Dynamic Term Structure Models”, The Review of Financial Studies, Vol. 24(3), March 2011, pp. 926-970. For the US decomposition, see Adrian, T., Crump, R., Mills, B. and Moench, E., “Treasury Term Premia: 1961-Present”, Liberty Street Economics, Federal Reserve Bank of New York, May 2014.

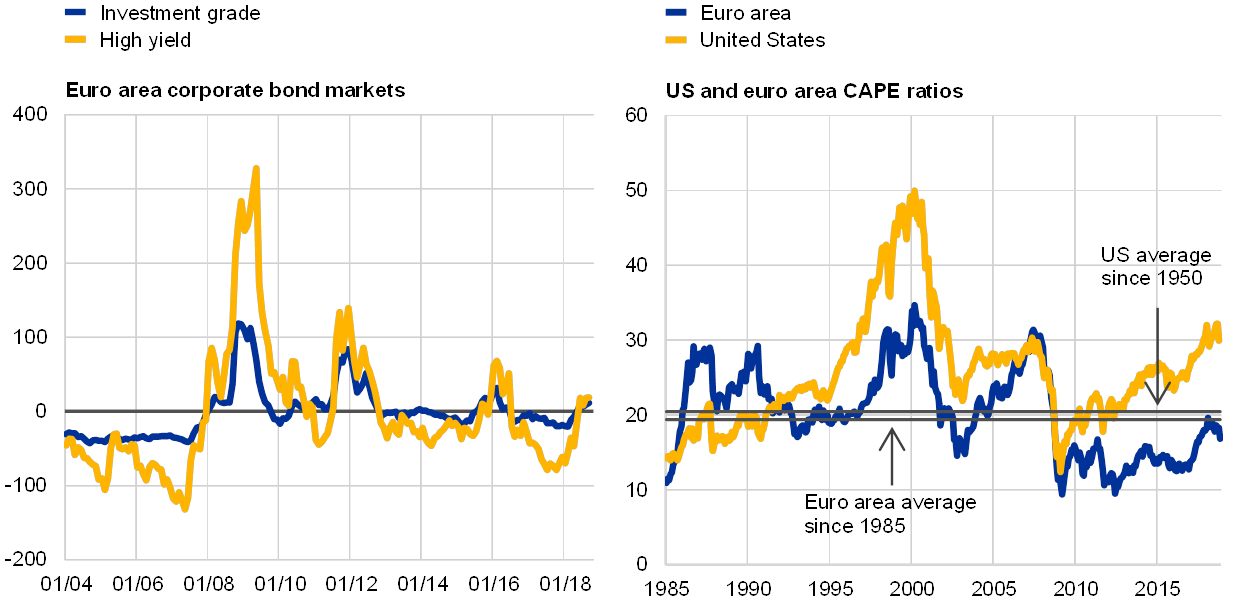

There are pockets of stretched valuations in global corporate bond and stock markets. Euro area equity markets appear broadly fairly valued according to standard valuation metrics such as the cyclically adjusted price/earnings (CAPE) ratio. In the United States, however, the CAPE ratio is hovering at levels significantly above its historical norm (see Chart 7). As for corporate bonds, although model-based methods signal broadly fair valuations, spreads in the riskiest non-investment-grade segment are still clearly below the historical average in both the euro area and the United States. At the same time, leveraged loan markets continue to expand amid compressed spreads and weakening underwriting standards. The United States still remains the dominant region in which leveraged lending activity is concentrated, with corporates accounting for around three-quarters of the total volume of the outstanding amount of global leveraged loans. Amid these pockets of richly valued assets, investor sentiment remains fickle – leading to risks in the event of broader asset price corrections with possible spillovers to euro area assets.

Chart 7

Euro area corporate bond and equity market valuations are broadly in line with historical norms

Valuation metrics for selected corporate bond markets (excess bond premium) and stock markets (CAPE ratio)

(left panel: Jan. 2004-Oct. 2018, basis points; right panel: Jan. 1985-Nov. 2018, ratio)

Sources: Bloomberg, R. Shiller’s homepage and ECB calculations.

Note: In the left panel, the excess bond premium is defined as the deviation of credit spreads from measures of credit risk and liquidity risk at individual bond level. Right panel: CAPE stands for cyclically adjusted price-earnings ratio.

As the current economic expansion matures, the favourable market environment observed over the past few years may quickly change. Risk management by financial institutions should be taking into account the possibility of an abrupt repricing of risk, including different possible scenarios, or a deterioration in liquidity conditions.

Increased debt sustainability concerns

The expansion of the euro area economy has continued since May. Economic growth in the euro area has slowed down somewhat in 2018, but the recovery still remains broad-based. Going forward, the euro area economy is expected to grow at continued solid rates in the coming years, supported by improving labour market conditions and stronger sectoral balance sheets. Downside risks to the euro area growth outlook have gained more prominence recently, mainly relating to global factors. Uncertainties regarding the course of US fiscal and monetary policies, a further rise in geopolitical risks across the globe, including those relating to growing trade protectionism, as well as a further intensification of stress in EMEs, may weigh on the global and euro area growth momentum.

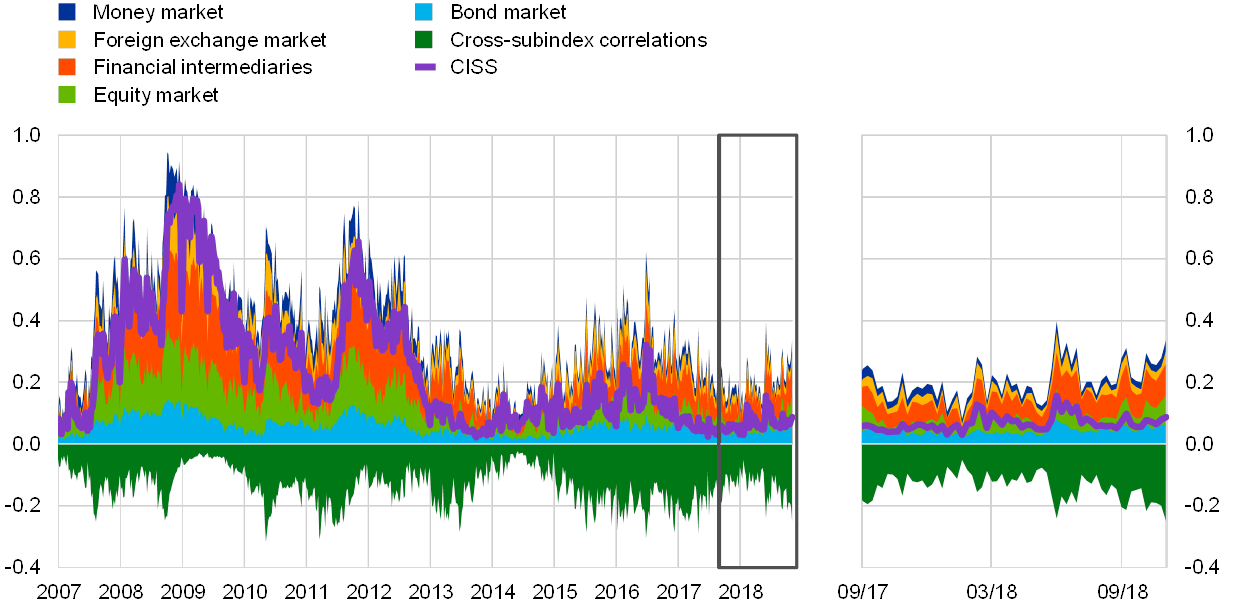

Within the euro area, debt sustainability concerns have remained country-specific. The composite indicator of systemic stress in the euro area sovereign bond markets (SovCISS) picked up slightly in May and remained stable thereafter (see Chart 8). The key driver for the somewhat higher systemic stress was related to political developments in Italy and, in particular, to market concerns about the government’s deficit targets for the coming years and the resulting implications for debt sustainability. Overall, the SovCISS still continues to fluctuate at low levels, indicating no generalised near-term debt sustainability concerns for the euro area as a whole.

Chart 8

A country-specific increase in sovereign bond market tensions

Composite indicator of systemic stress in the euro area sovereign bond markets

(Jan. 2006-Oct. 2018)

Sources: ECB and ECB calculations.

Notes: The SovCISS is available for the euro area as a whole and for 11 euro area countries. The methodology of the SovCISS is described in Garcia-de-Andoain, C. and Kremer, M., “Beyond spreads: measuring sovereign market stress in the euro area”, Working Paper Series, No 2185, ECB, October 2018.

A large public sector debt overhang leaves several countries vulnerable to higher funding costs. Public sector debt in almost all of the largest advanced economies is significantly higher today than the levels prevailing before the eruption of the global financial crisis (see Chart 9, left panel). Looking ahead, a failure to rein in fiscal deficits would place debt trajectories on a clear upward path in countries where debt ratios are already above 90% (see Section 1.2). Furthermore, private sector debt levels remain high by both historical and international standards and are above thresholds ordinarily associated with a debt overhang, although debt dynamics have continued to benefit from the strong cyclical momentum of the euro area economy combined with very favourable financing conditions.

Chart 9

Public sector debt levels markedly higher in most G7 countries than levels prevailing at the onset of the global financial crisis a decade ago

Sovereign debt-to-GDP ratios for G7 countries (left panel) and euro area countries (right panel)

(left panel: Q4 2008 and Q1 2018; right panel: Q2 2018)

Sources: Bank for International Settlements, ECB and ECB calculations.

Note: Numerator of the series defined as credit to general government from all sectors at nominal value.

Momentum is building up in real estate markets across the euro area. The robust dynamics of house prices continue to feed into mild signs of overvaluation for the euro area as a whole amid strong cross-country differences (see Chart 10, left panel). Despite only moderate growth in the stock of mortgage lending overall, it is important to monitor both the growth and quality of new lending, in particular in countries with stronger dynamics. In some countries, the state of household balance sheets contributes to risks in real estate markets. At the same time, while residential investment is trending upwards, there are no indications of overheating in the euro area as a whole. Since the current expansionary commercial real estate (CRE) cycle began in 2009, in almost every euro area country the compression of prime CRE yields has been driven by price increases which have significantly outpaced actual CRE rental price growth. Hence, yields on prime commercial property have been on a declining trend, reaching a new low in the current cycle. The observed yield compression might be indicative of possible overvaluation in CRE markets (see Chart 10, right panel).

Chart 10

Property valuations continue rising

Euro area residential property price deviations from estimated fair value (left panel) and euro area prime CRE yields (right panel)

(left panel: Q1 2004-Q2 2018, percentages, average valuations, minimum-maximum range across valuation estimates; right panel: Q1 2004-Q3 2018, annual percentages, historical average since 1997, grey shaded area represents minimum-maximum range across euro area countries)

Sources: ECB and ECB calculations.

Notes: In the left panel, the minimum-maximum range (dashed lines) is based on four different valuation methods: the price-to-rent ratio, the price-to-income ratio, an asset pricing approach and an estimated Bayesian vector autoregression model. For details of the methodology, see Box 3 in Financial Stability Review, ECB, June 2011, and Box 3 in Financial Stability Review, ECB, November 2015.

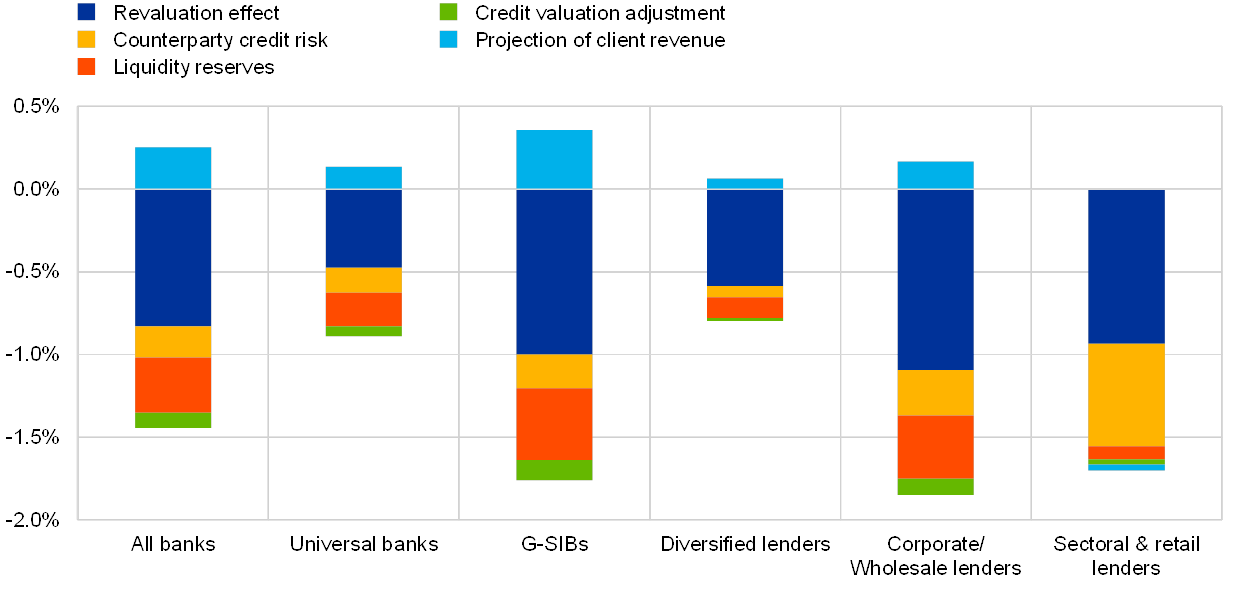

Risk of hampered bank intermediation capacity

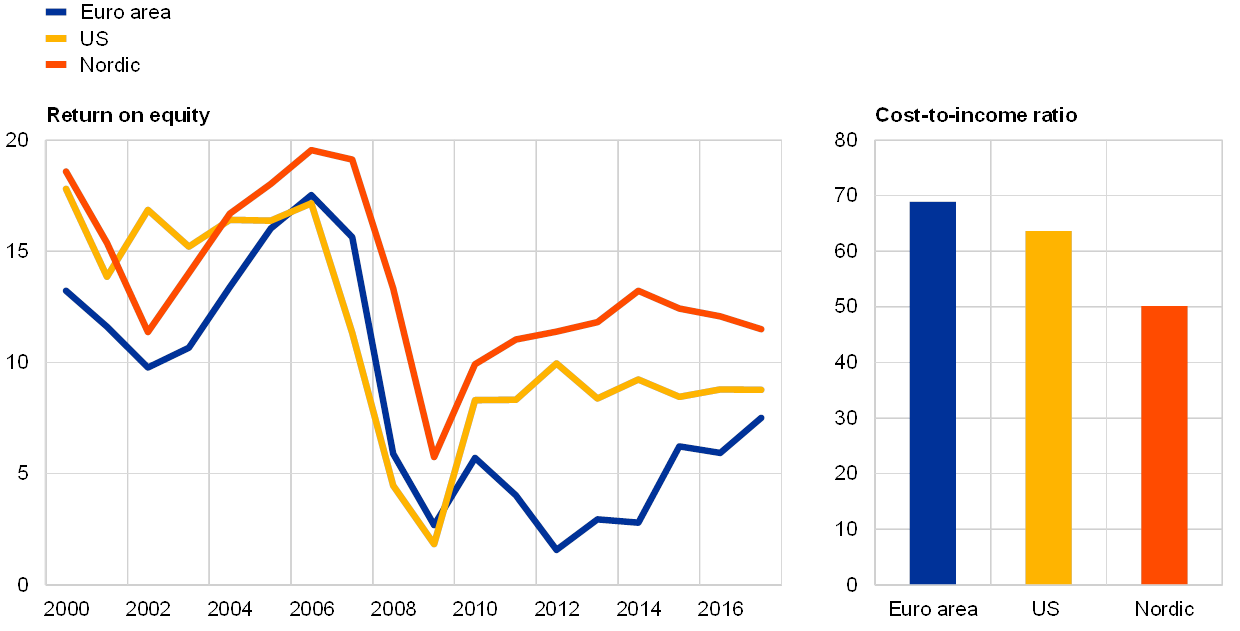

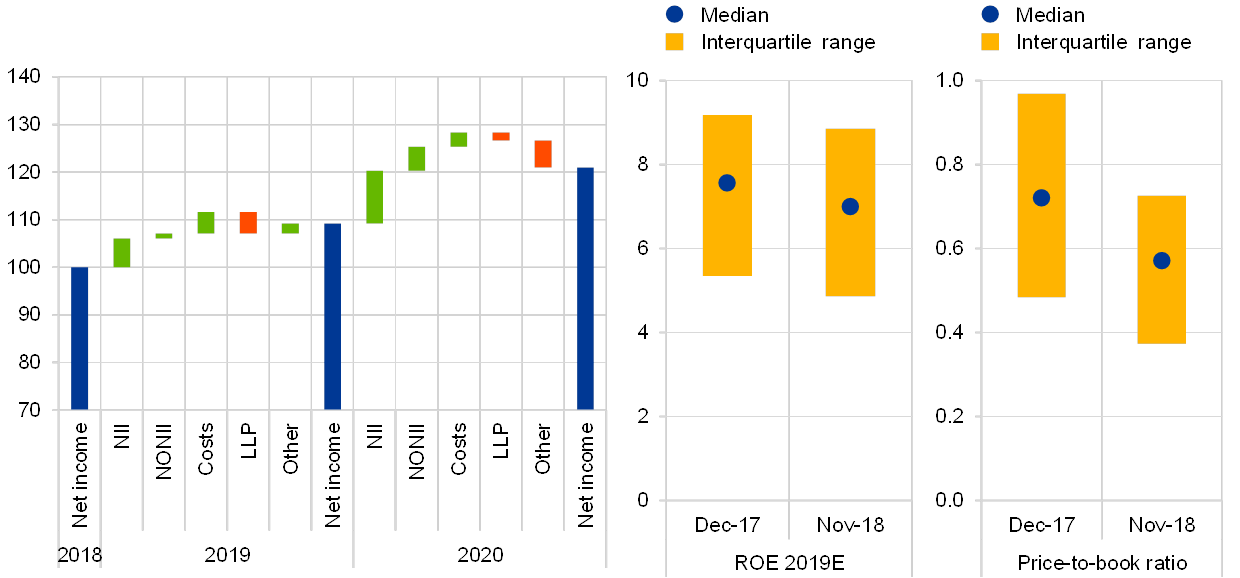

Bank profitability in the euro area has remained persistently weak, ten years after Lehman Brothers filed for bankruptcy. The banking crisis and subsequent recession that followed the failure of Lehman Brothers contributed to a sharp fall in global banks’ profitability. Euro area banks’ earnings have been particularly weak (see Chart 11). The low bank profitability in the euro area over this period is partly related to the fact that the crisis in the euro area was more protracted than that in other mature economies. Apart from cyclical factors, structural elements of the euro area banking system have also probably contributed to the underperformance – including overcapacity in certain domestic banking markets and high operating costs (see also Special Feature A). Looking at the most recent data and a broad set of banks, the annualised return on equity of euro area significant institutions slightly dropped in the first half of 2018 from a year earlier, but remained above 7%. Continuing the trend of the last few years, a fall in impairment costs was the largest positive contributing factor in the first half of 2018, helped by a favourable macroeconomic environment and banks’ continued efforts to reduce their non-performing loans. All in all, profitability prospects still remain weak and constitute a key risk to financial stability in the euro area since weak profitability can hamper banks’ intermediation capacity.

Chart 11

Profitability of euro area banks is lagging behind that of many of their global peers

Return on equity (left panel) and cost-to-income ratio (right panel) for large global listed banks

(left panel: 2000-17, median, annual percentages; right panel: averages over the period 2008-17)

Sources: Bloomberg and ECB calculations.

Note: The sample consists of 21 large banks for the euro area, 17 for the United States and 6 for the Nordic countries.

Euro area bank stock prices were lower, in part owing to higher political uncertainty. Euro area banks’ stock prices fell sharply, by about 25% since early May, owing to earnings expectation downgrades, while higher political uncertainty in Italy and renewed market turmoil in EMEs drove up the risk premia required on bank stocks. Across countries, Italy stood out with the Italian bank index dropping by about 37%. Furthermore, co-movements between government bond and bank stock prices in Italy recently reached levels not observed since the peak in 2011-12 (see Chart 12, left panel). Apart from global factors, the sharp repricing of Italian bank stocks likely reflected the sector’s holdings of domestic sovereign bonds (see Chart 12, right panel). In addition, spreads on Italian bank bonds increased, with the largest spread widening having taken place for the most credit-sensitive asset classes (see Box 7).

Chart 12

Bank stock prices closely followed Italian sovereign bond prices amid high exposures

Three-month moving correlations between Italian ten-year daily government bond price returns and Italian daily bank stock price returns (left panel); MFI holdings of debt securities issued by domestic general government (right panel)

(left panel: Mar. 1999-Nov. 2018, correlations; right panel: Jan. 2011-Sep. 2018, percentage of total assets)

Sources: Thomson Reuters, ECB and ECB calculations.

Notes: In the left panel, the vertical line indicates the 26 July 2012 speech by Mario Draghi at the Global Investment Conference in London. In the right panel, monetary financial institutions excluding the European System of Central Banks.

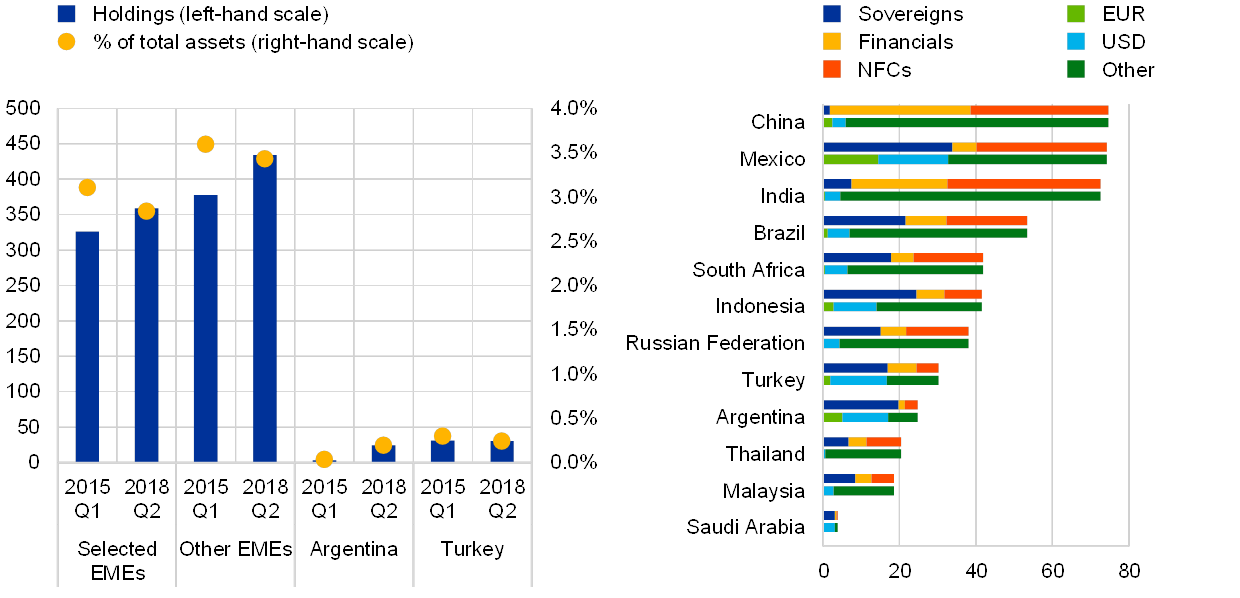

The exposure of euro area banks to EMEs is contained. Euro area banks have remained fairly resilient to the renewed stress in EMEs. Overall, the exposures are relatively small (on-balance-sheet exposures to all EMEs amounted to €1.5 trillion or 7% of total assets in early 2018). As shown in Chart 13, exposures to emerging Europe account for around 41% of euro area banks’ EME exposures, followed by exposures to Latin America (37%), while euro area banks appear to be much less exposed to emerging Asia (13%) and the Middle East and North Africa (9%). Even if the overall EME exposures are limited, the resilience of some individual euro area institutions may be tested should the EME turmoil continue. In fact, ten euro area significant institutions account for 93% of the total exposures to selected EMEs (i.e. Argentina, Brazil, China, Indonesia, Malaysia, Mexico, South Africa and Turkey).

Chart 13

Euro area banks’ EME exposures are concentrated in neighbouring countries and Latin America

Euro area banks’ exposures to emerging market and developing economies

(Q1 2018, € billions, percentage of total assets)

Source: ECB supervisory data.

Note: Country group classification is in line with the IMF’s country composition of World Economic Outlook Groups.

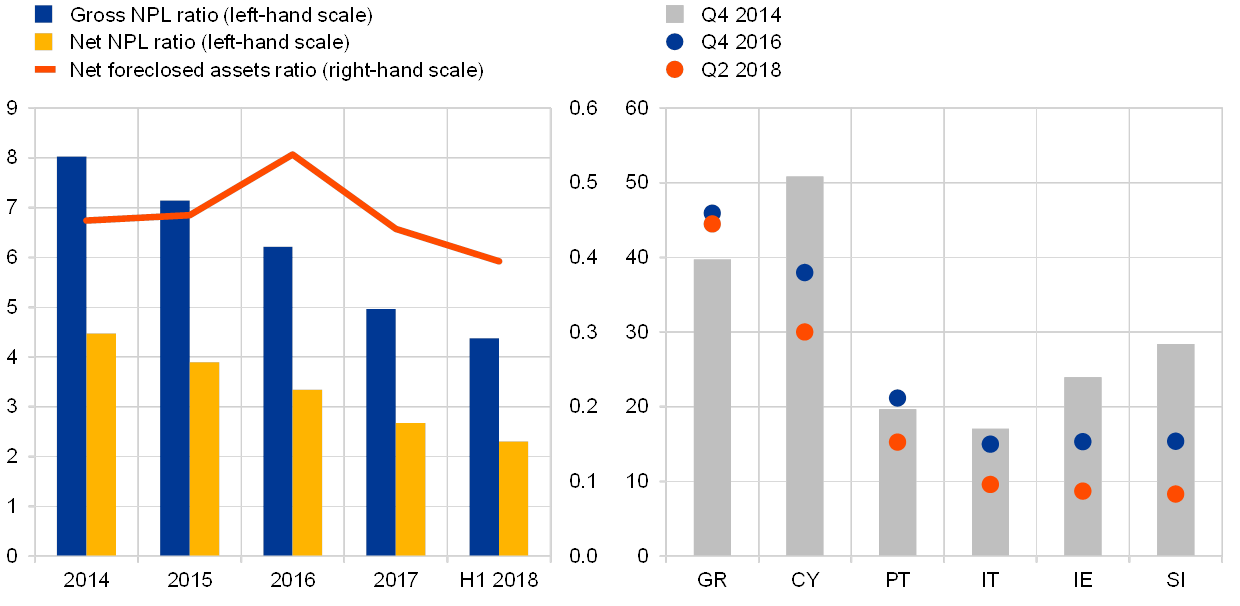

The steady decline in the non-performing loans (NPLs) of euro area banks has continued. In the second quarter of 2018, euro area significant institutions’ aggregate NPL ratio stood at 4.2%, down from 6.4% two years ago. The NPL reduction process either accelerated or continued apace in the majority of high-NPL countries. A granular decomposition of changes in NPL ratios over this period shows that the bulk of the reductions in NPL ratios were linked to cures, liquidations and write-offs (see Chart 14). At the same time, a more active secondary market for impaired assets also contributed significantly to NPL reductions. Across countries, disposal activity continued to be strongest in Italy and Spain. Notwithstanding the increased transactions, liquidity in the secondary markets for NPLs continues to be afflicted by several types of market failures. NPL transaction platforms could help in overcoming market failures by offering the prospect of greater transparency in NPL markets, fostering wider investor participation and addressing coordination issues.[1]

Chart 14

Reductions in euro area bank’s non-performing loans are gaining momentum

Decomposition of changes in NPL ratios

(Q2 2016-Q2 2018, percentage of total loans)

Sources: ECB supervisory data, KPMG Debt Sales Monitor and ECB calculations.

Notes: Based on a balanced sample of 70 significant institutions. “New default inflow” is used as a proxy for the new NPLs originated in euro area countries and is based on “observed new default” flows of the Common Reporting Framework (COREP). “NPL reduction” captures cures, liquidations and write-offs. “Total loans” takes into account the denominator effect represented by a rise in total loans over the complete time period and is based on supervisory statistics drawn from the Financial Reporting Framework (FINREP). While most indicators are constructed using ECB supervisory statistics, the “NPL sales” indicator is constructed using KPMG Debt Sales Monitor information. “NPL reduction” is derived as a residual item and therefore combines both supervisory and market-based data.

Risk of liquidity strains in the investment fund sector

The euro area investment fund sector has expanded rapidly since the global financial crisis, due to persistent net inflows and rising asset valuations. Over the past ten years, total assets in the euro area investment fund sector have more than doubled from €5.7 trillion at the end of 2008 to €13.8 trillion in June 2018 (see Chart 15). The investment fund sector now accounts for nearly 20% of total assets held by the euro area financial sector and is around 45% of the size of the banking sector. The growing share of asset management activities has potential implications for financial stability and the financing of the real economy through securities markets.

Chart 15

Rapid expansion of the euro area investment fund sector since the global financial crisis, both in terms of total assets and relative to the banking sector

Total assets of euro area investment funds

(Q1 2007-Q2 2018, percentages, € trillions)

Sources: ECB investment fund statistics and banking sector statistics.

Notes: Banking sector assets refers to total assets of euro area credit institutions (excluding central banks). IFs refers to investment funds and MMFs to money market funds.

Concerns are rising over increased risk-taking by investment funds, including liquidity, credit and duration risk. In particular, investment funds have increased their holdings of bonds with relatively low liquidity to 25% of their bond portfolio in June 2018 (see Chart 16). At the same time, funds’ holdings of risky assets have further increased, but their cash buffers have declined, raising the sector’s vulnerability to potential shocks in global financial markets. While existing rules in the EU provide a robust framework to address investor protection and fund-specific vulnerabilities, there are growing concerns over cyclical risks associated with increased liquidity risk-taking and a growing market footprint of the sector as a whole. As risks mainly stem from liquidity mismatches and leverage, macroprudential tools intended to limit these vulnerabilities need to be developed further.

Chart 16

Higher liquidity risk and a growing footprint of investment funds could increase the risk of liquidity spillovers in a possible future stress event

Breakdown of securities held by euro area investment funds by liquidity characteristics (left panel) and their holdings of debt securities (right panel)

(left panel: Q4 2013-Q2 2018, € trillions, percentages; right panel: Dec. 2009/Dec. 2014/Dec. 2017/June 2018, percentages, € trillions)

Sources: ECB (Securities Holdings Statistics) and ECB calculations.

Notes: In the left panel, the sample includes all types of investment funds domiciled in the euro area, except money market funds. Securities are mapped into liquidity classes according to the Commission Delegated Regulation (EU) 2015/61, which defines liquidity requirements for banks. Highly liquid assets correspond to Level 1, liquid assets to Levels 2A and 2B and little or no liquidity to non-HQLA (high-quality liquid assets). Securities held include debt and equity securities valued at market prices, which means that shifts in portfolio composition reflect both changes in stocks and valuation effects. Classifications from the banking regulation were used for practical reasons, as the SHS data do not provide any information on the time needed to liquidate holdings. In the right panel, debt securities issued by the monetary financial institution (MFI), government and non-financial corporate (NFC) sectors are measured as nominal amounts outstanding, while the holdings by funds are based on market value. The change in ratios over time thus partly reflects valuation effects.

The potential for forced asset selling into illiquid markets affecting market conditions more widely is growing. The more recently observed outflows from bond funds did not cause major disruptions in the underlying markets. However, going forward, an abrupt and sizeable adjustment of global risk premia could give rise to first-round losses for bond funds that trigger outflows, which could be particularly severe for funds investing in less liquid assets. Liquidity risks may be unearthed in situations of forced asset sales to meet investor redemptions. Asset managers can, in principle, limit redemptions in periods of stress through fund suspensions and redemption gates. However, during past periods of stress this option has rarely been used in a timely manner.

Risks stemming from the investment fund sector have increased since the previous assessment. The more challenging risk environment, coupled with increased risk-taking strategies and reduced liquidity buffers, underlies this assessment.

Scenario analysis

The European Banking Authority (EBA) published the results of its 2018 EU-wide stress test on 2 November 2018, which encompassed many of the risks highlighted in this Review. The EBA adverse scenario was very severe, with increased risk premia and worsening macroeconomic conditions driving bank losses. It encompassed a severe drop in GDP, a substantial rise in long-term interest rates and a pronounced fall in property and stock prices. The results suggest substantial capital depletion across euro area banks, leading to a decline in the Common Equity Tier 1 (CET1) capital ratio in the adverse scenario by 380 basis points to 9.9% at the end of 2020. Notwithstanding the magnitude of the impact, the euro area banking sector remains resilient, also reflecting improvements in capital ratios in recent years. To cater for the long time lag between the launch of the EBA stress-test exercise at the start of 2018 and the publication of the results, the Review includes supplementary sensitivity analyses for risks which have become prominent over the course of the year, such as the risks of an abrupt downturn of the most relevant EMEs for euro area banks and additional tension in sovereign debt markets. The results of these sensitivity analyses indicate that the materialisation of these risks would have a limited impact on the banking system, with an implied scope for further deterioration of the results of around 30 to 70 basis points of CET1 capital in addition to the capital depletion of 380 basis points.

Policy considerations

Ten years after the outbreak of the global financial crisis, the main regulatory reforms are close to completion. The focus is set to gradually shift to full and consistent implementation of the agreed measures. In this regard, the ECB has provided substantial contributions to various regulatory initiatives at both the international and EU levels, and continues to support the strengthening of the regulatory architecture and the establishment of a sound and robust regulatory framework for financial institutions, markets and infrastructures. While substantial progress has been made over the past decade, there are still a number of legal and institutional challenges to overcome before European banks can operate within a truly integrated financial framework. As regards the ongoing review of the institutional set-up, the ECB supports a limited number of targeted changes to the governance and operational framework of the European Systemic Risk Board (ESRB) proposed by the European Commission, which aim at enhancing the ESRB’s efficiency and effectiveness. Going forward, EU co-legislators should make progress towards completing the banking union by establishing: (i) a fully fledged European deposit insurance scheme as the necessary third pillar to underpin the confidence of all depositors in the financial system and thereby safeguard financial stability; and (ii) a common backstop to the Single Resolution Fund which will buttress the credibility of the resolution framework.

The implementation of the Basel III regulatory reforms for banks is expected to be concluded by the end of this year. The revisions will introduce into EU law the leverage ratio requirement, the revised market risk capital framework, and the net stable funding ratio requirement. In this context, EU co-legislators should consider an ambitious set of targeted changes to the macroprudential framework, with the aim of making it more coherent, consistent and operational. In the medium term, a comprehensive review of the macroprudential framework is still warranted to further streamline procedures and to complement it with tools addressing risks in the real estate and non-banking sectors. The reform package also includes additional revisions to the EU crisis management framework which are essential for strengthening the resilience of the EU banking sector. As further experience with the post-crisis reforms is gained, progress should be monitored through a comprehensive evidence-based evaluation. In this regard, the ECB closely collaborates with the Financial Stability Board and other standard-setting bodies to evaluate whether the G20 financial regulatory reforms are achieving their intended outcomes.

Further efforts are needed to strengthen the regulatory and supervisory framework for the non-bank financial sector. For instance, in view of the strong growth in the role of investment funds in financial intermediation and indications that the sector is assuming more risk, authorities need to be equipped with relevant powers to be able to mitigate structural vulnerabilities arising from asset management activities, in particular for situations where measures available to asset managers themselves would not be sufficient to address these vulnerabilities. EU co-legislators should introduce macroprudential tools designed to address systemic risks related to liquidity mismatches and the use of leverage in investment funds. Moreover, the European Commission’s review of the prudential treatment of investment firms sets out a prudential framework that is better adapted to the risks and business models of investment firms, as well as subjecting systemically important investment firms to the same prudential rules as banks. Investment firms that are significant market participants, engage in cross-border activities or are connected to credit institutions could function as shock amplifiers, irrespective of their size. Consequently, certain macroprudential tools could be developed to address specific risks that smaller investment firms could also pose to financial stability.

1 Macro-financial and credit environment

1.1 Continued euro area expansion, but risks are on the rise

Broad-based euro area growth continued amid some loss in momentum. The slowdown in euro area growth since the end of last year has been largely related to a weaker impetus from net exports, reflecting weakening global trade and the past appreciation of the euro. Domestic demand remained the main engine of economic growth, reinforced by the ECB’s monetary policy measures. Favourable labour and housing market developments continue to bolster private consumption, while benign financing conditions and rising corporate profitability underpin business investment. The economic expansion has remained broad-based across countries and sectors of economic activity, underpinning the resilience of the underlying cyclical momentum.

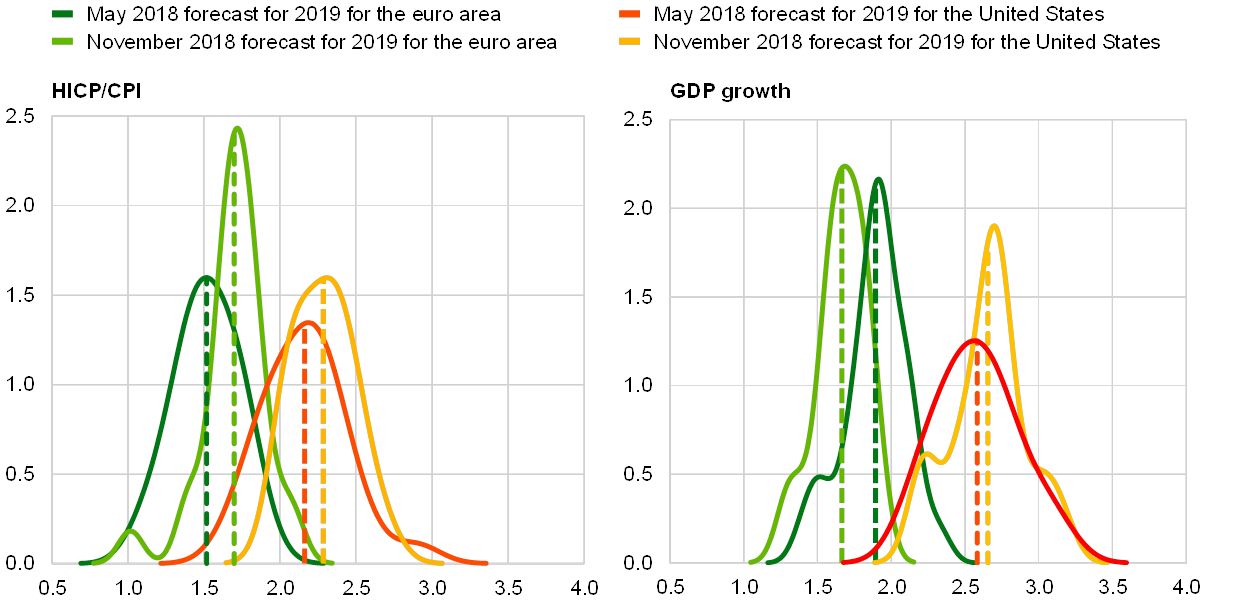

Fundamentals remain in place for a continued euro area economic expansion. The euro area economy is projected to grow at a pace slightly above potential, reflecting the favourable impact of the accommodative monetary policy, improving labour market conditions and stronger sectoral balance sheets. The September 2018 ECB staff macroeconomic projections envisage a slight moderation in real GDP growth from 2.0% in 2018 to 1.7% in 2020 amid a weaker stimulus from world trade and growing labour supply shortages. This euro area outlook continues to contrast with more buoyant developments in the United States, where uncertainties surrounding the outlook are higher given the late phase of the business cycle (see Chart 1.1).

Chart 1.1

The euro area nominal growth outlook continues to contrast with more buoyant developments in the United States

Distribution of the 2019 HICP/CPI inflation and real GDP growth forecasts of private sector professional forecasters for the euro area and the United States

(probability density)

Sources: Consensus Economics and ECB calculations.

Note: The dashed lines represent the average HICP (Harmonised Index of Consumer Prices)/CPI (Consumer Price Index) inflation and real GDP growth forecast values.

Nominal pressures are building up gradually in the euro area. Headline HICP inflation has inched up to slightly above 2% since the publication of the previous FSR (see Chart 1.2, left panel), mainly reflecting higher contributions from energy inflation. While measures of underlying inflation remain generally muted, domestic cost pressures are expected to strengthen and broaden amid high levels of capacity utilisation and tightening labour markets, which are pushing up wage growth (see Chart 1.2, right panel). The September 2018 ECB staff macroeconomic projections for the euro area foresee average headline inflation of 1.7% in both 2019 and 2020.

Global growth has become more uneven. Growth dynamics have become less synchronised across the globe since the beginning of the year (see Chart 1.3, left panel), as buoyant developments, in particular in the United States, contrast with a decelerating thrust in other advanced economies and emerging market economies (EMEs). Advanced economies outside the euro area continue to benefit from accommodative monetary policies and fiscal stimulus (in the United States). While higher (albeit more recently somewhat decreasing) oil prices have helped stabilise activity in many oil-exporting EMEs, tighter financial conditions as a result of idiosyncratic shocks are muting the cyclical momentum in some EMEs. Over the medium term, global economic activity is expected to expand at a pace close to potential growth, as output gaps close in most advanced economies amid gradually diminishing policy support and China transitions to a lower growth path.

Chart 1.2

Nominal pressures are building up gradually in the euro area

HICP inflation and HICP inflation excluding energy and food in the euro area (left panel); market-based inflation expectations, negotiated wages and the oil price (right panel)

(left panel: Jan. 2016-Oct. 2018, annual percentage changes; right panel: Jan. 2016-Oct. 2018, annual percentage change, percentage, USD per barrel)

Sources: Bloomberg, Eurostat, ECB and ECB calculations.

Notes: The vertical lines indicate the latest data point available at the time of the publication of the previous FSR. In the left panel, the dashed horizontal line indicates the long-term average for HICP inflation excluding energy and food in the euro area, capturing the time frame from January 1997 to October 2018.

Global risks cloud the baseline euro area growth outlook. Several downside risks to the euro area growth outlook relate to global factors. Uncertainties regarding the course of the US economy and monetary policy, a further rise in political and policy uncertainties across the globe, including those relating to growing trade protectionism, as well as a further intensification of stress in EMEs, may weigh on the global and euro area growth momentum. On the upside, domestic demand momentum could turn out stronger than expected, reflecting lower unemployment risk, a low saving ratio and improving earnings.

A turn of the US business cycle could affect global financial stability. The expansion of the US economy is currently the second longest on record, while it is operating at full employment – historically a herald of future downturns (see Chart 1.3, middle panel). The enacted fiscal stimuli make the risk of a cyclical turn less imminent, but higher inflationary pressures in the late phase of the business cycle may lead to faster than anticipated US monetary policy tightening. The ensuing tighter financing conditions and slowdown in growth in the United States could spill over to global financial markets and adversely affect the world economy. The current loose fiscal policies may also reignite public debt sustainability concerns and lead to a reassessment of US sovereign risk, triggering a repricing in global bond markets.

Chart 1.3

Global growth has become less synchronised, while a turn in the US business cycle and rising protectionism may weigh on global growth and trade going forward

Share of countries with GDP and import growth rates positively deviating from the past three-year average (left panel); unemployment rate and NAIRU in the United States (middle panel); share of trade affected by protectionism in total US, Chinese and global trade (right panel)

(left panel: Q1 2006-Q2 2018, percentages; middle panel: Q1 1968-Q2 2018, percentages; right panel: percentage of total goods trade, percentage point contributions)

Sources: National Bureau of Economic Research (NBER), Bloomberg, US census, IMF Direction of Trade Statistics and ECB calculations.

Notes: Left panel: the sample comprises 32 advanced and emerging market economies. 0% and 100% correspond to full synchronisation. Middle panel: the grey shaded areas indicate recessions as defined by the NBER. Right panel: US tariffs cover tariffs on steel and aluminium, tariffs on Chinese products of around USD 50 billion for China’s intellectual property practices and a further round of tariffs targeting Chinese products worth around USD 200 billion. The ensuing Chinese retaliatory measures amount to around USD 110 billion. NAIRU stands for non-accelerating inflation rate of unemployment.

Rising political and policy uncertainties could dent confidence and sentiment. Political and policy uncertainties both within and outside the euro area appear to have increased lately. Despite limited spillovers so far, the stress in Italian sovereign debt markets illustrates how quickly policy uncertainties and the ensuing sudden shift in market sentiment can unearth risks to financial stability via higher risk premia and rising public debt sustainability concerns. The remaining lack of clarity on the future relations between the United Kingdom and the European Union also implies uncertainty surrounding the sentiment and growth implications of the UK leaving the EU. Finally, a potential intensification of tensions in geopolitical hotspots (e.g. the Middle East) may have a severe impact on the world economy via deteriorating sentiment and a rise in global risk aversion.

A further escalation of trade tensions has the potential to weigh on global trade. Risks of trade protectionism have partly materialised with the intensification of strains in US-Chinese trade, but the amount of global trade affected remains contained (see Chart 1.3, right panel). While the tariffs could weigh somewhat on activity in the United States and China, their global impact is judged to be small. A possible further escalation of trade tensions could, however, significantly impact global trade, growth and asset prices, especially if direct trade effects are compounded by indirect adverse confidence effects stemming from increased uncertainty about future trade policies and trading relations (see Special Feature B).

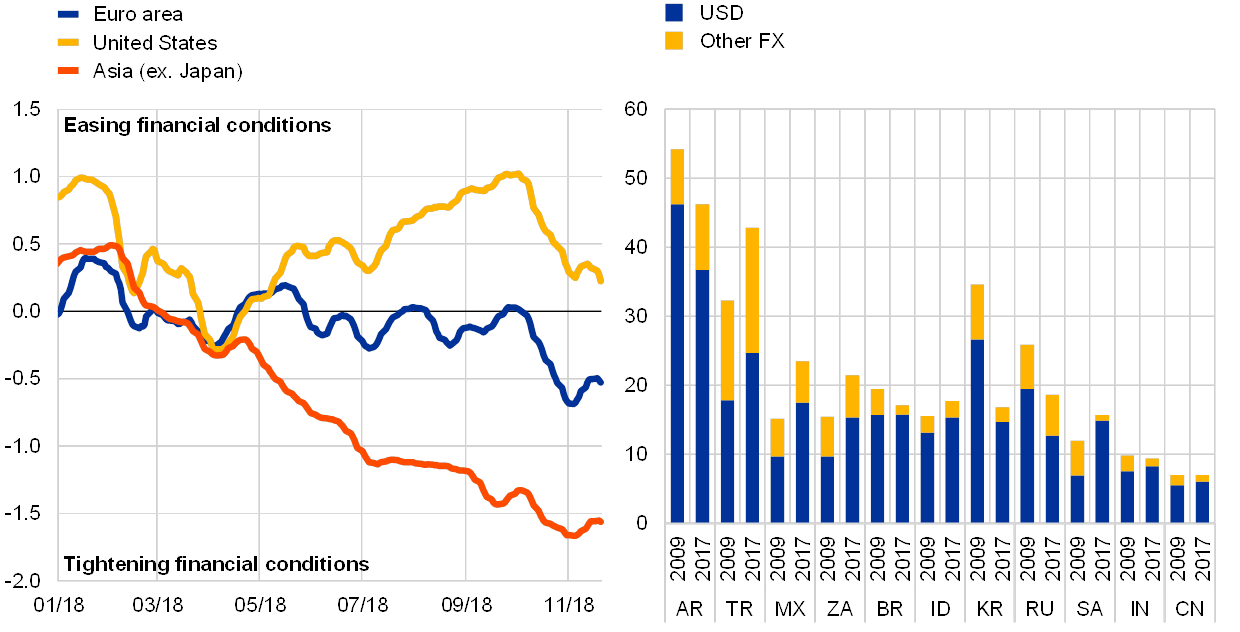

Chart 1.4

Financial conditions have tightened markedly in EMEs, in particular in those which are heavily reliant on US dollar funding

Financial conditions in advanced and emerging economies (left panel) and share of foreign currency-denominated debt in total non-financial corporate and sovereign debt (right panel)

(left panel: Jan. 2018-Nov. 2018, number of standard deviations, ten-day moving averages; right panel: percentage of GDP)

Sources: Bloomberg, Institute of International Finance and ECB calculations.

Notes: Right panel: AR: Argentina, TR: Turkey, MX: Mexico, ZA: South Africa, BR: Brazil, ID: Indonesia, KR: South Korea, RU: Russia, SA: Saudi Arabia, IN: India, CN: China. Figures comprise debt of non-financial corporations and sovereigns.

Vulnerabilities in EMEs remain a cause for concern. A combination of rising interest rates as a result of the ongoing normalisation of US monetary policy and a stronger dollar led to a broad tightening of financial conditions in EMEs (see Chart 1.4, left panel), highlighting the risk of sudden stops in capital flows to EMEs (see Box 1). More pronounced tensions were largely limited to Argentina and Turkey, i.e. countries with high current account deficits and a heavy reliance on US dollar funding (see Chart 1.4, right panel). Some spillovers to other EMEs have been observed though, with sovereign spreads rising and downward pressures on local currencies increasing. Unlike during previous episodes of EME stress, differences in underlying fundamentals have given rise to market discrimination across EMEs so far (see Chart 3 in the Overview). There is, however, the risk that idiosyncratic, country-level events – such as financial and real shocks associated with China’s rebalancing process or its trade dispute with the United States – spark a broader-based increase in risk aversion vis-à-vis EMEs at large, with significant implications for global financial markets and economic activity.

All in all, financial stability in the euro area could be challenged in the event of the materialisation of downside risks. These factors may not only undermine the sustainability of the global and euro area growth momentum, but also have the potential to trigger tensions in global financial markets and prompt a disorderly unwinding of global search-for-yield flows. A weaker than expected growth environment could trigger the materialisation of any of the main risks to euro area financial stability and could reinforce global risk repricing, further challenge bank profitability or fuel debt sustainability concerns.

Based on an indicator of cyclical systemic risk, medium-term risks appear to be low, while increasing in some countries. The composite domestic cyclical systemic risk indicator, designed to signal risks of a financial crisis over the medium term, has remained broadly stable below the long-term mean (see Chart 1.5), implying a low likelihood of cyclical systemic risks to the euro area materialising in the medium term. However, the dispersion across countries has continued to narrow amid a rise in risk indicators for countries with more subdued cycles.

Chart 1.5

The cyclical systemic risk indicator signals low levels of risk in the medium term

Cyclical systemic risk indicator across euro area countries

(Q1 1980-Q1 2018, median and interquartile range)

Sources: Bloomberg, Eurostat, ECB and ECB calculations.

Note: For details on the underlying methodology see Special Feature B in the May 2018 FSR.

Box 1

Explaining the slowdown in portfolio flows to EMEs

Portfolio flows to EMEs have declined significantly in the course of 2018, largely as a result of increased investor sensitivity towards EME asset markets and rising protectionist pressures. After a spell of strong and stable foreign purchases of debt and equity instruments issued by sovereigns and corporates in EMEs throughout 2017, aggregate portfolio flows to EMEs have dipped notably since February 2018 (see Chart A, left panel). Global investors started to reassess the potential negative effects of a tighter US monetary policy and a stronger dollar on financial conditions in EMEs and the downside risks to global growth stemming from mounting protectionist pressures. EMEs appear to be particularly exposed to these risks. Several EMEs borrow heavily in international markets and are affected by the tightening of US dollar funding conditions. Moreover, EMEs are generally more open to trade than advanced economies, relying on policies geared towards free trade to support economic growth. This box aims to disentangle the role of these global factors in driving the recent slowdown in portfolio flows to EMEs from country-specific vulnerabilities, which may have exacerbated the impact of global risks.

Chart A

EME portfolio outflows are still moderate compared with previous episodes of EME turmoil, but flows to several large EMEs came close to a sudden stop in the course of 2018

Non-resident portfolio flows to EMEs by asset class (left panel) and standardised flows to selected EMEs in 2018 (right panel)

(left panel: Jan. 2008-Oct. 2018, USD billions; right panel: minimum value for Jan. 2018-Sep. 2018)

Sources: Institute of International Finance (IIF) and ECB staff calculations.

Notes: Left panel: the aggregate is based on monthly data for 20 countries: Brazil, Bulgaria, Chile, China, the Czech Republic, Hungary, India, Indonesia, Korea, Lebanon, Malaysia, Mexico, the Philippines, Poland, South Africa, Taiwan, Thailand, Turkey, Ukraine and Vietnam. Right panel: a sudden stop is defined as a situation in which total portfolio flows are less than two standard deviations below their mean. See Forbes, K.J. and Warnock, F.E., “Capital flow waves: Surges, stops, flight, and retrenchment”, Journal of International Economics, Vol. 88(2), 2012, pp. 235-251. The mean and standard deviation of portfolio flows are estimated over a five-year rolling sample of three-month averages. The bars show the minimum estimates for January to October 2018. ID: Indonesia, ZA: South Africa, IN: India, TH: Thailand, MY: Malaysia, TR: Turkey, BR: Brazil, MX: Mexico, CL: Chile, KR: South Korea.

On aggregate, the slowdown in portfolio flows so far has been less abrupt compared with previous periods of market tensions in EMEs. In particular, non-resident purchases of EME portfolio instruments turned negative in May and June, but these outflows did not reach the intensity of previous similar episodes, such as the global financial crisis, the “taper tantrum” episode in 2013 and the correction in global commodity markets and Chinese equity markets in 2015. At the same time, the slowdown has been relatively sustained over time, marking the start of a new period of lower global appetite for the risky asset class of emerging market equity and debt.

While on aggregate portfolio flows to EMEs have shown some resilience to rising volatility, some large EMEs have experienced outflows approaching “sudden stop” levels. Notably, some of the largest EMEs have experienced sizeable portfolio outflows in the course of this year. Foreign flows out of bond and equity markets in Indonesia and South Africa, and to a lesser extent in India, Thailand, Malaysia, Turkey and Brazil, have been in a range from slightly above to somewhat below a threshold that defines a sudden stop according to popular metrics in the international finance literature (see Chart A, right panel).

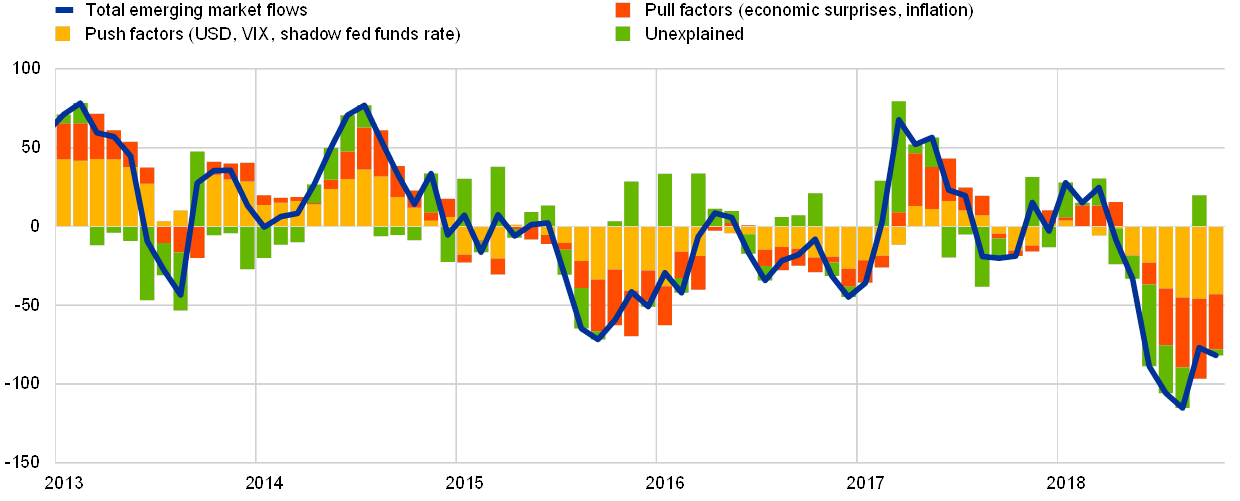

From an aggregate viewpoint, the slowdown in flows to EMEs can be explained by a tightening in global financial conditions as well as by domestic factors. There are two broad categories of factors explaining portfolio flows into EMEs.[2] Push factors comprise popular indicators of global risk and financial conditions, coming in particular from the United States, which are deemed key determinants of investors’ liquidity and risk appetite towards EMEs.[3] Pull factors, such as the strength of domestic growth and macroeconomic fundamentals, are also important factors in explaining investments in EMEs, beyond global financial conditions. A simple econometric model that decomposes recent dynamics in aggregate portfolio flows to EMEs into these two broad factors attributes the bulk of the recent slowdown to a stronger negative contribution from a set of push factors (see Chart B), notably the strengthening of the US dollar in 2018, several further US monetary policy rate hikes and, to a lesser extent, increases in equity market volatility from the extremely low levels observed in previous years.[4] Moreover, domestic factors have also increasingly contributed to the outflows. In particular, economic surprises have recently been on the downside and inflation rates have increased.

Chart B

The recent slowdown in aggregate portfolio flows was mainly driven by tighter global financial conditions, but also by waning domestic support

Total portfolio flows to EMEs decomposed into push and pull factors – deviations from sample means

(Jan. 2013-Oct. 2018, USD billions)

Sources: IIF, Citigroup, sentix, Federal Reserve Board, Haver and ECB calculations.

Notes: Total EME flows are de-meaned three-month moving sums of non-resident equity and bond flows to a set of EMEs listed in the notes of Chart A. Push and pull factors are derived from a univariate autoregressive distributed lag (ARDL(1)) model of total EME flows explained by five indicators: EME inflation (pull), EME economic surprise index (pull), narrow US dollar nominal exchange rate (push), VIX index (push) and the shadow US federal funds rate (push).

In sum, the slowdown in foreign portfolio flows to EMEs was driven by both push and pull factors. Higher interest rates for US dollar-denominated bonds and a stronger dollar have tightened financial conditions for a number of EMEs, exacerbating external vulnerabilities for corporate and sovereign borrowers that rely on dollar funding without sufficient hedges. Also, the news flow about the economic situation in EMEs has generated selling pressure for global portfolio investors. Finally, it should be noted that the aggregate analysis, presented here, masks important cross-country heterogeneity in respect of country-specific vulnerabilities, such as political uncertainty or the extent of external imbalances (see Chart 3 in the Overview).

1.2 Re-emerging sovereign debt sustainability concerns

Stress in euro area sovereign debt markets flared up. Sovereign debt sustainability concerns have come to the forefront since the previous FSR, triggered by heightened political and policy uncertainties surrounding the formation of a new Italian government in May/June this year. The related pick-up of the composite indicator of systemic stress for euro area sovereign bond markets went hand in hand with an increase in cross-country dispersion to levels last observed in early 2016 (see Chart 8 in the Overview). Contagion to other countries has remained relatively contained though, amid strong cyclical conditions and a continued positive news flow from countries more affected by the global financial and euro area sovereign debt crises, related for example to sovereign rating upgrades (e.g. for Cyprus, Greece, Spain) and the conclusion of the third economic adjustment programme for Greece.

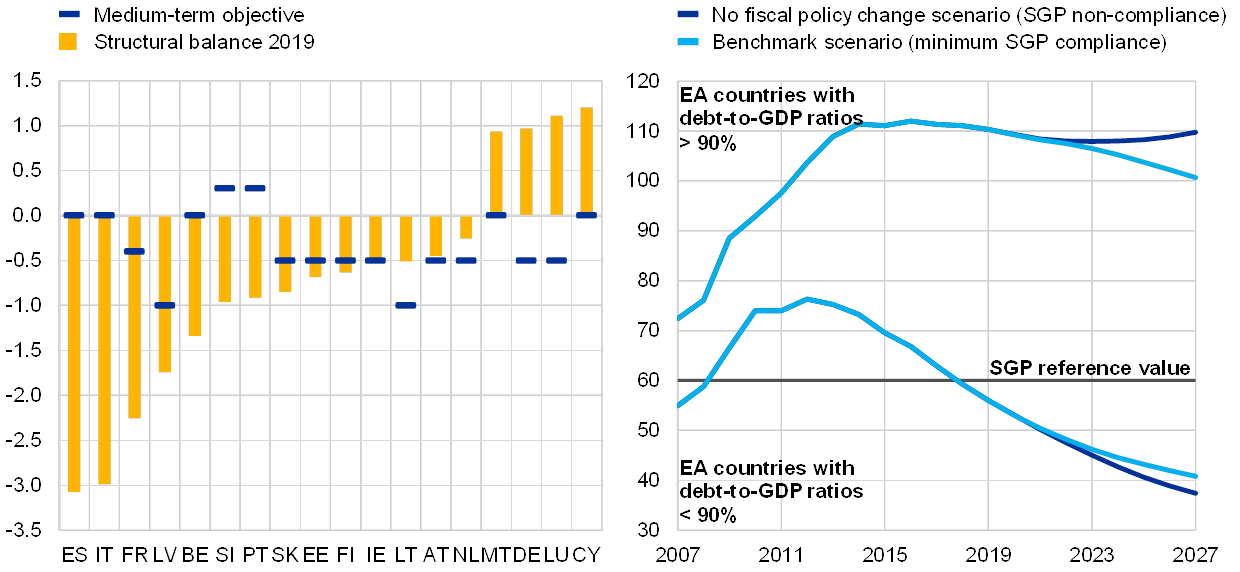

Chart 1.6

Fiscal adjustment needs remain considerable in several euro area countries, while fiscal discipline is key for the sustainability of public finances

Structural fiscal balances and medium-term objectives in individual euro area countries (left panel) and scenario analyses for euro area country groups with general government debt-to-GDP ratios of below and above 90% (right panel)

(left panel: percentage of GDP; right panel: 2007-27, percentage of GDP)

Sources: European Commission (AMECO database), ECB (Government Finance Statistics) and ECB calculations.

Notes: Left panel: under the preventive arm of the SGP, countries are required to ensure convergence towards their respective medium-term objectives (MTOs), in terms of their structural budget balances. These objectives are set by individual euro area countries in their national stability programmes and the envisaged date of compliance differs from country to country. Greece is not shown in the chart as it was subject to an economic adjustment programme until August 2018 and was thus outside the scope of the European Semester. The MTO for Greece is expected to be set only in spring 2019. Right panel: euro area countries with public debt-to-GDP ratios of over 90% of GDP (i.e. Belgium, Cyprus, France, Greece, Italy, Portugal and Spain) are considered as highly indebted. Under the minimum SGP compliance scenario, countries below their MTO are assumed to take additional consolidation measures (the minimum to avoid sanctions under the SGP) as of 2018 to reach the country-specific MTOs. In the no fiscal policy change scenario, no additional fiscal consolidation (stimulus) is assumed compared with what is implied by the European Commission’s autumn 2018 economic forecast.

Favourable cyclical and financing conditions mask underlying fiscal vulnerabilities. The aggregate euro area headline fiscal deficit declined from 1.6% of GDP in 2016 to 1.0% of GDP in 2017, and is set to drop further to 0.6% of GDP in 2018, while deteriorating slightly in 2019-20. The improvement in 2018 has been chiefly supported by continued strong (albeit somewhat softening) economic growth and the low interest rate environment. However, the positive cyclical component is more than compensated for by the projected structural loosening. Fiscal efforts continue to fall short of commitments under the Stability and Growth Pact (SGP) in several (in particular highly indebted) euro area countries (see Chart 1.6, left panel). Overall, the reliance of the projected improvement in fiscal balances on benign cyclical conditions renders the fiscal outlook particularly sensitive to changes in the growth and interest rate environment.

For highly indebted countries, addressing debt sustainability concerns requires active fiscal consolidation. The euro area aggregate general government debt-to-GDP ratio has been on a downward trajectory since the peak in 2014, reaching 88.9% in 2017. More recently, the stock of debt has continued to increase in several highly indebted countries, despite the downward effect of supportive macro and financial conditions. Hence, failure to rein in fiscal balances and to comply even with minimum SGP requirements would place debt trajectories on a clear upward path in most countries with debt ratios above 90% (see Chart 1.6, right panel). The strong reaction in Italian sovereign bond markets in May/June this year illustrates how quickly shifts in market sentiment can reignite pressures on more vulnerable sovereigns. Pressure on sovereign financing costs, in combination with a lack of sufficient fiscal consolidation efforts, may put the debt ratio on an unsustainable path in highly indebted countries.

Favourable sovereign financing conditions imply that rollover risks are concentrated among a few vulnerable issuers. Despite the spike in Italian government bond yields, overall pricing conditions have remained relatively benign for euro area sovereigns against the backdrop of ongoing Eurosystem asset purchases. The average residual maturity of outstanding euro area government debt securities continued to be extended (see Chart 1.7, left panel). The increase in fixed rate debt issuance allows governments to lock in long-term financing at low costs and to capitalise on historically low interest rates. The debt servicing obligations of euro area sovereigns have declined on aggregate. Nevertheless, they remain high for some highly indebted euro area countries (see Chart 1.7, right panel). This may suggest possible rollover risks in terms of both the availability and the cost of funding in the event of a reassessment of sovereign risk by market participants.

Chart 1.7

The shift towards long-term fixed rate debt issuance has continued, but debt servicing needs remain high in some countries

Outstanding amount of government debt securities by interest rate type (left panel) and total debt servicing needs due in two years and ten-year sovereign bond yields (right panel)

(left panel: left-hand scale: percentage of GDP; right-hand scale: years; right panel: x-axis: Sep. 2018, percentage of GDP; y-axis: Oct. 2018, percentages)

Sources: ECB and ECB calculations.

Notes: Left panel: the low debt category covers euro area countries with public debt levels below 60% of GDP (i.e. Estonia, Latvia, Lithuania, Luxembourg, Malta and Slovakia) as at year-end 2016. Countries with public debt levels of between 60% and 90% of GDP (i.e. Austria, Finland, Germany, Ireland, the Netherlands and Slovenia) are labelled as medium debt countries, while countries with debt levels of over 90% (i.e. Belgium, Cyprus, France, Greece, Italy, Portugal and Spain) are referred to as high debt countries. Figures are shown as at June 2012 (the height of the euro area sovereign debt crisis), February 2015 (the month preceding the start of the ECB’s public sector purchase programme) and September 2018 (most recent observation). Right panel: data on government debt service over the next two years only reflect existing maturing securities (principal and interest). The scheduled (future) redemptions are calculated based on the maturity date for each debt security. The amounts do not include government loans or redemptions of debt securities covering future budget deficits or redemptions of debt securities that will be issued in the future. Red dots represent euro area countries with non-investment-grade ratings (BB+/Ba1 or below), while countries with lower and upper medium investment-grade ratings as well as high investment-grade and prime investment-grade ratings (AA-/Aa3 or better) are marked yellow and green, respectively, based on the average sovereign rating by Standard & Poor’s, Moody’s and Fitch as at October 2018.

In sum, sovereign risks have increased since the previous FSR. Sovereign debt dynamics continue to benefit from the ongoing solid economic expansion and favourable financing conditions in terms of both pricing and duration. However, public finances remain fragile in a number of euro area countries, exposing them to the risk of a sudden change in market sentiment or deteriorating macroeconomic conditions. Waning fiscal consolidation efforts, particularly in combination with higher long-term interest rates, would fuel public debt sustainability concerns in more vulnerable euro area countries.

1.3 Solid household fundamentals, but pockets of vulnerability remain

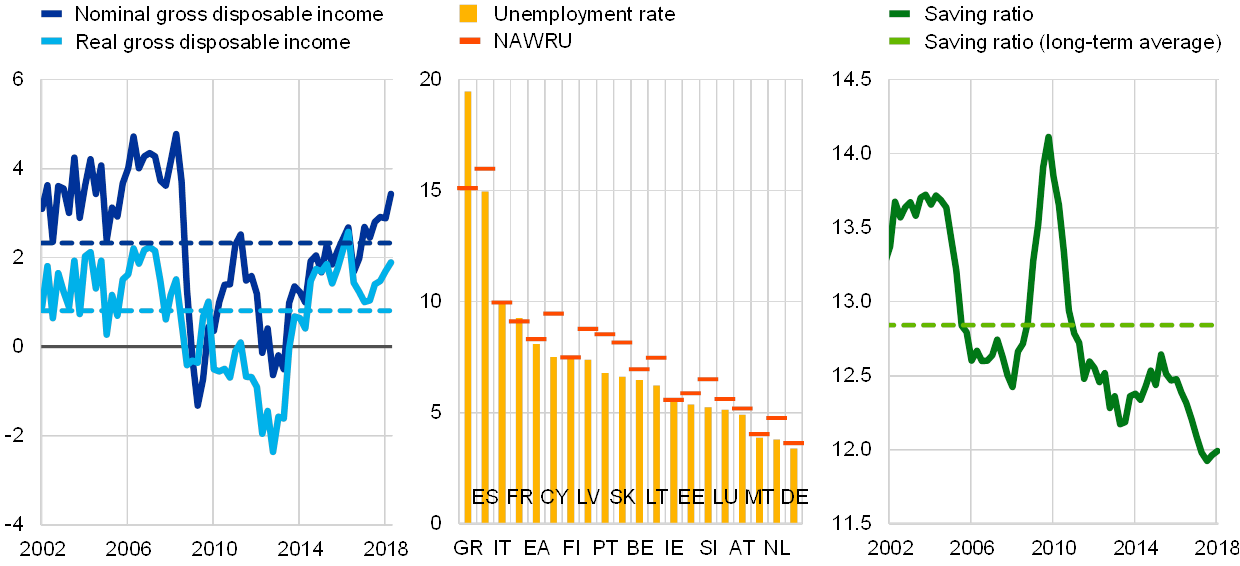

Favourable cyclical conditions have bolstered euro area households’ income position. Households’ disposable income continued to grow at above long-term average rates (see Chart 1.8, left panel). Rising euro area aggregate income growth has been mainly driven by ongoing job creation and the related robust growth in labour income. Labour market conditions remain heterogeneous across countries amid increasingly binding labour supply shortages in some countries and still elevated unemployment rates in others (see Chart 1.8, middle panel). Tighter labour market conditions and an upward trend in wage growth, coupled with strong valuation gains on property holdings, are boosting household incomes and net worth and, ultimately, household spending. A higher propensity to consume is also reflected in a saving ratio close to the record low (see Chart 1.8, right panel).

Chart 1.8

Income growth and tighter labour market conditions mitigate income risks for euro area households

Gross disposable income growth (left panel), unemployment rate and NAWRU across the euro area (middle panel) and saving ratio (right panel)

(left panel: Q1 2002-Q2 2018, annual percentage changes; middle panel: Q3 2018, percentages; right panel: Q1 2002-Q2 2018, percentages)

Sources: Eurostat, European Commission (AMECO database), ECB and ECB calculations.

Notes: Left panel: the dashed horizontal lines represent the long-term average, covering the period from Q2 2000 to Q2 2018. Middle panel: NAWRU stands for non-accelerating wage rate of unemployment.

The indebtedness of euro area households has stabilised at pre-crisis levels, but vulnerabilities at the country level remain. The indebtedness of euro area households stabilised at slightly below 58% of GDP in the first half of 2018. While this is not particularly high by international standards, it is still somewhat above the estimated benchmark level of 53% of GDP derived from the macroeconomic imbalance procedure (MIP) threshold for non-financial private sector debt. The euro area aggregate continues to mask marked cross-country heterogeneity though, with the household debt-to-GDP ratio ranging from about 20% in Latvia and Lithuania to above 100% in Cyprus and the Netherlands (see Chart 1.9, left panel). From a flow perspective, continued deleveraging (in both absolute and relative terms) in some euro area countries that were more affected by the crisis (e.g. Cyprus, Greece, Ireland and Spain) contrasts with signs of releveraging in most others. However, only in a few countries, notably Belgium and France, does the pace of new debt accumulation outstrip nominal GDP growth.

Debt sustainability concerns are mitigated by the low level of interest rates. An improved income position coupled with record low interest payment burdens support euro area households’ debt servicing capacity. Simulation results suggest that a 100 basis point increase in short and long-term market rates would have a fairly limited impact on household debt-to-GDP ratios and gross interest payments (see Chart 1.9, right panel). However, especially in the event of an interest rate shock without a commensurate boost to household income, more vulnerable households might be challenged in countries where loans at floating rates or rates with rather short fixation periods predominate. Further balance sheet repair in countries with elevated levels of household debt should help mitigate the risks related to an eventual normalisation of interest rates and the ensuing rise in debt servicing costs.

Chart 1.9

More vulnerable households could come under pressure in the event of an unforeseen shock to interest rates

Household debt-to-GDP ratios across the euro area (left panel); cumulative impact of a 100 basis point interest rate increase on the household debt-to-GDP ratio and household gross interest payments (right panel)

(left panel: percentages; right panel: percentage points of GDP)

Sources: Eurostat, ECB and ECB calculations.

Notes: Left panel: the dashed horizontal line represents the estimated MIP benchmark of 53% of GDP for household debt. The 133% of GDP MIP benchmark for fully consolidated non-financial private sector debt is split between households and firms based on their average past shares in the stock of euro area non-financial private debt. In the case of Ireland, GDP may not be the most representative scaling variable given the activities of foreign-owned multinational enterprises resident in the country. Alternative metrics that are more related to the domestic economy, such as modified gross national income (GNI*) or modified domestic demand, would yield considerably higher levels of household indebtedness. Right panel: the simulations capture the effects of a permanent one-off 100 basis point increase in short and long-term market interest rates in Q3 2018 (with higher rates kept constant thereafter) on gross interest payments based on a national accounts concept before FISIM (financial intermediation services indirectly measured) allocation, and gross indebtedness ½, 1½ and 2½ years after the shock. The results are based on models and tools used in the context of the Eurosystem projection exercises. They take into account the dampening impact of higher market interest rates on economic activity, prices and debt financing.

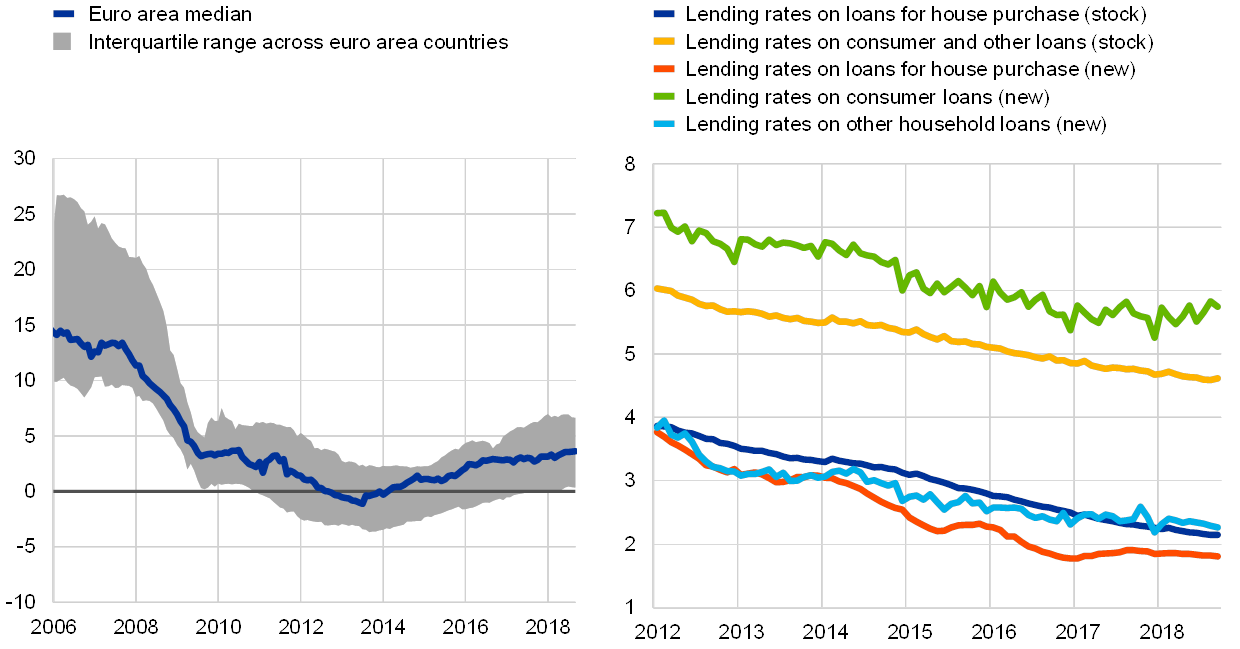

Lending flows to households have recovered further amid signs of buoyancy in some lending types and countries. On aggregate, lending to euro area households is supported by very favourable financing conditions, improvements in labour markets, an ongoing upturn in housing markets and growth in both residential investment and private consumption. At the country level, lending dynamics have continued to be muted in some countries that were more affected by the crisis (e.g. Cyprus, Greece, Ireland and Spain), while in other euro area countries (e.g. Slovakia, Lithuania, Luxembourg and Malta) developments were more buoyant (see Chart 1.10, left panel). The continued rapid growth of consumer lending in some countries is not an immediate source of concern from a financial stability perspective. Nevertheless, it may indicate a niche of increased risk-taking by banks due to higher margins in that business segment (as reflected by the still comparatively high lending rates) and thus warrants monitoring going forward (see Chart 1.10, right panel).

Chart 1.10

Growth in bank lending to euro area households is supported by lending rates close to historical lows, but heterogeneity across countries remains pronounced

Annual growth rate of loans to euro area households (left panel) and household lending rates by type of lending (right panel)

(left panel: Jan. 2006-Sep. 2018, annual percentage changes; right panel: Jan. 2012-Sep. 2018, percentages)

Sources: ECB and ECB calculations.

Note: In the left panel, loans are adjusted for loan sales and securitisation.

All in all, while euro area households are benefiting from cyclical tailwinds, stock imbalances remain a vulnerability in some countries. Improving income positions coupled with continued favourable financing conditions are supporting households’ debt servicing capacity. However, a sudden rise in interest rates may spark debt sustainability concerns in countries with elevated levels of household debt and a predominance of floating rate contracts. The buoyancy of certain types of bank lending in some euro area countries requires monitoring.

1.4 High corporate indebtedness remains a challenge

Cyclical tailwinds are alleviating credit and earnings risks for euro area non-financial corporations (NFCs). The expected default frequency and distance-to-distress measures currently signal relatively low levels of balance sheet risk for euro area NFCs that were last observed back in early 2008 (see Chart 1.11, left panel). Improved creditworthiness is buttressed by solid corporate profit growth and the related decline in earnings risks (see Chart 1.11, right panel). Well-filled order books and high levels of capacity utilisation, coupled with low interest rates, bode well for further improvements in corporate profitability. A sudden deterioration in economic growth prospects or a cost shock could, however, undermine corporate profitability, while rising trade protectionism may hamper the profit-generating capacity of export-oriented firms.

Chart 1.11

Market price-based measures continue to signal low credit risk for euro area NFCs as solid profits mitigate earnings risks

Distance to distress and expected default frequency for euro area NFCs (left panel); gross and net operating surplus of euro area NFCs (right panel)

(left panel: Jan. 2004-Sep. 2018, percentages, averages, weighted by total assets; right panel: Q1 2004-Q2 2018)

Sources: Moody’s Credit Edge, ECB and ECB calculations.

Note: In the right panel, the dashed horizontal lines illustrate the long-term averages, covering the period from Q1 1999 to Q2 2018.

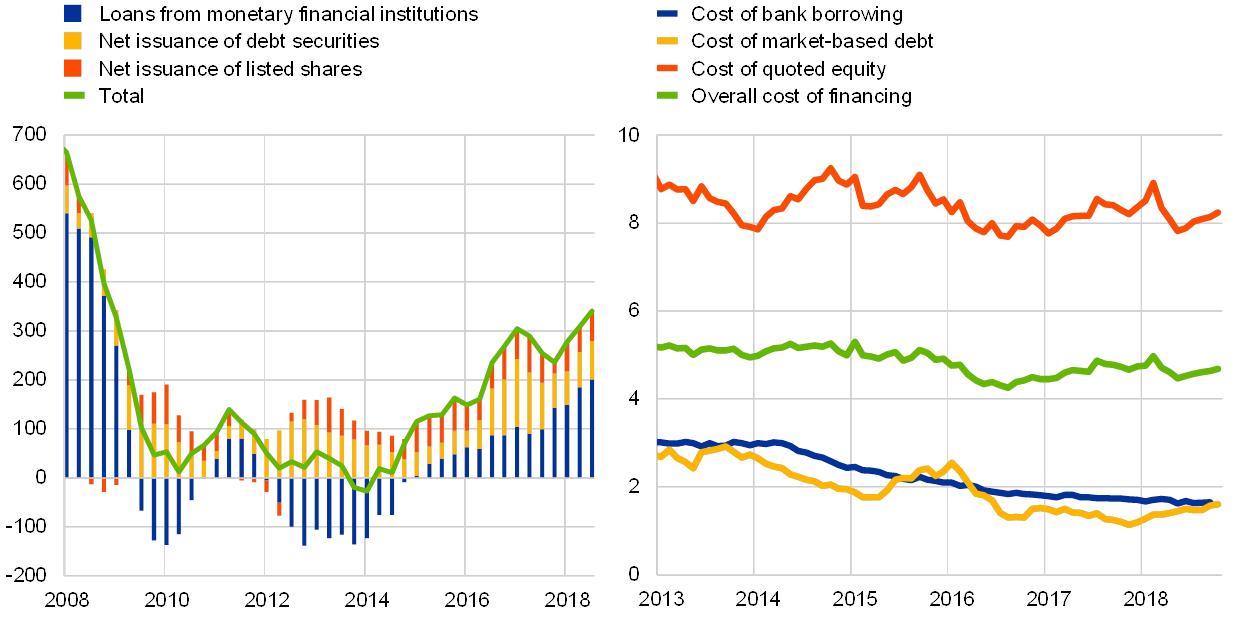

A large stock of legacy debt continues to weigh on the euro area non-financial corporate sector. On aggregate, the indebtedness of euro area NFCs remains high by both historical and international standards. The falling trend observed since early 2016 appears to have come to an end, with the consolidated NFC debt-to-GDP ratio stabilising at 82% for the euro area aggregate – a level that is still above thresholds associated with a debt overhang (see Chart 1.12, left panel). Heterogeneity across the euro area remains high in terms of both debt levels and the underlying dynamics, as debt accumulation in some countries contrasts with continued deleveraging in others. Other leverage measures at market values such as debt-to-total assets and debt-to-equity ratios for euro area NFCs point to more favourable developments though, having approached or even fallen below the levels observed at the start of EMU given higher share prices and the related positive denominator effect.