Euro area spread divergence, risk premia and financial stability

Published as part of the Financial Stability Review, November 2022.

When financial fragmentation becomes a self-reinforcing dynamic, it can present a risk to financial stability.[2],[3] As long as market functioning is orderly, credit spreads reflect macroeconomic fundamentals and risks. However, history has shown that spread-widening dynamics can become self-reinforcing. In the euro area, such adverse market dynamics have often been termed “fragmentation”. This is often associated with impaired market liquidity conditions, ultimately resulting in impaired market functioning. In such conditions spread differences may start to diverge from fundamentals. However, differences in spreads alone do not necessarily point to fragmentation (Figure A).

A key feature of fragmentation is market segmentation, whereby some segments display divergent dynamics. In integrated and efficient markets, risk premia on similar assets, such as sovereign debt, tend to co-move to the extent that such movements are driven by common, systematic risk factors. By contrast, when markets are more fragmented, differences in risk premia can emerge beyond those that can be explained by an asset’s fundamentals and some market segments displaying divergent dynamics. This box constructs an indicator of such divergent dynamics for euro area bond markets, assesses the resilience of bond markets under different regimes for this indicator and discusses the financial stability risks associated with financial fragmentation.[4]

Figure A

Differences in risk premia do not always point to fragmentation

Illustration of the relationship between financial fragmentation, financial stability risk and differences in risk premia

Source: ECB staff.

Notes: Financial stability is defined on the ECB website. Financial fragmentation does not always immediately manifest itself through differences in risk premia (area A). For example, a market segment might be characterised by a different investor base or mediated through less sophisticated financial intermediaries. In the event of a shock, risk premia may start to diverge (moving from area A to area B). Similarly, differences in risk premia do not always point to fragmentation, as this may simply reflect differences in underlying credit risk. However, increases in credit premia can be self-reinforcing and could lead to disorderly conditions within specific market segments. In this case, differences in risk premia can lead to a breakdown of markets into segments (moving from area C to area B).

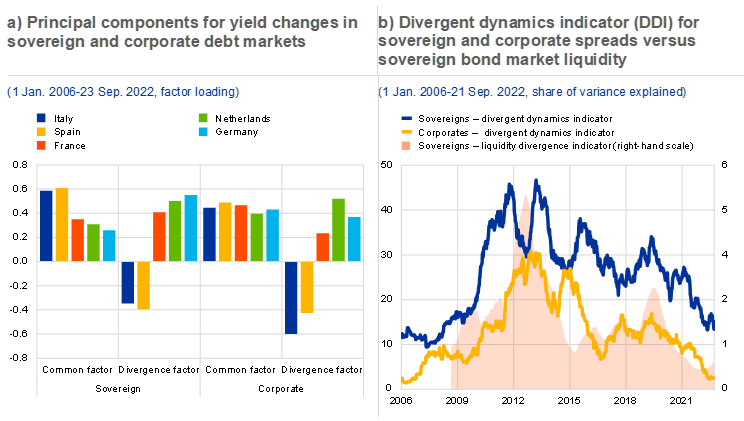

Euro area bond market dynamics in recent years can largely be explained by two factors, one which reflects common trends and another, secondary, factor which reflects divergences across countries. A statistical analysis of euro area bond yields finds that the two factors can explain most of their movements between 2006 and 2022. The first, and most important, factor reflects unfragmented dynamics whereby yields co-move across countries (Chart A, panel a). The second factor – a divergence factor – captures the segmentation of the bond markets in two distinct country blocks, with yields moving in opposite directions (Chart A, panel a). This finding is consistent with those of other studies that identify the factors that drive bond markets.[5] Flight-to-safety behaviour and elevated uncertainty may contribute to such divergent dynamics.[6]

In 2022, euro area bond markets have shown limited signs of the divergent dynamics that were prevalent during the euro area sovereign debt crisis. This can be seen from the divergent dynamics indicator (DDI), an indicator which reflects the fraction of weekly euro area bond yield movements that can be explained by the divergence factor. Considering longer-term trends, the DDI has declined gradually from the heights reached during the sovereign debt crisis in 2011, for both sovereign and corporate bonds. This may be related to ECB communications and the ECB’s public sector purchase programme. The divergence factor has almost always played a more important role for sovereign bonds than for corporate bonds (Chart A, panel b). This has also been the case more recently, with the bulk of euro area bond yield dynamics explained by the common factor. This indicates that sovereign and corporate spreads have generally been widening in a synchronous fashion, likely in reaction to euro area monetary policy normalisation. The introduction of the TPI, the flexibility in PEPP reinvestments, and the Next Generation EU package may have contributed to the relatively limited role played by the divergences in explaining recent bond market dynamics.

Chart A

Euro area sovereign and corporate credit risk premia are largely driven by a common factor, but also by a factor which reflects diverging dynamics across countries

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel b: the indicator is defined as the return that is explained by the second principal component. The DDI is defined as follows: /, where is the weekly change in sovereign (corporate) yields and PC2 is the second principal component constructed based on the sovereign yields of Germany, Spain, France, Italy and the Netherlands with a maturity of ten years between January 2006 and September 2022. The indicator shows the 52-week moving average. The sovereign bond market liquidity divergence indicator is the debt-weighted standard deviation for liquidity indices for Germany, Spain, France and Italy. These individual indices reflect the average yield pricing error for sovereign bonds along the yield curve. A higher value reflects lower liquidity. Under stressed liquidity conditions, dislocations from fair value implied by the distance from the fitted yield curve can remain persistent, resulting in large average yield errors.

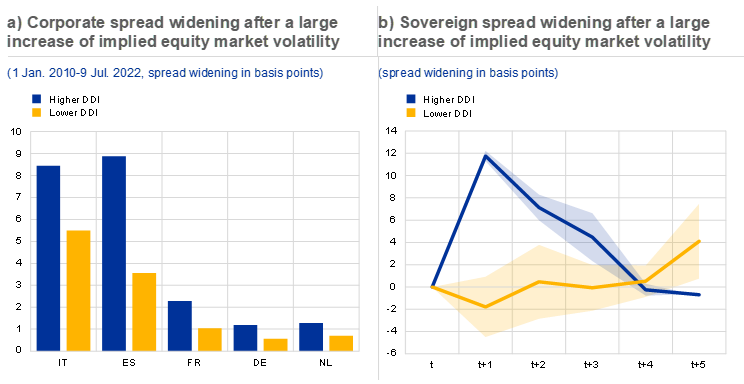

Bond markets seem to feature stronger amplification dynamics when divergences are elevated. Diverging bond market dynamics do not trivially imply that financial stability risks are elevated (Figure A). Empirical analysis, however, shows that elevated levels of the DDI are correlated with larger differences in market liquidity conditions. This points to pockets of reduced market liquidity (Chart A, panel b). There also appear to be stronger price spillovers between asset classes. When divergences are larger, both corporate bond and sovereign CDS spreads show higher sensitivity to equity price volatility (Chart B, panels a and b). The risks of disorderly and self-reinforcing dynamics might, therefore, be higher when divergences in market dynamics are more material. This could, in turn, feed back into sovereign risk pricing and drive a wedge between the yields of different countries.

All in all, risks to financial stability originating from euro area bond markets seem to be higher when divergent dynamics are more material. While spreads have widened over the course of 2022, euro area bond markets have largely shown unfragmented dynamics whereby yields have co-moved across countries (Chart A, panel b). However, this does not mean that divergent dynamics of the kind seen during the euro area sovereign debt crisis could not return, as in the past these dynamics emerged suddenly. Should that happen, market liquidity could dry up more easily in some sub-segments, making bond yields more vulnerable to adverse shocks, possibly exacerbating a tightening in financial conditions.

Chart B

When divergences in bond markets are larger, spreads widen more strongly in response to a shock in equity markets

Sources: Refinitiv, Bloomberg Finance L.P. and ECB calculations.

Notes: Higher and lower divergence regimes are defined by the upper and lower quantiles of the indicator (DDI) presented in Chart A. Panel a: corporate spread widening is based on the option-adjusted spreads of investment-grade country-level bond indices. Panel b: the graph depicts a non-linear impulse response of the median euro area five-year sovereign CDS spreads to a one standard deviation shock in the VSTOXX index during periods of low (yellow) and high (blue) DDI regimes. The threshold for a high DDI regime is set at >75th percentile. The sovereign CDS spread used in the calculations is taken as the median over the five-year USD-denominated CDS on Germany, France, Spain, Italy and the Netherlands. Variables in the regression are included in (log) first differences and are the VSTOXX index, EURO STOXX 50, Citi Economic Surprise Index for the Eurozone and the median five-year sovereign CDS spread. Non-linear impulse response functions are calculated using local projections.*

*) See Jordà, Ò., “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, Vol. 95, No 1, March 2005, pp. 161-182.

The authors would like to thank Luca Mingarelli for his valuable comments.

This box uses sovereign and corporate bond pricing to construct a statistical indicator that captures the dynamics driving credit spreads in sovereign and corporate bond markets. The box does not provide a quantitative indicator that is part of the Transmission Protection Instrument (TPI) activation assessment. A decision by the ECB’s Governing Council to activate the TPI will be based on a comprehensive assessment of market and transmission indicators, an evaluation of the eligibility criteria and a judgement that the activation of purchases under the TPI is in line with the achievement of the ECB’s primary objective. See the press release entitled “The Transmission Protection Instrument”, 21 July 2022.

We follow the definition of fragmentation as presented in the “FSB Report on Market Fragmentation”, Financial Stability Board, 4 June 2019. See Annex A of the FSB report for an overview of the literature on market fragmentation.

The analysis in this box is based on weekly data. Idiosyncratic changes in credit fundamentals would generally be expected to result in lower-frequency or longer-lasting yield changes. Therefore, country divergences of these relatively high-frequency movements could point to fragmentation.

Fabozzi, F. J., Giacometti, R. and Tsuchida, N., “Factor decomposition of the Eurozone sovereign CDS spreads”, Journal of International Money and Finance, Vol. 65, July 2016, pp. 1-23. The authors find similar dynamics and factors in their analysis of CDS spreads.

See Costantini, M. and Sousa, R. M., “What uncertainty does to euro area sovereign bond markets: Flight to safety and flight to quality”, Journal of International Money and Finance, Vol. 122, April 2022.