The sensitivity of asset prices to risk shocks when corporate vulnerabilities are high

Published as part of the Financial Stability Review, November 2021.

Fragilities created by the interaction of stretched valuations and corporate balance sheet vulnerabilities may represent a risk to financial stability. Corporate asset prices have soared at the same time as the pandemic shock has prompted an increase in the vulnerability and indebtedness of many corporates. Corporate asset valuations look high relative to the fundamentals and rest to some degree on strong risk appetite, which could make them vulnerable to shifts in global risk sentiment.[1] In the current environment, where balance sheet fragilities depend on policy support and uncertainty about the recovery is still elevated, corporate vulnerabilities could re-emerge and stock and bond market prices may be more sensitive to reversals in global risk appetite. An interaction of such vulnerabilities may have an impact on financial conditions and pose risks to financial stability. This box examines the increased sensitivity of US corporate markets to risk-off shocks when corporate vulnerabilities are high, and considers the implications from a euro area perspective.

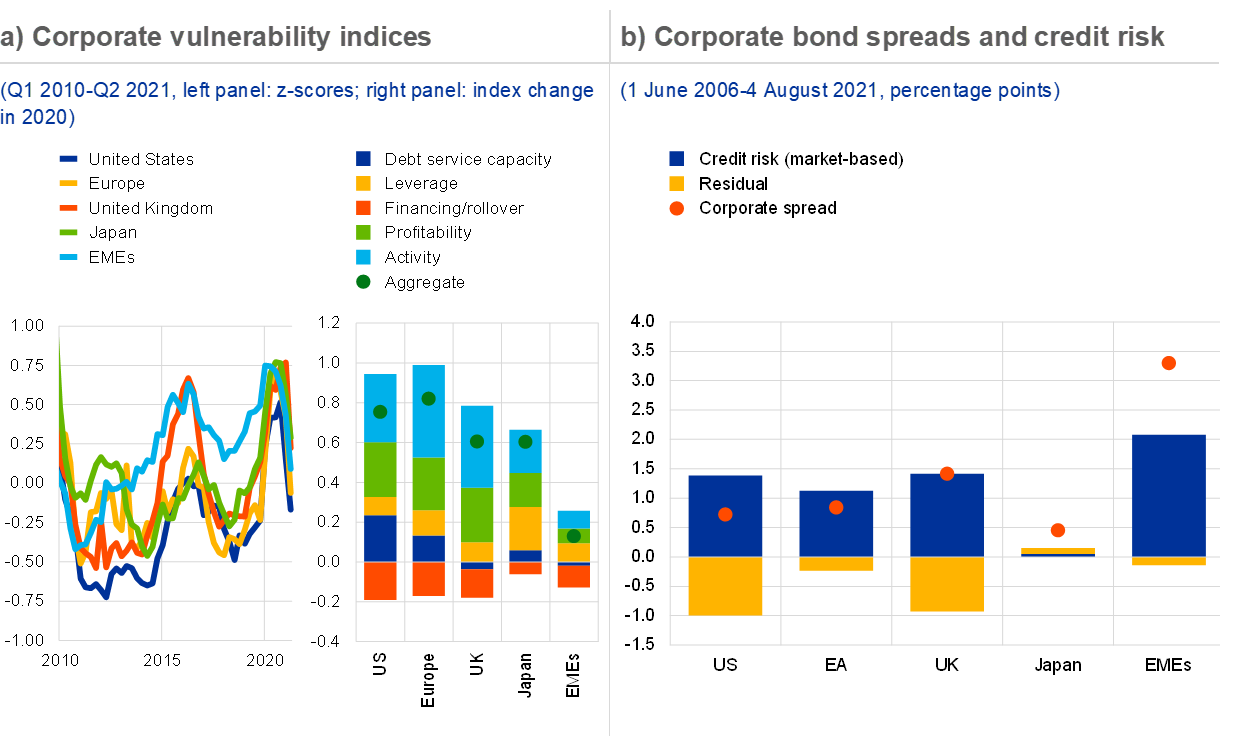

Global corporate vulnerabilities rose to elevated levels at the onset of the pandemic, mostly subsiding thereafter on the back of strong policy support and recovering earnings. An overview of corporate vulnerability indices, comprising information from a large set of corporate balance sheet indicators, suggests that fragilities across firms increased globally in 2020 (see Chart A, panel a). The increases were related to weaker activity, earnings losses, higher leverage as well as tighter debt service capacity, and were partly offset by accommodative financing conditions. Since then, global corporate vulnerabilities have eased on the back of a strong economic recovery and fiscal stimulus. Yet the resilience of the corporate sector is highly dependent on the pace of the economic recovery across countries, continued fiscal measures and monetary accommodation. It is also subject to challenging debt service capacity for highly leveraged firms.

Chart A

Global corporate vulnerabilities and financial market risk appetite

Sources: Moody’s Analytics, Bloomberg Finance L.P., Refinitiv and ECB calculations.

Notes: Panel a: the corporate vulnerability index is an aggregate measure of corporate risk, computed for US, European, UK, Japanese and emerging market economy (EME) firms included in the corresponding equity indices: S&P 500 (United States), STOXX Europe 600 (Europe), FTSE 350 (United Kingdom), TOPIX (Japan) and MSCI EME Index (EMEs). The index broadly follows the methodology in Box 1 entitled “Assessing corporate vulnerabilities in the euro area”, Financial Stability Review, ECB, November 2020. The index includes five components computed as average z-scores of balance sheet indicators since Q2 2002, due to data availability. The components include: activity (one-year moving average of year-on-year sales growth, turnover ratio), profitability (return on assets, profit margin), leverage (ratios of gross and net debt to EBITDA (earnings before interest, taxes, depreciation and amortisation), ratio of debt to book value of equity), debt service capacity (retained earnings, ratio of EBITDA to short-term liabilities, revenue generation) and financing (short-to-long-term liabilities, quick ratio, return on equity, corporate spread). Panel b: the chart shows the model-based contribution of credit risk to BBB-rated corporate spreads, following the approach in Gilchrist, S. and Zakrajšek, E., “Credit spreads and business cycle fluctuations”, American Economic Review, Vol. 102(4), 2012, pp. 1692-1720. Credit risk is measured by Moody’s KMV expected default frequencies (EDFs), and corporate spreads are measured at the country index level for bonds with a BBB rating and a three to five-year maturity. For EMEs, the EMBIG blended spread is used and credit risk is proxied by the simple average of EDFs for 14 major EMEs. The model is estimated using daily data since June 2006. The constant term is not depicted in the chart, which is why the credit risk component and the residual depicted in the chart do not tally with corporate spreads. For a broader review of euro area valuations, see, for example, Altavilla, C., Lemke, W., Linzert, T., Tapking, J. and von Landesberger, J., “Assessing the efficacy, efficiency and the potential side effects of the ECB’s monetary policy instruments since 2014”, Occasional Paper Series, No 278, ECB, September 2021. EA: euro area. The latest observations are for Q2 2021 (panel a) and 4 August 2021 (panel b).

Financial markets appear relatively sanguine about credit risks and reliant on strong risk appetite, which makes them potentially sensitive to shifts in investor sentiment. Increases in valuations across asset classes have fuelled concerns about a potential disconnect between financial markets and the real economy. Corporate credit markets point towards risk appetite having a significant influence on prices, with bond yields and spreads trading close to historic lows. Model-based analysis suggests that global corporate bond valuations, in particular for the lower-rated segments, may be stretched relative to their average historical levels and fundamentals. In particular, a market assessment of credit risk only partly explains corporate bond spreads, and the “excess bond premium” – captured by the model’s residual – is negative across several markets (see Chart A, panel b).

Chart B

Increased sensitivity to risk-off shocks in states of elevated corporate fragility

Sources: Bloomberg Finance L.P., Refinitiv and ECB calculations.

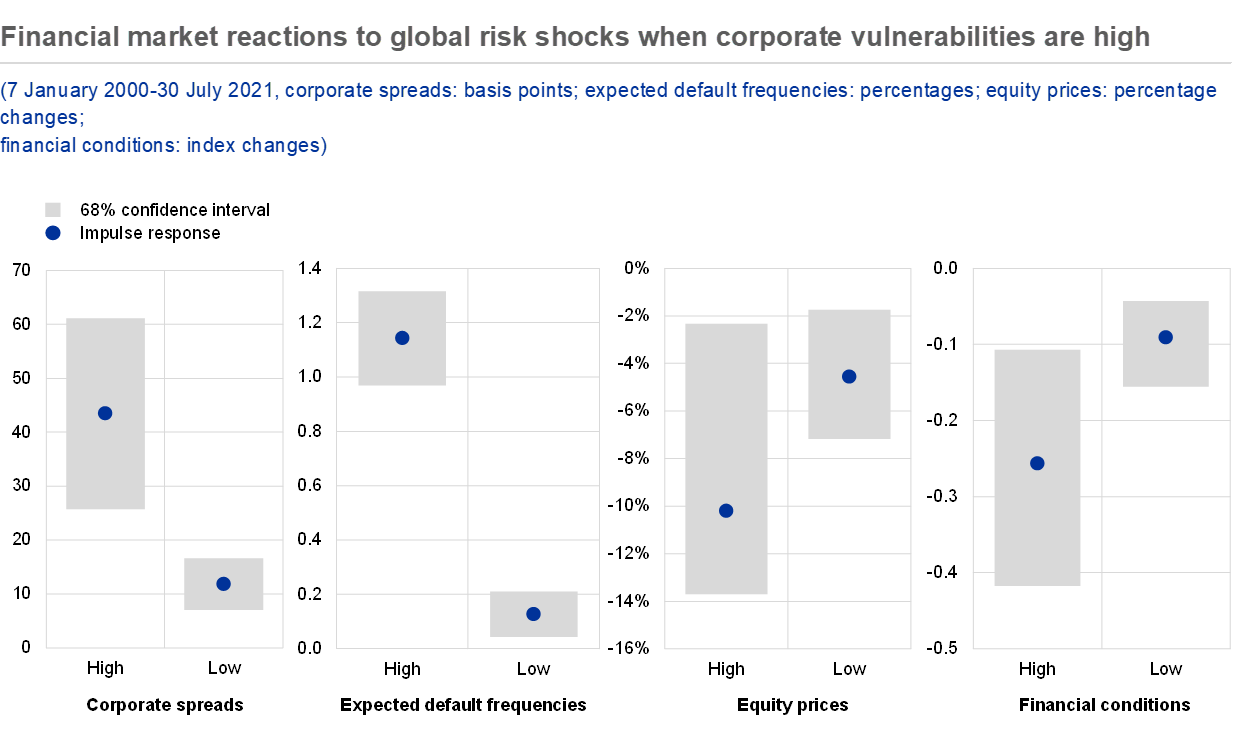

Notes: The dots represent the mean estimate of the response of US corporate spreads, expected default frequencies, equity prices and financial conditions (measured by a financial conditions index) following a global risk shock. Corporate spreads refer to a BBB-rated US corporate index for three to five-year maturities over the Treasury curve. The global risk shock captures flight-to-safety dynamics and is estimated in a daily Bayesian vector autoregression (BVAR) model using a combination of sign, relative magnitude and narrative restrictions along the lines of Brandt, L., Saint Guilhem, A., Schröder, M. and Van Robays, I., “What drives euro area financial market developments? The role of US spillovers and global risk”, Working Paper Series, No 2560, ECB, May 2021. Impulse responses are shown at impact and are estimated by local projections allowing for state dependence (for example, similar to the approach in Ramey, V. and Zubairy, S., “Government spending multipliers in good times and in bad: evidence from US historical data”, Journal of Political Economy, Vol. 126(2), 2018, pp. 850-901). “High/Low” refers to a state of relatively elevated (benign) corporate vulnerabilities, with probabilities derived from a logistic transformation of the corporate vulnerability index, similar to equation 4 in Auerbach, A. and Gorodnichenko, Y., “Measuring the output responses to fiscal policy”, American Economic Journal: Economic Policy, Vol. 4(2), 2012, pp. 1-27. The gamma parameter is assumed to be 2. The estimation is conducted based on weekly data over the period 2000-21, controlling for economic activity, interest rates and market uncertainty (measured by the Citigroup Economic Surprise Index, the two-year US Treasury rate and the VIX respectively), and includes crisis dummies for the weeks of the peak of the global financial crisis and the COVID-19 crisis. The estimates are shown at the 68% confidence interval in line with, for example, Jordà, O., “Estimation and inference of impulse responses by local projections”, American Economic Review, Vol. 95(1), 2005, pp. 161-182 and Box 3 in Financial Stability Review, ECB, May 2021. The latest observations are for 30 July 2021 (weekly).

Corporate asset prices may be particularly sensitive to risk-off shocks when corporate vulnerabilities are high. Risk-off shocks related to sudden changes in investor sentiment often have a significant impact on financial markets, causing investors to shed risky assets. Empirical analysis conducted for the US market shows that corporate market reactions to global risk shocks are stronger when corporate vulnerabilities are high relative to the historical average (see Chart B).[2] The impact of identified global risk shocks on corporate bond spreads, expected default frequencies, stock returns and financial conditions is estimated through threshold local projections which differentiate between states of high and low vulnerabilities in the corporate sector. Corporate bond spreads reprice by around 40 basis points when firms’ balance sheets are fragile, as compared with an average reaction of about 10 basis points in low-vulnerability regimes. Similarly, expected default frequencies increase far more strongly in times of corporate weakness. The different impact on equity prices and overall financial conditions is also visible, although less significant.

Weakening investor risk sentiment could translate into corrections in US corporate markets, posing risks to macro-financial stability in the euro area. Larger corrections in US corporate markets could have a substantial impact on euro area financial markets and lead to a tightening of financial conditions. In fact, past US equity market corrections have also been associated with declines in euro area equity markets, as well as increases in euro area corporate bond spreads for both the investment-grade and non-investment-grade sectors.[3] Given the still elevated uncertainty about the recovery and the reliance of asset valuations on investor risk sentiment, a strong sensitivity to risk-off shocks when corporate balance sheets are fragile may translate into risks to macro-financial stability.

- See, for example, recent assessments in “Global Financial Stability Report”, International Monetary Fund, October 2021, and “BIS Quarterly Review”, Bank for International Settlements, September 2021.

- The global risk shock captures flight-to-safety dynamics, assuming that heightened global risk aversion triggers a flow out of equity into safe long-term US bonds while also causing the US dollar to appreciate.

- See, for example, Box 3 entitled “Risk of spillovers from US equity market corrections to euro area markets and financial conditions”, Financial Stability Review, ECB, May 2021.