Investment fund flows, risk-taking and monetary policy

Published as part of the Financial Stability Review, May 2021.

This box examines the response of the investment fund sector to monetary policy shocks and the implications of this for financial stability. The investment fund sector has more than doubled in size since the global financial crisis. As the sector grows, so does its importance for the funding of economic activity and the transmission of monetary policy. But excessive risk-taking by funds can also have damaging effects for the wider financial system when it contributes to high levels of corporate leverage or when risky asset holdings need to be unwound quickly in times of market stress, as occurred in March 2020.

Aggregate flows into investment funds are highly responsive to monetary policy, with investors clearly demonstrating search-for-yield behaviour. Extended periods of low interest rates may then result in riskier parts of the fund sector expanding. However, this also suggests that the ECB’s pandemic emergency purchase programme (PEPP) and pandemic emergency longer-term refinancing operation (PELTRO) announcements played a key role in stemming outflows from high-yield and corporate bond funds following the outbreak of the pandemic early last year. Empirical evidence further suggests that fund managers reduce liquidity holdings following expansionary monetary policy shocks, which points towards increased liquidity risk-taking. Insufficient liquidity holdings may have resulted in funds amplifying market dynamics following the outbreak of the pandemic.[1]

Chart A

Investors’ search for yield in response to expansionary monetary policy shocks

Sources: EPFR Global, ECB Investment Funds Balance Sheet Statistics and authors’ calculations.

Notes: Estimates in both panels are based on a BVAR model using monthly data between April 2007 and June 2019. Monetary policy shocks are identified using an adapted version of the method in Jarociński, M. and Karadi, P., “Deconstructing monetary policy surprises – the role of information shocks”, American Economic Journal: Macroeconomics, Vol. 12, No 2, April 2020, pp. 1-43, using data provided by Altavilla, C., Brugnolini, L., Gürkaynak, R., Motto, R. and Ragusa, G., “Measuring euro area monetary policy”, Journal of Monetary Economics, Vol. 108, December 2019, pp. 162-179. The model includes the five-year Bund yield, the five-year euro area NFC bond spread, the EURO STOXX index and its volatility (VSTOXX). The left panel shows the median impulse response function, with areas shaded blue (grey) denoting 68% (90%) credibility intervals after a monetary policy shock equivalent to a 25 basis point reduction of the five-year euro area risk-free rate. The right panel shows the first-month response for different fund types. The monetary policy shocks are equivalent to a 25 basis point reduction in the five-year euro area risk-free rate for long-end shocks and in the three-month OIS for short-end shocks. Flows examined are to funds with euro area domicile and European investment focus.

An accommodative monetary policy shock is associated with persistent net inflows into bond funds, which are strongest most notably for riskier bond fund types. The analysis focuses on shocks to the longer end of the yield curve to reflect a baseline monetary policy measure, given the extensive use of unconventional tools over the period considered, starting in 2007. A 25 basis point reduction in the five-year euro area risk-free rate is followed by large and persistent inflows across the investment fund sector. For bond funds, these amount to 1.8% of net asset value after six months (Chart A, left panel). These inflows are even larger for riskier fund types (Chart A, right panel). This risk-taking channel of monetary policy involving funds has economically significant effects, with different bond fund categories experiencing inflows of between €4 billion and €22 billion in the first month after the shock. There is less evidence of risk-taking from end investors following short-end shocks to the short-end of the yield curve. High-yield funds receive smaller proportional inflows than any other type of bond fund, whereas the flow response for corporate and sovereign bond funds is broadly similar for short- and long-end shocks.

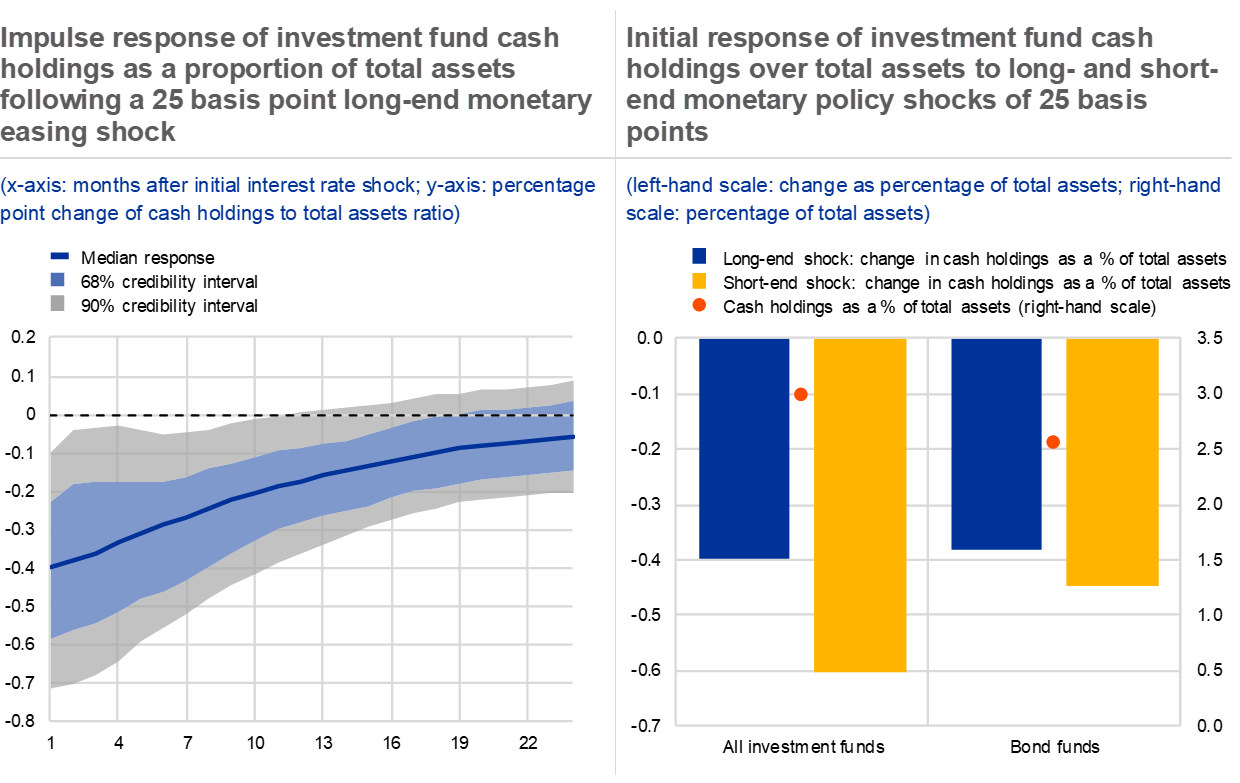

Chart B

Fund managers reduce cash holdings in response to expansionary monetary policy shocks

Sources: EPFR Global, ECB Investment Funds Balance Sheet Statistics and authors’ calculations.

Note: The monetary policy shock is equivalent to a 25 basis point reduction in the five-year euro area risk-free rate for long-end shocks and in the three month OIS for short-end shocks.

Asset managers also persistently reduce fund cash holdings following announcements of expansionary monetary policy (Chart B, left panel). First, a low or negative interest rate environment makes it more expensive to hold cash, thus increasing the attractiveness of riskier securities to help improve fund profitability. Second, the introduction of the ECB’s asset purchase programme eased liquidity conditions in bond markets,[2] which may have resulted in fund managers reducing cash positions and relying to a higher degree on improved bond market liquidity conditions. While this shift towards riskier assets aids the transmission of monetary policy and may help to support the real economy in the short run, excessively low liquidity holdings leaves funds vulnerable to large outflows during periods of stress. If this results in funds having to engage in fire sales to meet crisis-related redemption needs, this may undermine market functioning, credit provision and ultimately the transmission of monetary policy. Shocks to short-term rates have a greater relative impact on funds’ cash holding than shocks to long-term rates (Chart B, right panel). This suggests that interest rate changes which directly affect the short-term cost of holding cash are, in relative terms, more important drivers of fund liquidity than quantitative easing policies, which affect the long end of the yield curve.

It is important to devise macroprudential policies that could help restrict risk building up in the investment fund sector during extended periods of accommodative monetary policy. For example, pre-emptive liquidity policies, such as usable liquidity requirements, or a better alignment of fund redemption terms with asset liquidity may help to mitigate the build-up of vulnerabilities in the fund sector. This may increase the resilience of the financial system as a whole.[3] By reducing the likelihood of fund risk-taking amplifying market disruptions, such measures could also support the smooth transmission of monetary policy by ensuring stable funding for the economy and reduce the need for additional central bank intervention in times of crisis.

- See the ECB blog post “The ECB’s commercial paper purchases: A targeted response to the economic disturbances caused by COVID-19” and Chapter 4 in the Financial Stability Review, ECB, May 2020.

- See De Santis, R., Geis, A., Juskaite, A. and Vaz Cruz, L., “The impact of the corporate sector purchase programme on corporate bond markets and the financing of euro area non-financial corporations”, Economic Bulletin, Issue 3, 2018, ECB, pp. 66-84.

- Policy options would need to depend on the type of fund and an in-depth analysis of options is needed before considering implementation.