- 24 FEBRUARY 2023 · RESEARCH BULLETIN NO. 104

Recent changes in consumers’ medium-term inflation expectations – a detailed look

In this article we exploit the richness and flexible design of the ECB’s Consumer Expectations Survey (CES) to explore in detail recent changes in consumers’ medium-term inflation expectations. The data suggest that over the course of 2022 these expectations became less well anchored around the ECB’s 2% inflation target. By taking the necessary monetary policy actions and by actively communicating how monetary policy is contributing to stabilising future inflation, the ECB can help strengthen public trust and prevent recent price and cost shocks from having longer-lasting effects on inflation expectations.

Overview

Central banks typically pay considerable attention to economic agents’ expectations about inflation at medium-term horizons. This is because developments in such indicators provide information on the extent to which agents perceive that the central bank will be able to maintain price stability over the medium term. In our analysis we draw on CES data and research to shed light on the evolution and significance of recent developments in medium-term expectations of euro area consumers.[2] We not only explore the aggregate patterns in such expectations, but we are also able to dig deeper into their evolution, particularly over the period since the outbreak of the war in Ukraine. The article focuses on two subjects that are especially relevant to the interpretation of recent changes from a monetary policy perspective. First, we investigate the cross-sectional patterns and the scale of revisions of medium-term inflation expectations across different types of agents, including their possible association with a survey-based measure of trust in the ECB. Second, we explore changes in the expectations of survey respondents who indicate that they play an active role in wage and price-setting via their employment or business activities.

Chart 1

Developments in inflation expectations and sensitivity to news about inflation

a) Inflation expectations and euro area HICP developments

(y-axis: annual percentage change)

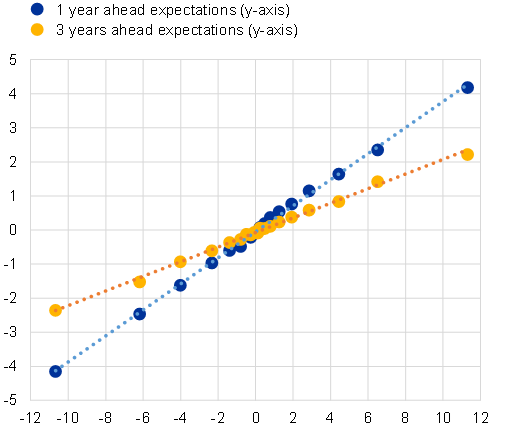

b) Sensitivity of inflation expectations to current inflation news

(x-axis: revision to the perceived current inflation rate, in percentage points; y-axis: revision to inflation expectations, in percentage points)

Source: ECB Consumer Expectations Survey.

Notes: The left-hand panel a) depicts population-weighted survey responses about the expected change in prices in general. The median is computed based on a symmetric linear interpolation that thereby accounts for rounding of responses. Mean values are winsorised at the 2nd and 98th percentiles of each survey round and country. The underlying question asks: “How much higher/lower do you think prices in general will be (12 months from now / 3 years ahead) in the country you currently live in?”. Respondents are asked to provide numerical answers. The right-hand panel b) shows an unweighted binned scatterplot of average winsorised monthly revisions to expectations (y-axis) against the monthly revisions to currently perceived inflation over the past 12 months (x-axis). The linear fit accounts for survey wave-specific and country-specific effects. The underlying regression coefficients are 0.39 (R-Squared: 0.16) for revisions to short-term, and 0.22 (R-Squared: 0.05) for revisions to medium-term inflation expectations. Both coefficients are significant at the 0.1% level. The EA HICP is the euro area Harmonised Index of Consumer Prices.

A noticeable shift in households’ medium-term inflation expectations

According to the CES, there was a notable increase in consumers’ medium-term (three years ahead) inflation expectations in March 2022, with the median increasing by 0.8 percentage points compared with February 2022, to stand at 2.9% (Chart 1).[3] Subsequently, median three years ahead inflation expectations eased back modestly in April and May 2022, but edged up again in June 2022 and stood at an elevated level in the period to November 2022. This is noteworthy because medium-term expectations had been relatively stable until March 2022 and in line with the ECB’s inflation target of 2%. The jump in expectations in March suggests that households perceived the rise in actual inflation in the first quarter of 2022 to be potentially of a more persistent nature. A similar pattern is observed for the mean of the medium-term inflation expectations.

The pattern of revisions and co-movement with other economic expectations over the period between March and November 2022 also sheds light on what was likely driving consumers’ medium-term inflation expectations. For example, consumers may tend to give a relatively high weight to recent news about and experience with inflation, compared with economic experts. In particular, news about very salient prices, such as for food, energy and other utilities, can have a very strong impact on short-run perceptions and expectations about inflation, and this may also tend to fuel higher medium-term expectations. In line with this pattern, the CES shows a strong link between revisions to the perceived current rate of inflation and revisions to one-year ahead inflation expectations. However, a striking feature of the recent data is that this positive association with inflation perceptions is also observed for medium-term (three years ahead) expectations (Chart 1b). On the one hand, this tendency of consumers to extrapolate from recent experience may reflect genuine concerns about the persistence of the ongoing price shocks and about the ability of monetary policy to counteract them at a horizon of two to three years ahead. On the other hand, it could also be an indication of a tendency to overreact to recent bad news about actual inflation.

Looking in more detail at the pattern of revisions between March and June 2022, there is some evidence that overreaction and excess sensitivity to recent news about the rate of inflation played a role. In particular, in the April and May 2022 waves of the CES there were downward revisions to average medium-term inflation expectations (Chart 1a). They can be interpreted as a possible correction of an overreaction to news in March 2022. This tendency to make downward corrections in April and May was most evident in Spain and Italy and tended to be stronger among consumers with lower levels of educational attainment and financial literacy. However, the later upward revision to medium-term expectations of 0.2 percentage points that was observed in the period from June to October 2022 must also be interpreted in part as confirming ex post consumers’ earlier concerns about the persistence of inflation over the medium term.

Stagflationary risks and the link with bad news about consumers’ own financial situation

Clearly, the recent changes in medium-term inflation expectations took place in a context of more elevated concerns about the real economy, related in part to the effects of the Russian invasion of Ukraine. The CES data also reveal a strong positive association between medium-term inflation expectations and consumers’ concerns about their own financial situation. Chart 2a highlights this strong positive association. In the CES, consumers’ concerns about the effects of the war on their household financial situation are measured on a scale between 0 and 10, with 10 indicating the highest level of concern. According to the results, the positive relationship is particularly strong when the level of concern is above 4 and is noticeably stronger than for financial concerns associated with the coronavirus (COVID-19) pandemic (surveyed separately and measured on the same scale). For example, an increase in financial concerns related to the war from the median level of concern of 7 to the highest possible level of concern of 10 is associated with a rise of almost 5 percentage points in medium-term inflation expectations. On the one hand, this strong positive association with consumers’ own financial concerns suggests that any positive news that gave rise to a reduction in such concerns may also contribute to an easing of the upward pressure on inflation expectations. These patterns are also consistent with the stagflationary or supply-side narrative that can often underpin households’ inflation expectations (see Candia et al., 2020). According to this view, consumers often associate higher expected inflation with bad news about their own financial situation and the macroeconomy, and this can cause them to reduce their spending (Coibion et al., 2019). In line with such a stagflationary dynamic, the share of consumers anticipating simultaneously both a recession in the euro area and relatively high inflation above 4% has risen steadily according to the CES, particularly since the first quarter of 2022 (Chart 2b).

Chart 2

Co-movement with economic and financial concerns, trust and the anchoring of inflation expectations

a) 3 years ahead inflation expectations and financial concerns

(x-axis: financial concerns in a range from 0 (not concerned at all) to 10 (extremely concerned); y-axis: average inflation expectations, annual percentage changes)

b) Trust in the ECB and risks of unanchoring

(left-hand y-axis: average trust scores; right-hand y-axis: percentages of respondents)

Source: ECB Consumer Expectations Survey.

Notes: The left-hand panel a) shows a binned scatterplot based on cross-sectional data from April 2020 to February 2022 for COVID-19 concerns, while the data on households’ financial concerns owing to the war in Ukraine extend from May to November 2022. Findings are similar when controlling for wave and country fixed-effects. To elicit their concerns, respondents were asked, using a scale from 0 (not concerned at all) to 10 (extremely concerned), “How concerned are you about the [war in Ukraine / impact of the coronavirus (COVID-19)] on the financial situation of your household?”. The right-hand panel b) shows population-weighted data. Inflation expectations are elicited for a three years ahead horizon and economic growth expectations for the next 12 months. The yellow line shows the share of respondents who expect zero or negative growth over the next 12 months and also expect inflation three years ahead to be higher than 4%. Trust in the ECB is measured, alongside trust in other European and international organisations, on a scale from 0 to 10, with respondents being asked “How much do you trust each of the following institutions and organisations?”.

Trust and the anchoring of medium-term expectations

Earlier research has shown that public trust in the central bank contributes to the anchoring of household inflation expectations (Christelis et al., 2020). Thus, to help mitigate the risks associated with a possible unanchoring, it is important to carefully gauge the level of consumers’ trust in the ECB. Following an increase in trust during the pandemic in 2020, more recent CES data point to a gradual decline in overall levels of trust in the period after June 2021, and, in particular, a noticeable further decline in June 2022. At the same time, in November 2022 consumers’ trust in the ECB remained above the level reported when the CES started in April 2020 (Chart 2b). The recent pattern of declining trust certainly appears to be linked with the upward trend seen in medium-term inflation expectations and is also reflected in an increasing share of consumers with medium-term expectations above 4%.[4] This share edged above 40% of CES respondents for the first time in October 2022. A closer look at the data reveals that the recent decline in trust has been quite broad-based across CES respondents. However, since June 2021 the decline seems to have been more pronounced for high-income and employed consumers. The ongoing adjustment of the monetary policy stance, aimed at delivering 2% inflation over the medium term, can play an important role in avoiding further declines in trust. However, it will also be important to communicate effectively with euro area consumers to strengthen public knowledge about monetary policy (see Assenmacher et al. 2021). Recent research has shown that when consumers understand what monetary policy is doing and what it is trying to achieve, they are more likely to have higher levels of trust in the central bank. For example, in a recent study using CES data, Ehrmann, Georgarakos and Kenny (2022) have shown how communicating with the public about the primary objective of monetary policy can help increase the public’s perception that price stability will be maintained. Importantly, these credibility gains are shown to be strongest when the stabilising benefits of monetary policy for the economy are clearly explained to the public.

How did wage and price-setters revise their medium-term expectations?

Looking ahead, it will be crucial to examine the extent to which higher inflation expectations may potentially feed through into price and wage-setting behaviour in the euro area economy. To shed some light on this question, it is possible to identify those CES respondents who play active roles in price and wage-setting via their employment or business activities.[5] Given these roles, such respondents may be better informed and have insights about recent and future developments in inflation and wages, reflecting their first-hand experience of firms’ decision-making. In May 2022, CES respondents were asked about such roles for the first time. According to the results, 14.8% and 9.7% employed consumers reported that they were at the time involved in price and wage-setting decisions respectively. This represents a relatively significant number of responses – resulting in an average sample size of 1,172 price-setters and 750 wage-setters for the period between January and November 2022.

The results show that respondents who report having a current role in price or wage-setting revised their medium-term inflation expectations upwards by more than the average upward revision across all CES respondents over the same period. Importantly, the CES data also show that respondents playing a role in price and wage-setting revised down their overall trust score by more than the average CES respondent (Chart 3). These findings may thus signal an augmented risk to future inflation linked to increased inflation expectations and diminishing trust among both price and wage-setters. This points to a need to take the necessary actions and communicate them in an effective way to ensure a return to price stability in the euro area.

Chart 3

Evolution of medium-term inflation expectations and trust in the ECB among managers

a) 3 years ahead inflation expectations

(y-axis: average inflation expectations, annual percentage changes, by group)

b) Trust in the ECB

(y-axis: average trust score in a range from 0 (no trust at all) to 10 (trust completely), by group)

Source: ECB Consumer Expectations Survey.

Notes: Population weights are used. The left-hand panel a) shows three years ahead inflation expectations of average consumers and of respondents who indicated in May 2022 that they currently play a role in price and wage-setting. The right-hand panel b) shows the level of trust in the ECB (see the notes to Chart 2) among the same groups.

Conclusion

In this article we have exploited the richness and flexible design of the CES to explore in detail recent changes in consumers’ medium-term inflation expectations. The data suggest that over the course of 2022 these expectations became less well anchored around the ECB’s 2% inflation aim. By implementing necessary changes to the monetary policy stance and actively communicating how monetary policy is contributing to stabilising future inflation, the ECB can help strengthen public trust and prevent recent price and cost shocks from having longer-lasting effects on inflation expectations.

References

Assenmacher, K., Glöckler, G., Holton, S., Ioannou, D., Mee, S. and Trautmann, P., (2021), “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, Occasional Paper Series, No 274, ECB, September.

Candia, B., Coibion, O. and Gorodnichenko, Y. (2020), “Communication and the beliefs of economic agents”, NBER Working Paper, No 27800, September.

Christelis, D., Georgarakos, D., Jappelli, T. and van Rooij, M. (2020), “Trust in the Central Bank and Inflation Expectations”, International Journal of Central Banking.

Coibion, O., Georgarakos, D., Gorodnichenko, Y. and van Rooij, M. (2019), “How Does Consumption Respond to News about Inflation? Field Evidence from a Randomized Control Trial”, American Economic Journal: Macroeconomics, forthcoming.

Coibion, O., Gorodnichenko, Y. and Ropele, T. (2020), “Inflation Expectations and Firm Decisions: New Causal Evidence”, The Quarterly Journal of Economics, Vol. 135(1), pp.165–219.

ECB (2021), “ECB Consumer Expectations Survey: an overview and first evaluation”, Occasional Paper Series, No 287, ECB, December.

Ehrmann, M., Georgarakos, D. and Kenny, G. (2023), “Credibility gains from communicating with the public: evidence from the ECB’s new monetary policy strategy”, Working Paper Series, No. 2785, ECB, February.

Georgarakos, D. and Kenny, G. (2022), “Household spending and government support during the COVID-19 pandemic: Insights from a new consumer survey”, Journal of Monetary Economics, Vol. 129, pp. S1-S14.

Gornicka, L., Meyer, J. and Meyler, A. (2022), “A closer look at consumers’ inflation expectations – evidence from the ECB’s Consumer Expectations Survey”, Economic Bulletin, Issue 7, ECB, 2022.

McClure, E. M. L., Coibion, O. and Gorodnichenko, Y. (2022), “The Macroeconomic Expectations of U.S. Managers”, NBER Working Paper, No 29986, April.

Van der Cruijsen, C., De Haan, J. and van Rooij, M. (2023), “High inflation erodes trust in the ECB”, VoxEU.org, 25 January.

This article was written by Dimitris Georgarakos, Geoff Kenny and Justus Meyer (all Directorate General Research, European Central Bank). The authors gratefully acknowledge the comments of Gareth Budden, Alexandra Buist, Ana Maria Borlescu, António Dias Da Silva, Maarten Dosche, Virginia Di Nino, Michael Ehrmann, Aleksandra Kolndrekaj, Omiros Kouvavas, Eszter Miltényi-Torstensson, Alexander Popov and Athanasios Tsiortas. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

The CES started in April 2020 and is a monthly panel survey of approximately 14,000 respondents from the six largest euro area countries (Belgium, Germany, Spain, France, Italy and the Netherlands). The survey is administered by the ECB and collects fully harmonised data on consumer expectations from a representative sample of the underlying population via the internet (see ECB 2021 and Georgarakos and Kenny 2022). For further methodological information, further publications and recent updates on the ECB’s CES, see the dedicated CES web page.

See also Gornicka, Meyer and Meyler (2022) for changes in the distribution of inflation expectations.

In line with this pattern, Van der Cruijsen, De Haan and van Rooij (2023) report that Dutch households with higher perceptions about current inflation tend to trust the ECB less.

Coibion et al. (2020) show how an increase in expected inflation at the firm level can give rise to an increase in firms’ output prices. McClure et al. (2022) provide evidence on US managers’ and non-managers’ expectations about inflation.