- 20 DECEMBER 2022 · RESEARCH BULLETIN NO. 102

Model-based regulation: lending in times of Covid

When the coronavirus (COVID-19) pandemic struck, retaining access to funding became vital for a great many firms. We assess whether model-based bank regulation constrained bank lending during the pandemic. Our results show that banks that used “their own” models – i.e. approved internal ratings-based (IRB) models – to calculate their regulatory capital requirements reduced their lending more than banks that used a standardised approach. This effect was not driven by borrowers’ credit quality, or by those banks located in countries where there had been credit booms before the pandemic. Certain features of the models, such as the “downturn loss-given default” parameter, which reflects how much money a bank can expect to lose when borrowers default on loans during downturns, can be helpful to bolster banks’ resilience and preserve their intermediation capacity during times of economic decline.

Introduction

Bank lending is inherently procyclical. This is because during upswings in the business cycle banks tend to overestimate the creditworthiness of their borrowers, often resulting in excessive credit expansion, while they rapidly cut lending during downturns. When the economy is hit by an exogenous shock, this reduction in the provision of bank credit may exacerbate the negative effects of the shock and potentially worsen the credit risk outlook for banks. In the euro area, banks provide the bulk of funds to the corporate sector and their financial intermediation role is particularly important during crises, such as at the outset of the pandemic: it was essential to continue lending to viable firms in need of funding.

In our recent paper (Fiordelisi et al., 2022), we focus on the impact of model-based regulation on lending during the pandemic. Introduced under the Basel II agreement, the use of model-based bank regulation was a historical change that gave banks the choice of using either the standardised, or the IRB approach to calculate their minimum capital requirements. The standardised approach entails a simpler methodology based on fixed risk weights that are assigned to different categories of borrower, so all banks apply the same risk weights. By contrast, banks that opt for the IRB approach are allowed to apply their own models to estimate the credit risk parameters for the regulatory formulas used to calculate risk weights, and thus their minimum level of regulatory capital. These models have been scrutinised and approved by the supervisory authority. The rationale behind model-based regulation was to increase the risk sensitivity of capital requirements so that the level of capital a bank holds would better reflect the underlying risks to which it is exposed.

It was expected that the use of internal models would induce banks to incorporate any increase in risk in a faster and more dynamic fashion, especially when compared with banks using the standardised approach (Repullo and Suarez, 2013). Elevated risk increases the capital absorbed by banks’ exposures and ultimately prompts them to reduce their credit exposure, mainly by not granting new loans and/or not renewing maturing loans. This could exacerbate procyclicality, worsen the economic downturn and potentially have negative consequences for the overall stability of the banking sector.

At the same time, it is important to recognise that IRB models have complex features, and they differ across banks in terms of both the parameters and the calibration used. Therefore, they should not be treated as a homogenous group. For example, there are model parameters specifically designed to increase banks’ resilience during economic downturns that should support lending during such times.

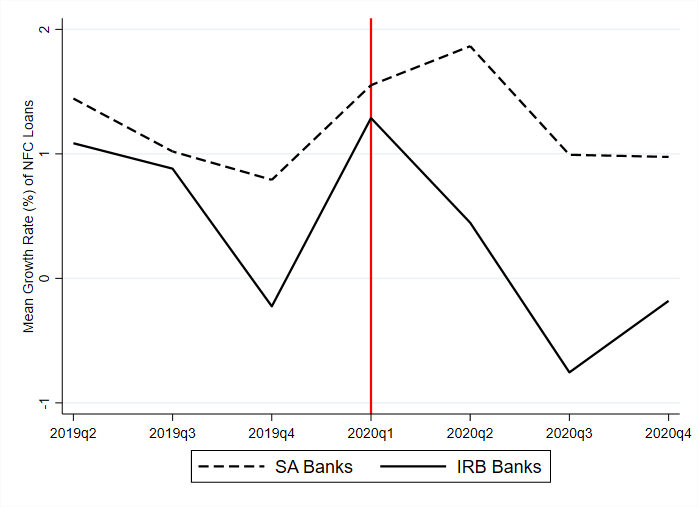

Figure 1 shows how credit provision changed with the outbreak of the pandemic for banks using IRB models (IRB banks) and banks using the standardised approach (SA banks). While the trends in lending for the two groups were largely comparable before the pandemic, after March 2020 IRB banks cut lending significantly compared with SA banks.

Figure 1

Loans to non-financial corporations (NFCs)

Notes: “SA banks” are banks reporting all corporate credit risk exposures using a standardised approach. “IRB banks” are banks which evaluate a share of their credit risk exposure using an internal ratings-based approach. The vertical red line indicates the start of the pandemic.

Source: Fiordelisi et al. (2022), based on FINREP and COREP reporting.

Does model-based regulation during a crisis increase cyclicality?

Our analysis shows that after the outbreak of the pandemic, model-based regulation led to a decrease in credit exposures of IRB, compared with SA banks. These results support the argument that the use of internal models facilitates the recognition of increased risk when a large shock occurs which translates into higher capital requirements. The use of internal models therefore supports the stability and soundness of individual banks. At the same time, certain characteristics of IRB models can mitigate the negative effects on credit supply during a downturn. Banks that include these features in their models continue to provide credit to the corporate sector in bad times, thereby also supporting the economic recovery.

Our study also shows that lower level of lending by IRB banks was due to a reduction in credit supply, rather than a decrease in demand for loans owing to the pandemic. The analysis is based on borrower-level supervisory data on large banking exposures looking at the lending relationships of borrowers with loans from banks using different models for the calculations of their capital requirements. The analysis provides robust evidence that banks using internal models did in fact reduce their exposures more than banks using the standardised approach.

The capital level of IRB banks when the pandemic occurred is key since the results are driven by IRB banks with low levels of capital. Our findings complement those of Behn et al. (2016, 2022) which show that in Germany, model-based risk estimates systematically understated actual default rates and had a procyclical effect. We also show that the reduction in credit exposures of IRB banks did not depend on the position in the credit cycle before the pandemic started – i.e. results are not driven by countries that were experiencing a credit boom prior to the shock. At the same time, certain features of model-based regulation (like the downturn LGD parameter) are important to ensure that banks build up their capital appropriately to mitigate the negative effects on lending if a crisis occurs. In this respect, we illustrate how banks using certain advanced IRB approaches, and in particular the downturn LGD adjustment, decreased their corporate exposures less. Finally, we find that firms were not able to replace lower funding from an IRB bank that was reducing its credit exposure. These firms cut their investment by more, suggesting the presence of financing constraints.

Policy implications

When the economy suffers a recession or is hit by a catastrophic event – like the COVID-19 pandemic – banks play a critical role in supporting the corporate sector. Credit provision to firms that are still viable but may suffer from an increase in temporary financing needs is essential to prevent a deeper economic downturn. The current regulatory framework for banks has an impact on their function as financial intermediaries providing funding to the economy, especially in the face of a crisis.

The use of internal models for calculating banks’ capital requirements (i.e. model-based regulation) aims to ensure that an increase in risks is swiftly taken into account, which supports the financial soundness of individual banks. At the same time, the use of these models generally induces lower lending to firms during crises. However, there are ways to increase the resilience of banks using IRB models: An appropriate calibration of these models contributes to the adequate capitalisation of banks so that they are less constrained and more able to maintain their exposures to viable borrowers when a major shock occurs.

Overall, our analysis highlights the trade-off between adopting regulatory policies that quickly adjust to changes in the risk outlook – thereby supporting the health of individual banks – and ensuring that funding is provided to productive firms during a downturn, in order to limit further negative consequences for the economy.

References

Behn, M., Haselmann, R. and Vig, V. (2022), “The limits of model-based regulation”, The Journal of Finance, Vol. 77(3), pp. 1635–1684.

Behn, M., Haselmann, R. and Wachtel, P. (2016), “Procyclical capital regulation and lending”, The Journal of Finance, Vol. 71(2), pp. 919–956.

Fiordelisi, F., Fusi, G., Maddaloni, A. and Marques-Ibanez, D. (2022), “Pandemic lending: effects of model-based regulation”, Working Paper Series No. 2760, ECB, Frankfurt am Main.

Repullo, R. and Suarez, J. (2013), "The procyclical effects of bank capital regulation, Review of Financial Studies, Vol. 26(2), pp. 452-490.

This article was written by Franco Fiordelisi (University of Essex), Giulia Fusi (European Stability Mechanism), Angela Maddaloni (European Central Bank, Directorate General Research) and David Marques-Ibanez (European Central Bank, Directorate General Research). The authors gratefully acknowledge the comments of Alexander Popov, Gareth Budden and Alexandra Buist. The views expressed here are the views of the authors and do not necessarily represent the views of the ESM, the European Central Bank or the Eurosystem.