- 24 MARCH 2022

- RESEARCH BULLETIN NO. 93

Monetary policy communication – past ECB policymakers commend Bank’s progress and call for more

A survey among former ECB policymakers about the Bank’s monetary policy communication provides broad support for recent innovations in communication practices. It suggests that communication with expert audiences is generally adequate. Nevertheless, it highlights room for improvement along several dimensions, in particular in communication with the wider public.

The evolution of central bank communication

The way central banks communicate has evolved significantly over recent years. In a 2016 survey among central bank governors, more than 80% indicated that their institution’s communications had intensified since the global financial crisis. A clear majority also expected these changes to remain (Blinder et al. 2017). This is not surprising – central banks need to explain increasingly complex monetary policies, often in the context of broader mandates.

Central banks have also become the subject of intense and often controversial public discussions, at times accompanied by a loss of trust (van der Cruijsen and Samarina 2021). To increase trust and ensure accountability, central banks must communicate more with the wider public. This poses very different challenges than communicating with financial markets and other expert audiences – the traditional counterparts of central banks (Coibion et al. 2022).

In addition, changing media landscapes make central bank communication more challenging. However, new technologies, such as social media, also offer possibilities to engage with a wider audience (Ehrmann and Wabitsch 2022).

In the light of these developments, it is important to assess current communication practices and identify any room for improvement. And who better to do so than former policymakers? They have an intimate knowledge of the subject matter and can pass judgement without fear or favour, as they are no longer in office.

In Ehrmann, Holton, Kedan and Phelan (2021), we report the results from a survey of just such a group – former members of the ECB’s Governing Council. In the survey we sought their views on euro area monetary policy communication, the related challenges and the road ahead. The survey was conducted between November and December 2020. By the closing date we had received 27 responses, making for a response rate of 59% and a good reflection of the composition of the addressees in terms of country groups, time of tenure and the share of Executive Board members and national central bank (NCB) Governors.

A first notable finding is that although the survey allows us to differentiate between several respondent groups, pronounced differences are few and far between. This suggests a broad consensus of opinion, even though the survey includes a wide range of issues and covers a monetary union with 19 separate countries.

With whom to communicate and why?

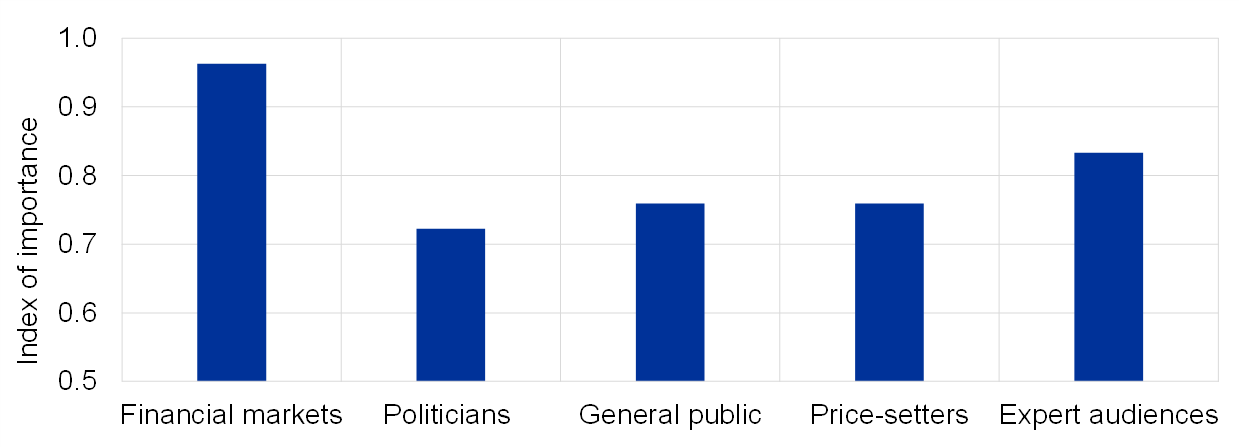

Enhancing credibility and trust was seen as the most important objective of central bank communication by our respondents, closely followed by managing expectations and enhancing transparency. When asked which target audiences were most relevant for the effectiveness of monetary policy, they emphasised the more traditional target groups of financial markets and other expert audiences (Chart 1). Nevertheless, some respondents commented on the risk that communication with financial markets can go too far, in particular if market expectations dominate policy.

Chart 1

The importance of different audiences for the effectiveness of monetary policy

Notes: The chart shows the responses to the question “With regard to the effectiveness of monetary policy, how important is it to communicate with different audience groups?” The “Index of importance” is the percentage of respondents reporting on the importance of the objectives weighted by the level of importance attached to each. If all respondents answered “extremely important”, the index would be 1, while “very important” would correspond to an index of 0.75, “important” to 0.5, “somewhat important” to 0.25, and “not important at all” to 0.

As to the ECB’s practices, communication with the more traditional target groups is considered adequate by an overwhelming majority (74%) of respondents. In contrast, respondents see substantial room for improvement in communication with the general public: only 22% think that communication with this audience is adequate, while 33% see a lot of room for improvement – this is supported by the positive feedback from euro area citizens on the various listening events that were conducted as part of the ECB’s strategy review.

What to communicate?

The next part of the survey asked about the topics for communication. Communication about the central bank objective is seen as the single most important topic: 100% of former Governing Council members saw it as either “very important” or “extremely important”. Several respondents considered that the ECB’s former inflation aim – still in place at the time of the survey – was not clear enough, citing the ambiguity of the “below, but close to, 2%” formulation. Respondents also particularly valued communication on the rationale for monetary policy decisions and on the economic outlook, whereas communication on uncertainty, the reaction function and the future path of policy was perceived as relatively less important.

The survey also asked for respondents’ views regarding the various types of “forward guidance”, which refers to central banks communicating about the future path of monetary policy. The ECB, like many other central banks, has employed different forms of forward guidance. The Bank has used: calendar-based forward guidance (statements about the policy path explicitly linked to a calendar date); state-contingent forward guidance (where the policy path is conditional on economic outcomes); and purely qualitative statements (not linked to a date or any data).

Most respondents (67%) suggested that state-contingent forward guidance should remain in the ECB’s toolbox. Just over half thought that purely qualitative guidance should remain in use, and less than a third were supportive of calendar-based guidance (Chart 2). In fact, a very slight majority of respondents believed that calendar-based guidance should no longer be in the toolkit.

Chart 2

What type of forward guidance?

Notes: The figure shows the proportion of the respondents selecting each of the possible responses to the question “For several years, the ECB has provided forward guidance, in different forms. Forward guidance is often classified as being either calendar-based (or ‘time contingent’), data-based (or ‘state contingent’), or purely qualitative (that is, providing neither a time frame nor economic conditions). Which type(s) of forward guidance do you believe should be part of the ECB toolkit?”.

How to communicate?

Having asked about the “who”, the “why” and the “what”, the survey turned to the “how”. Communication innovations, such as publishing accounts of the discussions at monetary policy meetings and the use of social media, were endorsed by the majority of respondents, who felt these innovations should remain in place. Regarding the accounts of meetings, a large majority of 67% was in favour of continuing to publish “unattributed” accounts, which outline the discussions without identifying individual speakers. However, 26% supported the publication of “attributed” accounts, which would include this information. On the use of social media, views were balanced. Some 48% of respondents favoured the status quo, another 22% suggested that social media should be used more, and 26% said it should be used less.

With regard to the representation of individual views, most respondents thought that the ECB’s monetary policy communication was about right (Chart 3). However, more respondents believed that there was too much representation of individual views than believed that there was too little. Relatedly, the survey also asked to what extent communication should come from the ECB as opposed to the NCBs. A majority of respondents believed that the balance of communication between the ECB and NCBs was currently about right. At the same time, more respondents believed the balance should shift further towards the ECB than further towards the NCBs.

Chart 3

Diversity of views on the Governing Council

Notes: The figure shows the responses to the question “In most central banks, monetary policy is set by a committee. Whereas some central banks encourage that the diversity of views on the committee is represented in the external communication, others have adopted a one-voice policy. Where, in your view, is the monetary policy communication by Governing Council members located along this spectrum?”

The survey also asked whether the language used in the ECB’s communication was too complex. The introductory statement at the start of the ECB’s monetary policy press conferences used to be a case in point – to understand it required around 13-15 years of formal education (Coenen et al. 2017). This was why the ECB decided in last year’s strategy review to reduce the length and the complexity of these statements. But simplification also carries a risk, in particular if it gives the public a false sense of certainty about future developments (Assenmacher et al. 2021). When asked how well they thought the ECB was handling this trade-off, a majority of respondents thought that its communication at the time of the survey was just about right. Nonetheless, a substantial share believed that it was too complex, while virtually no one thought it risked being overly simplistic.

The future evolution of monetary policy communication

Overall, the respondents assessed the ECB’s monetary policy communication as broadly adequate. But challenges remain. When asked how monetary policy communication should evolve over the next five to ten years, respondents most often mentioned: simplification and greater clarity; greater coordination between NCBs and the ECB; and the need to avoid a cacophony of voices. Less complex, clearer and more targeted communication is seen as a means to reach a wider audience. These results reveal that, from the perspective of former policymakers, what constitutes effective communication varies across audiences and is likely to evolve over time. Central banks would therefore be well advised to continue assessing and adjusting their communication practices.

References

Assenmacher, K., Glöckler, G., Holton, S., Trautmann, P., Ioannou, D. and Mee, S. (2021), “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, Occasional Paper Series, No 274, ECB, Frankfurt am Main.

Blinder, A.S., Ehrmann, M., de Haan, J. and Jansen, D.-J. (2017), “Necessity as the mother of invention: Monetary policy after the crisis”, Economic Policy, Vol. 32, Issue 92, pp. 707-755.

Coenen, G., Ehrmann, M., Gaballo, G., Hoffmann, P., Nakov, A., Nardelli, S., Persson, E. and Strasser, G. (2017), “Communication of monetary policy in unconventional times”, Working Paper Series, No 2080, ECB, Frankfurt am Main.

Coibion, O., Gorodnichenko, Y. and Weber, M. (2022), “Monetary policy communications and their effects on household inflation expectations” (forthcoming), Journal of Political Economy.

Ehrmann, M. and Wabitsch, A. (2022), “Central bank communication with non-experts – a road to nowhere?” (forthcoming), Journal of Monetary Economics.

Ehrmann, M., Holton, S., Kedan, D. and Phelan, G. (2021), “Monetary policy communication: Perspectives from former policy makers at the ECB”, Working Paper Series, No 2627, ECB, Frankfurt am Main.

van der Cruijsen, C. and Samarina, A. (2021), “Trust in the ECB in turbulent times”, Working Paper series, No 722, De Nederlandsche Bank.

- The article was written by Michael Ehrmann (Head of Monetary Policy Research Division, Directorate General Research, ECB), Sarah Holton (Head of Section, Monetary Analysis Division, Directorate General Monetary Policy, ECB), Danielle Kedan (Lead Economist, Monetary Policy Strategy Division, Directorate General Monetary Policy, ECB) and Gillian Phelan (Head of Monetary Policy Division, Central Bank of Ireland). The authors would like to thank Alexandra Buist, Alexander Popov and Zoë Sprokel for their comments. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank, the Central Bank of Ireland or the Eurosystem.