- 28 July 2021

- RESEARCH BULLETIN NO. 86

A time-varying carbon tax to protect the environment while safeguarding the economy

By Ghassane Benmir, Ivan Jaccard and Gauthier Vermandel[1]

Climate change is one of the most pressing issues of our time. The challenge for policymakers is that climate policies could have a negative impact on the economy in the short term. In this article we discuss how this trade-off between fighting climate change and ensuring a stable business cycle affects the design of environmental policies. We argue in favour of a time-varying carbon tax that is increased during booms and decreased during recessions.

Market mechanisms do not address climate change

Climate change is a classic example of a negative externality. Indeed, a fundamental problem is that the cost for society of activities that emit greenhouse gases into the atmosphere is not reflected in market prices. Emissions cause climate change, a phenomenon that hurts society as a whole, but this social cost is typically not taken into account by carbon emitters. Moreover, since the consequences of climate change will largely be suffered by future generations, the implementation of climate policies is often postponed until later.

This constitutes a market failure, the source of which is the absence of a market price on emissions. Consequently, policies that substitute market mechanisms by putting a price on emissions can address the root cause of the problem. In contrast, laissez-faire strategies that rely exclusively on market mechanisms to determine prices are not suited to addressing the challenge posed by climate change.

Asset pricing theory can put a price on emissions

Putting a price on emissions can be achieved by introducing a carbon tax. This price should represent the cost for society caused by greenhouse gas emissions. The main challenge, therefore, is to design a carbon tax that reflects the social cost of emissions. In our recent study (Benmir, Jaccard and Vermandel, 2020), we argue that asset pricing theory can provide useful insights into this question.

Indeed, the pricing of carbon emissions shares some key similarities with asset pricing. Carbon emissions have a long duration in the sense that they remain in the atmosphere for very long periods of time. Consequently, the price of carbon not only needs to reflect the current damage caused to the environment. The price must also reflect the impact that carbon emitted into the atmosphere will have over the entire course of its lifetime. To obtain this value, we need to convert a sum of future costs – in our case the costs caused by carbon emissions to society – into a present value. In finance, the tool that allows us to convert future flows into a present value is the discount factor. The discount factor reflects the weight that agents assign to future outcomes when making decisions today.

Discounting plays a central role in climate economics. As illustrated by the debate between Professor William D. Nordhaus (Nordhaus, 2007) and Professor Nicholas Stern (Stern, 2007), the choice of a discount factor has a critical impact on the outcome of cost and benefit analyses. In risk assessment studies, the discount factor can for example determine whether extreme policies are immediately needed. If a high weight is assigned to short-term costs, the need for adopting measures is less pressing. In contrast, immediate action becomes critical if a higher weight is assigned to long-term costs that are expected to materialise in a distant future.

Our approach incorporates recent advances in asset pricing theory into the study of environmental policies. Discount factors are a cornerstone of modern finance (e.g. Cochrane, 2011; 2017). Building on this knowledge, we introduce a novel discount factor specification that bridges the gap between finance and environmental economics. The novelty of our approach is to introduce a link between climate change and attitudes towards risk, where the presence of an environmental externality induces time variation in risk aversion.[2]

The optimal policy is a carbon tax that varies over the cycle

We find that the optimal policy to counter climate change embeds a trade-off between environmental protection and safeguarding the economy. There is now a consensus that immediate action to combat climate change is urgently needed. The challenge, however, is that curbing emissions cannot be achieved without costs. Indeed, there is evidence that an increase in the price of emissions can have a negative impact on the economy in the short term (e.g. Bijnens et al., 2021; Känzig, 2021). Our theory shows that a carbon tax that is optimally designed takes this dimension into account.

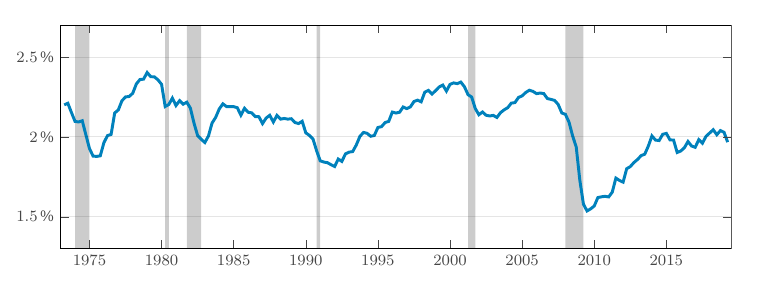

Combining our theory with econometric techniques allows us to provide an estimate of the optimal carbon tax over the cycle. In Chart 1, we report the results of a counterfactual exercise that estimates the historical evolution of the revenues of an optimal carbon tax for the US economy (expressed in percent of GDP), as predicted by our theory.

We propose that in crisis times macroeconomic stabilisation should be given priority over environmental protection. Indeed, as illustrated in Chart 1, the optimal policy should be used to mitigate the effect of severe recessions. For example, it would have been optimal to reduce the carbon tax sharply during the great recession of 2007-2009. During booms, in contrast, curbing emissions should be the prime concern. As emissions in the data are strongly procyclical, combating climate change is optimally achieved by raising the carbon tax during expansions. Carbon emitters therefore bear the burden of an increase in taxation during booms, but not during recessions.

Our policy recommendation is robust to variations in specification. The novelty of our approach is to highlight the possible impact of climate change on attitudes towards risk. However, studies that focus on the damage caused by climate change to production reach a similar conclusion (e.g. Heutel, 2012). Environmental policies should be time-varying and prudential.

Chart 1

Counterfactual environmental tax bill in % of GDP for the US economy

Note: Gray shaded areas are NBER dated recessions.

Implications for equilibrium real interest rates

We find that climate policies and climate change could affect equilibrium real interest rates, i.e. the rates that equate saving and investment. According to our theory, the reason is that climate change raises risk aversion. Since risk aversion amplifies the effect of uncertainty on economic decisions, climate change stimulates precautionary savings. The increase in the supply of savings induced by this mechanism then lowers equilibrium real interest rates.

Consequently, policies that mitigate the effect of climate change could raise equilibrium real interest rates. Indeed, the optimal policy set out in our theory reduces the uncertainty caused by climate change. The key is that this reduction in uncertainty lowers the need for precautionary saving. This lower willingness to save in turn puts upward pressure on real interest rates, as the availability of funds declines.

This result is potentially relevant for monetary policy. Indeed, low real interest rates increase the likelihood of hitting the effective lower bound on nominal rates, i.e. the point where nominal interest rates can go no lower. Policies that increase equilibrium real rates therefore help monetary policy by alleviating this constraint.

Conclusion

Climate change is a long-term phenomenon. However, as our results suggest, climate policies have implications for the short and medium term. One main takeaway from our analysis is that the optimal carbon tax should vary substantially over the cycle. In practice, however, constraints related to political economy considerations[3] or the difficulty in assessing the state of the economy in real time could make the optimal policy difficult to implement. One possible solution would be to delegate this function to an independent institution endowed with sufficient resources.[4]

References

Benmir, G., Jaccard, I. and Vermandel, G. (2020), “Green Asset Pricing”, Working Paper Series, No 2477, European Central Bank.

Bijnens, G., Hutchinson, J., Konings, J. and Saint-Guilhem, A. (2021), “The interplay between green policy, electricity prices, financial constraints and jobs: firm-level evidence”, Working Paper Series, No 2537, European Central Bank.

Cochrane, J. (2011), “Presidential Address: Discount Rates”, Journal of Finance, Vol. 66, No. 4, pp. 1047-1108.

Cochrane, J. (2017), “Macro-Finance”, Review of Finance, Vol. 21, No. 3, pp. 945-985.

Delpla, J. and Gollier, C. (2019), “Pour une Banque Centrale du Carbone”, Analyse pour la politique économique, Asterion, 1 October 2019.

Heutel, G. (2012), “How Should Environmental Policy Respond to Business Cycles? Optimal Policy under Persistent Productivity Shocks”, Review of Economic Dynamics, Vol. 15, No. 2, pp. 244-264.

Känzig, D. R. (2021), “The Economic Consequences of Putting a Price on Carbon”, mimeo, London Business School.

Nordhaus, W. D. (2007), “A Review of the Stern Review on the Economics of Climate Change”, Journal of Economic Literature, Vol. 45, No. 3, pp. 686-702.

Stern, N. (2007), “The Economics of Climate Change: The Stern Review”, Cambridge and New York: Cambridge University Press.

- This article was written by Ghassane Benmir (London School of Economics), Ivan Jaccard (Directorate General Research, European Central Bank) and Gauthier Vermandel (University Paris-Dauphine, PSL). The authors gratefully acknowledge comments and suggestions from Georgi Krustev, Arthur Saint-Guilhem, Alex Popov, Michael Ehrmann and Louise Sagar. The views expressed here are those of the authors and do not necessarily represent the views of either the European Central Bank or the Eurosystem.

- This time variation in risk aversion enables our model to reproduce a risk premium on long-term bonds of a realistic magnitude. Environmental policies are therefore studied within a framework immune to some well-known asset pricing anomalies, such as the bond premium puzzle.

- Indeed, decisions to increase taxes are typically unpopular and may therefore affect re-election prospects of politicians.

- As suggested by Delpla and Gollier (2019), this institution could for instance take the form of a “carbon central bank”.