- 24 June 2021

- RESEARCH BULLETIN NO. 85

Avoiding a self-fulfilling low-inflation trap

A low-inflation trap is a situation where both actual and expected inflation are firmly below the central bank’s target and nominal interest rates are close to or at their lower bound. The concept is often used to characterise Japan’s quarter-century of very low, and often negative, inflation.[2] More recently, persistent inflation shortfalls across the industrialised world have raised concerns that other jurisdictions, too, may be on the verge of getting caught in a Japanese-style low-inflation trap. Our new research shows how fiscal policy can help guard economies against this fate.

Low-inflation trap – a self-fulfilling prophecy?

Japan’s experience suggests that once an economy is stuck in a low-inflation trap, it is difficult to escape. The country has so far failed to reflate its economy, in spite of multifaceted monetary policy stimulus programmes launched over the past 25 years.

A potential reason for the persistence of the low-inflation environment is that it can involve elements of a self-fulfilling prophecy.[3] That is, inflation is low because the private sector believes that inflation will remain low in the future, and the lower bound on nominal interest rates prevents the central bank from lowering interest rates enough to invalidate these pessimistic beliefs.[4]

Empirical evidence suggests that such pessimistic expectations have indeed been an important driver of the low-inflation environment in Japan.[5] In a recent paper (Nakata and Schmidt, 2021), we study implications of such self-fulfilling dynamics for the design of macroeconomic stabilisation policy.

Conceptual framework

The analysis is based on a New Keynesian model of inflation. The private sector is made up of households and goods-producing firms, and the public sector consists of a central bank and a fiscal authority. The central bank sets the short-term nominal interest rate, and the fiscal authority controls the level of government spending, which is financed by current and future taxes. The two policy authorities are assumed to act under discretion in the sense that they periodically readjust their decisions.[6] Both the private and the public sector are forward-looking, that is, their expectations about future economic conditions affect their decisions.

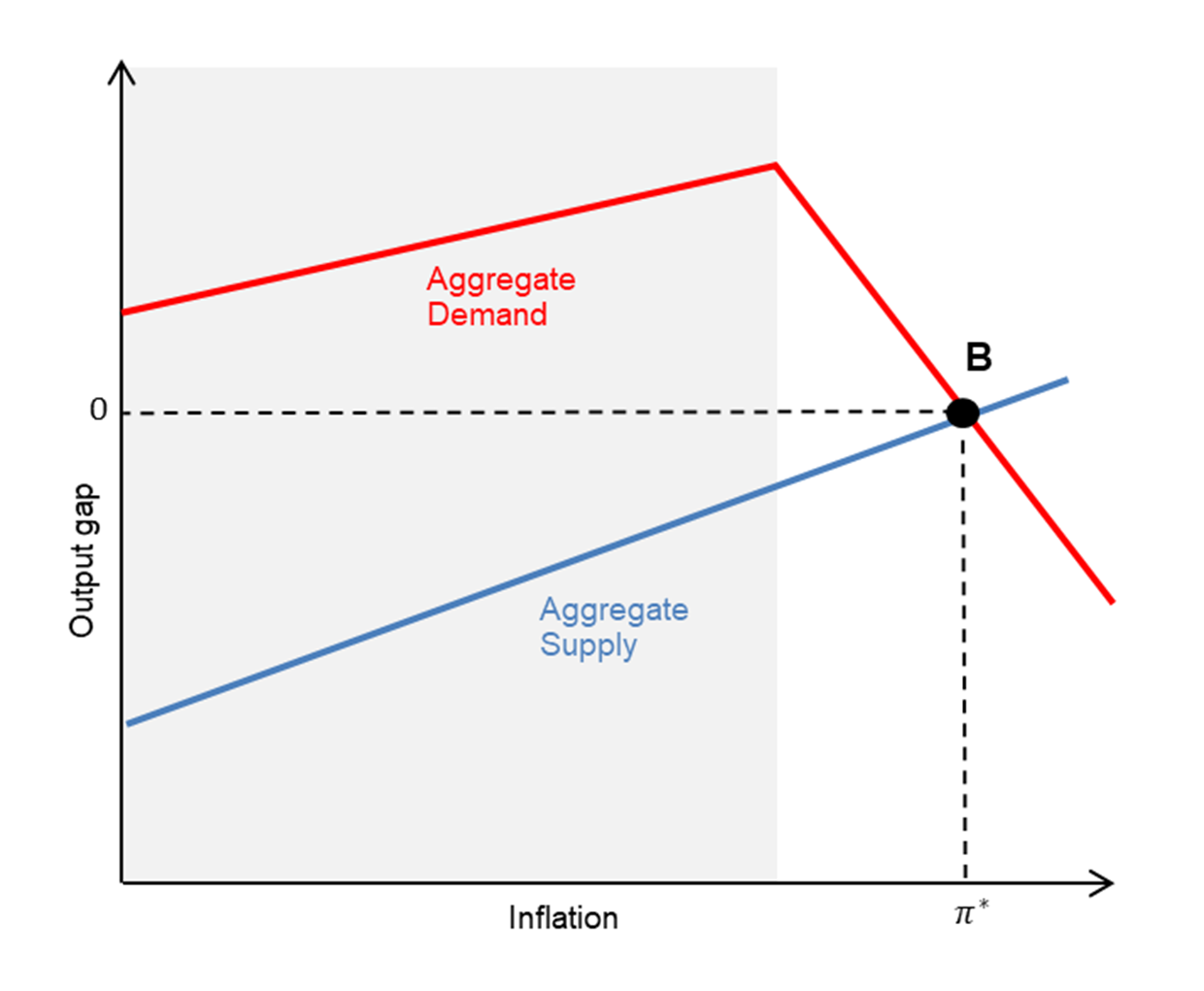

In our model, occasional declines in people’s confidence can, collectively, drag the economy into a low-inflation trap.[7] Chart 1 provides a graphical illustration. It casts the model in terms of an aggregate supply (AS) curve and an aggregate demand (AD) curve, assuming for now that the role of fiscal policy as a stabilisation tool is limited. The AS curve is upward-sloping – an increase in demand creates inflationary pressures. The AD curve has a kink. To the left of the kink (shaded area), the lower bound constraint is binding and the AD curve is upward-sloping – at the lower bound, an increase in inflation lowers the real interest rate and stimulates demand. To the right of the kink (non-shaded area), the lower bound constraint is slack and the AD curve is downward-sloping – away from the lower bound, an increase in inflation causes the central bank to raise nominal interest rates more than one-for-one with inflation, leading to an increase in the real interest rate and downward pressure on aggregate demand.

Chart 1

The threat of a self-fulfilling low-inflation trap

Notes: The chart shows aggregate supply and aggregate demand curves when confidence is low, and there is a small positive probability that confidence resumes in subsequent periods. The shaded area indicates pairs of values for inflation and the output gap for which the lower bound on interest rates is binding. The output gap is the difference between the economy’s actual output and potential output. denotes the central bank’s inflation target.

There are two intersections of the AS and AD curves, reflecting two distinct equilibria. At point A, the output gap is negative, so the economy is performing below its potential, and inflation is below the central bank’s target. That is the self-fulfilling low-inflation trap equilibrium. At point B, the output gap is closed, meaning the economy is performing well, and inflation is at target. That is the benign equilibrium without a self-fulfilling low-inflation trap. In our model, the central bank alone is unable to influence whether the economy is in the low-inflation trap equilibrium or in the benign equilibrium. This naturally raises the question: can fiscal policy help to eliminate the low-inflation trap equilibrium and steer the economy towards the benign equilibrium?

A fiscal escape route?

In Nakata and Schmidt (2021), we show how a fiscal authority geared towards macroeconomic stabilisation can prevent an economy from falling into a self-fulfilling low-inflation trap. Key to this result are that:

- fiscal policy is able to affect economic activity and inflation;

- government spending is not constrained in the way interest-rate policy is constrained by a lower bound.

In our model, the fiscal authority raises government spending when the lower bound on nominal interest rates becomes binding. The size of the fiscal stimulus increases with the severity of the economic downturn and the inflation shortfall. To rule out the self-fulfilling low-inflation trap in the model, the fiscal authority’s response to changes in economic conditions at the lower bound has to be sufficiently elastic – in principle, the fiscal authority has to be willing to raise government spending by whatever amount is needed to more than offset the effects of a possible drop in private sector confidence.[8]

Chart 2 shows that when the private sector expects the fiscal authority to respond decisively enough, the only equilibrium is the benign one. The AD curve to the left of the kink becomes flatter than the AS curve. When the fiscal authority responds with an aggressive increase in government spending, there is a much smaller fall in aggregate demand in response to any decline in inflation. As a result, the AS and AD curves do not intersect in the region where the lower bound is binding. The only remaining intersection is at point B, where the economy is in the benign equilibrium, characterised by inflation at target, a closed output gap, and nominal interest rates above their lower bound.

Chart 2

Avoiding a self-fulfilling low-inflation trap through fiscal policy

Notes: See Chart 1.

In the model, the mere presence of a fiscal authority that is credibly pursuing the above approach is enough to anchor expectations, so no actual policy intervention is needed. This is unlikely to work in practice. More likely, a fiscal authority would have to actually take action on the right scale to prevent an economy from getting caught in a self-fulfilling low-inflation trap.

Conclusion

Standard models of inflation that are widely used by academics and policy institutions predict that a bout of economic pessimism can become self-fulfilling, dragging the economy into a low-inflation equilibrium. However, these models also predict that policymakers are not reduced to inaction. To steer an economy away from a low-inflation trap, policymakers require both the willingness and the tools to act accordingly. In our model, we find that when monetary policy has run out of room for interest-rate cuts, decisive counter-cyclical fiscal policy protects the economy from the low-inflation equilibrium.

Following this policy prescription in practice might be particularly difficult in a monetary union like the euro area, that consists of a supranational central bank and many decentralised fiscal authorities. First, some euro area countries have high public debt levels. Second, timely coordination among national fiscal stabilisation policies can be difficult to achieve and its aggregate effect can be hampered by small international spillovers. Therefore, preventing self-fulfilling low-inflation traps could be another reason to create a central fiscal capacity in Europe.

References

Aruoba, B., Cuba-Borda, P. and Schorfheide, F. (2018), "Macroeconomic dynamics near the ZLB: A tale of two countries,” Review of Economic Studies, Vol. 85, pp. 87-118.

Benhabib, J., Schmitt-Grohé, S. and Uríbe, M. (2001), “The perils of Taylor rules”, Journal of Economic Theory, Vol. 96, pp. 40-69.

Benhabib, J., Schmitt-Grohé, S. and Uríbe, M. (2002), “Avoiding liquidity traps”, Journal of Political Economy, Vol. 110, pp. 535-563.

Cuba-Borda, P. and Singh, S. (2020), “Understanding persistent ZLB: Theory and assessment," mimeo.

Krugman, P. (1998), “It’s baaack: Japan’s slump and the return of the liquidity trap,” Brookings Papers on Economic Activity, Vol. 29, No 2, pp. 137-206.

Mertens, K. and Ravn M. (2014), “Fiscal policy in an expectations-driven liquidity trap”, Review of Economic Studies, Vol. 81, pp. 1637-1667.

Nakata, T. and Schmidt, S. (2021), “Expectations-driven liquidity traps: Implications for monetary and fiscal policy” American Economic Journal: Macroeconomics, forthcoming.

Shiller, R. J. (2019), Narrative economics, Princeton University Press, Princeton and Oxford.

- This article was written by Sebastian Schmidt (Directorate General Research, European Central Bank). The author gratefully acknowledges comments from Krzysztof Bankowski, Michael Ehrmann, Alexander Popov and Zoë Sprokel. The views expressed here are those of the author and do not necessarily represent the views of either the European Central Bank or the Eurosystem.

- See, for example, Krugman (1998).

- See Benhabib, Schmitt-Grohé and Uríbe (2001) and Mertens and Ravn (2014).

- The central bank may try to reverse people’s expectations using unconventional instruments. However, the effectiveness of some unconventional monetary policies could be impaired if they confirm low interest rate expectations.

- See Aruoba, Cuba-Borda and Schorfheide (2018) and Cuba-Borda and Singh (2020).

- As a result, promises by the two public authorities about their future policies are only credible to the private sector if the public authorities do not have an incentive to renege on their promises at a later stage.

- These shifts in people’s confidence are random events that are unrelated to the economy’s fundamentals. In the spirit of Shiller (2019), one may think about these events as the manifestation of a new dominant “narrative” about the future path of the economy that has spread to enough people to affect the economy at large.

- This approach to ruling out self-fulfilling low-inflation traps differs from the approach analysed in Benhabib, Schmitt-Grohé and Uríbe (2002). In Benhabib et al., self-fulfilling low-inflation traps are ruled out by a debt-financed tax cut or transfer that is understood not to be followed by an adjustment of future fiscal surpluses. In this case, the debt-financed fiscal intervention increases households’ after-tax wealth, which stimulates private demand and, thereby, inflation.