- RESEARCH BULLETIN NO.71

- 27 May 2020

COVID-19 and non-performing loans: lessons from past crises

During crises, the number of loans that cannot be paid back increases. What are the lessons from past crises for non-performing loan resolution after COVID-19? In this article we use a new database covering non-performing loans (NPLs) in 88 banking crises since 1990 to find out. The data show that dealing with NPLs is critical to economic recovery. Compared with the 2008 crisis, some factors are conducive to NPL resolution this time: banks have higher capital, the forward-looking IFRS 9 accounting standards can help NPL recognition, and the COVID-19 crisis was not preceded by a credit boom. However, other factors could make NPL resolution more challenging: government debt is substantially higher, banks are less profitable, and corporate balance sheets are often weak.

A new dataset on the dynamics of non-performing loans during banking crises

As a result of the coronavirus (COVID-19) pandemic, the economy has come to a sudden halt. This is likely to bring about high levels of non-performing loans (NPLs)¬ – i.e. loans that are in or close to default. High levels of NPLs are problematic because they impair bank balance sheets, depress credit growth, and delay economic recovery (Aiyar et al., 2015; Kalemli-Ozcan et al., 2015). Persistently high NPL ratios were a concern in several European countries after the 2008-2012 crisis, and the COVID-19 pandemic can cause a re-emergence of the NPL problem.

High NPL levels are a common feature of banking crises, and are often studied around such events. Existing Laeven and Valencia (2013) data report peak NPL levels during crises, but more data are needed to understand how NPLs evolve and are resolved. Our recent ECB working paper (Ari et al., 2020) bridges this gap by presenting a new dataset on yearly NPL evolution during 88 banking crises since 1990. The dataset covers major regional and global crises – the Nordic crisis, the Asian financial crisis, the global financial crisis – and many standalone crises in developing, transition, and low-income economies. For each crisis, we report NPLs over an 11-year window around the crisis.

What do we learn from these data?

Most banking crises lead to high NPL levels

During crises, NPLs typically follow an inverse U-shaped pattern. They start at modest levels, rise rapidly around the start of the crisis, and peak some years afterwards, before stabilising and declining. Looking at all crises, we see that NPL levels peak at about 20% of total loans on average, but the variance is large: in developing countries in particular, NPLs can exceed 50% of total loans. Only less than a fifth of banking crises avoid high NPL levels – which we define as NPLs exceeding 7% of total loans.

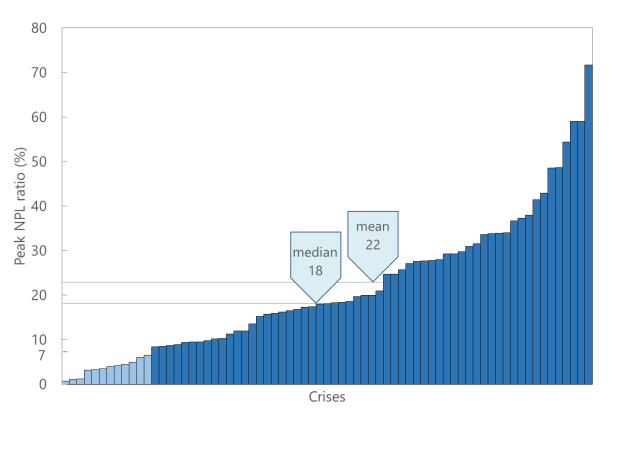

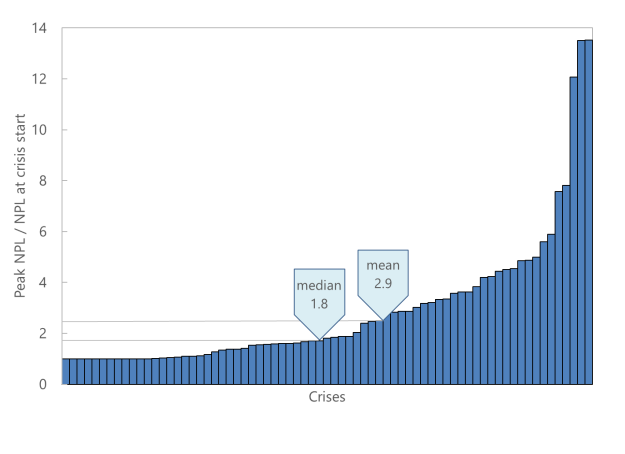

Anticipating future levels of NPLs is key for formulating NPL resolution strategies. It is tempting to use pre-crisis NPL levels to anchor such forecasts. Yet, pre-crisis NPL levels are not a good indicator of post-crisis NPL problems. After a crisis, NPLs increase to three times their pre-crisis values on average, and over ten times in extreme cases (see Chart 1).

Chart 1

Peak non-performing loans during 88 banking crises

Panel A. Peak NPLs, percent of total loans

Panel B. Peak NPLs, multiples of pre-crisis NPLs

Note: Reproduced from Ari, Chen and Ratnovski (2020), Figure 4. The chart shows NPL peaks during 88 banking crises since 1990. The left panel shows NPL peaks expressed as percent of total loans; the right panel shows the peak NPL ratio (i.e. NPLs/total loans) expressed as a multiple of the pre-crisis NPL ratio. Crises that did not have high NPL levels (with NPLs under 7% of total loans) are shown in light blue in the left panel.

Timely NPL resolution is difficult, but essential for economic recovery

Countries can facilitate the resolution of high NPLs using a mix of policy measures such as:

- Asset quality reviews, to identify loans that are non-performing and need restructuring;

- Separating good and bad assets of banks (known as “good bank”-“bad bank” resolution). This makes the balance sheets of “good banks” more transparent, steadies their market access, and lets them focus on extending new loans. “Bad banks”, often structured as asset management companies, proceed to extracting value from bad assets;

- Recapitalising “good banks”, to ensure their lending capacity.

More details on NPL resolution methods are provided in Balgova et al. (2016), Beck (2017), Brei et al. (2020), and in ECB Financial Stability Reviews: Grodzicki et al. (2015) and Fell et al. (2016 and 2017).

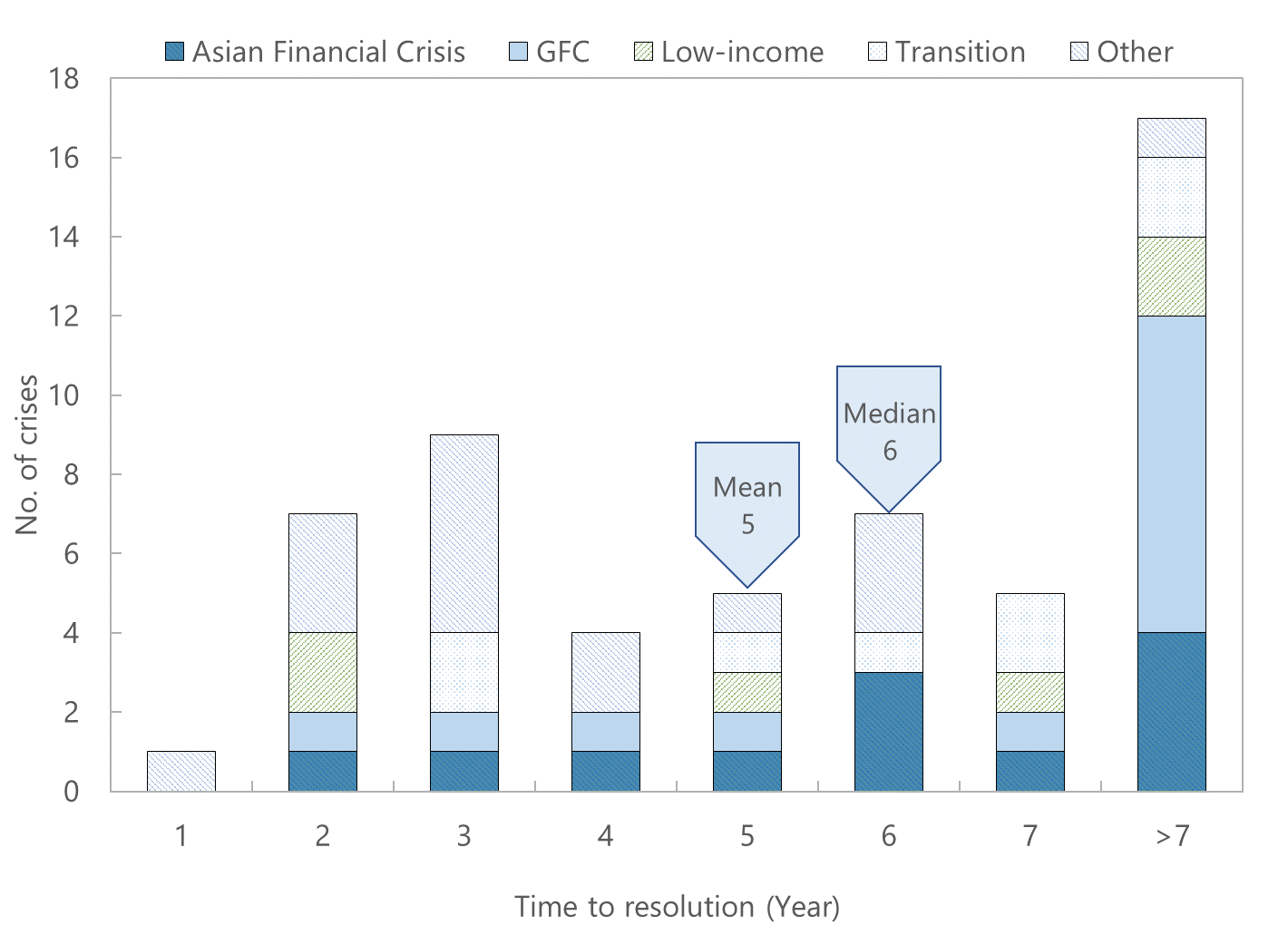

Despite the economic benefits of NPL reduction and the variety of methods available, the data paint a sobering picture of historic NPL resolution. While some countries resolve NPLs rapidly, a third of countries are saddled with NPLs for over seven years after a crisis. The NPL reduction outcomes after the global financial crisis are direr yet: two-thirds of the countries that experienced high NPL levels could not resolve those within seven years after the crisis (see Chart 2). Strikingly, this also implies that while advanced economies tend to have lower post-crisis NPLs, these take longer on average to resolve.

Chart 2

Mixed success in resolving non-performing loans after crises

Panel A. How many years did NPL resolution take?

Panel B. Were NPLs resolved within 7 years?

Note: Reproduced from Ari, Chen and Ratnovski (2020), Figure 6. The left panel shows the number of countries that resolved NPLs (i.e. reached NPL ratios of under 7% of total loans) in each year after the crisis. The right panel compares the number of countries that resolved NPLs within 7 years with the number of those that didn’t. The colours distinguish the crisis waves and types

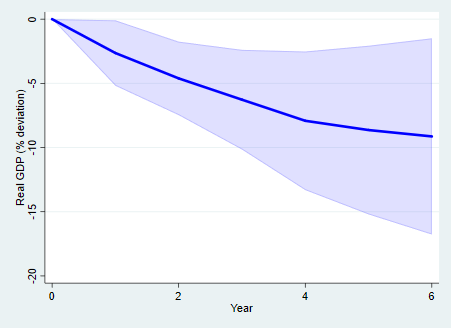

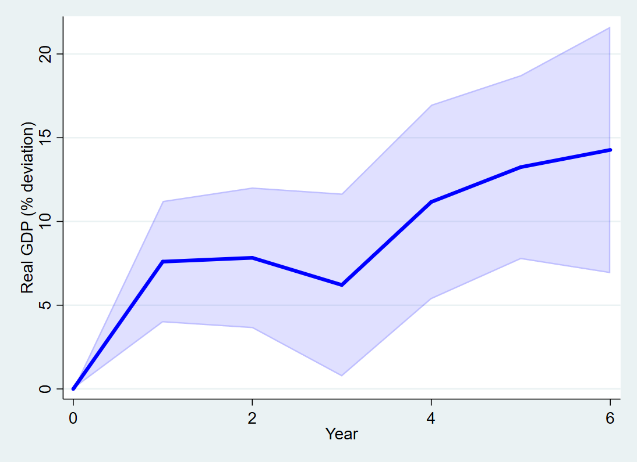

In our paper, we use the “local projections” method to assess the link between NPL resolution and post-crisis output dynamics, while controlling for their co-dependence. The results underscore that NPL resolution is critical for economic recovery. High and unresolved NPLs are associated with deeper recessions and slower recoveries. Six years after the start of a banking crisis, output in countries that experience high NPL levels is 6.5 percentage points lower than in countries that don’t. Of the countries that have high NPL levels, output in those that do not resolve NPLs is more than 10 percentage points lower than in those that do (see Chart 3). This means that not resolving high NPL levels reduced output growth by 1.5 percentage points per year at least for the next six years.

Chart 3

Non-performing loans and economic recovery

Panel A. Difference in post-crisis GDP between countries that experience high NPLs and those that do not

Panel B. Difference in post-crisis GDP between countries that resolve high NPLs (within 7 years) and those that do not

Note: Reproduced from Ari, Chen and Ratnovski (2020), Figure 6. The charts report the difference in output paths (expressed as percent of deviation from pre-crisis output) between countries that, following a banking crisis, have NPLs exceeding 7% of total loans and those that have NPLs under 7% of total loans (left panel); and between countries that, having experienced NPLs exceeding 7% of total loans, manage to resolve them and those that do not (right panel). The blue line is a central projection of the impulse response function. The x-axis shows the number of years after a crisis.

What explained slow NPL resolution in Europe after the 2008-2012 crisis?

We further use a model selection approach to assess which pre-crisis indicators predict the dynamics of NPLs in banking crises. We document that NPL peaks are higher in countries with lower GDP per capita, after a credit boom, under fixed exchange rates, with less profitable banks and with more fragile corporate balance sheets. NPL resolution is more protracted in similar circumstances, and in countries with high public debt and more sophisticated banking sectors. Interestingly, these high-level indicators have good predictive power: the average (pseudo) adjusted R-squared across the specifications is 0.24.

These results shed light on the factors behind high and persistent NPLs in some European countries after the 2008-2012 crisis. In our paper, we compare actual NPL dynamics in seven European countries (Greece, Ireland, Italy, Portugal, Spain, Hungary and Slovenia) with what could have been anticipated based on historical patterns.

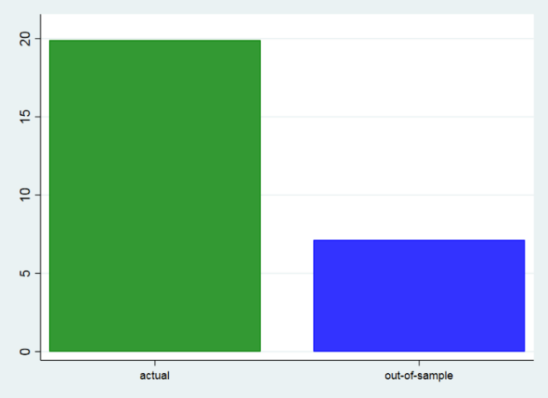

It turns out that high NPL levels in Europe in the 2010s were hard to anticipate: the crisis was extraordinarily severe for advanced economies. By contrast, protracted NPL resolution was in line with historical patterns: it is common for crises that follow a credit boom (see Chart 4). Indeed, the long-term negative consequences of credit booms are well-documented in the literature (Caballero et al., 2008, among others). They are related to the difficulties in resolving the debt of non-viable “zombie” firms and households that are “underwater” on their housing assets.

Chart 4

Actual non-performing loans in Europe versus what could have been predicted

NPL peaks, % of total loans

Time to resolve NPLs, years

Note: Reproduced from Ari, Chen and Ratnovski (2020), Figure 7. The chart shows NPL metrics: actual (in green) and out-of-sample predicted (in blue), on average for a sample of European countries affected by the 2008-2012 crisis. The metrics of NPLs are: NPL peaks as percent of total loans (left panel) and the duration of NPL resolution in years (right panel).

What can we infer for NPL resolution after COVID-19?

Even though our paper studies NPLs in the context of banking crises, and thus cannot perfectly be mapped to the COVID-19 events, it provides valuable insights into impending NPL challenges. Our results highlight forces that can make NPL resolution after the COVID-19 events different from that after the 2008-2012 crisis.

Some forces are conducive to NPL resolution. For example, the COVID-19 pandemic is not a credit-boom-induced crisis. If the economic downturn proves temporary, many post-COVID-19 NPLs may relate to viable illiquid firms, rather than unviable zombie firms. European banks have entered the COVID-19 pandemic with on average higher capital ratios compared with the 2008 crisis. The recently introduced IFRS 9 accounting standards may induce faster NPL recognition, and hence resolution, thanks to their forward-looking nature (although NPL recognition that is too fast may also constrain bank lending during downturns).

Other forces point to challenges in NPL resolution. Compared with 2008, most European countries have substantially higher public debt, less profitable banks, and in many cases weaker corporate sector conditions – the factors that, historically, have complicated NPL resolution. Moreover, if the economic recovery from the pandemic is slow and protracted, credit losses from corporate distress will rise and could overwhelm banks, further complicating NPL resolution.

Given the importance of NPL reduction for economic recovery and many countries’ historical difficulties in implementing effective NPL-related measures, designing effective NPL resolution policies for the post-COVID-19 world is a key forward-looking financial policy issue for Europe today.

References

Aiyar, S., Bergthaler, W., Garrido, J.M., Ilyina, A., Jobst, A., Kang, K., Kovtun, D., Liu, Y., Monaghan, D., and Moretti, M. (2015), “A strategy for resolving Europe’s problem loans”, IMF Staff Discussion Note 15/19, Washington.

Ari, A., Chen, S. and Ratnovski, L. (2020), “The dynamics of non-performing loans during banking crises: a new database”, ECB Working Papers, No 2395, Frankfurt am Main.

Balgova, M., Nies, M. and Plekhanov, A. (2016), “The economic impact of reducing non-performing loans”, EBRD Working Papers, No 193, London.

Beck, T. (2017), “An asset management company for the Eurozone: Time to revive an old idea”, VOXEU.

Brei, M., Gambacorta, L., Lucchetta, M. and Parigi, B.-M. (2020), “Bad bank resolutions and bank lending”, BIS Working Papers, No 837, Basel.

Caballero, R.J., Hoshi, T., and Kashyap, A.K. (2008), “Zombie lending and depressed restructuring in Japan”, American Economic Review, No 98(5), pp. 1943-77.

Grodzicki, M., Laliotis, D., Leber, M., Martin, R., O’Brien, E., and Zboromirsk, P. (2015), “Resolving the legacy of non-performing exposures in euro area banks”, Financial Stability Review, ECB, May.

Fell, J., Grodzicki, M., Martin, R. and O’Brien, E. (2016), “Addressing market failures in the resolution of non-performing loans in the euro area”, Financial Stability Review, ECB, November.

Fell, J., Moldovan, C. and O’Brien, E. (2017), “Resolving non-performing loans: a role for securitisation and other financial structures?”, Financial Stability Review, ECB, May.

Kalemli-Ozcan, S., Laeven, L., and Moreno, D. (2015), “Debt overhang, rollover risk and investment in Europe”, mimeo.

Laeven, L. and Valencia, F.V. (2013), “Systemic banking crises database”, IMF Economic Review, No 61(2), pp. 225-270.

- This article was written by Anil Ari (Economist, International Monetary Fund, European Department), Sophia Chen (Economist, International Monetary Fund, Research Department) and Lev Ratnovski (Lead Economist, European Central Bank, Directorate General Research, Financial Research Division). It is based on ECB Working Paper 2395 “The dynamics of non-performing loans during banking crises: a new database”, by the same authors. The authors gratefully acknowledge the comments of Maciej Grodzicki, Paul Hiebert, Luc Laeven, Alberto Martin and Thomas Vlassopoulos. The views expressed here are those of the authors and do not necessarily represent the views of the ECB, the Eurosystem or the IMF.