Update on economic, financial and monetary developments

Summary

The Governing Council will stay the course in raising interest rates significantly at a steady pace and in keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target. Accordingly, at its meeting on 2 February 2023, the Governing Council decided to raise the three key ECB interest rates by 50 basis points and it expects to raise them further. In view of the underlying inflation pressures, the Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March and it will then evaluate the subsequent path of its monetary policy. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations. In any event, the Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

At its meeting on 2 February 2023, the Governing Council also decided on the modalities for reducing the Eurosystem’s holdings of securities under the asset purchase programme (APP). As communicated in December, the APP portfolio will decline by €15 billion per month on average from the beginning of March until the end of June 2023, and the subsequent pace of portfolio reduction will be determined over time. Partial reinvestments will be conducted broadly in line with current practice. In particular, the remaining reinvestment amounts will be allocated proportionally to the share of redemptions across each constituent programme of the APP and, under the public sector purchase programme (PSPP), to the share of redemptions of each jurisdiction and across national and supranational issuers. For the Eurosystem’s corporate bond purchases, the remaining reinvestments will be tilted more strongly towards issuers with a better climate performance. Without prejudice to the ECB’s price stability objective, this approach will support the gradual decarbonisation of the Eurosystem’s corporate bond holdings, in line with the goals of the Paris Agreement.

Economic activity

Survey data point to weakening global economic activity at the turn of the year, following robust growth in the third quarter of 2022. The abrupt reversal of the zero-COVID policy in China is likely to weigh on Chinese activity in the near term. At a global level, persistent inflationary pressures are eroding disposable income. Bottlenecks in global supply chains have continued to normalise, but disruptions to economic activity in China could trigger renewed supply chain bottlenecks, with global repercussions. Global trade momentum continued to moderate in November, while early indicators and nowcasts point to a contraction in the fourth quarter of 2022. Price pressures at the global level remain high but may have peaked, as headline inflation for the OECD as a whole moderated further in November.

According to Eurostat’s preliminary flash estimate, the euro area economy grew by 0.1% in the fourth quarter of 2022. While above the December 2022 Eurosystem staff projections, this outcome means that economic activity has slowed markedly since mid-2022 and the Governing Council expects it to stay weak in the near term. Subdued global activity and high geopolitical uncertainty, especially owing to Russia’s unjustified war against Ukraine and its people, continue to act as headwinds to euro area growth. Together with high inflation and tighter financing conditions, these headwinds dampen spending and production, especially in the manufacturing sector.

However, supply bottlenecks are gradually easing, the supply of gas has become more secure, firms are still working off large order backlogs and confidence is improving. Moreover, output in the services sector has been holding up, supported by continuing reopening effects and stronger demand for leisure activities. Rising wages and the recent decline in energy price inflation are also set to ease the loss of purchasing power that many people have experienced owing to high inflation. This, in turn, will support consumption. Overall, the economy has proved more resilient than expected and should recover over the coming quarters.

The unemployment rate remained at its historical low of 6.6% in December 2022. However, the rate at which jobs are being created may slow and unemployment could rise over the coming quarters.

Government support measures to shield the economy from the impact of high energy prices should be temporary, targeted and tailored to preserving incentives to consume less energy. In particular, as the energy crisis becomes less acute, it is important to now start rolling these measures back promptly in line with the fall in energy prices and in a concerted manner. Any such measures falling short of these principles are likely to drive up medium-term inflationary pressures, which would call for a stronger monetary policy response. Moreover, in line with the EU’s economic governance framework, fiscal policies should be oriented towards making the economy more productive and gradually bringing down high public debt. Policies to enhance the euro area’s supply capacity, especially in the energy sector, can help reduce price pressures in the medium term. To that end, governments should swiftly implement their investment and structural reform plans under the Next Generation EU programme. The reform of the EU’s economic governance framework should be concluded rapidly.

Inflation

According to Eurostat’s flash estimate, which has been calculated using Eurostat estimates for Germany, inflation was 8.5% in January. This would be 0.7 percentage points lower than the December figure, with the decline owing mainly to a renewed sharp drop in energy prices. Market-based indicators suggest that energy prices over the coming years will be significantly lower than expected at the time of the December 2022 meeting. Food price inflation edged higher to 14.1%, as the past surge in the cost of energy and of other inputs for food production is still feeding through to consumer prices.

Price pressures remain strong, partly because high energy costs are spreading throughout the economy. Inflation excluding energy and food remained at 5.2% in January, with inflation for non-energy industrial goods rising to 6.9% and services inflation declining to 4.2%. Other indicators of underlying inflation are also still high. Government measures to compensate households for high energy prices will dampen inflation in 2023 but are expected to raise inflation once they expire. At the same time, the scale of some of these measures depends on the evolution of energy prices and their expected contribution to inflation is particularly uncertain.

Although supply bottlenecks are gradually easing, their delayed effects are still pushing up goods price inflation. The same holds true for the lifting of pandemic-related restrictions: while weakening, the effect of pent-up demand is still driving up prices, especially in the services sector.

Wages are growing faster, supported by robust labour markets, with some catch-up to high inflation becoming the main theme in wage negotiations. At the same time, recent data on wage dynamics have been in line with the December 2022 Eurosystem staff projections. Most measures of longer-term inflation expectations currently stand at around 2%, but these warrant continued monitoring.

Risk assessment

The risks to the outlook for economic growth have become more balanced. Russia’s unjustified war against Ukraine and its people continues to be a significant downside risk to the economy and could again push up the costs of energy and food. There could also be an additional drag on euro area growth if the world economy weakened more sharply than expected. Moreover, the recovery would face obstacles if the pandemic were to re-intensify and cause renewed supply disruptions. However, the energy shock could fade away faster than anticipated and euro area companies could adapt more quickly to the challenging international environment. This would support higher growth than currently expected.

The risks to the inflation outlook have also become more balanced, especially in the near term. On the upside, existing pipeline pressures could still send retail prices higher in the near term. Moreover, a stronger than expected economic rebound in China could give a fresh boost to commodity prices and foreign demand. Domestic factors such as a persistent rise in inflation expectations above target or higher than anticipated wage rises could drive inflation higher, also over the medium term. On the downside, the recent fall in energy prices, if it persists, may slow inflation more rapidly than expected. This downward pressure in the energy component could then also translate into weaker dynamics for underlying inflation. A further weakening of demand would also contribute to lower price pressures than currently anticipated, especially over the medium term.

Financial and monetary conditions

As the Governing Council tightens monetary policy, market interest rates are rising further and credit to the private sector is becoming more expensive. Bank lending to firms has decelerated sharply over recent months. This partly stems from lower financing needs for inventories. But it also reflects weakening demand for loans to finance business investment, in the context of a steep upward move in bank lending rates and a considerable tightening in credit standards, which is also visible in the most recent euro area bank lending survey. Household borrowing has continued to weaken as well, reflecting rising lending rates, tighter credit standards and a sharp fall in the demand for mortgages. As loan creation decelerates, money growth is also slowing rapidly, with a marked decline in its most liquid components, including overnight deposits, only partially compensated by a shift to term deposits.

Conclusion

Summing up, the Governing Council will stay the course in raising interest rates significantly at a steady pace and in keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation to its 2% medium-term target. Accordingly, the Governing Council decided at its meeting on 2 February 2023 to raise the three key ECB interest rates by 50 basis points and expects to raise them further. In view of the underlying inflation pressures, the Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March and it will then evaluate the subsequent path of its monetary policy. Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations. Moreover, from the beginning of March 2023, the APP portfolio will decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities.

The Governing Council’s future policy rate decisions will continue to be data-dependent and determined meeting by meeting. It stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its medium-term target.

Monetary policy decisions

At its meeting on 2 February 2023, the Governing Council decided to raise the three key ECB interest rates by 50 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 3.00%, 3.25% and 2.50% respectively, with effect from 8 February 2023. In view of the underlying inflation pressures, the Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March and it will then evaluate the subsequent path of its monetary policy.

As communicated in December, from the beginning of March 2023, the APP portfolio will decline at a measured and predictable pace, as the Eurosystem will not reinvest all of the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023 and its subsequent pace will be determined over time. The Governing Council will regularly reassess the pace of the APP portfolio reduction to ensure it remains consistent with the overall monetary policy strategy and stance, to preserve market functioning, and to maintain firm control over short-term money market conditions.

On the basis of the December decision, in February the Governing Council decided on the detailed modalities for reducing the Eurosystem’s holdings of securities under APP through the partial reinvestment of the principal payments from maturing securities.

During the period of partial reinvestment, the Eurosystem will retain the existing smooth reinvestment approach. The monthly redemptions under the APP between March and June 2023 will exceed the decided average run-off pace of €15 billion per month. Partial reinvestments in excess of €15 billion per month will ensure that the Eurosystem maintains a continuous market presence under the APP over this period.

The remaining reinvestment amounts will be allocated proportionally to the share of redemptions across each constituent programme of the APP, i.e. the public sector purchase programme (PSPP), the asset-backed securities purchase programme (ABSPP), the third covered bond purchase programme (CBPP3) and the corporate sector purchase programme (CSPP).

Under the PSPP, the allocation of the reinvestments across jurisdictions and over time will continue to follow current practice. Specifically, the remaining reinvestment amounts will be allocated proportionally to the share of redemptions of each jurisdiction and across national and supranational issuers. Reinvestments will be distributed over time to allow a regular and balanced market presence.

For the private sector programmes (ABSPP, CBPP3 and CSPP), primary market purchases will be phased out by the start of the partial reinvestments in order to better steer the amount of the purchases conducted under each programme. The Eurosystem’s market presence during the period of partial reinvestment will therefore be focused on secondary market purchases. However, non-bank corporate issuers with a better climate performance and green corporate bonds will continue to be purchased in the primary market.

Finally, the Governing Council decided on a stronger tilting of its corporate bond purchases towards issuers with a better climate performance during the period of partial reinvestment. Without prejudice to the ECB’s price stability objective, and in keeping with the Governing Council’s climate action plan, this approach will support the gradual decarbonisation of the Eurosystem’s corporate bond holdings, in line with the goals of the Paris Agreement.

As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations are contributing to its monetary policy stance.

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over the medium term. The Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

1 External environment

Survey data point to weakening global economic activity at the turn of the year, following robust growth in the third quarter of 2022. The abrupt reversal of the zero-COVID policy in China is likely to weigh on Chinese activity in the near term. At a global level, persistent inflationary pressures are eroding disposable income. Bottlenecks in global supply chains have continued to normalise, but disruptions to economic activity in China could trigger renewed supply chain pressures, with global repercussions. Global trade momentum continued to moderate in November, while early indicators and nowcasts point to a contraction in the fourth quarter of 2022. Price pressures at a global level remain high but may have already peaked, as headline inflation for the OECD as a whole moderated further in November.

The global outlook is being held back by slowing demand. The December global composite output Purchasing Managers’ Index (PMI) confirmed the downshift in momentum of the global economy towards the end of year, with the index remaining below the neutral threshold (48.7). The ECB’s internal global activity tracker, which is based on high-frequency data, is also signalling a further slowdown in economic activity in the fourth quarter. The weakening global economic growth momentum in the fourth quarter followed strong growth in the third quarter, in which global GDP increased by 1.7% quarter on quarter, driven by the rebound in the United States and China. However, the tracker signalled some improvement in December on the back of stronger labour market and financial market data. This points to a possible gradual recovery at the start of 2023, which could be further supported over the course of the year by the reopening of the Chinese economy.

Global supply chains remain fairly resilient despite COVID-related disruptions in China. Signs of renewed supply bottlenecks emerged in China amid surging COVID-19 infections, reflected in the longer Chinese PMI suppliers’ delivery times in November and December. However, there is little evidence that longer delivery times in China are spilling over to the rest of the world. In fact, global supply chain bottlenecks have continued to normalise, on the back of slowing global demand. In January, global PMI suppliers’ delivery times continued to improve, moving towards the neutral threshold (Chart 1). Global supply pressures declined across all items including textiles and electronic goods. Nevertheless, worsening bottlenecks in the global supply chain remain a downside risk to the global economy following the lifting of COVID-19 restrictions in China.

Chart 1

PMI suppliers’ delivery times

(diffusion indices)

Sources: S&P Global, CNBS and ECB staff calculations.

Note: The latest observations are for January 2023.

Global trade lost momentum at the end of 2022, in line with global activity. Global imports showed some resilience in the third quarter of the year (growing by 0.9% quarter on quarter) but the outlook for trade in the fourth quarter has become more clouded. The momentum of world merchandise trade turned negative in November, driven by declining imports in advanced economies and emerging market economies (EMEs). Early and leading indicators also point to a contraction in world trade in the fourth quarter of 2022. Notably, December aggregate indices for PMI new export orders in both advanced economies and EMEs remained below their long-term median and the neutral threshold. This is consistent with the ECB’s internal trade nowcast, which predicts that global imports will contract in the fourth quarter amid negative contributions from hard data and transport data.

Global inflationary pressures remain high but may have already peaked. In November annual headline Consumer Price Index (CPI) inflation across the OECD area decreased to 10.3% (7.0% excluding Türkiye), as energy inflation continued to fall while food inflation remained unchanged. Core inflation declined marginally to 7.5%. Headline inflation momentum in annualised three-month-on-three-month terms slowed for the sixth consecutive month, extending the trend of softening price pressures. Momentum in services and core inflation also started to slow in several advanced economies, suggesting that global inflationary pressures remain high but may have already peaked (Chart 2).

Chart 2

Headline and core inflation in the United States, United Kingdom and Japan

(year-on-year percentage changes)

Sources: OECD, Haver Analytics and ECB staff calculations.

Notes: Core inflation refers to inflation for all items excluding food and energy. The latest observations are for December 2022.

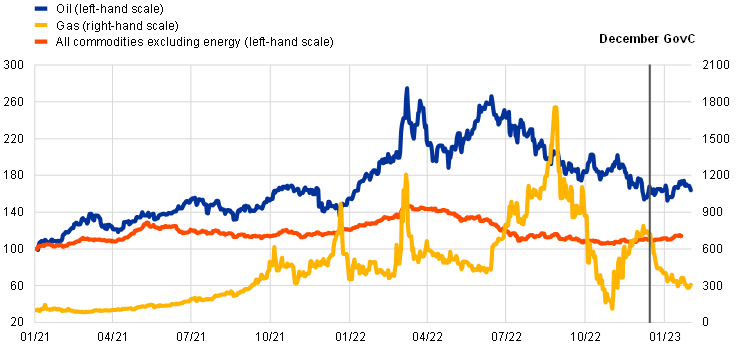

Natural gas prices have declined significantly since the December Governing Council meeting as a result of the slowdown in global demand, together with the comparatively warm winter and effective gas saving measures (Chart 3). Oil prices have seen a small decline of 2% since the December Governing Council meeting, as the expected rise in demand following China’s reopening was outweighed by the global economic slowdown, which continues to affect oil prices. The effect of China’s reopening on oil prices has been relatively contained so far, indicating that the impact of surging cases of COVID-19 caused economic activity to fall. Global oil prices have been little affected by the EU embargo and price cap on Russian crude oil, while sanctions have pushed down the selling price of Russian oil. However, there are risks ahead. In particular, in February the EU embargo and price cap were extended to refined oil prices. Furthermore, Russia announced it will ban oil sales to countries that implement the oil price cap from February onwards. European gas spot and futures prices fell by around 50% on the back of very low demand for gas in Europe caused by the unusually warm winter and the effectiveness of gas savings measures. As a result, European gas storage levels remain high and this should make it easier to replenish supplies ahead of next winter. Nonetheless, the European gas market remains vulnerable to global supply risks such as a rebound in demand for gas from China as its economy reopens. The increase in metal prices since the December Governing Council meeting (+9%) has been driven by optimism about future demand following China’s reopening. After the sluggish demand seen in 2022, a rebound in Chinese demand would represent a substantial upside risk to metal prices. The increase in food prices (+1%) was driven by downward revisions to the global corn supply.

Chart 3

Commodity price developments

(index: 1 January 2021 = 100)

Sources: Refinitiv, HWWI and ECB calculations.

Notes: Gas refers to the Dutch TTF gas price. The vertical line marks the date of the Governing Council meeting in December 2022. The latest observations are for 31 January 2023 for oil and gas, and 20 January 2023 for commodities excluding energy.

In the United States, economic activity has been more resilient than expected. Real GDP grew at an annualised rate of 2.9% in the fourth quarter of 2022. The slight deceleration in economic activity compared with the previous quarter reflected weaker domestic demand and a marked decline in net trade, driven by a larger fall in real exports compared with the previous quarter. However, the stronger growth in the second half of 2022 compared with the first half of the year masks an underlying downward trend in private consumption and investment over the year as a whole. Despite the tightness of the labour market, headline inflation is declining as energy pressures ease. Annual headline CPI inflation fell to 6.5% in December, while annual inflation excluding food and energy dropped to 5.7%, reflecting a slowdown in core goods prices that was partly offset by persistently high core services prices. Looking ahead the growth outlook for the first half of 2023 remains clouded by the expected further deterioration in residential private investment, despite moderating inflation and strong labour markets.

In China, the abrupt end of the zero-COVID policy is disrupting economic activity in the near term. The sudden lifting of COVID-related restrictions on 7 December came as a surprise and followed protests in China against containment measures. In December the National Bureau of Statistics PMI for China, which captured the latter part of the month (when infections were surging) fell sharply, particularly for services-related activity. This plunge in demand was mirrored by the high-frequency QuantCube consumption index for China. Daily mobility indicators for Chinese cities also suggested a steep fall in December, although this was followed by a tentative partial rebound in January. Reflecting these trends, GDP slowed to 2.9% year on year in the last quarter of 2022. Inflationary pressures in China were subdued, consistent with weak economic activity. Producer price index inflation remained negative for the third consecutive month in December, while annual CPI inflation has been below 2% since October.

In Japan, economic activity continues to recover amid rising inflation. Real GDP is expected to have returned to positive growth in the fourth quarter, but significant headwinds remain. The rebound in real private consumption has thus far been modest, with real private spending in goods still below pre-COVID levels. At the same time, manufacturing activity weakened in the fourth quarter of 2022, weighed down by moderating global demand and a slowdown in the recovery of supply constraints. Headline inflation increased further to 4% in December, largely supported by higher energy prices and, to a lesser extent, food prices. Core inflation increased marginally from 1.5% in November to 1.6% in December. Looking ahead headline inflation is expected to ease somewhat in 2023 on the back of lower import cost pressures, a stronger yen and energy subsidies.

In the United Kingdom, growth momentum is set to weaken further. While monthly GDP surprised on the upside in November – with a modest increase on account of strong services activity – most short-term indicators point to prolonged weakness in growth momentum as households continue to face falling real wages, tight financial conditions and a housing market correction. The widespread strikes by UK public employees in December and January will also weigh on activity. Annual CPI inflation fell to 10.5% in December. This drop was once again primarily driven by the negative contribution of vehicle fuel prices, which was only partially offset by higher food, restaurant and hotel prices. Core inflation held steady at 6.3% in December, driven largely by rising services prices.

The outlook for EMEs remains subdued. Survey data for December signal a further decline in manufacturing output across large EMEs, except for India and Russia. Moreover, the outlook for EMEs, as proxied by new export orders, has weakened in all countries. In particular, Asia – a global hub for tech sector products – seems to have been significantly hit by weakening global demand, as evidenced by declining exports of semiconductors. At the same time, CPI inflation fell in some EMEs but remains high and is likely to prove persistent. December data suggest that core inflation remained broadly stable and is already exceeding headline inflation in several countries.

2 Economic activity

Economic growth in the euro area slowed in the second half of last year. After 0.3% in the third quarter of 2022, growth was 0.1% in the fourth quarter. Subdued global activity and high geopolitical uncertainty, especially owing to Russia’s unjustified war against Ukraine, continue to act as headwinds to euro area growth. Together with high inflation and tighter financing conditions, these headwinds are dampening spending and production, especially in the manufacturing sector. However, supply bottlenecks are gradually easing, the supply of gas has become more secure, firms are still working off large order backlogs and confidence is improving. Moreover, output in the services sector has been holding up, supported by continuing reopening effects and stronger demand for leisure activities. Rising wages and the recent decline in energy price inflation are also set to ease the loss of purchasing power that many people have experienced owing to high inflation. This, in turn, will support consumption. Overall, the economy has proved more resilient than expected and should recover over the coming quarters. The risks to the outlook for economic growth have become more balanced.

Euro area economic growth slowed in the second half of 2022. Following dynamic economic developments in the first half of 2022, growth eased substantially to 0.3% in the third quarter and 0.1% in the final quarter of last year (Chart 4). While the earlier strong growth was brought about by a rebound in demand for contact-intensive services following the reopening of the economy after the lifting of pandemic-related restrictions in the first half of the year, soaring energy prices started to dampen spending and production in the second half of the year. The euro area has also been affected by the impact of the weakening of global demand alongside tighter monetary policy in many major economies. No breakdown of growth is available as yet, but short-term indicators and released country data suggest that domestic demand and changes in inventories provided a negative contribution to growth in the fourth quarter, while net trade provided a positive contribution. According to a first estimation of annual growth for 2022, based on seasonally and calendar adjusted quarterly data, GDP rose by 3.5%. The carry-over effect to growth in 2023 is estimated at 0.5%, which is slightly below the historical average contribution.[1]

Chart 4

Euro area real GDP, composite output PMI and ESI

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: diffusion index)

Sources: Eurostat, European Commission, S&P Global and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The European Commission’s Economic Sentiment Indicator (ESI) has been standardised and rescaled to have the same mean and standard deviation as the composite output Purchasing Managers’ Index (PMI). The latest observations are for the fourth quarter of 2022 for real GDP and January 2023 for the ESI and the PMI.

Despite continuous weakness, recent economic indicators provide mixed signals regarding GDP growth at the beginning of the year. In January the euro area composite output PMI stood at 50.2, above the fourth quarter average and in line with a broadly stagnating level of output. While the PMI for manufacturing still points to a contraction in the first quarter of 2023, the PMI for services now stands slightly above 50, indicating slow but positive growth (Chart 5). Although prospects slightly improved in January for both sectors, developments are being affected by easing but still present supply chain disruptions and high commodity prices and by the subsequent high levels of overall uncertainty. In the latest ECB Survey of Professional Forecasters, which was conducted in early January, respondents forecast negative growth in the first quarter, before turning positive again in the second quarter.[2] As the effects of Russia’s invasion of Ukraine, including continued high inflation, still elevated uncertainty and slow foreign demand, abate, a gradual recovery is expected on the back of a resilient labour market and fiscal support measures.

Chart 5

Value added, production and PMI for manufacturing and services

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: index, February 2021 = 50, diffusion index)

Sources: S&P Global, Eurostat and ECB calculations.

Notes: The latest observation is for the third quarter of 2022 for value added and January 2023 for PMI output/activity. In the manufacturing panel, the latest observation for production is for November 2022, while in the services panel, the latest observation for production is for October 2022 (with an estimate for November 2022 based on published country data).

The labour market in the euro area remains robust but is losing some momentum. The unemployment rate stood at 6.6% in December 2022, unchanged from November and 0.8 percentage points lower than the pre-pandemic level observed in February 2020 (Chart 6). Quarter on quarter, total employment rose by 0.3% in the third quarter of 2022, after growing by 0.4% in the second quarter, broadly in line with economic activity. As a result of the economic recovery that followed the lifting of pandemic-related restrictions, job retention schemes largely ceased, returning to the pre-crisis level of around 0.3% of the labour force at the end of 2022. Total hours worked in the third quarter of 2022 were 0.2% above pre-pandemic levels. Among the main economic sectors, less hours were worked in the industry sector in the third quarter of 2022 than before the pandemic crisis, while total hours worked in the third quarter of 2022 exceeded pre-pandemic levels in the public services and construction sectors.

Chart 6

Euro area employment, PMI employment indicator and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, S&P Global and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The PMI is expressed as the deviation from 50 divided by 10. The latest observations are for the third quarter of 2022 for employment, January 2023 for the PMI assessment of employment and December 2022 for the unemployment rate.

Short-term labour market indicators continue to point to a resilient euro area labour market overall with some signs of stabilisation. The composite PMI employment indicator stood at 52.5 in January. The reading of above 50 suggests further employment growth, although not as strongly as indicated in the second half of 2022. Looking at developments across different sectors, the PMI employment indicator continues to point to robust employment growth in services and manufacturing, while it continues to show signs of deceleration in the construction sector.

Private consumption is likely to have been weak in the last quarter of 2022. The positive dynamics of household consumption up to the third quarter of 2022 were underpinned mainly by consumption of services, which rose as the economy reopened, while consumption of goods remained weak. Continued elevated inflation and tighter financing conditions dampened spending in the euro area in the fourth quarter despite some positive news in incoming hard data, also supported by the easing of supply disruptions in the car sector. Accordingly, new passenger car registrations increased further in December and stood 12.6% higher in the fourth quarter than in the third quarter. The ECB Corporate Telephone Survey (CTS) suggests strong registrations, reflecting some reduction in inventory of semi-finished vehicles, but also indicates that delivery times remain long despite some easing and that supply constraints are expected to continue to be a factor throughout 2023. Retail sales in October and November taken together remained 0.6% below their level in the third quarter, pointing to a likely contraction of spending on goods in the last quarter. Looking forward, incoming soft economic data point to some resilience in consumer spending at the beginning of the year, despite persistent headwinds. The European Commission’s consumer confidence indicator continued its recovery in the last quarter of 2022 (Chart 7, left panel), to stand above its third-quarter level, driven mainly by an improvement in households’ economic and financial expectations (Chart 7, right panel), and it improved further in January. The Commission’s latest consumer and business surveys also indicate that expected demand for accommodation, food and travel services remained resilient at the beginning of the year, alongside some recovery in expected major purchases by households in the last quarter. This is also confirmed by the latest Consumer Expectations Survey (CES), which points to more favourable expected demand for holidays and purchases of durable goods over the next 12 months. Despite proving fairly resilient thanks to labour market robustness and fiscal support, households’ real disposable income contracted slightly in the third quarter and is likely to decline further, dampening consumer spending. Nevertheless, the use of savings should help to smooth consumption to some extent in the face of weak real disposable income. The saving rate fell from 14.9% in the first quarter of 2022 to 13.2% in the third quarter, the same level as at the end of 2019. Meanwhile, the latest CES indicates that consumers expect lower spending due to the ongoing tightening of borrowing conditions.

Chart 7

(standardised percentage balances)

Sources: European Commission (DG ECFIN) and ECB calculations.

Note: The latest observations are for January 2023.

Business investment is expected to have been subdued in the fourth quarter of 2022. Following a quarterly growth rate of 7.7% in the third quarter (1.2% excluding Irish intangibles), PMI new orders and PMI output for the capital goods sector suggest that business investment in the fourth quarter was weak. Meanwhile, capital goods production rose by 3.0% in the first two months of the fourth quarter compared to the third quarter of 2022. According to the January CTS, the outlook for investment in 2023 is relatively favourable among larger firms, despite higher costs related to energy prices, wages and financing conditions.[3] Commission survey data show that, from a historical perspective, the availability of space and/or equipment and availability of labour remained the most pressing factors limiting production in the capital goods sector in the first quarter of 2023 (Chart 8).

Chart 8

Limits to production in the capital goods sector

(changes in de-meaned percentage balances)

Sources: European Commission (DG ECFIN) and ECB calculations.

Notes: The net percentage balances have been adjusted for the average over the period 2000-19. The latest observations, referring to the first quarter of 2023, pertain to the release of data for January 2023.

Housing investment remained weak in the final quarter of 2022. After two consecutive quarterly declines in the second and third quarters of 2022, housing investment is estimated to have broadly stagnated in the fourth quarter, according to several short-term indicators. Building construction output in October and November stood on average 0.5% above its level in the third quarter. However, the number of building permits – a leading indicator of construction activity – declined further in the third quarter, signalling fewer new projects in the pipeline and thus a weak near-term outlook for the construction sector. Moreover, the PMI for residential construction output dipped further into contractionary territory, averaging 40.8 in the fourth quarter, down from 44.4 in the third quarter. According to the European Commission’s construction survey, the index for trends in construction activity also remained subdued up to January. This is mainly due to depressed demand and tightening financial conditions, while labour and materials shortages eased. ECB surveys confirm the weakening in demand for housing investment. The CES for December revealed worsening household perceptions about the housing market amid tightening financing conditions since the start of 2022. In the January 2023 round of the CTS, respondents from construction companies also indicated a broad-based weakening of demand in the construction sector, despite pockets of resilience in some countries. Overall, weakening demand should continue to weigh on housing investment in the near term.

The momentum in euro area exports stabilised in November, while import values are declining and the outlook for trade improved somewhat. In November 2022 nominal extra-euro area goods exports moderately expanded after a decrease in October, while extra-euro area goods imports continued to decline substantially. The goods trade balance turned into a surplus in November, mainly driven by falling prices for imported energy. Import volumes also moderated as gas storage levels approached full capacity.[4] High-frequency data on trade point to a further easing of supply bottlenecks in the fourth quarter of 2022, supporting volumes of extra-euro area goods exports. Survey indicators for new orders point to subdued export performance for both goods and services trade in the coming months, but this weakness may be less severe than normally suggested by these indicators as easing supply bottlenecks enable firms to further reduce their order backlogs. January 2023 flash PMIs for new export orders for goods and services remained in contractionary territory but point to some stabilisation. After a strong summer season, tourism indicators moderated in November and December in seasonally adjusted terms.

3 Prices and costs

According to Eurostat’s flash estimate, inflation in the euro area declined further in January to 8.5%. The flash estimate was calculated using Eurostat estimates for Germany. This fall was mainly attributable to a renewed sharp drop in energy inflation. At the same time, price pressures remained strong across all sectors, in part owing to high energy costs still feeding through to the overall economy. Inflation excluding energy and food remained at 5.2% in January and the latest available data also show other indicators of underlying inflation remaining high. Wages have been growing faster, broadly in line with the December Eurosystem staff macroeconomic projections for the euro area, supported by robust labour markets and a catch-up with high inflation becoming the main theme in wage negotiations. Most indicators of longer-term inflation expectations currently stand at around 2%, but these warrant continued monitoring.

Headline inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), fell in January 2023, for the third consecutive month, driven by lower energy price inflation. The further decline from 9.2% in December 2022 to 8.5% in January 2023 reflected a sizeable drop in energy inflation from 25.5% to 17.2%. At the same time, food inflation rose further from 13.8% in December to 14.1% in January, and HICP excluding energy and food (HICPX) inflation was unchanged from December, standing at 5.2%. This suggests that the lagged effects of the surge in energy and other input costs, supply bottlenecks and pent-up demand continued to sustain inflationary pressures. While NEIG inflation increased further to a new record level of 6.9%, services inflation declined from 4.4% in December to 4.2% in January (Chart 9).

Chart 9

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: HICP stands for Harmonised Index of Consumer Prices. HICPX stands for HICP inflation excluding energy and food. NEIG stands for non-energy industrial goods. The latest observations are for January 2023.

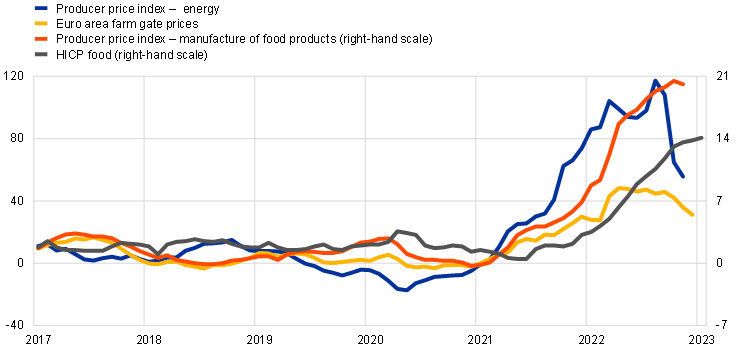

The drop in energy inflation in the euro area in January 2023 reflected both a month-on-month decline in the price level and a large downward base effect, as a result of a major price increase one year earlier falling out of the calculation of the annual rate. The cross-country differences in energy inflation rates remained sizeable owing, among other things, to differing energy production mixes, regulatory approaches and the implications of various fiscal measures implemented to compensate for high prices, as well as varying coverage of contract types in the HICP. The growth in energy producer prices started to decline in September 2022, falling from a peak of 117.3% in August to 55.7% in November (Chart 10).

Food inflation in the euro area continued to rise on the back of a further increase in processed food prices. This is consistent with the notion of the pass-through of pipeline cost pressures remaining strong, leading to an annual rate of change for processed food prices of 14.9% in January, up from 14.3% in December. At the same time, the annual rate of change for unprocessed food prices continued to decline, falling to 11.6% in January from 12.0% in December, likely reflecting corrections from earlier price surges relating to last summer’s drought, among other things (Chart 10).

Chart 10

Energy and food input cost pressures on HICP food prices

(annual percentage changes)

Source: Eurostat.

Notes: HICP stands for Harmonised Index of Consumer Prices. The latest observations are for January 2023 for HICP food, December 2022 for euro area farm gate prices and November 2022 for the remaining items.

Most indicators of underlying inflation in the euro area remained at elevated levels over the review period, although the latest data give mixed signals (Chart 11). This reflected factors such as the indirect effects of energy and food prices and the effects of the reopening of the economy, despite the recent unwinding of supply bottlenecks. HICPX inflation excluding the more volatile travel-related items together with clothing and footwear (HICPXX) increased from 4.8% in November to 5.0% in December. The Supercore indicator, which comprises cyclically sensitive HICP items, rose from 5.8% in November to 5.9% in December. Many such exclusion-based measures of underlying inflation serve as lagging indicators, given that they are reported in terms of year-on-year rates of change. The model-based Persistent and Common Component of Inflation (PCCI), which is constructed by filtering out shorter-term disturbances and idiosyncratic developments in HICP items, has continued to decline over the last few months, falling from 5.3% in November to 4.7% in December.[5] The PCCI includes energy items, and its decline therefore reflects the lower monthly rate of change for energy inflation. The PCCI excluding energy has also edged downwards slightly since September, to stand at 4.1% in December. More generally, the short-term rates of change of several underlying inflation indicators, measured in terms of month-on-month or quarter-on-quarter developments, have started to point to more moderate price pressures.

Chart 11

Indicators of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range for the indicators of underlying inflation includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX, HICPXX, the 10% and 30% trimmed means and the weighted median. The grey dashed line represents the ECB’s inflation target of 2% over the medium term. HICP stands for Harmonised Index of Consumer Prices. HICPX stands for HICP excluding energy and food. HICPXX stands for HICP excluding energy, food, travel-related items, clothing and footwear. PCCI stands for Persistent and Common Component of Inflation. The latest observations are for January 2023 for HICPX and December 2022 for the remaining items.

Developments in wages and labour costs have been a key factor in the degree of persistence of underlying inflation in the euro area over the review period. The latest available data suggest that wage pressures are strengthening, albeit remaining at moderate levels. Negotiated wage growth increased from 2.5% in the second quarter of 2022 to 2.9% in the third quarter. Actual wage growth, as measured in terms of compensation per employee or compensation per hour, continued to be affected by distortions during the pandemic period. The annual growth rates of these two wage measures stood at 3.9% and 2.9% respectively in the third quarter of 2022, lower than in the previous quarter but primarily reflecting base effects. Clearer signs of strengthening wage pressures going forward come from wage negotiations concluded in late 2022.

While there were some signs of pipeline pressures easing in the euro area over the review period, NEIG inflation increased further, to 6.9%, in January 2023. Data for November show that pipeline pressures have started to decline at the earlier stages of the pricing chain, as reflected in negative month-on-month growth rates for import prices and domestic producer prices for intermediate goods. These pressures have also begun to soften at later stages of the chain, with the month-on-month growth rate for domestic producer prices for non-food goods having moderated to 0.2% in November, close to its historical average of 0.1%. At the same time, annual growth rates for import prices and producer prices, while easing, have remained elevated, indicating accumulated pipeline pressures that might keep price inflation for consumer goods high for some time to come (Chart 12).

Chart 12

Indicators of pipeline pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for November 2022.

Survey-based indicators of longer-term inflation expectations in the euro area declined marginally to around 2% and were broadly in line with market-based measures of inflation compensation (Chart 13). According to the ECB’s Survey of Professional Forecasters for the first quarter of 2023, average longer-term inflation expectations (for 2027) fell to 2.1%. The January 2023 Consensus Economics survey reported broadly unchanged longer-term expectations, standing at 2.1%. In the February 2023 ECB Survey of Monetary Analysts, the median longer-term expectation remained unchanged at 2.0%. These data suggest that survey participants expect a fast decline in inflation in the near term and point to the anchoring of longer-term expectations. The ECB’s Consumer Expectations Survey for November 2022 also indicated that expectations for inflation three years ahead had remained relatively stable at around 3.0%.[6] Overall, market-based measures of inflation compensation (which are based on HICP excluding tobacco) generally declined over the review period; the most pronounced change was for very near-term maturities, with inflation data being lower than expected and energy prices softening. The survey-based indicators suggest that market participants expect inflation to return to levels close to 2% over the course of 2023, faster than anticipated at the time of the December Governing Council meeting. While near-term measures of inflation compensation fell strongly, longer-term forward measures were more stable. The five-year forward inflation-linked swap rate five years ahead was little changed, standing at around 2.3%. However, it should be noted that market-based measures of inflation compensation are not a direct gauge of market participants’ genuine inflation expectations, given that these measures include inflation risk premia that compensate for inflation risks.

Chart 13

Survey-based indicators of inflation expectations and market-based measures of inflation compensation

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, Survey of Professional Forecasters, Eurosystem staff macroeconomic projections for the euro area, December 2022, and ECB calculations.

Notes: HICP stands for Harmonised Index of Consumer Prices. SPF stands for Survey of Professional Forecasters. The market-based measures of inflation compensation series is based on the one-year spot inflation rate, the one-year forward rate one year ahead, the one-year forward rate two years ahead and the one-year forward rate three years ahead. The latest observations for market-based measures of inflation compensation are for 1 February 2023. The ECB Survey of Professional Forecasters for the first quarter of 2023 was conducted between 6 and 12 January 2023. The cut-off for the Consensus Economics long-term forecasts was January 2023. The cut-off date for data included in the Eurosystem staff macroeconomic projections was 30 November 2022. The latest observations for the HICP are for January 2023.

The risks to the inflation outlook in the euro area have become more balanced over the review period, especially in the near term. On the upside, existing pipeline pressures could still send retail prices higher in the near term. Moreover, a stronger than expected economic rebound in China could give a fresh boost to commodity prices and foreign demand. Over the medium term, upside risks stem primarily from domestic factors, such as a persistent rise in inflation expectations above the ECB’s target or higher than anticipated wage rises. By contrast, a decline in energy costs and a further weakening of demand would soften price pressures.

4 Financial market developments

Over the review period (15 December to 1 February 2023) market participants’ expectations of euro area policy rates initially moved substantially higher, in line with the Governing Council’s December communication that additional policy tightening is needed to ensure a timely return of inflation to the 2% medium-term target. Subsequently, policy rate expectations beyond the next few meetings were pared back amid the market perception that inflationary pressures may be easing. Accordingly, near-term risk-free rates ended the review period higher, while long-term risk-free rates partially reversed their initial increase, ending the review period somewhat higher. Sovereign bond yields in the euro area moved broadly in line with risk-free rates, with sovereign spreads little changed. The market perception that inflationary pressures may be easing created a tailwind for risk assets, ultimately outweighing the drag from higher near-term risk-free rates. As a result, euro area corporate bond spreads narrowed and equity prices rose strongly. In foreign exchange markets, the euro strengthened broadly in trade-weighted terms.

Following the Governing Council’s December meeting, euro area near-term risk-free rates rose as market participants revised up their policy rate expectations. Over the review period, the euro short-term rate (€STR) averaged 185 basis points, rising from an average of 140 basis points between 15 December and 20 December to an average of 190 basis points after 20 December, i.e. during the reserve maintenance period following the ECB’s December interest rate hike. Excess liquidity decreased by approximately €358 billion to €4,128 billion, mainly reflecting the December repayment of targeted longer-term refinancing operations. The overnight index swap (OIS) forward curve – based on the benchmark €STR – initially rose across maturities, reflecting the Governing Council’s December communication that interest rates will still have to rise significantly. Over the remainder of the reference period, forward rates for horizons beyond mid-2023 were pared back amid the market perception that inflation pressures may be abating over time. At the end of the review period, the OIS forward curve almost fully priced in 50 basis point rate hikes for both the February and March Governing Council meetings, followed by additional rate increases of a cumulative 30 basis points, implying a peak rate of approximately 3.4% to be reached by mid-2023.

Long-term sovereign bond yields rose somewhat, as the initial increase on the back of higher near-term policy rate expectations was partially offset by market expectations that inflationary pressures may be easing (Chart 14). The overall change masks significant intra-period moves, as long-term bond yields initially rose substantially on expectations of further policy rate tightening following the Governing Council’s December communication. Since the turn of the year, however, the initial increase in long-term bond yields has been partially reversed following lower-than-expected inflation data and softening energy prices. Overall, the euro area GDP-weighted average ten-year sovereign bond yield stands at around 2.9%, increasing by 19 basis points relative to the timing of the December meeting held by the Governing Council. Similarly, the ten-year US, UK and German sovereign bond yields stand at around 3.4%, 3.3%, and 2.3% respectively. Sovereign bond yields in the euro area generally moved in sync with risk-free rates. As a result, the average spread of the aggregate GDP-weighted euro area ten-year sovereign bond over the OIS rate remained relatively stable at around 0.3 percentage points.

Chart 14

Ten-year sovereign bond yields and the ten-year OIS rate based on the €STR

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 15 December 2022. The latest observations are for 1 February 2023.

Corporate bond spreads narrowed over the review period, with the decline most pronounced in the high-yield segment. During the review period, the market perception of improving economic prospects and inflationary pressures that may be cooling created a tailwind for risk appetite, which ultimately meant that corporate bond spreads narrowed. Spreads on high-yield corporate bonds fell by about 46 basis points, while spreads on investment-grade corporate bonds fell by about 14 basis points.

European equity markets rose strongly over the review period. Stock prices in the euro area rose strongly, outstripping their global peers, as the general improvement in risk appetite outweighed the drag from higher near-term risk-free rates and some decline in earnings expectations. The equity price increases were unevenly distributed, with banks outperforming non-financial corporations (NFCs) amid the higher interest rate environment, which may support the banking sector through increases in net interest rate margins. NFCs’ equity prices rose by about 7%, while banks’ equity prices rose by about 22%. The difference between NFCs and banks was less pronounced in the United States, where the former’s equity prices rose by about 6% and the latter’s by about 12%.

In foreign exchange markets, the euro strengthened in trade-weighted terms (Chart 15). During the review period the nominal effective exchange rate of the euro – as measured against the currencies of 41 of the euro area’s most important trading partners – appreciated by 1.0%. In terms of bilateral exchange rate developments against major currencies, the euro appreciated against the US dollar (by 2.6%), the pound sterling (by 2.6%) and the Swiss franc (by 1.2%) while it depreciated against the Japanese yen (by 2.6%). The euro also weakened against the Chinese renminbi (by 0.7%) and the currencies of some other major emerging economies, as well as against the currencies of most non-euro area EU countries.

Chart 15

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-41 is the nominal effective exchange rate of the euro against the currencies of 41 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 1 February 2023.

5 Financing conditions and credit developments

Bank lending rates have continued to rise, reflecting the increases in the key ECB interest rates. Bank lending to firms and households moderated further in December, amid higher interest rates, weaker demand and tighter credit standards. Over the period from 15 December 2022 to 1 February 2023, the cost of equity financing declined while the cost of market-based debt financing remained stable. The most recent bank lending survey indicates that credit standards for firms and households tightened substantially in the fourth quarter of 2023 as interest rates continued to rise. The moderation in monetary dynamics continued in December, driven by higher interest rates and slower credit growth.

The funding costs of euro area banks remained broadly unchanged in November, as deposit rates continued to increase but bank bond yields receded. The composite cost of debt financing of euro area banks stood at its highest level since 2014 (Chart 16, panel a). Following marked increases since the start of 2022, bank bond yields eased in November, but picked up again after the Governing Council’s December monetary policy meeting (Chart 16, panel b). The composite deposit rate stood at 0.44% in November, which was 37 basis points above its level at the start of 2022. However, this increase was significantly below the 250 basis point rise in the key ECB interest rates in that period. This development largely reflects two factors. First, overnight deposits make up a large share of banks’ deposit base and the remuneration of these deposits tends to respond less to policy rate increases than that of time deposits, as overnight deposits offer liquidity and payment services that are often not explicitly priced. The widening of the spread between deposit and policy rates is therefore characteristic of interest rate hiking cycles. Second, deposit rates were at a relatively high level compared with ECB interest rates at the start of the present hiking cycle, as banks avoided charging negative rates on retail deposits. The recalibration of the third series of targeted longer-term refinancing operations (TLTRO III) which took effect on 23 November 2022 also contributed to the normalisation of bank funding costs.[7] Between November 2022 and January 2023 banks made sizeable voluntary repayments of funds borrowed under TLTRO III (€858 billion), reducing outstanding amounts by around 40% following the recalibration.

In terms of balance sheet strength, euro area banks are well capitalised overall, exceeding regulatory requirements and capital targets. However, the weakening economic environment may worsen their asset quality and increase credit risk.

Chart 16

Composite bank funding rates in selected euro area countries

(annual percentages)

Sources: ECB, IHS Markit iBoxx indices and ECB calculations.

Notes: Composite bank funding rates are a weighted average of the composite cost of deposits and unsecured market-based debt financing. The composite cost of deposits is calculated as an average of new business rates on overnight deposits, deposits with an agreed maturity and deposits redeemable at notice, weighted by their respective outstanding amounts. Bank bond yields are monthly averages for senior-tranche bonds. The latest observations are for November 2022 for composite bank funding rates and 1 February 2023 for bank bond yields.

Bank lending rates for firms and households increased further in November 2022, as banks continued to tighten their loan supply. Since the beginning of 2022 increases in bank funding costs have pushed lending rates up sharply in all euro area countries (Chart 17), while credit standards have become tighter. Bank lending rates for loans to non-financial corporations (NFCs) increased to 3.09% in November, a level last seen in summer 2012. Bank lending rates for loans to households for house purchase also rose further, to stand at 2.88% in November, the highest level since summer 2014. The cumulative increases in lending rates for firms and households compared with the start of 2022 were thus 123 and 157 basis points respectively. These increases were faster than in previous hiking cycles, mainly reflecting the faster pace of policy rate hikes. Results from the November 2022 Consumer Expectations Survey suggest that consumers expect mortgage rates to increase further over the next 12 months and that they expect it to become harder to obtain housing loans. The spread between bank lending rates on small and large loans narrowed in November, reflecting developments in the rates on large loans. The cross-country dispersion of lending rates to firms and households remained stable, suggesting that the transmission of the ECB’s monetary policy tightening is working smoothly (Chart 17, panels a and b).

Chart 17

Composite bank lending rates for NFCs and households in selected countries

(annual percentages; standard deviation)

Source: ECB.

Notes: Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The cross-country standard deviation is calculated using a fixed sample of 12 euro area countries. The latest observations are for November 2022.

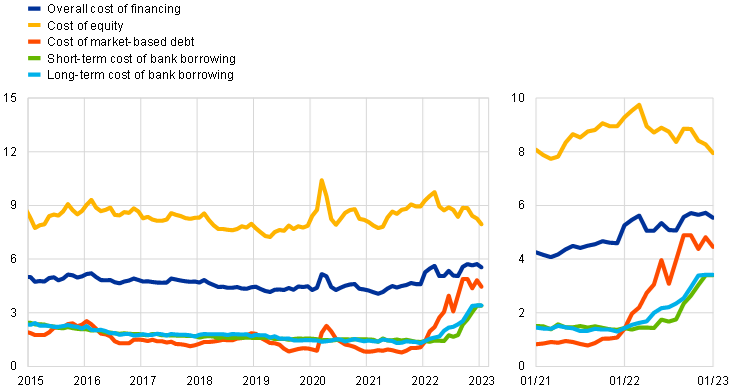

Over the period from 15 December 2022 to 1 February 2023 the cost of equity financing for NFCs declined while the cost of market-based debt remained unaltered. Owing to lags in the data available on the cost of borrowing from banks, the overall cost of financing for NFCs, comprising the cost of bank borrowing, the cost of market-based debt and the cost of equity, can be calculated only up to November 2022, when it stood at 5.6%, around 10 basis points below its level in the previous month (Chart 18). This was the result of a decline in the cost of both market-based debt and equity financing that outweighed a sizeable increase in the cost of both short and long-term bank debt. While decreasing slightly from its peak in October, the overall cost of financing remained in November 2022 close to the elevated levels last seen at the end of 2011. Over the review period the cost of market-based debt remained stable, as the increase in the risk-free rates – concentrated mostly on the short end of the curve – compensated for reduced corporate bond spreads both in the investment grade and, more noticeably, the high-yield segments. The cost of equity declined, however, on account of the sizeable fall in the equity risk premium, which more than offset the impact of the higher risk-free rates.

Chart 18

Nominal cost of external financing for euro area NFCs, broken down by components

Sources: ECB and ECB estimates, Eurostat, Dealogic, Merrill Lynch, Bloomberg and Thomson Reuters.

Notes: The overall cost of financing for NFCs is calculated as a weighted average of the cost of borrowing from banks, market-based debt and equity, based on their respective outstanding amounts. The latest observations are for 1 February 2023 for the cost of market-based debt (monthly average of daily data), 27 January 2023 for the cost of equity (weekly data) and December 2022 for the overall cost of financing and the cost of borrowing from banks (monthly data).

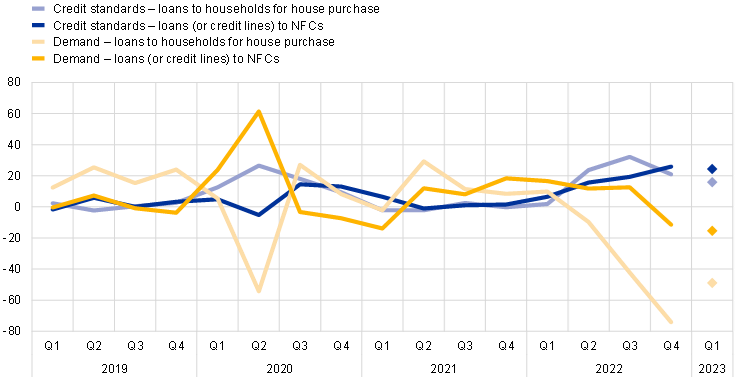

According to the January 2023 euro area bank lending survey, credit standards for loans to firms and to households for house purchase tightened substantially in the fourth quarter of 2022 (Chart 19). From a historical perspective, the tightening in credit standards was the largest reported since the euro area sovereign debt crisis in 2011. Against the background of high uncertainty, the main factors underlying the tightening of credit standards for firms and households were higher risk perceptions related to the economic outlook, lower risk tolerance by banks and higher financing costs. For the first quarter of 2023, banks expect a further tightening of credit standards on loans to firms and to households.

Banks reported a decrease in loan demand from firms and, most notably, from households in the fourth quarter of 2022 (Chart 19). Banks indicated that the rising general level of interest rates had made a significant negative contribution to loan demand. Falling financing needs for fixed investment had further dampened firms’ loan demand in line with the expected slowdown in investment and despite some recent improvements in economic sentiment. Financing needs for inventories and working capital had made a smaller positive contribution to loan demand than in the previous two quarters, which likely reflects the gradual easing in supply bottlenecks. The decrease in the demand for housing loans registered in the survey was the strongest on record and was driven mainly by rising interest rates, lower consumer confidence and deteriorating housing market prospects. For the first quarter of 2023, banks expected a further decrease in firms’ demand for loans and a further sharp fall in the demand for housing loans.

Chart 19

Changes in credit standards and net demand for loans to NFCs and loans to households for house purchase

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Source: Euro area bank lending survey.

Notes: For survey questions on credit standards, “net percentages” are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. For survey questions on demand for loans, “net percentages” are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The diamonds denote expectations reported by banks in the current round. The latest observations are for the fourth quarter of 2022.

The survey also suggests that banks expect asset quality considerations to affect their lending policies in the first half of 2023. Banks reported that compliance with supervisory and regulatory measures contributed to a tightening of credit standards and credit margins in the second half of 2022. Although their non-performing loan ratios had had a broadly neutral impact on credit standards for loans to firms and households in the second half of 2022, respondents expected these ratios to contribute to a tightening of both credit standards and terms and conditions in the first half of 2023. Banks also reported a moderate deterioration in their access to retail funding, consistent with the increase in interest rates on time deposits.

Bank lending to firms and households slowed further in December, amid higher interest rates, weakening demand and tighter credit standards. The annual growth rate of loans to NFCs declined to 6.3% in December from 8.3% in November (Chart 20, panel a). The slowdown in loans to firms was widespread across the largest economies and observed across short-term and long-term loans. The annual growth rate of loans to households also moderated, to 3.8% in December from 4.1% in November (Chart 20, panel b). This development is explained by a decline in the growth of housing loans, amid rising interest rates, banks tightening lending standards and demand weakening on the back of deteriorating housing market prospects and low consumer confidence. Recent information from the euro area bank lending survey, which has leading indicator properties for future growth of loans to firms and households, suggests that loan dynamics are likely to moderate further over the coming quarters.[8]

Chart 20

MFI loans in selected euro area countries

(annual percentage changes; standard deviation)

Source: ECB.

Notes: Loans from monetary financial institutions (MFIs) are adjusted for loan sales and securitisation; in the case of NFCs, loans are also adjusted for notional cash pooling. The cross-country standard deviation is calculated using a fixed sample of 12 euro area countries. The latest observations are for December 2022.

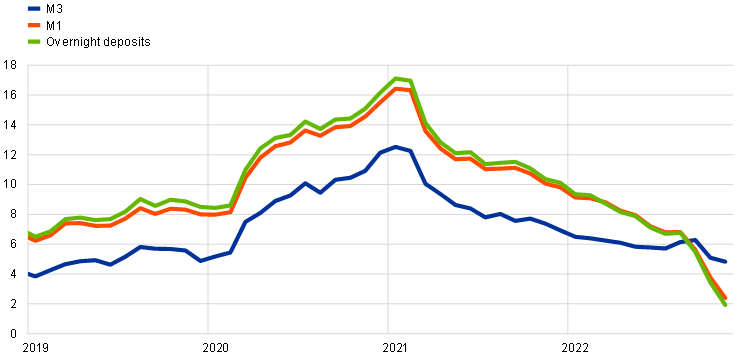

The reallocation of funds from overnight deposits to time deposits continued in December, reflecting the relative remuneration of those instruments. The annual growth rate of overnight deposits fell to 0.6% in December from 1.9% in November (Chart 21). The sharp drop in the growth of overnight deposits since the second quarter of 2022 is explained mainly by the large-scale substitution of overnight deposits with time deposits. This portfolio reallocation has been triggered by the higher remuneration of time deposits relative to overnight deposits, which is consistent with patterns that are typical for monetary policy tightening cycles. In line with this, larger shifts tended to be observed in those jurisdictions with wider spreads between the remuneration of time and overnight deposits.

Chart 21

M3, M1 and overnight deposits

(annual growth rate, adjusted for seasonal and calendar effects)

Source: ECB.

Note: The latest observations are for December 2022.

The moderation in monetary dynamics continued in December, reflecting higher interest rates and slower credit growth. Annual broad money (M3) growth decreased to 4.1% in December from 4.8% in November (Chart 21). The declining trend has been driven by weaker credit dynamics amid higher interest rates. As regards the components of broad money, the ongoing shift away from overnight deposits led in December to a further marked decline in the growth of the narrow aggregate M1, thus further reducing its contribution to annual M3 growth. Time deposits included in the broad monetary aggregate benefited from this development and made the largest contribution to M3 growth. Moreover, higher interest rates also incentivised shifts towards M3 instruments offering a remuneration closely linked to market rates. On the counterparts side, credit to the private sector continued to be the main contributor to annual M3 growth. The (annual) contribution from the Eurosystem’s purchases of government securities under the asset purchase programme and the pandemic emergency purchase programme declined further, reflecting the end of net asset purchases as of July 2022. Meanwhile, (monthly) monetary inflows into the euro area from the rest of the world supported broad money growth in December, in the context of a moderation in energy prices.

Boxes

1 Global risks to the EU natural gas market

The Russian war against Ukraine has both reduced gas supply to the EU and created risks for future supply. The amount of gas delivered from Russia to the EU fell to historically low levels at the end of 2022, reaching around 20% of pre-war levels. The fall in Russian gas exports to the EU started before the war, resulting in low gas storage levels already at the beginning of 2022. The response of the EU in implementing gas saving measures and sourcing alternative gas supplies – particularly by tapping LNG markets – bolstered the accumulation of gas in storage over the summer of 2022. Such measures provided some reassurance about the security of gas supplies for this winter, contingent on the weather not being too severe. However, the EU could face greater challenges when replenishing gas storage levels ahead of the 2023-24 winter. In particular, as gas supplies from Russia have dwindled, the EU has had to turn to global LNG markets. While this has alleviated immediate supply problems, it has meant that gas supply and prices in the EU have become more sensitive to swings in energy demand from the rest of the world, in particular from China. This box analyses the potential global risks posed to EU gas supplies in 2023 resulting from shifts in Russian supply and Chinese gas demand in a historically tight global gas market.

More2 How have higher energy prices affected industrial production and imports?

This box analyses how the increase in energy prices since autumn 2021 has affected euro area aggregate industrial production and import volumes. In autumn 2021 gas supplies from Russia to the European Union (EU) were cut significantly, contributing to the slow replenishment of gas inventories in Europe ahead of the winter season. Between September 2021 and October 2022 average euro area consumer and producer energy prices increased by 49.5% and 93.4% respectively. In the same period euro area industrial production excluding construction and import volumes excluding energy grew by 2.3% and 10.3% respectively. This box shows that the adverse energy supply shocks have been offset by a simultaneous easing of supply bottlenecks, a related workout of backlog orders and recovering demand which benefited from the effects of reopening following the coronavirus (COVID-19) pandemic. There are signs that imports, particularly of intermediate goods, partly replaced domestic manufacturing production in more energy-intensive sectors, as imports were relatively cheap compared to domestic production.

More3 Main findings from the ECB’s recent contacts with non-financial companies

This box summarises the findings of recent contacts between ECB staff and representatives of 73 leading non-financial companies operating in the euro area. The exchanges took place between 4 and 12 January 2023.[9]

More4 How people want to work – preferences for remote work after the pandemic

Work from home (WFH) patterns have changed substantially following the onset of the coronavirus (COVID-19) pandemic and point to a persistently higher preference for remote work. WFH was not particularly prevalent in the euro area before the onset of the pandemic in March 2020. According to Eurostat data, 85% of employees had never worked from home in 2019, a small decrease from 92% in 2000.[10] The COVID-19 shock led to a sudden increase in demand for WFH policies that would allow the majority of employees to work from home at least once per week.[11] This rise in WFH was enabled by investments made by both employers and workers. This box documents the changes in WFH during the pandemic and the main drivers behind them as well as future expectations for work preferences. Changes in WFH patterns and preferences potentially have important consequences for economic and social developments, including in the labour market and housing choices.[12]

More5 Climate-related policies in the Eurosystem/ECB staff macroeconomic projections for the euro area and the macroeconomic impact of green fiscal measures

Following the conclusion of the ECB’s strategy review in 2021, the Governing Council adopted a comprehensive action plan to incorporate climate change considerations into its policy framework. Two of the action points presented in the accompanying detailed roadmap were: (i) introducing technical assumptions on carbon pricing; and (ii) regularly evaluating the impact of climate-related fiscal policies on the Eurosystem/ECB staff macroeconomic projections.[13] This box summarises the climate-related fiscal measures included in the December 2022 projections baseline. In order to evaluate the macroeconomic impact of climate-related transition policies, it assesses the impact of green fiscal measures on output and inflation in this baseline.[14] It then discusses the potential impact of the EU Emissions Trading System (ETS) and non-fiscal climate-related measures, as well as the risks they pose to the outlook for inflation and GDP growth.