Published as part of the ECB Economic Bulletin, Issue 2/2023.

This box analyses how the pandemic affected global value chains. It uses data for France, in particular between September 2020 and December 2021 when supply bottlenecks emerged.[1] The pandemic resulted in a contraction of demand and supply that occurred both domestically and internationally. For this reason, firms engaged in international trade were exposed to international disruptions on top of domestic ones: a reduction in supply resulted in shortages of intermediate inputs for importing firms, which coincided with weaker foreign demand for exporting firms. Firms involved in global value chains (“GVC” firms), namely firms that both import and export, faced both of these challenges simultaneously. Anecdotal evidence shows that the constrained availability of key inputs acted as a drag on the production capacity of firms involved in global value chains and therefore on their exports, for instance in the case of the availability of microchips in the automotive industry.[2] This box, based on highly granular trade data for the full universe of French firms, shows that participation in global value chains increased firms’ vulnerability to the economic implications of the pandemic. The results can be informative for developments in the euro area in general, as the dynamics of French exports during the pandemic, as well as their exposure over time to supply bottlenecks, were similar to those observed for the euro area as a whole in terms of the timing and size of the adjustment.[3]

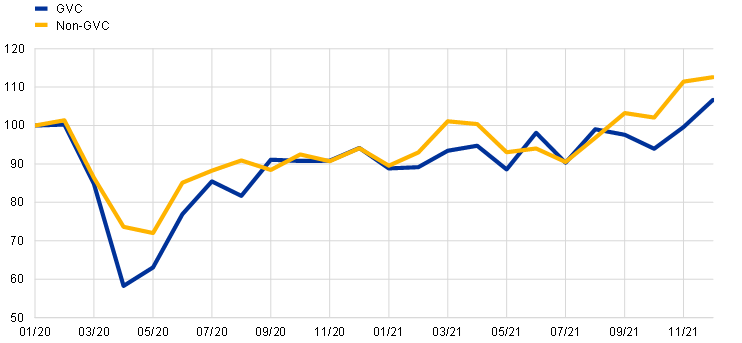

Unlike during the global financial crisis, during the pandemic GVC firms experienced a larger drop in exports compared with other exporters, suggesting that supply value chains can be either a source of vulnerability or a source of resilience, depending on the nature of the crisis. For the purpose of this box, firms that exported every month during the six months before the outbreak of the pandemic and imported at least once during the same period are considered GVC firms. At the onset of the COVID-19 crisis, firms involved in global production networks experienced the sharpest fall in exports and, after the economic reopening, recovered at a slower pace than other exporters (Chart A, panel a). In April 2020, exporters involved in global value chains recorded a decline in their export values of 42% compared with January 2020. For other exporters, the cumulative decline was less drastic, reaching a trough in May 2020 of 28% below the level recorded in January 2020. The two groups of exporters diverged further when pandemic-related restrictions were lifted in the summer of 2020. By March 2021, exporters not involved in global value chains had reached their January 2020 levels and by September 2021 had recovered well beyond their pre-pandemic levels, while it took until December 2021 for GVC firms to exceed their January 2020 export levels. During the 2008 global financial crisis, however, firms involved in global value chains proved more resilient (Chart A, panel b). Compared with the COVID-19 crisis, the 2008 collapse in international trade was less sizeable and less abrupt, although it was more persistent.

Chart A

Export values of firms

a) Global financial crisis

(total exports, base month (August 2008) = 100)

b) COVID-19 crisis

(total exports, base month (January 2020) = 100)

Sources: Direction générale des douanes et droits indirects and authors’ own calculations.

Note: The chart is based on firm-level data for France.

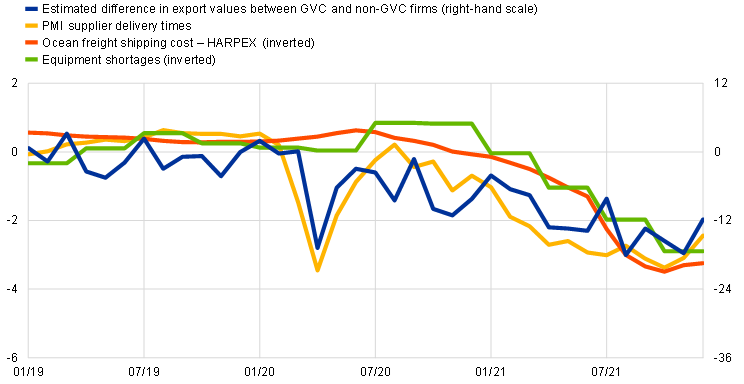

Empirical analysis confirms that GVC firms’ exports were relatively strongly affected by the pandemic, in particular following the rise of supply bottlenecks in September 2020. An event study comparing both types of exporters illustrates the emergence, in April and May 2020, of the first negative and sudden effect of being part of a global value chain during the COVID-19 crisis, and a new decline in exports from October 2020 that was more progressive and persistent (Chart B, blue line).[4] The first drop in exports of GVC firms relative to other exporters took place in April, while the Chinese lockdown started in January. This lagged impact might be explained by the time it takes for a cargo ship to travel from China to France (six weeks). This delayed the propagation of the crisis and the negative effect on the stocks of intermediate inputs among firms involved in global value chains, allowing them to maintain their production for a short time. The blue line in Chart B shows the difference in export values between GVC and non-GVC firms between September 2020 and December 2021 and can be interpreted as a firm-level-based measure of supply disruptions. The evolution of this line is very similar to that of other indicators normally used to monitor bottlenecks (e.g. indicators based on supply delivery times, shipping costs or equipment shortages).

Chart B

Bottleneck indicators for international trade and difference in export values between GVC and non-GVC firms

(z-score)

Sources: Direction générale des douanes et droits indirects, Markit, S&P Global, Harper Petersen, European Commission and authors’ own calculations.

Notes: All the indices were normalised using z-scores over the period from January 2000 to October 2022. An increase in the score for PMI supplier delivery times for all goods and intermediate goods signifies an improvement (i.e. a reduction in delivery times). The Harper Petersen Charter Rates Index (HARPEX) reflects worldwide price developments on the charter market for container ships. The European Commission measures equipment shortages as a factor limiting production in terms of the percentage of respondents reporting an increase minus the percentage of respondents reporting a decrease. All bottleneck indicators relate to France, except for HARPEX, which is global.

Exporters that source their imports from geographically closer destinations were less affected by supply bottlenecks than those importing from further afield. Firms with higher shares of inputs imported from other EU countries were less affected during the lockdown phase than firms that relied more on inputs from the rest of the world (Chart C, panel a). Furthermore, firms involved in global value chains importing mostly from the EU were hit later by supply bottlenecks, with the negative effects being visible only from April 2021. Between September 2020 and December 2021, export losses among firms importing from further afield were twice as big as those experienced by firms importing from the EU. Conversely, firms with the greatest reliance on inputs from China were the most affected for the same period (Chart C, panel b), possibly due to the more stringent and protracted lockdown in China and the longer delivery times for sea freight from Asia.

Chart C

Differences in export values between GVC firms depending on the sourcing countries for their imported inputs

a) European Union

(coefficients and 95% confidence intervals)

b) China

(coefficients and 95% confidence intervals)

Notes: This is an event study using a similar setting to the blue line in Chart B. The regression of the event study is as follows: . LowShare takes the value 1 if the share of goods imported from the country is below the median (among GVC firms) in the six months before the pandemic, while HighShare is the opposite. The reference point is December 2019.

A stylised calculation based on the above estimates suggests that the supply disruptions can explain a decline in exports that is approximately equivalent to 1% of euro area nominal GDP in 2020 and 2% in 2021. This calculation involved combining the elasticity derived from Chart B with country indicators of firms’ global value chain participation in the other euro area countries in order to calculate an estimate of the implications of COVID-19 and the associated supply bottlenecks for euro area exports.[5] The figures produced by this calculation are in line with previous ECB analysis for the euro area using macroeconomic data.[6] The impact of supply bottlenecks is likely to have varied significantly across euro area countries given the differences in global value chain participation among these countries.

This box is partially based on Lebastard, L., Matani, M. and Serafini, R., “GVC exporter performance during the COVID-19 pandemic: the role of supply bottlenecks”, Working Paper Series, No 2766, ECB, January 2023.

See the box entitled “Motor vehicle sector: explaining the drop in output and the rise in prices”, Economic Bulletin, Issue 7, ECB, 2022.

France has a similar composition of firms in international trade to other euro area countries. In particular, two-way traders make up a relatively low share of the total number of companies engaged in trade, but they account for the vast majority of total trade in terms of value (see Eurostat, “Globalisation patterns in EU trade and investment”, 2017 edition). The sourcing countries are also similar (see Marin, D., Schymik, J. and Tscheke, J., “Europe’s export superstars – it’s the organisation!”, Working Papers, No 2015/05, Bruegel, July 2015).

Chart B shows the estimated , computed as in Lebastard, L., Matani, M. and Serafini, R., op. cit., using the following econometric specification, where the dependent variable is the natural logarithm of exports: . The treatment group features all GVC firms in the pre-pandemic period (i.e. both importing and exporting), while the control group is made up of the other exporters. The econometric model controls for the size of the firms by including firm-fixed effects, and for time-specific shocks by using time-fixed effects. The reference point is December 2019. The database includes the full universe of exporting firms in France, while occasional exporters in the pre-pandemic period were dropped.

The share of GVC firms’ exports in total exports is calculated based on estimates in Lebastard, L., Matani, M. and Serafini, R., op. cit. These are estimates for France (95% of exports come from GVC firms) and they are extended to the other euro area countries by rescaling the “GVC backward participation” index of the OECD’s TiVa database. Total exports by GVC firms are then calculated as the share of GVC firms’ exports in total exports of each country in December 2019. Assuming that the results for France are representative for the euro area as a whole, the elasticity shown in panel a of Chart C is then applied to total exports of GVC firms in each month for every country to calculate the total drop in exports due to supply bottlenecks. This decline is then divided by each country’s GDP and annualised to obtain the annual impact of bottlenecks on exports as a share of GDP.

See the box entitled “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB, 2021.