Does the tail wag the dog? A closer look at recent movements in the distributions of inflation expectations

Published as part of the ECB Economic Bulletin, Issue 6/2022.

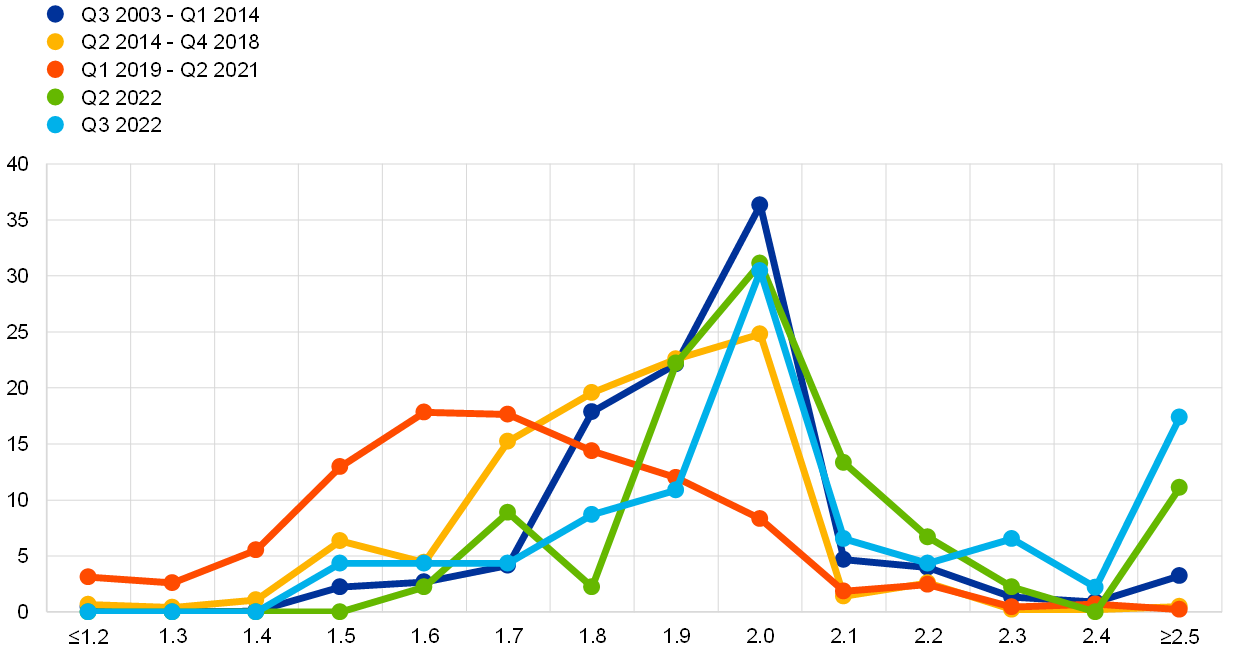

Having moved below 2% over the period spanning the first quarter of 2019 to the second quarter of 2021, the distribution of individual longer-term inflation expectations from the ECB Survey of Professional Forecasters (SPF) has most recently recentred around 2% and is now quite similar to the average distribution experienced over the period from the third quarter of 2003 to the first quarter of 2014 (Chart A).[1],[2] However, one difference stands out: a perceptible “tail” of respondents is now reporting longer-term inflation expectations of 2.5% or higher. In the SPF for the third quarter of 2022, this portion increased to 17% (representing eight of the 46 respondents who provided longer-term inflation expectations).[3] This box analyses in more detail the expectations of the respondents in this upper tail, in order to understand whether its recent overall fattening might harbinger a movement in the rest of the distribution.[4]

Chart A

Histogram of individual longer-term inflation expectations in the ECB SPF

(y-axis: percentage of respondents; x-axis: percentage of inflation)

Notes: The SPF asks respondents to report their point forecasts and to separately assign probabilities to different ranges of outcomes. This chart shows the spread of point forecast responses.

Since 2010 longer-term inflation expectations of the current tail group have been higher and more volatile than those of the rest of respondents (Chart B). On average, inflation expectations of the current tail group have been 0.3 percentage points higher than those of the rest (2.15% vs 1.85%). However, the gap has widened over the past four survey rounds. The volatility (measured by standard deviation) of the tail group’s inflation expectations has also been much higher since 2010 (0.3 vs 0.1 percentage points). However, given the small sample size (eight in the most recent round, but on average only five have responded in each round since 2010), some caution is warranted when interpreting these data.

Chart B

Evolution of longer-term inflation expectations from the ECB SPF

(year-on-year percentage changes)

Note: ”Current tail group” refers to eight respondents providing longer-term expectations of 2.5% or above in the round for the third quarter of 2022.

The current tail group expects the current inflation spike to be more persistent. The reasons for this can be explored by considering the group’s most recent expectations for other variables. Table A reports only the longer-term expectations for other variables, but the complete time profile is informative. The tail group expects the current spike in headline inflation to be more persistent and also expects higher and more persistent underlying inflation than the rest of the SPF respondents. This is reflected in the tail group’s higher headline and core inflation expectations across forecast horizons, from near to longer term. The tail group’s labour cost expectations are higher from the next calendar year onward and their unemployment rate expectations are generally lower (i.e. consistent with a tighter labour market in the long run) than those of the rest of the panel. There is no clear relation with real GDP growth expectations for either group. Overall, the differences in expectations for the unemployment rate, although consistent with a view of a tighter labour market, do not appear large enough to explain the wide gap between the tail group’s longer-term inflation expectations and those of other professional forecasters.

Table A

Longer-term expectations across macroeconomic variables in the ECB SPF for the third quarter of 2022

Note: Where percentages are shown in brackets, they denote the value excluding one extreme outlier, whereas the percentage without brackets includes the outlier.

The forecasters who currently report the highest longer-term inflation expectations have tended to be more sensitive to realised inflation in the past. When assessing the correlations with inflation and growth (both realised values and short-term expectations) over time, the longer-term inflation expectations appear more correlated with realised inflation and with individual short-term expectations among the tail group than among the rest of forecasters, while there is no clear link with realised growth or short-term growth expectations for either group.[5]

Finally, do the tail group’s expectations lead those of the rest of the respondents? This can be checked by conducting Granger causality tests of the tail group’s average expectations, for the long term and for the next year, versus those of the rest of the panel.[6] This analysis produces no clear evidence of Granger causality in either direction: in other words, the tail, historically, does not appear to have wagged the dog.

Our analysis thus suggests that the tail group’s expectations have not led movements in the expectations of the rest of the professional forecasters. Some recent research argues that the right tail of the forecasters’ distribution is composed of fast learners, identified as those attentive to new data and news. [7] According to this view, forecasters who updated their beliefs early were good predictors of the future. Our findings suggest that respondents in the tail group are more sensitive to the current developments than other forecasters and might be extrapolating short-term inflation dynamics more strongly and persistently into the longer term.

The panel of the ECB SPF, which was established in 1999, is composed of professional macroeconomic forecasters operating in Europe. The currently active panel comprises 75 to 80 institutions, of which around 60 respond in any given round – of these, on average 75%, or 45 institutions, provide their longer-term inflation expectations.

This reference period is chosen as it starts after the ECB’s monetary policy strategy review in 2003 which clarified the medium-term inflation objective of below, but close to, 2%. In 2014 (when the ECB started its asset purchase programme) the number of respondents reporting expectations of 2.0% declined and that of those reporting 1.7% increased.

Never before did more than 10% of SPF respondents report longer-term inflation expectations of 2.5% or more. The only other period (beyond one single round) in which more than 5% of respondents reported longer-term inflation expectations of 2.5% or above was that from the second quarter of 2011 to the third quarter of 2013 when 7 to 9% (or three to four respondents) did so.

For an argument that movements in the cross-sectional distribution of inflation expectations could provide early warnings of de-anchoring, see Reis, R., “Losing the Inflation Anchor”, Brookings Papers on Economic Activity, BPEA Conference Drafts, 9 September 2021.

This assessment is confirmed by forecaster-level regressions of long-term inflation expectations on past realised inflation, GDP growth and unemployment (controlling for forecaster fixed effects). While both the tail group and the rest of the panel respond to realised inflation, the tail does so considerably more than the rest of the panel: a 1 percentage point increase in inflation increases the tail group’s longer-term inflation expectations by 0.2 percentage point compared with only 0.03 percentage point for the rest of the panel.

Granger, C. W. J., "Investigating Causal Relations by Econometric Models and Cross-spectral Methods", Econometrica, 1969.

Reis, R., “Inflation expectations: rise and responses”, Speech at the ECB Forum on Central Banking, 29 June 2022.