Published as part of the ECB Economic Bulletin, Issue 5/2022.

This box summarises the results of contacts between ECB staff and representatives of 71 leading non-financial companies operating in the euro area. The exchanges mainly took place between 20 and 29 June 2022.[1]

Contacts reported continued growth in activity, albeit with quite divergent developments both across and within sectors. Despite signs of weakening demand in some sectors, overall activity in recent months had been more resilient than many had anticipated given the uncertainty created by the war in Ukraine and rising inflation. The recovery in sectors benefiting from the relaxation of pandemic-related restrictions was particularly strong — even if tempered by labour constraints in some cases — and generally exceeded expectations. Tourism-related bookings for the spring and summer were said to be at or above pre-pandemic levels. Consumer demand for clothing and other personal items was also reported to be recovering well in the context of a return to more normal spending patterns. By contrast, food manufacturers and retailers pointed to consumption shifts in response to high food inflation, with fewer meals out and more meals being consumed at home, as well as a shift in spending towards less expensive products. Demand for many household items was also reported to be declining, reflecting low consumer confidence and the anticipated shift in consumption from durable goods to services. There were signs of weakening demand for construction, mainly in the residential sector, against the backdrop of rising costs and interest rates and elevated uncertainty. Meanwhile, manufacturing activity remained to a large degree supply-constrained, with long order backlogs, despite many contacts pointing to a decline in new orders.

Looking ahead, there was widespread uncertainty and concern about the outlook for activity, particularly beyond the summer. Besides the cooling housing market, contacts widely referred to consumer confidence being very low. Some (especially in the retail and consumer goods sectors) were already uncertain about the outlook for consumer spending in the third quarter. Others, while not seeing any signs of a downturn in their own figures yet, referred more to the possibility of a recession later in the year. Several factors were cited as being likely to help sustain activity in the coming months. These included pent-up demand (e.g. for holidays), accumulated savings, a gradual easing of supply constraints, long order books and the desire of many firms to hold more inventory. Some contacts noted, however, that over time households would increasingly feel the financial squeeze caused by rising prices. There would clearly also be downside scenarios if gas supplies were to be curtailed even further.

Contacts reported continued positive employment growth, albeit dampened in some countries and sectors by difficulties recruiting and retaining staff. The recovery in hospitality, travel, and entertainment services was the main driver of employment growth according to recruitment agencies. The latter also reported a shift from temporary to permanent recruitment, as governments had reduced their COVID-19-related testing activities. Many firms continued to report difficulties in recruiting and retaining staff, and while this was primarily the case for high-skilled professionals (especially in IT), shortages of unskilled labour were also reported in some countries and sectors. The influx of refugees from Ukraine was not currently seen as having much of an impact on labour supply.

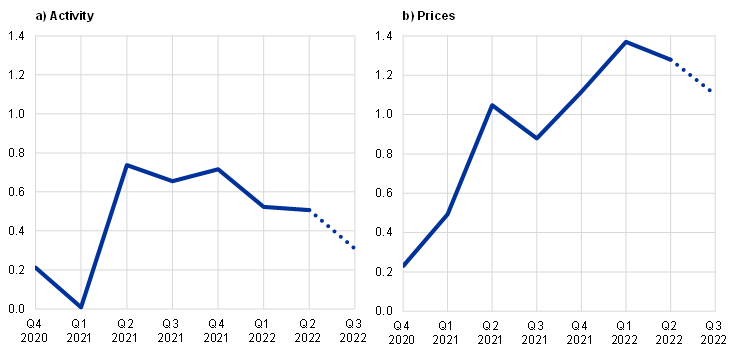

Chart A

Summary of views on developments in and the outlook for activity and prices

(average of ECB staff scores, ranging from -2 (significant decrease) to +2 (significant increase))

Source: ECB.

Notes: The scores reflect the average of ECB staff scores in their assessment of what contacts said about developments in activity (sales, production and orders) and prices in the second quarter of 2022. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change, while a score of 1 would be typical for normal growth. The dotted line refers to expectations for the next quarter.

Contacts continued to report a high magnitude and/or frequency of selling price increases, as substantial cost pressures were passed through the value chain. Rising costs for energy and/or transport were the main concern for most firms, while the prices of most material and component inputs also continued to rise, despite somewhat more mixed developments in commodity prices of late. Energy markets were pricing in high risk premia for gas and electricity due to the uncertainty about the supply of gas from Russia, while refining margins had also increased substantially.[2] Many companies still had to pass on the recent rise in energy costs, which itself was only being felt gradually as related contracts expired. Some companies were reluctant to conclude new, long-term hedging contracts, as this would lock in high prices, even if it left their cost bases more exposed to volatile energy prices in the future. The pass-through of rising costs to selling prices was facilitated by the fact that nearly all companies were increasing their prices in parallel and, in the manufacturing sector in particular, customers focused more on the availability and timeliness of delivery than the price. Consequently, many companies could broadly maintain or even increase their margins, albeit this was more difficult in consumer-oriented sectors where companies faced greater competition. That said, substantial price increases were also seen for many consumer goods and services (food, travel, accommodation, etc.) and price increases were also prevalent in those sectors (e.g. telecommunications) where prices usually declined. Looking ahead, while most contacts anticipated a similar trend in selling price increases in the third quarter, some were more hesitant in view of faltering demand, pointing to a potential for some moderation in the overall rate of increase.

Most contacts thought wage pressures were gradually building up, although there was a good deal of uncertainty and differences across countries. The different timing of wage negotiations, the length of existing contracts and many one-off and ad hoc elements made it difficult to quantify the underlying pace of wage growth. That said, around three-quarters of contacts expected existing or future wage negotiations to imply higher wage growth in 2023 than in 2022, with most contacts placing wage growth in 2022 at between 2% and 4%. For many it was, however, difficult at this stage to give any quantitative indication. A key aspect of many of the impending wage negotiations would be the balance between the permanent and one-off elements. There were also significant regional differences, with wage pressure and bargaining power being comparably lower in countries or areas with continuing high rates of unemployment.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.

Refining margins have increased both for petrol/gasoline and for diesel/gasoil, but more so for the latter. Pressure on refining margins is attributable to a combination of factors, in particular reduced exports of refined petroleum products from Russia, but also reduced refining capacity globally (which had accelerated during the earlier stages of the pandemic) in a context of recovering demand.