Published as part of the ECB Economic Bulletin, Issue 3/2022.

This box summarises the results of contacts between ECB staff and representatives of 67 leading non-financial companies operating in the euro area. The exchanges mainly took place between 20 and 30 March 2022.[1]

Contacts generally reported a good start to the year in terms of activity growth. The manufacturing and construction sectors continued to benefit from strong or growing demand, as reflected in healthy order books, while production levels were still largely supply-driven. In this respect, some constraints (notably the shortage of semiconductors for the automotive industry) were gradually easing, although many contacts said that disruption in terms of lacking materials and components due to factors like shipping delays had not dissipated in recent months. The loss of working hours due to the coronavirus (COVID-19) pandemic had also been substantial, but the effect of this on production had been masked by broader supply problems. Contacts in the services sector also reported broad-based growth momentum across a range of activities in the first quarter of the year. The spread of the Omicron variant of the coronavirus (COVID-19) around the turn of the year had led to a pause in the recovery of hospitality, tourism and recreation services. All the same, restrictions were now being lifted again and consumers seemed to be increasingly putting the pandemic behind them, prompting renewed recovery in these sectors.

The Russian invasion of Ukraine has clouded the outlook and created substantial downside risks. Many contacts described an abrupt change in business conditions after the conflict flared up in late-February, albeit largely in terms of prices and costs rather than activity. The direct financial impact was small, while the immediate impact on production (and intermediate demand) was largely limited to specific industries dependent on materials or components from Russia or Ukraine, or for which rising energy costs made some production unviable. This created a new source of (potential) supply disruption, along with the spread of the Omicron variant through China and public health measures taken in response. A few contacts pointed to broader changes in behaviour, such as households shifting their consumption to less expensive items, reduced vehicle use or businesses postponing advertising orders, as early evidence of more widespread demand effects. Most contacts expected rising inflation to dampen consumer spending and both uncertainty and rising costs to have an impact on business investment in the coming quarters. This was, however, tempered by a view that, in an environment still characterised by supply constraints, the effect of reduced demand on production would be gradual. Furthermore, receding concern surrounding the pandemic would continue to support growth in the services sector. Overall, therefore, contacts tended to anticipate a slowdown rather than a sudden contraction in activity, while at the same time stressing huge uncertainty and substantial downside risks if the conflict were to escalate.

Contacts reported a largely unchanged employment outlook and labour market conditions. Many said that it was still difficult to recruit and retain staff. This was especially true for certain high-level skills and for jobs with working conditions which were in some way viewed as being undesirable (e.g. shift work or work away from home). In the short term, the conflict in Ukraine was likely to have a limited effect on labour supply and demand. Firms that had to cut production in response to input shortages or surging energy costs furloughed workers or reduced their use of temporary labour. However, the difficulty of re-recruiting was likely to make businesses reluctant to lay off permanent staff.

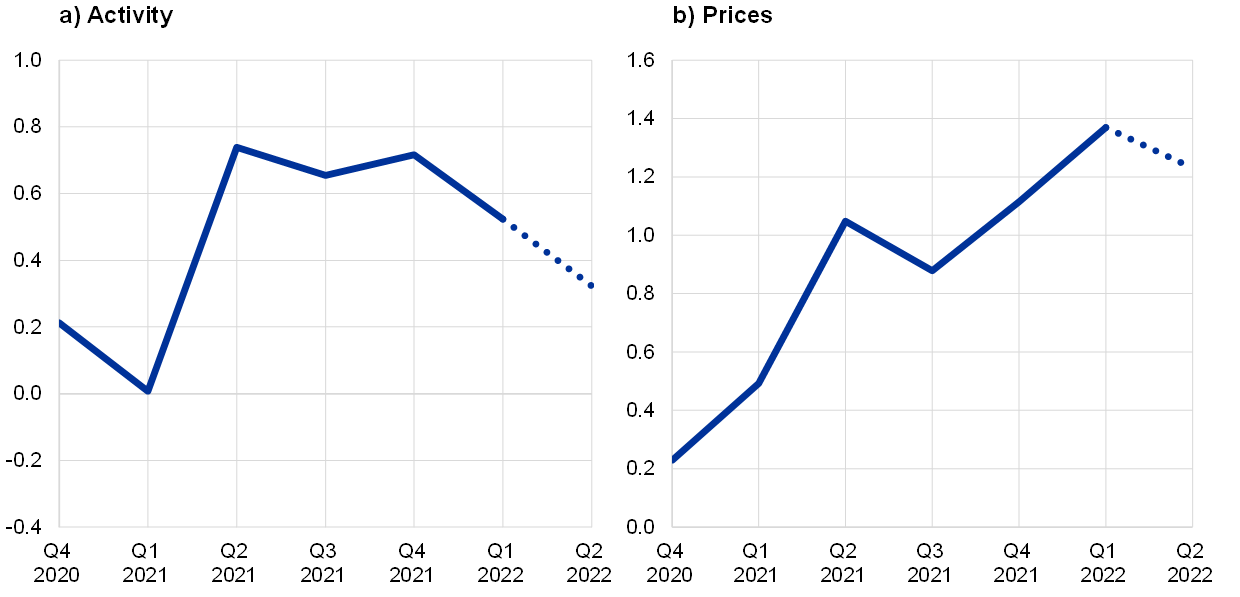

Chart A

Summary of views on developments in and the outlook for activity and prices

(average of ECB staff scores ranging from -2 (significant decrease) to +2 (significant increase))

Source: ECB.

Notes: Scores reflect the average ECB staff assessment from each call of what contacts said about developments in activity (sales, production and orders) and prices in their sector during the preceding quarter. Scores can range from -2 (significant decrease) to +2 (significant increase). A score of 0 would represent no change while a score of 1 would be typical in the event of normal growth. The dotted line refers to expectations for the next quarter.

Price and cost pressures remained strong and received further impetus from the conflict in Ukraine. Most contacts described a very dynamic pricing environment in the first months of the year. Cost pressures related to the surge in the prices of many raw materials and logistics in 2021 were still feeding through the value chain. At the same time, the conflict in Ukraine has now given rise to further cost pressures and to extreme volatility in the prices not only of gas and electricity but also many commodities (especially metals, wood, oil derivatives and food). The environment for passing rising costs through to prices remained very favourable in most sectors, as business customers in particular became more accustomed to price increases, while there was more resistance to price increases from – or near to – the final consumer. Many contacts said that prices were being adjusted more frequently than in the past and/or that companies were adapting to the environment by, for example, writing new indexation clauses into contracts.

Contacts continued to anticipate a pick-up in wage growth. Most wage agreements in 2020 and 2021 had been very modest and still influenced wage growth this year, but more recent agreements and expectations in relation to ongoing and upcoming negotiations were on average somewhat higher. Thus, most contacts saw wage pressures gradually building, with the currently high level of inflation and improving labour market being the main drivers. Given uncertainty surrounding the outlook for both output and inflation, some contacts expected upcoming agreements to cover a shorter horizon than usual.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.