The role of credit risk in recent global corporate bond valuations

Published as part of the ECB Economic Bulletin, Issue 2/2022.

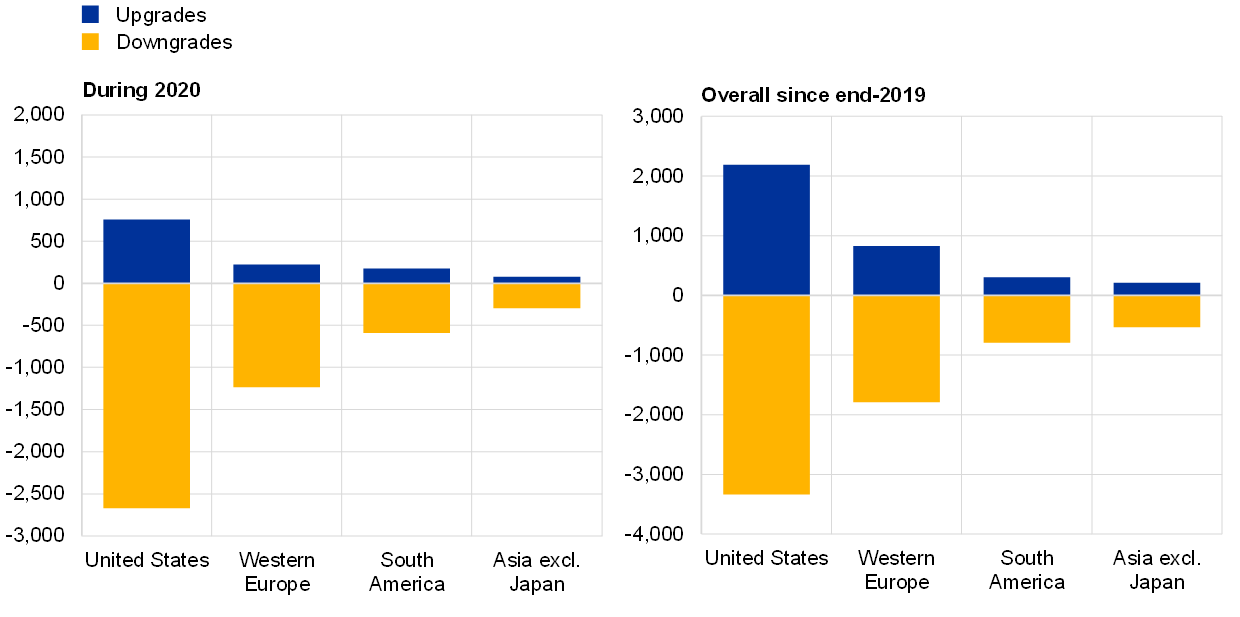

Corporate vulnerabilities increased particularly strongly around the world at the onset of the coronavirus (COVID-19) pandemic and – despite the subsequent recovery – could still be a cause for concern in some parts of the market. Vulnerabilities increased markedly, with firms around the world experiencing a wave of credit rating downgrades (Chart A, panel a). In the course of 2021, corporate credit quality (as assessed by credit rating agencies) recovered somewhat, with US firms, for instance, seeing more upgrades than downgrades. However, credit ratings have not yet fully returned to pre-pandemic levels, as there is uncertainty about longer-term prospects in some sectors – particularly those that have been more affected by the pandemic. Moreover, while earnings per share have increased on average, the ongoing pandemic has had a scarring effect, leaving some firms with weaker earnings, despite public support measures (see, for example, panel b of Chart A, which looks at firms in the S&P 500).

Chart A

Changes in corporate credit quality during the pandemic

a) Changes to the long-term ratings of firms

(numbers of upgrades and downgrades)

b) Earnings per share and interest coverage ratios for firms in the S&P 500

(USD for earnings per share; percentages for interest coverage ratios)

Sources: Bloomberg and ECB calculations.

Notes: Panel a shows the numbers of non-financial corporations in different regions which were upgraded and downgraded (i) in 2020 and (ii) in the period since end-2019, with the latest observations relating to Q1 2022. Panel b shows the realised earnings per share and interest coverage ratios (interest payments relative to earnings) of firms in the S&P 500, with dots representing the median, bars showing the interquartile range (25th to 75th percentiles) and whiskers indicating the 2nd and 98th percentiles. In the right-hand chart in panel b, the 98th percentiles of the two interest coverage ratio distributions (not shown in the chart) stand at around 130% and 390% for end-2019 and the latest data respectively. In panel b, the latest observations relate to 14 January 2022 (earnings per share; weekly) and Q4 2021 (interest coverage ratios; quarterly).

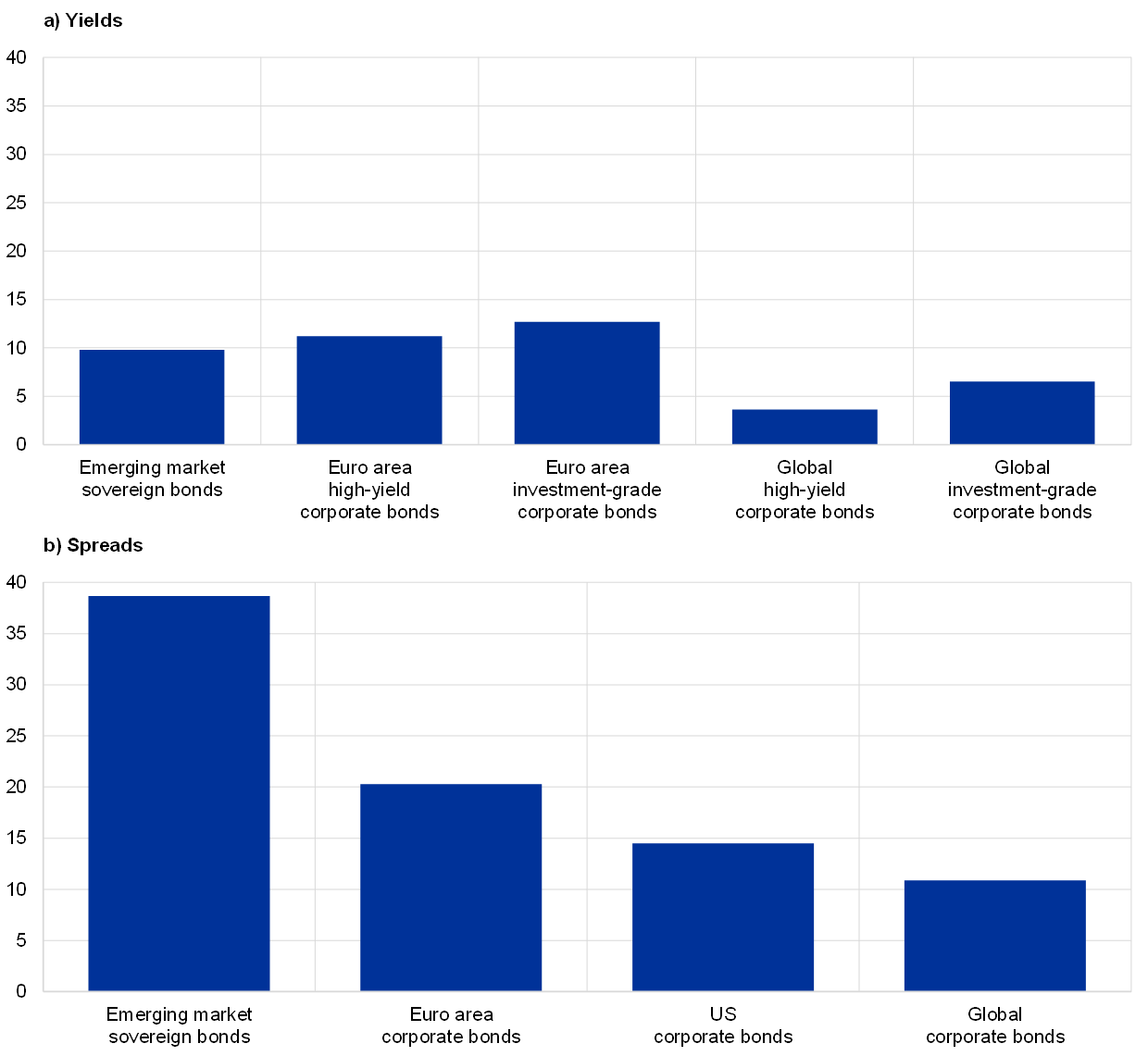

Corporate bond valuations are close to historical highs, despite those lingering vulnerabilities. That is particularly true of lower-rated segments. After spiking in March 2020, US corporate bond yields have fallen to historical lows across rating classes. Those low yields are, in part, a reflection of the low level of interest rates, as central banks have reduced policy rates and used asset purchases to compress term premia on government bonds. However, corporate bond valuations are also very high in relative terms, as usually measured by the difference between the yields on high and low-risk corporate bonds or the difference between corporate bond yields and risk-free rates. Corporate spreads are back to pre‑pandemic levels and close to the historical lows that were observed in the run-up to the global financial crisis. With further compression of spreads being seen across most asset classes in recent months, concerns have emerged about possible exuberance in some corporate market segments (Chart B).[2]

Chart B

Valuations in global bond markets

(percentage of months since January 1999 where lower yields/spreads have been recorded)

Sources: Bloomberg, Refinitiv Datastream and ECB calculations.

Notes: Valuations are based on ICE BofA corporate bond indices, as well as JPM EMBI indices for emerging US dollar-denominated sovereign markets. In this chart, corporate spreads are calculated as the difference between high-yield and investment-grade corporate bonds. The latest observations relate to January 2022.

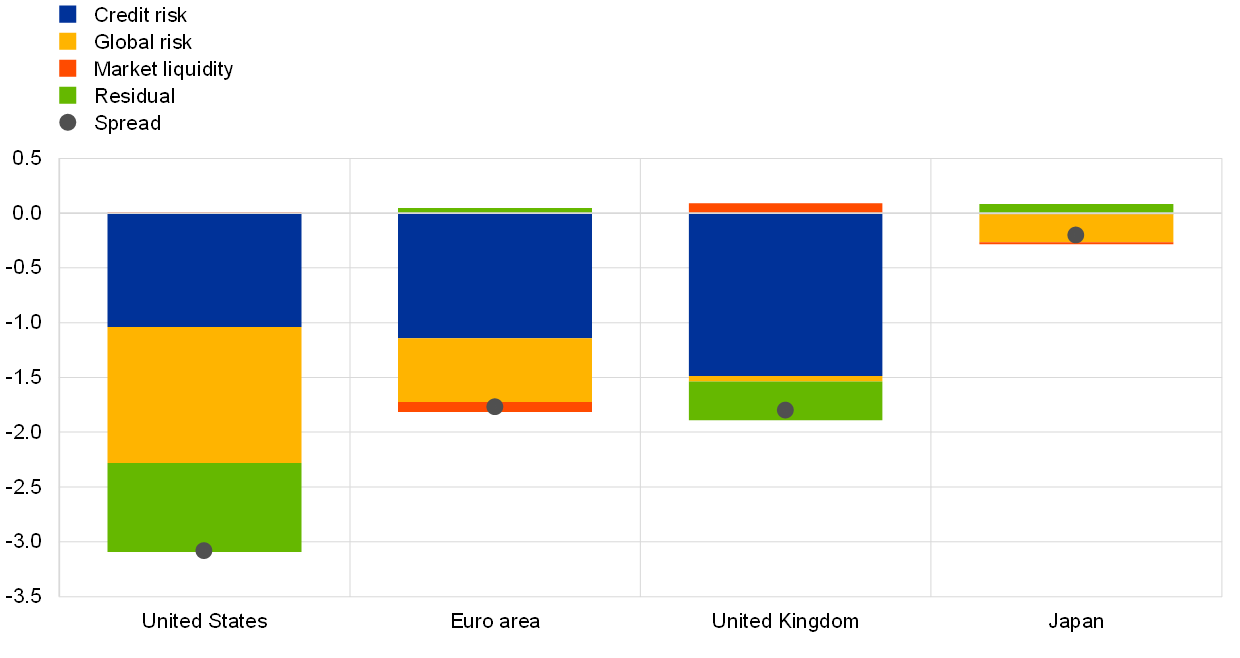

Notwithstanding the recent pick-up in corporate spreads in some markets, the strong declines seen overall since the peak of the COVID-19 crisis have largely been linked to the strength of investors’ risk appetite. Building on literature on corporate bond pricing, developments in global corporate bond valuations can be interpreted using a model with a credit risk component and factors capturing broader market conditions and liquidity. Credit risk is measured using an indicator of expected default frequency (EDF) provided by the rating agency Moody’s. Rooted in option pricing theory, this measures the probability that a firm will default (i.e. fail to make scheduled payments of principal or interest) over the next 12 months.[3] It therefore captures the market’s assessment of corporate credit quality. The model captures market uncertainty and risk aversion using the VIX, which provides a measure of expected stock market volatility derived from option prices (and is commonly used as a proxy for uncertainty and risk aversion across financial markets). The model captures liquidity conditions using the money market spread, which is defined as the spread between the three-month interbank rate and the yield on three-month government bonds. Estimates derived from the model suggest that the overall declines seen in global corporate bond spreads since the peak of the pandemic – notwithstanding the recent increases in some segments – have been driven by the easing of market uncertainty, as well as the market’s relatively favourable assessment of corporate default risk (Chart C).[4] The contributions made by model residuals in some markets point to potential exuberance in valuations and suggest that investors have an exceptionally strong risk appetite.

Chart C

Factors driving the recovery in global corporate spreads since March 2020

(percentage points)

Sources: Moody’s Analytics, Refinitiv Datastream and ECB calculations.

Notes: This chart shows model-based estimates of the contributions that credit risk, market uncertainty and market liquidity have made to the changes seen in BBB-rated corporate bond spreads since March 2020. Here, corporate spreads measure the difference between the yields on corporate bonds and government bonds with the same maturity in the same jurisdiction. Corporate spreads are measured at country index level for BBB-rated bonds with maturities of three to five years. “Credit risk” denotes the market’s assessment of corporate default risk, as measured by the EDF indicator produced by Moody’s; “global risk” is proxied by the VIX; and “market liquidity” is proxied by the money market spread – i.e. the spread between the three-month interbank rate and the yield on three-month government bonds (e.g. the TED spread for the United States). The model has been estimated using daily data extending back to June 2006, with the latest observations relating to 17 February 2022.

Those results can be checked against the findings of a second model based on more granular data, which confirms the role of risk appetite for recent valuations, pointing to a potential risk of market repricing. Indeed, using bond and firm-level data for the United States, one of the world’s largest corporate markets, model-based estimates illustrate the key role that investors’ risk appetite has played in recent corporate bond valuations for non‑financial corporations in the S&P 500. The model assumes that there is a linear relationship between corporate spreads and firm-specific default risk and a vector of bond-specific characteristics.[5] A positive value for a bond’s model residual, also referred to as the “excess bond premium”, can be interpreted as compensation for incurring exposure to the bond that exceeds the compensation which is typically required for expected defaults. Since the peak of the COVID-19 crisis, the excess bond premium has declined and reached negative levels, above those observed before 2007 and similar to those seen prior to the pandemic. This indicates that the strength of investors’ risk appetite has pushed risk premia down to levels somewhat lower than the market’s historical pricing of default risk (Chart D).

Chart D

Excess bond premium for non-financial corporations in the S&P 500

(basis points)

Sources: Bloomberg, Moody’s Analytics, Refinitiv Datastream and ECB calculations.

Notes: The excess bond premium component of option-adjusted corporate spreads has been estimated for a panel of non-financial corporations in the S&P 500 and aggregated at firm level, following the approach adopted by Gilchrist and Zakrajšek. This chart shows the excess bond premium for firms with median profitability in terms of realised earnings per share. The estimation process accounts for a firm-specific measure of expected default (as captured by the EDF indicator produced by Moody’s) and a vector of bond-specific characteristics (including duration, coupon, age and volume, and a dummy for callable bonds), as well as industry fixed effects and double-clustered standard errors. The measure of option-adjusted corporate spreads accounts for the presence of embedded options in a subset of the sample of bonds. The latest observations relate to 17 December 2021 (weekly data).

Possible market-wide risk-off shocks could significantly increase corporate funding costs and expected default probabilities, particularly for firms with the weakest balance sheets. A repricing of assets in response to a shift in global risk sentiment could exacerbate firms’ funding vulnerabilities and increase their probability of default. This effect could be particularly strong for firms with weak fundamentals (e.g. poor earnings prospects or low interest coverage ratios). Model‑based estimates looking at the response to a global risk-off shock enable us to estimate the impact that a reversal of investor sentiment could have on corporate spreads and default probabilities.[6] The results show that corporate spreads are highly sensitive to global risk‑off shocks, particularly for the weakest firms. For those firms, the estimated response in terms of repricing stands at around 70 basis points three weeks after the shock, compared with around 40 basis points for stronger firms (Chart E, panel a). In addition, the expected probability of a firm defaulting over the next year rises by 0.2 percentage points (Chart E, panel b), which is a substantial increase considering that the expected default frequency of a median US non‑financial corporation does not usually exceed 1%. The bulk of the sensitivity of funding costs can be attributed to the increase in investors’ risk aversion, as proxied by the excess bond premium (Chart E, panel c).

Chart E

The impact that market-wide risk-off shocks have on corporate spreads, expected default probabilities and excess bond premia for the strongest and weakest firms

(corporate spreads and excess bond premia in basis points; expected default probabilities in percentages)

Sources: Bloomberg, Moody’s Analytics, Refinitiv Datastream and ECB calculations.

Notes: This chart shows the estimated responses of corporate spreads, expected default probabilities and excess bond premia three weeks after a global risk-off shock for a panel of non-financial corporations in the S&P 500. The responses are estimated using panel local projections. “Weak” firms are the 20% of the panel that have the lowest interest coverage ratios; “strong” firms are the 20% with the highest ratios. The shocks are estimated using a daily BVAR model with a combination of sign, relative magnitude and narrative restrictions and are calibrated as a 10 basis point decline in long-term US Treasury yields over five days. Estimates of local projections are weekly, span the period from January 2005 to May 2021, control for the Citigroup Economic Surprise Index, the two-year US Treasury rate and the VIX, as well as dummies for the global financial crisis and the COVID-19 crisis, and account for firm fixed effects. Standard errors are clustered by industry and time. Expected default probabilities are measured using the EDF indicator produced by Moody’s, which captures the probability that a firm will default (i.e. fail to make scheduled payments of principal or interest) over the next year. The excess bond premium component of corporate spreads is estimated for the panel of S&P 500 corporate bonds and aggregated at firm level, in line with the approach adopted by Gilchrist and Zakrajšek. That estimation process accounts for a firm‑specific measure of expected default (as captured by the EDF indicator produced by Moody’s) and a vector of bond-specific characteristics (including duration, coupon, age and volume, and a dummy for callable bonds), as well as industry fixed effects. The latest observations relate to 17 December 2021 (weekly data).

Overall, this box illustrates the important role that risk appetite plays in corporate bond valuations, both internationally and across firms in one of the largest corporate bond markets. Model-based analysis suggests that, while the strong decline that has been seen in corporate bond spreads across countries since the peak of the COVID-19 pandemic has partly reflected the market’s assessment of improving credit quality across firms, it has also, to a large extent, been driven by a strengthening of investors’ risk appetite. This is confirmed by analysis of bond‑level valuations in the US corporate market. Looking ahead, the box also indicates that – given that some firms have relatively weak balance sheets and there is potential for a shift in investor sentiment – market-wide risk-off shocks could conceivably result in a significant increase in corporate funding costs and expected default probabilities, particularly for the weakest firms.

- Tatjana Schulze contributed to this box during her traineeship at the European Central Bank.

- For a comprehensive discussion of risks relating to asset market valuations, see ECB, Financial Stability Review, November 2021, Chapter 2.

- See, for example, Moody’s Analytics, “EDF Overview”, 2011.

- The results are robust to the use of alternative metrics for explanatory variables. For a broader review of euro area valuations, see, for example, Altavilla, C., Lemke, W., Linzert, T., Tapking, J. and von Landesberger, J., “Assessing the efficacy, efficiency and potential side effects of the ECB’s monetary policy instruments since 2014”, Occasional Paper Series, No 278, ECB, September 2021.

- This approach is in line with Gilchrist, S. and Zakrajšek, E., “Credit Spreads and Business Cycle Fluctuations”, American Economic Review, Vol. 102, No 4, June 2012, pp. 1692-1720, as well as Favara, G., Gilchrist, S., Lewis, K. and Zakrajšek, E., “Updating the Recession Risk and the Excess Bond Premium”, FEDS Notes, 2016.

- That shock is estimated using a daily BVAR model in the spirit of Brandt, L., Saint Guilhem, A., Schröder, M. and Van Robays, I., “What drives euro area financial market developments? The role of US spillovers and global risk”, Working Paper Series, No 2560, ECB, 2021. The model uses a combination of sign, relative magnitude and narrative restrictions. Thanks to this approach, the global risk shock captures flight-to-safety dynamics, assuming that heightened global risk aversion triggers a shift out of equity and into safe long-term US bonds, while also leading to a strengthening of the US dollar given its status as a safe haven. In addition, a narrative event is imposed on the day of Lehman Brothers’ collapse, whereby the global risk shock is the most important driver of equity prices on that day. The impact of the shock is calibrated as a 10 basis point decline in long-term US Treasury yields over five days. We are grateful to Ine Van Robays for sharing the global risk shock series that was used for this project.