Public wage and pension indexation in the euro area

Published as part of the ECB Economic Bulletin, Issue 1/2022.

If the response of wages – both private and public – and pensions to an increase in inflation leads to second-round effects, then this can make an inflationary shock more persistent. Transmission is more likely where wage and pension indexation is automatic. It can, however, also play an important role in wage negotiations, especially in times of high inflation. The link through wages, particularly in the private sector, is likely to be more prominent and affect prices from both the demand and the production side; pensions are likely to impact demand through disposable income. On private wages, various recent ECB and Eurosystem analyses have concluded that the likelihood of wage-setting schemes triggering second-round effects based on inflation indexation is relatively limited in the euro area.[1] This holds in particular when inflation is driven by higher energy prices.

This box provides an overview of indexation schemes of public wages and pensions across the euro area. It is based on information provided through a questionnaire completed by the members of the Working Group on Public Finance (WGPF) as part of the December 2021 Eurosystem staff projections. The box also provides a brief discussion of public wage and pension developments for the euro area aggregate.

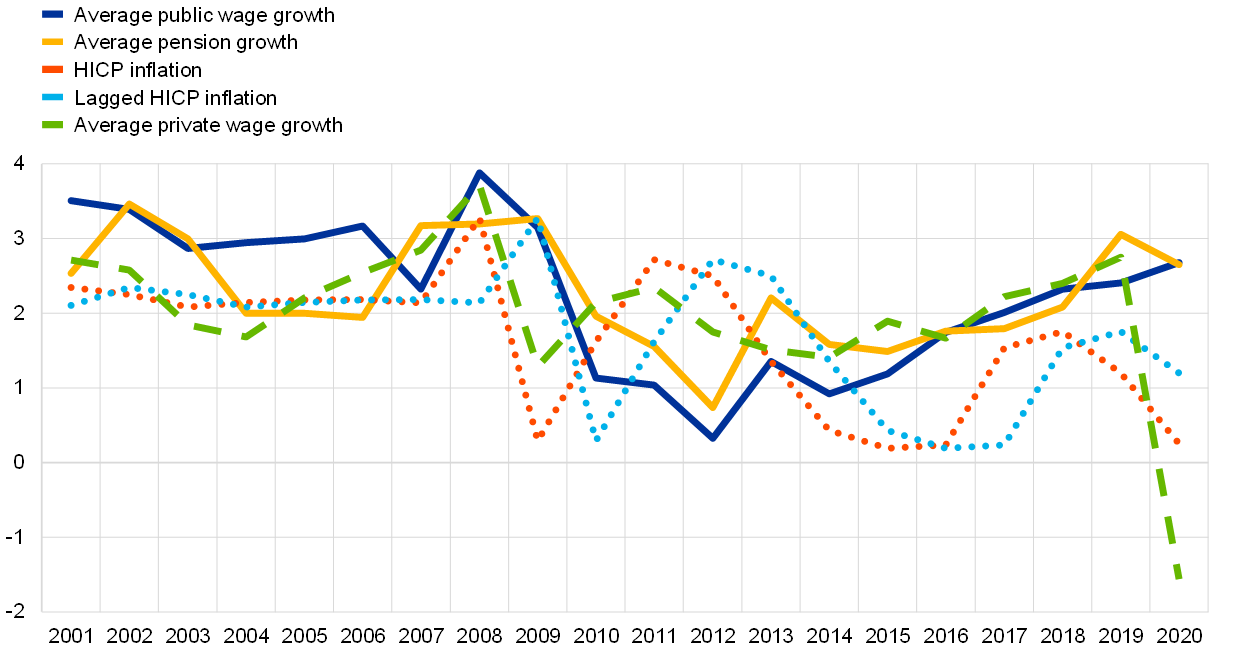

Euro area public wage and pension expenditure accounts for significant budget resources, which have grown recently. In 2020, the euro area public wage bill (compensation of employees, excluding employers’ social contributions) is estimated to have amounted to around 7.8% of GDP, while public old age and survivors’ pensions accounted for around 12.7%. Over the almost two decades running up to the coronavirus (COVID-19) crisis (2001-19), the average growth rates of public and private wages per employee, and of the average pension, were remarkably similar at the euro area aggregate level.[2] They stood at around 2.2-2.3%, that is, above the average HICP inflation rate of 1.7%. This masks differences across periods, with public wages growing faster than inflation (and private wages) before and during the great financial crisis and more slowly during the sovereign debt crisis (Chart A). Since 2015, average public wages and pensions have grown at rates well above contemporaneous or lagged HICP inflation at the euro area aggregate level, recovering after the subdued growth during the sovereign debt crisis.[3] In 2020, when the COVID-19 pandemic hit the euro area, wage trends were affected by one-off factors. The increase in public wages reflected bonuses in the health sector, amongst other things, while the decline in the growth of private wages was related to the partial coverage by public funds under job retention schemes. Public pensions have followed lagged inflation more closely, especially after the sovereign debt crisis.

Chart A

Average public wage and pension growth rate: euro area aggregate

(percentages per annum)

Source: ECB, December 2021 Eurosystem staff macroeconomic projections database and ECB calculations.

Notes: Data on average public wages are computed at the country level by dividing expenditure recorded under "Wages and salaries" in the Government Finance Statistics database (also referred to in this box as public wages or the public wage bill) by the number of government employees. Average pension refers to old age pensions and survivors' pensions and is computed as total expenditure divided by the number of pensions. The euro area aggregate is a GDP-weighted average of country-specific data. Average private wage denotes private wage per employee. For average pensions, consistent data for France is available from 2010, for Greece from 2014 and for Luxembourg from 2007; the euro area aggregate excludes these countries when data is not available. Growth rates are on an annual basis. Lagged inflation is annual end-of-period inflation lagged one year.

Price indexation of public wages is relatively limited and applies to about one-fifth of the euro area public wage bill (Chart B). Full and partial price indexation is reported in five countries, representing 19% of the euro area public wage bill in 2021. In two of these (Belgium and Luxembourg), public wages are fully automatically indexed to prices (with a backward-looking index, linked to the cost of living); Cyprus and Malta have a similar but more restricted indexation scheme categorised as partially automatic.[4] In Italy, expected inflation excluding energy is taken into account during negotiations for contract renewals: if inflation turns out to be higher than the increase in public wages over the three-year contract period, the difference is made up in the following three-year period. In most euro area countries, public wages are not automatically indexed to inflation, nor does inflation play a formal role in wage setting. However, inflation is or can be taken into account informally in public wage negotiations.[5] Public wages are currently frozen in Greece and France (in the latter, until end-2022; the freeze does not apply to education, health and low wages).

Chart B

Public wage indexation across euro area countries

a) Price indexation of public wages by country

(share in euro area 2021 public wage expenditure)

b) Type of indexation reference

(percentage of 2021 euro area public wage expenditure)

Source: WGPF questionnaire, December 2021 Eurosystem staff macroeconomic projections and ECB calculations.

Notes: See description in the text for the various categories. In chart a), “Partially automatic price indexation” refers to restrictions on full indexation to prices, either in the amount (an adjustment lower than 100% of a given price index) or depending on other trigger variables and/or administrative decisions. In chart b), the left-hand bar includes Belgium, Luxembourg, Cyprus and Malta (blue) and Italy (yellow). The right-hand bar shows the percentage of euro area countries where inflation does not play a formal role in public wage setting, though inflation may be taken into account informally in wage negotiations.

Euro area public pensions are indexed automatically – fully or partially – to prices and wages, mostly in a backward-looking way, in almost all countries (Chart C). Four categories can be identified based on the questionnaire:

(i) Full price indexation of public pensions: this applies in six countries (Belgium, Greece, Spain, Italy, Luxembourg[6] and Slovakia), representing 37% of euro area pension expenditure in 2021. In Spain, this is enshrined in a new law to be applied from 2022, following a regime of no automatic indexation in place since 2014. In Greece, a nominal freeze is currently in effect, with the automatic pension indexation formula to apply again from 2023.

(ii) Partial automatic price indexation: this applies in ten euro area countries, representing one-third of the euro area pension bill. Indexation is categorised as partial because some restrictions on full price index adjustment may apply and/or other variables, most importantly the growth rate of economy-wide or private wages, are automatically taken into account. In four members of this group (France, Cyprus, Austria and Portugal), full price indexation can be modified or restricted during the decision-making process.[7] In the remaining six countries (Estonia, Latvia, Lithuania, Malta, Slovenia and Finland), pensions are automatically indexed to prices and wages, mostly in a backward-looking way.[8]

(iii) Indexation to economy-wide wages and the minimum wage: this applies in Germany and the Netherlands respectively, which together represented about 30% of euro area pension expenditure in 2021.

(iv) No automatic indexation system: this applies only in Ireland, with public pensions increases decided as a rule in the annual budget law.

Chart C

Public pension indexation across euro area countries

a) Indexation of public pensions by country

(share in 2021 euro area public pension expenditure)

b) Type of indexation reference

(percentage of 2021 euro area public pension expenditure)

Source: WGPF questionnaire, December 2021 Eurosystem staff macroeconomic projections and ECB calculations.

Notes: The four categories in the two charts are identical in terms of country coverage (see text for description). In b) the second bar includes France, where the majority of the pension bill represents basic pensions, which are automatically indexed to prices in a backward-looking way (included in the blue part of the bar); the rest is supplementary pensions, where the revaluation depends on specific regimes (no automaticity, the grey part of the bar). The small yellow part of the central bar represents pensions in Lithuania, which are adjusted with a mixed (forward and backward-looking) indicator.

Looking ahead, in the December 2021 Eurosystem projections public wage and pension growth is not expected to lead to significant second-round effects.[9] At the euro area aggregate level, wage growth in the public sector is projected to be consistently below that in the private sector, suggesting positive spillovers from the public to the private sector are unlikely. Reflecting the mostly backward-looking indexation schemes, the path of average pension growth follows one-year lagged HICP inflation closely, while remaining above it over the projection horizon. At the country level, due attention should be paid over the medium term also to the fiscal consequences of increases in public wages and pensions by balancing stabilisation and sustainability objectives, especially in countries with high debt and high ageing costs.

- See, for instance “The prevalence of private sector wage indexation in the euro area and its potential role for the impact of inflation on wages”, Economic Bulletin, Issue 7, ECB, 2021 and the December 2021 Eurosystem staff macroeconomic projections.

- See the notes to Chart A for the computation of average public wages and pensions.

- In general, where public wages and pensions are indexed, this is done based on national price indices that can differ from the harmonised ones. The indices can also exclude selected components, most frequently health-related items such as tobacco. Energy is excluded from the price index used for public wage indexation (HICP) in Italy.

- For instance, in Cyprus, public wages and pensions are adjusted in a backward-looking way with a payment equal to 50% of the increase in the cost of living index (COLA, which is the consumer price index, adjusted to exclude excise duties, in the previous year), provided there was positive growth in the second and third quarters of that year; this adjustment cannot be negative. In Malta, the government may decide to apply a public wage increase higher than the rise in the cost of living index, and part-time employees are entitled to partial adjustments.

- In Slovenia, only a small portion of public wages (e.g. meal allowances, business trips, tenure allowances, etc.) are indexed to past inflation; the minimum wage is also adjusted (at least) in line with inflation. In Slovakia, about 12% of public employees are subject to a backward-looking automatic wage indexation system linked to economy-wide wages. In other countries, for example, inflation is used in a backward looking way as a reference in wage negotiations in Lithuania and Austria, and in a forward-looking way in Portugal.

- In Luxembourg, public pensions are also indexed every two years based on the developments in the real wages of the private sector.

- For instance, in France, indexation covers basic pensions, but supplementary pension revaluations depend on specific regimes (with no automaticity). In Estonia, France, Cyprus and Austria, government decisions may imply deviations from the indexation formula. In Portugal, pension indexation is determined by a backward-looking formula in which the main inflation benchmark is adjusted up or down depending on past real GDP growth; extraordinary increases have been granted by the government in recent years for the lowest pensions.

- Wages have a higher weighting in the index in all countries apart from Finland and (currently, but not in the future) in Malta.

- The December projection exercise covers the period 2021-24. Projections were finalised on 1 December 2021 based on the policy measures approved or likely to be approved at the time. Due to uncertainty with regard to its timing and implementation, the announced minimum wage increase in Germany was not included in the baseline projections. For more details, see the December 2021 Eurosystem staff macroeconomic projections.