Recent inflation developments in the United States and the euro area – an update

Published as part of the ECB Economic Bulletin, Issue 1/2022.

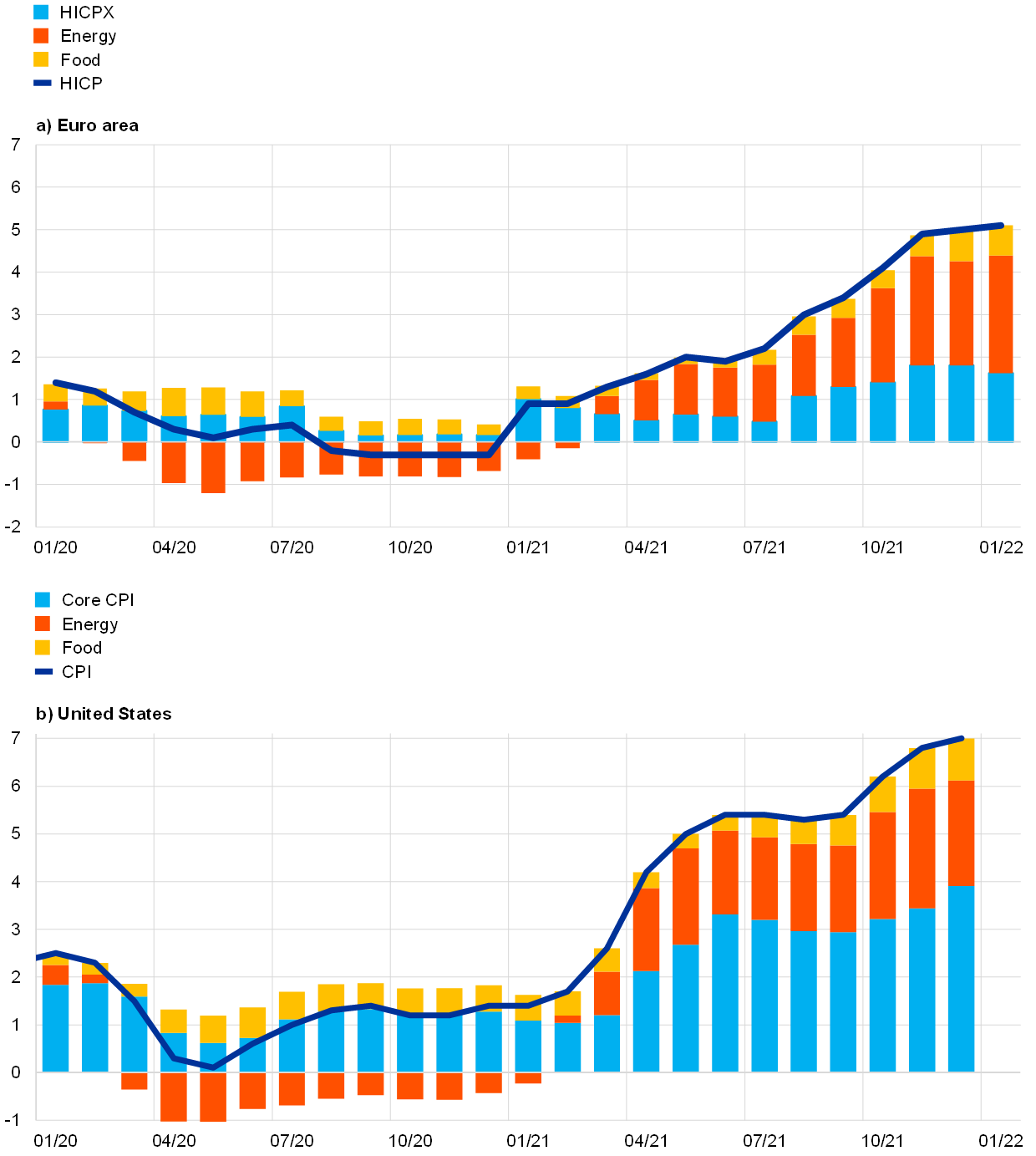

After headline inflation had already reached very high levels in the United States in the first half of 2021, euro area inflation also recorded a very rapid increase in the second half of the year but remained much lower than in the United States. Comparing inflation developments in both economic areas could help to separate idiosyncratic factors from those related to the cyclical position, taking into account the fact that the euro area is lagging the US cycle. By December 2021 inflation in the United States, as measured by the US consumer price index (CPI), had reached 7.0% (up by 5.6 percentage points since January 2021), compared with inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), which stood at 5.0% (up by 4.1 percentage points since January 2021) – see Chart A.[1] Energy inflation made a 2.2 percentage point contribution to headline inflation in the United States and a 2.5 percentage point contribution in the euro area in December, thereby accounting for around half of headline inflation for the euro area and around one-third for the United States in that month.[2] In January 2022 headline inflation in the euro area – according to Eurostat’s flash release – increased slightly further to 5.1%

Chart A

Headline inflation

(annual percentage changes, percentage point contributions)

Sources: US Bureau of Labor Statistics and ECB staff calculations.

Note: The latest observation is for December 2021 for the United States and January 2022 (flash release) for the euro area.

Most of the difference in overall inflation developments was due to the far stronger increase in inflation excluding energy and food (and from a higher starting point) in the United States than in the euro area. In the euro area, HICP inflation excluding energy and food (HICPX) started to increase in the second half of 2021 and stood at 2.6% in December – up 1.4 percentage points from the pre-crisis level of 1.2% recorded in February 2020. In the United States, by contrast, CPI inflation less food and energy, which had been substantially higher before the pandemic (standing at 2.4% in February 2020), began to soar from as early as April 2021 and increased substantially more (by 3.1 percentage points) to stand at 5.5% in December 2021 (Charts A and B). Part of the increase in HICPX inflation in the second half of 2021 in the euro area was due to base effects resulting from the temporary cut in value added tax in Germany in the second half of 2020. Without this temporary factor, HICPX inflation in the euro area would have been around 0.2 percentage points lower in each month of the second half of 2021 – leading to an even more marked difference in inflation excluding energy and food between the euro area and the United States. In January 2022 HICP excluding energy and food– according to Eurostat’s flash release – decreased to 2.3%.

Chart B

Inflation excluding food and energy

(annual percentage changes, percentage point contributions)

Sources: ECB and ECB staff calculations.

Notes: Items affected by supply disruptions and bottlenecks comprise new motor cars, second-hand motor cars, spare parts and accessories for personal transport equipment, and household furnishings and equipment (including electronics). Items affected by the reopening of the economy comprise clothing and footwear; recreation and culture; recreation services; hotels/motels; and domestic and international flight prices. Rents comprise actual rents paid by tenants – and for the United States also imputed rents for owner-occupied housing. The latest observation is for December 2021 for the United States and January 2022 (flash release) for the euro area.

Items affected by supply disruptions and bottlenecks and by the reopening of the economy play an important role as drivers of inflation excluding food and energy in the euro area and the United States. As illustrated in Chart B, one important factor in the differences in inflation excluding food and energy between the United States and the euro area is rents, which contribute much more strongly to inflation in the United States. This is in part linked to the fact that rents have recorded substantially stronger growth in the United States, but it also reflects the larger share of rents in the US consumption basket, which includes not only actual rents but also imputed rents for owner-occupied housing. While the impact of rents can help to explain differences in the level of inflation between the euro area and the United States, including before the pandemic, the high level of inflation excluding food and energy observed recently has been driven mainly by supply disruptions and bottlenecks and by effects related to the reopening of the economy. Supply chain bottlenecks have particularly affected prices for used and new cars, and car components, as well as household furnishings and equipment. In the United States, the prices for this group of items soared during the second quarter of 2021 and, after briefly easing, regained momentum in the last quarter of 2021. In particular, used car prices alone accounted for around 1.6 percentage points of CPI inflation less food and energy in December. Overall, items affected by supply disruptions and bottlenecks made a contribution of 2.6 percentage points to the annual growth rate of core CPI inflation in the United States in December (Chart D), whereas the average monthly contribution of this aggregate of items in 2015-19 had been marginally negative. In the euro area, the role of this aggregate has also increased – but its monthly contribution to HICPX inflation remained around 0.5 to 0.6 percentage points up to December 2021 and, thus, substantially smaller than in the United States (Chart B). Additionally, the prices of some goods and services have rebounded owing to the reopening of the economy, with their levels returning to or even exceeding pre-crisis levels. In the United States, this rebound is visible in prices for apparel and, among services, in prices for travel-related services and transportation, which have all risen strongly following the easing of containment measures. This contributed substantially to core CPI inflation in the second quarter of 2021 and remained significant in the last quarter, at around 0.7 to 0.8 percentage points in year-on-year terms (compared with a historical contribution of 0.04 percentage points). In the euro area, the contribution from such reopening effects only started to increase from late summer – in part linked to the later lifting of containment measures – but in recent months it has been similar in size to the contribution seen in the United States.

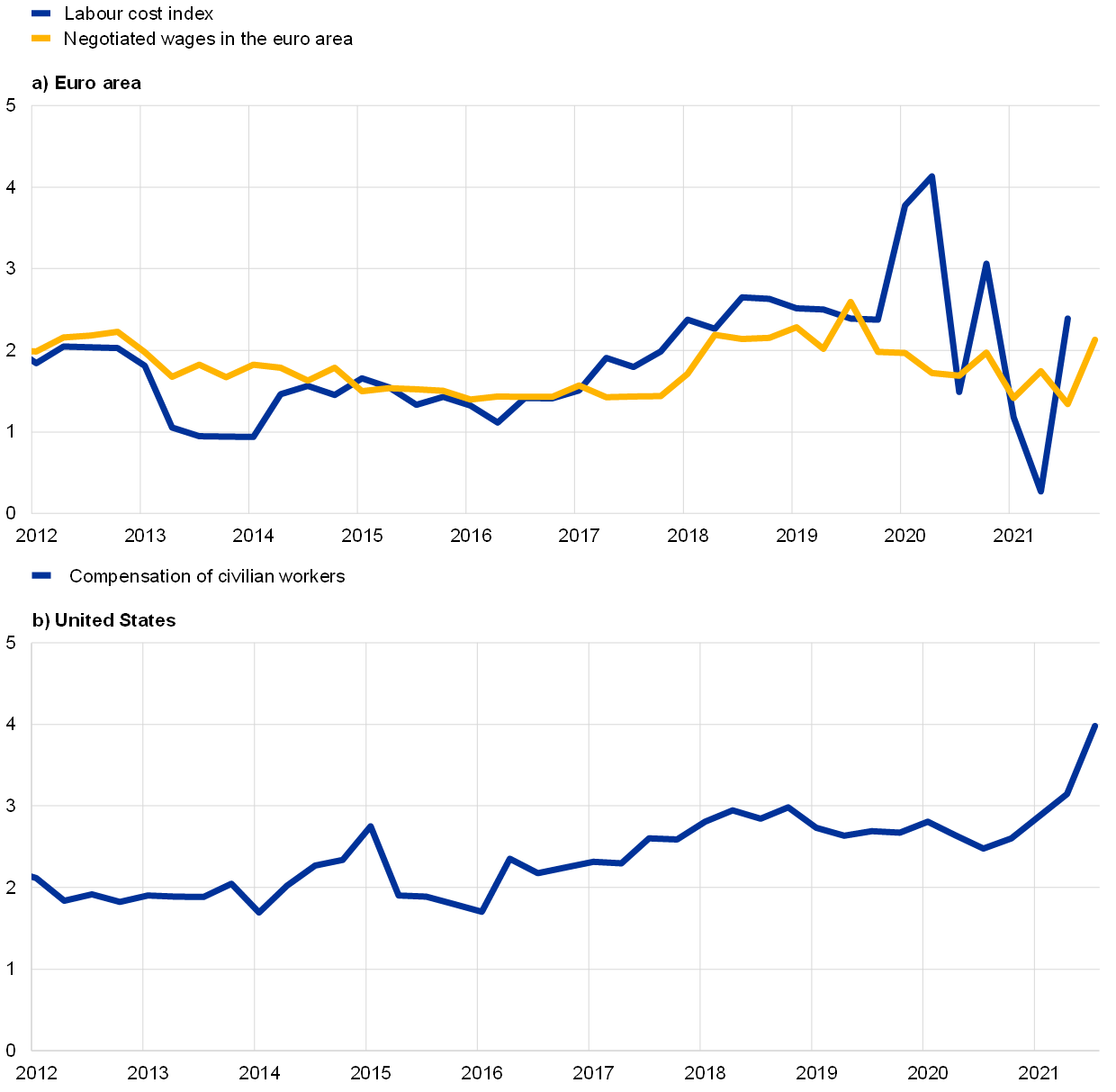

Turning to the underlying drivers of inflation developments, the United States is more advanced in the business cycle than the euro area and the US labour market has tightened, which has started to be reflected in some upward pressure on wages. Real GDP had already surpassed its pre-crisis level in the United States in the second quarter of 2021 – while in the euro area GDP reached its pre-crisis level only in the fourth quarter of 2021. In the United States, labour market tightness has increased sharply over recent months and the employment cost index for civilian workers has shown a relatively large increase (Chart C). This stands in contrast to the euro area, where so far wage growth – as measured by negotiated wages or, for example, the labour cost index – has remained quite subdued. It should be kept in mind that wage indicators are being distorted by the effects of the crisis, including the important role of job retention schemes, especially in the euro area, which complicates their interpretation.

Chart C

Developments in wages and labour costs

(annual percentage changes, ratio, share of survey respondents)

Sources: US Bureau of Labor Statistics, NBER, ECB, European Commission and ECB staff calculations.

Notes: The latest observation is for October 2021. For the United States, civilian workers comprise workers in the private non-farm economy, except those employed in private households, and workers in the public sector, except the federal government. Wage indicators are being distorted by the effects of the crisis, which complicates their interpretation.

Upside surprises in inflation data releases have continued to be larger for the United States than for the euro area over recent quarters. Consensus Economics forecasts, produced at a monthly frequency (Chart D, panel a), show that in recent months inflation developments have been higher than forecast in the euro area and even more so in the United States. Looking ahead, the latest monthly Consensus Economics forecasts published in January 2022 see headline inflation remaining elevated over most of 2022 both in the United States and in the euro area. Overall, headline inflation in the United States – which had exceeded 2% before the start of the pandemic – is expected to remain above 2% much longer than in the euro area (Chart D, panels a and b).

Chart D

Inflation expectations based on Consensus Economics surveys for US headline CPI inflation and euro area headline HICP inflation

a) Monthly inflation forecasts

(annual percentage changes)

b) Annual inflation forecasts

(annual percentage changes)

Sources: Consensus Economics, Eurostat, Haver Analytics and ECB calculations.

Note: In panel b) the shaded blue and yellow areas denote the ranges of forecasts included in Consensus Economics surveys.

Looking ahead, the degree of uncertainty around the outlook for inflation seems to be much larger for the United States than for the euro area. The latest Consensus Economics forecasts published in January 2022 expect headline inflation in the euro area to be 3.1% in 2022 and 1.6% in 2023. This was broadly in line with the December 2021 Eurosystem staff macroeconomic projections, which foresaw euro area annual inflation at 3.2% in 2022 and 1.8% in 2023 and 2024. The range of annual forecasts included in Consensus Economics, which can be seen as a measure of uncertainty, is especially wide for 2022 and somewhat narrower for 2023. For 2023, all annual forecasts included in the January 2022 Consensus Economics survey round see inflation in the euro area at between 0.8% and 2.2%, while for the United States all forecasts are in a range between 1.9% and 4% and only one forecaster sees inflation being below 2%. This higher level of inflation in the United States can be linked to differences in economic slack and labour market tightness compared with the euro area, leading to stronger wage pressures in the United States. At the same time, the pandemic is a unique situation with considerable differences compared with inflation developments in “normal” times, which require close monitoring and add to the uncertainty surrounding the inflation outlook in the United States as well as in the euro area.

- To facilitate a comparison with the euro area, this box focuses on developments in CPI inflation in the United States, rather than developments in the US price index for total personal consumption expenditures (PCE). Although an indicator of HICP inflation is also available for the United States, the CPI is chosen as it allows for a greater level of detail for the analyses.

- For a discussion of developments up to August 2021, see the box entitled “Comparing recent inflation developments in the United States and the euro area”, Economic Bulletin, Issue 6, ECB, 2021.