Recent dynamics in energy inflation: the role of base effects and taxes

Published as part of the ECB Economic Bulletin, Issue 3/2021.

Energy price developments have caused a pronounced pick-up in euro area headline HICP inflation over recent months. This box reviews the factors behind the 11-percentage point swing in energy inflation between December 2020 and March 2021 (which accounted for 1.1 percentage points of the corresponding swing in headline HICP inflation), with a particular focus on oil prices, base effects and the impact of indirect taxation, and discusses their implications for the outlook.

The most prominent factor driving energy inflation is typically the price of oil. This reflects the strong and immediate pass-through of oil price changes to transport fuel prices (Chart A). The link with electricity, gas and other energy price components tends to be looser.[1]

Chart A

Inflation developments for energy and oil prices

(left-hand scale: annual percentage changes; right-hand scale: annual percentage changes)

Sources: Eurostat, Bloomberg, ECB and ECB calculations.

Notes: The latest observation for the HICP inflation components is for March 2021; for oil prices and the USD/EUR exchange rate the latest observation is for 15 April 2021. Oil price inflation from 16 April 2021 is extended to March 2022 using oil prices futures and the USD/EUR exchange rate according to the methodology used for the technical assumptions for the Eurosystem/ECB staff macroeconomic projections.

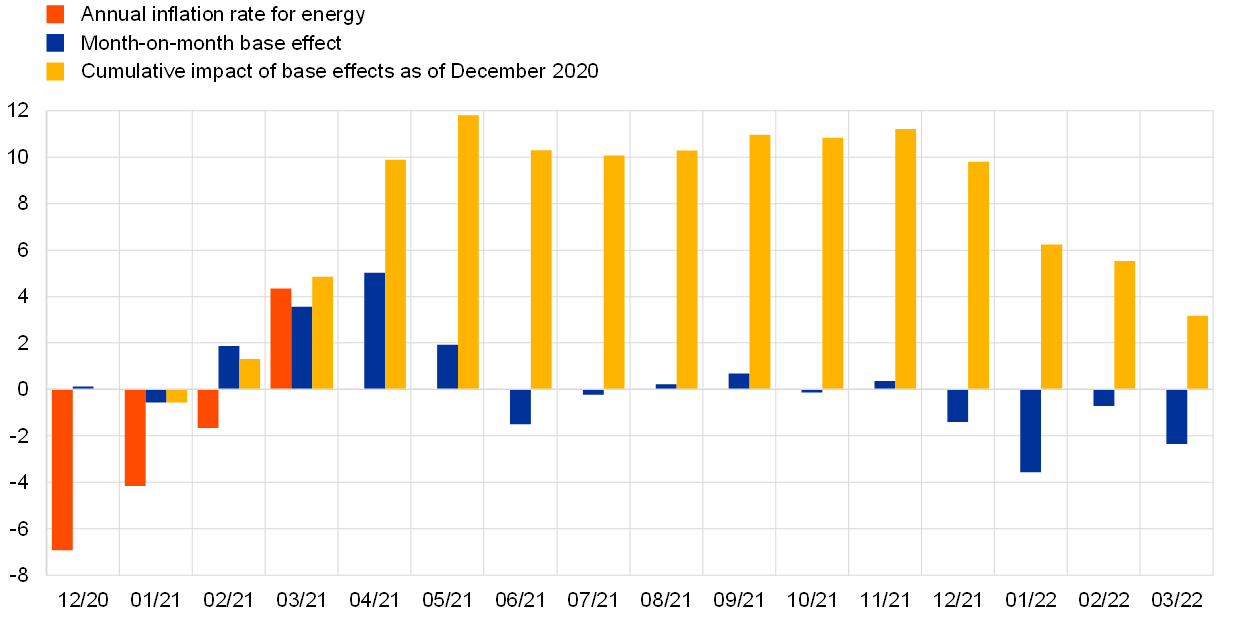

Energy inflation has been pushed up both by recent oil price increases and by base effects linked to the collapse in oil prices at the beginning of 2020. As a result of the coronavirus (COVID-19)-related collapse in oil prices in spring 2020, prices for personal transportation fuels also fell sharply – leading to a drop in energy inflation as large as that recorded during the 2009 financial crisis. This massive decline is having significant base effects on monthly year-on-year inflation rates for energy in spring 2021. A base effect is the effect on the year-on-year rate of inflation when an unusually large month-on-month change 12 months earlier drops out of the index.[2] As a result of this effect, even if oil and energy prices had remained at the low levels these reached after the onset of the pandemic, there would still have been an upward impact on annual rates of change in spring 2021. Around 60% of the total 6-percentage point increase in energy inflation between February and March 2021 (i.e. just below 4 percentage points) can be attributed to the upward base effect (Chart B). Cumulatively, base effects contributed around 5 percentage points to the increase in energy inflation between December 2020 and March 2021. This cumulative contribution since December can be expected to double in April to 10 percentage points (the contribution to headline inflation being around 1 percentage point). This impact will remain in the data for most of the year.

Chart B

Impact of base effects on energy inflation

(percentage points)

Sources: Eurostat and ECB calculations.

Note: Month-on-month base effects show the contribution of the base effect to the change in the annual energy inflation rate from one month to the next. The cumulative impact of base effects is calculated by summing month-on-month base effects and is always shown relative to a specific reference month. For example, 10 percentage points of the increase in energy inflation in April 2021 compared with the inflation rate in December 2020 is due to base effects.

The impact of the marked increase in oil prices since November 2020 has come on top of these base effects. In particular the month-on-month increase in energy prices in January 2021 was stronger than usual and will thus give rise to a downward base effect on energy inflation, expected to be around 4 percentage points, in January 2022 (which would lead to a decline of around 0.4 percentage points in headline HICP inflation compared with December 2021). The outcome for energy inflation and the extent to which it conforms with the March 2021 ECB staff macroeconomic projections for the euro area will naturally depend on whether oil prices move in line with the path of oil futures prices assumed in these projections and many other factors that can have an impact on energy prices over time. However, the size of the base effects can be estimated for the period of 12 months after the latest available inflation outcome and provide some indication as to likely broad directional movements.

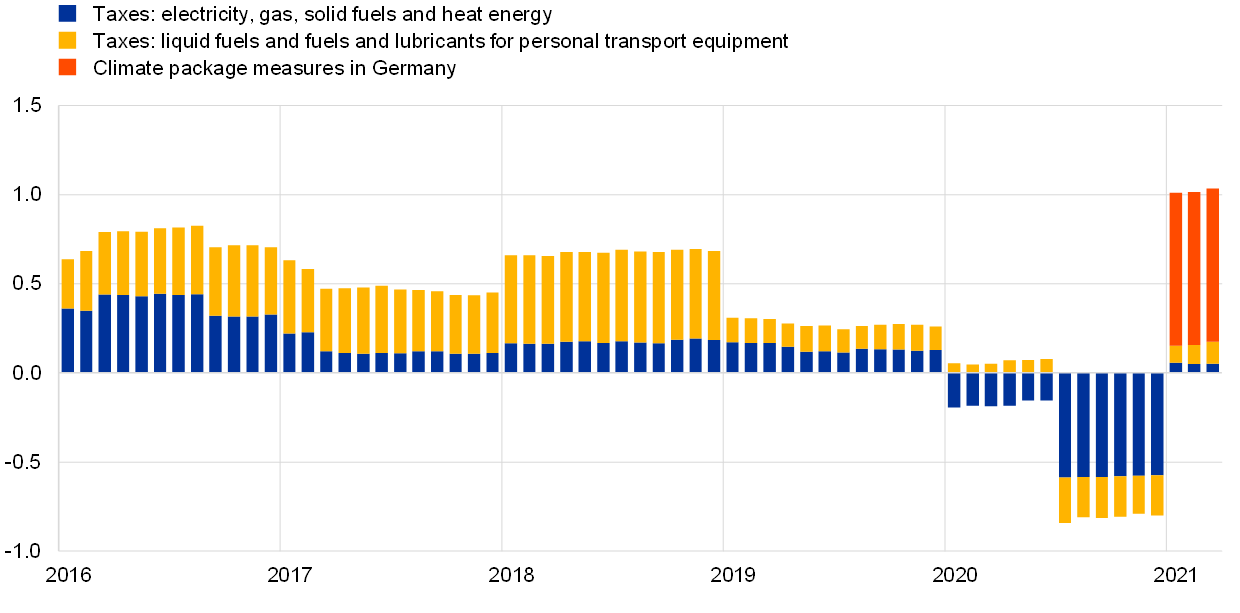

The strengthening of energy inflation in early 2021 reflected not only oil price developments but also changes in taxes and other surcharges. This relates most prominently to the reversal, in January, of the earlier VAT reduction in Germany, which also had a substantial effect on energy inflation in the euro area (Chart C).[3] In addition, government measures aiming to reduce CO2 emissions affected developments in euro area energy inflation at the beginning of 2021. These included the introduction of carbon emission certificates in the transport and heating sectors in Germany, which push up prices for refined petroleum products and gas, and a reduction in the surcharge to support the production of green electricity, with downward effects on electricity prices. Taken together these measures in Germany pushed up the annual rate of energy inflation in the euro area by around 0.8 percentage points from January 2021 onwards (Chart C). The upward impact of the VAT and environment-related government measures will stay in the energy inflation data for 2021 but then drop out of the annual rates of change and reinforce the downward impact of oil price-related base effects in early 2022. Compared with the impact of changes in oil prices, however, these changes in taxes and government measures have played only a very limited role in developments in HICP energy inflation in the euro area.[4]

Chart C

Impact of indirect taxes and recent major climate-related measures on energy inflation in the euro area

(percentage point contributions)

Sources: Eurostat, ECB, Deutsche Bundesbank and ECB calculations.

Notes: The impact of changes in indirect taxes is calculated as the difference between HICP energy inflation and HICP energy inflation at constant tax rates, assuming full and immediate pass-through of indirect taxes. “Climate package measures in Germany” refers to the estimated effect, as given in “Outlook for the Germany economy 2021 to 2023”, Monthly Report, Deutsche Bundesbank, December 2020, of the introduction of carbon emission certificates in the transport and heating sectors in Germany and the reduction of the surcharge to support the production of green electricity. The introduction of carbon emission certificates for transportation fuels and gas and the reduction in the surcharge to support the production of green energy are not classified as indirect tax measures in the HICP framework.

In the March 2021 ECB staff projections energy inflation played a prominent role in the projected temporary rise in HICP inflation in 2021 and its reduction in early 2022. Much of that role can already be gauged quantitatively when base effects, one-off tax impacts, climate package measures in Germany and current oil futures prices are considered.[5]

- See Task Force of the Monetary Policy Committee of the European System of Central Banks, “Energy markets and the euro area macroeconomy”, Occasional Paper Series, No 113, ECB, June 2010, in particular the section entitled “The impact of energy prices on inflation”, and also the box entitled “The role of energy prices in recent inflation outcomes: a cross-country perspective”, Economic Bulletin, Issue 7, ECB, 2018.

- See the box entitled “Base effects from the volatile components of the HICP and their impact on HICP inflation in 2014”, Monthly Bulletin, ECB, February 2014 and the box entitled “The role of energy base effects in short-term inflation developments”, Economic Bulletin, Issue 1, ECB, 2017.

- See also the box entitled “The role of indirect taxes in euro area inflation and its outlook”, Economic Bulletin, Issue 6, ECB, 2020.

- Such changes in taxes, surcharges or other government measures, e.g. changes in the relative rates of taxation of various forms of energy towards favouring alternative energy consumption, may push up energy inflation in the euro area in the medium to longer term, especially if they become more common across euro area countries in order to achieve ambitious emission-cutting targets.

- The upward effects of the climate change measures in Germany will largely fall out of year-on-year energy inflation rates at the beginning of 2022. Prices for carbon emission certificates will be raised only moderately in 2022, with ongoing reductions in electricity prices dampening the impact on overall energy inflation in 2022. See for details “Outlook for the German economy 2021 to 2023”, Monthly Report, Deutsche Bundesbank, December 2020.