The role of profit margins in the adjustment to the COVID-19 shock

Published as part of the ECB Economic Bulletin, Issue 2/2021.

Profit margins are an integral part of domestic price setting and have had an impact on the response of euro area inflation to the coronavirus (COVID-19) shock. Growth in the GDP deflator remained robust in the first half of 2020, despite the sharp fall in economic activity. This box illustrates that developments in profit margins in terms of unit profits (i.e. gross operating surplus per unit of GDP) have been exceptional during the crisis, including in comparison to past recessions, and have shaped GDP deflator-based inflation developments. The box also elaborates on likely sources of the unusual profit margin response and examines developments in more granular profit indicators in main institutional sectors since the start of the crisis.

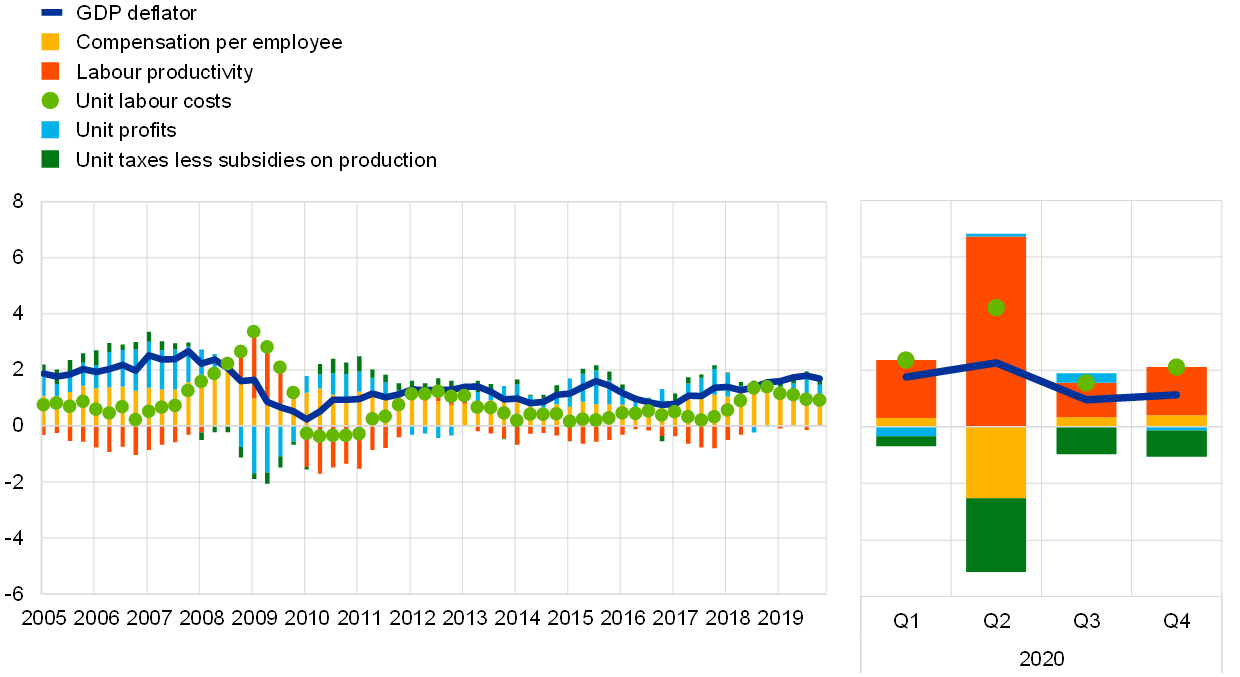

Developments in the GDP deflator and its components have been exceptional since the start of the COVID-19 crisis (Chart A). Despite the recession, the annual growth rate of the GDP deflator rose to 2.3% in the second quarter of 2020, from 1.8% in the first quarter, before slumping to rates around 1.0% in the following two quarters. This was the largest movement between two quarters in the history of the series. However, rather than reflecting genuine changes in domestic price pressures, the hump in the profile of the GDP deflator appears to reflect mainly statistical measurement effects.[1] At the same time, changes in the components of the GDP deflator also went far beyond those observed in past crises. In particular, unit labour costs posted a sharp temporary increase in the second quarter, and unit taxes less subsidies on production made an unprecedentedly large negative contribution to the GDP deflator. The latter reflected government support measures implemented in the context of job retention schemes, while in the third and fourth quarters lower recourse to these schemes in view of the rebound in economic activity led to a significant decline in this contribution.[2] Job retention schemes also had a substantial impact on developments in profit margins during the crisis, as discussed below.[3]

Chart A

GDP deflator and components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2020.

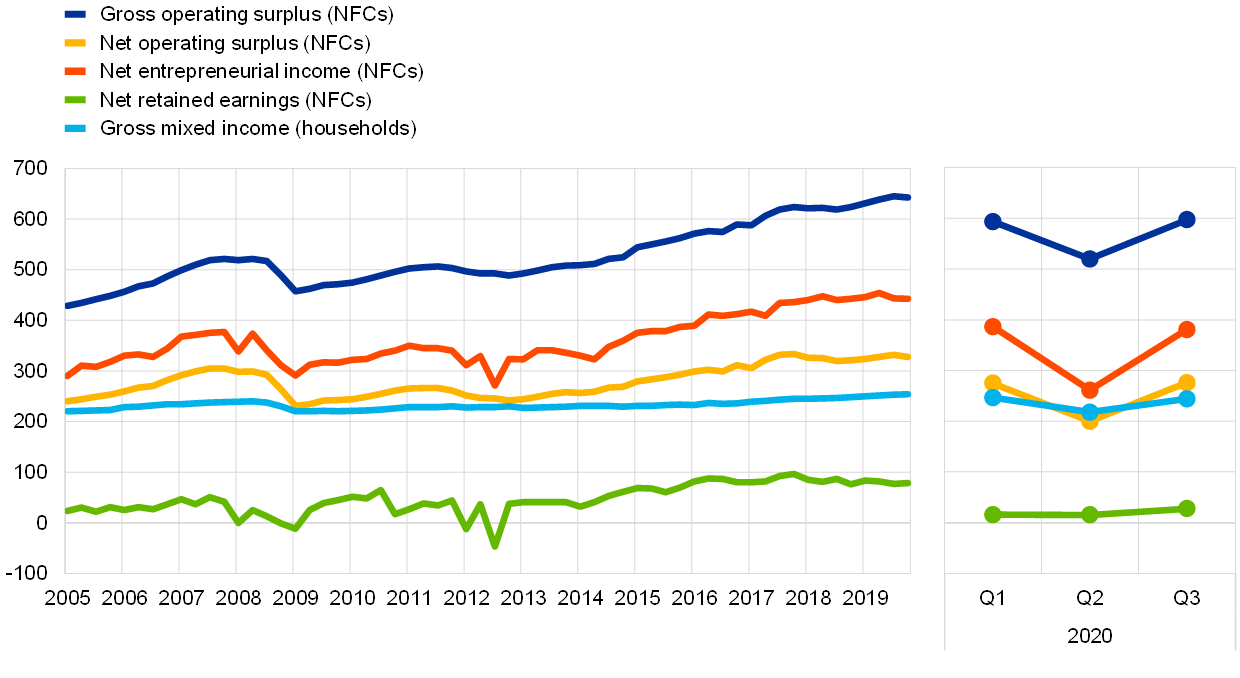

Total profits declined sharply during the COVID-19 crisis in both the non-financial corporation (NFC) sector and the household sector (Chart B). Both the gross operating surplus of NFCs and the gross mixed income of the smaller unincorporated enterprises covered by the household sector, which together account for roughly three quarters of total economy profits, dropped significantly in the second quarter of 2020 and much more strongly than during the great financial crisis.[4] In the third quarter of 2020 much of the decline in profits in the previous quarter was recouped. The same was true for most of the more specific profit indicators available for the NFC sector. Only net retained earnings, which have developed relatively favourably in recent years, remained at a more modest level.

Chart B

Profits in the NFC sector and the household sector

(EUR billions)

Sources: Eurostat, ECB and author’s calculations.

Note: The latest observations are for the third quarter of 2020.

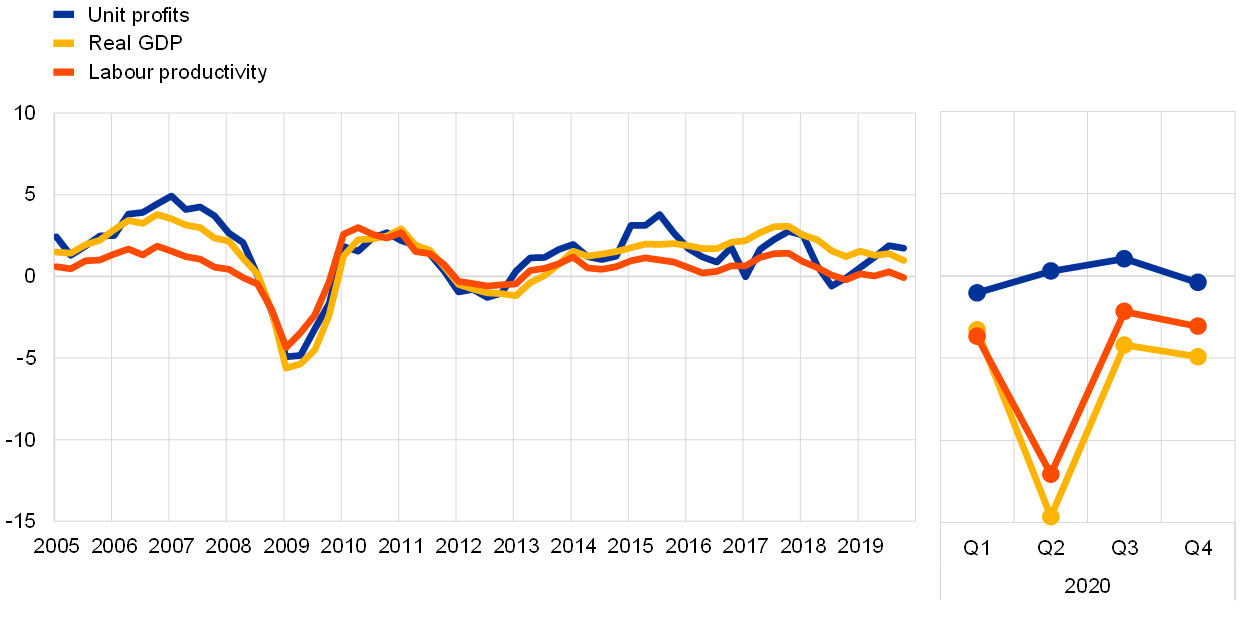

Despite the overall fall in profits, unit profits have shown resilience relative to the depth of the recession. Developments in unit profits are highly cyclical and tend to strongly co-move with cyclical indicators like GDP and labour productivity (Chart C). However, in the second quarter of 2020 the typical cyclical co-movement of unit profits with real economic activity broke down. This can be clearly seen when a comparison is made with developments during and after the great financial crisis. In the second quarter of 2020 unit profits were weak, but held up much better than implied by typical cyclical co-movement, even providing a small positive contribution to the GDP deflator, despite the strong fall in GDP. In the third and fourth quarters of 2020 unit profits remained weak and disconnected from the sharp cyclical rebound, but were still stronger than implied by the cyclical situation as reflected in, for instance, developments in GDP. While statistical measurement effects are likely to have played a role in developments in unit profits, they cannot explain their observed resilience.

Chart C

Unit profits, real GDP and labour productivity

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2020.

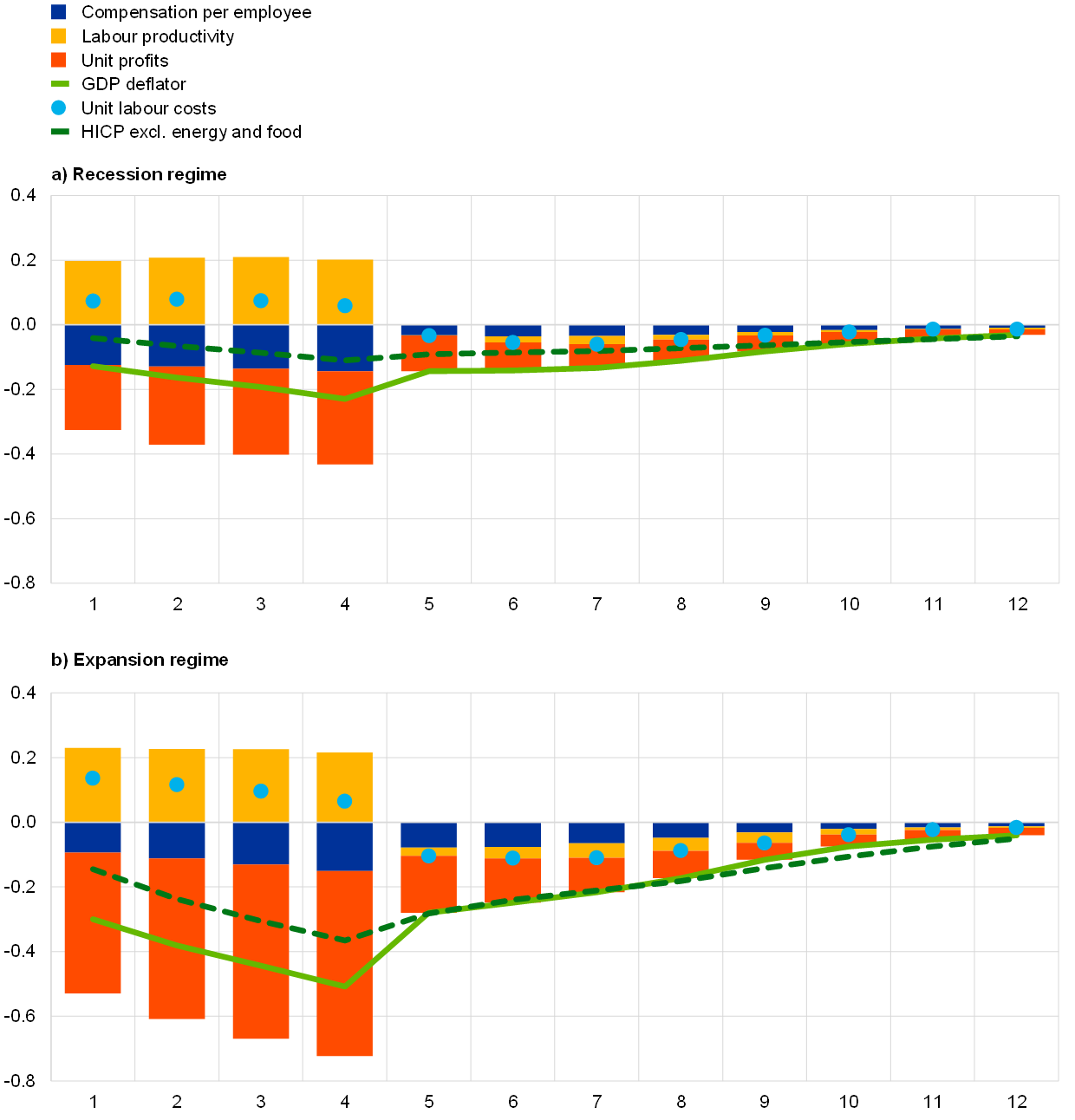

Empirical evidence based on past recessions points to non-linearities and relatively more moderate cyclical adjustments of unit profits during recessions than during expansions (Chart D).[5] The results from a threshold vector autoregressive model indicate that a demand shock has a proportionally smaller effect on inflation in recessions than in expansions on account of a smaller response in unit profits, and this behaviour also appears to have prevailed during the COVID-19 crisis.[6] The estimated non-linearity in the response of unit profits also helps to explain why inflation tended to fall by less in past recessions than signalled by linear models, a behaviour referred to as “missing disinflation”. Nonetheless, the resilience of profit margins during the COVID-19 crisis is exceptional, even when compared with past recessions.

Chart D

Response of GDP deflator and components and of HICP excluding energy and food to adverse demand shocks in recessions and expansions

(annual percentage changes, percentage point contributions)

Source: Hahn, E. (2020).

Notes: The x-axis refers to the horizon of the impulse responses in quarters. The magnitude of the demand shock corresponds to a 1% decline in real GDP over the first year. It is assumed that indirect taxes net of subsidies respond proportionally to real GDP such that this component does not contribute to changes in the GDP deflator.

Job retention schemes have played an important role in the resilience of unit profits during the COVID-19 crisis.[7] In the early stages of a downturn firms generally strive to retain workers, even at the cost of lower profit margins. This downward pressure on profit margins can be alleviated by government wage support schemes. Such schemes have been much more common during the COVID-19 crisis than during previous recessions, and this probably explains the resilience of profit margins in the current crisis when compared to past recessions.

To conclude, while profits have fallen more strongly during the COVID-19 crisis than during earlier recessions, relative to activity they have shown a high degree of resilience. This has contributed to the attenuation of downward pressures on inflation during this period. It is likely that the strong resilience of profit margins during this crisis reflects both the normal resilience of profit margins in recessions and the impact of job retention schemes. As job retention schemes are likely to remain in force as long as the COVID-19 crisis persists, profit margins may be expected to remain relatively resilient given the activity developments.

- The GDP deflator implicit in national accounts is derived by dividing nominal GDP by real (chain-linked volume) GDP. As a result, it can be analysed from the expenditure, income and production side of GDP. The breakdown of the GDP deflator from the production side shows that the increase in the annual growth rate of the GDP deflator in the second quarter of 2020 was largely accounted for by the deflator of the “public administration, defence, education, human health and social work activities” sector. The deflator of the public sector increased in the second quarter because nominal output did not fall by as much as real output. Many national statistical institutes (NSIs) have experienced difficulties in measuring non-market output owing to the COVID-19 crisis, and Eurostat was urged to provide specific guidance in this field (see “Guidance on non-market output in the context of the COVID-19 crisis”, Eurostat, May 2020). According to this guidance, deviating from the conventional “sum of costs” approach for output in current prices because of temporary changes in activity is not justified and the legal requirement of the European System of Accounts (ESA 2010) in this respect should continue to be followed. This also ensures a harmonised approach across EU Member States. The fact that, as it currently stands, there was a counterintuitive development in the deflator of the public sector in the second quarter of 2020 could be partly due to insufficient information being available to NSIs at that point in time. Revisions to these results in subsequent GDP releases and once the complete annual results for 2020 become available later in 2021 cannot be excluded.

- The recording of such government support measures in national accounts differs across euro area countries because of the way the support is provided by national governments. In some countries the support is provided as a subsidy to employers who pass it on to employees in the form of compensation. This implies a dampening impact on the “taxes less subsidies on production” component of the GDP deflator and a corresponding upward impact on compensation per employee.

- For more information on the effects of job retention schemes on wages, see the box entitled “Developments in compensation per hour and per employee since the start of the COVID-19 pandemic” in the article entitled “The impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 8, ECB, 2020.

- The gross operating surplus of the household sector is not considered here as it mainly refers to the activities of owner-occupied housing.

- See Hahn, E., “The wage-price pass-through in the euro area: does the growth regime matter?”, Working Paper Series, No 2485, ECB, October 2020.

- For supply shocks, no non-linear behaviour between recessions and expansions was found in the empirical analysis.

- For more information on job retention schemes, see the article entitled “The impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 8, ECB, 2020.