Pandemic-induced constraints and inflation in advanced economies

The coronavirus (COVID-19) pandemic had a severe and extraordinary impact on the global economy during the first half of 2020. Economic activity across advanced economies was severely affected, and consumer price inflation declined on the back of these developments. The pandemic weighed on not only headline inflation but also underlying inflation measures, such as consumer price inflation excluding food and energy, which declined during the initial lockdowns and gradually rebounded thereafter. This pattern was shaped by the confluence of two key forces triggered by the crisis: weak demand and constrained supply. This box uses granular data on consumer spending and prices, together with a structural analysis using Bayesian Vector Autoregression (BVAR) models, to study their relative impact on inflation in key advanced economies outside the euro area.[1]

Understanding the relative impact of demand and supply shocks in the pandemic is crucial for gauging the inflation outlook. As the crisis propagated through many channels in the economy, the existing literature has not yet reached a consensus on the relative contribution of demand and supply shocks.[2] Lockdowns and public health measures reduce economic activity by making it impossible for firms and households to produce and spend as they usually would. This results in varied disruption to production networks across countries and sectors.

Survey data show sectoral output and prices declining precipitously in the second quarter amid strict containment measures. Lockdowns and mobility restrictions were tightened further as the pandemic spread, stoking uncertainty among firms and consumers. This negative shock to the labour supply meant that firms were unable to meet existing demand. Activity in contact-intensive services sectors, such as tourism and recreation, fell particularly sharply, as did demand for transport services (Chart A, panel (a)). Healthcare services was the only sector where output remained broadly unchanged, while foodstuffs and pharmaceutical and biotechnology products saw rising prices despite falling output. In the third quarter, when less stringent containment measures were in place, output and prices recovered across most sectors of the economy, with the notable exception of tourism and recreation, where the impact of the pandemic persisted (Chart A, panel (b)).

Chart A

Global sectoral output and prices: a survey data perspective

(x-axis: output; y-axis: output price; PMI, diffusion indices, quarterly averages)

Source: IHS Markit (via Haver Analytics).

Notes: PMI surveys for global sectoral output and output prices. Values above (below) 50 indicate an increase (decline) in global sectoral output and output prices. The charts report 11 manufacturing sectors and 12 services sectors.

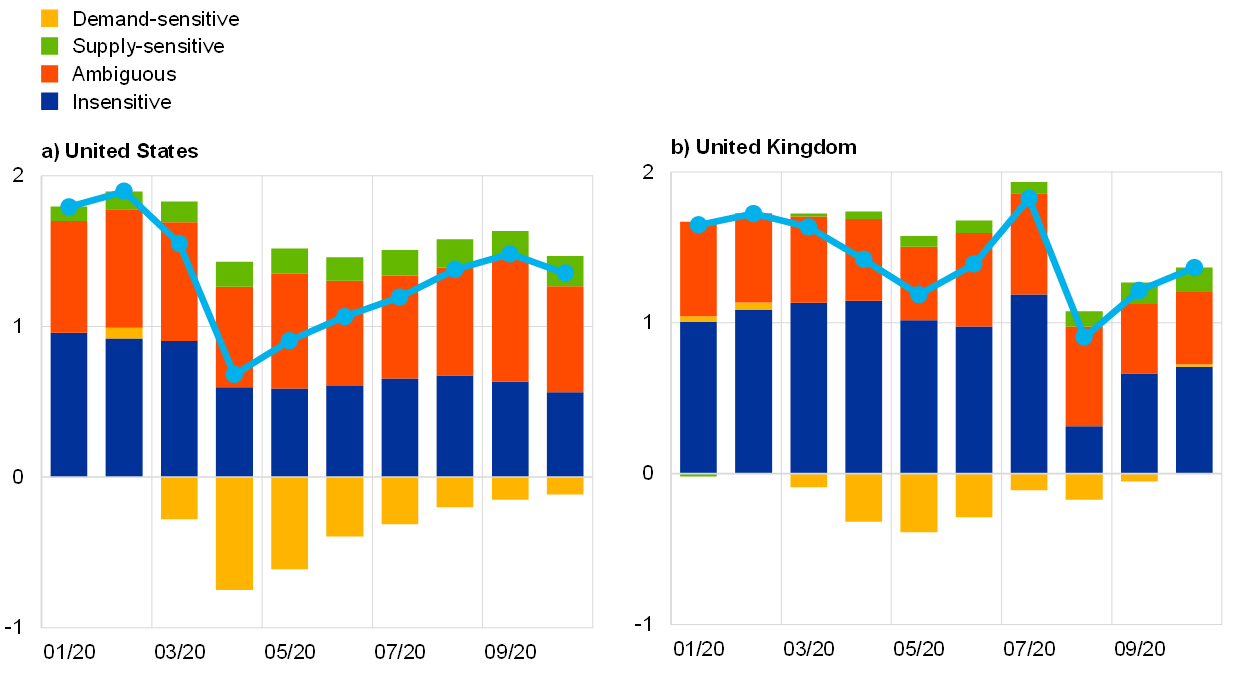

Demand-sensitive components of the consumption basket largely account for declining core inflation during the initial lockdowns. Following Shapiro,[3] we study the sensitivity of consumer basket components to disruptions caused by the pandemic.[4] For the United States, more than 60% of personal consumption expenditures show some degree of sensitivity, while the equivalent share in the United Kingdom is around 40%. For both countries, the demand-sensitive components account for a large proportion of the initial decline in consumer price inflation during the first lockdowns, as well as for its gradual increase observed during the third quarter (see Chart B). Looking ahead, the inflation outlook remains subject to large uncertainty. For instance, disagreement among consumers surveyed by the Federal Reserve Bank of New York on the expected level of inflation one year ahead in the United States, measured by the interquartile range of their responses, has widened significantly since the onset of the pandemic. Meanwhile, inflation expectations appear to remain skewed towards higher inflation following an initial drop.

Chart B

Core inflation decomposition

(percentage points)

Source: ECB calculations based on Shapiro.

Notes: The framework relies on a two-equation, seemingly unrelated univariate regression of prices and quantities.

. , where for the United States and for the United Kingdom. These equations are estimated for the period from January 2010 to October 2020 in case of the United States and from the first quarter of 2010 to the third quarter of 2020 for the United Kingdom. In the charts we report results for the period from January to October 2020, which is relevant for the pandemic crisis. COVID-19-sensitive components include those categories where either prices or quantities moved in a statistically significant manner at the onset of the pandemic, while COVID-19-insensitive components include all other core inflation categories. Among the sensitive components, demand-sensitive components are those for which prices and quantities changed in the same direction during the initial lockdown period; supply-sensitive components are those for which prices and quantities moved in opposite directions; ambiguous components are defined as sensitive categories with a statistically significant change in either prices or quantity, but not both.

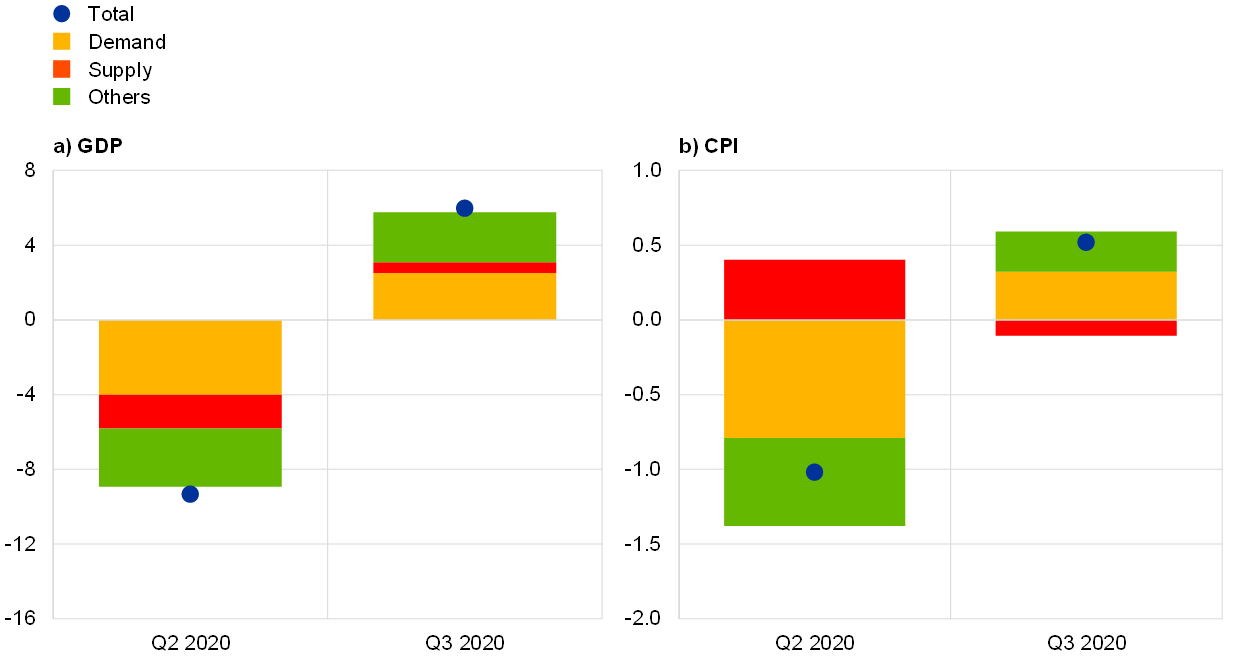

Results from a structural model confirm that demand effects dominate during the crisis, though supply effects remain notable. We estimate a structural BVAR model for the United States, United Kingdom and Japan and find that during the second quarter of 2020, demand shocks contributed around twice as much to the decline in output as supply shocks (Chart C, panel (a)).[5] The recovery in the third quarter of 2020 was driven by both demand and supply factors in broadly similar proportions. Turning to nominal developments, the impact of weak demand on inflation dominated in the second quarter of 2020, as it was only partly outweighed by supply constraints. During the initial recovery, demand strengthened and pushed up inflation, which was also supported by some unwinding of the supply constraints (Chart C, panel (b)). The model provides a relatively accurate forecast for consumer inflation for the second and third quarters of 2020, if conditioned on the actual path for GDP and oil prices. This in turn supports the above findings, which suggest that inflation dynamics during the crisis were shaped by a combination of shocks, with those originating from the demand side dominating.

The pace of recovery in supply and demand are key determinants of inflation moving forward. While pent-up demand may support the recovery and push up inflation, supply constraints could unwind quickly, which would create disinflationary pressures.[6] Nonetheless, supply disruptions could still be significant, especially if a renewed rise in infections and waning policy support trigger a series of bankruptcies. The economic ramifications of the pandemic could persist for the labour supply, especially in those sectors where human capital formation is contact-intensive. This could lower incomes and employment, thus undermining the recovery in demand. Furthermore, human capital and labour supply could be eroded in the long term by the re-introduction of strict containment measures weighing on educational attainment and keeping unemployment elevated.

More granular analysis is needed to assess the consequences of the pandemic for the drivers of inflation. Recent international evidence also raises the possibility that supply shocks could affect different sectors of the economy asymmetrically and morph into larger negative demand effects with disinflationary pressures.[7] These findings argue against approaches that use aggregate data and may erroneously classify such sectoral supply shocks as aggregate demand shocks. Therefore, a more granular sectoral analysis could provide additional insights.[8]

Chart C

Historical decomposition of gross domestic product (GDP) and consumer price inflation (CPI)

(quarterly percentage changes, percentage points)

Source: ECB calculations.

Notes: GDP and inflation are shown in deviation from trend/steady state and are based on an aggregation with GDP weights of country-specific results for the United States, the United Kingdom and Japan. “Others” refers to monetary policy and oil shocks. The ECB’s BEAR toolbox Version 4.2 was used.

- For analysis of the euro area and euro area countries, see “The role of demand and supply factors in HICP inflation during the COVID-19 pandemic – a disaggregated perspective”, Monthly Bulletin, Issue 1, ECB, 2021.

- Some papers find that aggregate demand shocks dominated in the first quarter of 2020, whereas aggregate supply shocks prevailed in the second quarter of 2020 (see Bekaert, G., Engstrom E. and Ermolov A., “Aggregate Demand and Aggregate Supply Effects of COVID-19: A Real-time Analysis”, Finance and Economics Discussion Series, No 2020-049, Board of Governors of the Federal Reserve System, 2020). By contrast, other analysis (see Baqaee, D. and Farhi, E., “Supply and Demand in Disaggregated Keynesian Economies with an Application to the Covid-19 crisis”, CEPR Discussion Papers, No 14743, Centre for Economic Policy Research, 2020) used a sectoral model to demonstrate that both stagflationary sectoral supply shocks and deflationary demand shocks are needed to explain the large fall in output and moderate inflation response observed in the United States during the initial lockdown.

- See Shapiro A.H., “A Simple Framework to Monitor Inflation”, Working Papers, 2020-29, Federal Reserve Bank of San Francisco, 2020.

- The methodology is based on a system of seemingly unrelated regressions, which aims at assessing the role of demand and supply factors in explaining sectoral inflation developments during the pandemic.

- The Structural Vector Autoregressive model comprises oil prices, GDP, inflation and shadow interest rates. A standard set of sign restrictions identification is used: a demand shock moves prices and output in the same direction, while a supply shock moves them in opposing directions. The oil supply shock increases inflation and decreases GDP, but does not react to domestic interest shocks. A tightening of monetary policy lowers both GDP and prices.

- See Baqaee and Farhi, op. cit. The authors find that sectors classified as demand-constrained in April (e.g. air and water transport, oil and gas extraction) recovered by an average of 1.8%, whereas those classified as supply-constrained (e.g. food services and accommodation) recovered by 7.5% after the economy started to improve in May. Other analysis (see Coibion, O., Gorodnichenko Y. and Weber M., “The Cost of the Covid-19 Crisis: Lockdowns, Macroeconomic Expectations, and Consumer Spending”, NBER Working Paper, No 27141, National Bureau of Economic Research, 2020), using survey data for the United States, finds that changes in the spending patterns of survey respondents indicate a persistent drop in future aggregate demand, reflecting low expected income and heightened uncertainty.

- See Guerrieri V., Lorenzoni G., Straub L. and Werning I., “Macroeconomic Implications of COVID-19: Can Negative Supply Shocks Cause Demand Shortages?”, NBER Working Paper, No 26918, National Bureau of Economic Research, 2020. The authors propose a concept in which supply shocks can trigger a response in demand that leads to a larger contraction of output than the supply shock itself. Other analysis (see Cesa-Bianchi, A. and Ferrero A., “The Transmission of Keynesian Supply Shocks”, Working Paper, Bank of England, 2020) provide empirical support for this concept. The same argument of supply-induced disruption is supported by other analysis (see Fornaro, L. and Wolf, M., “Covid-19 Coronavirus and Macroeconomic Policy: Some Analytical Notes”, manuscript, VoxEU, 2020). They argue that negative supply shocks generate persistent or permanent drops in GDP, thus depressing aggregate demand, which might even fall more than supply.

- Other challenges include the inflation measurement issues which relate to the rapidly changing consumption patterns and price collection difficulties brought on by the lockdown measures. Although the measurement issues had an impact on published statistics in the first few months of the pandemic, ECB staff analysis indicates that they have decreased significantly in recent months, see the box entitled “Consumption patterns and inflation measurement issues during the COVID-19 pandemic”, Economic Bulletin, Issue 7, ECB, 2020.