New euro area statistics on insurance corporations’ premiums, claims and expenses

Published as part of the ECB Economic Bulletin, Issue 7/2020.

August 2020 marked the ECB’s first release of statistics on insurance corporations’ written premiums, incurred claims and acquisition expenses.[1] The data are annual and are available from 2017. For the euro area aggregate data, a breakdown by type of insurer (reinsurance, life, non-life and composite) is available. In addition, a breakdown by country is also provided for the total insurance sector. These data complement the ECB’s quarterly statistics on the assets and liabilities of the insurance corporation sector.[2]

The new dataset helps monitor a growing sector that is becoming increasingly important for the financing of the economy.[3] In the first quarter of 2020 insurance corporations represented 10% of the total assets held by the euro area financial sector. Insurers provide important financial services: as well as enabling risk sharing in the overall economy, they make it possible for households to store their savings in life insurance products. Insurers provide financing to the economy by purchasing corporate bonds. For instance, in the first quarter of 2020 euro area insurers held 25% of outstanding domestic non-financial corporate bonds, while total debt securities holdings also accounted for about 40% of insurers’ assets.

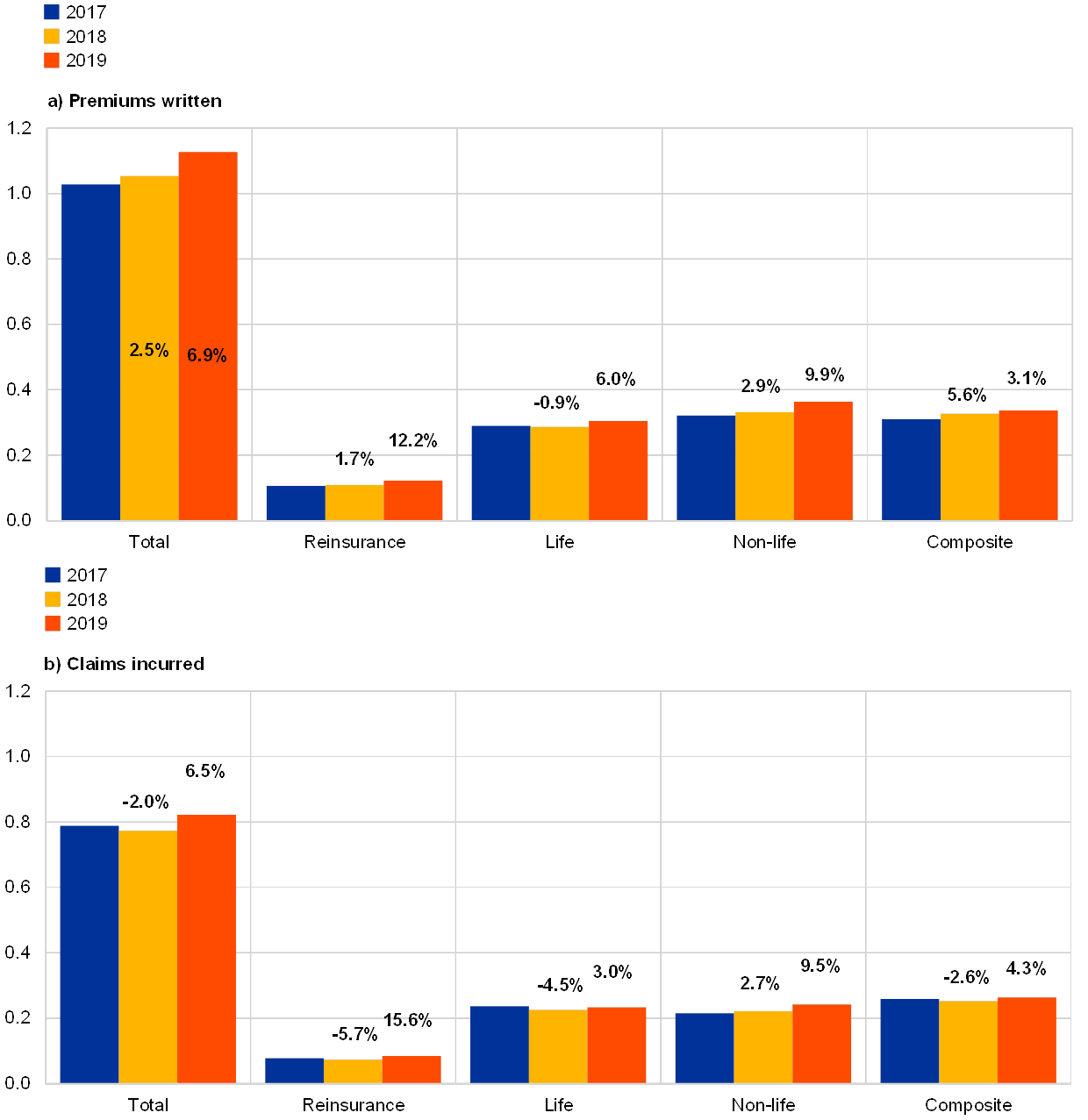

The total amount of premiums written stood at €1,127 billion at the end of 2019, reflecting a 6.9% year-on-year increase (Chart A, panel a)). The growth of premiums in the reinsurance (12.2%) and non-life insurance (9.9%) sectors in 2019 exceeded the total insurance corporation sector’s growth for that year. The relatively lower growth in the life (6.0%) and composite (3.1%) insurance sectors may reflect business models that have been facing profitability challenges in the prevailing low interest rate environment.[4] Overall, premiums written are a valuable indicator for monitoring the growth of the sector as they are not – in contrast to total assets – subject to valuation effects.

In 2019 incurred claims and their year-on-year growth remained below the amount and growth of premiums written (Chart A, panel b)). Compared with 2018, incurred claims increased by 6.5% and corresponded to 13.8% of total insurance technical reserves at the end of 2018. Overall claims stood at €822 billion in 2019 with claims incurred by life, non-life and composite insurance corporations each amounting to between €230 billion and €270 billion, while reinsurance corporations incurred claims of €84 billion.

Chart A

Premiums written and claims incurred by euro area insurance corporation sector

(EUR trillions, year-on-year growth rates in percentages)

Source: ECB.

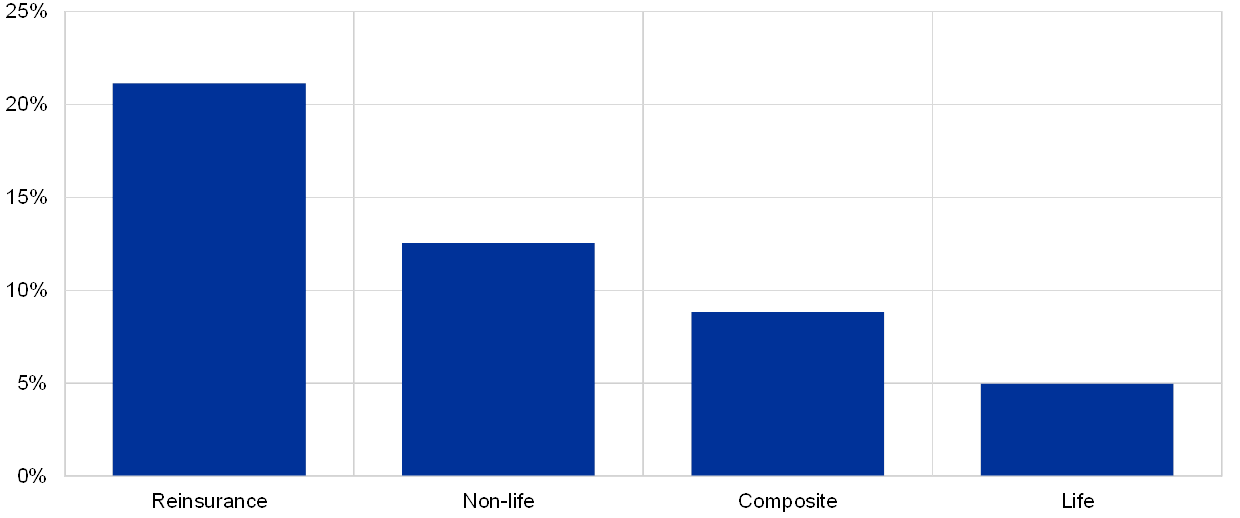

Acquisition expenses (mainly commissions) as a share of premiums written depict the relative costs incurred for attracting new policy holders. Total acquisition expenses in 2019 stood at €116 billion. Relative to other segments, the life insurance business has the lowest acquisition expenses as a share of premiums written, as life insurance policies typically have a very long duration and thus the number of new contracts (relative to total contracts) per year is also likely to be the lowest (see Chart B). By contrast, the reinsurance sector spends around a fifth of premiums written on acquisition expenses.

Chart B

Acquisition expenses as a share of premiums written

(percentages)

Source: ECB.

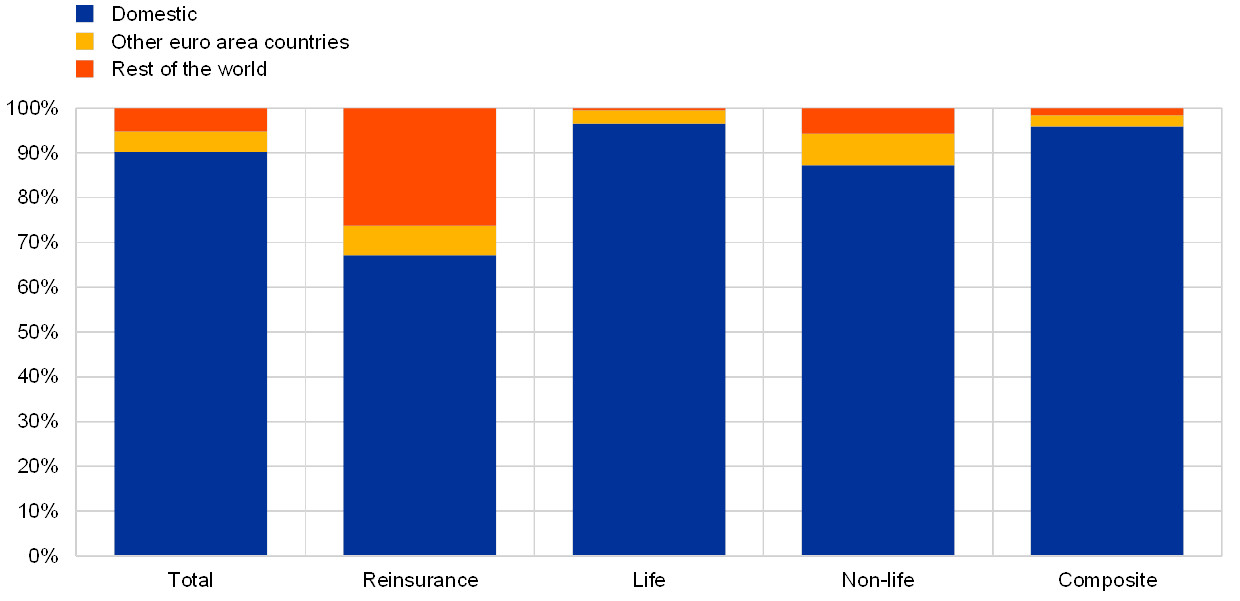

The new dataset also provides breakdowns by location of underwriting, i.e. by the location of a corporation’s head office and the locations of its branches in other countries. The data reveal that in 2019 most of the insurance business within the euro area was conducted domestically, with over 90% of premiums written and claims incurred in the country where the head office is located (see Chart C).[5] Around 4.5% of premiums were written by branches in other euro area countries, with branches located in France, Germany, Italy, Spain and the Netherlands accounting for 81% of cross-country branch business within the euro area. In addition, 5.3% of premiums were written by branches outside the euro area, with branches in the United Kingdom contributing to more than a third of this share.

The reinsurance sector stands out for its significant share of cross-border business activity, with a third of premiums written via non-domestic branches. Of these, 7% were written in other euro area countries and 26% in the rest of the world. Cross-border activity can expose reinsurers to currency risk, which they may need to hedge using derivatives. Indeed, an analysis based on end-2017 data has shown that foreign exchange contracts are the second most prevalent derivative contract held by the euro area insurance sector after interest rate derivatives.[6]

Chart C

Premiums written by location of underwriting

(percentages of total premiums written, 2019)

Source: ECB.

In designing the framework for compiling the new dataset, the ECB and the European Insurance and Occupational Pensions Authority (EIOPA) have made a concerted effort to minimise the reporting burden on insurance corporations by integrating the European statistical and supervisory data reporting requirements. This allows the statistical information to be derived, to a large extent, from data reported for supervisory purposes under the EU’s Solvency II framework. This means insurance corporations in most euro area countries only need to submit a single integrated report that covers both statistical and supervisory requirements.

- Premiums written are amounts due during the financial year in respect of insurance contracts, regardless of the fact that such amounts may relate in whole or in part to a later financial year. Claims incurred relate to insured claim events taking place during the financial year. Acquisition expenses comprise commission costs and the costs of selling, underwriting and initiating an insurance contract, including renewal expenses. The data are released on the ECB’s Statistical Data Warehouse (SDW) online platform.

- Data are available on the SDW.

- See “Non-bank financial sector”, Financial Stability Review, ECB, November 2019, Chapter 4.

- Composite insurers run both life and non-life insurance business.

- Domestic business also covers business carried out by the subsidiaries of foreign insurers resident in the country. The data do not provide any information on the location of the policy holder.

- See Box 8, “Insurance companies and derivatives exposures: evidence from EMIR data”, Financial Stability Review, ECB, November 2018.