The ECB’s enhanced effective exchange rate measures

Published as part of the ECB Economic Bulletin, Issue 6/2020.

The effective exchange rate (EER) of a currency is an index of the weighted average of its bilateral exchange rates vis-à-vis the currencies of selected trading partners; a real EER is derived by adjusting this nominal index for relative prices or costs.[1] The weighting scheme used to aggregate the bilateral rates accounts for the relative importance of each country as a trading partner. The nominal trade-weighted EER provides a summary measure of a currency’s external value, whereas the real trade-weighted EER is the most commonly used indicator of the international price and cost competitiveness of an economy.

The ECB has recently enhanced the calculation of its euro EER indices to take account of the evolution of international trade linkages and, in particular, the growing importance of international trade in services.[2] The ECB updates the trade weights underlying the calculation of its EER indices every three years, in order to capture medium-term changes in the pattern of euro area trade in a timely fashion. In the most recent exercise, which was finalised in July 2020, the ECB revised the weighting scheme to include not only manufacturing but also services trade.[3] While manufacturing still accounts for the largest part of euro area trade, services trade has gained in importance over the past decades in the light of globalisation and digitalisation and represented around 30% of euro area trade at the end of 2019.[4] In addition, improved data coverage made it easier to include services trade on the basis of the established ECB methodology. The number of trading partners covered by the EER indices was also increased from 38 to 42, accounting for close to 90% of euro area trade in manufacturing goods and services.[5]

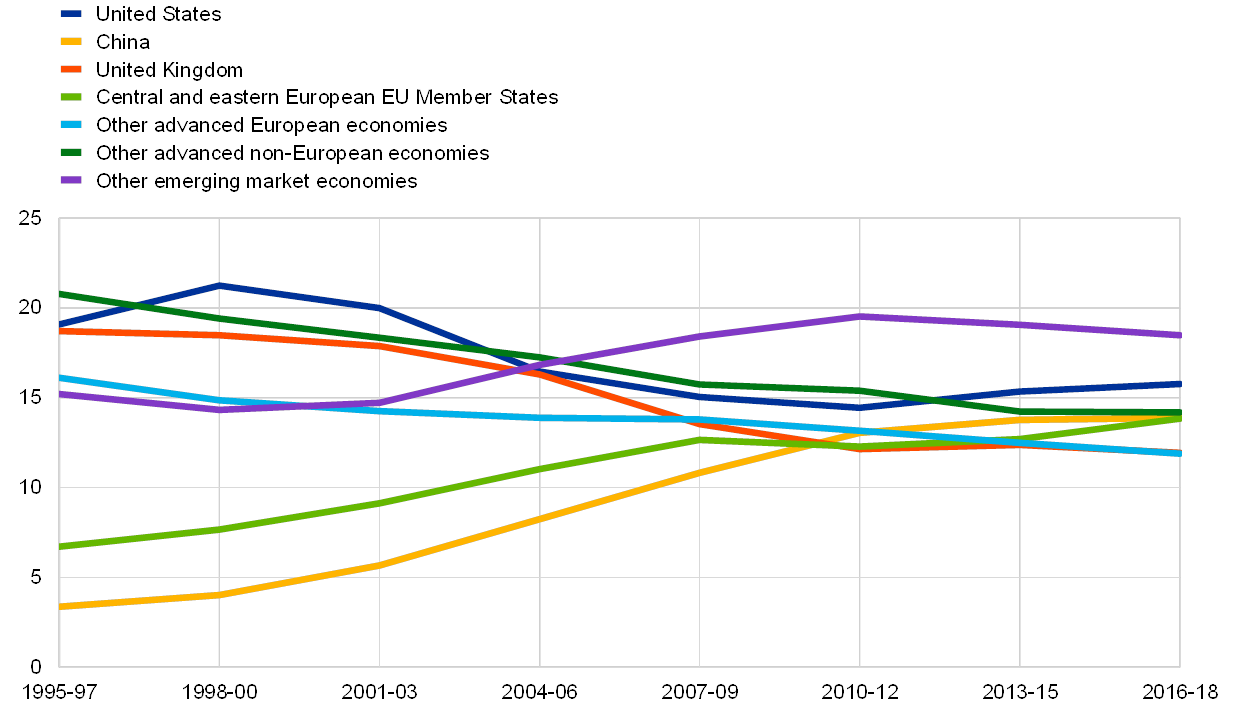

The new trade weights show the role of emerging market economies, which became increasingly important for euro area trade during the 2000s, to be no longer growing, whereas central and eastern European EU Member States gained in importance (see Chart A). In fact, central and eastern European EU Member States – owing to their further integration into European value chains – increased their combined share in euro area trade in the period from 2016 to 2018 to virtually equal that of China. The share of emerging market economies, on the other hand, even declined, despite China’s share having marginally increased. In terms of individual countries, the United States remained the euro area’s most important trading partner – its share even increasing slightly, reflecting mainly the growing importance of services trade – followed by China and the United Kingdom, whose share has, however, decreased significantly since the mid-1990s.

Chart A

The evolution of overall trade weights in the euro EER-42 over time

(percentages)

Source: ECB.

Notes: “Central and eastern European EU Member States” comprises Bulgaria, the Czech Republic, Croatia, Hungary, Poland and Romania; “other advanced European economies” comprises Denmark, Iceland, Norway, Sweden and Switzerland; “other advanced non-European economies” comprises Australia, Canada, Hong Kong SAR, Israel, Japan, New Zealand, Singapore, South Korea and Taiwan; and “other emerging market economies” comprises Algeria, Argentina, Brazil, Chile, Colombia, India, Indonesia, Malaysia, Mexico, Morocco, Philippines, Peru, Russia, Saudi Arabia, South Africa, Thailand, Turkey, Ukraine and the United Arab Emirates.

There are significant differences in the relative importance of manufacturing and services trade for the euro area’s most important trading partners (see Chart B). The role of the United States as the euro area’s single most important trading partner is primarily due to its large share in services trade with the euro area, in particular in terms of telecommunications, computer and information services, as well as other business services; the United States’ share in manufacturing trade is well below that of China, the euro area’s most important trading partner when only manufacturing is considered. Trade in services is also much higher than manufacturing trade for the United Kingdom and the group “other advanced European economies”, whereas it is much lower for central and eastern European EU Member States, whose trade linkages with the euro area are to a large extent shaped by their integration in European manufacturing value chains.

Chart B

Trade weights in the euro EER-42: manufacturing, services and combined

(percentages)

Source: ECB.

Notes: Trade weights are averages over the period 2016 to 2018. Country groups are as defined in the notes to Chart A.

Import and export weights are broadly similar for most countries and regions, even after correcting for competition in “third markets” (see Chart C). Overall trade weights are calculated as (weighted) averages of export and import weights measuring the share of each country in the euro area’s exports or imports respectively. On the export side, however, euro area companies compete with producers from a particular country not only in the latter’s home market but also in other foreign markets, i.e. “third markets”. To take account of this effect, “double” export weights are used to calculate the overall trade weights. While for most countries and regions the single and double export weights do not deviate much from one another, for China the difference is pronounced. This reflects China’s role as the leading global exporter of goods, which also implies that it is an important competitor in third markets. The opposite is true for other emerging market economies, which account for a significant share of the euro area’s direct exports, but compete only to a limited extent in third countries as their share in global exports is relatively small. For most countries, the import and (double) export weights are also similar. A notable exception to this general pattern is found, however, for EU Member States from central and eastern Europe. The role this region plays in Europe’s highly integrated value chains implies that it is more important for the euro area in terms of imports than exports, both on the basis of direct exports and even more so when third market competition is considered.

Chart C

Trade weights in the euro EER-42: overall weights, import weights, simple export weights and double export weights

(percentages)

Source: ECB.

Notes: Trade weights are averages over the period 2016 to 2018. Country groups are as defined in the notes to Chart A.

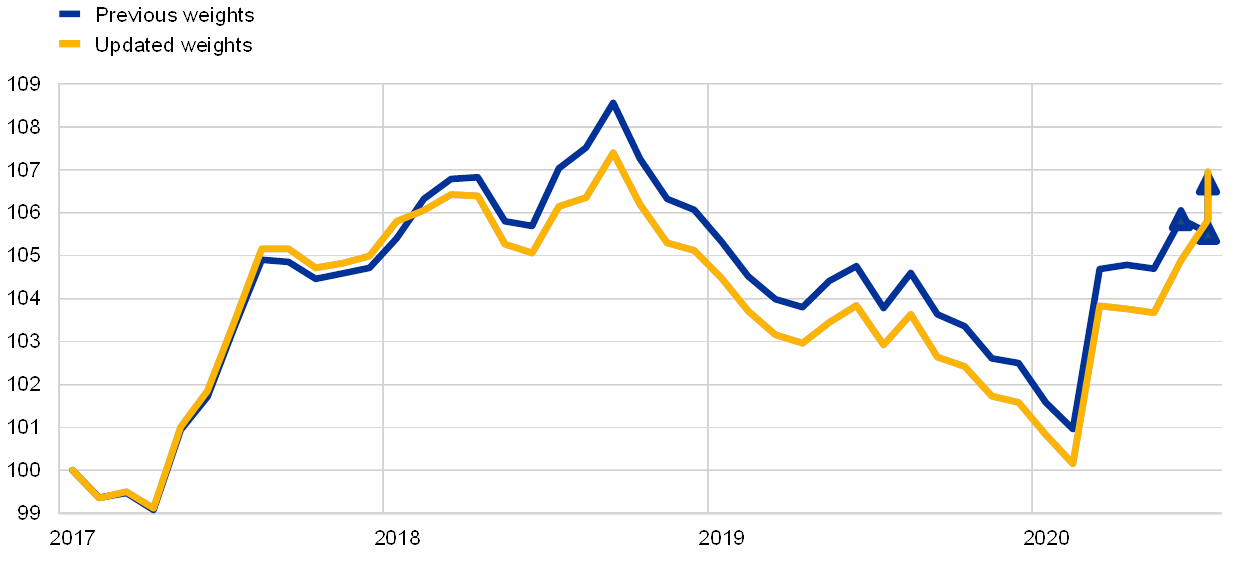

With the enhanced weighting scheme, it emerges that the appreciation of the euro since the beginning of 2017 has been slightly less pronounced in nominal terms than it appeared to be based on the previous weighting scheme, primarily owing to the increased weight of advanced economies.[6] Between the beginning of 2017 and the end of August 2020, the updated daily nominal EER of the euro vis-à-vis the EER-42 group of trading partners appreciated by 12.3%, compared with 13.8% according to the indicator based on the old manufacturing weighting scheme (see Chart D).[7] This revision is mainly due to the increased weight of advanced economies (reflecting mostly the inclusion of services trade in the weighting scheme), whose currencies depreciated against the euro by less, on average, than the currencies of emerging market economies. In real terms, however, developments were very consistent, with both the enhanced real EER-42 (deflated by the consumer price index) and the previously published series appreciating by just below 7% between January 2017 and August 2020 (see Chart E).

Chart D

The evolution of the nominal euro EER based on previous and updated weights

(percentage changes, 31 August 2020 relative to 2 January 2017)

Source: ECB.

Notes: Country groups are as defined in the notes to Chart A. The “updated weights” series refers to the EER-42, encompassing 42 countries and trade weights combining manufacturing and services trade, while the “previous weights” series refers to the EER-38 based on the old manufacturing weighting scheme (i.e. excluding trade in services and covering only 38 trading partners), which was discontinued as of June 2020.

Chart E

The evolution of the real euro EER deflated by the consumer price index based on previous and updated weights

(index; rebased to January 2017 = 100)

Source: ECB.

Notes: The “updated weights” series refers to the EER-42, encompassing 42 countries and trade weights combining manufacturing and services trade, while the “previous weights” series refers to the EER-38 based on the old manufacturing weighting scheme (i.e. excluding trade in services and covering only 38 trading partners), which was discontinued as of June 2020. Observations for the period June to August 2020 (as indicated by the triangles) are mechanical updates of the discontinued series.

- Harmonised competitiveness indicators (HCIs), which are based on the same methodology and data as the euro EER indices, are computed for the individual euro area countries. They have been enhanced in the same way as the EER indices.

- For an overview of the methodology used to calculate the EER indices, see Schmitz, M., De Clercq, M., Fidora, M., Lauro, B. and Pinheiro, C., “Revisiting the effective exchange rates of the euro”, Journal of Economic and Social Measurement, Vol. 38, No 2, 2013, pp. 127-158; and Brisson, R. and Schmitz, M. “The ECB’s enhanced effective exchange rates and harmonised competitiveness indicators – an updated weighting scheme including trade in services”, Statistics Paper Series, ECB (forthcoming).

- In this exercise the average trade weights for the three-year period from 2016 to 2018 were added to the series, while the weights for previous periods (from 1995 to 2015) were revised.

- Services trade is larger than manufacturing trade for Luxembourg, Cyprus, Malta, Ireland and Greece (in descending order).

- Colombia, Peru, Saudi Arabia, Ukraine and the United Arab Emirates were added to the group of trading partners, which now comprises all non-euro area countries in the EU, the G20 and the Organisation for Economic Co-operation and Development, as well as Algeria, Hong Kong SAR, Malaysia, Morocco, Peru, the Philippines, Taiwan, Thailand, the United Arab Emirates and Ukraine. Venezuela was excluded from the group of trading partners owing to the difficulty in obtaining reliable economic statistics for this country and to its diminished role as a trading partner for the euro area.

- The weights combining manufacturing and services trade are used for the nominal EER indices and the real EER indices deflated by consumer prices, the GDP deflator and unit labour costs in the total economy, whereas the real EER indices deflated by manufacturing producer prices and unit labour costs in the manufacturing sector continue to be based on manufacturing weights.

- Differences between the updated and previous EERs also arise from the fact that all trade weights – including those for manufacturing – were updated to reflect data revisions and methodological improvements.