Impact of the COVID-19 lockdown on trade in travel services

Published as part of the ECB Economic Bulletin, Issue 4/2020.

The lockdown measures adopted to contain the coronavirus (COVID-19) pandemic are having a significant impact on euro area trade in services, in particular on travel and passenger transportation. Exports of services dropped by 10.6% and imports of services dropped by 3.3% in March 2020 compared to the previous year, according to the latest available balance of payments data. Among several heterogeneous sectors, those involving physical contact are severely affected. The Purchasing Managers’ Index for Europe[1] suggests that tourism and leisure services and transport services are the sectors with the sharpest decline in activity in April 2020.

The global travel sector has experienced severe disruptions, for example as a result of travel restrictions and the closure of tourist attractions. More than 110 countries have stopped incoming travellers, and almost all countries have put in place restrictions of some kind. Some countries have adopted complete travel bans, while others have banned travel only from areas with a high number of infections. Tourism is heavily affected, especially international travel. Even after the severe lockdown measures have been lifted, the pandemic itself is triggering lasting effects on the sector through risk aversion and a change in preferences.

Travel and tourism as part of euro area trade in services

Tourism is travel for leisure or business and involves several stages and components, such as travel planning, transport, accommodation, food and shopping, local travel and tourist sites.[2] International tourism enters a country’s balance of payments as exports and imports of travel and transportation services. According to Balance of Payments and International Investment Position Manual (BPM6), “[t]ravel covers primarily the goods and services acquired from an economy by travellers (…) during visits of less than one year in that economy” and excludes the international carriage of travellers, which is covered in passenger services under transportation.

Net trade in travel contributed €42 billion to the euro area surplus of €68 billion in the trade balance for services in 2019. Extra-euro area services exports amounted to €988 billion, of which €124 billion from trade in travel services, accounting for 17% of the total amount. The transport sector accounts for 16% and includes both freight and passenger transportation, with the latter accounting for 23% of exports and 15% of imports in 2019. Imports amounted to €920 billion, with transport (16%) and travel (13%) being the largest categories.

The euro area is exposed to trade in heavily affected service sectors, in which it recorded a surplus in 2019. The geographical breakdown of services trade balances (see Chart A) illustrates the categories for euro area in services by main trade partners. The euro area had an overall surplus in trade in travel services, which is particularly exposed as the sector is among the most affected. The United Kingdom, Switzerland and the United States accounted for the largest contributions to the trade in travel surplus in 2019. Other sectors such as insurance, pensions and financial services as well as telecommunication, computers and information services trade are less affected.[3]

Chart A

Geographical breakdown of euro area service trade balance in 2019

(EUR billions)

Source: ECB.

Notes: Other business services comprise research and development services, professional and management consulting services and technical, trade-related and other business services not included in the previous categories. Other services refer to manufacturing services on physical inputs owned by others, maintenance and repair services, construction, charges for the use of intellectual property, government goods and services, personal, cultural and recreational services and the category “services not allocated”.

The crisis in the passenger transportation sector

The airline industry faces strong headwinds, as global travel is severely affected by the COVID-19 containment measures. Air transportation, which accounts for by far the largest share of passenger transportation export and import values,[4] is particularly affected. Major airports in the euro area (especially Paris, Amsterdam and Frankfurt) serve as a hub for international travel connections. Water, road and rail transportation are affected to a lesser extent.[5]

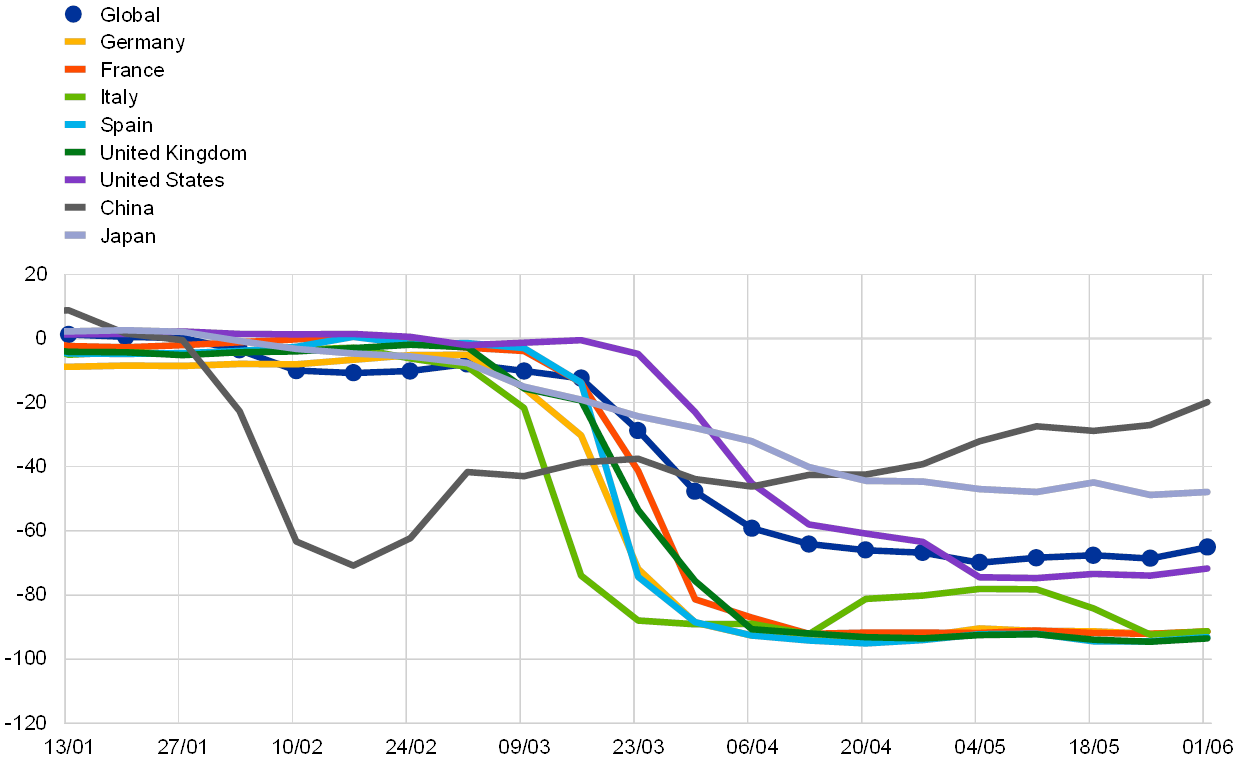

Flight capacity has been significantly reduced since the outbreak of COVID-19 (see Chart B). Globally, scheduled flight capacity[6] has declined by 65%. In the United States and Japan, flight capacity has dropped by 72% and 48% respectively. In China, flight capacity fell by 71% and has since recovered to 20% below 2019 levels. In Italy, Spain, France and Germany, flight capacity plunged by more than 90% compared with the same period in 2019 (according to data released on 1 June 2020).

The collapse in flight capacity across regions is unprecedented in the history of aviation. Flight passenger revenues fell by approximately 15% following the terrorist attacks in September 2001 and required two to three years to completely recover in the United States and Europe.[7] Following the SARS outbreak in 2002-03, passenger revenues declined by approximately two-thirds and did not recover until one year later.[8] The fall in international airline activity as a result of COVID-19 is, however, much broader and deeper and is likely to have more lasting consequences for the industry than these previous episodes.

Chart B

Global scheduled flight capacity in 2020

(percentage changes compared with the same period in 2019)

Source: OAG Schedules Analyser.

Notes: The data for each week are compared with the same week in 2019. The latest observation is for 1 June 2020.

The impact on the travel sector of individual euro area countries

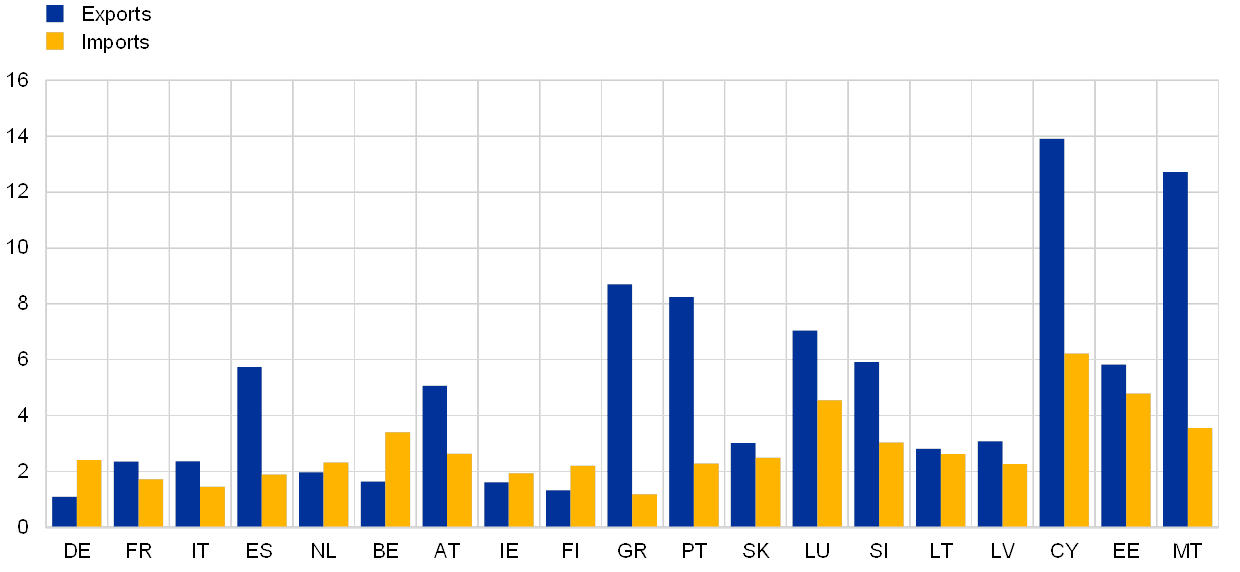

Travel exports play an important role for several euro area countries (see Chart C). Travel exports are mainly accommodation and hospitality services provided to travellers. The largest exporters in terms of receipts are Spain, France, Italy and Germany, with more than half of their travel exports to countries outside the euro area. Austria, the Netherlands, Greece and Portugal are also major travel destinations in the euro area, with Austria and the Netherlands recording higher shares in intra-euro area exports. In relative terms, travel exports are also significant for Cyprus, Malta, Greece and Portugal.

Chart C

Euro area countries’ travel exports and imports as a share of GDP in 2018

(percentage of GDP)

Sources: Eurostat and ECB staff calculations.

Note: Exports and imports include intra- and extra-euro area trade.

The majority of euro area countries spend between 2% and 4% of GDP abroad, which is recorded as travel services imports. Germany is by far the largest importer of travel services in absolute terms. Belgium, Luxembourg and Cyprus are relatively large importers of travel services in relation to their GDP, given their interconnectedness with other neighbouring economies.

The euro area countries more exposed to the impact of the pandemic in terms of net exports of travel services are estimated to be Cyprus, Malta, Greece and Portugal. Spain, Austria, Luxembourg and Slovenia are also expected to eventually face a significant hit in terms of net travel exports. By contrast, Germany and Belgium are expected to benefit slightly in terms of net exports as they are major importers of travel services.

In countries which depend on travel and tourism, the COVID-19 pandemic is having a severe and lasting impact on the overall economy. Travel has direct benefits through commercial activities along its value chain (i.e. travel planning, transport, accommodation, food and shopping, local travel and tourist sites) as well as indirect benefits through the demand and growth that it creates in many other industries. The lockdown measures adopted to contain the pandemic and confidence effects are having significant impacts on firms and employees in the labour-intensive travel industry.

- See the press release published by Markit on 8 May 2020.

- For definitions of the concepts of travel and tourism, see the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6) and the International Recommendations for Tourism Statistics by the United Nations World Tourism Organization (UNWTO). While travel (as defined in BPM6) and tourism (as defined by the UNWTO) largely overlap, the statistical concepts differ in two dimensions. First, “travel” includes purchases by short-term cross-border workers, which are not considered tourism expenditure. Second, tourism includes purchases of (international) passenger transport services, which fall under transport rather than travel services according to BPM6.

- The surplus in telecommunications, computers and information services was mainly with the United Kingdom, other EU Member States and other countries. By contrast, the euro area recorded a deficit in trade in other business services, mainly vis-à-vis offshore centres and the United States. The euro area is a net importer of “other services”, a category which includes charges for the use of intellectual property and which is largely affected by multinational enterprises’ internal transactions. For more details, see the article entitled “Multinational enterprises, financial centres and their implications for external imbalances: a euro area perspective”, Economic Bulletin, Issue 2, ECB, 2020.

- Based on International Trade in Services (ITS) statistics.

- Cruise ship services, which have been heavily affected by the containment measures, are included in the “travel” category in ITS statistics.

- Global scheduled flight capacity includes both domestic and international flight capacity. Owing to travel restrictions, international air travel is more severely affected than domestic air travel.

- Assessment based on revenue passenger miles and kilometres, respectively, from the US Department of Transportation and the Association of European Airlines. Revenue passenger miles and kilometres are calculated by multiplying the number of paying passengers by the distance travelled.

- Assessment based on data provided by the International Air Transport Association and the International Civil Aviation Organization.