The fall in manufacturing and services activity in the euro area: foreign versus domestic shocks

Published as part of the ECB Economic Bulletin, Issue 3/2020.

The coronavirus (COVID-19) pandemic, which has brought human suffering and disruption in economic activity globally, has affected manufacturing and services activity in all euro area countries. Economic growth in the euro area will be severely undermined in the short term. Three concomitant developments have adversely affected economic growth in the euro area since the beginning of 2018: (i) a weakening in global trade, related in part to rising international trade tensions and persistent policy uncertainty surrounding Brexit; (ii) a fall in automotive production, mainly owing to a decline in foreign demand as well as the introduction of more stringent environmental regulations in Europe; and (iii) a severe drop in economic activity as a result of the coronavirus. Between January 2018 and February 2020, despite the weakness in manufacturing in the euro area, the services sector as a whole – in particular market services – remained relatively resilient (see Chart A). In March, however, economic activity in both sectors fell sharply owing to the pandemic. Survey-based indicators such as the Purchasing Managers’ Index (PMI) (see Charts B and C), business and consumer sentiment indicators, and other more timely statistics such as international air travel and energy consumption, all point to a severe downturn in both manufacturing and services in the euro area as well as in many other countries.

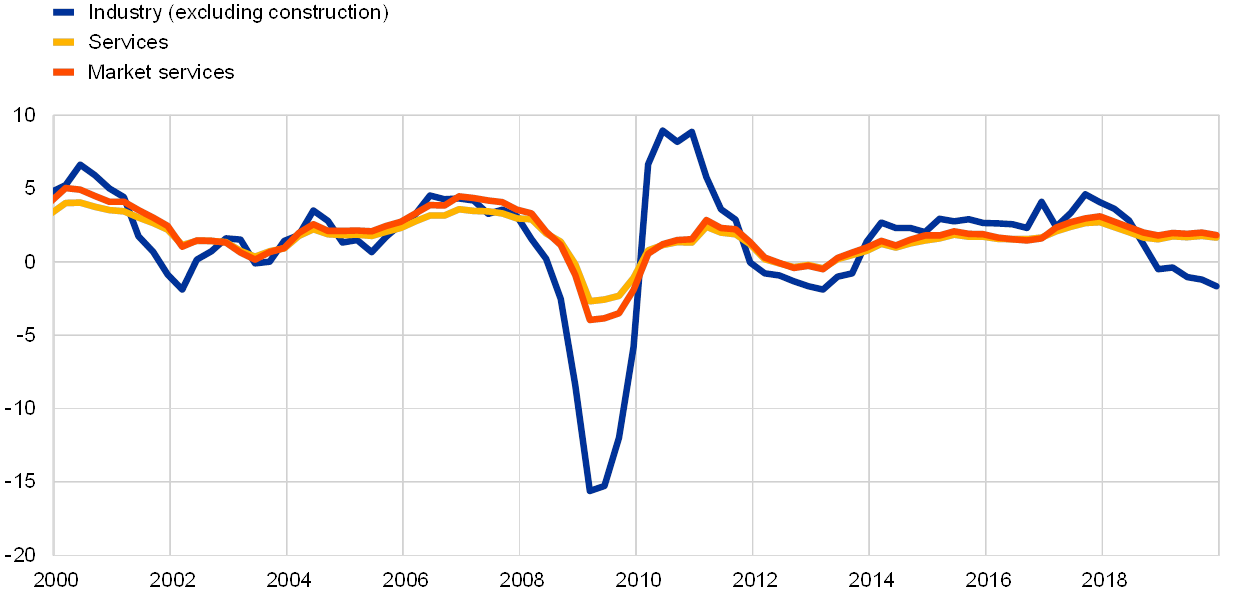

Chart A

Real value added in industry and services

(year-on-year percentage changes)

Source: Eurostat.

Note: The latest observation is for the fourth quarter of 2019.

Chart B

Output and employment PMIs for euro area manufacturing and services

(diffusion indices: 50 = no change, <50 = contraction; >50 = expansion)

Source: Markit.

Note: The latest observation is for March 2020.

Chart C

Composite PMI developments across selected economies in the first quarter of 2020

(change in the diffusion index)

Source: Markit and ECB calculations.

Note: The blue bars show the difference between the average monthly figure recorded in the first quarter of 2020 and the average monthly figure recorded in the fourth quarter of 2019. The yellow bars show the difference between the figures for March 2020 and December 2019.

A model covering manufacturing and services activity in a number of large economies is used to assess the importance of foreign and domestic factors for the euro area economy in three different periods: 2018, January 2019 to February 2020, and March 2020. PMI indicators are the first major survey indicators, harmonised across countries, to provide evidence of a sharp drop in economic activity in March 2020 across the globe. Therefore, in order to capture the effects of coronavirus outbreak, the model uses monthly PMI values for manufacturing output and services output for the euro area, China, the United Kingdom and the United States. It is estimated over the sample period January 2007 to March 2020, partly because the economic relationships between countries may have been different before the Great Recession in 2008-09, but also to include data for China. The model also controls for a global trade factor, which is proxied by the PMI for world new export orders. To give more prominence to this global factor, it is assumed to only react with a lag to shocks generated by manufacturing and services output in individual countries, while economic activity in each country reacts to global trade shocks contemporaneously. All the other eight variables are modelled assuming that a shock has an instantaneous effect on the variable that originated it which is larger in absolute value than its effect on other variables.[1]

The econometric evidence corroborates the view that both foreign and domestic shocks to manufacturing activity play a key role in explaining the downturn in economic activity in the euro area between January 2018 and February 2020. The model results suggest that the foreign factor was the key reason for the weakness of manufacturing activity in the euro area in the first half of 2018, but since the summer of 2018 shocks which can be attributed to specific developments in the automotive sector have also played a central role. According to the econometric results, 53% of the decline in manufacturing activity in 2018 is attributable to domestic factors (see Chart D). The evidence from PMIs corroborates the econometric results reported in the Economic Bulletin in September 2019 with the aim of explaining the drivers behind the fall in euro area industrial production growth at that time.[2] The stabilisation in the manufacturing output PMI recorded between January 2019 and February 2020 seems due to foreign developments, while domestic factors continued to be a drag on manufacturing activity. On the supply side, the introduction of certain environmental regulations in the EU caused temporary supply disruptions in the automotive industry. Some large car producers increased their efforts to raise local production and sales of electric cars. However, the required changes in factories may have entailed temporary production shortfalls. On the demand side, uncertainty about the diesel ban in some euro area countries caused a fall in demand for diesel cars and a switch to petrol cars, in part imported from countries outside the euro area. The automotive industry accounts for a large part of developments in capital goods and intermediate goods, as it is highly interconnected across sectors and countries.[3] It remains to be seen to what extent such temporary and structural domestic factors, which have played a role in the weakness of euro area manufacturing activity in the recent past, may also affect the recovery in this sector in the future.

Services have also been negatively affected by foreign and domestic developments in manufacturing, given the relatively strong link between production in the car industry and certain services sectors, although the services sector was more resilient up to February 2020. The model results suggest that negative spillovers from manufacturing to services can be significant. Services can be negatively affected via the relatively strong links between production in the car industry and consumer finance and retailers. At the same time, the services sector as a whole has remained more resilient than manufacturing, since it was affected less by developments in the car industry and benefited, like all sectors, from favourable financing conditions. The services output PMI started to decline from the second quarter of 2018, initially owing to global trade developments, which affected manufacturing directly and services indirectly, but then rose between January 2019 and February 2020 for the same reason. However, activity will be significantly affected by the containment measures introduced to fight the coronavirus as well as the policy response.

Chart D

Drivers of the euro area manufacturing and services PMIs – domestic versus foreign factors

(cumulative change in the diffusion index) Sources: Markit and ECB calculations.

Note: Shocks to countries’ PMI manufacturing/services activity are identified using the absolute magnitude restriction method (see De Santis, R.A. and Zimic, S., op. cit.).

The sharp drop in the PMI indices in March 2020, particularly in services, is unprecedented. Given the spread of the coronavirus across countries, it is reasonable to argue that output in March 2020 was driven by a global shock. Although services are less trade-intensive, they have become strongly correlated globally owing to the pandemic and the common measures which have been taken to contain it, namely the adoption of social distancing policies, as also recommended by the World Health Organization. The econometric model attributes a large fraction of the collapse in the manufacturing and services output PMIs for the euro area in March to the foreign factor, which is likely to reflect the fall in global trade and the lagged impact of the global slowdown given the sharp drop in economic activity in China in February. It is worth pointing out, however, that the euro area domestic factors also account for a significant part of the decline in both sectors in March 2020.

All in all, the pandemic outbreak is causing a broad-based fall in euro area economic activity. Between January 2018 and February 2020, domestic factors contributed to a large share of the decline in manufacturing activity, reflecting temporary and structural factors linked to the car industry. The marked weakness in manufacturing activity fed into some sub-components of services, but overall the services sector withstood this negative shock. Economic activity in the euro area fell sharply in March 2020, as a result of the spread of the virus and measures implemented to contain it. Many countries around the world have introduced measures since March 2020, and the economic outlook will continue to be affected by the evolution of the pandemic, the associated containment measures and the policy response. At the current juncture, therefore, the economic outlook remains highly uncertain.

- . The shock identification method is explained in De Santis, R. A. and Zimic, S, “Spillovers among sovereign debt markets: Identification through absolute magnitude restrictions”, Journal of Applied Econometrics, Vol. 33, No 5, 2018, pp. 727-747.

- . See the box entitled “Domestic versus foreign factors behind the fall in euro area industrial production”, Economic Bulletin, Issue 6, ECB, 2019. The model described in the current box has characteristics which are very similar to those of the model in Issue 6, 2019. It replaces industrial production with PMI manufacturing output and adds PMI services output for the four economies.

- See also, “The impact of the car industry slowdown from a global value chain perspective”, Economic Bulletin, No 2, Banco de España, 2019, pp. 1922.