Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area

Published as part of the ECB Economic Bulletin, Issue 3/2020.

The outbreak of the COVID-19 pandemic has dramatically affected global economic activity since early 2020. The rapid spread of the novel coronavirus (COVID-19) has required drastic measures to be taken, ranging from social distancing and the banning of public events to shutdowns, lockdowns and restrictions on numerous activities. The severity of these measures has begun to ease in some jurisdictions, as authorities are proceeding to gradually lift them and reopen certain sectors of the economies. Nevertheless, there could still be a prolonged period of social distancing and other containment measures in force for some time. These containment measures have weighed on supply and – together with increased uncertainty and self-isolation by individuals due to the rapid spread of the disease – have also induced households and firms to retrench their spending, thereby reducing aggregate demand. Widespread closures of firms have triggered a marked deterioration in employment conditions, an increase in firms’ liquidity needs, and pronounced financial market disruptions. Despite the shortage of timely hard data, it is already clear that there has been a decline in economic activity of an unprecedented magnitude.

The high uncertainty surrounding the economic impact of the COVID-19 pandemic warrants an analysis based on alternative scenarios. There are high uncertainties surrounding the developments of the pandemic, the need for and effectiveness of containment measures, and the possible emergence of medical treatments and solutions. These uncertainties can be illustrated through a scenario analysis, based on broad narratives for the aforementioned factors and their economic impact. It should be noted that these are illustrative scenarios compiled by ECB staff and, as such, they should not be seen as an indication of the forthcoming June 2020 Eurosystem staff macroeconomic projections for the euro area and thus they do not pre-empt in any way that projection exercise. Moreover, this box focuses only on economic activity, while the forthcoming June 2020 Eurosystem staff macroeconomic projections will be a fully-fledged projection exercise, including a detailed assessment of the inflation outlook.

This box presents three alternative scenarios to illustrate the range of likely impacts of the COVID-19 pandemic on the euro area economy. The scenarios vary according to a number of factors, namely the duration of the strict lockdown measures and their impact on sectoral economic activity, the economic effects of protracted containment measures during a post-lockdown transition period, the behavioural responses by economic agents to minimise economic disruptions, and the longer-lasting effects for economic activity once all containment measures have been lifted. This scenario analysis for the euro area is based on the same broad narratives for the global economy (and thus for the euro area foreign demand), while it abstracts from further feedback loops related to financial market disruptions or long-term implications of persistently high unemployment.

The different assumptions underlying the three illustrative alternative scenarios imply a range spanning from mild to severe expected economic impact. In the first (mild) scenario, strict lockdown and further containment measures, as well as rapid advances in medical treatments, entail relatively short-lived strict lockdown periods (ending in the course of May 2020), a gradual return to normal activity thereafter and only temporary economic losses. In the second (medium) scenario, a short-lived strict lockdown period (also ending in the course of May 2020) is followed by relatively stringent and protracted containment measures, implying a delayed return to normal activity, as well as persistent output losses. In the third (severe) scenario, a longer-term strict lockdown period (ending in the course of June 2020) has only limited success in containing the spread of the virus, thus requiring ongoing tough containment measures to remain in place even after some loosening of the very strict lockdowns. The sustained efforts to prevent the spread of the virus would continue to significantly dampen activity across sectors of the economy until a vaccine (or another effective medical solution) were to become available. This is not expected to occur until around mid-2021. Therefore, this scenario envisages significant and permanent output losses.

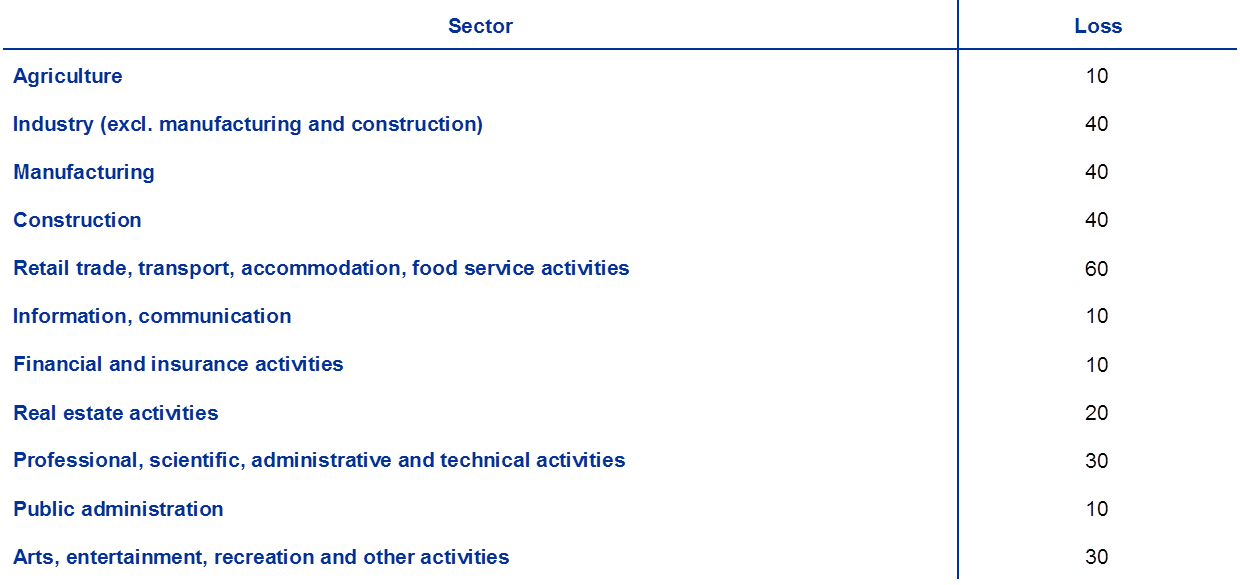

Containment measures during the lockdown periods have a diverse impact across economic sectors in the euro area. The collapse in activity is initially the strongest for services, particularly those related to travel and recreational activities. This has already been indicated by some of the available survey evidence. However, the lockdown measures and the ensuing supply bottlenecks reduce production dramatically, also across large segments of the industry. Overall, the containment measures are assumed to cause a relatively larger loss of value added in retail trade, transport, accommodation and food service activities compared to manufacturing, construction and other sectors (see Table A). The sectoral breakdown is indicative and based on anecdotal evidence and available survey evidence. It helped derive economy-wide estimates for the likely economic losses, which are broadly in line with available estimates from other institutions. The total initial economic loss implied during the lockdown is estimated to amount to around 30% – depending on the country – of value added relative to the normal level of activity. On account of agents’ responses aimed at minimising economic disruptions, the total initial economic losses are assumed to decline in the course of the second quarter of 2020. Under the assumptions used for these illustrative scenarios, the marginal impact of an additional month of lockdown measures on the annual GDP level is initially, approximately, between 2 and 2½ percent.

Table A

Initial sectoral losses due to strict lockdown measures

(percentage of gross value added)

Source: ECB staff.

Note: Under these scenarios, the lockdown is assumed to have a softer sectoral impact (by around 20-30%) in the course of the second quarter of 2020 on account of agents’ reaction (behavioural response) to minimise economic disruptions.

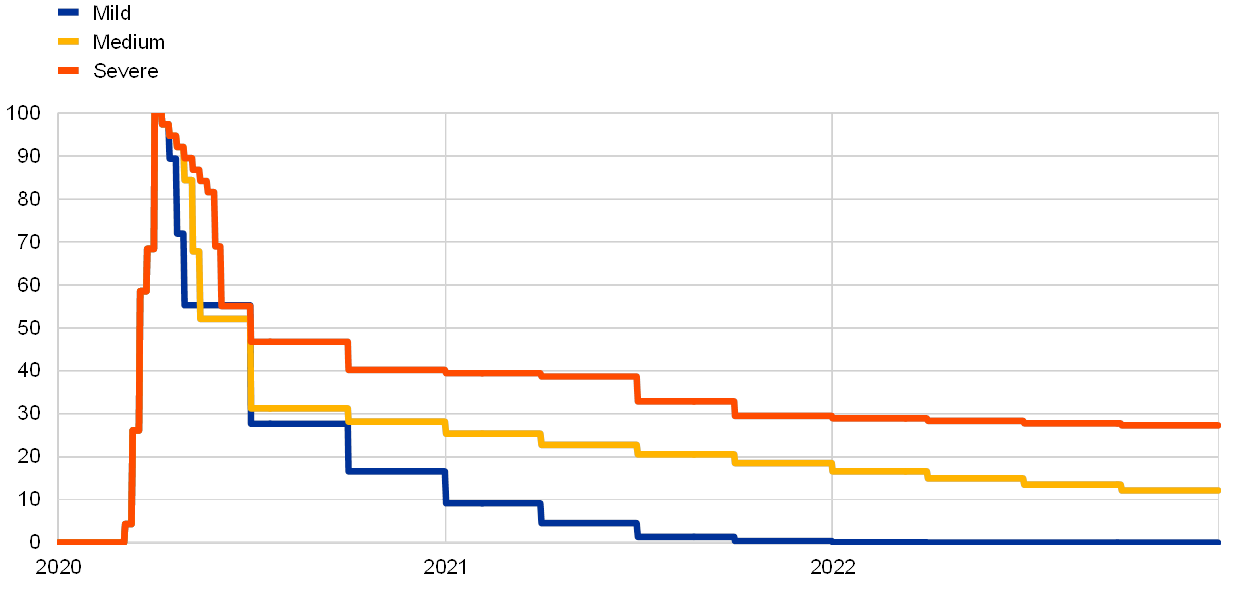

Strict containment measures are expected to severely affect economic activity in the euro area well beyond the short-term horizon. The sectoral approach used to assess the economic losses associated with the COVID-19 pandemic allows for the calculation of a time profile of indicative losses (as a percentage of maximum sectoral losses) implied by the virus containment measures in the euro area under the three alternative scenarios (see Chart A). The maximum sectoral losses (including direct and carry-over impacts) are assumed to occur in the first week of April 2020. The economic losses due to lockdowns began to build up in March – as different countries enforced lockdown measures – and after reaching a peak at the beginning of April, they are expected to decline to close to 50% of their maximum level by mid-May, end-May and in the course of June under the mild, medium and severe scenarios, respectively, as looser containment measures allow for a gradual restart of economic activity. While containment measures – coupled with the longer-lasting costs inflicted on activity stemming from the pandemic – are expected to exhaust their negative impact by end-2021 under the mild scenario, they would continue to weigh on economic activity in 2022 under the medium and severe scenarios.

Chart A

Time profile of indicative losses in gross value added implied by containment measures in the euro area under the mild, medium and severe scenarios

(percentage of maximum euro area sectoral loss)

Source: ECB calculations.

Note: Losses are measured relative to the maximum sectoral losses for the euro area, computed as a weighted average of the losses for the largest five euro area countries.

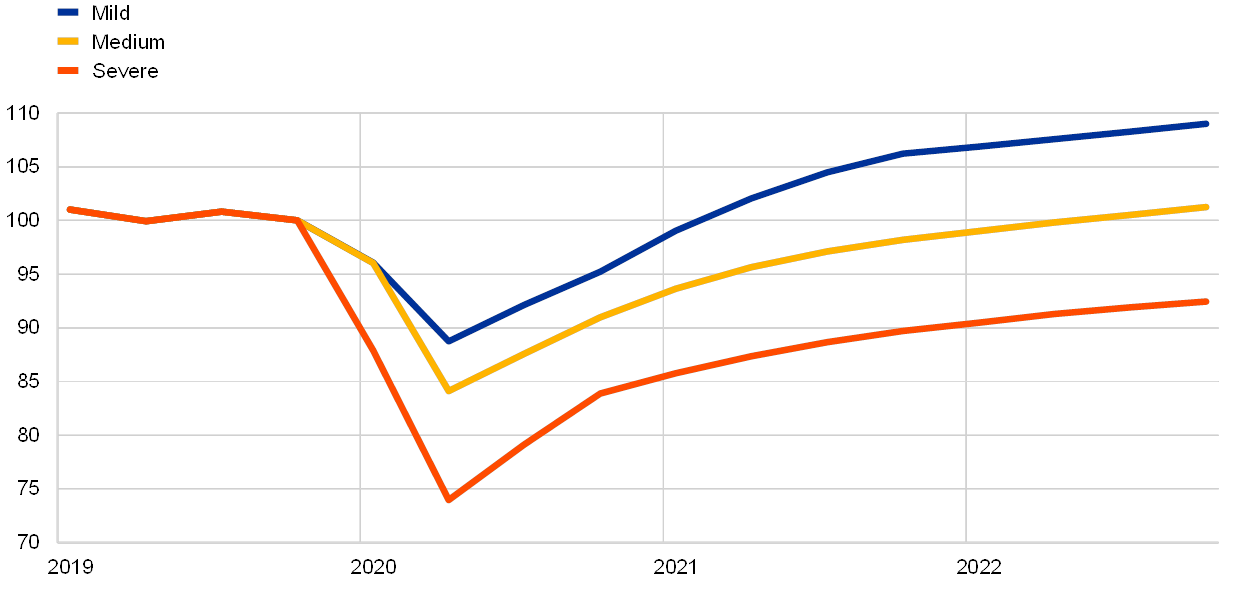

The containment measures enforced by countries worldwide severely affect global economic activity and strongly curtail global trade. Similarly to the euro area, three illustrative scenarios are also considered for global real GDP excluding the euro area and euro area implied foreign demand of goods and services (see Chart B). The COVID-19 pandemic and its fallout implies large losses for global real GDP. As a result of the high procyclicality of global trade with respect to global activity, euro area foreign demand would fall by around 7%, 11% and 19% under the mild, medium and severe scenarios, respectively, in 2020. Looking further ahead, losses in euro area foreign demand compared to its end-2019 level are likely to persist only under the severe scenario up to the end of 2022.

Chart B

Euro area foreign demand under the mild, medium and severe scenarios

(index, 2019 Q4 = 100)

Source: ECB calculations.

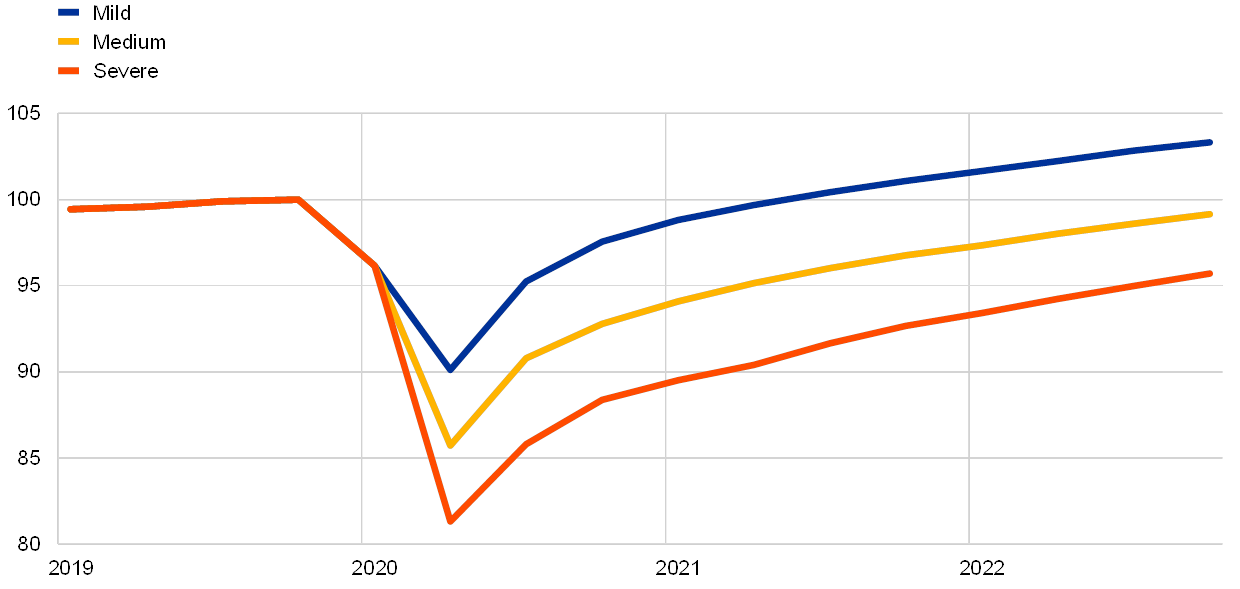

Euro area real GDP is expected to drop sharply in the short term, while effective containment measures would be crucial to ensuring a robust recovery thereafter. The scenario analysis used in this box points towards an unprecedented contraction in economic activity, with real GDP plummeting by around 5%, 8% and 12% under the mild, medium and severe scenarios, respectively, in 2020 (see Chart C). The annual figure under the severe scenario reflects a quarterly real GDP growth reaching a trough of around -15% in the second quarter of 2020, followed by a protracted and incomplete recovery, entailing quarterly growth rates of around 6% and 3%, respectively, in the third and fourth quarters of 2020. As containment measures allow for a gradual normalisation of economic activity, real GDP is expected to increase by around 6%, 5% and 4% under the mild, medium and severe scenarios, respectively, in 2021. The uncertain epidemiology of the virus, the expected diverse effectiveness of containment measures and the assumed persistent economic damage under the medium and severe scenarios would continue to weigh on the economic recovery throughout the horizon. Under the severe scenario, in particular, real GDP is expected to remain well below the level observed at the end of 2019 until the end of 2022.

Chart C

Euro area real GDP under the mild, medium and severe scenarios

(index, 2019 Q4 = 100)

Source: ECB calculations.

These illustrative scenarios abstract from a number of other relevant factors that would also influence the magnitude of the recession in the euro area. The scenarios are built on the assumed containment by economic policy measures of prospective negative real-financial feedback loops. In addition, they do not include other non-linear amplification mechanisms due to extreme events, such as severe losses to household income and persistently high unemployment as a result of an increase in bankruptcy rates in the corporate sector. Furthermore, these scenarios have been prepared under the usual assumption applied in ECB and Eurosystem staff macroeconomic projections for monetary policy, which is to take the same path for interest rates already reflected in market developments under all three alternative scenarios. Finally, the three scenarios take into account the fiscal measures that have recently been announced by euro area countries. Under the severe scenario, the prospective fiscal responses have been scaled up to better reflect the expected stronger economic severity of lockdown measures.

Given the unprecedented uncertainty surrounding the developments and economic impact of the COVID-19 pandemic, the assessments underlying these illustrative scenarios need to be continuously updated. The results of the analysis presented in this box crucially depend on the underlying assumptions. These include the (direct and indirect) effects of lockdown and other containment measures on global and domestic supply and demand forces, as well as the effectiveness of policy responses worldwide in containing the spread of the virus and in supporting economic activity. Ultimately, rapid and decisive containment and economic policy measures – besides an effective medical solution – will be crucial to ensuring a robust recovery of economic activity in the euro area. While this box focuses on the impact of the COVID-19 pandemic on economic activity in the euro area, the implications for consumer price inflation depend on the balance between demand and supply factors and, as mentioned, this will be assessed in the forthcoming June 2020 Eurosystem staff macroeconomic projections.