Tracking global economic uncertainty: implications for global investment and trade

Published as part of the ECB Economic Bulletin, Issue 1/2020.

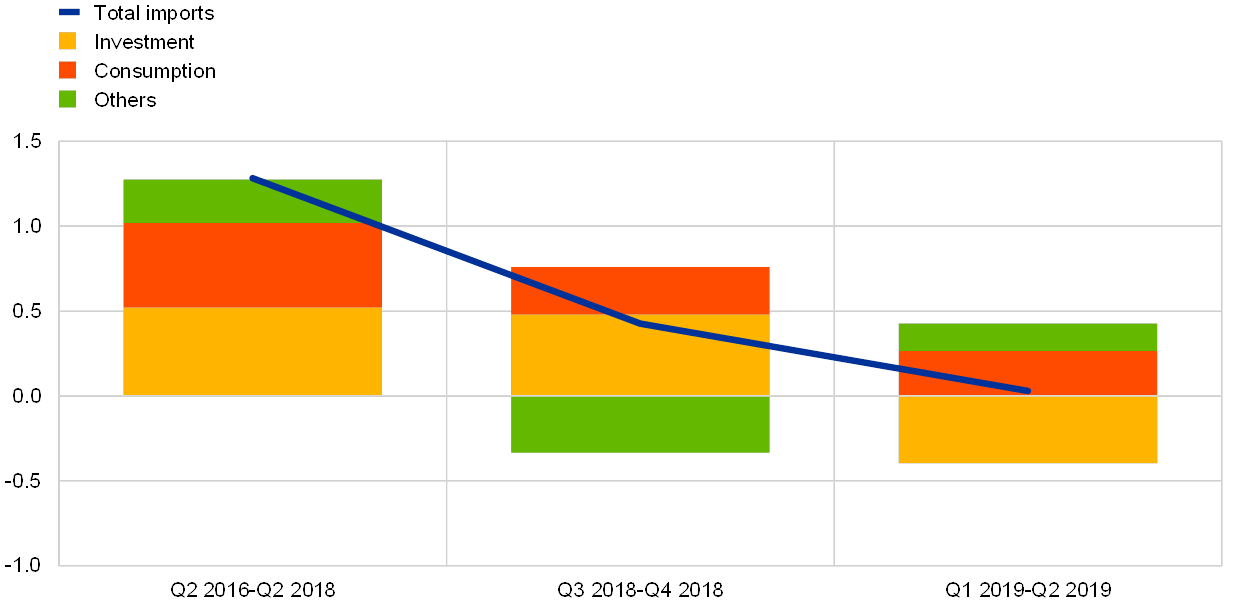

This box sheds light on the role of uncertainty in the recent slowdown of global investment and trade. Over the past year the global economy has transitioned from a robust and synchronised expansion to a widespread slowdown. Global growth has weakened on the back of soft investment, which was also a key driver of the sharp fall in global trade growth in the first half of 2019 (see Chart A)[2]. The slowdown in global investment and trade has occurred in an environment of rising trade tensions between the United States and China, slowing Chinese demand, (geo-)political tensions, Brexit and idiosyncratic stresses in several emerging economies, with rising uncertainty magnifying the negative impact. Against this backdrop, this box assesses the role of uncertainty in the recent slowdown of global investment and trade.

Chart A

Drivers of world imports (excluding the euro area)

(qoq % change)

Source: ECB calculations.

Notes: Aggregation of 18 countries representing approximatively 75% of euro area foreign demand. Contributions are obtained from individual countries’ error-correction models. The models relate import volumes to domestic demand components, commodity prices and relative import prices. According to Bussière et al.[3], measures of import intensity-adjusted demand (IAD) are computed by weighting the components of domestic demand according to their import content derived from global input-output tables. In order to capture long-term factors such as shifts in non-price competitiveness or changes in trade openness, non-linear deterministic trends are also included in the long-run relationships. The long-term coefficient of the elasticity of imports to domestic demand is restricted to one.

Since uncertainty cannot be observed directly, proxies are generally used. Economic uncertainty can stem from different sources and is characterised by a situation in which agents cannot contemplate all the possible states of nature or characterise their probability distributions. While the literature goes some way towards defining the concept of uncertainty, including by setting it apart from risk and confidence[4], there is no single commonly accepted measure of uncertainty. Several proxies have been proposed, such as indicators based on stock market volatility, counts of the word “uncertainty” in newspaper articles and measures based on disagreement between professional forecasters.[5]

In this box we present synthetic measures of time-varying macroeconomic uncertainty. Jurado et al. define economic uncertainty as the “conditional volatility of a disturbance that is unforecastable from the perspective of economic agents”[6], with an increase in uncertainty generally being associated with a growing difficulty of predicting future economic outcomes. Based on this definition, we developed measures of economic uncertainty for 16 euro area trading partners, together accounting for around 70% of world GDP (excluding the euro area). The measures were derived from the time-varying volatility of model-based forecast errors of a broad selection of macroeconomic and financial market time series.[7] Applying the same approach to a large selection of country trade indicators, we also derived a measure of global trade uncertainty[8].

The estimation results suggest that while global economic uncertainty has increased gradually over the past year, global trade uncertainty has surged more rapidly. Trade-related uncertainty has risen by some two standard deviations over the past year; more than twice the increase observed in economic uncertainty (see Chart B). While our measures line up reassuringly well with past political, geopolitical and economic events generally associated with high uncertainty, the recent intensification coincides with various tariff announcements made by the United States and China. For instance, the trade uncertainty indicator started rising in mid-2018 when US tariffs on steel and aluminium were announced, and spiked again in the first quarter of 2019 after the United States increased tariffs on USD 200 billion of imports from China. All countries in the sample (except Switzerland) have experienced an increase in uncertainty since early 2018.

Chart B

Global economic and trade uncertainty

(standard deviation from mean)

Source: ECB calculations.

Note: Standard deviations from means are computed over the period Jan 1998-August 2019.

Following the global financial crisis, policy debates have increasingly focused on the macroeconomic consequences of heightened uncertainty. Recent ECB analysis suggests that rising uncertainty had negative effects on euro area investment during the global financial and euro area sovereign debt crises.[9] An often-cited channel linking uncertainty to real activity is the irreversibility of investment.[10] Moreover, the interplay between uncertainty shocks and financial frictions can have powerful effects on economic activity.[11] Consumers may also react to increased uncertainty by raising their precautionary savings.[12]

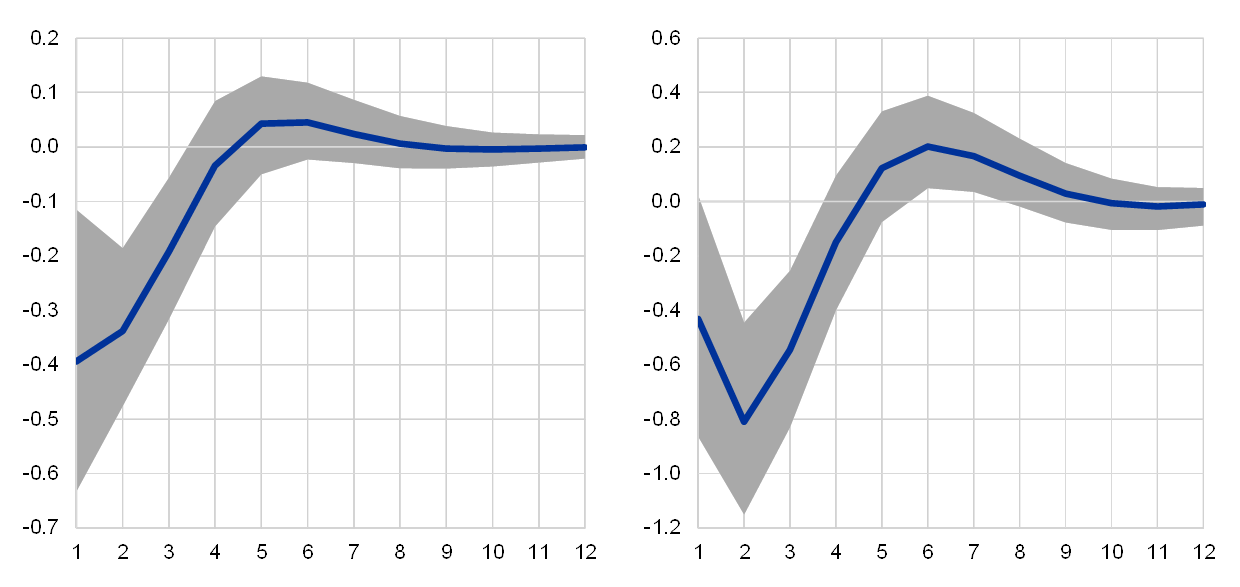

Economic uncertainty also appears to play an important role at the current juncture. Analysing the causal relationship between fluctuations in uncertainty and output growth is not straightforward as causality can be bi-directional: higher uncertainty affects economic activity, but (adverse) shocks to output are also likely to raise uncertainty. In order to distinguish exogenous shocks from uncertainty we rely on the methodology proposed by Piffer and Podstawski[13] and estimate a proxy structural vector autoregression (SVAR) in which we use variations in the price of gold as an instrument for uncertainty.[14] The results of this analysis suggest that uncertainty shocks matter and are significant in size. On impact, a one standard deviation uncertainty shock subtracts around 0.4 p.p. from growth in global investment and 0.8 p.p. from global imports, respectively (see Chart C). Our analysis also suggests that uncertainty has been a drag on global investment and trade growth over the past year, accounting for a third of the decline in investment and for 40% of the decline in global imports (see Chart D).

Chart C

Impulse response of world investment (lhs) and world imports (rhs), excluding the euro area, to a one standard deviation uncertainty shock

(y-axis: percentage points, x-axis: quarters)

Source: ECB calculations.

Notes: The chart shows impulse response functions obtained from an SVAR model featuring our measure of global economic uncertainty, global investment, global imports, an aggregate measure of interest rates, global CPI inflation and an index of world equity prices. The model is estimated over the period 1996Q1 to 2019Q2. Global aggregates of the variables included in the VAR are constructed from 16 countries accounting for 75% of world GDP using GDP PPP weights. The blue lines show the pointwise medians while the grey areas show the 68% confidence intervals.

Chart D

Decomposition of world investment growth and world imports growth (excluding the euro area)

(quarterly average percentage change between 2017Q2-2018Q2 and 2018Q2-2019Q2, deviation from trend)

Source: ECB calculations.

A dissipation of uncertainty may also contribute to the pickup in global activity as anticipated by the December 2019 Eurosystem macroeconomic projections. With the headwinds clouding the global economy slowly fading and uncertainty receding, a modest recovery of global activity and trade is expected in the medium term.[15] Growth-supportive policies across many economies are expected to provide additional relief. However, many of the events that have spurred the rise in uncertainty are far from being resolved, and risks to global economic activity are judged to be tilted to the downside. Therefore, uncertainty could continue to cloud the global outlook in the coming quarters.

- With thanks to Simone Cigna and Ben Schumann for their valuable input.

- For more information see Box 1 “What is behind the decoupling of global activity and trade?”, Economic Bulletin, Issue 5, ECB, Frankfurt am Main, 2019.

- Bussière et al., “Estimating Trade Elasticities: Demand Composition and the Trade Collapse of 2008-2009”, American Economic Journal: Macroeconomics, Vol. 5, No 3, 2013.

- For a review see Stracca, L. and Nowzohour, L., “More than a feeling: confidence, uncertainty and macroeconomic fluctuations”, Working Paper Series, No 2100, ECB, September 2017.

- See Bloom, N., “The impact of uncertainty shocks”, Econometrica, Vol. 77, No 3, 2009; Baker, S. et al., “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics, Vol. 131, No 4, 2016; Bachmann et al., “Uncertainty and Economic Activity: Evidence from Business Survey Data”, American Economic Journal: Macroeconomics, Vol. 5, No 2, 2013.

- See Jurado, K. et al., “Measuring Uncertainty”, American Economic Review, Vol. 105, No 3, 2015.

- In more detail, a (monthly) dynamic factor model is deployed to forecast country-specific macro and financial variables one month in advance. A stochastic volatility model is then used to derive the conditional volatility of the model-based forecast error over time. Thereafter, a principal component of the individual time series is extracted to produce a measure of economic uncertainty for each country. Finally, a global uncertainty indicator is produced by aggregating the country-specific indicators using GDP PPP weights. Similarly, a measure of global trade uncertainty is derived from a large database of monthly country-level trade indicators.

- The trade uncertainty indicator reflects the unforecastable component of a broad set of trade-specific variables such as imports and exports. It therefore accounts for a variety of sources of trade uncertainty, including, but not limited to trade policy uncertainty. The proxy has been chosen based on the fact that gold is considered a safe asset and should therefore emphasise the uncertainty‐related component of the events.

- See ECB Working Group on Econometric Modelling, “Business investment in EU countries”, Occasional Paper Series, No 215, ECB, October 2018.

- See Bloom, N., op. cit.

- See Christiano L. J., Motto, R. and Rostagno, M., “Risk Shocks”, American Economic Review, Vol. 104, 2014, and Gilchrist, S., Sim, J. W. and Zakrajšek, E., “Uncertainty, Financial Frictions, and Investment Dynamics”, NBER Working Paper, No 20038, National Bureau of Economic Research, 2014.

- See Basu, S. and Bundick, B., “Uncertainty Shocks in a Model of Effective Demand: Reply”, Federal Reserve Bank of Kansas City, RWP 18-05, 2017.

- See Piffer, M. and Podstawski, M., “Identifying uncertainty shocks using the price of gold”, The Economic Journal, Vol. 128, 2018. Their proxy, available until 2015, has been extended by adding 20 additional events from 2015Q2 to 2019Q2 that have the potential to generate or reduce uncertainty, are not anticipated and are exogenous to other macroeconomic shocks.

- A narrative approach is used to identify uncertainty shocks. More specifically, the (percentage) change of the gold price around each event is computed and then all changes are aggregated into a monthly time series. This proxy series is correlated with uncertainty shocks but uncorrelated with other common macroeconomic disturbances. The proxy is then incorporated in a global SVAR model featuring, in addition, the estimated measure of global economic uncertainty, global GDP, global investment, an aggregate measure of interest rates, global inflation and an equity index.

- The recent US-China agreement on “Phase 1 trade deal” is likely to reduce uncertainty, removing some drag from global activity and trade.